July 5th, 2016 by Elma Jane

With the ever growing number of financial crimes occurring within the payments industry, initiatives to identify patterns of possible suspicious behavior has been enhanced. The Loss Prevention team recently put into place a new procedure for collecting information pertaining to the Anti-Money Laundering requirements of “Customer Due Diligence” (CDD) and “Customer Identification Program” (CIP).

If a merchant reaches their Processing Limit (Soft Cap), or they request a change to their MCC/SIC, Loss Prevention is required to obtain and validate CDD and CIP information prior to making updates to the account. Loss Prevention representatives will reach out to the customer’s Merchant Service provider (MSP) office first, in an effort to effectively obtain the information without causing potential alarm to the customer.

Thank you for being a partner with NTC, and helping to prevent financial crimes in our industry.

Posted in Best Practices for Merchants Tagged with: customer, financial, merchant, payments, payments industry, service provider

June 10th, 2016 by Elma Jane

In-app purchases are important in getting customers engaged with mobile wallets, now, NTC has made it easier to implement Apple Pay into mobile apps with the launch of Converge In-App Payments. You are able to provide your customer with Commerce SDK, a software development kit, to integrate Apple Pay with our powerful omni-commerce platform, Converge. By reducing development effort, customers can save time and resources. Their mobile app gets to market faster, and they can capitalize on the growing market.

More mobile wallets will be available in the future.

To know more about this platform give us a call at 888-996-2273

Posted in Uncategorized Tagged with: commerce, customers, Mobile Apps, mobile wallets, omni-commerce, payments, platform

June 8th, 2016 by Elma Jane

Near field communication technology (NFC) is on the rise, and consumers can use NFC not just for making payments.

Top ways consumers can use NFC (Near field communications):

NFC Access Keys – can also be used as your access to certain buildings or hotels.

NFC Boarding Pass – are used in airports to expedite the boarding process. No more keeping track of that printed boarding pass!

File Sharing – on certain Android phones, consumers can share songs, contacts and files from phone to phone with a simple tap.

Retail – Paying in stores simply requires a wave of the customer’s smartphone. This provides speedier transactions, but also provides merchants the opportunity to offer their customers loyalty points and rewards.

NFC Ticketing – speeds up subway boarding time by allowing consumers to use their phones at the reader.

Vending Machines – NFC-enabled vending machines will allow customers to simply tap and go.

With the growing list of NFC technology uses, merchants should be prepared for the adoption. Upgrade your terminal to be NFC-enabled give us a call at 888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: consumers, customer’s smartphone, merchants, Near Field Communication, nfc, payments, retail, rewards, technology, terminal, transactions

June 2nd, 2016 by Elma Jane

Having the right tools to provide great service is important, this will make and keep your customers happy. An updated point-of-sale (POS) can help you improve customer satisfaction.

EMV – merchants are still behind in EMV acceptance. It may cost you to update but, it will save you money in the event of a fraudulent charge. EMV is here to stay, it is best to update your POS equipment now.

Insights – inventory management feature enables sales people to see available inventory. Tracking the products that sell the best and identifying products in high demand helps the owner stock strategically to better assist customers.

Loyalty Programs – an excellent way to keep current customers coming back.

Mobile Payments – Giving your customers more options on how to make payments by accepting mobile payments. Merchant gains the ability to speed up transaction times for customers.

Speed – customers want to check out at the store as quickly as possible. An updated point-of-sale solution will process transaction faster. A fast and easy system contribute to a better customer experience.

Need to upgrade your point-of-sale give us a call at 888-996-2273. NTC is here to help you.

Posted in Best Practices for Merchants Tagged with: customers, EMV, Loyalty Programs, merchants, Mobile Payments, payments, point of sale, POS, service, solution, transaction

May 5th, 2016 by Elma Jane

Businesses or merchants accepting payments online needs an up-to-date and active security software that includes:

- FIREWALL PROTECTION – a software program that helps to screen out malware and hackers that try to reach you through the internet.

- ANTI-VIRUS PROGRAMS – Not all anti-virus program offers protection against all kinds of malware. Viruses are one type of malware. Spyware is another type of malware that can steal credit card information or your bank account.

Update:

- Keeping your operating systems, security software programs, and browser current can help secure your data information.

- Evaluate browser’s privacy settings, limit or disable cookies. Other cookies can be used maliciously and collect data information.

- Back up your data regularly. If your computer or device got compromised, you still have access to important files.

Need to set up an account give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank account, credit card, data, merchants, online, payments, Security

April 28th, 2016 by Elma Jane

You may now give your customers the option to pay with PayPal in person. There is nothing you or they need to do – merchant card processing accounts with NTC have been automatically updated to accept PayPal in-person payments in addition to the other payment options currently offered.

How PayPal transactions work

When businesses accept a PayPal in-person payment, it could be processed in a number of ways. This will be reflected on the monthly processing statement and customer receipts, and the businesses you serve will receive the same pricing they currently do for payments over these networks:

- PayPal mobile payments will be processed as Discover transactions and are subject to Discover operating regulations.

- PayPal-branded card payments will be processed over the payment network designated on the card and are subject to operating regulations designated by the network on the card.

Posted in Best Practices for Merchants, Credit card Processing Tagged with: card, card payments, card processing, customer, merchant, Mobile Payments, payment network, payments, transactions

April 14th, 2016 by Elma Jane

Accepting credit card payments is a must if you’re planning to start a business. It’s good to know what is out there and how it applies to your situation. So you need to learn about credit card processing machines, depending on your business.

Here are some of the different types of credit card processing machines:

Dial-Up Terminal – the grandfather of credit card processing machines. Dial-up terminals use a phone line to connect with a credit card processing company. The advantage is that they are normally inexpensive than some higher-end options. The disadvantage is slower processor speed.

IP Terminal – connect the merchant over a high-speed internet connection. The advantage of IP terminal over dial-up terminal is speed. IP machines can process transactions as fast as 3 seconds as opposed the 10 to 25 seconds that a dedicated dial-up machine might take. IP terminals now cost about the same as dial-up units and that a single DSL link can accommodate more than one credit card terminal.

Wireless Terminals – the priciest yet most convenient type is a wireless machine that runs on a wireless network, much like your mobile phone.

Virtual Terminal – virtual terminals are computers running credit card processing software connected to a credit card reader. Virtual terminals are a great addition to an office because they don’t require a standalone credit card processing terminal.

There are many options available for your business, whether you’re e-Commerce, MOTO, In-Store or Mobile there’s a credit card processing machine and platform out there that will fit your business.

Give us a call to know more at 888-996-2273 or visit us at www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce Tagged with: card reader, credit card, credit card processing, e-commerce, merchant, mobile, moto, payments, terminal, virtual terminal

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

April 8th, 2016 by Elma Jane

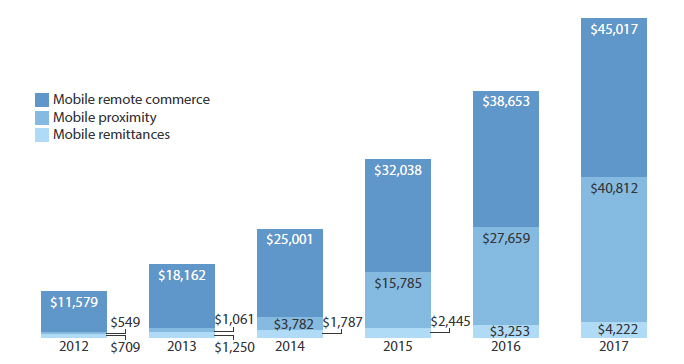

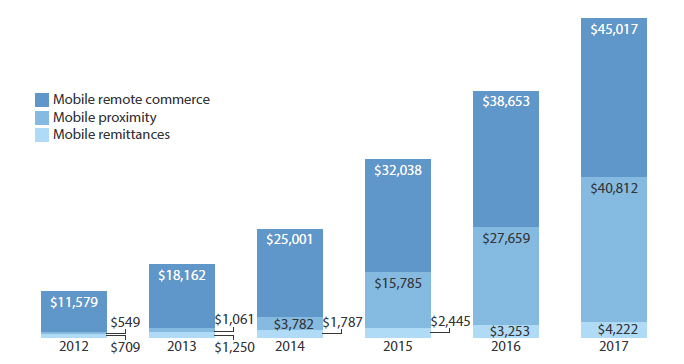

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

April 4th, 2016 by Elma Jane

Accept Payments Your Way – In-Person, Online, and On The Go

Keeping up with customer demands and growing your business can be challenging. With NTC’s payments platform, you can process payments from customers quickly and securely, whether in-person, online or on the go. NTC can help you manage it all in one place, easily, securely and cost effectively.

Posted in Best Practices for Merchants Tagged with: customer, online, payments