July 30th, 2015 by Elma Jane

Converge Powers Potential

Over the next several weeks, we’ll focus on a series of topics to hopefully provide a better understanding of the payment capabilities

Converge can bring you customers. In this article, we’ll zoom in on the card-present product enhancements of Converge first, including bringing EMV and mobile wallet capabilities to in-person payments, and ultimately VirtualMerchant Mobile later this year.

New Peripherals Added to Converge – Ingenico iSC250 and Star Micronics TSP650II Printer

Ingenico iSC250 Signature-Capture PIN Pad – is a signature-capture PIN pad offering the ability to accept PIN-based transactions, like debit card and Electronic Benefit Transfer (EBT), as well as EMV chip card and mobile wallet payments.

The iSC250 will initially ship EMV-capable meaning it’s physically configured with a slot to accept an EMV chip card, but it does not yet have the EMV application to process a chip card transaction.

A simple download process later in the year will allow customers to accept chip cards. The good news is customers can accept NFC contactless payments right away, including Apple Pay and Google Wallet.

Key features of the Ingenico iSC250 include:

- EMV-capable smart card reader to support EMV chip cards; EMV-enabled with a download later in the year

- NFC-enabled for contactless cards and Apple Pay and Google Wallet mobile wallets

- Magnetic stripe capture for all standard mag stripe cards

- Encryption technology to help secure cardholder data at point of entry and throughout the payment network

- Signature Area Display for signature capture with electronic stylus

- Bright color 4.3″ display and backlit key pad for ease of use

Star Micronics TSP650III:

In addition to the new iSC250PIN pad, a new USB printer were also added to the lineup of Converge supported peripherals, the Star Micronics TSP650II receipt printer. Now customers have two options for thermal receipt printing!

ConvergeConnect Makes Device Setup a Snap

A new peripheral and device management software called ConvergeConnect to make it easier for your customers to setup their devices quickly as well as add additional peripherals as their business needs grow. It will be the go-forward device management application, and we’ll be able to bring more and more EMV and NFC devices to market faster, giving our customers even more in-store payment processing options.

Legacy peripherals, like magnetic stripe card readers, check imagers and the Epson ReadyPrint T20 printer will continue to be managed using the Device Assistant.

Customers may have to use both ConvergeConnect and Device Assistant depending on their peripheral configuration.

A new Peripheral Device Installation and Setup Guide was developed to help customers install and manage their peripherals for both applications.

Converge Mobile with EMV on the Horizon

Work continues on the new VirtualMerchant Mobile app to be branded as Converge Mobile, and releasing the Ingenico iCMP in the third quarter. The Ingenico iCMP accepts EMV and NFC transactions, including contactless cards and mobile wallets, like Apple Pay. Stay tuned as more information becomes available.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication Tagged with: card-present product, cardholder, chip card, contactless payments, data, debit card, EBT, Electronic Benefit Transfer, EMV, mag stripe cards, mobile wallet, nfc, NFC transactions, payment network, payments, PIN pad, PIN-based transactions, smart card reader, VirtualMerchant Mobile

July 10th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal. Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: cardholder, cards, chips, EMV, emv cards, EMV terminal, EuroPay, magnetic stripes, MasterCard, merchant, nfc, payment cards, payments, PIN transactions, terminal, visa

July 7th, 2015 by Elma Jane

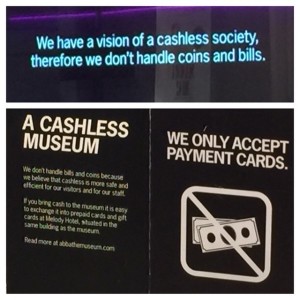

Cashless society is about to happen, hard to believe for some. We are all unable to decide on the edge of a new, cashless world where mobile payments reign supreme. If so, is this a bad thing? For some people yes, because for them change can be scary.

Every revolution needs a good crisis in order to grow its seed. The cashless revolution is the same. Current global financial conditions serves as the potential crisis, and truly the cashless revolution is upon us. Society is on the brink of great economic change, which will likely usher in a new era of worldwide, electronic currencies. The cashless society is coming.

Advances in mobile payment options as evidence of this impending cashless society, consider the practical benefits of mobile payments for the consumer. The most obvious is convenience. Many people prefer to swipe their smartphone atop a scanner to carrying around a stack of cash. Electronic payments are traceable, which is useful for tracking one’s spending and can add a sense of security. Also, carrying around large stacks of cash isn’t always feasible or safe.

Mobile payments also offer interested individuals a way to incorporate social media into their purchases; they can check-in to a site and tell all their friends about an exciting new product they bought, or announce their presence at a new coffee shop, all with that same initial swipe of an NFC-enabled phone. Add to this the many practical benefits of mobile payments as far as business owners are concerned, and it’s easy to see why so the technology is becoming so widespread.

And yet for all the benefits of mobile payments and point of sale technology, the two don’t necessarily exclude cash. Other company focuses on blending cash transactions with POS. This allows technologically savvy businesses to incorporate POS and mobile payment technology into their business, without excluding potential customers who prefer to use cash.

We aren’t necessarily evolving towards a cashless society, but towards a society with a plethora of payment options. POS technology is all about options. Want to pay with a swipe of your credit card? Swipe your credit card. Want to tap your NFC-enabled phone against a console. Tap and go. Want to pull a crisp twenty-dollar bill from your wallet and walk away from the counter with milk and eggs in your hand and a handful of coins jingling in your pocket? Go for it.

The question is: Will we ever become a truly cashless society? Maybe, maybe not, but as mobile payments become increasingly common, cash may very well fall into the retro category.

Posted in Best Practices for Merchants, Mobile Payments, Near Field Communication, Point of Sale Tagged with: credit card, electronic currencies, electronic payments, Mobile Payments, nfc, point of sale, POS, swipe

June 26th, 2015 by Elma Jane

As you can tell from the name, Android Pay playbook is remarkably similar to Apple Pay. Android Pay will use an on-board Near Field Communication (NFC) chip and tokenization services from the major networks to deliver a token from the phone to an NFC-enabled point of sale. Just like Apple Pay. Android Pay is supported by more than 700,000 merchant locations and Android Pay will provide APIs for app developers to take in-app payments from the on-board wallet. Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

While details are barely sufficient, rumor has it Google won’t charge banks a fee as Apple does on the transactions and that’s the difference. Additionally, technical differences in the operating systems underlying the payment system exist, but they won’t affect how every day users experience the system. Android Pay will suffer a slower upgrade path than Apple Pay, due to the lack of hardware support for the newer operating system (it can take Android twice as long to get users upgraded).

There is no war between Apple and google. NFC won the war! We are seeing all of the armies gather together under its flag. As consumers, we love to see better products. When it comes to payments, we need standards and reliability.

With the alignment of the two operating system platforms on NFC, on user experiences like fingerprint unlocking and on both in-app and retail payments, consumers, retailers, and app developers can build an ecosystem we can all understand. Credit cards work great because they are ubiquitous. Everyone can use them everywhere, and every retailer has incentives to be a part of the system.

An NFC-based mobile payments experience will have this same effect. Over the next five years more and more retailers will add NFC-capable terminals. More phones will be fully capable of NFC payments with fingerprint sensors. More consumers will carry those phones.

So if it’s not a war, are there any losers? Companies focused on plastic cards, but not NFC. Transitory technologies like Samsung Pay’s MST (magnetic secure transmission) also have a strong transition period as they enable payments at non-NFC enabled terminals. MST (magnetic secure transmission) is a strong player because the user experience is very similar (hold a phone to a reader), even if the technical method is not the same.

Posted in Best Practices for Merchants, Near Field Communication Tagged with: banks, chip, credit cards, merchant, Mobile Payments, Near Field Communication, nfc, NFC payments, NFC-capable terminals, NFC-enabled, payment system, payments, point of sale, tokenization

June 18th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal.

Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

By accepting chip cards EMV terminal, you help protect your business from card present fraud liability and prepare your business for the future of payment application technology. If your business accepts and processes a counterfeit card transaction on a non-EMV terminal, the liability for that fraudulent transaction is yours, not incurred by the card issuers.

How do you process an EMV chip card transaction?

- Insert Card. Instead of swiping, the customer will insert the card into the terminal, chip first, face up.

- Leave the Card in the Terminal. The card must remain in the terminal during the entire transaction.

- The Receipt or Enter a PIN. As prompted, the customer will sign the receipt or enter their PIN to complete the transaction.

- Remove Your Card. When the purchase is complete, remind the customer to take the card with them.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: cardholder, cards, chips cards, contactless payment, EMV, emv chip cards, EMV terminal, EuroPay, magnetic stripe cards, MasterCard, merchant, nfc, payment cards, payments, visa

February 27th, 2015 by Elma Jane

Here are the Frequently Asked Questions:

You’re probably finding yourself staring at your old credit card machine and worrying about the cost of buying a new machine. The transition doesn’t have to be an expensive one, but it pays to be educated as you consider this important upgrade.

Things you need to know in the form of a brief FAQ.

Where To Buy an EMV Credit Card Terminal?

All the same places you can buy or rent a non-EMV terminal, for the most part. The vast majority of the time supported EMV machines can be reprogrammed just like their non-EMV predecessors. While credit card terminal tampering has occurred in the past, it is not common and is even less easily achieved with new EMV terminals.Terminals have built-in anti-tampering features to prevent this. Your provider is free to either charge a reprograming fee, or simply refuse to reprogram outside machines. While they can reprogram, there’s no law saying that they have to.

Is It A Must to Have an EMV-Compliant Machine?

NO BUT THERE IS RISK. NFC (Near Field Communication) is the technology used by digital wallets for contactless payments. NFC EMV terminals can be considerably more expensive than standard EMV terminals. You can buy a separate NFC reader without replacing your existing EMV terminal.

Does an EMV Chip Card Reader Cost Much?

NOT VERY MUCH! These terminals are really not more expensive that the old terminals. You can find them as cheap, especially if it’s refurbished. There’s no reason to sign on to an expensive non-cancellable lease. If you’d rather rent than own, at least look for inexpensive rental options. If you want a wireless terminal or an NFC-capable terminal, the prices will be a little bit higher. But for baseline EMV-compatible chip card readers, it’s a pretty minor investment even for a very small business.

Does EMV Terminal Upgrade Really Needed?

Technically? No, but it would be like buying a new computer and not getting a virus protection program. Worse because you have financial data on. Your CUSTOMER! Practically? You should!

If you stick with your old non-chip credit card terminal, you will still be able to run transactions. All chip cards are also equipped with the same magnetic stripe used previously, so you can still swipe them. The difference is that if one of those chip cards that you swipe is used fraudulently, you will now be liable. The rationale behind this is that if you had upgraded your terminal, the fraud could have been prevented. Therefore you are held accountable. You might be tempted to think that your small businesses is unlikely to be a victim of such fraud because it hasn’t happened in the past. But consider that all of the big retailers will be upgrading to the EMV terminals, which is likely to drive fraudsters to more vulnerable outlets (ie, small businesses). So I don’t want to be a fear-mongerer but for the fairly small business expense of a terminal upgrade you get a lot of fraud protection. If it prevents just one instance of fraud in the years to come, it has likely paid for itself many times over.

For most merchants, it’s not that expensive or difficult to switch over to EMV equipment and the insurance that the switch will provide you with is well worth the effort. So start thinking about it, and don’t wait until the last minute. The last month before the liability shift occurs in the US, equipment providers will be backed up with orders, making the transition less smooth. So there’s no time like the present to start looking into chip card machines. It might even be a good time to think about switching providers.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: chip card readers, chip cards, contactless payments, credit card machine, credit card terminal, credit-card, Digital wallets, EMV, EMV compliant, EMV machines, EMV terminal, magnetic stripe, Merchant's, Near Field Communication, nfc, NFC reader, NFC-capable terminal, wireless terminal

September 17th, 2014 by Elma Jane

Host Card Emulation (HCE) offers virtual payment card issuers the promise of removing dependencies on secure element issuers such as mobile network operators (MNOs). HCE allows issuers to run the payment application in the operating system (OS) environment of the smart phone, so the issuing bank does not depend on a secure element issuer. This means lower barriers to entry and potentially a boost to the NFC ecosystem in general. The issuer will have to deal with the absence of a hardware secure element, since the OS environment itself cannot offer equivalent security. The issuer must mitigate risk using software based techniques, to reduce the risk of an attack. Considering that the risk is based on probability of an attack times the impact of an attack, mitigation measures will generally be geared towards minimizing either one of those.

To reduce the probability of an attack, various software based methods are available. The most obvious one in this category is to move part of the hardware secure element’s functionality from the device to the cloud (thus creating a cloud based secure element). This effectively means that valuable assets are not stored in the easily accessible device, but in the cloud. Secondly, user and hardware verification methods can be implemented. The mobile application itself can be secured with software based technologies.

Should an attack occur, several approaches exist for mitigating the Impact of such an attack. On an application level, it is straightforward to impose transaction constraints (allowing low value and/or a limited number of transactions per timeframe, geographical limitations). But the most characteristic risk mitigation method associated with HCE is to devaluate the assets that are contained by the mobile app, that is to tokenize such assets. Tokenization is based on replacing valuable assets with something that has no value to an attacker, and for which the relation to the valuable asset is established only in the cloud. Since the token itself has no value to the attacker it may be stored in the mobile app. The principle of tokenization is leveraged in the cloud based payments specifications which are (or will soon be) issued by the different card schemes such as Visa and MasterCard.

HCE gives the issuer complete autonomy in defining and implementing the payment application and required risk mitigations (of course within the boundaries set by the schemes). However, the hardware based security approach allowed for a strict separation between the issuance of the mobile payment application on one hand and the transactions performed with that application on the other hand. For the technology and operations related to the issuance, a bank had the option of outsourcing it to a third party (a Trusted Service Manager). From the payment transaction processing perspective, there would be negligible impact and it would practically be business as usual for the bank.

This is quite different for HCE-based approaches. As a consequence of tokenization, the issuance and transaction domains become entangled. The platform involved in generating the tokens, which constitute payment credentials and are therefore related to the issuance domain, is also involved in the transaction authorization.

HCE is offering autonomy to the banks because it brings independence of secure element issuers. But this comes at a cost, namely the full insourcing of all related technologies and systems. Outsourcing becomes less of an option, largely due to the entanglement of the issuance and transaction validation processes, as a result of tokenization.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication, Visa MasterCard American Express Tagged with: (MNOs), (OS), assets, bank, card, card issuers, cloud, cloud based payments, cloud based secure element, cloud-based, hardware secure element, Host Card Emulation (HCE), issuing bank, MasterCard, mobile, mobile app, mobile application, mobile network operators, mobile payment, mobile payment application, nfc, operating system, payment application, payment transaction, payments, platform, risk, secure element, smart phone, software, software based technologies, token, tokenization, transaction, virtual payment, visa

September 2nd, 2014 by Elma Jane

While Apple doesn’t talk about future products,latest report that the next iPhone would include mobile-payment capabilities powered by a short-distance wireless technology called near-field communication or NFC. Apple is hosting an event on September 9th, that’s widely expected to be the debut of the next iPhone or iPhones. Mobile payments, or the notion that you can pay for goods and services at the checkout with your smartphone, may finally break into the mainstream if Apple and the iPhone 6 get involved.

Apple’s embrace of mobile payments would represent a watershed moment for how people pay at drugstores, supermarkets or for cabs. The technology and capability to pay with a tap of your mobile device has been around for years, you can tap an NFC-enabled Samsung Galaxy S5 or NFC-enabled credit card at point-of-sale terminals found at many Walgreen drugstores, but awareness and usage remain low. Apple has again the opportunity to transform, disrupt and reshape an entire business sector. It is hard to overestimate what impact Apple could have if it really wants to play in the payments market.

Apple won’t be the first to enter the mobile-payments arena. Google introduced its Google Wallet service in May 2011. The wireless carriers formed their joint venture with the intent to create a platform for mobile payments. Apple tends to stay away from new technologies until it has had a chance to smooth out the kinks. It was two years behind some smartphones in offering an iPhone that could tap into the faster LTE wireless network. NFC was rumored to be included in at least the last two iPhones and could finally make its appearance in the iPhone 6. The technology will be the linchpin to enabling transactions at the checkout.

Struggles

The notion of turning smartphones into true digital wallets including the ability to pay at the register, has been hyped up for years. But so far, it’s been more promise than results. There have been many technical hurdles to making mobile devices an alternative to cash, checks, and credit cards. NFC technology has to be included in both the smartphone and the point-of-sale terminal to work, and it’s been a slow process getting NFC chips into more equipment. NFC has largely been relegated to a feature found on higher-end smartphones such as the Galaxy S5 or the Nexus 5. There’s also confusion on both sides, the merchant and the customer, on how the tech works and why tapping your smartphone on a checkout machine is any faster, better or easier than swiping a card. There’s a chicken-and-egg problem between lack of user adoption and lack of retailer adoption. It’s one reason why even powerhouses such as Google have struggled. Despite a splashy launch of its digital wallet and payment service more than three years ago, Google hasn’t won mainstream acceptance or even awareness for its mobile wallet. Google hasn’t said how many people are using Google Wallet, but a look at its page on the Google Play store lists more than 47,000 reviews giving it an average of a four-star rating.

The Puzzle

Apple has quietly built the foundation to its mobile-payment service in Passbook, an app introduced two years ago in its iOS software and released as a feature with the iPhone 4S. Passbook has so far served as a repository for airline tickets, membership cards, and credit card statements. While it started out with just a handful of compatible apps, Passbook works with apps from Delta, Starbucks, Fandango, The Home Depot, and more. But it could potentially be more powerful. Apple’s already made great inroads with Passbook, it could totally crack open the mobile payments space in the US. Apple could make up a fifth of the share of the mobile-payment transactions in a short few months after the launch. The company also has the credit or debit card information for virtually all of its customers thanks to its iTunes service, so it doesn’t have to go the extra step of asking people to sign up for a new service. That takes away one of the biggest hurdles to adoption. The last piece of the mobile-payments puzzle with the iPhone is the fingerprint recognition sensor Apple added into last year’s iPhone 5S. That sensor will almost certainly make its way to the upcoming iPhone 6. The fingerprint sensor, which Apple obtained through its acquisition of Authentic in 2012, could serve as a quick and secure way of verifying purchases, not just through online purchases, but large transactions made at big-box retailers such as Best Buy. Today, you can use the fingerprint sensor to quickly buy content from Apple’s iTunes, App and iBooks stores.

The bigger win for Apple is the services and features it could add on to a simple transaction, if it’s successful in raising the awareness of a form of payment that has been quietly lingering for years. Google had previously seen mobile payments as the optimal location for targeted advertisements and offers. It’s those services and features that ultimately matter in the end, replacing a simple credit card swipe isn’t that big of a deal.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: app, Apple, card, card swipe, cash, checkout machine, checks, chips, credit, credit card swipe, credit-card, customer, debit card, Digital wallets, fingerprint recognition, fingerprint sensor, Galaxy S5, Google Wallet, iOS, Iphone, market, merchant, mobile, mobile device, mobile payment, mobile wallet, Near Field Communication, network, Nexus 5, nfc, payment, payment service, platform, point of sale, products, sensor, services, smartphone, software, statements, swiping card, terminals, transactions, wireless technology

August 8th, 2014 by Elma Jane

Apple talking to Visa about mobile payments

Apple is in talks with Visa as it ponders launching a mobile wallet this autumn. The latest bout of rumours suggest that the ability to make instore payments could finally arrive with the iPhone 6, although the information’s sources offer contradictory takes on the technology, with one saying that the system is likely to be NFC-based and another suggesting that it will rely on Bluetooth and WiFi. The report suggests that Apple will not be going down the host card emulation route, instead making use of the Secure Element, although the famously proprietorial tech titan has no intention of giving up any control to wireless carriers. Apple hopes that working with Visa will also help it bypass the payment processing chain, helping it to lower costs for merchants and customers.

Posted in EMV EuroPay MasterCard Visa, Mobile Payments, Smartphone, Visa MasterCard American Express Tagged with: Apple, bluetooth, customers, host card emulation, instore payments, iPhone 6, Merchant's, mobile wallet, nfc, payment processing, secure element, visa, wifi, wireless carriers

May 29th, 2014 by Elma Jane

A point-of-sale facial recognition system that uses NFC to help combat card fraud has been created during a recent company hack-a-thon, together with a group of engineers and designers from Logic PD. Hackathon was an opportunity for experts to explore the possibilities of useful solutions to today’s challenges, with the recent significant breaches in security at leading retailers, the need for this type of solution is particularly meaningful.

The solution, is a multi-modal security platform for card purchases, uses NFC authentication combined with camera imaging to protect users. When users make a mobile payment at the point of sale, the kiosk snaps a picture of the purchaser. This image can be incorporated via the cloud into the user’s digital transactional record, which was stored and distributed via SeeControl in this example, allowing users to identify who made each purchase, and easily identify those that are fraudulent even before banks and financial institutions.

Posted in Credit Card Security, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: banks, breaches, card, card fraud, card purchases, cloud, digital, facial recognition system, financial institutions, mobile payment, nfc, NFC authentication, platform, point of sale, retailers, Security, security platform