March 7th, 2017 by Elma Jane

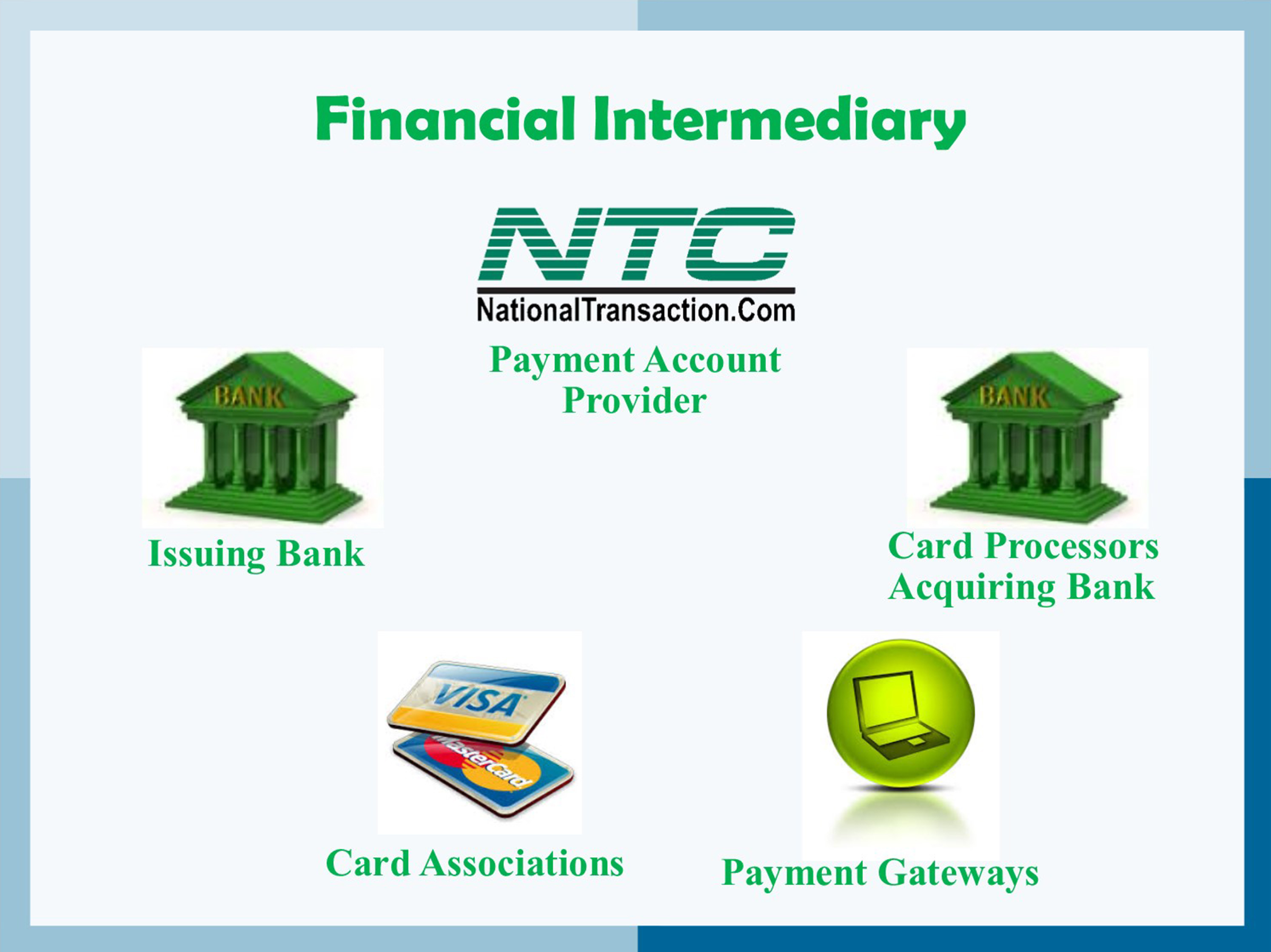

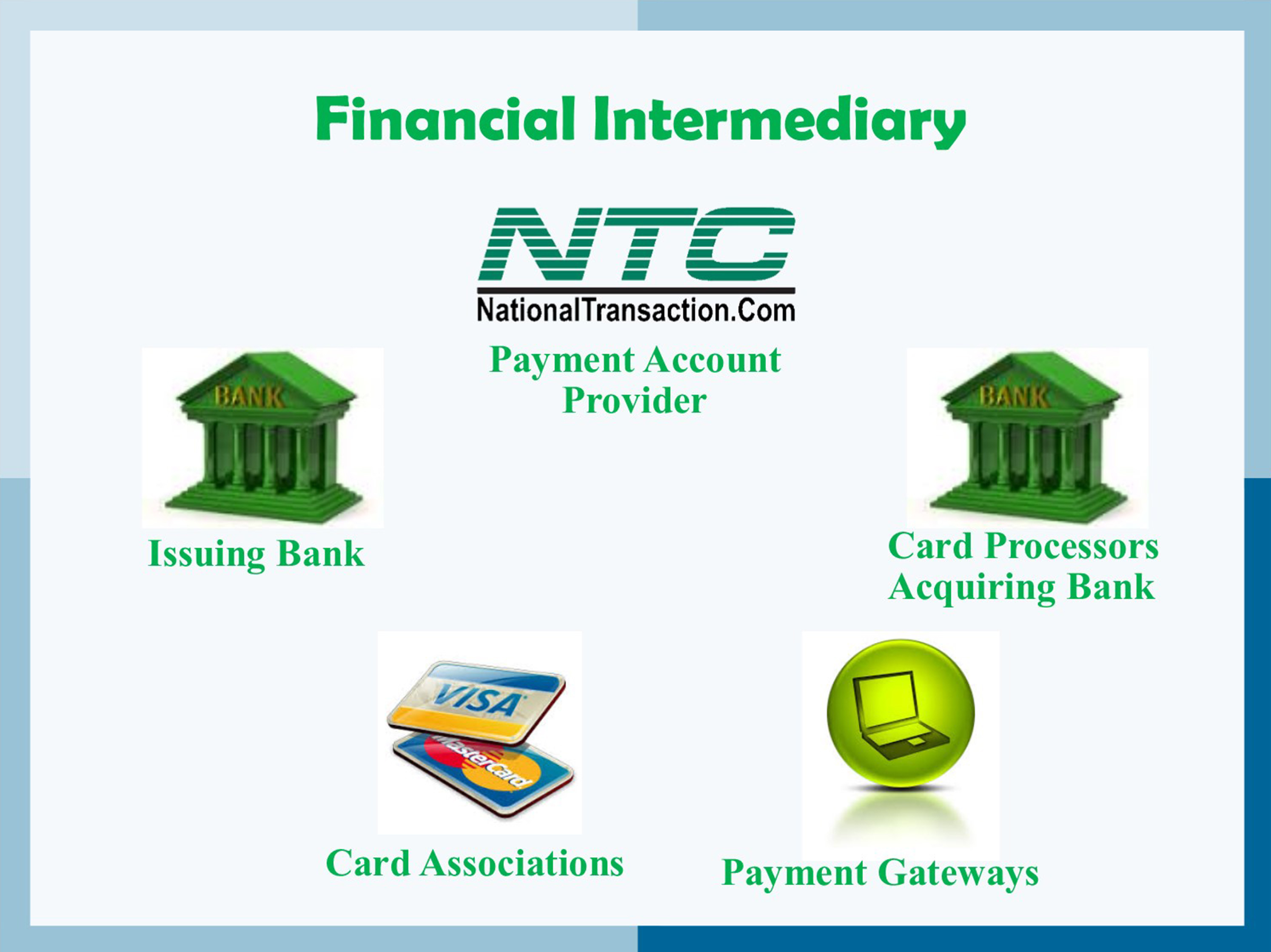

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

February 21st, 2017 by Elma Jane

The Travel Payment Expert

No Setup or Cancellation Fees

100% Next day Funding

Lowest price Guarantee

24/7 US Based Support

#1 Preferred Payment Processor among Travel Associations

NTC ePay, our exclusive electronic invoicing platform. (Email customers invoices and get paid even faster, eliminating paperwork and saving time).

For Electronic Payment Setup or FREE Rate review, call us now 888-996-2273

or visit www.nationaltransaction.com/travel/ and use our contact form.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: Electronic invoicing, electronic payment, payment, processor, travel

February 13th, 2017 by Elma Jane

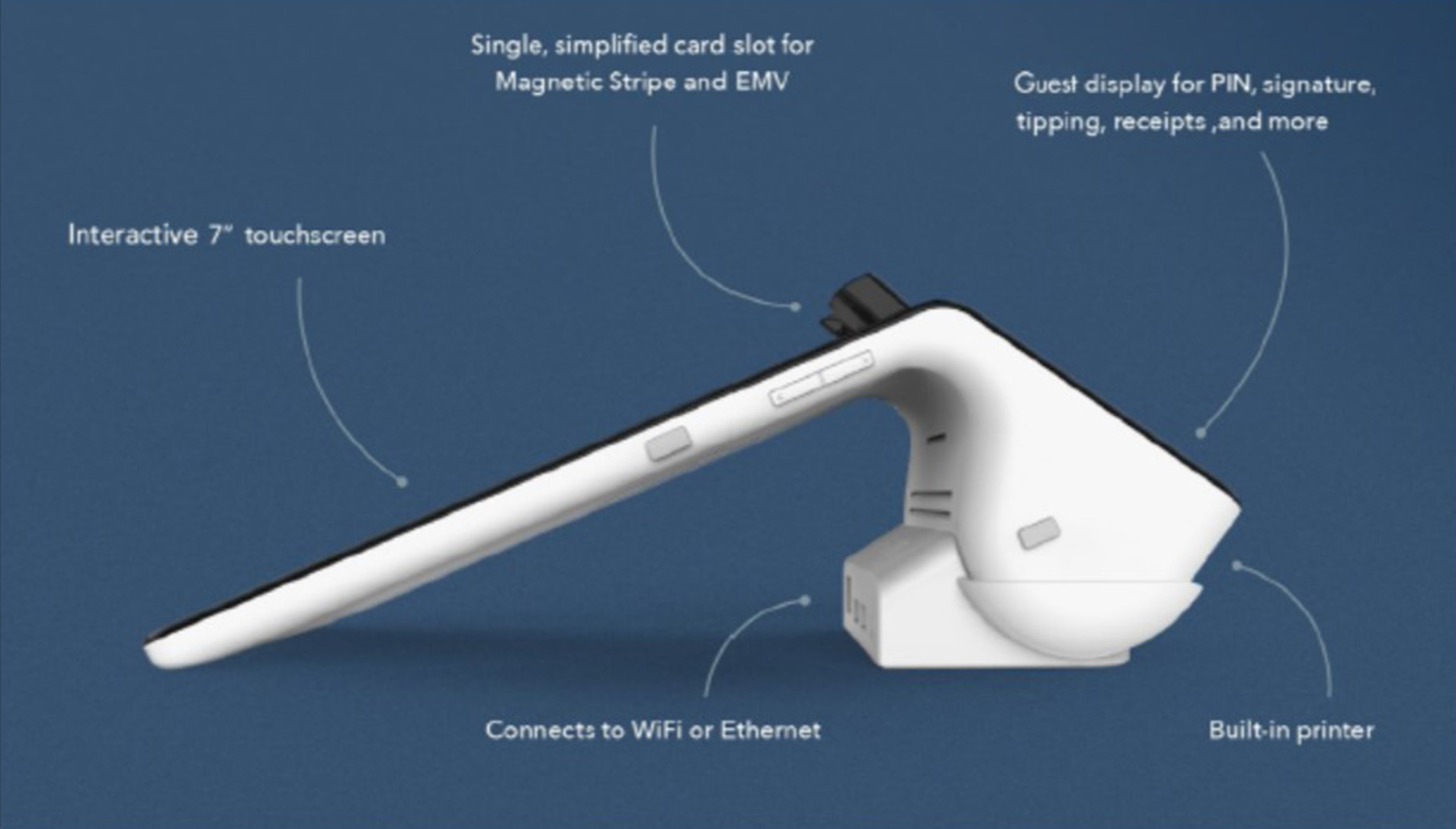

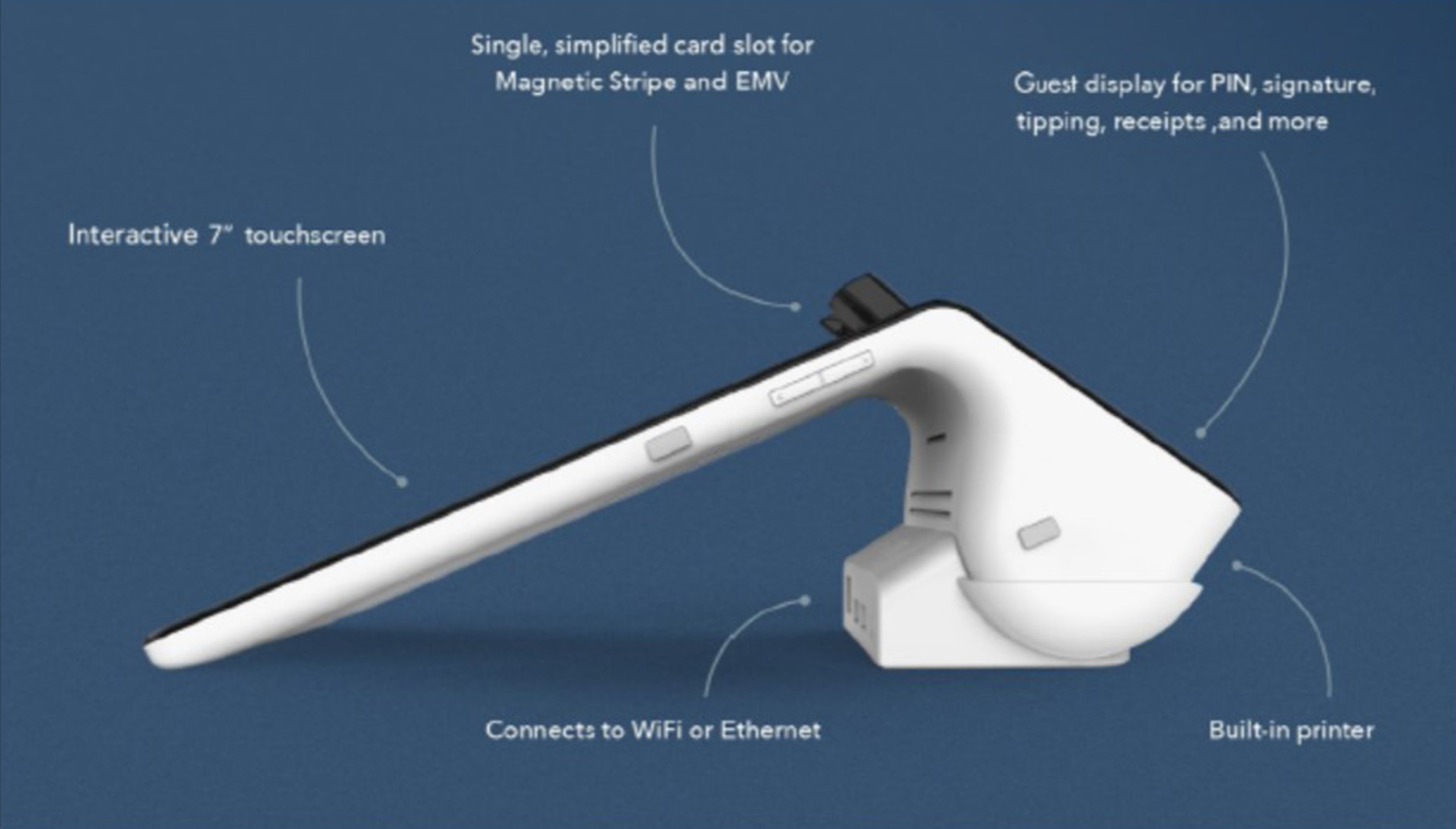

Smart Device for Lodging Transactions

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions

January 30th, 2017 by Elma Jane

U.S. Based Payment Processing Account?

How do you get a U.S.-based payment processing account when you are based outside of the country?

Here are several steps you need to take before applying a U.S. payment processing account:

The first thing you need to do is get incorporated.

Get an office – typically comes as a part of the package offered by the company that is doing your incorporation. Opt for real physical presence, rather than just a mailing address.

Get a U.S. representative – that representative is not only a name to use in the incorporation paperwork and in your office rental agreement. The U.S. representative person will be acting on behalf of your company in the U.S. This person will need to have a U.S. social security number (SSN) and will be the one who signs your credit card processing agreement.

If you are unable or unwilling to find one, you will not be able to get approved for a domestic payment processing account and will have to settle for an offshore one.

Lastly get a business checking account.

Only U.S.- based businesses are eligible for U.S. payment processing accounts, talk to a Payment Specialist 888-996-2273.

Posted in Best Practices for Merchants Tagged with: credit card, merchant account, payment, Security

January 25th, 2017 by Elma Jane

PIN vs. Signature: What’s the Difference?

PIN Debit – PIN transactions are routed through what are known as (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

Signature Debit – Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, debit card, electronic, electronic funds transfer, online, payment, PIN, POS, terminal, transactions

January 23rd, 2017 by Elma Jane

What Makes Up The Rate That You’re Paying?

Most rates are made up of three parts:

Interchange – Goes to the bank that issued the card, and is typically made up of a flat rate plus a percentage of the sale.

Assessments – Go to card network like Visa, MasterCard, Amex, Discover etc.

Processor fees – Fees involved with providing the service, risk assessments, the type of transaction, and the size of the transaction. This portion includes the margin between the total rate and the two previous parts, along with any incidental fees, like chargeback or statement fees.

There are a lot more intricacies of what makes up a credit card rate, but this information gets you off to a good start. If you’re interested in learning more about electronic payments, check our website www.nationaltransaction.com or call now 888-996-2273 and talk to our Payment Consultant.

Posted in Best Practices for Merchants Tagged with: bank, card, card network, chargeback, credit card, merchant, payment, processor, transaction

January 20th, 2017 by Elma Jane

Qualified vs Non-Qualified credit card rates

The most common forms of rate structures for credit card rates are:

2-Tiered: Qualified and Non-Qualified

3-Tiered: Qualified, Mid-qualified, or Non-qualified

Each and every transaction you accept is classified into one of the above and is the basis for the credit card rate you see on your statement.

As a general rule, qualified transactions are going to be “standard” cards; without any consumer or corporate rewards associated with them. Accepted in the “standard” method expressed in your merchant processing agreement, this is where Card-Not-Present (CNP) setup comes into play.

Mid and Non-Qualified transactions include:

Rewards cards, keyed-in payments (for swipe accounts), AVS (Address Verification Service) does not match or is not performed, not all required fields are entered, or the payment was entered in a late batch. Ex. the payment was sent to the processor 48 hours or more past the time of the authorization.

Posted in Uncategorized Tagged with: card-not-present, consumer, credit card, merchant, payment, processor, transaction

January 9th, 2017 by Elma Jane

The Travel industry payment experts! Why NTC?

NTC is the preferred payment processor for over 3,000 Travel Related Agencies.

High application approval rates while striving to eliminate holds & reserves is a big part of our Travel Merchant’s success.

Guaranteed Lowest Rates

Next Day Deposits

We Integrate with Trams & Sabre Red

Integration with a wide range of Booking Engines

Live US Based Concierge Service within three rings

Preferred by Many Associations including ASTA

NTC ePay Electronic Invoicing

Highest Approval Rating

Accept Payment from Anywhere in the World

Online Reporting and Processing Tools Included

Get the most from your Payment Processing Call Now 888-472-7112

Not all Travel Merchant Accounts Are The Same!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: merchant, online, payment, payment processing, payment processor, travel, travel industry, Travel Merchant

January 6th, 2017 by Elma Jane

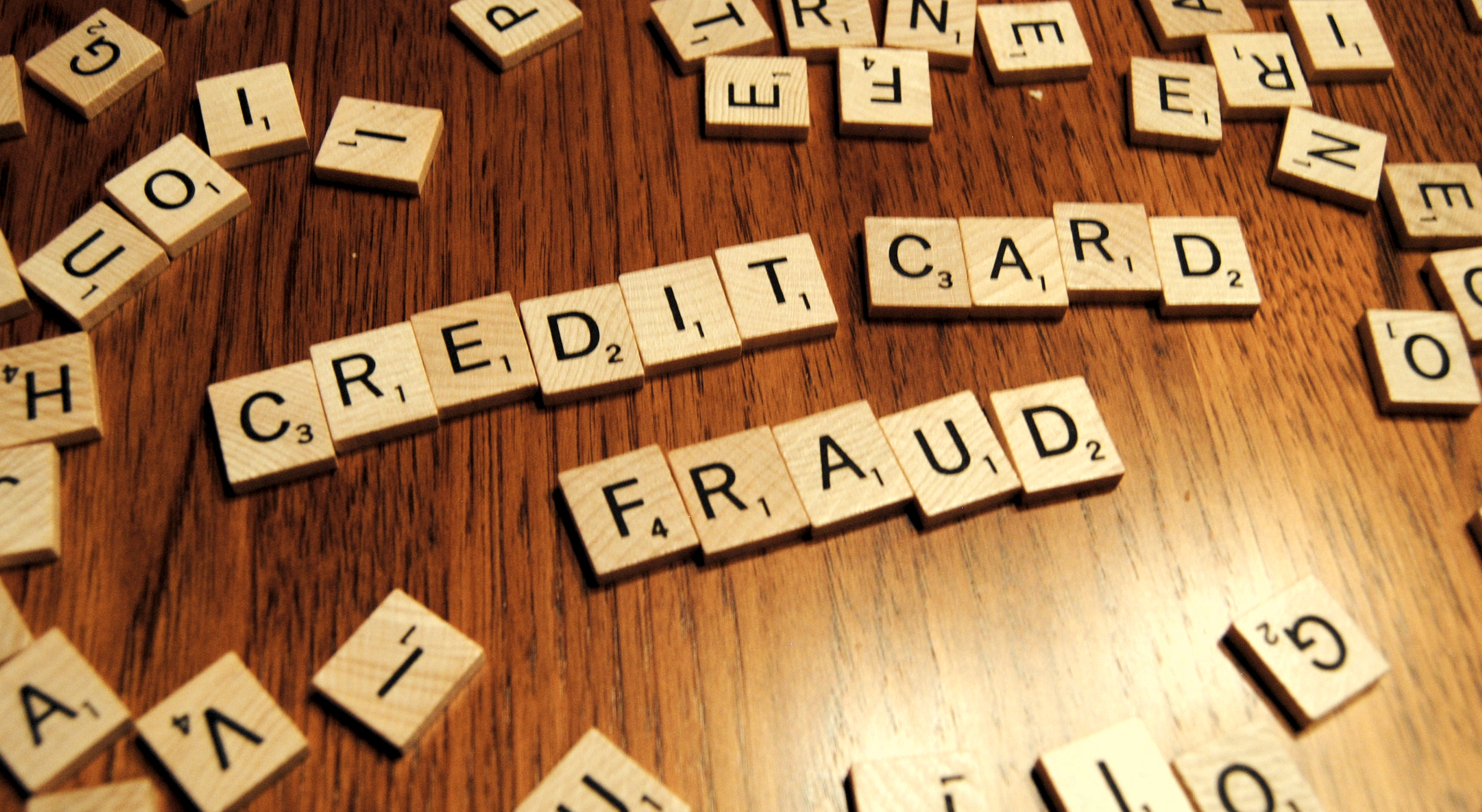

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions