June 23rd, 2024 by Elma Jane

Merchant Aggregators, Merchants of Records and Payment Service Provider what’s the difference?

Payment Service Provider – is a company, which provides payment gateway and related services (like antifraud tools) to merchants. PSP is a representative of one or several acquiring banks. The merchant signs an agreement with the acquiring bank and PSP. The acquiring bank provides a merchant account and secures settlements for merchant’s transactions directly to the merchant’s bank account. Payment Service Provider secures delivery of the merchant’s transactions to the acquiring bank and some related services like fraud scrubbing and recurring transactions. The merchant has an own merchant account with this model.

Merchant Aggregator – is a company, which uses one merchant account to process transactions from many merchants. Merchants don’t have any agreements with an acquiring bank, but with the merchant aggregator. You get quick setup and get shut down quickly. Most aggregators are hard to get hold of, they don’t have human customer support. The problem with this model is, it’s not intended as a long-term, scalable solution to accepting payments and they can freeze your account or hold your money if anything unusual happens.

Merchants of Record – are a merchant, who use services of payment service provider (PSP) or merchant aggregators to accept payments on their websites for goods or services they sell. Merchant of record role requires an array of administrative responsibilities, such as managing a merchant account with a payment processor, paying associated credit card rates & fees for the transactions and other responsibilities like complying with PCI DSS Standards.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank account, credit card, customer, merchant, payment gateway, payment processor, Payment Service Provider, PCI, transactions

May 5th, 2024 by Elma Jane

Tokenization is a powerful security feature that allows a merchant to support all of their existing business processes that require card data without the risk of holding card data and without any security implications, because tokens are useless to criminals, they can be saved by the merchant as they do not represent any threat.

The liability and costs associated with PCI compliance is substantially reduced and the risk of storing sensitive data is eliminated.

Tokenization applies to credit card and gift card transactions.

Imagine a world where you could accept credit card payments without actually storing any sensitive cardholder data. No more worrying about data breaches, PCI compliance headaches, or the crippling costs of a security breach. That’s the power of tokenization.

Here’s how it works:

Instead of storing sensitive credit card information on your systems, each card number is replaced with a unique, randomly generated “token.” This token is useless to hackers, but it can be used to process payments securely on the merchant account that created the token.

Think of it like a valet ticket:

You hand over your car (the sensitive data) to the valet (the tokenization provider), who gives you a unique ticket (the token). The valet keeps your car safe, and you can use the ticket to retrieve it when needed.

The benefits are immense:

- Ironclad Security: Reduce your PCI DSS scope and minimize the risk of costly data breaches. With tokenization, even if your system is compromised, the actual card data remains safe.

- Effortless Compliance: Simplify PCI compliance and avoid hefty fines. Tokenization helps you meet the stringent security requirements for handling sensitive cardholder data.

- Recurring Billing Made Easy: Securely store tokens for recurring billing or future transactions. This allows you to charge customers later without having to store their sensitive information.

- Improved Customer Trust: Demonstrate your commitment to data security and build customer trust. Knowing their information is protected encourages repeat business and loyalty.

- Streamlined Checkout: Offer a frictionless checkout experience with saved payment information. Tokenization enables faster and more convenient payments for your customers.

Tokenization is not just a security measure, it’s a strategic advantage:

- Reduce costs: Minimize the expenses associated with data breaches and PCI compliance audits.

- Boost efficiency: Streamline your payment processes and reduce administrative overhead.

- Enhance your reputation: Position your business as a leader in data security and customer trust.

In conclusion:

Tokenization is a game-changer for businesses that accept credit cards. It offers unparalleled security, simplifies compliance, and unlocks new opportunities for growth. Embrace the future of secure payments with tokenization and watch your business thrive.

For Electronic Payments with Tokenization call now 888-996-2273 or click here NationalTransaction.Com

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, Payment Card Industry PCI Security Tagged with: card, credit card, data, electronic payments, merchant, PCI, Security, token, tokenization, transaction

March 8th, 2024 by Elma Jane

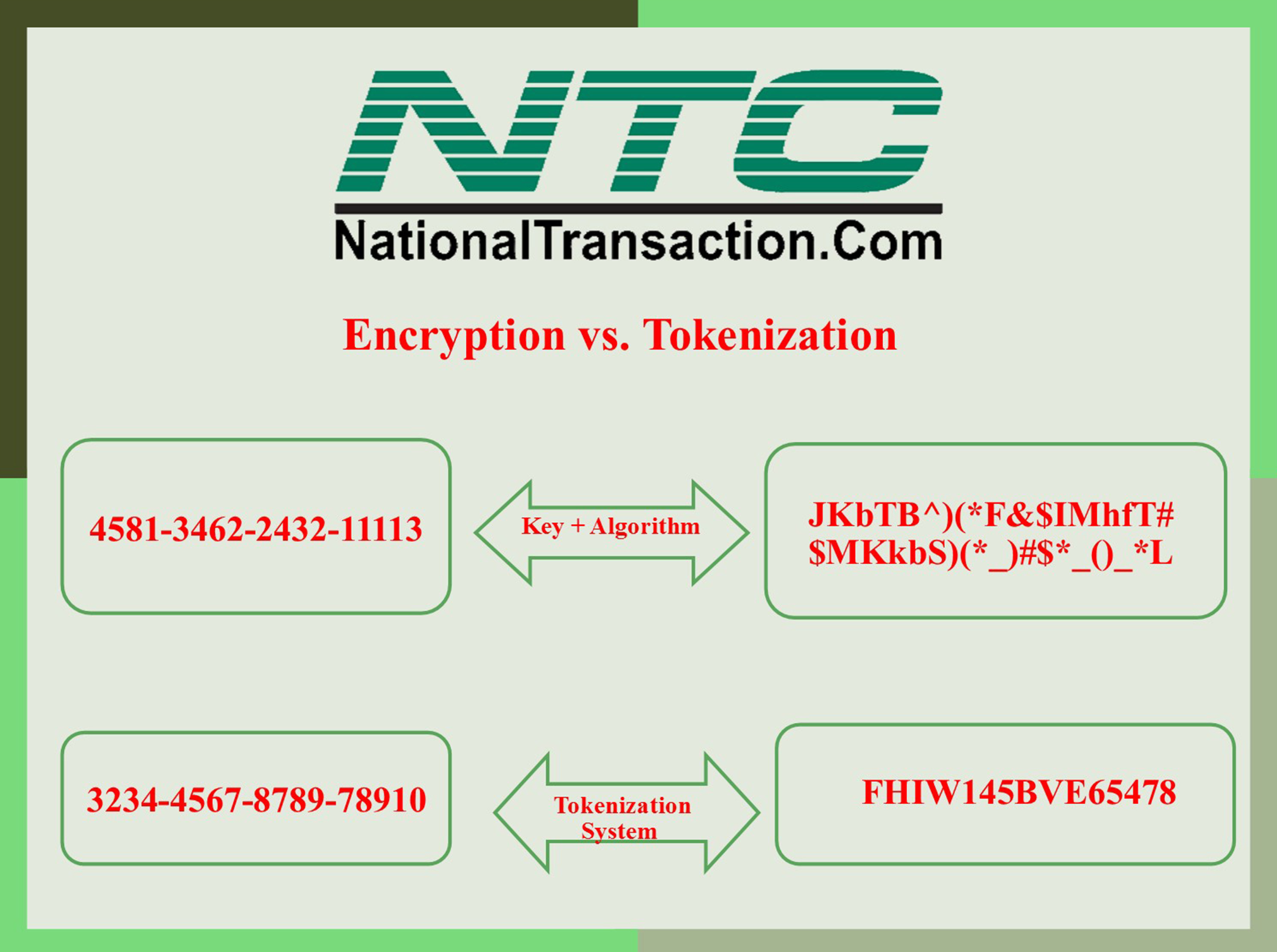

TOKENIZATION AND ENCRYPTION SECURITY

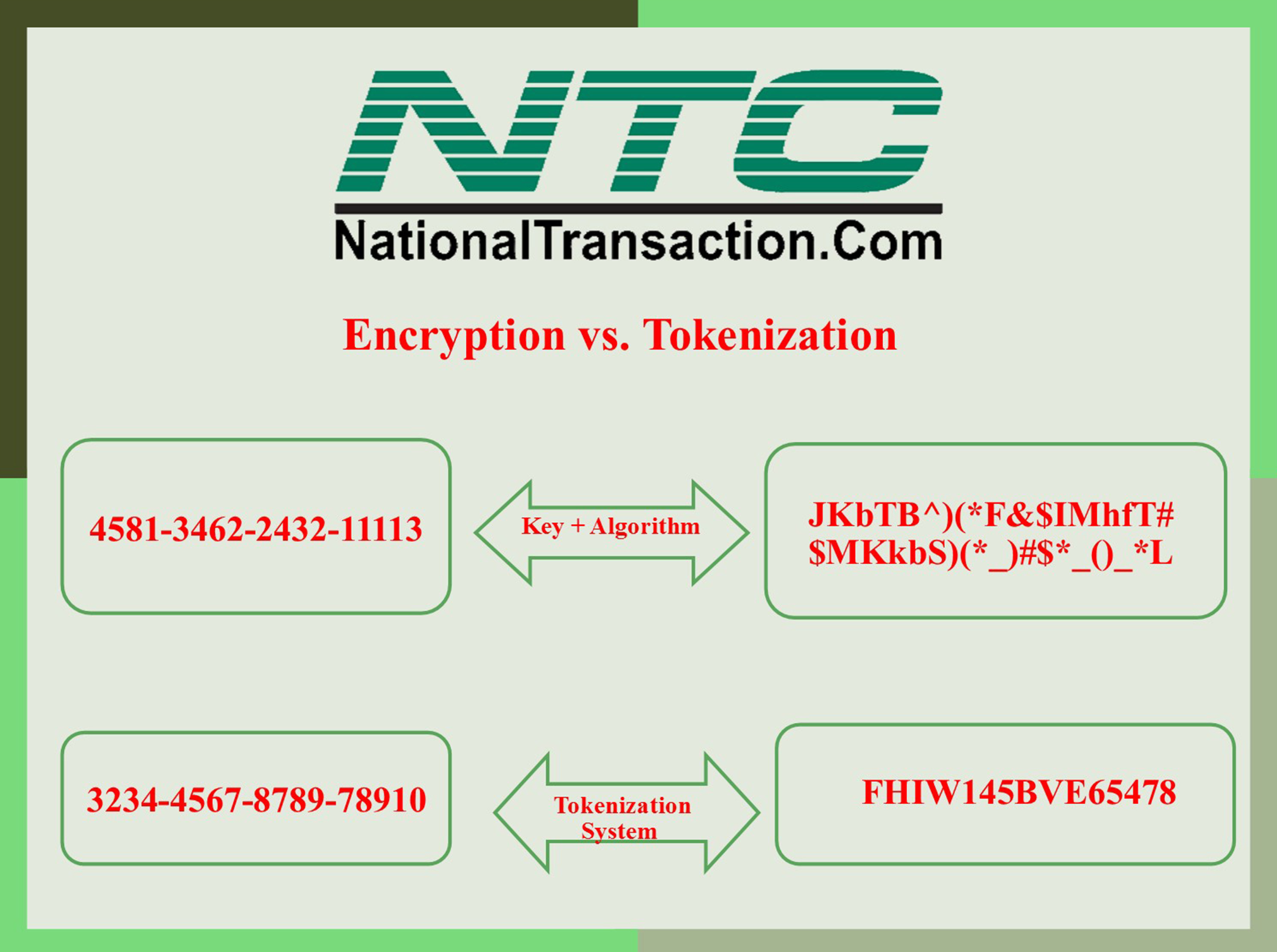

Encryption is reversible. Encrypted data can be returned back to its original, unencrypted form. The encryption strength is based on the algorithm it uses. A more complex algorithm will create stronger encryption to secure the data. Encryption is most often “end-to-end.”

PCI Security Standards Council and other governing compliance entities still view encrypted data as sensitive data.

Tokenization system replaces sensitive data and the token cannot be reversed into true data, it has no value. The real, sensitive information is stored in a secured offsite platform. An entirely different location. That means sensitive customer data does not enter or reside within your environment.

Unlike encryption, tokenization isn’t subject to issues with PCI/DSS compliance or other data security organizations, because tokens do not contain any real data.

If a hacker managed to steal your tokens they cannot be used for a fraudulent transaction.

Using tokens doesn’t change a merchant’s payment processing experience as it protects their valuable credit card information.

For Electronic Payments call us now 888-996-2273

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: data, encryption, PCI, Security, tokenization, transaction

September 18th, 2017 by Elma Jane

Smart Security for Smart Businesses:

Safe-T for SMB streamlines the PCI process while providing the layered security needed to protect card data

EMV – Fraud protection at the point of sale

EMV chip technology keeps the consumer’s card in their hand. It also helps protect the business from card-present fraud related chargebacks.

Encryption – Protection of payment card data in-transit

Safe-T scrambles cardholder data using advanced encryption technology, so data is protected at the point of entry, and throughout the authorization process.

Tokenization – Token ID protection of stored payment card data

Safe-T returns a token ID or an alias, consisting of a random sequence of numbers to the point-of-sale so the actual card number is never stored. Token IDs can be used for follow up transactions (i.e. recurring payments, voids, etc.).

Reduced PCI – Protection from complex PCI compliance

Maintaining PCI Compliance can be intimidating – second only, perhaps, to completing your taxes. Safe-T eases this process for customers by reducing the number of PCI Self-Assessment questions by more than 60% from 80 questions to 31.

Financial Reimbursement – Financial protection from a card data breach

Recovering from a card data breach can be costly for a small business. Safe-T offers Card Data Breach Reimbursement to financially protect your customer’s business in the event of a card data breach – regardless of the type of card data breach.

For Electronic Payment Set up with this feature call now! 888-996-2273

Posted in Best Practices for Merchants Tagged with: card data, card present, chargebacks, chip, data, data breach, EMV, encryption, fraud, payment, PCI, point of sale, Security, tokenization

August 25th, 2017 by Elma Jane

A travel merchant account helps you manage all your transactions. It also allows you to integrate into your booking software; plus, there are more features that you get to process payments in a secure environment.

Virtual Merchant Payment Terminal

This is a web-based system that allows you to view processed payments in real-time. You can access it using any web browser, and the transactions are conducted over a secure and encrypted connection.

Customers get receipts for their payments via email once the transaction is complete. You can also handle installments and recurring payments online. It also accepts different payment methods, including gift cards, electronic checks, and credit and debit cards.

Loyalty Programs

With a travel merchant account, you are able to reward your loyal travel customers. You can personalize your loyalty program for customers basing on their behavior. A loyalty program can offer free products or discounts on certain tour or travel packages.

Also, you can make gift cards part of your program. With these cards, you can simply load them with any dollar amount and present them to your customers. Plus, they’re re-loadable and offer a great way of advertising. These programs can go a long way in boosting your customer’s loyalty.

Trams & Sabre Integration

If you’re using Sabre Travel Network for agency services, you can easily integrate your account into Sabre to improve your travel options. This integration allows you to provide convenient payment methods for customers searching for cruise lines, hotel properties, car rental services, and airlines.

Also, for those using Trams for accounting and reporting, NTC travel merchant account lets you make a simple integration. In the long run, you are able to focus on growing your travel agency and offer quality services to your clients.

Mobile Processing

Accepts payments fast and on-the-go with mobile processing solutions that are PCI compliant. With this service, you only need to use a mobile device card reader to swipe cards.

Mobile payment processing allows you to use your own iOS or Android device with a free mobile app which you can integrate with your account to manage transactions.

Offering a convenient and smooth payment methods to your clients is one of the ways to grow your business. National Transaction Corporation merchant account, offers secured travel payment processing services e-Pay, to process your payments; with no delays and at a very competitive rates.

Also, you can accept payments from anywhere and get 100 percent funding. Faster deposits for bookings, which can occur as quick as the next business day.

To speak to our travel payment consultant, call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: card reader, credit, debit cards, electronic checks, Gift Cards, Loyalty Programs, mobile, payment processing, payments, PCI, swipe, terminal, transactions, travel agency, Travel Merchant, virtual merchant

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Hotel, Motel and Bed & Breakfast customers will benefit from this smart terminal:

- Smaller, independent motels or hotels

- Hotels without property management systems

- Existing hospitality customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

March 30th, 2017 by Elma Jane

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

February 13th, 2017 by Elma Jane

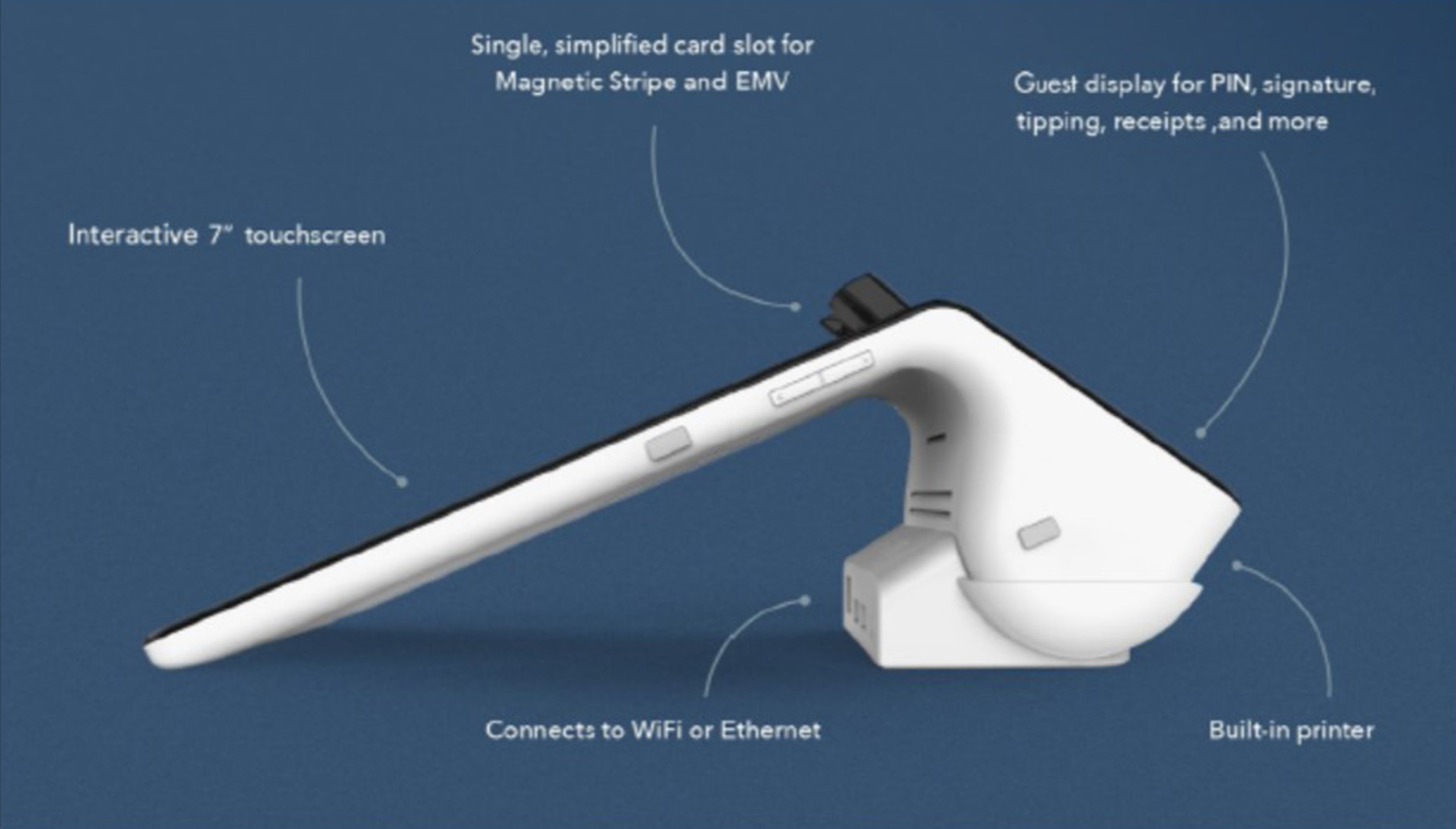

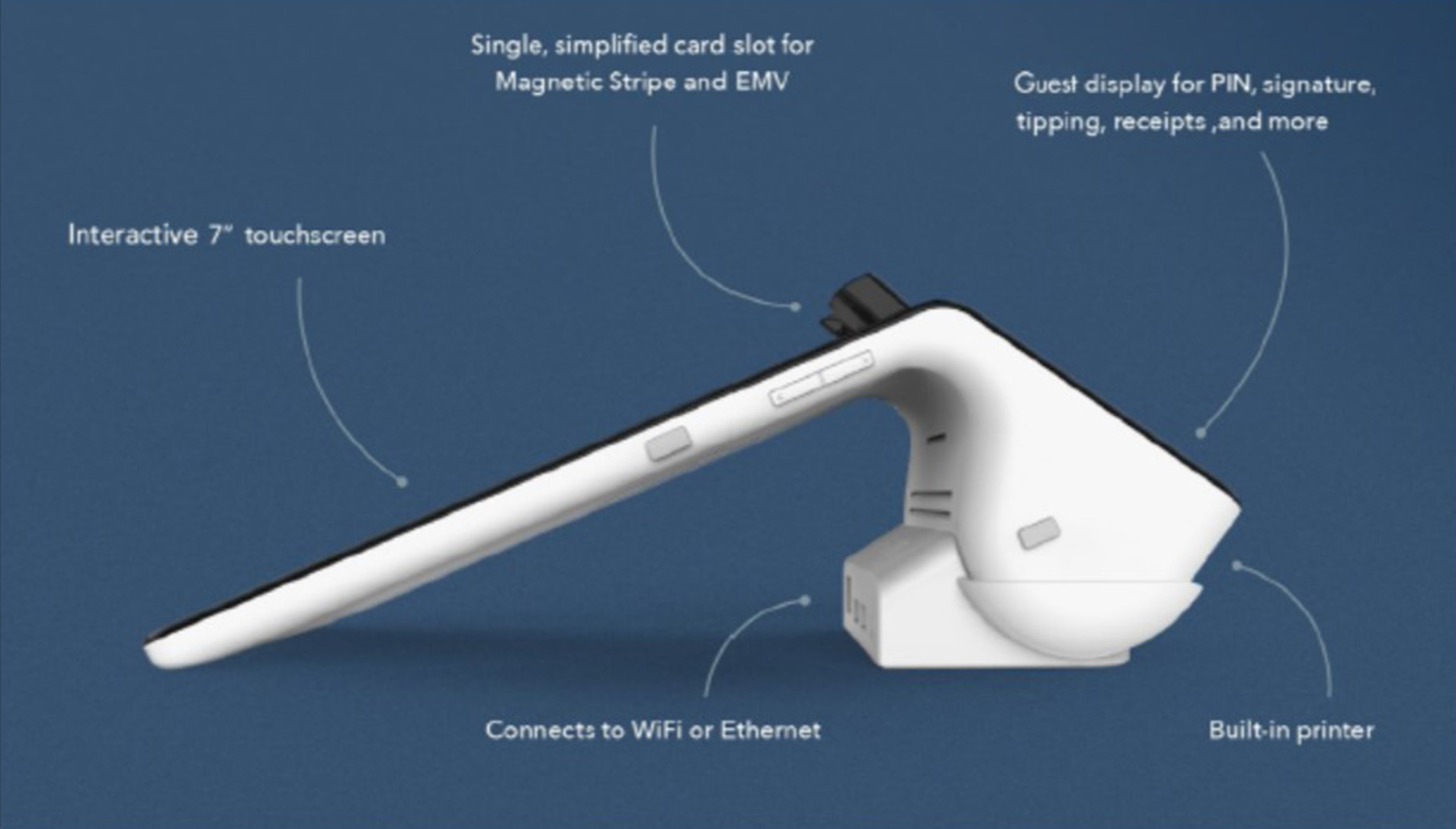

Smart Device for Lodging Transactions

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions