July 11th, 2016 by Elma Jane

Facebook announcement of News Feed algorithm shift will affect how businesses use this platform. Content posted by brands and publishers will show up less prominent in News Feeds.

This Facebook update may cause reach and referral traffic to decline for many Pages who’s traffic comes directly through Page posts. To limit the impact of this change Boost Engagement is the key, individual users commenting, liking and sharing on business posts will help circumnavigate the new algorithm. Diversify your referral traffic sources. Look for alternative social media platforms, pay per click ads or blogs to make up for the loss in referrals and increase your reach.

To limit the impact of this change, Boost Engagement is the key. Individual users commenting, liking and sharing on business posts will help circumnavigate the new algorithm. Diversify your referral traffic sources. Look for alternative social media platforms, pay per click ads or blogs to make up for the loss in referrals and increase your reach.

Diversify your referral traffic sources. Look for alternative social media platforms, pay per click ads or blogs to make up for the loss in referrals and increase your reach.

While this change will have an impact on big businesses that rely on Facebook for their referral traffic and content sharing, small businesses will still feel the change. By boosting your engagement and diversifying your referral traffic sources, you can lessen the impact to your business.

Posted in Best Practices for Merchants Tagged with: business, pay, platform, referral, social media, traffic

June 10th, 2016 by Elma Jane

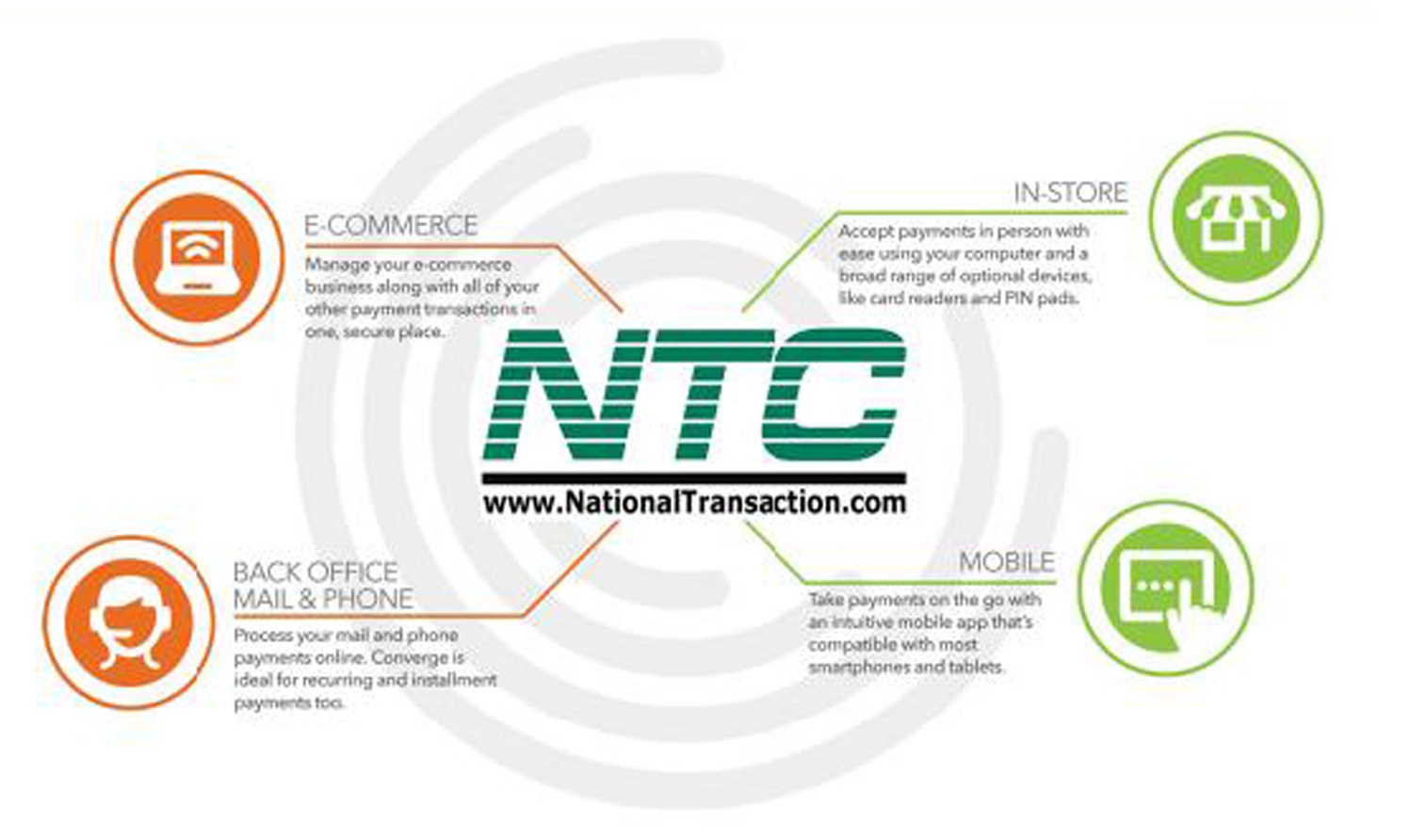

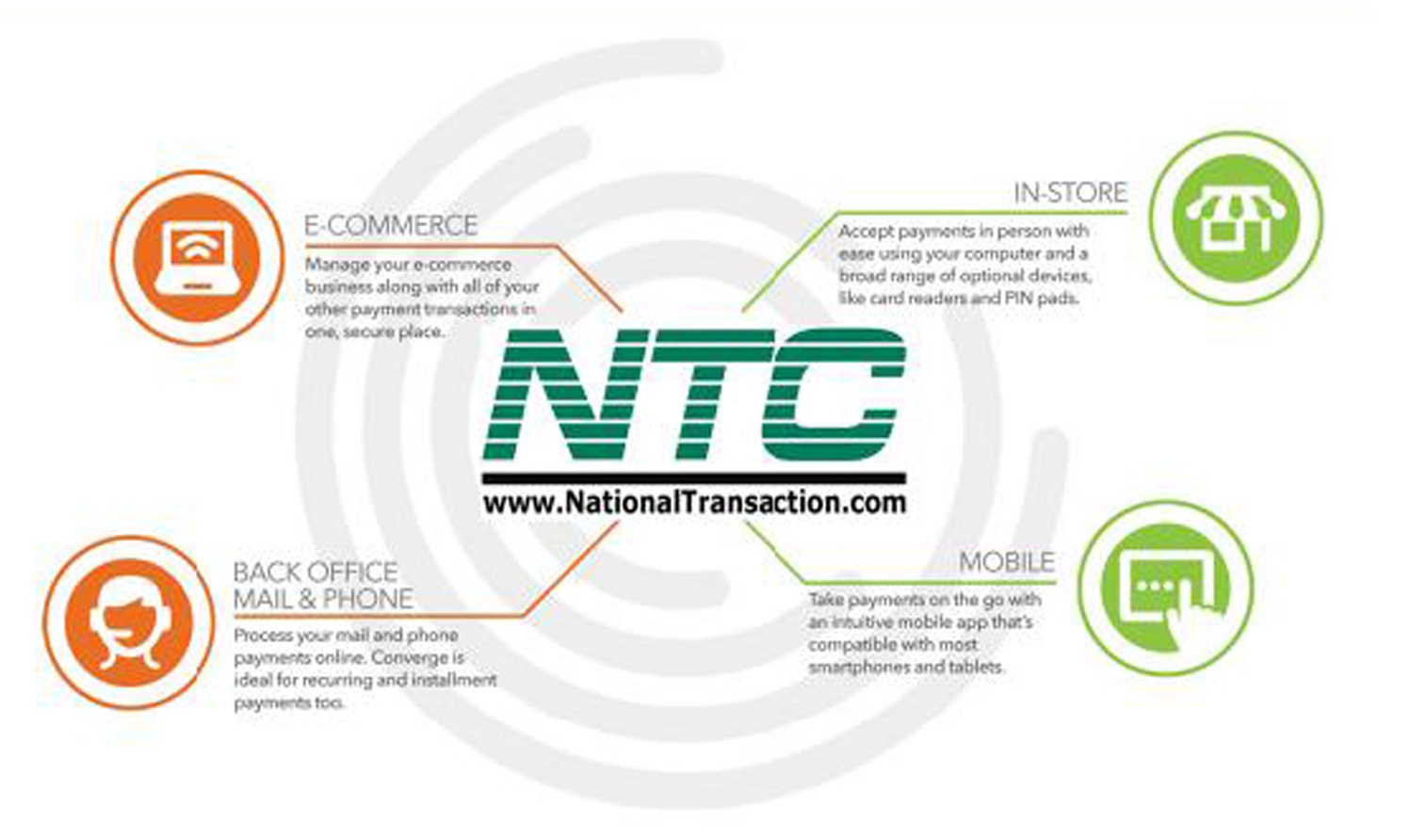

In-app purchases are important in getting customers engaged with mobile wallets, now, NTC has made it easier to implement Apple Pay into mobile apps with the launch of Converge In-App Payments. You are able to provide your customer with Commerce SDK, a software development kit, to integrate Apple Pay with our powerful omni-commerce platform, Converge. By reducing development effort, customers can save time and resources. Their mobile app gets to market faster, and they can capitalize on the growing market.

More mobile wallets will be available in the future.

To know more about this platform give us a call at 888-996-2273

Posted in Uncategorized Tagged with: commerce, customers, Mobile Apps, mobile wallets, omni-commerce, payments, platform

September 19th, 2014 by Elma Jane

MasterCard is claiming a 98% success rate for pilot trials of a biometric verification system combining both voice and facial recognition.

It recently held a closed pilot to understand the consumer experience around voice and facial recognition.

A beta mobile app was tested in an e-commerce environment on over 14,000 transactions. The test group, used both Android and iOS operating systems. The results, yielding a successful verification rate of 98%, mixing a combination of voice and facial recognition. The process usually took less than 10 seconds.

With the first wave of apps utilising Apple’s TouchID fingerprint recognition system coming to market – both US neo-bank Simple and PFM outfit Mint have shipped their first iOS upgrades to incorporate the technology. Biometric verification is beginning to gain currency among businesses and consumers as a useful tool in the fight against fraud.

The launch of Apple Pay will start to bring true scale to the next generation of payments authentication. The challenge is to take lessons from the different applications of biometrics already in place and elevate them into the next generation of authentication, not just for one platform, but for the mass market globally.

MasterCard already has first hand experience of a mass-market implementation of biometric card technology with the recent launch of the Nigerian eIDcard, which combines payment card functionality with a mix of fingerprint, facial and iris recognition.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: Android, Android and iOS operating systems, Apple Pay, Apple's TouchID, beta mobile app, biometric card, biometric card technology, biometric verification, biometric verification system, card, card technology, consumer, currency, e-commerce, facial recognition, fingerprint recognition, fingerprint recognition system, fraud, iOS, iOS operating systems, iris recognition, mass market, MasterCard, mobile app, payments authentication, platform, rate, transactions, verification rate, verification system, voice and facial recognition

September 17th, 2014 by Elma Jane

Host Card Emulation (HCE) offers virtual payment card issuers the promise of removing dependencies on secure element issuers such as mobile network operators (MNOs). HCE allows issuers to run the payment application in the operating system (OS) environment of the smart phone, so the issuing bank does not depend on a secure element issuer. This means lower barriers to entry and potentially a boost to the NFC ecosystem in general. The issuer will have to deal with the absence of a hardware secure element, since the OS environment itself cannot offer equivalent security. The issuer must mitigate risk using software based techniques, to reduce the risk of an attack. Considering that the risk is based on probability of an attack times the impact of an attack, mitigation measures will generally be geared towards minimizing either one of those.

To reduce the probability of an attack, various software based methods are available. The most obvious one in this category is to move part of the hardware secure element’s functionality from the device to the cloud (thus creating a cloud based secure element). This effectively means that valuable assets are not stored in the easily accessible device, but in the cloud. Secondly, user and hardware verification methods can be implemented. The mobile application itself can be secured with software based technologies.

Should an attack occur, several approaches exist for mitigating the Impact of such an attack. On an application level, it is straightforward to impose transaction constraints (allowing low value and/or a limited number of transactions per timeframe, geographical limitations). But the most characteristic risk mitigation method associated with HCE is to devaluate the assets that are contained by the mobile app, that is to tokenize such assets. Tokenization is based on replacing valuable assets with something that has no value to an attacker, and for which the relation to the valuable asset is established only in the cloud. Since the token itself has no value to the attacker it may be stored in the mobile app. The principle of tokenization is leveraged in the cloud based payments specifications which are (or will soon be) issued by the different card schemes such as Visa and MasterCard.

HCE gives the issuer complete autonomy in defining and implementing the payment application and required risk mitigations (of course within the boundaries set by the schemes). However, the hardware based security approach allowed for a strict separation between the issuance of the mobile payment application on one hand and the transactions performed with that application on the other hand. For the technology and operations related to the issuance, a bank had the option of outsourcing it to a third party (a Trusted Service Manager). From the payment transaction processing perspective, there would be negligible impact and it would practically be business as usual for the bank.

This is quite different for HCE-based approaches. As a consequence of tokenization, the issuance and transaction domains become entangled. The platform involved in generating the tokens, which constitute payment credentials and are therefore related to the issuance domain, is also involved in the transaction authorization.

HCE is offering autonomy to the banks because it brings independence of secure element issuers. But this comes at a cost, namely the full insourcing of all related technologies and systems. Outsourcing becomes less of an option, largely due to the entanglement of the issuance and transaction validation processes, as a result of tokenization.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication, Visa MasterCard American Express Tagged with: (MNOs), (OS), assets, bank, card, card issuers, cloud, cloud based payments, cloud based secure element, cloud-based, hardware secure element, Host Card Emulation (HCE), issuing bank, MasterCard, mobile, mobile app, mobile application, mobile network operators, mobile payment, mobile payment application, nfc, operating system, payment application, payment transaction, payments, platform, risk, secure element, smart phone, software, software based technologies, token, tokenization, transaction, virtual payment, visa

September 2nd, 2014 by Elma Jane

While Apple doesn’t talk about future products,latest report that the next iPhone would include mobile-payment capabilities powered by a short-distance wireless technology called near-field communication or NFC. Apple is hosting an event on September 9th, that’s widely expected to be the debut of the next iPhone or iPhones. Mobile payments, or the notion that you can pay for goods and services at the checkout with your smartphone, may finally break into the mainstream if Apple and the iPhone 6 get involved.

Apple’s embrace of mobile payments would represent a watershed moment for how people pay at drugstores, supermarkets or for cabs. The technology and capability to pay with a tap of your mobile device has been around for years, you can tap an NFC-enabled Samsung Galaxy S5 or NFC-enabled credit card at point-of-sale terminals found at many Walgreen drugstores, but awareness and usage remain low. Apple has again the opportunity to transform, disrupt and reshape an entire business sector. It is hard to overestimate what impact Apple could have if it really wants to play in the payments market.

Apple won’t be the first to enter the mobile-payments arena. Google introduced its Google Wallet service in May 2011. The wireless carriers formed their joint venture with the intent to create a platform for mobile payments. Apple tends to stay away from new technologies until it has had a chance to smooth out the kinks. It was two years behind some smartphones in offering an iPhone that could tap into the faster LTE wireless network. NFC was rumored to be included in at least the last two iPhones and could finally make its appearance in the iPhone 6. The technology will be the linchpin to enabling transactions at the checkout.

Struggles

The notion of turning smartphones into true digital wallets including the ability to pay at the register, has been hyped up for years. But so far, it’s been more promise than results. There have been many technical hurdles to making mobile devices an alternative to cash, checks, and credit cards. NFC technology has to be included in both the smartphone and the point-of-sale terminal to work, and it’s been a slow process getting NFC chips into more equipment. NFC has largely been relegated to a feature found on higher-end smartphones such as the Galaxy S5 or the Nexus 5. There’s also confusion on both sides, the merchant and the customer, on how the tech works and why tapping your smartphone on a checkout machine is any faster, better or easier than swiping a card. There’s a chicken-and-egg problem between lack of user adoption and lack of retailer adoption. It’s one reason why even powerhouses such as Google have struggled. Despite a splashy launch of its digital wallet and payment service more than three years ago, Google hasn’t won mainstream acceptance or even awareness for its mobile wallet. Google hasn’t said how many people are using Google Wallet, but a look at its page on the Google Play store lists more than 47,000 reviews giving it an average of a four-star rating.

The Puzzle

Apple has quietly built the foundation to its mobile-payment service in Passbook, an app introduced two years ago in its iOS software and released as a feature with the iPhone 4S. Passbook has so far served as a repository for airline tickets, membership cards, and credit card statements. While it started out with just a handful of compatible apps, Passbook works with apps from Delta, Starbucks, Fandango, The Home Depot, and more. But it could potentially be more powerful. Apple’s already made great inroads with Passbook, it could totally crack open the mobile payments space in the US. Apple could make up a fifth of the share of the mobile-payment transactions in a short few months after the launch. The company also has the credit or debit card information for virtually all of its customers thanks to its iTunes service, so it doesn’t have to go the extra step of asking people to sign up for a new service. That takes away one of the biggest hurdles to adoption. The last piece of the mobile-payments puzzle with the iPhone is the fingerprint recognition sensor Apple added into last year’s iPhone 5S. That sensor will almost certainly make its way to the upcoming iPhone 6. The fingerprint sensor, which Apple obtained through its acquisition of Authentic in 2012, could serve as a quick and secure way of verifying purchases, not just through online purchases, but large transactions made at big-box retailers such as Best Buy. Today, you can use the fingerprint sensor to quickly buy content from Apple’s iTunes, App and iBooks stores.

The bigger win for Apple is the services and features it could add on to a simple transaction, if it’s successful in raising the awareness of a form of payment that has been quietly lingering for years. Google had previously seen mobile payments as the optimal location for targeted advertisements and offers. It’s those services and features that ultimately matter in the end, replacing a simple credit card swipe isn’t that big of a deal.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: app, Apple, card, card swipe, cash, checkout machine, checks, chips, credit, credit card swipe, credit-card, customer, debit card, Digital wallets, fingerprint recognition, fingerprint sensor, Galaxy S5, Google Wallet, iOS, Iphone, market, merchant, mobile, mobile device, mobile payment, mobile wallet, Near Field Communication, network, Nexus 5, nfc, payment, payment service, platform, point of sale, products, sensor, services, smartphone, software, statements, swiping card, terminals, transactions, wireless technology

August 27th, 2014 by Elma Jane

An IT services firm, announced earlier this week that it purchased a majority stake in cloud-based travel management company. With the move,hopes to strengthen its travel vertical by using software-as-a service travel IT platform. The future of software services lies in blending models with customized solutions and services over different stages of an enterprise lifecycle and across different business segments within the enterprise. The platform combined with the strong management team and travel domain specialist will further strengthen competitive position in the travel vertical.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: business, cloud-based, company, domain, IT, management, platform, service, software, solutions, specialist, team, travel, travel domain, travel management, travel vertical

July 24th, 2014 by Elma Jane

You may only think of Instagram as a place to edit and share snapshots of your fancy vegan lunch or your adorable new kitten, but the photo-sharing app can be highly useful when it comes to building your business’s brand. Social media not only Instagram, is an incredible platform for people to use to drive more interest to their business. When it comes to building up your following, having good content is the most important factor. While paid traffic is a useful way to gain traction and drive more interest to your pages, she said that at the end of the day, word-of-mouth is the most beneficial.If you want to have more people inviting their friends to your page, you have to have something that’s worth sharing or talking about. Since content is king on social media, businesses looking to market on Instagram in particular should make sure that their posts are relevant and eye-catching with high-quality photos and videos. Most important tip for Instagram success however, isn’t about what hash tags or filters and photo effects to use. It’s even more straightforward: Social media is just like the rest of your life relationships. People want you to be real, honest and address issues we all have on a day-to-day basis. Instagram is a fairly simple social network to use, because unlike other social networks such as Facebook, Tumblr and Twitter, where text is the focus and no form of multimedia is off-limits, you’re limited to only posting photos or videos (15 seconds or less) with captions. For this reason, maintaining an active Instagram presence may seem almost effortless. However, Insta-fame doesn’t come without issues. The biggest challenge would be trying to help everyone. Obviously, the more interest and followers you gain, the more unique problems and questions you receive. For businesses looking to grow their Instagram pages, just remember. It’s all about quality. Great content, honesty and a personable, likable brand voice are all you really need for Insta-success.

Posted in Uncategorized Tagged with: Facebook, Instagram, multimedia, platform, social media, social network, Tumblr, twitter

July 22nd, 2014 by Elma Jane

An Android tablet is a great tool for work, but not every Android app was made for tablets. In fact, most Android apps were made for smaller smartphone displays. While those apps will run just fine on your tablet, they don’t do anything to take advantage of the extra screen space, and while smartphone apps are forced to hide options deep in menus, tablet apps have more room to put those controls front and center. Plus, phone apps just don’t look very good on a tablet. The interface is usually stretched and skewed to fill the larger screen. With that in mind, here are apps that will help you get to work on your Android tablet.

Android Device Manager (Free) – a good tool to help you find a lost or stolen Android device. Keeping it installed on your Android tablet will enable you to quickly locate your business phone if it’s ever misplaced. The app can force your phone to ring even if it’s in silent mode. Lock it to prevent thieves from accessing private or confidential business data and even locate your phone using its built-in GPS sensor. Using Android Device Manager on a tablet gives you plenty of space to view and pan around the map while you’re pinpointing the location of your phone. As a last resort, you can use the app to remotely wipe all the data from your smartphone.

Evernote (Free) – is a great app for taking notes, making to-do lists and saving photos and it’s even better on a tablet. The biggest difference between the smartphone and tablet version of Evernote is that the latter features a persistent sidebar that lets you quickly flip between notes, notebooks and tagged items. It has large buttons that let you create a new note, snap a photo or quickly dictate a voice memo. Those options are hidden in a slide-out menu in the smartphone app. You also get more space to view each individual note, which means you can see your entire memo or list at once with less scrolling and swiping.

Google Docs (Free) – Let’s face it: a word processor like Google Docs isn’t all that useful on your smartphone. Sure, it can come in handy when you need to make a few tweaks to an existing document, but you’ll need a bigger display to get much work done. The Google Docs app was really made for tablets, especially when you pair your slate with a Bluetooth keyboard to use it like a laptop computer. Not only do you get a better view of your entire document on the tablet, but you also get quick access to formatting options at the top of the interface, letting you change fonts, colors, text alignment and more. Those options are tucked away in several layers of menus in the smartphone app. Google’s Sheet spreadsheet editor and Slides presentation maker are also better suited for a large tablet display than a smartphone.

Google Drive (Free) – is a solid cloud storage platform for Android users, and a large tablet screen makes it easier to navigate your file library, thanks to a persistent sidebar that lets you jump to any folder with one tap. It also helps you search through shared and starred documents, or jump to a view of your recently uploaded files. But the best reason to use Google Drive on your tablet is that it lets you open those documents on the tablet version of Google Docs, which is much more functional on a large screen than on a smartphone.

Google Keep (Free) – is a minimalist productivity app that lets you quickly capture notes, voice memos and photos, then view all items in a colorful pinboard-style layout. It works fine on smartphones, but on tablets the app scales beautifully to fill the entire screen, letting you view more notes and photos at once. Otherwise, the app offers identical functionality on smartphones and tablets. In addition to pinning new notes to your board, you can create a to-do list and check items off with one tap. You can also set reminders for any item on your tablet and receive an alert on your smartphone when the time comes.

Hangouts (Free) – is an all-in-one messaging app that combines text messaging and videoconferencing functionality. The app imports your contacts from your Google account to let you create new conversations quickly and the ability to add and remove participants in the middle of a conversation helps it stand out from other messaging apps. You can start a video chat session at any time by tapping the video call button during a Hangouts session. That comes in handy when you need to meet with an employee, colleague or client, but can’t meet face-to-face. Hangouts works fine on a smartphone, but it’s better on a tablet. A persistent sidebar makes it easier to browse through your past conversations, and a larger touch-screen keyboard makes it easier to type out messages.

Informant 3 ($9.99) – is a powerful productivity app that combines a business calendar and task manager in a single location. The calendar automatically imports all your events and appointments from the stock Android calendar, so getting started with Informant 3 is easy. Once it’s set up, you can view your agenda at a glance. Change the view to get the optimal view of your day, week or month and add, move and delete items with a few taps. Meanwhile, the task manager lets you add items to a dynamic to-do list, set reminders and alerts, sort tasks by importance and more. Informant 3 works best on a tablet. Browsing your calendars and lists is easier and more comfortable on a larger display. The app also features a special tablet mode with a sidebar that lets you quickly jump between calendar dates.

Posted in Uncategorized Tagged with: Android, Android Device Manager, app, Bluetooth keyboard, computer, data, evernote, Google Docs, google drive, Google Keep, hangouts, Informant 3, laptop, notebooks, notes, phone apps, platform, smartphone, tablet

July 15th, 2014 by Elma Jane

Businesses only stand to benefit by making themselves accessible via mobile devices. With a mobile website or mobile app, businesses can boost sales, retain loyal customers and expand their reach. The question is, which type of mobile presence is best for your business Or should you have both? Both mobile websites and mobile apps let customers find and access your business from devices they use the most, but a mobile website and mobile app are not the same thing. To help you decide, check out the differences between the two and how they can benefit your business.

Mobile App – is a smartphone or tablet application. Unlike a mobile website, a mobile app must be downloaded and installed, typically from an app marketplace, such as the Apple App Store or Android’s Google Play store.

Mobile Website – is designed specifically for the smaller screens and touch-screen capabilities of smartphones and tablets. It can be accessed using any mobile devices Web browser, like Safari on iOS and Chrome on Android. Users simply type in the URL or click on a link to your website, and the website automatically detects the mobile device and redirects the viewer to the mobile version of your website.

Mobile website’s benefits

The primary benefit of a mobile website is that it makes regular websites more accessible for mobile users. It can have all the same elements as the regular version of the website, such as its look and feel, pages, images and other content, but it features a mobile-friendly layout that offers improved readability and functionality when viewed on a smartphone or tablet. By having a mobile website, customers can access your website anytime, anywhere using any device, without compromising the user experience.

Mobile app’s benefits

Although a mobile app functions a lot like a mobile website, a mobile app gives businesses the advantage of having their own corner on a customer’s device, because users have to download and install the app, businesses have more control over their presence on a device than they would with a mobile website. For instance, a mobile app can be closed or inactive, but still work in the background to send geo-targeted push notifications and gather data about customer’s preferences and behaviors. Moreover, mobile apps make it easy to deploy loyalty programs and use mobile payments using a single platform. It’s also much easier to access a mobile app than a mobile website all it takes is one tap, versus having to open a Web browser then type in a URL.

Mobile website and Mobile app features

Although mobile websites and mobile apps aren’t the same thing, they generally offer the same features that can help grow your business by making it easier for customers to find and reach you.

Features include the following:

Click-to-map: Users can use their devices’ GPS to locate your business and instantly get directions, without having to manually input your address.

Mobile commerce: Take your online store mobile with e-commerce-capable mobile websites and apps, such as with Buy Now buttons and mobile carts.

One-click calling: Users can call your business simply by tapping on your phone number from your website or app.

Social sharing: This feature integrates social media apps and websites to enable users to easily share content with friends and followers.

Mobile marketing: This lets users sign up for marketing lists and loyalty programs while enabling businesses to easily launch location-based text-message marketing and email marketing campaigns.

How to build a mobile app

Just like the options available for building a mobile website, businesses can either hire an app developer to build a mobile app or take the budget-friendly DIY mobile app maker route.

How to build a mobile website

To build a mobile website, one option is to hire a mobile Web developer to create one from scratch or convert an existing website into a mobile-friendly one. A more affordable option is to build one yourself with a free DIY mobile website builder, which uses a drag-and-drop platform that doesn’t require programming or Web design skills.

Posted in Uncategorized Tagged with: Android's Google Play, Apple App, Chrome, customers, data, devices, e-commerce, email marketing, GPS, iOS, mobile, mobile app, mobile carts, Mobile Devices, mobile website, platform, programs, Safari, smartphone, tablet, URL, Web browser

May 29th, 2014 by Elma Jane

A point-of-sale facial recognition system that uses NFC to help combat card fraud has been created during a recent company hack-a-thon, together with a group of engineers and designers from Logic PD. Hackathon was an opportunity for experts to explore the possibilities of useful solutions to today’s challenges, with the recent significant breaches in security at leading retailers, the need for this type of solution is particularly meaningful.

The solution, is a multi-modal security platform for card purchases, uses NFC authentication combined with camera imaging to protect users. When users make a mobile payment at the point of sale, the kiosk snaps a picture of the purchaser. This image can be incorporated via the cloud into the user’s digital transactional record, which was stored and distributed via SeeControl in this example, allowing users to identify who made each purchase, and easily identify those that are fraudulent even before banks and financial institutions.

Posted in Credit Card Security, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: banks, breaches, card, card fraud, card purchases, cloud, digital, facial recognition system, financial institutions, mobile payment, nfc, NFC authentication, platform, point of sale, retailers, Security, security platform