December 15th, 2015 by Elma Jane

Visa Inc. has launched the Visa Token Service in Asia Pacific, in association with United Overseas Bank (UOB). Store tokens on mobile devices, cloud-based mobile applications, and e-commerce merchants carry less risk of security hack. This security technology will replace sensitive account information to make payments without exposing bank details.

Tokenized cards are linked to customer’s wallet application or mobile and validated by VisaNet. Biometric authentication and device identification features are available through this service. Visa debit or credit cardholders with NFC-enabled Android smarthphones cardholders will be able to make contacless payments.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: bank, biometric, cardholders, cards, contacless payments, credit, debit, e-commerce, e-commerce merchants, merchants, nfc, payments, token, Tokenized cards, visa

December 11th, 2015 by Elma Jane

The use of in-store mobile payments increased in the US this year, from 5% in 2014 to 18% in 2015, research reveals, with approximately one in five consumers using their phone to make a payment at the point of sale.

The most popular uses of mobile payments in the US:

Public Parking (19%)

Gas Station Purchases (18%)

Coffee Shops and Fast Food Dining (17%)

Paying for Groceries (16%)

Public Transportation (16%)

Paying for a Taxi (16%)

Paying for restaurant bills (15%)

Checking out of a Hotel and Paying the Bill (13%)

Shopping for Clothing (12%)

Shopping in General on the High Street or in the Mall (10%)

Other (7%)

US consumers aged between 25 – 34 were seen as driving the largest portion of mobile payment activity at 36%, with those aged from 45-74 accounting for less than 10% of activity.

Half of the survey’s 2,000 respondents in the US cited security concerns as the main reason for not using mobile devices for in-store payments, while consumers place the greatest trust in traditional financial institutions like banks (49%) for provision of payment services.

Mobile technology is now moving beyond simply being a mode of communication and advancing towards the era of the always-connected consumer, says US telecommunications sector leader at Deloitte.

http://www.nfcworld.com/2015/12/11/340588/store-mobile-payments-increase-four-fold-across-us/

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale Tagged with: banks, financial institutions, Mobile Payments, payment services, payments, point of sale

December 9th, 2015 by Elma Jane

The RushCard catastrophe affected more than 132,000 consumers, without access to their prepaid card accounts to get their paychecks, buy groceries, pay bills or pay rent for days.

The total number of customers, and a tally of how many people were affected, haven’t previously been disclosed because it is a privately held company.

Senator Brown urged UniRush on Monday to cooperate with an investigation from the Consumer Financial Protection Bureau, which has requested documents and other information to determine what caused the outage and what the company was doing to compensate consumers.

The card company petitioned to push back the deadline for compiling the information to Jan. 15, from Nov. 10, calling the request broad and overly burdensome, but the bureau denied the request last week.

The prepaid card company announced in October that it would create a multimillion-dollar fund to compensate customers who faced financial issues after being locked out of their accounts.

RushCard spokesman said Monday that the company has started to compensate customers, even hand delivering cash in some cases, but he wouldn’t specify how many people had received payments.

RushCard is a Prepaid Card Company co-founded by Russell Simons.

Posted in Best Practices for Merchants Tagged with: card, card company, payments, prepaid card

December 7th, 2015 by Elma Jane

Most payments will probably be made with apps in phones or smartwatches in less than a decade from now, using NFC, biometrics or other mechanisms that don’t involve swiping or using plastic cards.

If your mobile device has an integrated NFC chip, you can use a mobile wallet app like Apple Pay and Android Pay to pay for items that support NFC transactions at a retail store. Simply wave your device near an NFC compatible terminal to pay, no card swiping required.

Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

In some countries, it’s easy for consumers to get credit cards with imbedded NFC chips. This means that you may be able to wave your card at the terminal instead of swiping, no phone required. In America, though, because NFC hasn’t caught on until recently, analysts expect that NFC via smartphone and smartwatch services such as Apple Pay and Android Pay will dominate contactless transactions in the next few years.

Just as credit cards replaced cash, credit cards will be replaced by digital payments which will continue to rely on the credit infrastructure but will obscure the plastic card itself.

As consumers, we love to see better products. When it comes to payments, we need Standards and Reliability.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: biometrics, cards, contactless transactions, credit cards, digital payments, mobile wallet, nfc, NFC chip, payments, smartphone, terminal

December 4th, 2015 by Elma Jane

The payments world continues to reinvent itself almost daily, predictions have now become reality. Demand for mobile payments are growing, with the increasing mobile internet penetration that enables the users to process Mobile Point-of-Sale (MPOS) and close the sales process quickly. Moreover, the rising adoption of tablets and smartphones across the globe allows the retailers and merchants to integrate MPOS into their payment systems.

Mobile presents a tremendous opportunity for merchants today. The usage of cloud-based solutions is expected to fuel the MPOS market. These solutions enable merchants to access customer information and product data across multiple platforms. Large amount of data would require highly compatible Mobile Point-of-Sale (MPOS) that will capture information such as payment preferences, and buying behavior to fuel the market. MPOS would also enable merchants to store a large amount of data that can be accessed from anywhere across the globe by authorized personnel. The value that this channel can provide is very powerful creating new business opportunities.

Interested in Electronic Payments give us a call now at 888-996-2273

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale Tagged with: merchants, mobile, mobile internet, mobile point of sale, MPOS, payments, point of sale

December 1st, 2015 by Elma Jane

Merchant account Aggregators has one merchant account that they let people use. You get quick setup, and get shut down quickly. A post approval risk management technique!

What’s the problem with Aggregators? If anything unusual happens their only recourse is to freeze your account entirely or hold your money. Most Aggregators are hard to get hold of because they don’t have human customer support.

Visa and MasterCard monitor Aggregators very closely. Once an individual or business sells more than $100,000, they force the Aggregator to issue individual, traditional Merchant Accounts for the business.

Aggregator is not intended as a long term, scalable solution to accepting payments.

While Aggregators have a One to Many structure, Traditional Merchant Accounts like National Transaction have a One to One structure. Traditional Merchant Accounts are not balancing the risk of your account against others, they want details on your specific situation before they give you a Merchant Account.

Traditional Merchant Account look at three things:

Your personal history “credit”, your business history if you have one and your business model. If you are working with the Right Merchant Account provider, they will know your business and understand the risk before you accept cards. They have other options to mitigate the risk than simply freezing funds or closing your account.

Why you may want to consider National Transaction over Aggregators, of the thousands of Merchant Account providers out there, only about 1% of them consider themselves High Risk Providers like National Transaction, which despite the abrasive term, are the ones who do effective underwriting.

Give us a call now at 888-996-2273 https://www.nationaltransaction.com/

Posted in Best Practices for Merchants Tagged with: aggregators, High Risk Providers, MasterCard, merchant account, payments, visa

November 12th, 2015 by Elma Jane

The United States will leap-frog over chip-and-signature EMV cards quickly and move into biometrics and other security measures, a recent panel discussion on payment technology has heard.

Biometrics is going to play a bigger role in payments going forward because it can be more convenient and it can be a stronger form of verification.

Biometric technology has been a major topic in the payment industry. In another panel held during the recently concluded Money 20/20, experts discussed the role that it will play in the future of the payment industry.

The panel also talked about various biometric technologies including voice, face, iris and fingerprint recognition, which are paving way for new applications in the financial services and payments sectors.

Posted in Best Practices for Merchants Tagged with: biometrics, EMV, financial services, payment industry, payment technology, payments, payments sectors

November 6th, 2015 by Elma Jane

Money 20/20 was billed as the largest convention in payments history held in Las Las Vegas, during the last week of October 2015.

The show delivered well-organized, incisive content such as Europay, MasterCard and Visa (EMV) migration, mobile payments, security and omnichannel commerce.

20/20 Highlights

- Alternative lending and credit.

- Bill Payments, Financial Services: Newly released market research provides insights into the future of household bill payments, millennials, and financial services.

- Connected Commerce and the Mobile Enterprise: The Internet of Things is changing the way that consumers interact with their environments. Analysts predict up to 30 billion interactive devices will be connected to the Internet by 2020, noting that many of these devices will be payment-enabled.

- Marketing and Customer Experience: Most marketers agree that the era of demographic profiles and pull marketing is over. Retailers, card brands and information technology professionals looked at the customer experience in the digital world. They explored new marketing practices, trends in e-commerce and mobile commerce, and big data findings in other industries that may be useful to financial service companies.

- Mobile Banking: Banks are undergoing an incremental transformation as they learn to compete with nonbank lenders, balance cash management with digital currencies, and shift from local branches to online and mobile forms of banking.

- Mobile Payments: Payments analysts reviewed Apple Pay a year after its launch and a range of other mobile wallet offerings, and they speculated on how third-party wallets will impact bank apps.

- Payment Card Evolution: Payment card issuers, processors and network service providers analyzed the changing look, feel and role of payment cards in the greater ecosystem. Discussions ranged from card linking to the coolness factor of gift cards to how e-cards are expanding market opportunities.

- POS, Processing and Open Platforms: Executive roundtables with leading acquirers explored front-end and back-end technology and omnichannel commerce for small and midsize businesses.

- Regulatory Landscape: Increased federal and state oversight has had a significant impact on the financial services sector.

- Security: Security analysts made in-depth presentations on tokenization, end-to-end encryption, and secure methods of authentication designed to protect consumers, merchants and industry stakeholders from cybercriminals. Many agreed that EMV implementation in the United States will drive fraudsters to the card-not-present space. They discussed how EMV adoption has changed fraud patterns in other regions and offered examples of best practices geared toward identifying and preventing electronic payment fraud.

More than 10,000 attendees and 3,000 exhibitors from 75 countries attended Money20/20. Financial services professionals from mobile, retail, marketing services, data and technology met at what show organizers described as the intersection of mobile, retail, marketing services, data and technology.

The years to come will be a turning point in the payments sector, and with the recent shift to EMV, the entire conference confirmed that all the players are more interested than ever in finding innovative solutions for combating online fraud.

Posted in Best Practices for Merchants Tagged with: Apple Pay, big data, bill payments, card-not-present, e-commerce, electronic payment, EMV, EuroPay, financial services, Gift Cards, MasterCard, merchants, Mobile Payments, mobile wallet, payments, POS, processors, Service providers, tokenization, visa

November 5th, 2015 by Elma Jane

EMV-compliant POS systems are now being equipped with NFC technology to accept contactless payments. What does this mean for the future of payments?

EMV lays the foundation for increased card-present and contactless payments security, with EMV, magnetic stripe cards are soon to be a bygone technology. Plastic EMV cards will not have a long lifespan as payments move into a more digital space, security and NFC upgrades merchants and consumers now will carry over into the digital and mobile payments space.

Consumers are constantly looking for more convenient ways to transact, which is made possible by the simultaneous adoption of EMV and NFC. While EMV supports plastic chip cards, payments are going digital and POS systems equipped with NFC technology save consumers from digging through their wallets, making it easier for consumers to transact via mobile devices. Mobile payments should be simple, scalable and affordable in today’s payment landscape and consumers should have the option to securely store and use multiple cards within their digital wallets or applications they most often use.

EMV standards increase security for card-present payments, which are relevant to many consumers today, but the convenience of mobile and contactless payments is the future. In an era of EMV, NFC plays as critical a role in propelling both technologies forward. Retailers and card issuers alike must recognize the opportunity to take advantage of both.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Smartphone Tagged with: (POS) systems, card present, chip cards, contactless payments, Digital wallets, EMV, magnetic stripe cards, merchants, Mobile Payments, nfc technology, payments

November 2nd, 2015 by Elma Jane

Delivering Paperless, Next-Day Deposits for Health Insurance Payments.

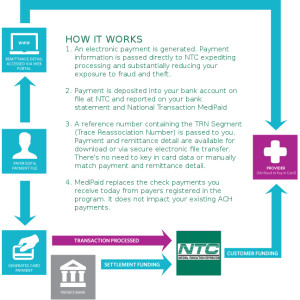

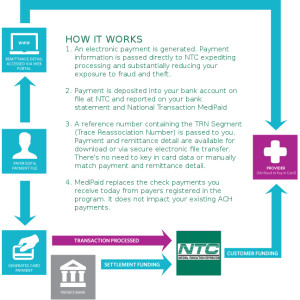

NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance payments. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: checking account, credit card, electronic payments, health insurance, healthcare provider's, medical insurance, MediPaid, merchant accounts, payments, provider's