May 23rd, 2016 by Elma Jane

Today, the information thieves want most from your customers is not their credit card numbers but their email addresses and account passwords. Criminals used stolen credentials to gain control of consumer accounts and open new accounts using their names to defraud merchants.

Data encryption and payment security are crucial for merchants, but so is helping customers keep their credentials secure. Encouraging customers to keep their information secure is a good thing.

Help customers practice good password habits – set up your system to require good passwords. Have account rules in place that require more secure passwords. ( a minimum number of characters and a mix of character types).

Remind customers what they can expect from your business – like your employee will never ask for customer account passwords or payment account information via email or no one from your company will call to ask for account passwords or credit-card information.

Offer security tips ahead of peak season – by reminding them ahead of time about account safety. Your business may receive a high volume of travel booking which means peak time for fraud attempts that need to be screened for fraud.

Keep your own fraud-prevention program updated – fraud prevention is an ongoing cost of doing business for merchants, but it doesn’t have to be too much expense. Working with your customers to keep their data and yours secure, will strengthen your business with them while protecting your business from fraud.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, customers, data, fraud, merchants, payment, payment security, Security, travel

May 19th, 2016 by Elma Jane

Transaction laundering, the new face of payment fraud is increasing and getting popular in the world of e-commerce.

Studies revealed that there are as many as 6% to 10% of additional unauthorized e-commerce sites that banks may be processing without their consent or awareness. A digital version of money-laundering, engaging in illicit commerce while using legal means to get paid.

Transaction laundering is another form of money-laundering and it is illegal.

Detecting fraudsters are becoming a major challenge not only for banks but financial service organizations like payment service providers as well. There have been dozens of cases where legitimate-looking websites were caught selling illegal products.

Acquirers, banks, and other institutions focused on websites as the central of transaction laundering while the mobile era has opened up a new ground for scammers to operate in. They provide new opportunities for fraudsters to do their work by routing payments for illicit goods and services through their own legitimate front accounts.

Mobile wallet apps, NFC chips, and payment apps are some of the new ways payments are being collected. Not to mention opening up an on-line storefront using web tools, which anyone can do is very easy.

Micro-merchants expansion of doing business on-line and the greater reach they have now to mobile technology, business opportunities for scammers doing transaction laundering have never been better.

It is important for the industry to know what is happening, and how great the risks are. It’s a new challenge for the payments industry, learning and educating ourselves on those dangers is a priority.

Posted in Best Practices for Merchants Tagged with: banks, e-commerce, financial service, fraud, merchants, mobile technology, mobile wallet, nfc, payment, payment service providers, payments industry, transaction

May 18th, 2016 by Elma Jane

Terminals are ready, but the software isn’t – many merchants have EMV capable equipment, but has not been activated yet because it still needs to be certified.

The certification process includes security and compatibility tests.

For a small merchant, all you need to worry about is your equipment or software is EMV certified.

For software, developers, terminal manufacturers needs to get certification before they can deploy their products to merchants.

So many merchants who want to accept EMV, are now just waiting for their POS system to get necessary upgrades, which they can’t do until they’re certified.

Slower Checkout Time – common complaint by consumers. Dipping takes several seconds longer than swiping the card. There’s also a chance of forgetting your card because you have to leave your card inserted while waiting for the transaction to get approved.

The fastest Path to EMV – Depending on the nature of your business, the risk of landing yourself for credit card fraud is slim. The easiest way is to contact your merchant account provider and they will tell you what equipment and software you need and how much it will cost.

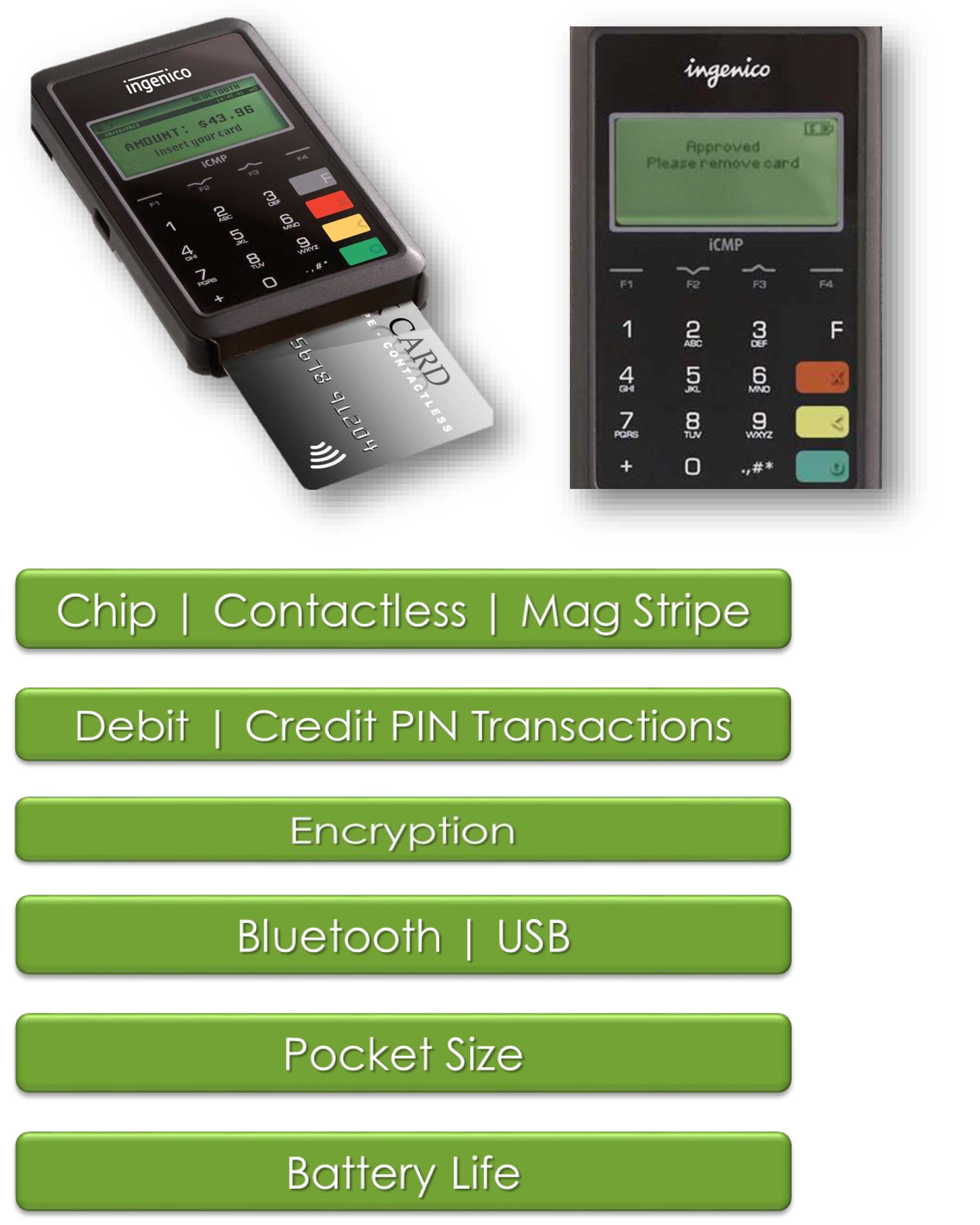

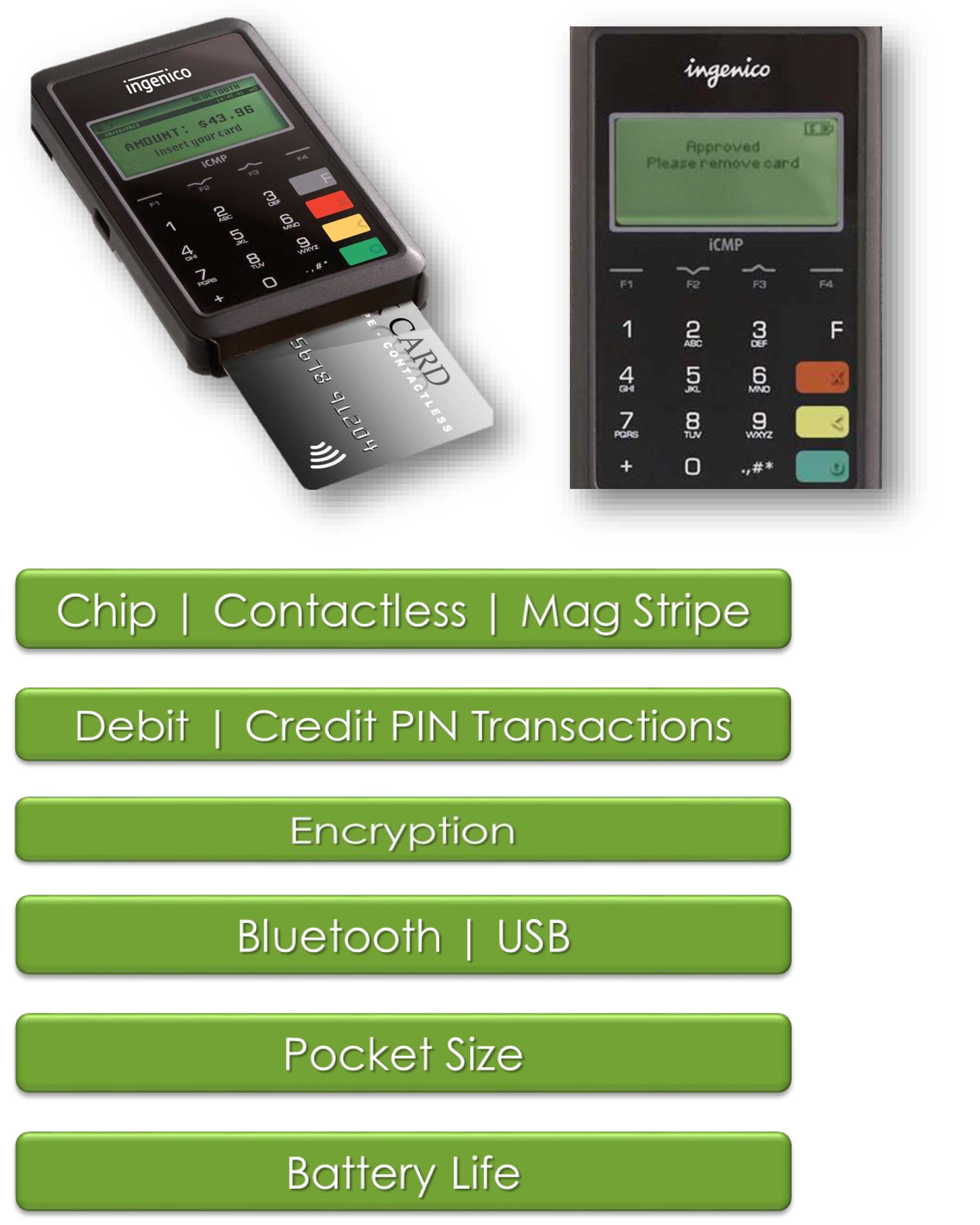

For our retail customers, we have the iCT250, the smart and compact desktop device designed for maximum efficiency. iCT250 offers a smart and effective payment experience on minimum counter space. Accept all electronic payment methods including EMV chip & PIN, magstripe and NFC/contactless.

For card-not-present, we have our payment gateway platform that accepts payments your way Online, In-Store and On the Go.

- E-commerce – manage your e-com business along with all of your other payment transactions in one, secure place.

- In-Store – accept payments in person with ease using your computer and a broad range of an optional device, like card readers and PIN pads.

- Back Office Mail & Phone – Process you mail and phone payments online. Converge is ideal for recurring and installment payments too.

- Mobile – Take payments on the go with an intuitive mobile app that’s compatible with most smartphones and tablets.

For more details give us a call at 888-996-2273 or check out our website for our products and services.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Internet Payment Gateway, Mail Order Telephone Order, Merchant Account Services News Articles, Mobile Payments, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: card, card readers, Chip & PIN, consumers, contactless, credit card, customers, e-commerce, electronic payment, EMV, fraud, in-store, magstripe, merchant account, merchants, mobile, nfc, online, payment, payment gateway, PIN pads, POS, provider, Security, terminals, transaction

May 10th, 2016 by Elma Jane

To our retailer partners, you are now able to accept UnionPay Cards with National Transaction. No additional steps are required; when a client hands you a UnionPay card just swipe it like you would with any other credit card.

What is UnionPay?

UnionPay was established in 2002 and has become the central and pivotal part of China’s bankcard industry. UnionPay cards are being accepted in 150 countries and regions outside of China. Since 2010, the number of bankcard networking merchants, POS terminals and ATM machines accepting UnionPay cards has increased by 40%, 30%, and 31% respectively. Chinese tourists are a huge strategic market with big profits and great potential for merchants in the US. These cards are currently being accepted at many large companies in North America including Niemen Marcus, Walmart, and Hertz.

Thank you for your business. At National Transaction Corporation our goal is to provide merchants with payment solutions and service beyond their expectations. If you have any questions please contact our Customer Service Department at 888-996-2273.

Posted in Best Practices for Merchants, Credit card Processing Tagged with: bankcard, cards, credit card, merchants, payment, payment solutions, POS, terminals

May 3rd, 2016 by Elma Jane

MerchantConnet is a great tool for merchants, it contains all the information that a merchant needs to manage their electronic payment activity. It’s fast, easy and secure!

- Merchant can view or update account information and make changes.

- Find copies of statements.

- Find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History.

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal.

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, card, chargeback, merchants, payment, terminal, transactions

April 29th, 2016 by Elma Jane

The credit card industry in the U.S. underwent a liability shift October 1st of 2015. The one major exception to the October 2015 liability shift has been automated fuel dispensers. Automated payment terminals at the pumps were given until October of 2017, to comply with the new standard.

Upgrading a gas pump payment terminal is more expensive than what other retailers face upgrading a typical credit card reader.

• First, the cost of replacing the payment terminal itself.

• After replacing gas station’s payment terminal, it also needs to re-certify the entire pump, which costs additional time and money.

• Gas pumps also have to be certified by state officials, to make sure that they are dispensing and charging correctly.

Consumers need to be vigilant while gas stations are getting a break, the card might be exposed to counterfeit credit card fraud, because whenever the card is swiped the traditional way using the mag-stripe, that EMV chip is not doing anything.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa Tagged with: card reader, chip, consumers, credit card, EMV, fraud, payment, terminals

April 28th, 2016 by Elma Jane

You can offer your customers preferred payment method with the next generation point-of-sales terminals, an all-in-one credit card processing experience: which not only support Near Field Communication (NFC) contactless payment transactions such as Apple Pay but chip cards and the traditional magnetic stripe cards; and manual entry transactions as well.

Contactless payment transactions are happening now. NTC are here to help.

Posted in Best Practices for Merchants Tagged with: chip cards, contactless payment, credit card processing, customers, magnetic stripe cards, Near Field Communication, nfc, payment, point-of-sales, terminals, transactions

April 27th, 2016 by Elma Jane

EMV Cards (Europay, MasterCard, and Visa) are smart cards (chip cards or IC cards) which store their data on integrated circuits rather than magnetic stripes. They can be contact cards that must be physically inserted or dipped into a card reader. Payment cards that comply with the EMV standard are often called chip-and-PIN or chip-and-signature cards, depending on the authentication methods required.

Posted in Best Practices for Merchants Tagged with: card reader, cards, chip cards, data, EMV, payment

April 27th, 2016 by Elma Jane

Near field communication is a contactless communication protocol between devices like (smartphones, tablets, smartwatches or even credit cards themselves) with a nearby NFC-enabled terminal by simply authorizing your device with a passcode or fingerprint authentication.

Both merchants and customers benefit from near field communication technology, by integrating credit cards, train tickets, and coupons all into one device. Faster payment transaction times and fewer physical cards to carry around.

If your smartphone has an integrated NFC chip, you can use a mobile wallet app like Apple Pay, Android Pay and Samsung Pay for items at retailers that support NFC transactions. Just load up your credit cards on your mobile device and wave or tap your device near an NFC compatible terminal to pay, no card swiping required.

As the technology keeps growing, more NFC compatible smartphones will be available and more businesses will offer NFC card readers for customer’s convenience.

Apple Pay, integrated into the newest generation of Apple mobile devices and incorporates NFC technology. If it becomes widely used by many iPhone users, perhaps merchants will be encouraged to more quickly adopt NFC technology.

Many major banks and credit cards are supporting NFC technology, issuing new cards with embedded NFC chips. This means that you may be able to tap or wave your card at the terminal instead of swiping, no phone required, in the next few years.

Posted in Best Practices for Merchants, Near Field Communication Tagged with: cards, contactless, credit cards, customers, merchants, mobile wallet, Near Field Communication, nfc, payment, Smartphones, tablets, terminal, transaction

April 11th, 2016 by Elma Jane

Card-not-present fraud is projected to worsen. However, 3D secure technology has made progress and is gaining more and more adoption.

How can e-Commerce merchants avoid CNP fraud?

Here are other ways to make card-not-present transaction safe:

Biometrics – Using Fingerprint Scans and Facial Recognition or Selfie. To validate the identity of the consumer.

Challenge Questions – Such as listing your father’s middle name or a fact known only to the consumer is an effectively added layer of security.

Location Data – Another way to fight against fraud is location data and the use of IP addresses to certify the location and identity of the consumer making the transaction.

Outsource Your Payment Platform – Payments pages hosted by a reputable payment service provider are much more secure.

One-time Passwords – During the checkout process, there will be a window to enter a one-time password which the consumer receives a text message on his/her mobile phone. The consumer enters the password within a short time frame to authenticate the transaction. This solution is especially effective against cyber criminals who steal credentials.

For your payment services needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: 3D Secure, biometrics, card-not-present, cnp, consumer, data, e-commerce, fraud, merchants, payment, Security, service provider, technology, transaction