October 26th, 2015 by Elma Jane

End Of Life (EOL) terminals are terminals that are no longer produced by the manufacturer, but are still commonly in use today, some of these terminals may be considered obsolete.

If you’re a merchant having trouble with your Hypercom/Equinox 4200 series terminals and they have stopped working or you’re receiving an error message such as Security Error please call your service provider to discuss available options. This is an industry-wide outage that potentially affects all Hypercom/Equinox users.

Now’s a great time to upgrade If you haven’t already, you will need to adopt point-of-sale devices with NFC/contactless readers where you can accept Apple Pay, Android Pay and other contactless device in your business. National Transaction Terminals are EMV/NFC/Contactless readers capable! Give us a call now! at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: Android Pay, Apple Pay, contactless readers, EMV, Equinox, hypercom, merchant, nfc, point of sale, terminal

October 22nd, 2015 by Elma Jane

Adoption of EMV technology in the U.S is important, because it provides protection against losses from counterfeit cards.

EMV, or chip cards, are the standard for secure point-of-sale (POS) transactions. Unlike magnetic stripe cards, chip cards are very difficult to counterfeit because of an embedded microchip that exchanges unique, dynamic data with a terminal each time it’s used.

To encourage the timely adoption of EMV, the leading payment networks have implemented an EMV Fraud Liability Shift that began in October 2015.

Both parties, card issuer and the merchant need to invest with EMV technology. If only one party has adopted EMV technology, the party that didn’t make the investment will be held liable.

For the card issuer, they came out with the chip cards, where all credit and debit cards have this security chips that are harder to counterfeit than magnetic strips.

For the merchant, an EMV capable terminals or POS hardware that can take advantage of the card’s security chip is needed.

With any new technology, there is a learning curve, and here are the things that you need to know.

For cardholders – with a chip card instead of swiping your card, you are going to do what is called card dipping; by inserting your card face-up and chip-first into the terminal slot. Wait and follow the terminal prompts, and only remove your card once the transaction is complete.

If you did a swipe on a chip card, an EMV-enabled terminal should prompt you to insert the card instead. If the terminal is not enabled for chip, you can still be able to swipe your card.

Employees will benefit from training – Once a merchant enables their EMV terminals, it is important to train your staff with talking points about why chip cards benefit consumers with greater security, and how they are used by helping customers with the new checkout process.

New mobile payment methods leverage both EMV and NFC, so the industry is now seeing greater interest in mobile payments among merchants and consumers.

There’s a lot of resources out there to help businesses make the transition with this EMV technology.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: card issuer, chip cards, debit cards, EMV, magnetic stripe, merchants, microchip, Mobile Payments, nfc, payment networks, point of sale, POS, terminal slot

October 8th, 2015 by Elma Jane

Rules have changed in regards to swiping credit cards October 1st, 2015 with the EMV Liability Shift; which may not cause much concern for most consumers, but for merchants.

EMV compliance isn’t a legal requirement. However, if you’re a merchant that accepts credit cards in-person, then you need to find out whether you’re meeting the EMV Standard. The new rule for the liability shift applies October 1st, regardless of the size or type of business.

What Is EMV Standard?

EMV stands for EuroPay, MasterCard, and Visa, the three companies that originally created the standard.

The EMV Shift is to provide enhanced security and prevent fraudulent activity with credit cards. Updated equipment is also necessary for processing the new computerized cards, and unfortunately, the responsibility of securing up-to-date hardware falls on the merchant.

Since card evolves more instead of cash in our society, fraud and data breaches is on the increase, and now a common occurrence. Adapting new technology is therefore necessary. A hassle for many merchants, but there are actually benefits from all parties involved in a credit card transaction.

Data shows that fraud decreases dramatically when EMV Standards are implemented In Europe. The region has experienced an 80% reduction in credit card fraud, while the USA has seen a 47% increase by NOT implementing EMV standards.

The new liability rules took effect on October 1st in the US, and any party that has not yet implemented EMV-compliant machines might now be liable for fraud committed with counterfeit chip cards. Note that this liability shift only applies to in-person transactions. Phone order and web order transactions will be dealt with as they always were.

For Merchants, it means you’ll eventually need to get new equipment for processing credit cards payments in-person (unless you’ve already done so not too long ago, as nearly all POS terminals sold in the USA nowadays are EMV compliant). For most business owners, it’s a good idea to implement the new system sooner rather than later.

Step to take as a Merchant Until you get your EMV equipment

- Ask for an official ID from customers whose credit card you process.

- Conduct some research to see which EMV system would be best for your business.

- Start shopping around for new payment processing options that are EMV compliant.

If you already have a machine that can process chip cards, you’re fully EMV-compliant.

If you don’t accept any in-person payments, then you’re all set.

If you do accept in-person payments and you do not have a chip card machine, chances are you’ll be fine for a little while. But those of you with a high risk of encountering a fake card (if you are a high-volume business with a large average ticket, for instance) should probably upgrade soon.

Fraudsters are going to be taking advantage of businesses that haven’t upgraded so it’s a great time to switch!

Check out NTC’s EMV/NFC Capable Terminal!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: chip cards, credit card transaction, credit cards, credit cards payments, EMV, EMV equipment, EuroPay, high risk, MasterCard, merchants, nfc, payment processing, POS terminals, visa

October 6th, 2015 by Elma Jane

If you accept credit cards and don’t know what EMV is here is what you need to know.

EMV stands for Europay, MasterCard and Visa. A credit card that had a chip embedded in it is an EMV. EMV Cards have been standard in Europe for more than 10 years because they’re more secure than magnetic stripe cards. Magnetic stripe cards doesn’t change, it has static data, which makes them easy to clone. The chip embedded card makes it more difficult and costly to counterfeit because the data that is transmitted changes each time the card is read. This means less fraud.

Liability Shift rules set by Visa and MasterCard as of October 1st. The liability for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards.

- Calculate your risk – Consider the cost of replacing your point-of-sale (POS) terminal vs. potential risk. Whether you replace it now or at a later time, eventually all businesses will have to replace their POS terminals.

- Educate your staff – Educated employees translate to better-educated customers. Merchants can help customers better understand this change and what it means for them.

- Upgrade your POS system – Consider using an EMV compliant credit-card reader on a wireless device for an ultra-secure mobile solution. This is also a chance to upgrade other options, such as near field communication NFC technology, which lets consumers use their mobile devices to make payments at the point of sale.

National Transaction Terminals with EMV and NFC (near field communication) Capability To accept Apple Pay, Android Pay and other NFC Transactions at your business. You will need to adopt point-of-sale devices with NFC/contactless readers.

National Transaction offer a range of options to suite your specific needs.

If you’re using Virtual Merchant Mobile now called Converge please contact our office at 888-996-2273 to know your options.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: Android Pay, Apple Pay, chip cards, contactless readers, Converge, credit cards, EMV, EuroPay, magnetic stripe, MasterCard, merchants, Near Field Communication, nfc, payments, POS, terminal, Virtual Merchant Mobile, visa

September 29th, 2015 by Elma Jane

There are three contenders competing for dominance in mobile payments.

NFC – or near-field communication, is a contactless data transfer system similar to RFID. When two NFC-enabled devices come into range, you can transfer data from one to the other (such as bringing a phone in range of a credit card terminal).

NFC is found in a lot of phones, especially the flagship devices from Samsung, LG, and Sony. Apple finally jumped into the NFC game in 2014, and Google relaunched its mobile payments service as Android Pay in 2015. Samsung also launched its own app, aptly named Samsung Pay, in 2015.

NFC is a safe method for payments. Sensitive data is stored in a secure element, either built into the SIM card of a phone or placed in a separate chip. In most cases, retailers never actually see your card or bank account data.

QR Codes – or quick-response codes, have the sort of ubiquity that NFC lacks. They work a bit like your standard bar codes, except that instead of relying on one-dimensional analog scanning, they are digital. That means that with a QR code reader app, your smartphone’s camera can be temporarily converted into a scanner. QR codes can embed way more information than your standard bar codes, which gives them the power to do things like open mobile sites, direct you to YouTube Videos, and even enable you to complete mobile payments.

iBeacon – is an Apple-developed technology that uses Bluetooth Low-Energy (BLE, or sometimes also called Bluetooth Smart). Unlike the other two types of technology, it’s really still in the developmental stages. While it can be used for mobile payments, at the moment the biggest application for iBeacon is actually as proximity alert or geo-fence that can go where GPS doesn’t.

It works like this: iBeacon units are set up throughout a building (such as a department store). When someone with an iBeacon-enabled device comes into range of those beacons, they transmit information. Some of the ways this technology could be used would be to transmit mobile coupons or other special offers, to guide customers throughout the store by department, or even to help them find specific items on a shopping list.

NFC devices need to be within 8 inches (though 2 inches is really most effective). iBeacons, on the other hand, have a range of 50 meters, or about 165 feet.

For payments, iBeacons would work nearly the same as NFC: the phone would wirelessly transmit payment information to the terminal or beacon via Bluetooth.

It’s also worth noting that while iBeacons are Apple technology, they are not exclusive to iOS devices. The phone just needs to have Bluetooth Smart and the appropriate app.

Samsung announced its own version of the iBeacon, called Proximity, at its 2014 developer conference in November. it works the same way as iBeacons, but rather than going through an app, Proximity works directly with the phone’s hardware.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: Android Pay, Apple, bank, card, credit card terminal, google, iBeacon, LG, Mobile Payments, Near Field Communication, nfc, payments, qr codes, Samsung, Samsung Pay, Sony

September 25th, 2015 by Elma Jane

National Transaction Terminals with NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC payment transactions at your business. You will need to adopt point-of-sale devices with NFC/Contactless readers.

National Transaction offer a range of options to suite your specific needs.

Give us a call now! 1-888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Android Pay, Apple Pay, contactless readers, Near Field Communication, nfc, payment, point of sale

September 24th, 2015 by Elma Jane

If you accept credit cards and don’t know what EMV is here is what you need to know.

EMV stands for Europay, MasterCard and Visa. A credit card that had a chip embedded in it is an EMV. EMV Cards have been standard in Europe for more than 10 years because they’re more secure than magnetic stripe cards. Magnetic stripe cards doesn’t change, it has static data, which makes them easy to clone. The chip embedded card makes it more difficult and costly to counterfeit because the data that is transmitted changes each time the card is read. This means less fraud.

Questions to ask to help you decide about terminal upgrade.

- Calculate your risk – Consider the cost of replacing your point-of-sale (POS) terminal vs. potential risk. Whether you replace it now or at a later time, eventually all businesses will have to replace their POS terminals.

- Educate your staff – Educated employees translate to better-educated customers. Merchants can help customers better understand this change and what it means for them.

- Upgrade your POS system – Consider using an EMV compliant credit-card reader on a wireless device for an ultra-secure mobile solution. This is also a chance to upgrade other options, such as near field communication NFC technology, which lets consumers use their mobile devices to make payments at the point of sale.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: chip, credit card reader, credit cards, data, EMV, emv cards, EuroPay, magnetic stripe cards, MasterCard, merchants, Mobile Devices, Near Field Communication, nfc, payments, point of sale, POS terminal, visa

September 22nd, 2015 by Elma Jane

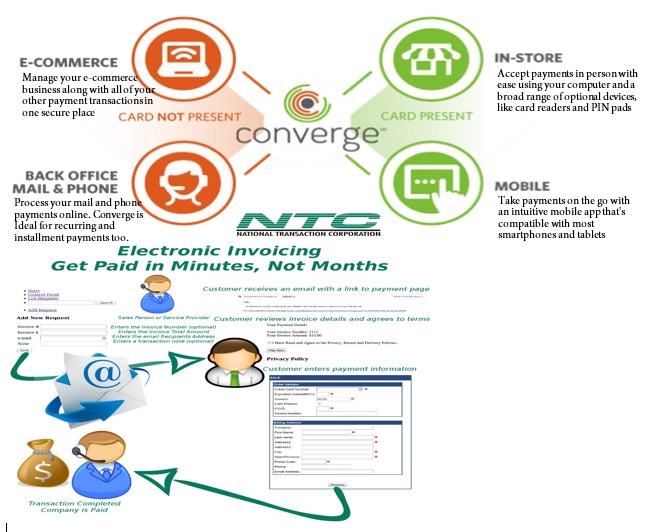

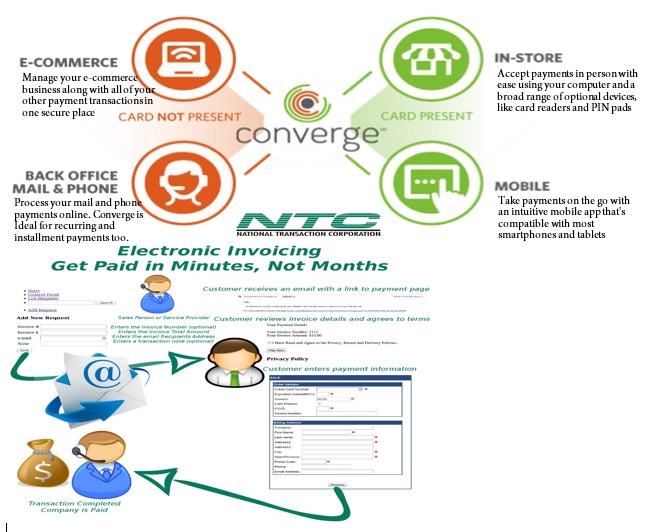

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

September 11th, 2015 by Elma Jane

National Transaction Terminals with NFC (near field communication) Capability

To accept Apple Pay transactions at your business, you will need to adopt point-of-sale devices with NFC/contactless readers.

National Transaction offer a range of options to suite your specific needs:

Tablet solutions: Talech with iCMP device and NCR Silver.

Short-range wireless terminals for pay at the table: Bring the point-of-sale to your customers. Ideal for table-service restaurants, curbside pick-up, salons and more.

These terminals are all-in-one solutions with an integrated PIN Pad and printer. The short range terminals use secure, encrypted Bluetooth technology, allowing only the base and terminal to talk to each other, while also monitoring channels to prevent interference from other devices.

The Bluetooth terminals we offer are: VeriFone VX680B and Ingenico iWL220B. (Both Bluetooth Wireless)

Long-range wireless (cellular/mobile) terminals: Have a long-life battery and compact design, which allows you to process transactions anywhere your customers are ideal for deliveries, kiosks and more.

These terminals are all-in-one solutions with an integrated PIN Pad and printer. Phone lines and internet connections are not required to take advantage of our mobile payment solutions.

The GPRS wireless terminals we offer are: VeriFone VX680G and Ingenico iWL250G. (Both GPRS Wireless)

Countertop terminals:

Ingenico iCT250 – has a “magic box” cable management system that prevents cable tangle and clutter. The terminal boasts a color display for improved readability and ease of use.

Verifone VX520 – has a built-in secure software authentication process which prevents unauthorized software applications from being downloaded.

Ingenico iCT220 with iPP320 external PIN pad – has a “magic box” cable management system that prevents cable tangle and clutter, along with a black and white screen for crisp visual clarity. Combine with an iPP320 for a consumer- facing solution to support contactless payments. (Note: the iCT220 device only supports contactless transactions when connected to this external PIN pad).

Whether you need a stand-alone POS terminal, want to take advantage of your existing tablet or PC, or require a wireless or mobile solution, National Transaction Corp., offers numerous user-friendly options. No matter how your customer wants to pay, NTC will help you enable quick and easy transactions from Traditional credit and debit cards, gift cards, smart cards (or EMV), mobile or digital wallets like Apple Pay and eCommerce or MOTO transactions.

Start growing your business quickly by accepting all kinds of credit card payments and debit cards. Choose a state-of-the-art solution so you can accept payment in store or on your mobile device. With transparent pricing, live customer support, no cancellation fees and a secure platform, you’ll be confident you made the right partner for your business with National Transaction Corp.

Learn how easy it can be to accept any contactless or Apple Pay transactions.

Click here for more information about Apple Pay.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Apple Pay transactions, contactless readers, Countertop terminals, credit card, debit cards, Digital wallets, ecommerce, Gift Cards, mobile payment, moto, Near Field Communication, nfc, PIN pad, point of sale, POS terminal, smart cards, wireless terminals

August 18th, 2015 by Elma Jane

NFC stands for near-field communication, it allows two devices to share data.

You’ve likely used it already, even if you haven’t realized it. It’s embedded in computer cards, print ads, smart cards and it is featured in many Android phones, Windows phones and the new iPhone.

NFC works in two ways:

The first is two-way communication, where two devices can read and write each other – like transferring contacts or photos from one device to another. The second is one-way communication where a device can read and write to an NFC chip – similar to using an NFC enabled card to pay for something using an NFC terminal.

Sure there are other technologies, like Bluetooth, that can do things similar to NFC, but NFC uses less power and is better for your smartphone’s battery life. NFC is also less complicated to use than Bluetooth and doesn’t need to be paired with anything.

NFC is extremely secure. Intercepting payment information from an NFC device is very difficult because of how the process works. To use NFC for payments, the payment application is first launched on a phone that is then tapped on a terminal. The customer then enters a code or scans a fingerprint to approve the transaction. A secure element (SE) then authorizes the payment and sends the information to the NFC modem. The payment is then processed like a credit card swipe.

NFC is likely to continue to grow in popularity in the mobile payments space, to learn more about NFC payments and how you can prepare your business with National Transaction Corporation, visit www.nationaltransaction.com or give us a call at 1-888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: credit card, Mobile Payments, Near Field Communication, nfc, NFC payments, payments, swipe, terminal