July 26th, 2017 by Elma Jane

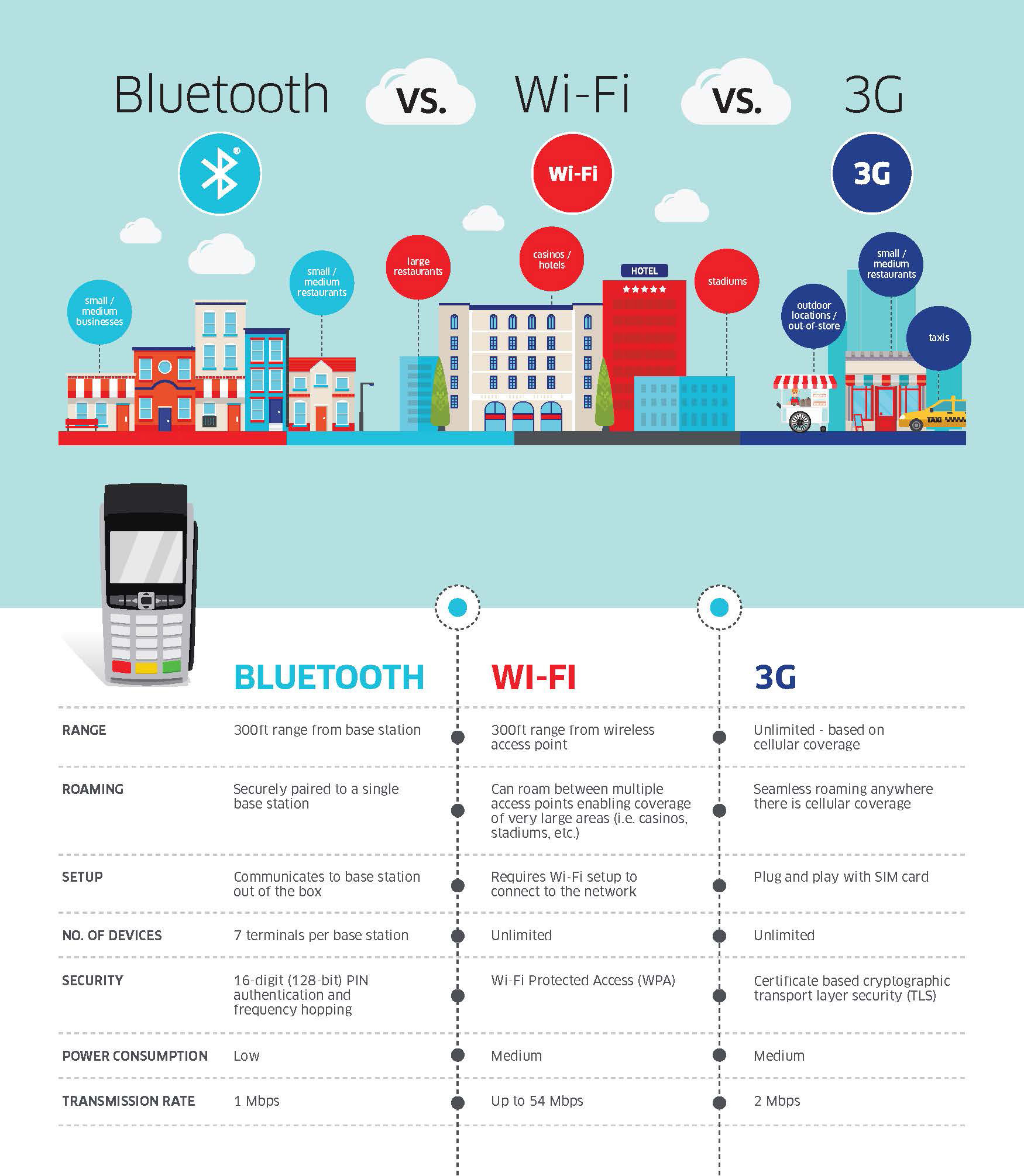

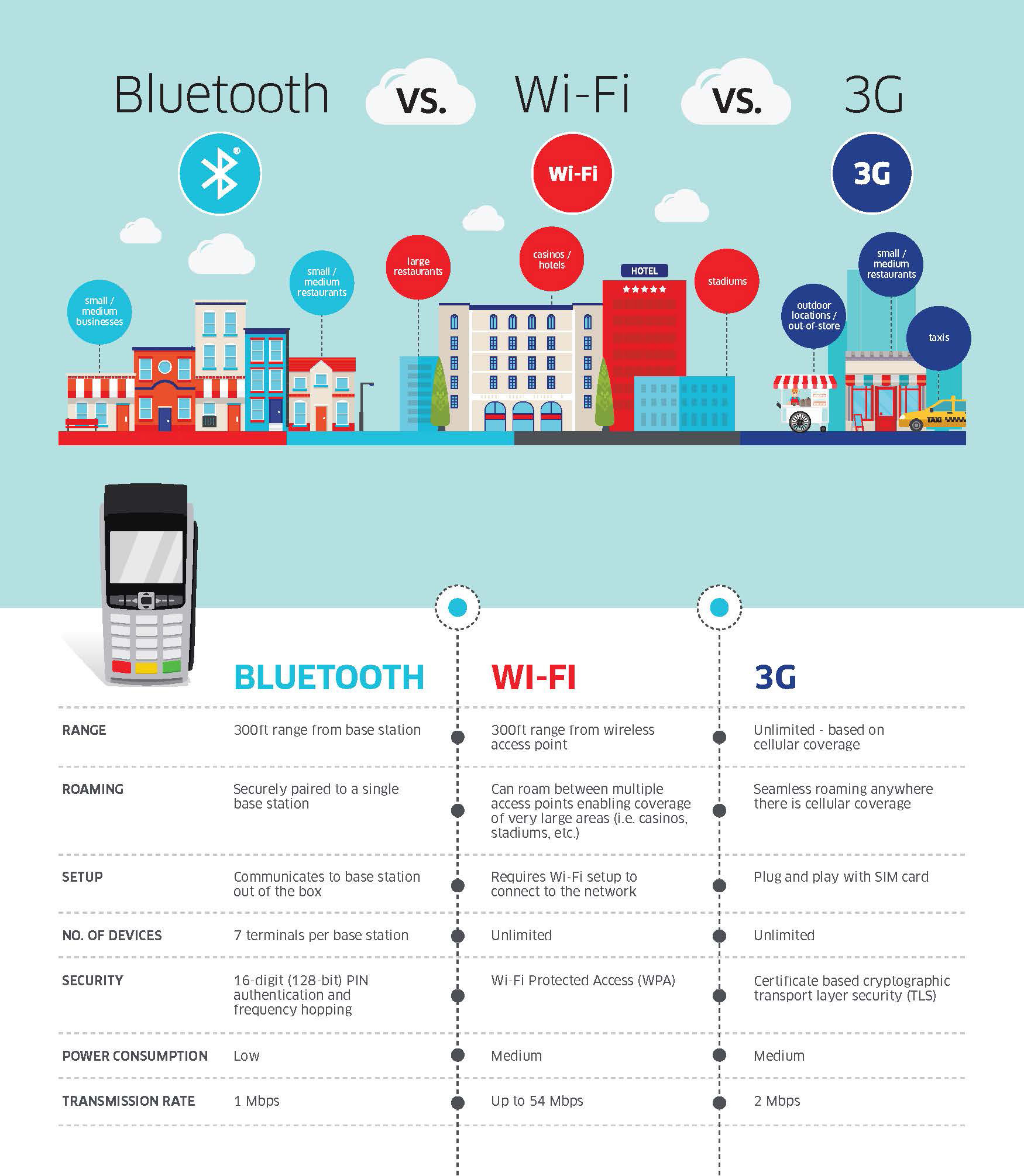

Check out the wide range of smart wireless terminal connectivity options and know the difference.

Bluetooth Wireless: Designed for reliable Bluetooth connectivity even in the most demanding environments.

Rage – 300ft from base station

Roaming – paired to single base station

Setup – Communicates to base station out of the box

No. Of Devices – 7 Terminals per base station

Security – 16-Digit (128-Bit) PIN authentication and frequency hopping

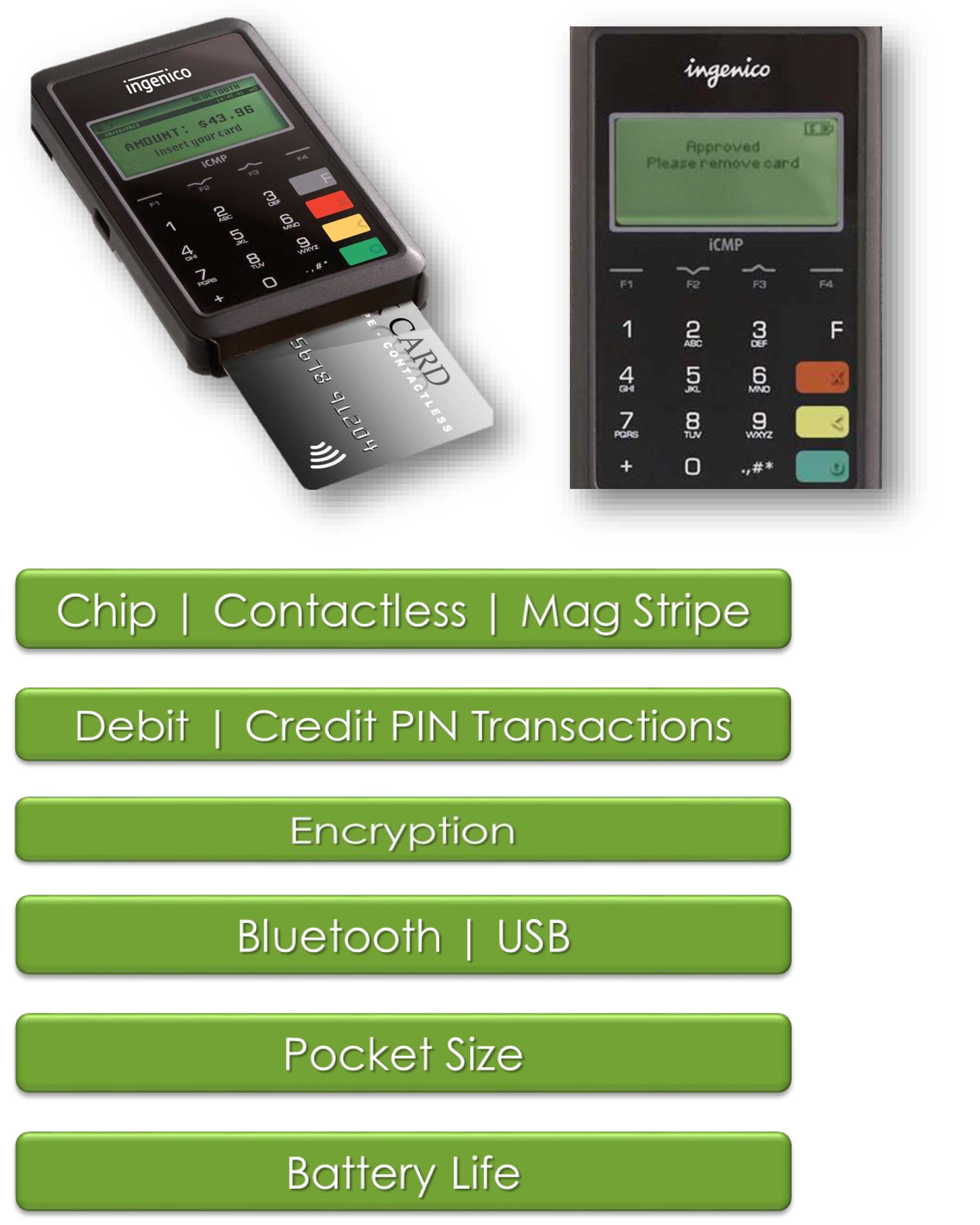

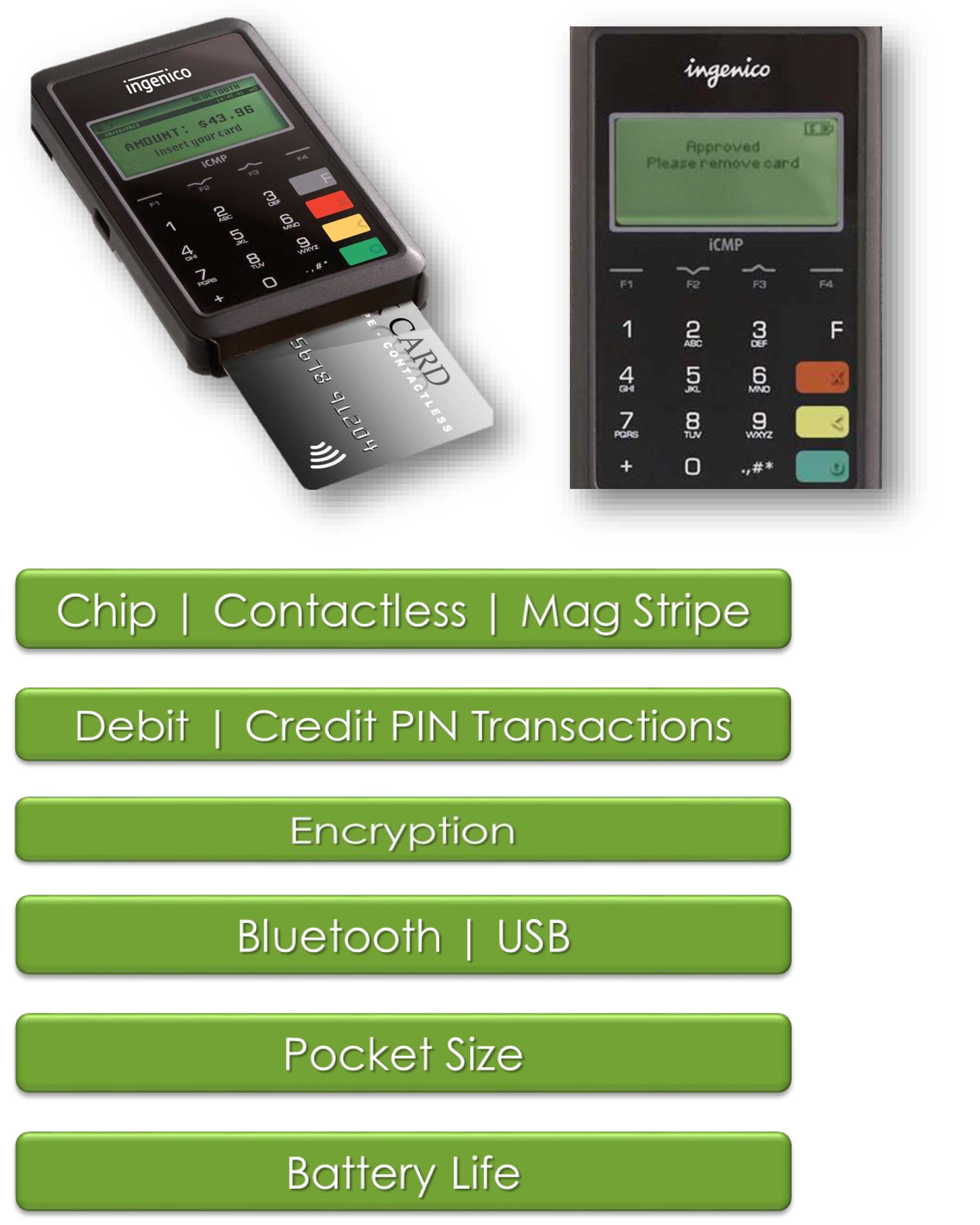

Accept EMV Chip & PIN, magstripe and NFC/Contactless

WiFi: Designed for reliable WiFi connectivity, Wireless mobility for the point of sale.

Rage – 300ft from base station

Roaming – can roam between multiple access points enabling coverage of very large areas.

Setup – Requires WiFi Setup to connect to the network

No. Of Devices – Unlimited

Security – WiFi Protected Access (WPA)

Accept EMV Chip & PIN, magstripe and NFC/Contactless

3G Wireless: Bring compact, reliable 3G Wireless Technology and mobility to the point of sale.

Rage – unlimited – based on cellular coverage

Roaming – Seamless roaming anywhere there is cellular coverage

Setup – Plug and play with SIM card

No. Of Devices – Unlimited

Security – Certificate based cryptographic transport layer security

Accept EMV Chip & PIN, magstripe and NFC/Contactless

Wireless terminals provide merchants with a number of benefits including:

Mobility – enable merchants to better serve the customer and bring the transaction right to the point of service.

Printed Receipt – give your servers the capability to print a receipt for the customer even when away from the POS.

Variety of Payment Options – provide the ability to accept magstripe, EMV, and NFC payments including the latest mobile wallets.

For Electronic Payment Set Up Call Now 888-996-2273

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: bluetooth, chip, Contacless, EMV, magstripe, nfc, PIN, Security

April 10th, 2017 by Elma Jane

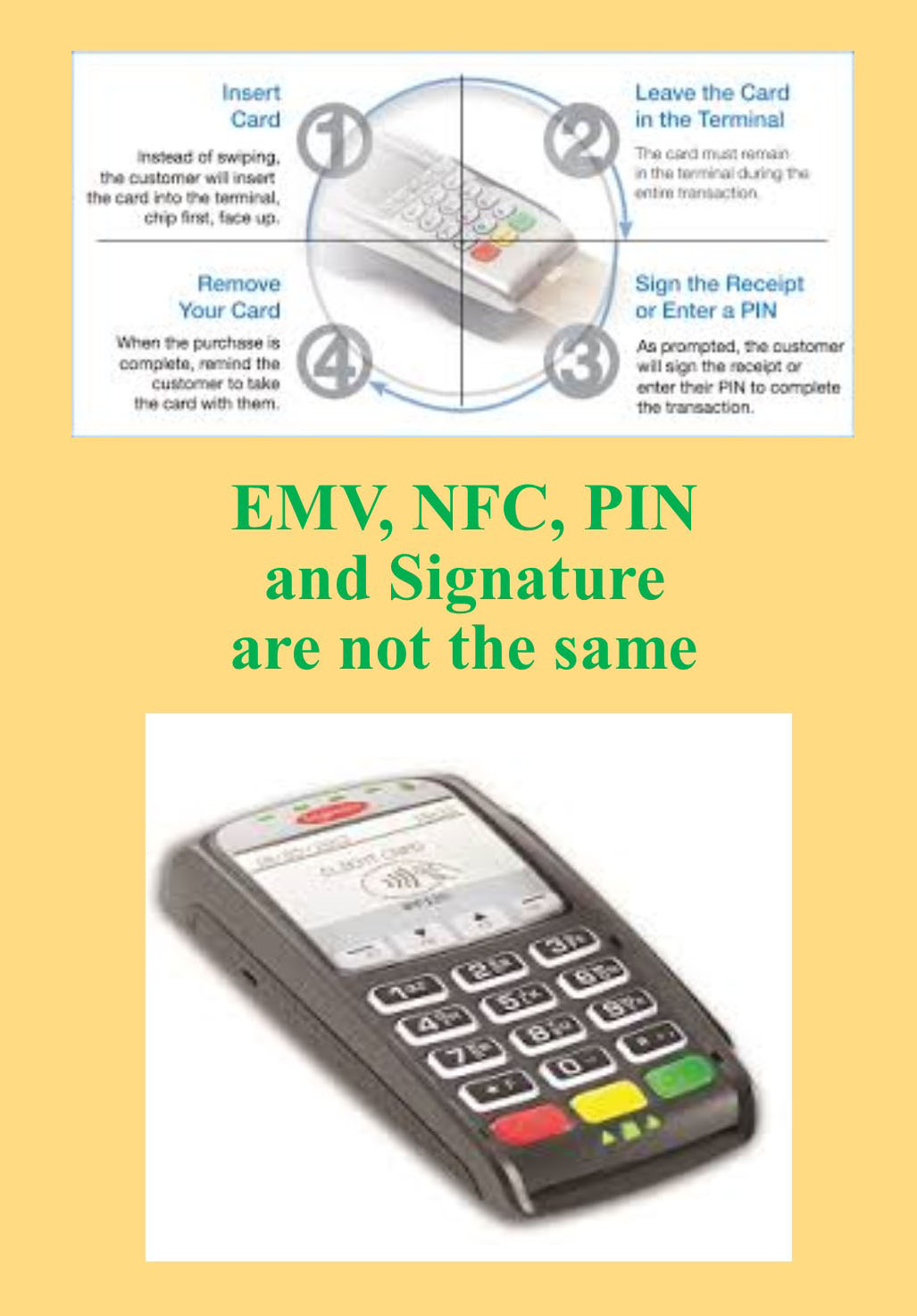

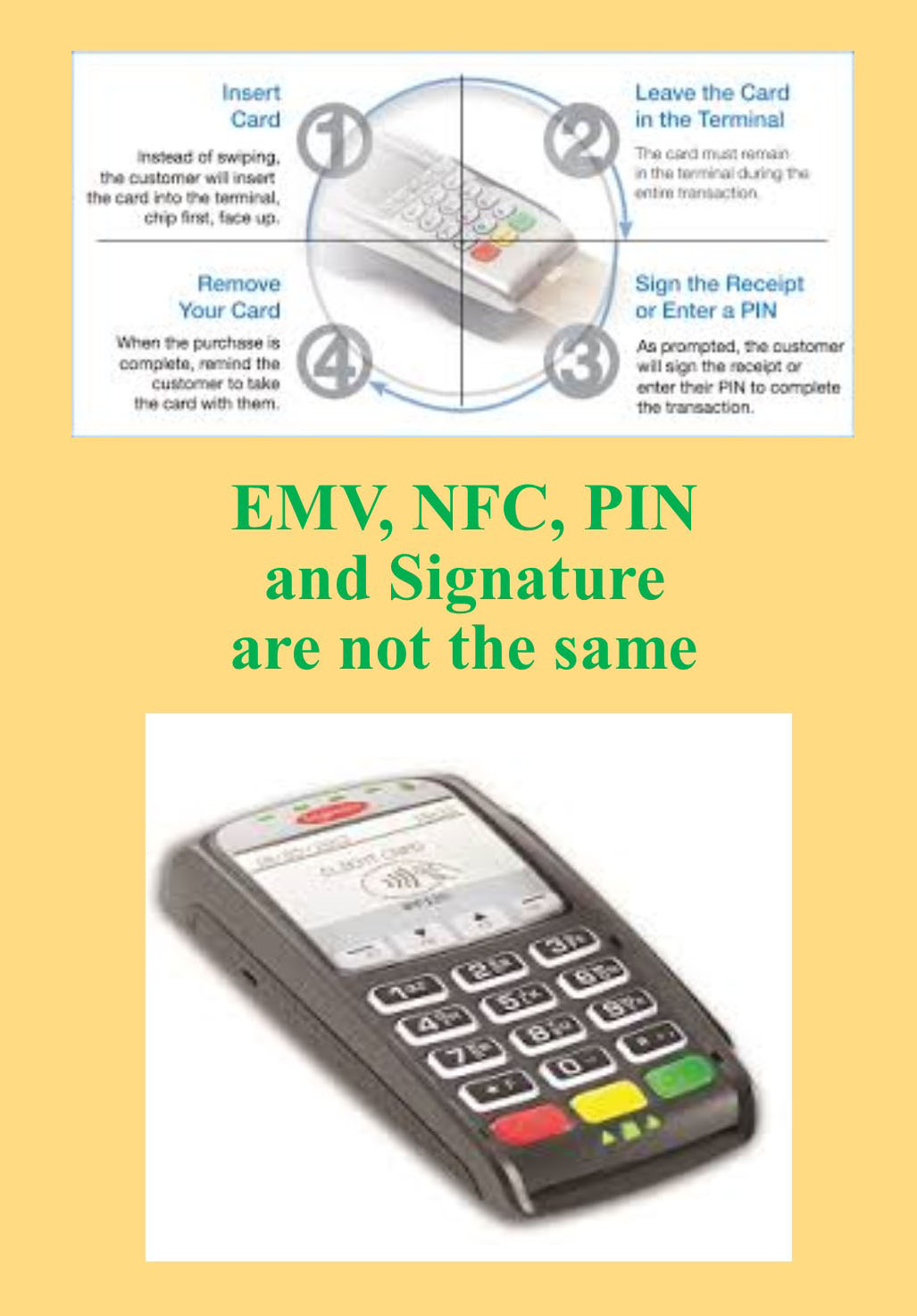

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

March 30th, 2017 by Elma Jane

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

January 25th, 2017 by Elma Jane

PIN vs. Signature: What’s the Difference?

PIN Debit – PIN transactions are routed through what are known as (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

Signature Debit – Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, debit card, electronic, electronic funds transfer, online, payment, PIN, POS, terminal, transactions

September 19th, 2016 by Elma Jane

Terminal or credit card machines are used for processing debit and credit card transactions. Therefore, are often integrated into a Point of Sale System.

Electronic Authorizations – merchants had the choice of calling in for an authorization or imprinting their transactions, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing transaction over the phone.

Manual Imprinters – are considered a great backup processing method. Although time consuming and did not offer the speed or instant transfer capabilities, this imprinters are still widely used.

Point of Sale Terminals: POS emerged in 1979, which was a turning point in the credit card processing industry. As a result,

Visa introduced a bulky electronic data capturing terminal. The first of credit card machine or terminal as we know them today. It has greatly reduced the time required to process a credit card.

In the same year, MasterCharge became MasterCard and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement.

Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Near Field Communication, Visa MasterCard American Express Tagged with: chip, contactless, credit card, debit, EMV, mobile, nfc, PIN, point of sale, Security, terminal, transactions, visa

August 2nd, 2016 by Elma Jane

Credit card machine or point of sale terminals are used for processing debit and credit card transactions and are often integrated into a Point of Sale System. Let’s take a look at the POS terminal evolution.

Manual Imprinters – although the process was time consuming and did not offer the speed or instant transfer capabilities, manual imprinters have been around since the start of a wide acceptance of credit cards. Manual imprinters are still widely used and are considered a great backup processing method.

Electronic Authorizations – Merchants had the choice of calling in for an authorization or imprinting their transactions. The first electronic credit card authorizations were done over the phone, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing a transaction over the phone,

Point of Sale Terminals: Point of sale terminals emerged in 1979, which was a turning point in the credit card processing industry. Visa introduced a bulky electronic data capturing terminal. This was the first of credit card machine or terminal as we know them today, it has greatly reduced the time required to process a credit card. MasterCharge became MasterCard in the same year and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement. Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: credit card, credit card machine, debit, electronic credit card, Electronic Data, EMV/chip, merchants, mobile, nfc, PIN, point of sale, POS, processing industry, terminals, transactions, visa

June 6th, 2016 by Elma Jane

The roll out for EMV PIN Debit and Tip Adjust functionalities for the Ingenico Telium POS terminals through a gradual download process begins July 24, 2016. Customers will receive an automatic download following the July release date, or they can go to their appropriate website for instructions to manually update their terminal file.

What to Expect

- EMV PIN Debit support for Visa, MasterCard, and Discover common Debit AIDs. Note that customers will see new prompts based on how card issuers configure EMV-enabled debit cards.

- Tip Adjust functionality on the restaurant application.The tip at the time-of-sale prompt will be on by default and will work as it always has. However, if this prompt is bypassed, a blank tip line will print on the receipt. This allows consumers to write the tip amount on the receipt and our customers can adjust as needed.

- Tip Adjust is supported on credit card transactions only, including magnetic stripe, EMV, key-entered and contactless.

Posted in Best Practices for Merchants Tagged with: consumers, contactless, credit card, customers, debit, debit cards, EMV, PIN, terminal

April 21st, 2016 by Elma Jane

Payment Acceptance

EMV Contact/Contactless

NFC Contacless

Mag Stripe

Premium NFC + EMV/PIN & Signature

Payment Acceptance

EMV Contact/Contactless

NFC Contactless

Mag Stripe

Basic NFC + EMV/PIN & Signature

For orders Plus Tax and Shipping If Applicable.

For more information give us a call at 888-996-273

Posted in Best Practices for Merchants Tagged with: chip, contactless, EMV, nfc, PIN

April 7th, 2016 by Elma Jane

The EMV technology does improve security because EMV cards are more difficult to counterfeit. Since U.S. is using chip-and-signature cards not the one requiring a PIN, anybody can use an EMV chip card whether it might be a lost or a stolen card. EMV chips will not prevent the data breach from occurring, but it will make it harder for criminals to successfully profit from what they steal.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: cards, chip card, data, EMV, PIN, Security

January 28th, 2016 by Elma Jane

The shift to EMV is helping to address vulnerabilities in the United States payments ecosystem. It has been shown that EMV can deliver benefits as a part of industry efforts to combat fraud.

EMV migration is a critical focus for enhancing payments security, which is why the current efforts around chip card deployment are greatly beneficial for consumers and merchants alike. EMV technology helps to reduce counterfeit card fraud, as it generates dynamic data with each payment to authenticate the card, after which the cardholder is prompted to sign or enter a PIN to confirm their identity.

The EMV rollout represents a dynamic time for card payments that promises great advances, among them is enhanced security for cardholders. It also presents an opportunity to consider other innovations such as mobile wallets and mobile POS to further engage your customers and drive customer loyalty. When merchants continue to invest in EMV and NFC (near field communications, used for tap-and-pay transactions), the purchases made at their EMV-enabled terminals are made more secure than magnetic stripe.

New mobile payment options such as mobile wallets support EMV and therefore offer this added layer of security. Ultimately, by enabling contactless payments, merchants can also enable more flexibility in addition to increasing security for their customers.

Additionally, industry players are backing major mobile wallets, such as Android Pay, Apple Pay, and Samsung Pay.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card, cardholder, chip card, consumers, contactless payments, customers, data, EMV, fraud, magnetic stripe, merchants, mobile, mobile payment, mobile wallets, near field communications, nfc, payments, PIN, POS, Security, terminals, transactions