July 18th, 2024 by Elma Jane

The way we pay for goods and services has undergone a dramatic transformation. From bartering to coins to paper money, the journey of payment methods has been long and fascinating. But no shift has been as revolutionary as the rise of electronic payments. Let’s dive into this evolution and explore where this exciting technology might lead us next.

Early Days (1950s – 1970s):

- 1950: The Diners Club card emerges as the first multipurpose charge card, laying the foundation for modern credit card systems.

- 1958: American Express launches its charge card, initially paper-based, revolutionizing travel and expense tracking.

- 1966: Barclays Bank in London introduces the first Automated Teller Machine (ATM), allowing customers basic account access outside banking hours.

- 1970s: Electronic Funds Transfer (EFT) systems gain traction, enabling direct deposit of paychecks and automated bill payments.

Rise of Digital Networks (1980s – 1990s):

- 1979: Visa introduces the first electronic authorization system and point-of-sale (POS) terminal, paving the way for real-time transaction processing.

- 1983: Debit cards become more prevalent, allowing consumers to access funds directly from their bank accounts.

- 1994: First Virtual Holdings pioneers the first secure online payment system, marking the dawn of e-commerce.

- Late 1990s: Online banking explodes in popularity, offering customers convenient account management and payment options.

The Internet Age (2000s – Present):

- 1998: PayPal emerges, simplifying online transactions and boosting consumer confidence in online shopping.

- 2003: Mobile payments gain momentum in various countries, driven by the increasing adoption of mobile phones.

- 2010s: Near Field Communication (NFC) technology enables contactless payments, giving rise to mobile wallets like Apple Pay and Google Pay.

- 2020s: Biometric authentication adds another layer of security to electronic payments, using fingerprints and facial recognition. Real-time payment systems gain popularity, allowing for instant fund transfers.

The Future of Electronic Payments:

- Invisible Payments: Imagine a world where payments happen seamlessly in the background. Technology like Amazon Go is already showcasing this, with customers simply walking out of stores with their purchases.

- Cryptocurrency and Blockchain: While still in its early stages, the potential of cryptocurrencies and blockchain technology to disrupt traditional payment systems is enormous. Expect to see more integration and wider acceptance in the coming years.

- AI-Powered Payments: Artificial intelligence will play a crucial role in fraud prevention, personalized payment experiences, and the development of even more innovative payment solutions.

- Increased Financial Inclusion: Electronic payments have the potential to bring banking services to underserved populations, promoting financial inclusion on a global scale.

The evolution of electronic payments is an ongoing journey. As technology continues to advance, we can expect even more exciting developments that will reshape the way we transact and interact with the world around us.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

February 25th, 2024 by Admin

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

But what exactly is m-commerce? M-commerce is a hybrid technology that takes web technologies that scale screens to mobile devices like Apple iPads and Android tablets. The commerce end of it comes from shoppers and merchants actually executing payment transactions over mobile devices of some form. Read more of this article »

Posted in Credit Card Security Tagged with: credit card, Digital Wallet, e-commerce, gateway, m-commerce, merchant account, nfc, payment, shopping cart, smartphone, tablet

January 21st, 2023 by Admin

Data Breaches Cost Consumers Billions

Exposure of personal information is a new challenge in todays environment, the initial exposure being a nightmare to unravel. A Javelin Strategy and Research study shows that a single data security breach can cost Billions of dollars in consumer fraud losses. Data security breaches rose 48% from 2011 in 2012 to 1,611 data breaches. Identity theft is on the rise too.

Walmart CEO Mike Duke Expecting $10 Billion in e-commerce payments 2013.

Commenting at a shareholder meeting WalMart CEO Mike Duke expected WalMarts online e-commerce site to bring in $10 Billion in transactions this year.

India Sees Spike in e-commerce and Mobile Payment Investments.

India is seeing deeper saturation of broadband rollouts connecting personal computers and laptops online at a faster pace. Big names such as Intel are keen on India’s development for market opportunities. Amazon and ebay just staked claims to India’s e-commerce playing field with deals to deliver their e-commerce services. Read more of this article »

Posted in Electronic Payments Tagged with: Breach, Digital Wallet, e-commerce, electronic payments, Mobile Payments, nfc, tablet, Virtual Currency

January 17th, 2023 by Admin

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Posted in Mobile Payments Tagged with: bluetooth, Chip and PIN, EMV, gift Card, Mobile Payments, MPOS, nfc, PayPal, QR Code Payments, retailers, smartphone, Square, tablet, Tap to Pay

July 26th, 2017 by Elma Jane

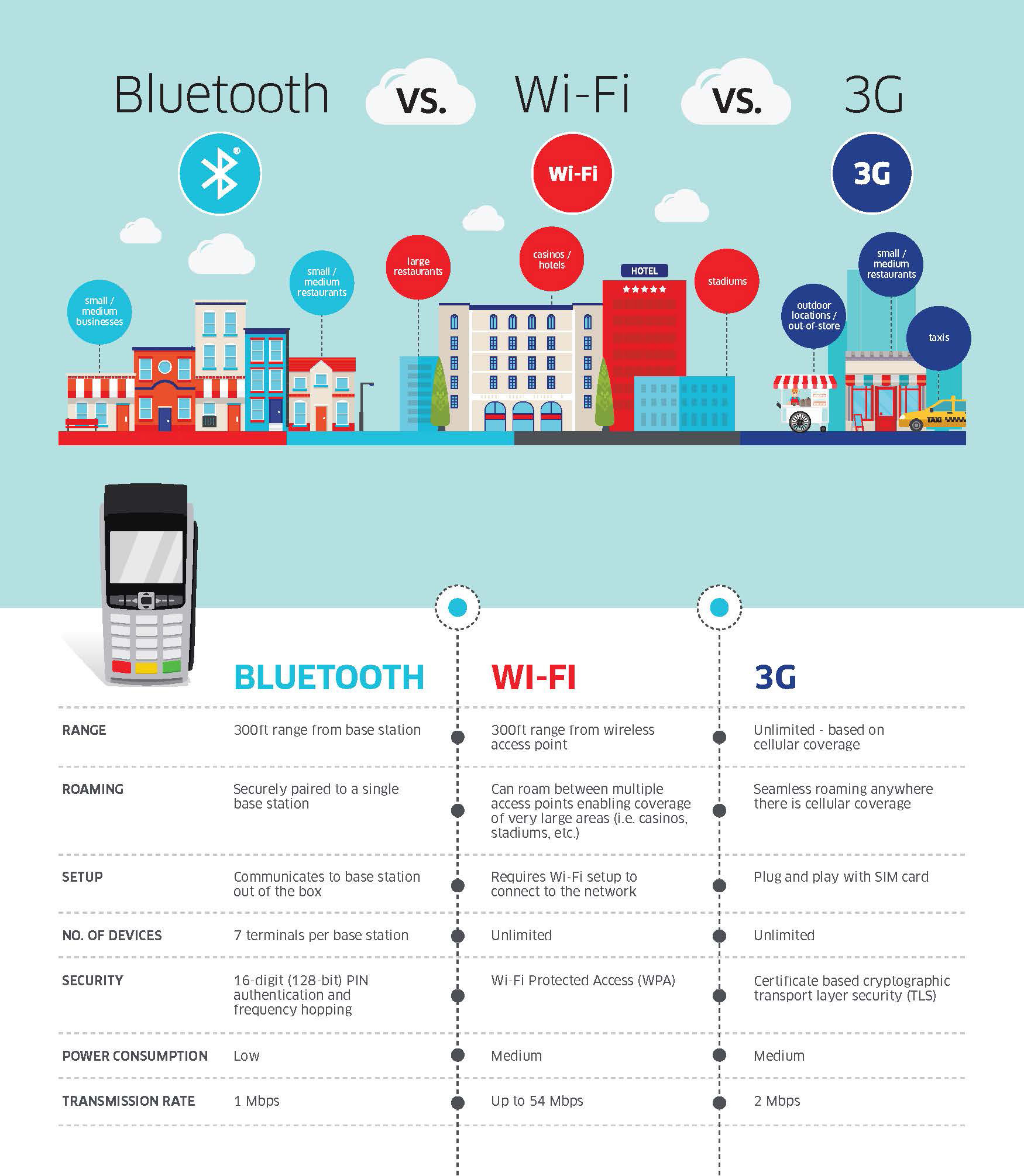

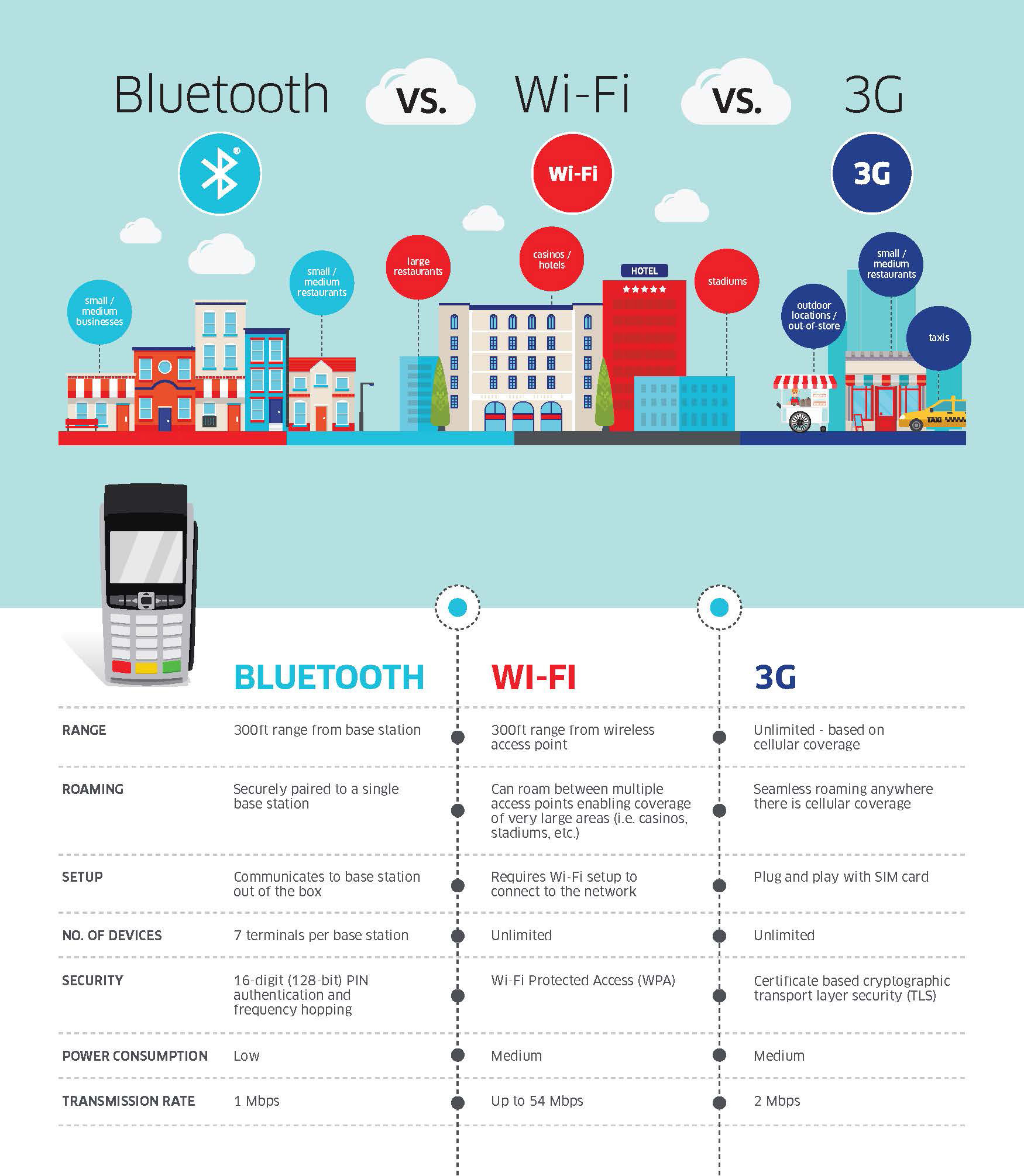

Check out the wide range of smart wireless terminal connectivity options and know the difference.

Bluetooth Wireless: Designed for reliable Bluetooth connectivity even in the most demanding environments.

Rage – 300ft from base station

Roaming – paired to single base station

Setup – Communicates to base station out of the box

No. Of Devices – 7 Terminals per base station

Security – 16-Digit (128-Bit) PIN authentication and frequency hopping

Accept EMV Chip & PIN, magstripe and NFC/Contactless

WiFi: Designed for reliable WiFi connectivity, Wireless mobility for the point of sale.

Rage – 300ft from base station

Roaming – can roam between multiple access points enabling coverage of very large areas.

Setup – Requires WiFi Setup to connect to the network

No. Of Devices – Unlimited

Security – WiFi Protected Access (WPA)

Accept EMV Chip & PIN, magstripe and NFC/Contactless

3G Wireless: Bring compact, reliable 3G Wireless Technology and mobility to the point of sale.

Rage – unlimited – based on cellular coverage

Roaming – Seamless roaming anywhere there is cellular coverage

Setup – Plug and play with SIM card

No. Of Devices – Unlimited

Security – Certificate based cryptographic transport layer security

Accept EMV Chip & PIN, magstripe and NFC/Contactless

Wireless terminals provide merchants with a number of benefits including:

Mobility – enable merchants to better serve the customer and bring the transaction right to the point of service.

Printed Receipt – give your servers the capability to print a receipt for the customer even when away from the POS.

Variety of Payment Options – provide the ability to accept magstripe, EMV, and NFC payments including the latest mobile wallets.

For Electronic Payment Set Up Call Now 888-996-2273

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: bluetooth, chip, Contacless, EMV, magstripe, nfc, PIN, Security

May 10th, 2017 by Elma Jane

Mobile Wallet Technology have flooded the market in the last few years with offerings such as Apple Pay, Android pay, Samsung Pay and more. And so far, they seem to be succeeding.

To understand how contactless payments work, here is an example.

A smart phone like Android or iPhone allows you to take advantage of mobile wallets like Android Pay, Apple Pay or Samsung Pay. You input your credit card information onto your phone, which stores it for later use.

If you’re shopping at a store that has mobile payment readers at the register, rather than reach for your wallet and get your credit card; you take out your phone to make a payment.

The point-of-sale (POS) terminal will automatically reads the payment information stored by holding your mobile phone a few inches away from the POS, and then processes the transaction. When the mobile device is in range, a wireless communication protocol links the terminal and the phone, which exchange information and conduct a secure transaction in a fraction of a second.

Near-field communication or NFC technology, works by bringing together two electronic devices. In terms of payments technology, a mobile device such as a smartphone and a reader. The reader would be the initiator and the smartphone would be the target, which contains the stored credit card information.

The market potential for NFC payment technology is huge, as more merchants adopt the EMV. EMV compliant terminals accept NFC payments through mobile wallets.

For Electronic Payment set up call now 888-996-2273!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Near Field Communication, Smartphone Tagged with: contactless payments, credit card, electronic payment, merchants, mobile wallets, Near Field Communication, nfc, point of sale, POS, smart phone, terminal

April 10th, 2017 by Elma Jane

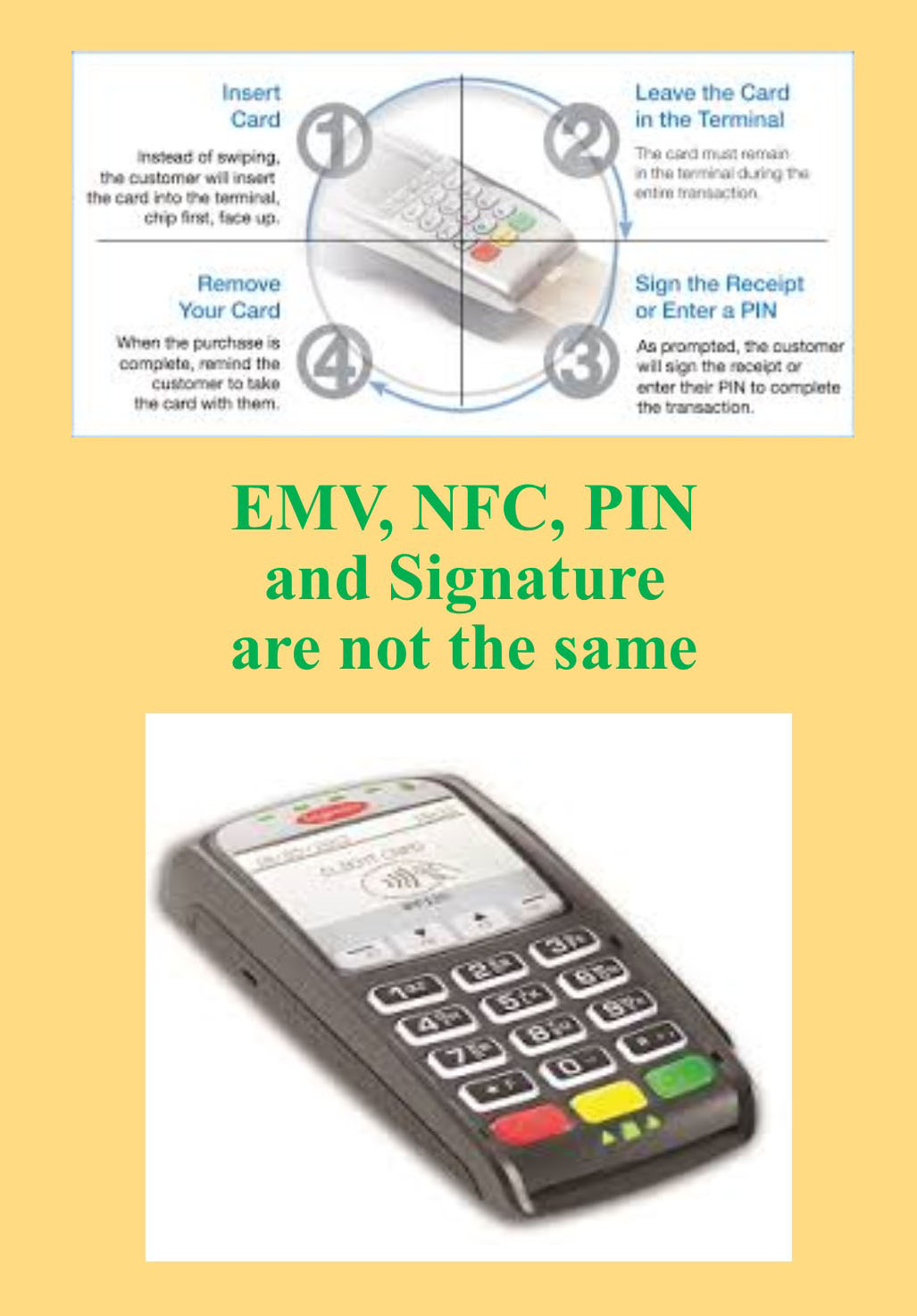

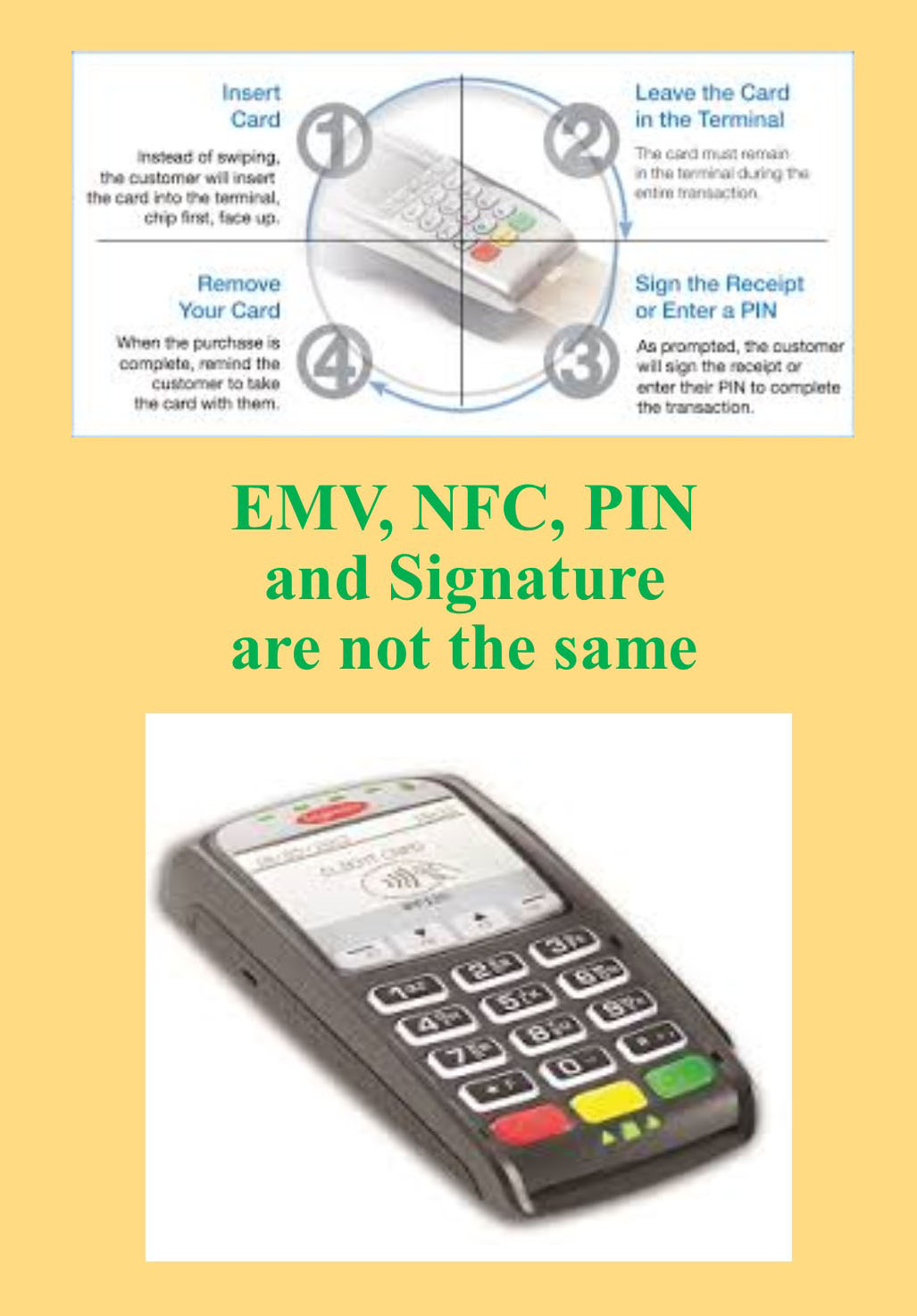

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

March 30th, 2017 by Elma Jane

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions

December 12th, 2016 by Elma Jane

Wireless Freedom with Smart Terminal!

Point-of-sale with WiFi capabilities. Now customers can take advantage of total mobility within their location when accepting payments, and managing their business either in-store or remotely. The device is NFC enabled for contactless transactions, and also designed to be easily transported due to its rechargeable battery.

Perfect for Pay at the Table!

Intended to provide cardholders with the ability to pay from anywhere within a business, the Smart Terminal is the ideal solution for processing transactions (and tips) tableside. Other benefits for this service include:

- 8 hour battery life on a single charge.

- Customer screen displays for PIN, Signature, tips, and receipts (via paper/email/text).

- Cardholders have the ability to complete transactions quicker, increasing profitability.

- Enhances the customer service experience.

Available for Retail and Restaurant customers only.

Posted in Best Practices for Merchants Tagged with: cardholders, customers, nfc, payments, POS, terminal, transactions

With smartphone users on the rise

With smartphone users on the rise  Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.