August 3rd, 2016 by Elma Jane

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions

July 19th, 2016 by Elma Jane

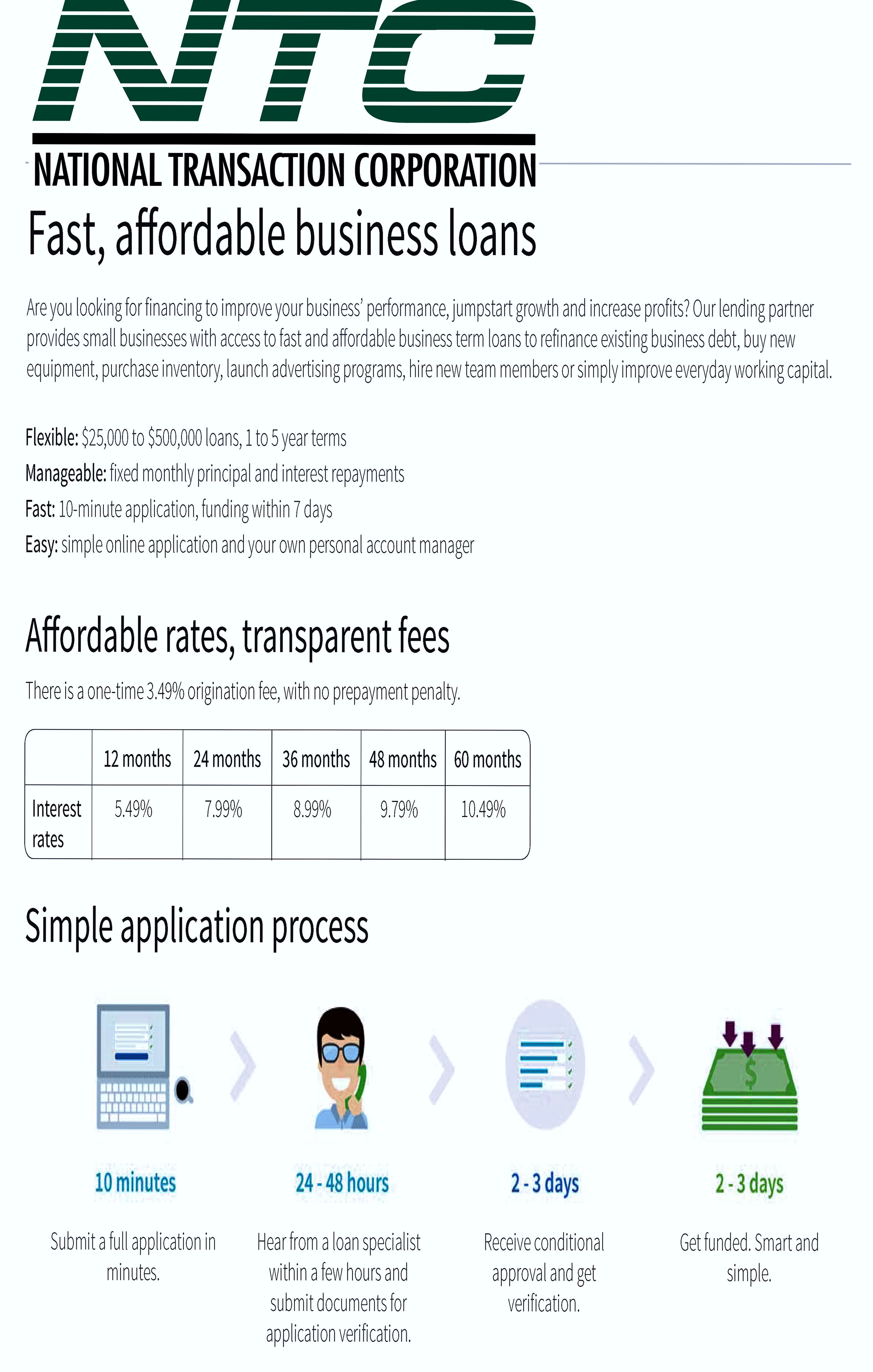

Here are some of the Common Business Loan Fees:

Application Fee – is a fee charged to cover the costs of processing and assessing your loan application.

Bank Wire Fee – When borrowing a loan, lenders commonly wire the money to your bank account via ACH, because the banks need to talk to each other and ensure the money is going to the right place and that no fraud is going on.

Check Processing Fee – ACH transfers are commonly used to collect periodic repayments from the debtor’s bank account. Some lenders offer the option of paying by check, but you’ll have to pay a fee for the extra cost involved.

Closing Cost – not to be confused with closing fees, encapsulate all the fees charged for processing a loan, including origination/closing fees, processing fees, referral fees, and/or packaging fees.

Draw Fee – similar to an origination fee, but is applicable instead for lines of credit.

Guarantee Fee – is charged on all SBA loans above $150K. Guarantee fee is charged to protect against credit-related losses in the mortgage portfolio.

Late Payment Fee – Missing a payment deadline can result in a late fee. A late payment may have an affect on your personal or business credit score.

Origination Fee – an up-front fee charged for processing a new loan application. Prepayment

Penalty – Is a borrower, a bank or mortgage lender agreement that regulates what the borrower is allowed to pay off and when.

Servicing and Maintenance Cost – fees charged to cover the costs associated with collecting payments, maintaining records, following up on delinquencies and any other costs associated with maintaining a term loan or line of credit.

Business loans are available in different types, from merchant cash advances to lines of credit. The most effective way to get the best deal on a business loan is to be educated and know that Fees are Negotiable.

Posted in Best Practices for Merchants, Financial Services Tagged with: ach, bank account, check, credit, fee, fraud, loan, payment

July 14th, 2016 by Elma Jane

PCI Compliance applies to every merchant who is accepting credit cards large or small. Refusing or delaying to become PCI Compliant can end up being a costly mistake.

If you accept any credit or debit card payment, you need to be PCI Compliant no matter the volume is.

PCI applies to any company, organization or merchant of any size or transaction volume that accepts, stores or transmits cardholder data. Any merchant accepting payments directly from the customer via credit or debit card must be PCI Compliant.

The merchant themselves are responsible for becoming PCI Compliant, as the deadline for merchants to become Compliant is long overdue

Understanding and knowing the details of PCI Compliance can help you better prepare your business. Failing and waiting to become compliant or ignoring them, could end up being an expensive mistake.

The VISA regulations have to adhere to the PCI standard forms part of the operating regulations, the regulations signed when you open an account at the bank. The rules under which merchants are allowed to operate merchant accounts.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, credit cards, customer, data, debit card, merchant, payment, PCI Compliance, transaction

July 12th, 2016 by Elma Jane

Interchange is where transactions are submitted for payment from the Acquirer or Merchant Processor to the Card Issuer or Debit Network. It also represents the fees paid by the merchant acquirer to the Card Issuer.

At the time the transaction is exchanged fees are paid and vary based on processing method utilized. It is more expensive to process a hand-keyed transaction than a card-swiped transaction.

Several rates may apply to your transactions, depending on your method of processing each transaction and the interchange qualification that is assigned to each transaction by the Card associations for processing transactions.

Rate qualification criteria: The card associations consider the card product used in the transaction, how the transaction data is entered, the time of settlement versus time of authorization.

Interchange Category Based on Card Type: Credit, Debit, and Rewards purchasing.

Industry Type: Retail or E-commerce.

Qualification Elements: Swiped card or Key entered.

When you settle your transactions each day, Acquirer or Merchant Processor like NTC routes them to the Card Associations (Visa, MasterCard, Discover) and debit networks through Interchange.

Visa, MasterCard, Discover (Card Associations and Debit Networks) establish the rules and manage the Interchange of all transactions.

Posted in Best Practices for Merchants Tagged with: card, card-swiped, credit, debit, e-commerce, merchant, payment, processor, transactions

June 21st, 2016 by Elma Jane

The Ingenico iPP320 PIN pad (Item Code: 320CV) is officially launched for Converge, making this the third EMV and NFC-enabled device available to our merchants. The iPP320 accepts mag stripe, chip cards, manual card entry and contactless payments, including Apple Pay.

Don’t Forget!

- Customers can hand-key card information into all of the new Converge PIN pads to encrypt payment information at the point of entry, including card-not-present payment environments. Encryption is a standard feature with all new PIN pads.

- In the February release, gratuity support was launched on devices, which means the consumer will be prompted to add a tip to the payment amount using the PIN pad, versus the business entering an amount into Converge.

For terminal upgrade give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: card-not-present, chip cards, contactless payments, customers, EMV, merchants, nfc, payment

June 16th, 2016 by Elma Jane

Merchants and cardholders have been challenged by the perceived additional time to complete the EMV transaction.

To address concern over EMV checkout time Visa and MasterCard create an alternate EMV payment process that will improve the speed of transaction:

Quick Chip from Visa is available free-of-charge to acquiring banks, payment networks, and other payment processors to offer to merchants. The enhancement requires only a simple software update to the merchant’s card terminal or point-of-sale system.

M/Chip Fast from MasterCard merchants can easily integrate this with their current systems to provide both speed and security for all chip cards. Designed for select environments where fast transaction times, in addition to security, are at a premium.

The new card network options do not require the financial institution to reissue cards, or the merchants to re-certify their point-of-sale terminals.

Alignment in the payments industry and the ability to process a secure transaction in a timely manner for the consumer experience is important.

Keeping current on the payment industry news like Quick Chip and M/Chip Fast or discussion about EMV developments is a smart move for merchants and cardholder as well.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa Tagged with: banks, card, card network, cardholders, chip cards, EMV, financial institution, merchants, payment, payment networks, payment processors, payments industry, point of sale, Security, terminal, transaction

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

May 26th, 2016 by Elma Jane

NFC stands for Near Field Communication. It is a technology that allows contactless data exchange between two electronic devices

Contactless Payment is a description for the ability to pay without touching anything.

How do mobile wallets fit into NFC?

Mobile wallets like Apple and Android Pay use NFC technology. NFC technology allows the data to securely pass back and forth between each device to make a contactless payment.

How secure are NFC Payments?

Tokenization converts or replaces cardholder data with a unique token ID. This eliminates the possibility of having card data stolen. These tokens help heighten protection and security for the consumer.

As a merchant, preparing to accept payments that meet customers satisfaction is needed. With the mobile wallet transaction process, it makes the traditional transaction quick and efficient.

NTC terminals allow merchants to accept NFC Payments, allowing you to process more transactions. For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: cardholder, consumer, contactless, customers, data, merchant, mobile wallets, Near Field Communication, nfc, payment, Security, terminals, tokenization, transaction

May 25th, 2016 by Elma Jane

No one likes waiting in a checkout line, the faster your checkout line moves, the faster you are able to turn more sales. Quick checkout lines lead to increased sales and higher customer satisfaction .

Cut your line and increase your sales by:

Upgrading your POS – if you haven’t upgraded your POS, do it now. Choosing a modern POS that is simple and easy to use like the iCT250, offers a smart, effective and highest security payment experience designed for merchants and easier for employees to understand.

Multiple Checkout – multiple checkout counters may be necessary depending on the size of your store. In a high volume situation such as the holiday season, more opportunities for checkout may be beneficial.

Accept A Variety of Payments – having alternative forms of payment by accepting credit, debit, EMV/NFC and mobile wallets, will open the door for a variety of customers, but also allow the customer to pay the way they want in a most convenient way.

Train Employees – most importantly, train your employees on how to use your new POS system. Employees need to be the expert on POS so that they are able to assist customers who may need help conducting their transaction.

Posted in Best Practices for Merchants Tagged with: credit, customer, debit, EMV, merchants, mobile, mobile wallets, nfc, payment, POS, sales, Security, transaction

May 24th, 2016 by Elma Jane

Top terms in your Merchant Statement:

Interchange – are the variable fees charged by the card payment networks for processing transaction. Credit card brands set these non-negotiable rates based on card type, business size, and industry.

Ancillary Fees – this include statement, batch and customer service fees, monthly minimums and more.

Authorizations – this section shows the charges per authorization that come from an interchange plus provider and is then split by card brand and transaction type. On your statement, you will see these charges as either AUTH or WAT charges.

Deposit Summary – following the summary is the deposit summary, where lists of your account activity broken down by day and card type.

Discount Rate – every transaction percentage that is deducted as a fee. Rates are categorized as qualified, mid-qualified and non-qualified.

Processing Services – this states your discount rate charges that you receive from your interchanges plus processor. This is divided by card brand and sales volume.

Summary – summary shows the processed sales by AMEX, Discover, JCB, MasterCard or Visa, as well as the total fees paid in order to process these sales. You can find this at the top of your statement.

Other items included in the summary:

Account adjustments, chargebacks, the breakdown of sales by card brand and number of refunds.

Understanding these terms on your statement will give you the confidence to read your merchant account statement with ease.

Posted in Best Practices for Merchants Tagged with: card, chargebacks, credit card, customer, fees, merchant, merchant account, payment, refunds, service, transaction