December 17th, 2015 by Elma Jane

Mobile Payments – It is bound to see more actions with tech giants Apple, Google and Samsung in mobile payment trends. We will also see new technologies like smartwatches, bracelets and rings that will give us the ability to provide payment options.

NFC – Near Field Communication, another familiar face among the payment trends. NFC, however, goes way beyond making payments using smartphones. These speed up POS payment processing quickly and easily without requiring a PIN or signature. While there are other POS payment methods, such as QR codes, NFC will come out on top. Merchants should ensure they have an overview of the current Point-of-Sale options and should, if needed, upgrade to the latest technology.

Security: Tokenization and biometric authentication will have a strong influence on the payment industry.

Tokenization – when applied to data security, is an extremely interesting method of securing credit card data. As the credit card numbers are substituted by tokens that has no value, then no harm can be done if tokens are stolen, which makes tokenization a secure process.

There are several new inventions when it comes to payment processing authentication such as password, PIN, and fingerprint methods. But they are weak so two-factor authentication is increasingly used to improve security.

Biometrics Authentication – like finger print scan, facial recognition, voice recognition, and pulse recognition are set to become increasingly significant. This will increase both security and convenience.

International E-Commerce – It’s important that merchants offer shoppers their preferred local payment method. Merchants who are looking for e-commerce success will need to create an international strategy. Merchants should also consider checking with their payment service providers. Providers know their way around to alternative payment methods.

Cash on the Retreat – Cashless Society? Some countries in Europe are certainly cutting down on the usage of cash. In Sweden, it is now almost impossible to use cash to pay for bus tickets. Acceptable payment methods include customer cards, credit cards, and payments via smartphone apps. Traditional cash-based bakeries no longer exist and instead, now display signs requesting that customers use cashless payment methods for even the smallest amounts. The situation in Denmark is similar; the government is currently debating whether or not to release smaller retailers from the obligation of having to accept cash as a payment method. Cash is on the retreat, and alternative payment methods are advancing. However, cash is still on the list.

Real-Time Payments (Instant Payments) – The European Central Bank (ECB) will bring instant payments strongly in the near future. Instant or real-time payments are a trend which will be with us for a long time to come.

Regulatory Changes – The first Payment Services Directive (PSD) from 2007 is still currently implemented domestically. After a tough two-year negotiation period, the EU has now, finally, agreed on a second payment services directive (PSD2). The European Banking Authority (EBA) is set to develop more detailed guidelines and regulatory standards for various industries. Payment industries should begin preparing themselves now for implementation, doing this will allow them to be ready for the appropriate steps necessary in 2016/2017.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: Apple, biometric, credit card, data security, e-commerce, google, merchants, Mobile Payments, Near Field Communication, nfc, payment industry, payment methods, payment options, payment processing, payment service providers, payment services, payment trends, payments, PIN, point of sale, POS, qr codes, real-time payments, Samsung, tokenization

October 19th, 2015 by Elma Jane

If you’re a merchant accepting credit cards, you’re probably aware that things are changing. As of October 1st, 2015, merchants are now liable for any fraudulent activity that occurs as a result of non-EMV-compliant. For those Merchants who haven’t yet updated their POS terminal, you need to talk with your processor to get a new equipment.

Things Merchant should know to be EMV ready:

What is EMV Chip Cards? Chip Cards are standard bank cards that are embedded with a micro-computer chip. Some may require a PIN instead of a signature to complete the transaction process. The new cards will still have magnetic stripes, at least for the time being, so you technically can continue to process payments with the same old equipment you’ve been using for years. But by refusing to upgrade your hardware, you are taking on responsibility for any fraud that might have otherwise been prevented with the new technology.

How does EMV Chip Cards Work? Instead of swiping your card, you are going to do what is called card dipping, which means inserting your card into a terminal slot and waiting for it to process.

When a Chip Card or EMV Card is dipped, data flows between the card chip and the issuing financial institution to verify the card’s legitimacy and create the unique transaction data.

This process isn’t as quick as a magnetic-stripe swipe. It will take a little longer for that transmission of data.

What Must a Merchant Do? For merchants and financial institutions, the switch to EMV chip cards means adding new in-store technology and internal processing systems, and complying with new liability rules. Merchants who have not yet purchased new POS Terminal may be held liable for fraud as of October 1st, 2015. Implementing EMV technology isn’t an option, it’s a necessity. If you are one of those in the retail business or retailers using mobile payment devices who missed the Oct. 1st deadline, you are already at risk. Upgrading should be a top priority.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: bank cards, chip cards, credit cards, data, EMV, financial institutions, magnetic stripes, merchant, mobile payment, PIN, POS terminal, processor, retail business, terminal slot

September 24th, 2014 by Elma Jane

The CVV Number (Card Verification Value) on your credit card or debit card is a 3 digit number on VISA, MasterCard and Discover branded credit and debit cards. On your American Express branded credit or debit card it is a 4 digit numeric code.

The codes have different names:

American Express – CID or unique card code.

Debit Card – CSC or card security code.

Discover – card identification number (CID)

Master Card – card validation code (CVC2)

Visa – card verification value (CVV2)

CVV numbers are NOT your card’s secret PIN (Personal Identification Number).

You should never enter your PIN number when asked to provide your CVV. (PIN numbers allow you to use your credit or debit card at an ATM or when making an in-person purchase with your debit card or a cash advance with any credit card.)

Types of security codes:

CVC1 or CVV1, is encoded on track-2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for card not present transactions occurring by mail or fax or over the telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless card and chip cards may supply their own codes generated electronically, such as iCVV or Dynamic CVV.

Code Location:

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card. On American Express cards, the card security code is the four digits printed (not embossed) on the front towards the right. The card security code is not encoded on the magnetic stripe but is printed flat.

American Express cards have a four-digit code printed on the front side of the card above the number.

MasterCard, Visa, Diners Club, Discover, and JCB credit and debit cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

New North American MasterCard and Visa cards feature the code in a separate panel to the right of the signature strip. This has been done to prevent overwriting of the numbers by signing the card.

Benefits when it comes to security:

As a security measure, merchants who require the CVV2 for card not present payment card transactions are required by the card issuer not to store the CVV2 once the individual transaction is authorized and completed. This way, if a database of transactions is compromised, the CVV2 is not included, and the stolen card numbers are less useful. Virtual Terminals and payment gateways do not store the CVV2 code, therefore employees and customer service representatives with access to these web-based payment interfaces who otherwise have access to complete card numbers, expiration dates, and other information still lack the CVV2 code.

The Payment Card Industry Data Security Standard (PCI DSS) also prohibits the storage of CSC (and other sensitive authorization data) post transaction authorization. This applies globally to anyone who stores, processes or transmits card holder data. Since the CSC is not contained on the magnetic stripe of the card, it is not typically included in the transaction when the card is used face to face at a merchant. However, some merchants in North America require the code. For American Express cards, this has been an invariable practice (for card not present transactions) in European Union (EU) states like Ireland and the United Kingdom since the start of 2005. This provides a level of protection to the bank/cardholder, in that a fraudulent merchant or employee cannot simply capture the magnetic stripe details of a card and use them later for card not present purchases over the phone, mail order or Internet. To do this, a merchant or its employee would also have to note the CVV2 visually and record it, which is more likely to arouse the cardholder’s suspicion.

Supplying the CSC code in a transaction is intended to verify that the customer has the card in their possession. Knowledge of the code proves that the customer has seen the card, or has seen a record made by somebody who saw the card.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale, Visa MasterCard American Express Tagged with: (Card Verification Value), (CVC2), American Express, atm, authorization data, bank/cardholder, card holder data, card identification number, card issuers, Card Not Present transactions, card number, card numbers, card security code, card validation code, card-not-present, card-present transactions, cardholder, cards, cash advance, chip cards, CID, code, Contactless card, credit, credit-card, CSC, customer, customer service, CVC1, CVV Number, CVV1, CVV2, Data Security Standard, debit, debit card, debit cards, device, Diners Club, Discover, fax, gateways, iCVV or Dynamic CVV, individual transaction, internet, issuer, JCB credit, magnetic stripe, mail, MasterCard, merchant, payment card, Payment Card Industry, payment card transactions, payment gateways, PCI-DSS, Personal Identification Number, PIN, point of sale, post transaction authorization, security codes, telephone, terminals, unique card code, virtual terminals, visa, web-based payment

September 16th, 2014 by Elma Jane

When plastic cards become digital tokens, they become virtual. So how do you say that the Card is Present or Not Present. The legendary regulatory difference that the cards industry has relied on to differentiate between interchange fees for Card Present and Card Not Present transactions.

Apple secured Card Present preferential rates for transactions acquired by iTunes on the basis that the card’s legitimacy is verified with the issuer at the time of registration and the token minimizes probability of fraud. If an API call to the issuing bank is sufficient to say that the Card is Present, who is to say that the same logic can’t apply to online merchants who also verify the authenticity of Cards on File when they tokenize them? How can one arbitrarily say that the transaction processed with token from an online merchant is Card Not Present, but the one processed with Apple Pay is Card Present even though both might have made the same API call to the bank to verify the card’s validity?

In the Apple case, a physical picture of the card is taken and used to verify that the person registering the card has it. It is not that hard for an online merchant to verify that the Card on File converted as a token does belong to the person performing an online transaction.

As we move towards chip and pin the card present merchants will spend substantial money upgrading their hardware and POS systems. That expense will be offset by that savings in losses due to fraud. MOTO and e-commerce transactions ( card NOT present ) will always have a higher cost because the nature of processing is NON face to face transactions. Of course the fraud and losses are higher when the card is manually entered or given to someone over the phone……Face to face will always have the lowest cost per transaction because it is usually the final step in the sale. Restaurants are low risk because you had the transaction AFTER you eat. If there is a dispute it happens before the merchant even sees the credit card.

In the long run, as cards become digital and virtual through tokens, we are all going to wonder if card is present or not present. May be some will say. Card is a ghost.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: (POS) systems, API call, Apple secured Card Present, bank, Card Not Present transactions, card present, card present merchants, cards, cards industry, chip, credit-card, digital and virtual, digital tokens, e-commerce transactions, fees, fraud, hardware, industry, interchange, interchange fees, issuer, issuing bank, low risk, Merchant's, moto, NON face to face transactions, online, online merchants, online transaction, PIN, Processing, Rates, token, transactions

September 11th, 2014 by Elma Jane

Every year Americans take more than 59 million trips abroad. Yet many of us don’t know which questions to ask regarding the use of credit cards. Before you hit the road, let your card issuer know where and when you’ll be traveling, so it doesn’t mistake those overseas charges with fraudulent activity. Start asking some questions below:

Does my card charge a foreign transaction fee? Because these fees can run as high as 3% and can be quite costly.

Does my card have an EMV chip? A smart chip widely used in Europe and other places. Contact your credit card provider and see if they can provide you at no cost a chip-and-PIN card if you don’t already have one. Most of the card companies are moving this way, but typically you have to request it.

Does my card offer any travel perks? You may want to inquire about additional coverage your card may provide you when you’re abroad such as insurance for accidents, lost luggage or auto collision.

How can I get cash overseas? Reach out to the bank or credit card provider and find out what relationships they have in the local market you’re traveling to. This will be helpful for avoiding ATM fees. Additionally, if you need to access cash from your credit card, they’ll be very helpful if you do it through a banking institution that has a relationship with your provider.

Will my card be accepted at my destination? Thirty to sixty days before traveling contact your bank or credit card provider and ask some important questions. Find out if their card is going to be accepted or if there will be any restrictions for it to be used abroad.

The best thing to do is to have a plan before you travel. Know how to minimize your fees and protect your credit cards. Then you can enjoy your adventure.

Posted in Uncategorized Tagged with: atm, ATM fees, bank, banking, banking institution, card, card issuer, chip, Chip and PIN, chip-and-PIN card, credit card provider, credit cards, EMV, EMV chip, fee, fees, foreign transaction fee, institution, PIN, provider, transaction, transaction fee, travel

September 4th, 2014 by Elma Jane

EMV, which stands for Europay, MasterCard and Visa, and is slated to be mandated across the United States starting in October 2015 and automated fuel dispensers have until October 2017 to comply. Unlike magnetic swipe cards, EMV chip cards encrypt data and authenticate communication between the card and card reader. Additionally, chip card user is prompted for a PIN for authentication.

Why are those dates important? Companies lose $5.33 billion to fraud today, with card issuers and merchants incurring 63 and 37 percent of these losses, respectively. Under the EMV mandate, merchants who do not process chip cards will bear the burden of the issuer loss. By accepting chip card transactions, merchants and issuers should see a reduction in fraud.

Overcoming Barriers to EMV Adoption

Given the significant barriers to EMV adoption, it may be tempting for merchants to meet minimum requirements for accepting EMV payments. However, medium to large retailers should also consider the bigger picture of customer security and peace of mind.

Some key critical success factors for a payment initiative of this size include:

Business Continuity Architecture: As with all payment systems, it is imperative to have the EMV system running at all times. The solution should preferably have Active-Active architecture across multiple data centers and have a low Recovery Point Objective (the point in time to which the systems and data must be recovered after an outage).

Cost Benefit Analysis: Take a top down approach and decide accordingly on the scope of the analysis. This will ensure that decisions on scope are made on basis of quantitative data and not just qualitative arguments.

Phased Approach: To overcome time or cost overage in a project of this scope and complexity, retailers should try using an iterative approach for development. The rollout can be divided into multiple releases of six to seven months, which will provide the opportunity to review, capture lessons learnt, and improve subsequent releases.

Proactive Monitoring Alerts: Considering the criticality of business function carried out by EMV, tokenization and payment gateway, a vigorous supervising environment must be defined to perform proactive and reactive monitoring. It should take into consideration the monitoring targets, tools, scope and methods. This will provide advance visibility to the failure points and better ensuring maximum system availability.

Resilience Testing: Typically in a software project, the testing is limited to the unit, integration, performance and user acceptance. However, due to the critical nature of the applications and systems involved, robust resiliency testing is vital. This will ensure that there are no single points of failure and the system remains available when running in error conditions.

Stakeholder Identification: This is a key step to ensure that you have varied perspectives from all departments and their support. It will keep your organization from being blindsided and reduce the risk of disagreements in later stages of the program. Key stakeholders should include Store Operations, Card Accounting, Loss Prevention, Contact Center and IT & Data Security.

Organizations should adopt a five step approach to implement a secure, robust and industry-leading payment solution:

Encryption – Point to point encryption will ensure card data is secure and encrypted from the point of capture to the processor. Usually, merchants use data encryption that is not point to point, rendering their organization vulnerable to data breaches. Software encryption is the most common form of encryption, as it is easily installed and quires little or no hardware upgrades; however, it is less secure, may expose encryption keys, and is prone to memory scanning attacks. Hardware encryption is considered more secure but requires more costly terminal upgrades. Hardware encryption is designed to self-destruct the keys if tampered, but is not well-defined as very limited headway has been made in this space.

Tokenization – Build a Card Data Environment (CDE) that will host a centralized card data storage solution. Only limited applications with firewall access and capability to mutually authenticate via certificates can access CDE and receive card data. The rest of the applications will have tokens which are random numbers. This architecture will ease the merchant’s burden with existing and emerging PCI Data Security Standards.

Payment Gateway – Perform a risk assessment on the current payment gateway and identify gaps in functionality, manageability, compliance, scalability, speed to market and best practices. Determine the alternatives to mitigate the risks. Some of the important aspects of a leading payment gateway solution are support for all forms of credit, debit, gift cards and check transactions. Its ability to work with any acquirer, in-built encryption abilities, support for settlement and reconciliation must also be kept into consideration.

Settlement, Funding and Reconciliation – A workflow-based system to handle chargebacks and the automation of chargeback processing will greatly reduce labor-intensive work and enhance the quality of data used for settlement and reconciliation. Upgrades to the existing receipt retrieval system may be needed.

Card fraud is on the rise in the U.S., and merchants are the primary target for stealing information. With the EMV deadline just over a year away, the responsible retailer must take steps to prepare now. Although EMV implementation might seem overwhelming to merchants, they should start their journey to secure payments rather than wait for a looming deadline. Solutions such as data encryption and tokenization should be used in combination with EMV to implement a robust payment solution to better protect merchants against fraud. By proactively adopting EMV payment solutions, merchants can stay ahead of the regulatory curve and better protect their customers from fraud.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: authentication, automation, card, card data, Card Data Environment, card fraud, card issuers, card transactions, CDE, chargeback, chargeback processing, check, check transactions, chip, chip cards, credit, customer, customer security, data, data breaches, data encryption, data security, debit, EMV, emv chip cards, EuroPay, fraud, gateway, Gift Cards, host, integration, magnetic swipe cards, MasterCard, Merchant's, payment, payment gateway, payment solution, payment systems, PCI, PCI Data Security Standards, PIN, processor, retailers, Security, software, swipe, terminal, tokenization, tools, visa

August 27th, 2014 by Elma Jane

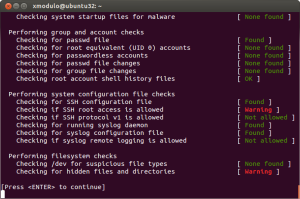

Backoff malware that has attacked point of sale systems at hundreds of businesses may accelerate adoption of EMV chip and PIN cards and two-factor authentication as merchants look for ways to soften the next attack. Chip and PIN are a big thing, because it greatly diminishes the value of the information that can be trapped by this malware, said Trustwave, a security company that estimates about 600 businesses have been victims of the new malware. The malware uses infected websites to infiltrate the computing devices that host point of sale systems or are used to make payments, such as PCs, tablets and smartphones. Merchants can install software that monitors their payments systems for intrusions, but the thing is you can’t just have anti-virus programs and think you are safe. Credit card data is particularly vulnerable because the malware can steal data directly from the magnetic stripe or keystrokes used to make card payments.

The point of sale system is low-hanging fruit because a lot of businesses don’t own their own POS system. They rent them, or a small business may hire a third party to implement their own point of sale system. The Payment Card Industry Security Standards Council issued new guidance this month to address security for outsourced digital payments. EMV-chip cards, which are designed to deter counterfeiting, would gut the value of any stolen data. With this magnetic stripe data, the crooks can clone the card and sell it on the black market. With chip and PIN, the data changes for each transaction, so each transaction is unique. Even if the malware grabs the data, there not a lot the crooks can do with it. The EMV transition in the U.S. has recently accelerated, driven in part by recent highprofile data breaches. Even with that momentum, the U.S. may still take longer than the card networks’ October 2015 deadline to fully shift to chip-card acceptance.

EMV does not by itself mitigate the threat of breaches. Two-factor authentication, or the use of a second channel or computing device to authorize a transaction, will likely share in the boost in investment stemming from data security concerns. The continued compromise of point of sale merchants through a variety of vectors, including malware such as Backoff, will motivate the implementation among merchants of stronger authentication to prevent unauthorized access to card data.

Backoff has garnered a lot of attention, including a warning from the U.S. government, but it’s not the only malware targeting payment card data. It is not the types of threats which are new, but rather the frequency with which they are occurring which has put merchants on their heels. There is also an acute need to educate small merchants on both the threats and respective mitigation techniques.. The heightened alert over data vulnerability should boost the card networks’ plans to replace account numbers with substitute tokens to protect digital payments. Tokens would not necessarily stop crooks from infiltrating point of sale systems, but like EMV technology, they would limit the value of the stolen data. There are two sides to the equation, the issuers and the merchants. To the extent we see both sides adopt tokenization, you will see fewer breaches and they will be less severe because the crooks will be getting a token instead of card data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Point of Sale Tagged with: access, account, account numbers, anti-virus programs, authentication, Backoff, card, card networks, chip, credit, Credit card data, credit-card, data, data breaches, devices, digital payments, EMV, magnetic stripe, Malware, Merchant's, Payment Card Industry, payments, PCs, PIN, PIN cards, point of sale, POS, POS system, programs, Security, security standards, Smartphones, software, system, tablets, tokenization, tokens, transaction, Trustwave, websites

July 14th, 2014 by Elma Jane

French financial services company LCL has introduced a service that securely issues payment card PIN codes to customers via SMS texting. The programme has been introduced initially for cardholders who forget their confidential code when out shopping or withdrawing cash. In a second phase, the bank intends to extend PIN issuance to coincide with the mail-out of newly-created cards.

LCL is using Gemalto’s Netsize platform, which offers direct connections to more than 160 mobile operators globally for message delivery. LCL recognizes the mobile channel as a new opportunity to support their continued drive to optimize card activation rates and be the top-of-wallet choice for payment. Enabling cardholders to get their PIN code on their mobile phone prompts them to start using their banking card as soon as they receive it.

Posted in Best Practices for Merchants, Mobile Payments, Smartphone Tagged with: bank, card, cardholders, codes, customers, mobile, mobile channel, payment, PIN, Rates, sms, wallet

June 9th, 2014 by Elma Jane

Some American banks and financial institutions, like JPMorgan Chase, American Express and Citi, have already issued credit cards with new security technology. Other banks will do so by the end of the year. Often referred to as E.M.V. (short for Europay, MasterCard and Visa) or chip-and-PIN, these new cards use a combination of an embedded microchip and a personal numeric code to authorize payment transactions. Depending on the card issuer, some cards may have the chip but require just the old-fashioned signature instead of a PIN.

Most traditional credit cards in the United States today use a magnetic strip and a customer signature to seal a deal. The information embedded in the stripe can be easily cloned, however, and signatures can be forged. The chips in the newer E.M.V. cards which encode account information when transferring it to the merchant are harder to duplicate. The PIN must be entered for each charge, which helps make the cards more secure for in-person purchases. The cards are not infallible, though, criminals have still found ways to steal PINs and make fraudulent online purchases.

With new types of credit cards come new payment terminals, and many retailers must upgrade their equipment to make it compatible with E.M.V. cards. Instead of a slot to swipe the strip, the new credit card terminals typically need a chip reader. Most merchants will probably have the new equipment in place by October 2015, when new rules about fraud liability kick in. Under these rules, the bank or the merchant could be held accountable for any fraudulent charges if one of them has not upgraded to the new system. The party with the weaker security measures must pay.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: account information, American banks, American Express, card issuer, cards, chip, Chip and PIN, chip reader, Citi, credit card terminals, credit cards, E.M.V., embedded microchip, EuroPay, financial institutions, fraud liability, JPMorgan Chase, magnetic strip, MasterCard, merchant, numeric code, payment terminals, payment transactions, PIN, Security, visa

May 29th, 2014 by Elma Jane

New enhancements intended to provide its U.S. cardholders with greater protection from fraud and identity theft has been announced by MasterCard.

All MasterCard credit, debit, prepaid and small business cards issued in the U.S. will now carry Identity Theft Resolution assistance. MasterCard new program will provide help in canceling missing cards and alerting credit reporting agencies, as well as targeting searches to detect if stolen personal and confidential data appears online. The new Identity Theft coverage extension begins in July 2014.

MasterCard is also extending its zero liability policy in the U.S. to include all MasterCard PIN-based and ATM transactions. This is in addition to coverage already provided on signature debit and credit transactions. The Zero Liability coverage extension takes effect in October 2014.

Fraud prevention and detection is a 24/7 job at MasterCard. The changes in cardholder protection is a combined efforts to move the U.S. payments industry to EMV chip technology will help deliver safer shopping experiences to consumers. MasterCard noted that tanks and financial institutions issuing MasterCard-branded cards provide financial indemnity against fraud.

Posted in Credit card Processing, Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: ATM transactions, business cards, cardholders, credit, credit reporting agencies, credit transactions, data, debit, EMV, EMV chip technology, financial institutions, fraud, Fraud prevention, identity theft, Identity Theft Resolution assistance, MasterCard, payments industry, PIN, prepaid, zero liability policy