September 18th, 2017 by Elma Jane

Smart Security for Smart Businesses:

Safe-T for SMB streamlines the PCI process while providing the layered security needed to protect card data

EMV – Fraud protection at the point of sale

EMV chip technology keeps the consumer’s card in their hand. It also helps protect the business from card-present fraud related chargebacks.

Encryption – Protection of payment card data in-transit

Safe-T scrambles cardholder data using advanced encryption technology, so data is protected at the point of entry, and throughout the authorization process.

Tokenization – Token ID protection of stored payment card data

Safe-T returns a token ID or an alias, consisting of a random sequence of numbers to the point-of-sale so the actual card number is never stored. Token IDs can be used for follow up transactions (i.e. recurring payments, voids, etc.).

Reduced PCI – Protection from complex PCI compliance

Maintaining PCI Compliance can be intimidating – second only, perhaps, to completing your taxes. Safe-T eases this process for customers by reducing the number of PCI Self-Assessment questions by more than 60% from 80 questions to 31.

Financial Reimbursement – Financial protection from a card data breach

Recovering from a card data breach can be costly for a small business. Safe-T offers Card Data Breach Reimbursement to financially protect your customer’s business in the event of a card data breach – regardless of the type of card data breach.

For Electronic Payment Set up with this feature call now! 888-996-2273

Posted in Best Practices for Merchants Tagged with: card data, card present, chargebacks, chip, data, data breach, EMV, encryption, fraud, payment, PCI, point of sale, Security, tokenization

August 28th, 2017 by Elma Jane

Megan Fravel and Richard Delos Santos

The Travel Payment Experts!

Premium Corner Booth 67

ASTA Global Convention

San Diego California

August 27-29, 2017

Sheraton San Diego Hotel Marina

Posted in Best Practices for Merchants Tagged with: payment, travel

August 17th, 2017 by Elma Jane

How Do Credit Cards Work?

Paying with a credit card seems like a simple process. You charge the customer, they swipe their card, and then they walk out the door.

But behind the scenes, it’s a bit more complicated.

A credit card payment involves four parties.

- The Merchant

- The Customer

- The Issuing Bank

- The Merchant Services Provider

You know who the Merchant and Customer are – that’s the easy part.

The Issuing Bank is the institution that lends money to the Customer.

When the Customer swipes their card, the Issuing Bank lends them the sale amount. This loan is given with the understanding that the Customer will pay the amount back within 30 days or repay it with interest.

Before the Merchant sees any of that money, it goes through the Merchant Services Provider. In exchange for their credit card processing services, they take out a fee before paying that money to the Merchant.

These fees vary between Merchant Services Providers, but one thing is certain: The Merchant always receives less money than the Customer paid them.

This might seem like a raw deal. However, accepting credit cards can lead to more sales than if you only accept cash.

On our next article we will discuss how to start accepting credit card payments and understanding the processing fees….so stand by for more information about Electronic Payment Processing.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments Tagged with: bank, credit card, customer, electronic payment, loan, merchant, payment

June 27th, 2017 by Elma Jane

E-commerce has been growing, and now the overall market is starting to take notice; thanks to advances in online payment processing and electronic payment technology, as well as the willingness of almost all merchants to accept credit cards online.

E-commerce ecosystem are set to double and will account for a rising share of overall card payments. In addition to increased internet and smartphone penetration; more e-commerce merchants and an increase in the use of digital wallets.

Cardholders globally are becoming more confident in the security of the e-commerce channel, with the expected implementation of 3D-Secure 2.0 and increased use of sophisticated anti-fraud systems in many markets it gives consumer assurance that payment cards are safe to use for e-commerce purchases.

Trends indicate that e-commerce is the wave of the future for shoppers. But digital shopping is just one piece of the broader payments ecosystem.

For Electronic Payment Set Up Call Now! 888-996-2273

Let’s Get Started National Transaction.Com

Posted in Best Practices for Merchants Tagged with: card payments, credit cards, Digital wallets, e-commerce, electronic payment, merchants, online, payment, Security, smartphone

May 31st, 2017 by Elma Jane

If you’re a retail business you’re going to need a credit card terminal to accept credit cards, and if you have multiple locations; you might need more than one terminal.

Obtaining terminals for your business with multiple locations can be expensive. Because of this, some merchants used leasing arrangements which they think that monthly leasing fee might seem like a bargain compared to the cost of buying a terminal.

One provision of the lease is: Non-Cancelable Lease

Leases commonly have a 48-month (four-year) term, and a clause that makes the lease completely non-cancelable.

They also have a purchase option at the end of the lease. You must exercise your option to end the lease.

In a non-cancelable provision, they’ll keep deducting monthly leasing fees from your account regardless of anything, or an immediate payment of all remaining months of your contract if you break your lease.

In addition to monthly leasing fee, you’ll also pay sales tax and a monthly equipment insurance fee; while you can purchase it for as low as $150-$200.

Beware of free terminal offers, other providers will offer a free terminal, but they also charge higher monthly fees if you elect the free terminal. So the terminal isn’t really FREE.

For Electronic Payment Set Up Call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants, Electronic Payments Tagged with: credit card, electronic payment, merchants, payment, terminal

May 11th, 2017 by Elma Jane

Three Domain Secure (3-D Secure)

Visa is announcing a global plan to support 3-D Secure 2.0 to help protect e-commerce transactions.

3-D Secure (3DS) – stands for Three-Domain Secure. A messaging protocol to enable consumers to authenticate themselves with their card issuer when making card-not-present (CNP) e-commerce purchases. 3DS is an additional security layer that will help prevent unauthorized CNP transactions and protects the merchant from CNP exposure to fraud.

The three domains consist of:

The merchant/acquirer domain

Issuer domain

the interoperability domain (payment systems)

The purpose of the 3DS protocol within the payments community is to facilitate the exchange of data between the merchant, cardholder and card issuer. The objective is to benefit each of these parties by providing the ability to authenticate cardholders during a CNP e-commerce purchase, reducing fraud.

Visa currently offers its 3-D Secure service through the Verified by Visa program, which supports the existing 3-D Secure 1.0 specifications for consumer authentication.

Visa anticipates that early adoption of 3-D Secure 2.0 will begin in the second half of 2017.

Merchants that authenticate transactions using 3-D Secure are generally protected from issuer card-not-present fraud-related chargeback claims,1 and this rule will extend to merchant-attempted 3-D Secure 2.0 transactions after 12 April 2019, the global program activation date.

For Electronic Payment Set Up go to NationalTransaction.Com or call now 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card, card-not-present, cnp, data, e-commerce, electronic payment, merchant, payment, Security, transactions

April 10th, 2017 by Elma Jane

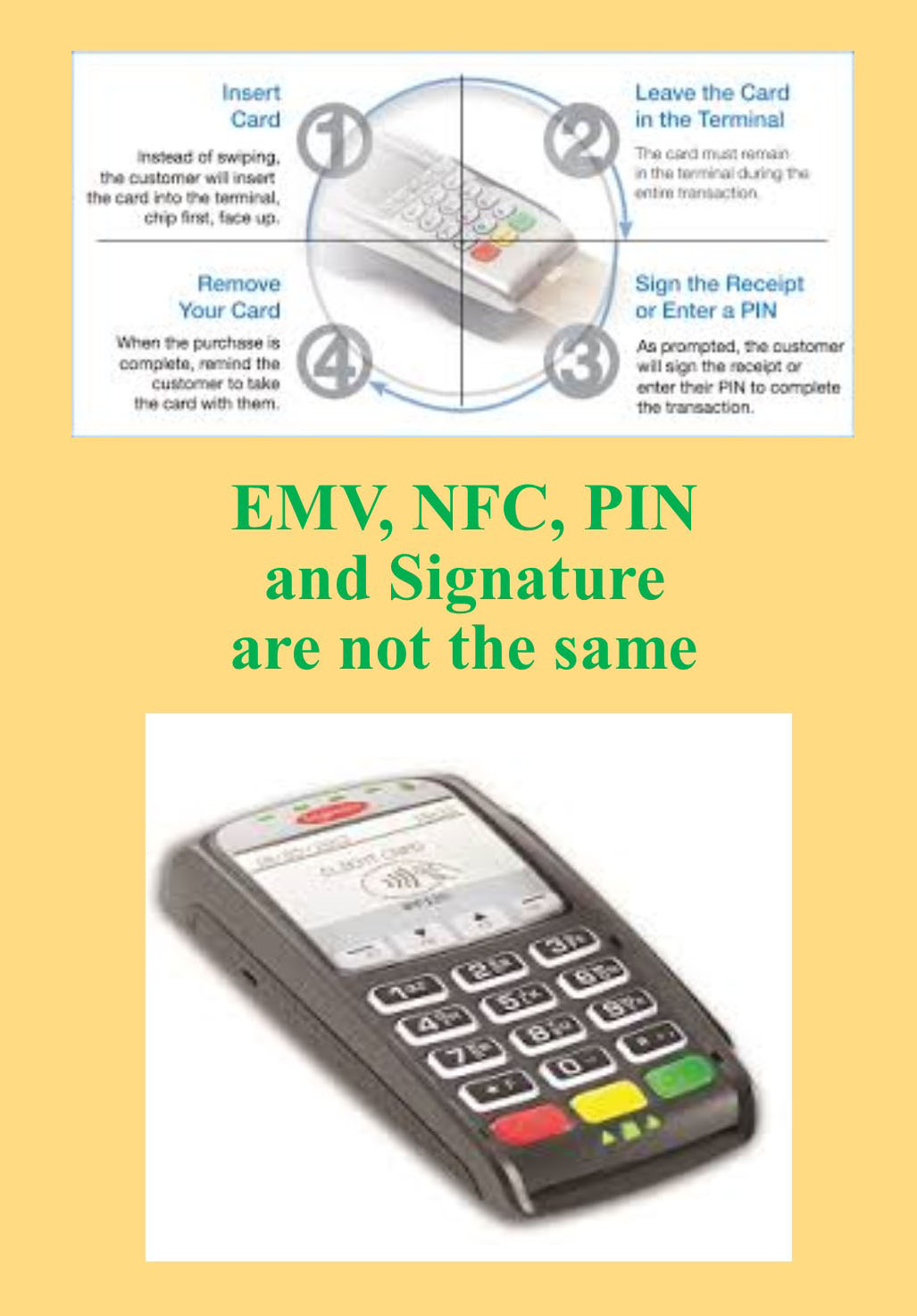

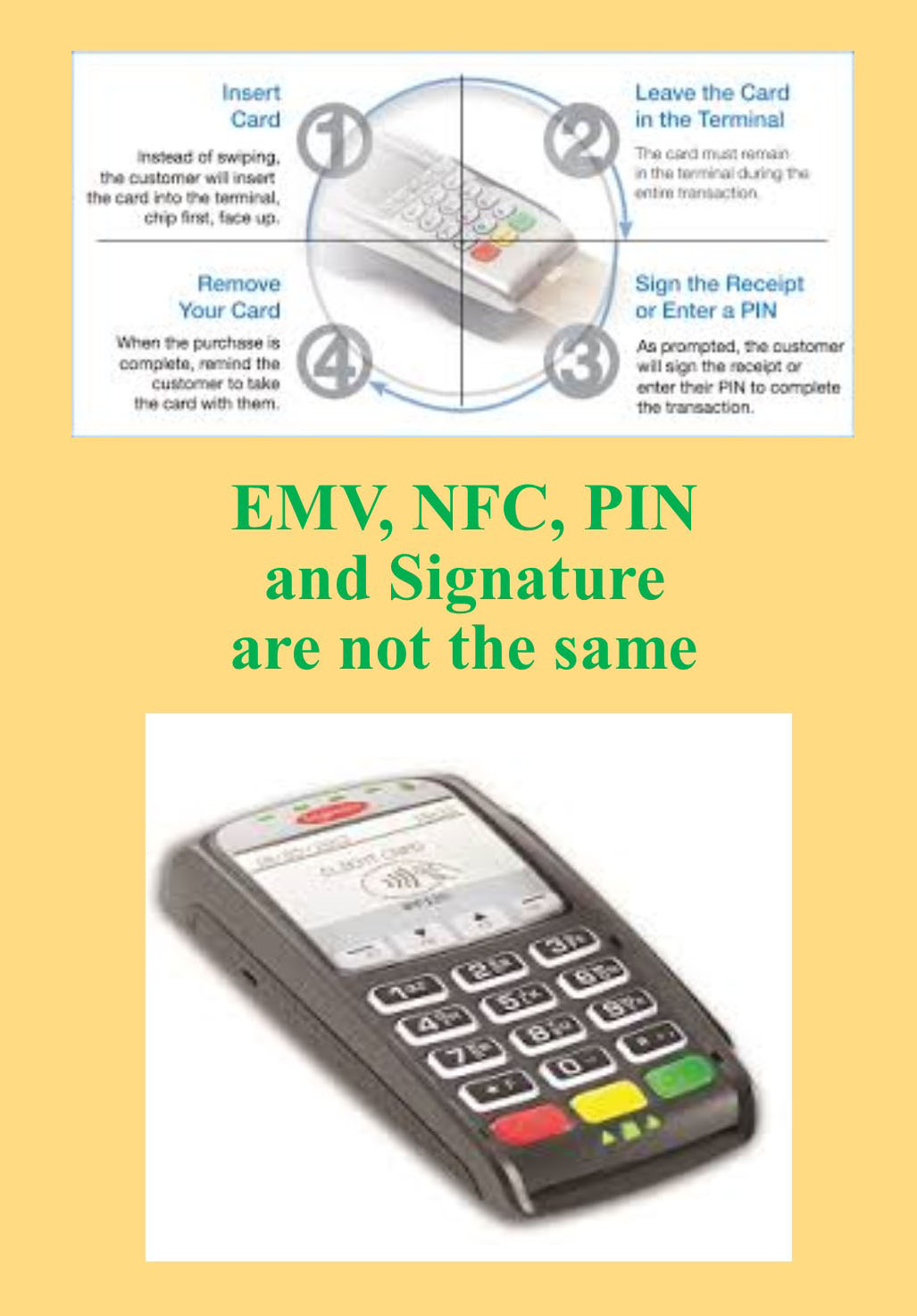

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

April 6th, 2017 by Elma Jane

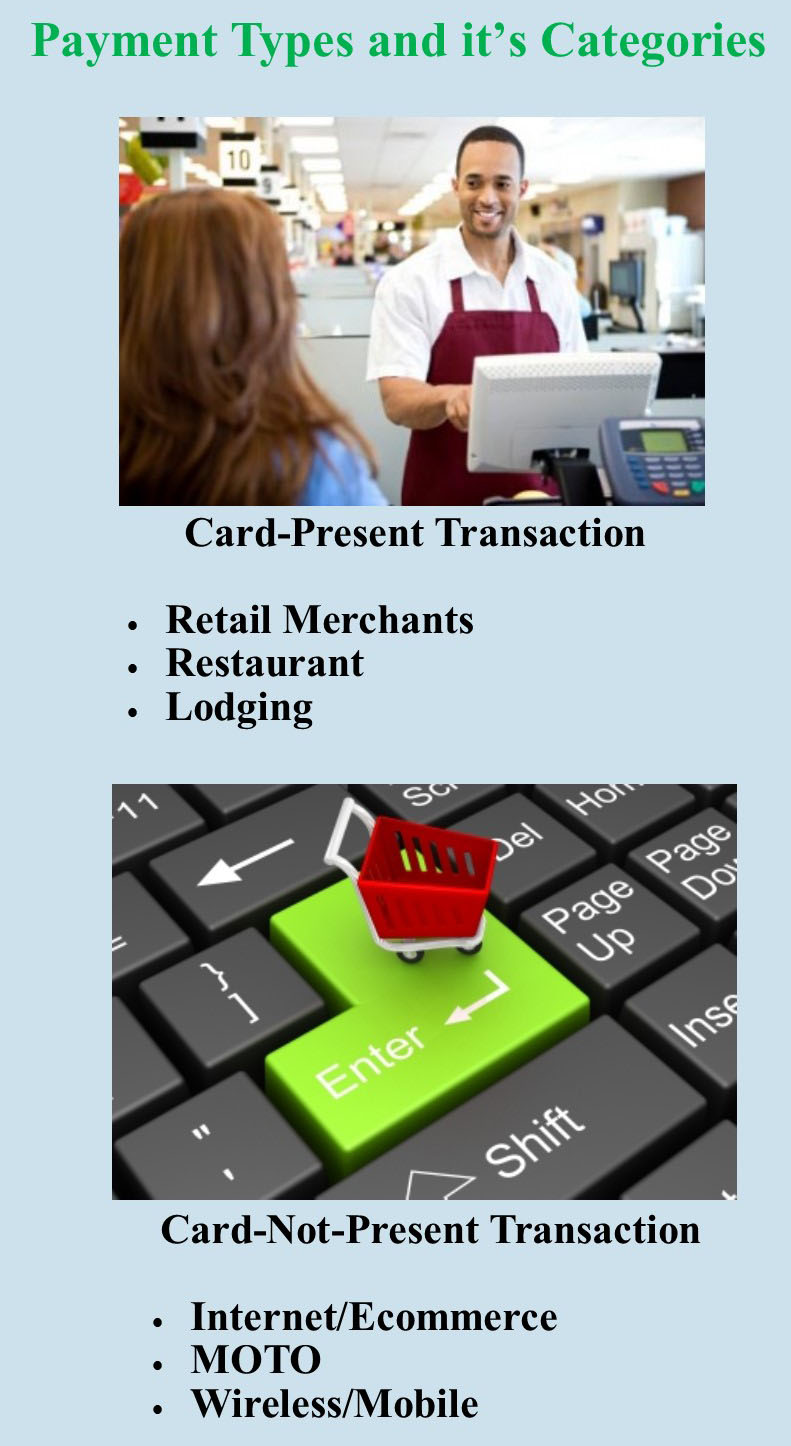

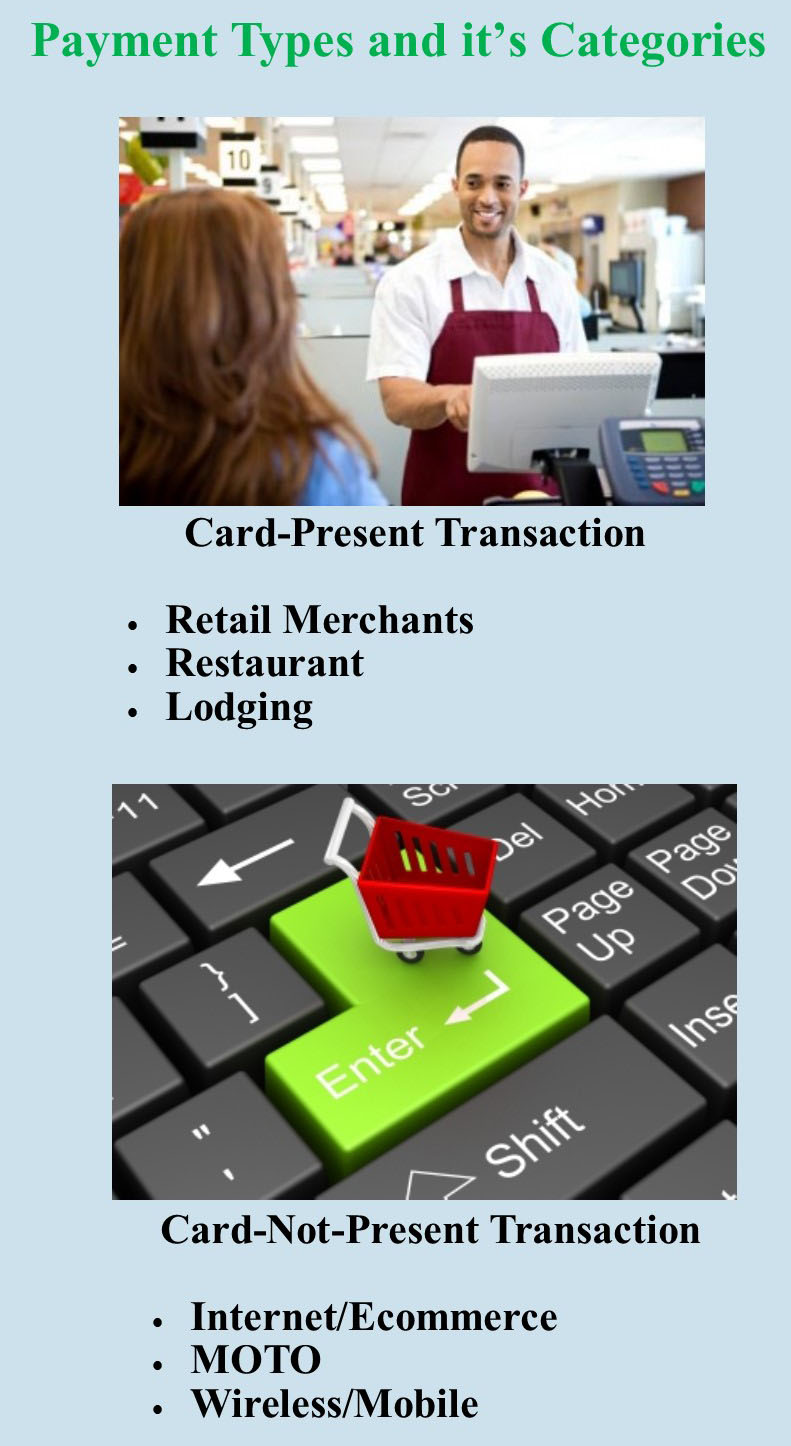

Payment types and it’s categories

The two main category types when it comes to credit card processing are swiped and keyed. Card present or card-not-present.

Swiped or card present transaction – merchants do a face-to-face transaction. A merchant can capture card information by dipping the chip or swiping the card in the terminal or POS. Merchants directly interact with a customer so the risk is low.

Card-Present Sub Categories:

Retail Merchants – conduct transactions face to face in a retail environment.

Face to Face (mobile) – this type of merchant is typically on the go, such as a vendor at a trade show. You can use a service like converge mobile that allows you to take the information in person.

Restaurant – the same as retail merchants, the difference is they may require the ability to add tips to their charges.

Lodging – processes their transactions like retail merchants except they may adjust the settlement amount depending on the customer’s length of stay.

Keyed or card-not-present are high risk, because merchants indirectly collect customers card information, and can process transactions in various ways.

Card-Not-Present Sub categories:

Internet/Ecommerce – conducts business through a web site by utilizing a shopping cart and an Internet payment gateway service. The payment gateway then collects the credit card information and processes it in real time.

Mail & Telephone Order (MOTO) – typically take the customer’s credit card information over the phone, by mail or through the Internet. They then manually process the transaction by keying it into either a credit card machine or through a virtual terminal such as Converge.

Talk to our payment consultant to know the best solution for your business.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit card, customer, ecommerce, merchants, payment, payment gateway, POS, swiped and keyed, terminal, virtual terminal

March 24th, 2017 by Elma Jane

NTC’s Payment Consultants!

For Electronic Payment Setup, consult with our payment specialists below:

Avail of our Free Rate Review and get 500 points!

A points code or certificate for Klosebuy, our new program.

You can use it to see our specials and collect points.

Get cool items in Klosebuy catalog. It’s free to join.

For Account Setup

Guaranteed Lowest Rates!

No Setup or Cancellation Fees

First Month Free!

No risk!

Posted in Best Practices for Merchants Tagged with: electronic payment, payment

March 15th, 2017 by Elma Jane

Payment Options

Technology continues to evolve, offering multiple billing and payment methods increases satisfaction by improving customer experience.

Customers will continue to move toward digital life, like embracing different forms of online billing and ways to accept payments.

Creating convenient ways to accept payments and having more options can reduce the time it takes your business to get paid.

Accept debit and credit card payments online; to offer this feature you need to get a merchant account.

Options for accepting payments:

Electronic Check Service (ECS) – convert paper checks to electronic transactions, with NTC’s ECS. Converting paper checks to electronic transactions eliminates many of the risks and costs, adding money to your bottom line.

Mobile Payments – the opportunity to increase revenue through mobile payments is huge. Many consumers find that mobile bill pay makes shopping easier, more convenient and saves time. Converge Mobile Solution lets you accept card payments using smartphone or tablet. The app works with most Apple and Android mobile devices.

Online Payment Gateway – offering customers an online payment form enables them to pay you easily and allows you to accept payments by credit card, debit card or echeck.

Electronic Invoicing (NTC ePay) – send your customers an invoice by email and get paid in minutes. Electronic Invoicing gives your customer the ability to pay their bills and receive a receipt in seconds by email.

Learn more about accepting electronic payments with NTC or sign up with us.

No setup or cancellation fees, there’s no risk! call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, echeck, ECS, Electronic invoicing, electronic transactions, merchant account, mobile, online, payment, payment gateway