April 24th, 2017 by Elma Jane

Recurring Payments through VirtualMerchant

Providing recurring payments is an easy way to increase retention, grow loyalty, and improve customer satisfaction.

Recurring Payments are automatic payments where a customer authorize a merchant to collect the total charges from a customer’s credit card or bank account every month. It is a useful feature with multiple applications: Donations, Memberships, subscriptions and utility payments.

Handle your recurring and installment payments with our single solution.

To set up a recurring payment, the merchant simply enters the specified charge, chooses the frequency of payment (weekly, monthly, annually) and the customer’s card is billed.

Automated recurring billing is an efficient, convenient and hassle-free service that can help merchants build and manage their business growth.

To set up recurring payment through VirtualMerchant call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, credit card, merchant, payments, recurring

April 7th, 2017 by Elma Jane

Merchant Cash Advance Or Loans

Merchant Cash Advance – is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Loans generally are lower rates than MCA? Monthly payments not daily and many of these loans may also be lines of credit. Lines of credit sometimes have collateral, real estate or other guarantees. These options can be uncovered through consultation service at NTC.

MCA companies provide funds to businesses in exchange for a percentage of the businesses daily credit card income directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed percentage of a merchant’s future credit card sales.

The Term Merchant Cash Advance – may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring short-term business loans, and it has a different set of rules and rates.

Cash advance has some advantage over a conventional loan structure. Payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans.

Ask our loan consultant if you were told you do not qualify for a loan.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, loan, merchant cash advance, payments

March 30th, 2017 by Elma Jane

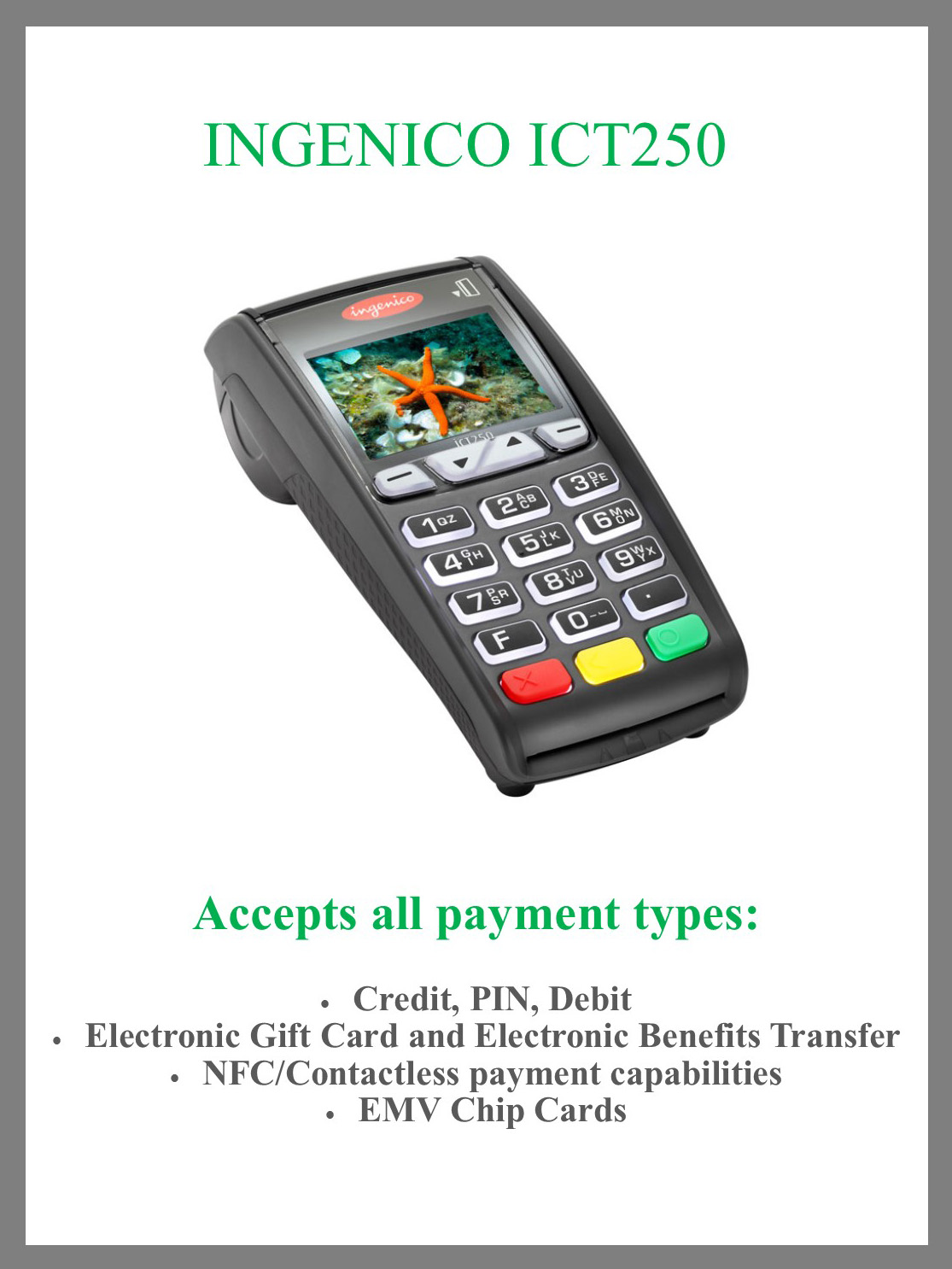

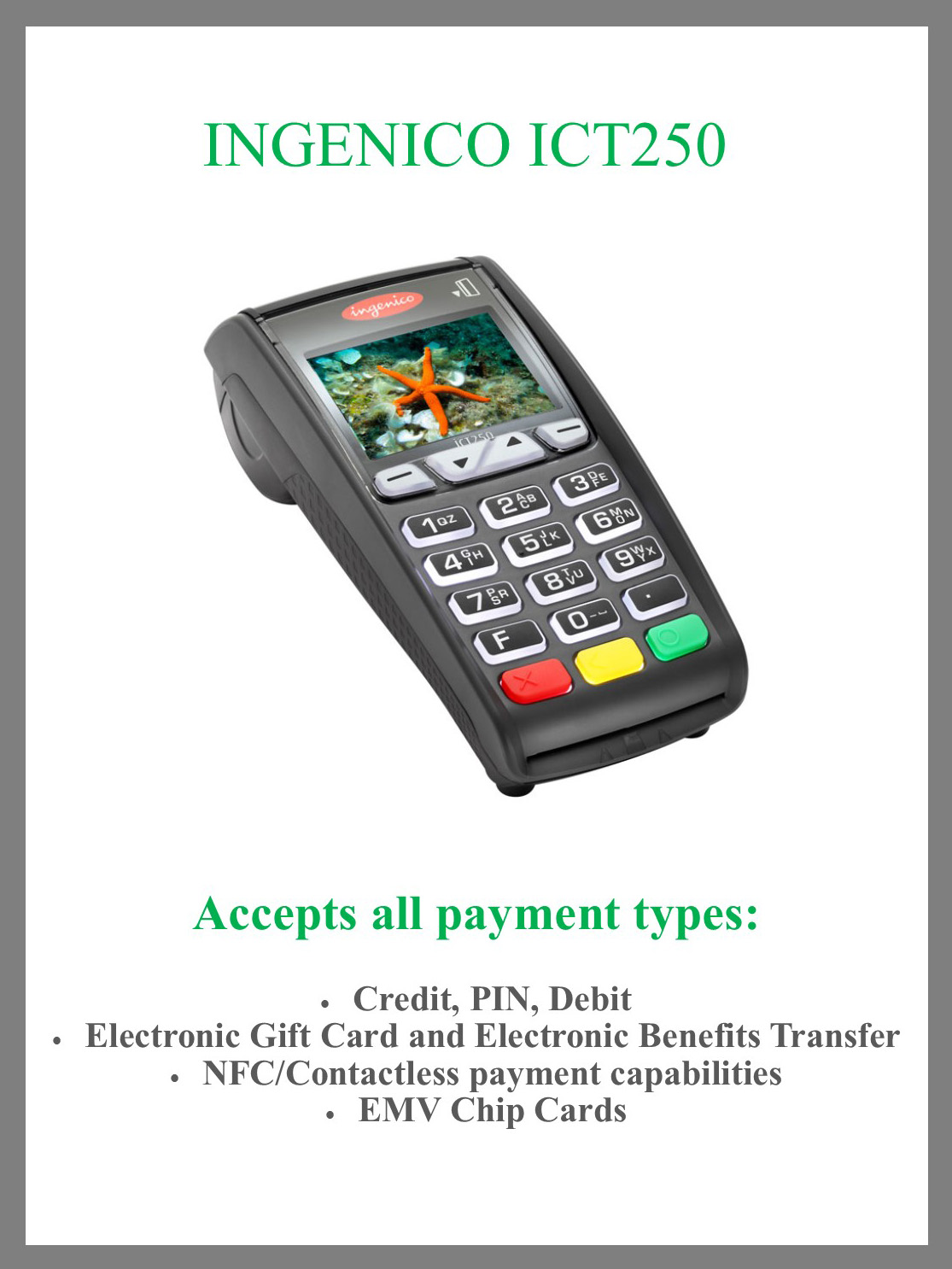

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

March 21st, 2017 by Elma Jane

Accepting Electronic Payments

Why do you need to accept electronic Payments?

Accepting credit card payment is becoming a must for businesses because 70% of consumer spending is done electronically.

Signing up with NTC is easy. No Setup or Cancellation Fees. No Risk!

Already accepting credit card payments? We can do FREE Rate Review and get 500 Points.

Call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, electronic payments, payments

March 20th, 2017 by Elma Jane

Process Your Travel Agency Payments For Less. Get 100% Funding The Next Day!

Call now 888-996-2273 or Sign Up now!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: payments, travel agency

March 17th, 2017 by Elma Jane

Southeast Acquirers Association (SEAA)

NTC will be attending the 2017 Southeast Acquirers Association (SEAA)

on March 20-22 at Le Meridien – 555 S McDowell Street, Charlotte, NC 28204

SEE YOU ALL!

For electronic payments setup, call us now 888-996-2273

Posted in Best Practices for Merchants Tagged with: electronic payments, payments

March 9th, 2017 by Elma Jane

Merchant Cash Advance

A Merchant Cash Advance is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Merchants sell a specific amount of their business’ future credit and debit card receivables at a discount in exchange for the capital they can use for business. Payments are often more flexible as they are based on sales.

For your loans and funding needs call now at 888-996-2273 Extension 1159

Posted in Best Practices for Merchants Tagged with: cash advance, credit, debit card, loan, merchant, payments

January 31st, 2017 by Elma Jane

Selecting a Payment Provider

Selecting electronic payments provider for your business is critical. NTC believes that the process starts with an honest assessment of your business and the types of credit card processing options it requires. (Retail or e-commerce, Card Present or Card-Not-Present)

Card present transaction is the most common type of account. Card-Not-Present (CNP) is a different type of account if you run a MOTO (mail order telephone order) or Internet operation.

Here are some points to keep in mind in selecting your electronic payments provider:

Referrals from fellow business owners and checking out payment providers online.

Evaluate products and services as well as cost to determine which electronic payments provider offers the biggest savings for your business.

Make sure the deals you’re considering include all the features and services you need and none that you won’t use.

Keep upgrade options in mind.

Look for 24/365 support and discuss customer service support.

Read the fine print in your contract.

The merchant account provider’s reputation is important, so find out how long they’ve been in business and their reputation in the industry.

NTC has over 20 years’ of Bankcard History. Helping businesses of all sizes for over 25 years in the industry. Call us now 888-996-2273 and tell us all about your business needs and requirements and we’ll put together a package of products and services that will best serve your credit card processing needs. There are a variety of solutions, so it’s important to focus in on those that directly address your needs.

Posted in Best Practices for Merchants Tagged with: cnp, credit card, customer, e-commerce, electronic payments, internet, merchant account, online, payment provider, payments, retail, transaction

January 24th, 2017 by Elma Jane

How to set up a travel merchant account?

First, you need to find a Merchant Service Provider.

Put together your business profile so you can start applying for a merchant account.

There are questions that you’ll need to answer, that way merchant account providers have an idea of how they should set up your account.

Some of the questions are:

Is your business seasonal?

For Travel Agencies or Tour Operators, it is seasonal, there will be high and low volume. NTC works with seasonal downtime.

How do you intend to accept payments?

Different business models require different methods of accepting payments.

If you’re doing face to face transaction and have a physical location then you need a credit card terminal.

If you process checks, then you need Electronic Check and ACH Transfers.

For e-Commerce shopping carts, wireless/mobile, you can check out our Converge Virtual Merchant and NTC e-Pay.

How much volume do you plan on processing?

Merchant account providers are going to want to know how much sales volume you plan on processing per month.

If you’re new in the business – give just an estimate average of how much you’ll be processing (per month), within the first 6-months of operation.

if you’ve been in the business – you’ll already have this number ready.

What will be your average ticket price?

Example:

Total Sales Revenue = $150,000

Total Number of Sales = 500 150,000/500 = $300 (Average Ticket Price)

If you need to setup an account give us a call at 888-996-2273 or use our contact form.

Posted in Best Practices for Merchants Tagged with: ach, credit card, e-commerce, E-Pay, Electronic Check, merchant account, merchant service provider, mobile, payments, shopping carts, terminal, transaction, travel, virtual merchant

January 19th, 2017 by Elma Jane

Card-Present vs Card-Not-Present – It’s important for a merchant to know what types of credit card payments their business will be taking.

If you rely on mailed, over-the-phone, or online payments a Card-Not-Present merchant account is what you need.

With this type of account, you don’t need the physical card. You are set up to accept credit cards where card information is being keyed into a credit card terminal or online.

A card-not-present merchant accounts base rate is higher than if you signed up for a Card-Present or swipe merchant account.

Why are card-not-present rates higher? There is less risk associated with a business swiping a credit card than keying it in. Why? When a card is swiped, a person is present; where the merchant can check ID and signature. When a person is not present, it’s open for consumer fraud.

However, when you’re setting up a Card-Not-Present merchant account, these factors are taken into consideration during the underwriting process, which leads to a lower base rate for keyed-in payments

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card present, card-not-present, credit card, merchant, online, payments, terminal