December 19th, 2024 by Elma Jane

Surcharges and Convenience Fees:

A surcharge is a fee that is added to a card transaction, either as a set amount or a percentage of a transaction. Typically, used to cover the cost of the merchant account charges.

There are rules, exceptions and state laws to observe to ensure you are compliant.

At present there are surcharge bans in the following states:

California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma and Texas. (Appeals are pending for California and Florida)

Surcharge Rules:

- Applicable only to credit card transactions, not debit or prepaid card transactions.

- The surcharge cannot be greater than the merchant’s average discount rate for that brand’s credit card transactions.

- Maximum surcharge allowed is 4%.

- Cardholder must be notified of the surcharge.

- Surcharge must be listed on the receipt as a line item and the primary payment amount must be processed together as one transaction.

A convenience fee is a fee charged for the “convenience” of being able to pay using an alternative payment channel outside the merchant’s customary payment channel.

Any merchant can charge a convenience fee IF the fee charged is for the legitimate convenience of being able to pay using a different payment channel than the merchant’s usual payment channel.

Example: Your business customary payment channel is face-to-face or card present and you provide an alternative payment channel, such as the option to pay by phone using a credit card, that could then charge a convenience fee along with the payment.

Mail Order/Telephone Order (MOTO) merchants and ecommerce merchants, whose customary payment channel is exclusively non face-to-face or card-not-present, are NOT permitted to charge convenience fees.

Convenience Fee Rules:

- Customer must be notified of the convenience fee prior to finalizing payment and given the opportunity to cancel.

- Payment must take place through an alternative payment channel.

- The fee can only be added to a non face-to-face transaction. Must be flat or fixed, regardless of the value of the payment due.

- The fee must be applied to all means of payment accepted through the alternative payment channel. Must be included in the total transaction amount.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order Tagged with: card-not-present, Convenience Fees, credit card, debit, ecommerce, merchant, moto, payment, prepaid card, Surcharges, transaction

December 18th, 2024 by Elma Jane

What makes your travel merchant account high risk?

Travel environments are unique and transactions are usually keyed in. There’s almost always a delayed delivery period, and large ticket transactions.

One card holder may be paying for multiple tickets and they tend to be seasonal; with peak season months generating an unusual spike in their “average” monthly volume and chargebacks, pose a potential threat by travelers who are unable to complete their trip.

These factors can cause for either a reserve or account termination. Therefore travel merchant accounts are considered high risk.

Most merchants do not realize that merchant processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank. Therefore, a merchant account is an unsecured loan.

The merchant runs a transaction and at the end of the day they settle their batch. The merchant will receive the funds for that batch in their bank account within 2 business days, even though the travel arrangements the client paid for do not take place right away.

Here at National Transaction Corp, we specialize in understanding what makes your transactions as a travel agent unique and how they affect your merchant account.

Educating the merchant and ensuring they have a good understanding of what makes travel merchant account high risk, is one of our specialties.

Call NTC to speak with a Travel Merchant Account Specialist today!

Dial 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, card, chargebacks, financial, loan, merchant, payment, processors, transactions, travel, travel agent, Travel Merchant

September 20th, 2024 by Elma Jane

Merchant Account Risks for Travel Agencies

The travel industry, with its high-value transactions and international clientele, faces unique challenges when it comes to credit card processing. While accepting plastic is crucial for smooth booking and customer convenience, travel agencies must be aware of the inherent risks and implement strategies to mitigate them. Here’s a breakdown of the key credit card processing risks and how to minimize them:

1. Chargebacks:

- The Problem: Travel plans change, flights get delayed, and unforeseen circumstances arise. This can lead to a higher rate of chargebacks, where customers dispute charges with their credit card company. Chargebacks can be costly, involving fees, lost revenue, and potential damage to your merchant account reputation.

- Mitigation:

- Clear Cancellation Policies: Crystal-clear terms and conditions regarding cancellations, refunds, and travel changes are essential. Ensure these are easily accessible during booking.

- Thorough Documentation: Maintain detailed records of all transactions, customer communications, and travel itineraries. This provides evidence in case of a dispute.

- Proactive Communication: Keep customers informed about any changes to their travel plans and address concerns promptly.

- Secure Payment Processing: Utilize 3D Secure (like Verified by Visa or Mastercard SecureCode) for added authentication and fraud prevention.

2. Fraud:

- The Problem: The travel industry is an attractive target for fraudsters due to high transaction values and the potential for anonymity. Fraudulent activities can include using stolen credit card details, booking fictitious trips, or exploiting vulnerabilities in online booking systems.

- Mitigation:

- Address Verification System (AVS): Verify the billing address provided by the customer against the address on file with the credit card company.

- Card Security Code (CVV): Always require the CVV code for card-not-present transactions.

- Fraud Detection Tools: Implement fraud screening tools that analyze transactions for suspicious patterns and flag potentially fraudulent activity.

- PCI DSS Compliance: Adhere to the Payment Card Industry Data Security Standard (PCI DSS) to ensure secure handling of sensitive cardholder data.

3. Currency Fluctuations:

- The Problem: International travel often involves transactions in multiple currencies. Fluctuating exchange rates can impact your profit margins and create uncertainty in pricing.

- Mitigation:

- Dynamic Currency Conversion: Offer customers the option to pay in their home currency, providing transparency and potentially reducing chargebacks related to exchange rate discrepancies.

- Hedging Strategies: Explore financial instruments to mitigate currency risk, such as forward contracts or currency options.

4. High Processing Fees:

- The Problem: Travel agencies often face higher processing fees due to the perceived risk associated with the industry.

- Mitigation:

- Negotiate with Processors: Shop around and compare rates from different credit card processors. Don’t hesitate to negotiate for better terms, especially if you have a high volume of transactions.

- Consider Interchange-Plus Pricing: Opt for transparent pricing models like interchange-plus, which separates the interchange fee (charged by card networks) from the processor’s markup.

5. Technological Challenges:

- The Problem: Keeping up with evolving payment technologies and security standards can be challenging. Outdated systems can increase your vulnerability to fraud and data breaches.

- Mitigation:

- Invest in Secure Technology: Use a robust and secure online booking system that integrates with reputable payment gateways.

- Regular System Updates: Ensure your software and security protocols are regularly updated to address emerging threats.

- Partner with Reliable Providers: Choose payment processors and technology vendors with a strong track record of security and reliability.

By understanding and proactively addressing these credit card processing risks, travel agencies can protect their business, enhance customer trust, and navigate the exciting world of travel with greater financial security.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card-not-present, cardholder, chargeback, credit card, customer, fraud, high-risk merchants, merchant account, merchants, payment, processors, risk, transaction, travel, travel agencies, travel agency, travel agents

September 5th, 2024 by Elma Jane

It’s true that the travel agencies are high risk. This is because of the high chargebacks by travelers who fail to complete their trips or stays due to a variety of reasons. It also has to do with the nature of delayed delivery where items or services are sold today but not used/consumed for a delayed period of time. Using the right merchant solutions can make a difference.

You want merchant solutions that help you to manage chargebacks, errant transactions, and terminal messages. Additionally, you should be able to integrate your software with services such as Sabre Red, Sabre, Trams or other accounting programs such as QuickBooks and Peachtree.

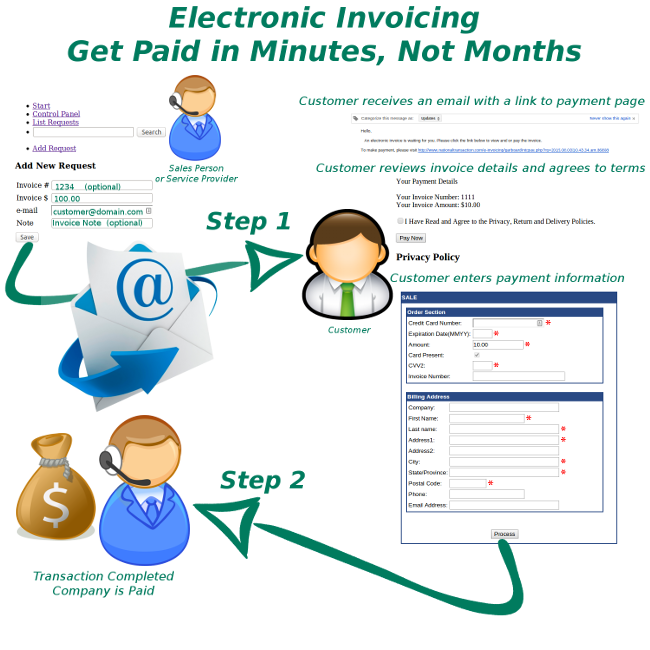

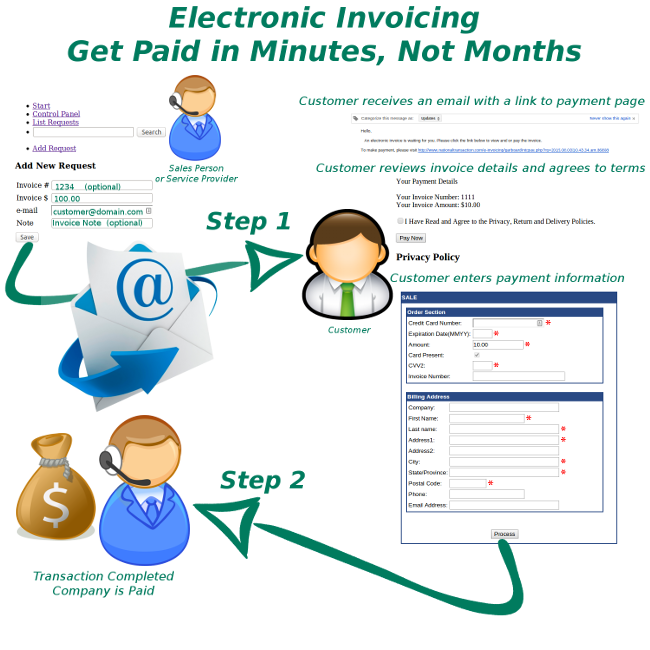

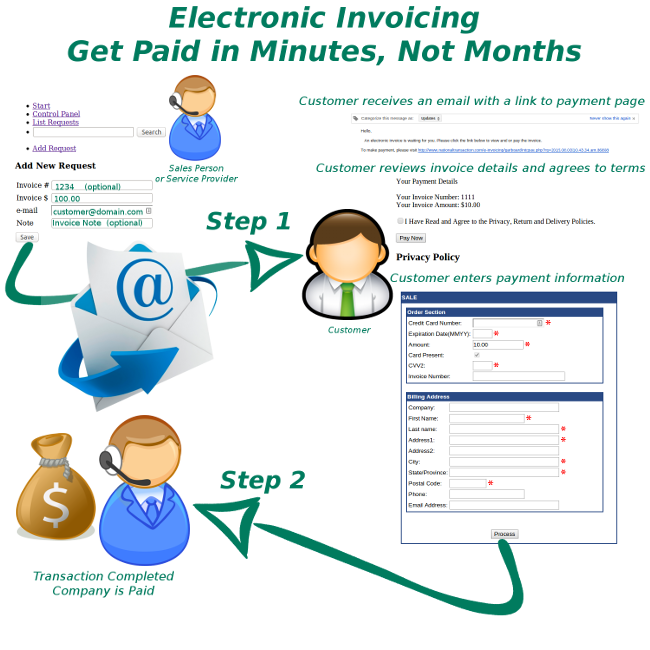

With NTCePay, simply create a pay button for any dollar amount. Then send this digital link to your customers via email. The customer reviews the invoice details and enters their payment information to complete payment. You can also create custom links that can be added to your web site or posted to your social media accounts for payment collection. With advanced invoices, you can easily break down payments into installments.

With this service, you avoid the complexities of integrating the software with your shopping cart, point of sale, or accounting system yet still collect your travel payments in a seamless manner.

For Electronic Payment Set Up Call Now! 888-996-227

Posted in Uncategorized Tagged with: chargebacks, high risk, merchant, payment, point of sale, terminal, transactions, travel

July 24th, 2024 by Elma Jane

In today’s fast-paced digital world, customers expect businesses to offer a variety of payment options. Electronic payment processing has become essential for businesses of all sizes, from small startups to large corporations. This article will provide you with all the information you need to know about electronic payment processing and why National Transaction Corporation is the best choice for your business.

What is Electronic Payment Processing?

Electronic payment processing refers to the electronic transfer of funds from a customer’s account to a business’s account. This can be done through various methods, including credit cards, debit cards, e-checks, and mobile payments. Electronic payment processing is faster, more secure, and more convenient than traditional paper-based methods.

Benefits of Electronic Payment Processing

- Faster Processing Times: Electronic payments are processed much faster than paper checks, which can take several days to clear.

- Improved Security: Electronic payment processing is more secure than traditional methods, as it uses encryption and other security measures to protect sensitive data.

- Increased Convenience: Customers can make payments from anywhere at any time, using their computer, smartphone, or tablet.

- Reduced Costs: Electronic payment processing can save businesses money on processing fees and other costs associated with traditional methods.

- Improved Cash Flow: Businesses can receive payments more quickly, which can improve their cash flow.

Why Choose National Transaction Corporation?

National Transaction Corporation is a leading provider of electronic payment processing solutions. We offer a wide range of services to businesses of all sizes, including:

- Credit and Debit Card Processing: We accept all major credit and debit cards, including Visa, Mastercard, American Express, and Discover.

- E-Check Processing: We offer e-check processing services, which allow customers to make payments directly from their bank account.

- Mobile Payment Processing: We offer mobile payment processing solutions, which allow customers to make payments using their smartphone or tablet.

- Online Payment Processing: We offer online payment processing solutions, which allow businesses to accept payments through their website.

At National Transaction Corporation, we are committed to providing our clients with the best possible service. We offer:

- Competitive Rates: We offer competitive rates on all of our services.

- Reliable Service: We provide reliable service that you can count on.

- Excellent Customer Support: We offer excellent customer support, available 24/7.

- Secure and Compliant Solutions: We are PCI DSS compliant, ensuring the security of your customers’ data.

Make the Switch to Electronic Payment Processing Today

If you’re not already accepting electronic payments, now is the time to make the switch. National Transaction Corporation can help you get started with our easy-to-use and affordable solutions. Contact us today to learn more about how we can help your business grow.

Posted in Best Practices for Merchants Tagged with: e-commerce, electronic payment, payment, recurring, transaction, Travel Agency Payments

July 18th, 2024 by Elma Jane

The way we pay for goods and services has undergone a dramatic transformation. From bartering to coins to paper money, the journey of payment methods has been long and fascinating. But no shift has been as revolutionary as the rise of electronic payments. Let’s dive into this evolution and explore where this exciting technology might lead us next.

Early Days (1950s – 1970s):

- 1950: The Diners Club card emerges as the first multipurpose charge card, laying the foundation for modern credit card systems.

- 1958: American Express launches its charge card, initially paper-based, revolutionizing travel and expense tracking.

- 1966: Barclays Bank in London introduces the first Automated Teller Machine (ATM), allowing customers basic account access outside banking hours.

- 1970s: Electronic Funds Transfer (EFT) systems gain traction, enabling direct deposit of paychecks and automated bill payments.

Rise of Digital Networks (1980s – 1990s):

- 1979: Visa introduces the first electronic authorization system and point-of-sale (POS) terminal, paving the way for real-time transaction processing.

- 1983: Debit cards become more prevalent, allowing consumers to access funds directly from their bank accounts.

- 1994: First Virtual Holdings pioneers the first secure online payment system, marking the dawn of e-commerce.

- Late 1990s: Online banking explodes in popularity, offering customers convenient account management and payment options.

The Internet Age (2000s – Present):

- 1998: PayPal emerges, simplifying online transactions and boosting consumer confidence in online shopping.

- 2003: Mobile payments gain momentum in various countries, driven by the increasing adoption of mobile phones.

- 2010s: Near Field Communication (NFC) technology enables contactless payments, giving rise to mobile wallets like Apple Pay and Google Pay.

- 2020s: Biometric authentication adds another layer of security to electronic payments, using fingerprints and facial recognition. Real-time payment systems gain popularity, allowing for instant fund transfers.

The Future of Electronic Payments:

- Invisible Payments: Imagine a world where payments happen seamlessly in the background. Technology like Amazon Go is already showcasing this, with customers simply walking out of stores with their purchases.

- Cryptocurrency and Blockchain: While still in its early stages, the potential of cryptocurrencies and blockchain technology to disrupt traditional payment systems is enormous. Expect to see more integration and wider acceptance in the coming years.

- AI-Powered Payments: Artificial intelligence will play a crucial role in fraud prevention, personalized payment experiences, and the development of even more innovative payment solutions.

- Increased Financial Inclusion: Electronic payments have the potential to bring banking services to underserved populations, promoting financial inclusion on a global scale.

The evolution of electronic payments is an ongoing journey. As technology continues to advance, we can expect even more exciting developments that will reshape the way we transact and interact with the world around us.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

July 11th, 2024 by Elma Jane

Travel agencies are viewed as high-risk merchants. As such, you need a merchant solution that best suits a travel merchant needs.

You want an account that eliminates the complexities of a typical shopping cart. Ideally, it allows you to request payment from clients without the need of setting up booking engines and carts.

This post is going to guide you on how to use a payment solution NTCePay and other merchant solutions to ensure a seamless operation of your business.

Leveraging the NTC e-Pay Service

Payment solution e-Pay allows you to eliminate the complexities of integrating payment processing into your point-of-sale or an accounting system.

With this payment method, you only need to send a payment request to your customers via email. You don’t need to send invoices via snail mail or fax any forms to your customers. Plus, NTC ePay doesn’t need you to take orders over the phone.

With this service, you can create a “BUY” button for any transaction amount in seconds. You also don’t need a website to you use this service. NTCePay allows you to generate a digital link that you can email to clients.

The service allows you to customize the process to make everything simple for your customers. After the customer pays the specified amount, a receipt is generated, and the amount is sent to your account.

Tomorrow we are going to discuss on how to understand your Travel Merchant Account….So standby to learn more.

For NTCePay Set Up call Now 888-996-2273

Posted in Best Practices for Merchants Tagged with: customers, merchants, payment, transaction, travel, travel agencies

February 25th, 2024 by Admin

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

But what exactly is m-commerce? M-commerce is a hybrid technology that takes web technologies that scale screens to mobile devices like Apple iPads and Android tablets. The commerce end of it comes from shoppers and merchants actually executing payment transactions over mobile devices of some form. Read more of this article »

Posted in Credit Card Security Tagged with: credit card, Digital Wallet, e-commerce, gateway, m-commerce, merchant account, nfc, payment, shopping cart, smartphone, tablet

July 11th, 2023 by Elma Jane

NTC ePay is for any merchant who wants to avoid the complexities of a shopping cart or integration into an accounting system or point-of-sale. When custom pricing becomes an issue, shopping carts, POS systems, and booking engines tend to get immensely complicated.

NTC ePay does away with those complications by allowing merchants to simply email a payment request that can be paid in 2 simple steps.

When you call National Transaction, we pick up the phone ready to assist your business. Our dedication to supporting our merchants is unparalleled, from the point of sale and beyond.

Our commitment to our merchants extends to their interests with NTC Gives.Com, a program designed to give back to a charity of their choice. Call today and let National Transaction Corporation earn your business.

Contact National Transaction Corporation today at 888-996-2273, or visit us online

at www.nationaltransaction.com for more information.

Posted in Best Practices for Merchants Tagged with: merchant, payment, point of sale

September 10th, 2020 by Admin

There are few moments like now where American consumers are collectively open to the idea of new payment methods – especially contactless ones such as mobile wallets. This is good news for businesses since mobile wallets offer a safer payment alternative to credit cards and drastically reduce customer wait times at checkout.

Mobile wallets (such as Apple Pay and PayPal) use authentication, monitoring and data encryption to secure and transmit personal information, and the level of security associated with them has payment card issuers backing their use. This is certainly helping drive consumer adoption, as does convenience.

In fact, global mobile wallet transaction value is estimated to reach nearly $14 trillion by 20201 – and that is a pre-COVID-19 estimate. New estimates are higher and point to further rapid adoption given the current need for touch-free payment options. According to a recently published Visa Back to Business report,* 70 percent of consumers surveyed in June 2020 have used a new shopping or payment method for the first time this year.

A rapid shift has begun and the numbers tell the storySo what is holding back business adoption of mobile wallets? Until recently, it just wasn’t a priority for many small- and medium-size businesses to enable it or educate their employees on its use. The lack of preferential demand didn’t make it a pressing topic. But that is changing. Consider this:

- According to Forbes,2 by 2026, digital natives will be 59 percent of the consumers in the U.S. market.

- Of this, 45 percent will be specifically Millennials and Gen Z, representing the largest purchasing power.

- As Gen Z move into becoming the largest generation cohort, their purchasing power will be $143 billion.

But it’s not just what lies ahead that SMBs should be focused on now.

According to Visa’s Back to Business report, shoppers are now putting COVID-19 safety measures at the top of their shopping lists and they will reward stores that do the same. In fact, if all other factors were equal (price, selection, location), nearly 63 percent of consumers surveyed would switch to a new store that installed contactless payment options, such as mobile wallets.3

What does this mean for you? Now is the time to connect with customers to make sure they are fully contactless capable and have the technology in place to accept many of the most popular mobile wallets.

1Payments Industry Intelligence, “The rise of digital and mobile wallet: Global usage statistics from 2018,” November 25, 2018.

2Forbes, January 2020

3Visa Back to Business report 2020

Posted in Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Uncategorized Tagged with: business, digital payment, digital payments, Digital Wallet, Digital wallets, mobile, mobile commerce, Mobile Devices, mobile payment, Mobile Payments, mobile wallet, mobile wallets, payment, payments

With smartphone users on the rise

With smartphone users on the rise