September 29th, 2014 by Elma Jane

If your retail business products sells only in-store, then you’re falling behind. Consumers in the digital age expect options when they shop, and if you’re not offering those choices, your customers may pass you by for a more tech-savvy competitor. Consumers go into stores, evaluate products and buy online, or research online and go into the store for purchase. The two worlds have merged, if you’re not covering both spectrums, you’re missing out.

Recent research by UPS showing 40 percent of today’s shoppers use a combination of online and in-store interactions to complete their purchases. The days of physical stores being separated from online shopping are over. They’re no longer channels that are happening on their own. The UPS survey found that a large chunk of online shoppers cross channels during their shopping path. Be present on both channels and take advantage of that.

It’s not always possible or economic for an online-only retailer to open up a physical storefront, but existing brick-and-mortar stores or wholesalers can easily introduce an e-commerce component to their sales to expand their customer reach. Online sales help reach consumers that may not otherwise be able to purchase your products. Even if your company’s main focus is creating a personalized in-store experience, there are still ways to capture the online shopper market. In addition to giving consumers a way to research your products before coming in-store to purchase your offerings, you can offer people a way to conveniently buy items they already know they want.

For all the advantages a multi-channel sales strategy can give a retailer, there are still some challenges to this approach. Managing inventory versus cash flow and ensuring even demand on both channels have been company’s two greatest challenges in balancing in-store and online sales. Creating demand is how companies set themselves apart from competition. The secret sauce. The challenge is making sure that retail operations have a turnover ratio that works for the shipping schedules from the main warehouse. This isn’t a problem for e-commerce businesses, because product can be packaged and shipped as fast as it gets produced. But an omnichannel company has to take retail and e-commerce into account when stocking a warehouse.

There are a few different strategies retailers can use to help keep their sales operations well-balanced. Offering different items online versus in-store, to avoid inventory competition (i.e., selling seasonal or discontinued items online and current items in-store). Requiring a minimum order for online purchases or grouping products together rather than selling them individually to make e-commerce more worth your while.

The best way to balance a multi-channel sales strategy is to take a unified view of consumers online and offline by connecting their on- and offline behaviors via technology. Some of the retailers questions have is how to connect a person offline with what they buy online, how to recognize who they are in the store and know what they look at on your website, because people are switching back and forth. Link behaviors online with a unique ID through email or a mobile app, since 66% of customers use smartphones in-store.

Even if your business can’t actually sell and ship products via e-commerce,it’s still important to be in tune and up-to-date with the way customers want to interact with you on the Web. People are on the go, researching on phones and tablets. If you’re not savvy to what’s happening out there and don’t have the best-in-class SEO, you’ll miss out. You still need to engage in the digital world, even if it’s not always obvious.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: brick and mortar, business products, consumers, customers, digital world, e-commerce, email, mobile app, multi-channel sales, online and in-store, online shoppers, online shopping, phones, products, retail business, SEO, shoppers, Smartphones, tablets, web

September 17th, 2014 by Elma Jane

Commuters using the London tube network can now tap their contactless bank cards on the ticket barriers to pay for their journeys, further displacing cash on the capital’s transit system.

Fares are cheaper than cash, with users being charged adult pay as you go fares and benefiting from daily and Monday to Sunday fare capping. Customers without bank cards will continue to benefit from cheaper fares through Transport for London’s Oyster card.

This is not the end of Oyster and it’s not the end of cash, but it is a significant dent in the market for cash.

The move follows the abolition of cash on London’s buses and covers all tube, overground, DLR, tram and National Rail services that accept Oyster.

The shift to contactless has future-proofed the capital’s transit system for up-and-coming innovations in payments. You can already use your mobile phones to make your payments and tap and go through the tube turnstiles, and in the future it will open up many other connected devices as well, whether that’s smart wristbands or smart watches.

An incredible response to the launch of contactless payments on London Buses with nearly 19 million Visa contactless journeys made since it launched in 2012. Today’s launch will be another major boost to contactless usage leading to the three-fold increase expected in the next year. To coincide with the rollout, Londoners are invited to sign up for 10,000 free bPay contactless payments bands. Its wearable device will let commuters pay for their journeys with a wave of their wrists and help avoid card clash.

Posted in Best Practices for Merchants Tagged with: bank, card clash, cards, contactless bank cards, contactless payments, customers, devices, mobile, mobile phones, network, payments, phones, smart watches, smart wristbands, Visa contactless journeys, wearable device

June 19th, 2014 by Elma Jane

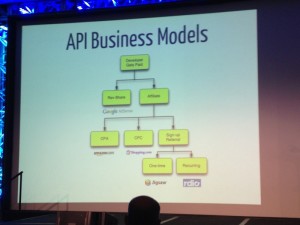

API Software Inc. has created an application ISOs can use to help merchants tabulate the best payment services deals. The Square Deal Pro app for the merchant services industry enables sales reps to compare their company’s rates to those of Square, PayPal, Stripe and other payments aggregators. Essentially, the application takes the mathematics burden off of the merchant and helps an ISO or agent compare bundled pricing with interchange-plus pricing.

Frank Haggar, a software developer, started asking merchants why they chose a certain provider and they just said the pricing was simpler. It might be more expensive, but it was easier for them to understand. That moved to develop Square Deal Pro. It’s a software that salespeople can have right on their phones and it makes a comparison and is easy to understand. Square Deal Pro, which operates on iPhones, Android devices and Windows phones, was established as a vendor-neutral tool that is also available for merchants to download if they were inclined to want to crunch numbers themselves. Service providers pay for the application and all of its sales features, but a free version for price comparisons only is available to merchants.

Merchants are experts in what they know how to do and they may not want something that includes math distracting them from that, but the sales rep can do it for them and use it along the lines of a calculator helping someone figure out mortgage rates. ISOs have various tools at their disposal and lock in key information in their brains to prepare for sales presentations, but most will likely find Square Deal Pro a valuable addition. Something that takes complicated pricing schemes and factors it all into an easy interface that puts out a clear comparison that is valuable, certainly out in the field.

API Software has to deliver something difficult or impossible to copy because that would set this permanently apart as opposed to being a lead to other similar products in the market. An ISO can change rates or make adjustments for a client if the numbers show that another provider is offering a less expensive option, but the numbers in the app don’t lie. The app will show how a bundled rate can work in your favor, such as if you are selling Girl Scouts cookies at $3 a box. Then use Square all day long, but an ISO can compare how his product works compared to others and the app can show, that at a certain time, it might be beneficial to switch over.

Square Deal Pro takes into account factors other than interchange rates, including merchant volume, average ticket price and whether transactions are keyed or swiped or both. All of those things determine where you fit in on the diagram of how your rate should be structured. There is a lot of analysis on minimal focal points. The application may also help defuse potential problems with merchants who sometimes feel their sales rep was not providing a fair assessment of pricing structure or comparisons.

As for the application’s name, Haggar doesn’t want any confusion over whether this might be a new Square product.

Posted in Best Practices for Merchants Tagged with: account, aggregators, Android, assessment, bundled pricing, developer, devices, interchange, interchange rates, interchange-plus pricing, iPhones, ISOs, market, merchant services, merchant volume, Merchant's, mortgage rates, payment, PayPal, phones, pricing, Pro app, products, provider, Rates, sales, Service providers, software, Square, Square Deal Pro app, Stripe, transactions, Windows phones

May 30th, 2014 by Elma Jane

Southwest Airlines is now accepting mobile boarding passes at 28 total U.S. airport locations, its newest convenience feature that enables fliers to pass security and board an aircraft simply by waving their mobile device.

Following a tiered rollout from last year, the paperless boarding system requires minimal user action. Passengers check in via the Southwest mobile site or branded app and choose to view their boarding pass. The image will open in a new browser and can be saved to a device’s photo gallery upon request.

Mobile apps are critical touch points in the customer journey. Native and hybrid apps are continuing to dramatically increase the ability to deploy and optimize digital strategy. If you’re customizing the experience on mobile Web only, you’re missing a huge opportunity.

Long awaited arrival

New airline initiatives are offering a level of customer service that has never before been possible, and is transforming the experience of traveling to create a new barometer on which carriers will be judged.

Southwest offers two ways to attain an e-boarding pass: have one sent directly to a mobile device though electronic mail or text message when checking in online, or use the airline’s app to check in and have the pass appear with the option to save a replica to the photo gallery. When ready for boarding, passengers present their screen at both security checkpoints and gate entrance to be scanned by staff. In addition to mobile boarding pass support, the app also now includes upcoming trip cards that display flight information such as boarding position, gate location and access to flight tools such mobile check-in from the home screen.

IT takes flight

An industry wide Airline IT Trends Survey shows that more than 90 percent of airlines are increasing their investment in mobile capabilities to ease the hassles of getting through the airport and improve the in-flight experience. American, Delta, Continental and United are the biggest adopters of e-boarding support, offering the service from at least 75 airports. Mobile boarding passes are the preferred method for frequent fliers, as business execs and the like are constantly engaged with their handhelds. Paper passes also become more likely to be lost or wrinkled.

Another advantage of the electronic offering is that some travelers may not have access to a printer, and so a mobile boarding pass relieves the frustration of waiting on line at a kiosk. Of course there are also obvious drawbacks that may hinder the proposed convenience factor, one being that a mobile device may malfunction or run out of battery, resulting in a delayed trip or even a missed flight.

Mobile passes may also present a challenge if multiple people are traveling under one reservation. U.S. Airways and Continental restrict the service to one person per reservation. Other airliners allow each group member to check in line and have a separate pass sent to appropriate phones. While certain cons defeat the purpose of going mobile for efficiency reasons, the benefits offer peace of mind as airline carriers continue to improve the technology.

The option helps deliver more personalized and relevant experiences to on-the-go consumers leveraging a unified customer profile to collect, own and act on data not only on mobile apps, but also across kiosks and other platforms. This approach to mobile apps uniquely sets marketers free in terms of customization and delivery of the experience, and has delivered great results.

Posted in Smartphone Tagged with: airline carriers, airports, American, app, boarding pass, cards, carriers, consumers, Continental, customer service, data, Delta, digital, e-boarding pass, electronic mail, hybrid apps, mobile, Mobile Apps, mobile boarding, mobile device, Mobile passes, mobile site, mobile Web, phones, platforms, Security, technology, tools, U.S. Airways and Continental

May 21st, 2014 by Elma Jane

Mobile credit card processing is way cheaper than traditional point-of-sale (POS) systems. Accepting credit cards using mobile devices is stressful, not to mention a hassle to set up and customers would never dare compromise security by saving or swiping their credit cards on a mobile device. Some of the many myths surrounding mobile payments, which allow merchants to process credit card payments using smartphones and tablets. Merchants process payments using a physical credit card reader attached to a mobile device or by scanning previously stored credit card information from a mobile app, as is the case with mobile wallets. Benefits include convenience, a streamlined POS system and access to a breadth of business opportunities based on collected consumer data. Nevertheless, mobile payments as a whole remains a hotly debated topic among retailers, customers and industry experts alike.

Although mobile payment adoption has been slow, consumers are steadily shifting their preferences as an increasing number of merchants implement mobile payment technologies (made easier and more accessible by major mobile payment players such as Square and PayPal). To stay competitive, it’s more important than ever for small businesses to stay current and understand where mobile payment technology is heading.

If you’re considering adopting mobile payments or are simply curious about the technology, here are mobile payment myths that you may have heard, but are completely untrue.

All rates are conveniently the same. Thanks to the marketing of big players like Square and PayPal – which are not actually credit card processors, but aggregators rates can vary widely and significantly. For instance, consider that the average debit rate is 1.35 percent. Square’s is 2.75 percent and PayPal Here’s is 2.7 percent, so customers will have to pay an additional 1.41 percent and 1.35 percent, respectively, using these two services. Some cards also get charged well over 4 percent, such as foreign rewards cards. These companies profit & mobile customers lose. Always read the fine print.

Credit card information is stored on my mobile device after a transaction. Good mobile developers do not store any critical information on the device. That information should only be transferred through an encrypted, secure handshake between the application and the processor. No information should be stored or left hanging around following the transaction.

I already have a POS system – the hassle isn’t worth it. Mobile payments offer more flexibility to reach the customer than ever before. No longer are sales people tied to a cash register and counters to finish the sale. That flexibility can mean the difference between revenue and a lost sale. Mobile payments also have the latest technology to track sales, log revenue, fight chargebacks, and analyze performance quickly and easily.

If we build it, they will come. Many wallet providers believe that if you simply build a new mobile payment method into the phones, consumers will adopt it as their new wallet. This includes proponents of NFC technology, QR codes, Bluetooth and other technologies, but given very few merchants have the POS systems to accept these new types of technologies, consumers have not adopted. Currently, only 6.6 percent of merchants can accept NFC, and even less for QR codes or BLE technology, hence the extremely slow adoption rate. Simply put, the new solutions are NOT convenient, and do not replace consumers’ existing wallets, not even close.

It raises the risk of fraud. Fraud’s always a concern. However, since data isn’t stored on the device for Square and others, the data is stored on their servers, the risk is lessened. For example, there’s no need for you to fear one of your employees walking out with your tablet and downloading all of your customers’ info from the tablet. There’s also no heightened fraud risk for data loss if a tablet or mobile device is ever sold.

Mobile processing apps are error-free. Data corruption glitches do happen on wireless mobile devices. A merchant using mobile credit card processing apps needs to be more diligent to review their mobile processing transactions. Mobile technology is fantastic when it works.

Mobile wallets are about to happen. They aren’t about to happen, especially in developed markets like the U.S. It took 60 years to put in the banking infrastructure we have today and it will take years for mobile wallets to achieve critical mass here.

Setup is difficult and complicated. Setting up usually just involves downloading the vendor’s app and following the necessary steps to get the hardware and software up and running. The beauty of modern payment solutions is that like most mobile apps, they are built to be user-friendly and intuitive so merchants would have little trouble setting them up. Most mobile payment providers offer customer support as well, so you can always give them a call in the unlikely event that you have trouble setting up the system.

The biggest business opportunity in the mobile payments space is in developed markets. While most investments and activity in the Mobile Point of Sale space take place today in developed markets (North America and Western Europe), the largest opportunity is actually in emerging markets where most merchants are informal and by definition can’t get a merchant account to accept card payments. Credit and debit card penetration is higher in developed markets, but informal merchants account for the majority of payments volume in emerging markets and all those transactions are conducted in cash today.

Wireless devices are unreliable. Reliability is very often brought up as I think many businesses are wary of fully wireless setups. I think this is partly justified, but very easily mitigated, for example with a separate Wi-Fi network solely for point of sale and payments. With the right device, network equipment, software and card processor, reliability shouldn’t be an issue.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: (POS) systems, aggregators rates, apps, BLE technology, bluetooth, card, card processor, card reader, cash, cash register, chargebacks, consumer data, credit, credit card payments, credit card processing, credit card processors, credit card reader, credit-card, customer support, data, data loss, debit card, debit rate, device, fraud, fraud risk, hardware, industry experts, merchant account, Merchant's, mobile, mobile app, mobile credit card processing, Mobile Devices, Mobile Payments, mobile point of sale, Mobile processing apps, mobile processing transactions, mobile technology, mobile wallets, network, network equipment, nfc, nfc technology, payment solutions, payment technology, PayPal, phones, point of sale, qr codes, retailers, rewards cards, Security, Smartphones, software, Square, tablet, tablets, vendor's app, wallet providers, Wi-Fi network, wireless mobile, wireless mobile devices

May 15th, 2014 by Elma Jane

Looking to buy a new business phone? Wait!!! A slew of hot new smartphones are set to launch in the coming months, 2014 has already seen its share of major releases. This spring, HTC unveiled the new HTC One M8, which packs a slick all-metal body and Samsung debuted the featured-packed Galaxy S5. Nokia also released the Lumia Icon, its new flagship Windows Phone. But some of the year’s biggest releases are still to come, including a new version of Apple’s iPhone and a follow-up to Samsung’s stylus-equipped Galaxy Note 3. Meanwhile, a new Android phone from startup OnePlus could make a splash.

Galaxy Note 4

Samsung is expected to launch a follow-up to the Galaxy Note 3 this fall, one of the best business phones ever made, thanks in part to the included S Pen stylus, which slides out from a slot on the phone’s chassis and turns the device into a note-taking machine. The phablet also boasts a stunning 5.7-inch display that’s big enough for real productivity tasks. Samsung hasn’t officially confirmed any details about the Note 3’s successor, but there are a few safe bets. For starters, fans can expect the line’s trademark stylus to return for the Galaxy Note 4. Its display meanwhile, should rival the Samsung’s newer Galaxy S5 in terms of brightness and picture quality. Finally, considering Samsung packed a fingerprint reader into the S5’s home button, it’s likely the company will do the same for the Note 4. A fingerprint reader can make your business phone more secure, since only you can unlock the device with a quick swipe of your finger.

iPhone 6

Apple’s iPhone 5s is a great phone, but its compact 4-inch display could be too small for some people. Reports indicate that Apple might deliver a much bigger device in the iPhone 6, which is expected to debut this fall in 4.7-inch and 5.5-inch variants. That’s a big deal for business users who depend on their smartphone to stay productive but prefer a larger display. Both models are also rumored to include a blazing-fast A8 processor, an upgrade over the speedy 64-bit A7 chip found in the iPhone 5s. The iPhone 6 is also expected to include the same fingerprint reader that debuted with the iPhone 5s. The reader is embedded in the phone’s home button, and lets you unlock the device simply by placing your finger on the button. And of course, the iPhone is the only smartphone that gives you access to Apple’s App Store, which features the biggest and arguably the best, library of business and productivity apps on any platform.

LG G3

LG is preparing to unveil a successor to its flagship phone, the LG G2 this spring. The so-called LG G3 could be one of the year’s most noteworthy business phones if it retains the G2’s superlong battery life. The phone ran for up to 11 hours in tests that involved continuous Web browsing, making it one of the longest-lasting smartphones ever made. In addition to longevity, the G2 boasts a snappy quad-core processor, a roomy 5.2-inch display and a handy multitasking feature called QSlide, which lets you run a second app in a floating window over your main app. That’s a plus for business users who need to juggle tasks such as responding to email while conducting research in a Web browser. LG hasn’t yet announced which features will get an upgrade for the LG G3, but fans won’t have to wait long to find out. The company is expected to show the device off at a special press event on May 27, though it’s not yet known when the phone will hit store shelves.

Lumia 635

Windows Phone fans saw the release of a new flagship device in the Nokia Lumia Icon this spring. Now, Nokia is following that up with the Lumia 635. A new midrange Windows Phone with a lower price point, that could make it worth a look for budget-minded business users, especially since the device runs on Windows Phone 8.1, a new version of Microsoft’s mobile operating system. One of the phone’s standout features is Cortana, a voice-activated personal digital assistant that can notify you of upcoming appointments, flight information, weather alerts and more. Also, new in Windows Phone 8.1 is the Action Center, which is similar to the notification hub found on both the Android and iOS operating systems. Just swipe down from the top of your phone’s display to view all of your alerts at a glance, and like every Windows Phone device. The Lumia 635 is fully integrated with the desktop version of Microsoft Office.

OnePlus One

The OnePlusOne set to launch this June, is a powerful new business phone with a unique set of features. The 5.5-inch Android device packs a huge display, a top-tier processor and a high-capacity battery. The phone also adds features you won’t find in many flagship phones, such as always-on voice commands. So instead of fiddling with menus and touch-screen controls, you can set an alarm, place an appointment in your calendar or access turn-by-turn directions by uttering a few words – even when the display is off. The OnePlus One also offers a few notable security features you won’t find in most other smartphones. For instance, the phone’s Privacy Guard setting lets you block individual apps from accessing personal information stored on your device. The OnePlus One also ships with built-in encryption for SMS text messages to ensure your private business communications remain private.

Posted in Smartphone Tagged with: Android, Android and iOS operating systems, Android device, Android phone, App Store, Apple's iPhone, Apple's iPhone 5s, chip, Cortana, desktop, device, digital, email, encryption, fingerprint reader, flagship phones, Galaxy Note 3, Galaxy Note 4, Galaxy S5, high-capacity, HTC, HTC One M8, hub, integrated, iOS, iPhone 6, LG G2, LG G3, Lumia 635, Microsoft, Microsoft Office, Microsoft's mobile operating system, mobile, Nokia, Nokia Lumia Icon, OnePlusOne, operating systems, phablet, phones, platform, Privacy Guard, processor, QSlide, S Pen stylus, Samsung, Security, slot, Smartphones, sms, stylus, swipe, top-tier processor, touch-screen controls, voice commands, web, Web browsing, windows, windows phone, Windows Phone 8.1

December 30th, 2013 by Elma Jane

Google

With New Debit Card, Google Admits Digital Isn’t Everything

The maker of all things digital is introducing a debit card for accessing Google Wallet accounts. Google is getting physical.

A debit card alone is not a platform, or at least not a new one. In this case, it’s the payments version of comfort food: an everyday, easy-to-use technology to drive greater adoption of the less familiar Wallet platform.

This isn’t a new concept for a digital wallet. PayPal itself has a debit card. The significance for Google is more in its apparent acknowledgment that its business needs to play in the physical world. Earlier this week, the company ramped up its Google Shopping Express service with a partnership with Costco, further expanding its presence in the buying and selling of physical goods. Its self-driving cars are another way the company is reaching beyond digital, though never losing sight of the digital-derived lesson that the real business opportunity is in platforms, not just products.

The MasterCard-branded card is swipe-able at stores, and it can be used to withdraw cash at ATMs, Google said. The company pitched its new plastic in a blog post today as a way to pay for things offline without waiting for the money in your Google Wallet to transfer to a bank account.

This should sound familiar to users of PayPal or any other digital wallet, where the lag time between receiving money and being able to spend it makes such services marginal in the brick-and-mortar world, where most consumer dollars get spent.

That it took Google this long to make such a card available shows just how hard it is for the company to re-imagine itself as expanding beyond digital. For years, Google has supported NFC tap-to-pay technology that lets users of the few phones with such chips use their handsets to pay by Wallet at the few merchants with point-of-sale systems that support NFC. With the release of a debit card, Google seems to be acknowledging that battle is lost for now. In a world Google is trying to remake in its digital-first image, plastic still prevails.

Posted in Digital Wallet Privacy, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: brick and mortar, costco, debit card, digital, handsets, MasterCard, nfc, payments, PayPal, phones, plastic, platform, point of sale, Tap to Pay, wallet

December 12th, 2013 by Elma Jane

A new study reveals that a staggering 68% of smartphone owners plan to use their devices to assist with their holiday shopping this year. According to Deloitte’s 28th annual survey of holiday spending intentions and trends, 56% of smartphone owners plan to use their phones to search for store locations. 54% will compare prices with their phones and 47% expect to use their phones to learn more about the products they wish to purchase.

The survey showed smartphone shoppers plan to spend 27% more on holiday gifts than non-mobile shoppers. Smartphone ownership has skyrocketed in 2013, rising from 42% last year to 61%, a change that is sure to influence the biggest buying season of the year.

The study also showed 38% of the consumers in the survey owned a tablet. 63% of those tablet owners will use their devices for holiday shopping this year. “Tablets are a two-way street for retailers. They have opened up an entirely new consumer touchpoint, where shoppers can view multiple retailers’ products regardless of their location…from their couch to the point of purchase. Retailers can also put tablets to work in their stores, providing both their sales team and customers with a broader lens into merchandise selection,” said Alison Paul, a vice chairman of Deloitte LLP retail & distribution. Now that the majority of consumers also own smartphones, these two devices have altered the way they interact with a brand, while also yielding a higher spend per customer.

Posted in Electronic Payments, Mobile Payments, Near Field Communication, Smartphone Tagged with: devices, merchandise, phones, retailers, shoppers, shopping, smartphone, tablet, touchpoint

September 30th, 2013 by Elma Jane

Future of Marketing Lies in Mobile Payments…Why?

Marketing and payments might seem like strange bedfellows to the average retailer, but in fact, they are converging rapidly to bring more value to consumers and merchants alike. Here are 10 reasons why the future of marketing is inextricably linked to payments innovation:

1. Cross-Platform Acceptance

Better yet, these targeted offers can be acquired and redeemed through different mediums…online, offline and mobile…and utilized interchangeably. This makes life easier on the consumer and thus makes them more likely to engage with new loyalty and rewards programs. Moreover, as the Internet and mobile solutions continue to merge, the digital “wallets” that many of us use online today (think PayPal) are, logically, moving to our phones. When these payment and marketing applications are accessible from the same device, customers can seamlessly receive pertinent offers and pay for goods at the same time in the same place. Other apps will give consumers the ability to shop in one medium and buy in another, simplifying omni-channel marketing to affect commerce across all channels. This kind of convenience and value is a win for both customer and merchant.

2. Loyalty and Rewards get Simpler

The reality is that it’s much easier to issue and redeem loyalty rewards, gift cards and discounts when they are integrated into the POS experience and don’t require customers or merchants to alter the existing in-store purchase or checkout stream. You can see these simplified applications already in practice at chains like Starbucks, as well as independent merchants that use systems like LevelUp.

3. Merchant adoption

The payment technologies that succeed will be the ones that are ultimately adopted by merchants, which in turn will lead to consumer usage. Key technologies that will likely facilitate widespread adoption of mobile payments…either proactively because merchants want to see what they can offer them, or passively as they upgrade devices…include:

EMV (chip and pin), which will force merchants to update their POS systems, likely catalyzing them to update all points of interaction.

NFC – Cloud Computing – Geofencing – QR Codes and even Basic Bar Codes

4. More Value for Consumers

And for consumers, the convergence of payments and marketing should deliver highly valuable deals, offers, comparisons information and more, ultimately providing drastic improvement of the buying and shopping experience.

5. More Value for Merchants

So what does this value look like? For merchants, the convergence of payments and marketing should bring in new customers, increase sales from existing customers, and provide more customer data. It should also create a more streamlined multi-channel experience so consumers have little barrier to adoption.

6. No Single Technology will Win

These new technologies introduce an interesting question: What should merchants do to prepare for this brave new world where payments and marketing collide? For one, merchants should avoid betting on any one technology. In fact, the POS needs to morph into something a little more complex, becoming instead a POI, where a broad variety of payment types, loyalty programs, coupons and more can be redeemed. Merchants should be in a position to choose what types of payment they want to accept and in what medium, and not be limited to fixed payment tenders.

When the convergence of marketing and payments will happen

The increasing adoption of mobile payments by merchants and consumers, when combined with new POS environments, will jump-start the convergence of marketing and payments. However, we’re still in the early stages.

Mobile commerce technologies are widespread but still working to gain traction from consumers en masse. Additionally, merchants haven’t yet felt the need to upgrade their POS systems to accept mobile payments

However, the October 2015 EMV Liability Shift, a date set by Visa and MasterCard for certain charge-back liabilities to fall to the merchant unless they have upgraded to EMV-capable POS systems, is likely to push merchants to upgrade their systems.

Once merchants begin to upgrade these POS systems, the smart ones will take the opportunity to add more features and functionality to the systems, including the ability to accept payment…and marketing-driven solutions from mobile handsets. That’s when we’ll see the value of two-way communication between merchants and consumers dramatically change the shopping experience and bring payments into the marketing mix.

7. Smartphone Adoption is Speeding Up

Consumers’ mobile phones are already equipped to deliver highly valuable offers, and adoption is increasing at a rapid pace. Smartphones bring with them new app technologies that include not only mobile payments but also loyalty and rewards programs that are designed to drive preference for stores, good and services.

8. Targeted Offers and Single-Use Applications

Of course, these solutions are still in their infancy. Elegant single-use applications, such as mobile wallets and gift cards, will soon grow to provide highly targeted offers that take into account everything from shopping preferences to location, providing incentives as a customer walks the aisle of a store. Just about every player in the payments ecosystem is thinking about these new commerce technologies. The winners will be those that demonstrate clear value for both the merchants and customers.

9. The “POS” is now a “POI”

A point-of-sale (POS) solution used to be a place where goods were purchased and money traded hands. Usually, this took the form of a cash register or credit card machine. Though these still exist, a wave of new value-added marketing services, such as targeted offers, discounts and highly valuable loyalty applications, have led to the transformation of the POS into a point-of-interaction (POI), a place where consumers and merchants meet to exchange value for value.

10. Two-way communication

When embedded in smartphones, new technologies…like near-field communication (NFC), QR codes, geofencing and cloud authentication solutions…allow for two-way communication between the consumer and the POS solution, enabling merchants to deliver coupons and offers directly to customers’ mobile phones through targeted integrated programs.

Posted in Digital Wallet Privacy, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: bar codes, cloud, device, EMV, handsets, innovation, loyalty, marketing, merchants, mobile, nfc, offline, omni-channel, online, payments, PayPal, phones, POI, point of interaction, POS, qr codes, rewards