November 30th, 2016 by Elma Jane

Understanding Interchange Rates & Fees

Credit card processing involves three separate cost components:

For vendors who choose to accept this type of payment, from customers for goods or services.

The same cost components apply to debit cards. Only one cost component is negotiable.

The first component is an interchange fee, which is payable to the card holder’s issuing bank. It is a combination of a transaction volume percentage fee and a flat-rate transaction fee. Interchange fees are collectively agreed upon through Visa and MasterCard by a card’s issuing bank and are fixed costs.

Interchange fees take into consideration various information about a card. Types of cards include debit and credit, while categories of cards refer to commercial and reward cards. Processing methods include whether a card is swiped or manually keyed. Swiping a card is usually more economical for vendors.

The second component is an assessment fee, charged by the card’s brand holder. Brand holders include Visa, MasterCard and Discover. Assessment fees are also fixed costs. Additionally, Visa charges a monthly fee.

The final charge is known as a processing fee. Processing fees vary among processors and is negotiable. Vendors are charged a processing fee, which can cause a difference in cost from one vendor to another.

For your electronic payments need give us a call 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, credit card, customers, debit cards, electronic payments, payment, reward cards, transaction

November 28th, 2016 by Elma Jane

Payment acceptance is key to making more money.

Let’s talk about your money, and how to make more of it. Today money is taking on a new form. It’s digital, it’s electronic and it’s everywhere and anywhere 24/7/365.

Payment acceptance is key to making more money. You don’t make more money by not accepting a transaction, and making the experience convenient and safe to your customer can bring loyalty.

Let’s break down a transaction.

Cash, but that would mean that the customer has to be in front of you. You could take checks, those are safe to mail, but then you don’t have your money until you drive to the bank and cash or deposit the check.

So how do we easily and securely transfer funds for a transaction? The answer lies in digital or electronic payments. Accepting credit cards, debit cards, ebt cards or even gift & loyalty cards and electronic checks. These provide secure and convenient ways to complete transactions for your customers. If you want to make more money, make it easy for customers to spend it while making it faster for you to receive it. That’s where a merchant account comes in.

A merchant account allows you to deposit funds directly into your bank account in as little as a few hours. Whether the customer swipes their card into your smartphone, calls it in over the phone or keys it into your web site, just having a merchant account can be a huge advantage over competitors.

It allows you to conduct transactions in more ways than cash or checks alone. Transactions are recorded automatically and can easily be reconciled for both customer and merchant. Most importantly it widens the opportunities to conduct sales to the widest customer audience possible.

No matter what you sell or how you sell it, the sale is only complete once the funds are transferred from one party to the other.

It’s important to recognize your missed opportunities. Could accepting electronic payments help increase your revenue stream? We’re here to help you make more money, let us show you the many ways we can do just that. Let’s talk, 888-996-CARD (2273)

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Mail Order Telephone Order, Mobile Payments, Travel Agency Agents Tagged with: credit cards, customer, debit cards, ebt cards, electronic checks, electronic payments, gift & loyalty cards, merchant account, payment, smartphone, transaction

November 22nd, 2016 by Elma Jane

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

In addition, you can enjoy from e-commerce payment gateways to retail and restaurant solutions, business-to-business processing capabilities to electronic invoicing (NTC ePay).

NTC is offering a cost-effective credit card payment processing services that are very fast, secure and easy to integrate.

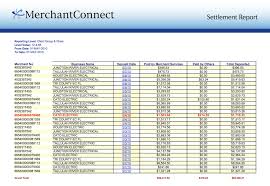

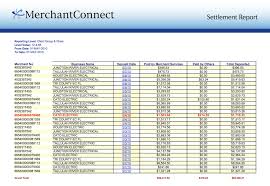

Get your Secure MerchantConnect Reporting Tool:

Get your Secure MerchantConnect Reporting Tool:

- Review and reconcile all of your transactions settle or batch settle and also much more.

- Create and save your custom reports that also can be imported or exported easily.

- Use our solution to turn any computer, laptop, smartphone or tablet into a processing center.

- Run & enjoy this on one or more devices to process credit card transactions with your merchant account.

- Peripherals allow swiping transactions and printing out receipts.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Receive up to $150,000 per location in less than 10 business days—sometimes in as few as 72 hours.

National Transaction Merchant Cash Advance eliminates many hassles and delays common with bank loans.

Our Merchant Cash Advance builds on the strength of your business’ future credit and debit card sales, so a damaged personal credit history is not an immediate disqualifier.

Posted in Best Practices for Merchants Tagged with: bank, cash advance, credit card, debit card, e-commerce, Electronic invoicing, electronic payment, gateways, loans, merchant account, payment, payment services, Security, smartphone, transactions

November 18th, 2016 by Elma Jane

Tokenization and Encryption are completely different technologies when it comes to securing sensitive data, such as credit cards.

Encryption tools and techniques is to mask original data, then allow it to be decrypted. It uses an algorithm to scramble credit card information that makes the data unreadable to anyone.

Encryption is most often “end-to-end.”

Example: When someone enters card data into a web browser to buy an item and decrypted when the purchaser’s authorized credit card information reaches its intended destination, which is the merchant’s e-commerce database.

Encrypted card data is unreadable while it’s “at rest” in a database or “in motion” during a purchase transaction; and inaccessible until a key decrypts it. The chances of a hacker stealing the data is minimal. But, if card data passes through multiple internal systems en route to an acquiring bank or payment gateway, the encrypt/decrypt/re-encrypt process could open a wide security hole, thus creating vulnerabilities to hackers.

Tokenization have found to be cheaper, easier to use and more secure than end-to-end encryption.

Tokenization completely removes credit card data from internal networks and replaces it with a generated, unique “token”. Tokens have no meaning and are worthless to criminals if a company’s system is breached.

Merchants use only the token to retrieve, access, or maintain their customers’ credit card information.

Example: Actual credit card number was 3234 4567 8789 78910, it might become FHIW145BVE65478 when a token is generated. The token is randomly generated and there is no algorithm to regain the original card number. hackers can’t reverse-engineer the actual credit card number, even if they were to grab the tokens off the servers.

Using tokens doesn’t change a merchant’s payment processing experience. Only they’re much safer for a merchant than actual credit cards.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: card, credit cards, customers, data, encryption, gateway, merchants, payment, Security, token, tokenization, transaction

November 17th, 2016 by Elma Jane

Payment Card Industry

What is PCI DSS (Payment Card Industry Data Security Standards)? A set of requirements, founded by Amex, Discover, JCB, MasterCard and Visa; to facilitate industry-wide adoption of consistent data security measures on a global basis. Best practices for enhancing payment account data security.

Why does my business need to be PCI Compliant? You help protect your business

by reducing the risk of a costly breach of your customers’ payment card data. Payment card brands (Amex, Discover, JCB, MasterCard and Visa) mandate that all businesses processing payment cards must be compliant.

Once my business validates PCI-DSS compliance, does that prevent a security breach from happening? No. It helps prevent security breaches and loss of cardholder data but do not provide a guarantee to your business. Also, similar to the regularly required updates to anti-virus and firewall software; data security is also continually subject to new threats.

What happens to my business if I am not PCI Compliant? If you do not comply with the security requirements contained within PCI-DSS as mandated by the payment card networks; you put your organization at risk of a payment card compromise.

In the event that your business is compromised, you may also be subject to additional fines, fees, and assessments by the card brands. You may also lose your credit card acceptance privileges.

What am I required to do to validate PCI compliance? The minimum requirement for PCI Level 4 business is to complete a PCI-DSS Self-Assessment Questionnaire (SAQ) on an annual basis and achieve a passing status.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: card, credit card, customers, data, payment, PCI, Security

October 14th, 2016 by Elma Jane

Merchant Account is a LOAN!

Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for processors or payment providers; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Posted in Best Practices for Merchants, Financial Services, Travel Agency Agents Tagged with: bank, credit, credit card, customer, loan, merchant, merchant account, payment, payment providers, processors

October 11th, 2016 by Elma Jane

Cybersecurity via Converge:

Converge uses a multi-layered approach to security which helps keep cardholder data safe throughout the entire payment process; from beginning to end.

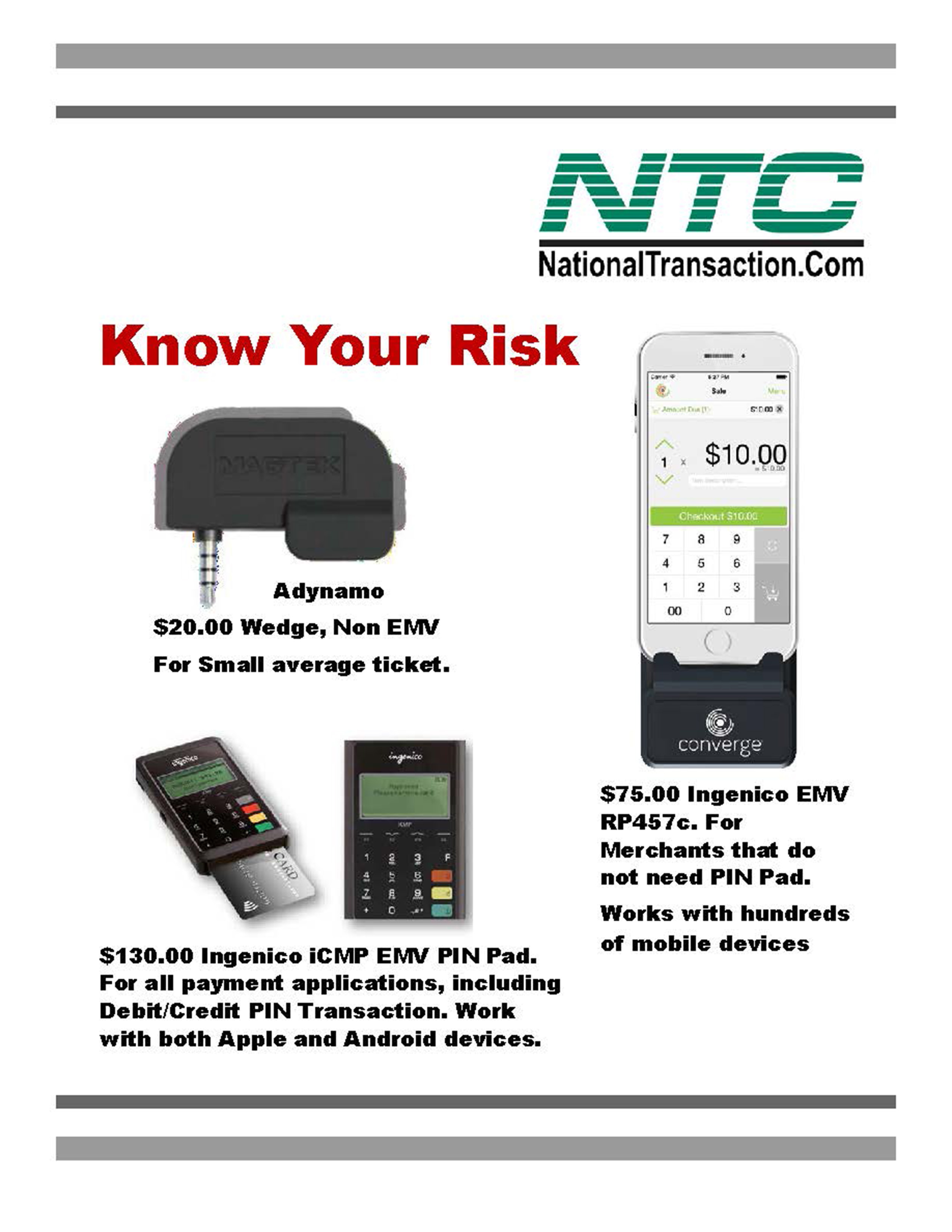

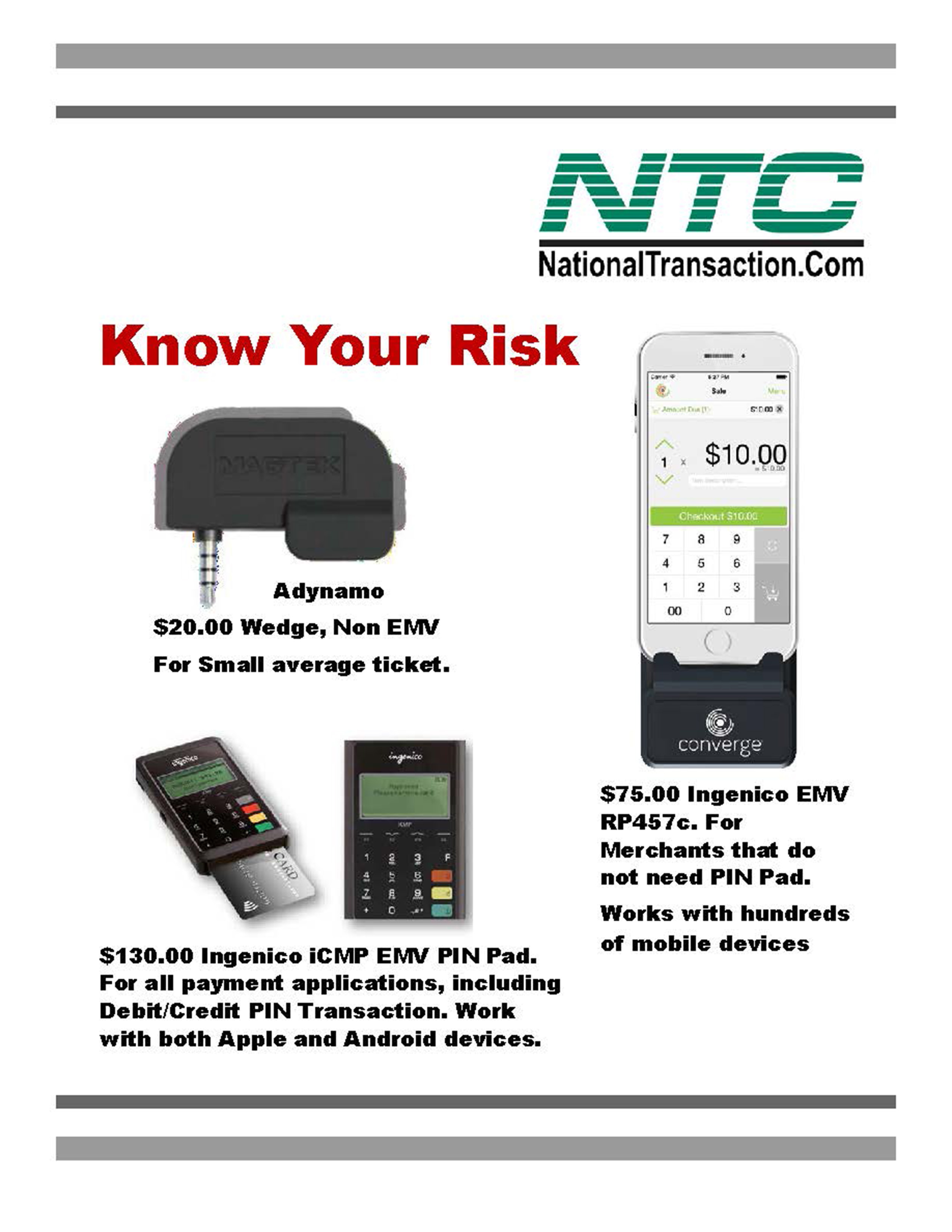

- EMV: All new Ingenico PIN pads and readers – iCMP and RP457c used with Converge Mobile offer EMV to help protect against counterfeit card use. The PIN pads go a step further in helping protect against lost; stolen and NRI (never received/issued) when a PIN-preferred card is accepted with PIN entry.

- Encryption: All new Ingenico devices also include encryption as a standard security component in addition to protect card data in transit.

- Tokenization: An enhanced security feature that is particularly valuable in card-not-present (CNP) environments when cards are stored on file for processing at a later time, or either for recurring/installment payments.

Get the Ingenico iCMP EMV PIN Pad for only $130.00.

For all payment applications, either Debit or Credit PIN Transaction. Work with both Apple and Android Devices.

Ingenico EMV RP457c card reader for only $75.00.

For Merchants that do not need PIN Pad. Works with hundreds of mobile devices.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Smartphone Tagged with: card, card-not-present, cardholder, data, EMV, mobile, payment, PIN pads, Security, tokenization

September 12th, 2016 by Elma Jane

Ingenico RP457c card reader is now available at NTC for $75.00 plus encryption and shipping!

NTC are pleased to announced the launch of Converge Mobile 1.3, which includes support for the new Ingenico RP457c.

An all-in-one card reader that accepts:

- Mag stripe

- chip card

- contactless payments including mobile wallets

Customers can utilize audio jack to connect the device to their either smartphone, tablet or connect via Bluetooth.

In addition to the converge Mobile portfolio, Ingenico RP457c is a lower price point for customers who are cost sensitive. It offers the same payment flexibility as the iCMP.

Both RP457c’s and iCMP devices also offer encryption technology, adding another layer of security to help protect card data at the point of entry and throughout the payment lifecycle.

One key difference is that iCMP is a PIN pad that supports chip & PIN as well as debit PIN transactions, while the PR457c is a card reader only; therefore chip and signature and signature debit are supported on this device.

For your electronic payment needs or to purchase the device give us a call now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card data, card reader, Chip & PIN, chip and signature, contactless payments, customers, mobile wallets, payment, PIN pad, Security, signature debit, smartphone, transactions

August 30th, 2016 by Elma Jane

NTC’S 20th Anniversary! October 7th, Friday at our sales office come join us.

As part of our celebration we have Lincoln Kokoram to do a brief Sales Training on How to Overcome Telephone Objections. 11am-3pm.

In addition, Mark Fravel, Founder/President of National Transaction; will have his FYI remarks from what he learned for over 20 years in the Payment Industry, while building a strong relationship with his partners’ and exceeded excellence in his company. 3pm-5pm

Cocktail Dinner will follow!

Come celebrate with us RSVP needed before September 30th.

Please contact or email Elaine Zamora at 888-996-2273 Extension 1111 elaine@nationaltransaction.com

Check our website: www.nationaltransaction.com/ www.ziebest.com/national/

Posted in Best Practices for Merchants, nationaltransaction.com Tagged with: payment, payment industry, transaction

August 22nd, 2016 by Elma Jane

National Transaction 20th Anniversary

Join National Transaction at our Sales Office, in celebration of our 20th Anniversary. October 7th Friday, from 11am until 3pm.

As part of our celebration we have Lincoln Kokoram to do a brief Sales Training on How to Overcome Telephone Objections.

Lincoln Kokoram has been conducting seminars, workshops and platform speaking for the past 32 years. And having trained in over 35 countries.

In addition, Mark Fravel, founder/President of National Transaction; will have his FYI remarks from what he learned for over 20 years in the payment industry while building a strong relationship with his partners’ and exceeded excellence in his company.

Come celebrate with us and attend the training! RSVP needed before September 30th.

Call us at 888-996-2273 or go to www.nationaltransaction.com for more information.

Posted in Best Practices for Merchants Tagged with: payment, payment industry, transaction