September 5th, 2024 by Elma Jane

It’s true that the travel agencies are high risk. This is because of the high chargebacks by travelers who fail to complete their trips or stays due to a variety of reasons. It also has to do with the nature of delayed delivery where items or services are sold today but not used/consumed for a delayed period of time. Using the right merchant solutions can make a difference.

You want merchant solutions that help you to manage chargebacks, errant transactions, and terminal messages. Additionally, you should be able to integrate your software with services such as Sabre Red, Sabre, Trams or other accounting programs such as QuickBooks and Peachtree.

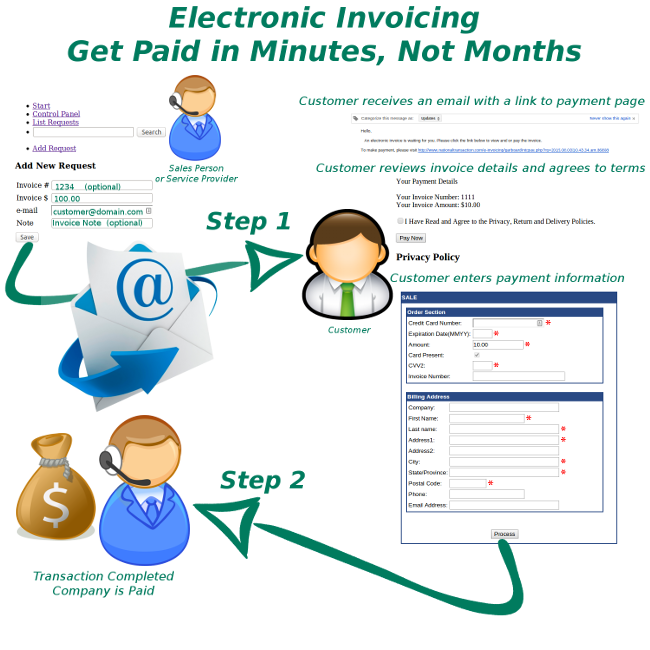

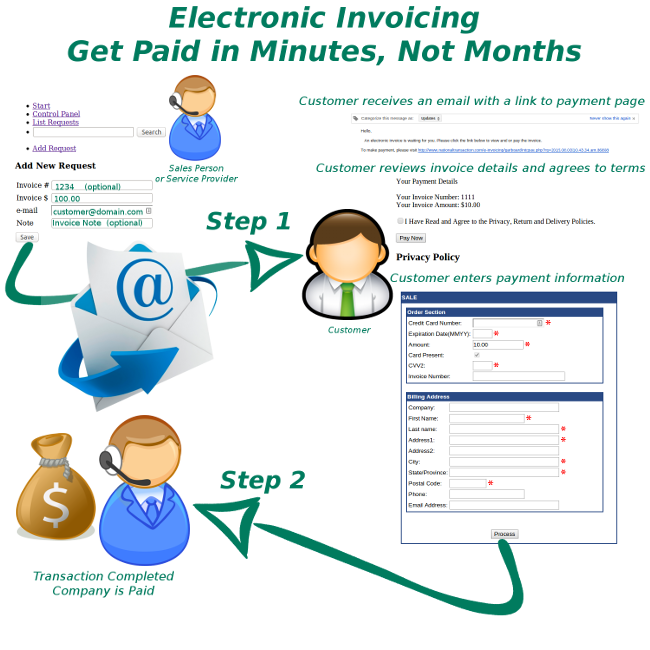

With NTCePay, simply create a pay button for any dollar amount. Then send this digital link to your customers via email. The customer reviews the invoice details and enters their payment information to complete payment. You can also create custom links that can be added to your web site or posted to your social media accounts for payment collection. With advanced invoices, you can easily break down payments into installments.

With this service, you avoid the complexities of integrating the software with your shopping cart, point of sale, or accounting system yet still collect your travel payments in a seamless manner.

For Electronic Payment Set Up Call Now! 888-996-227

Posted in Uncategorized Tagged with: chargebacks, high risk, merchant, payment, point of sale, terminal, transactions, travel

August 30th, 2024 by Admin

According to a poll by OnePoll on behalf of I Love Velvet titled “Consumer Mobile Point-of-Sale (MPOS) Attitudes Report” over half of retail customers think cash registers are outdated. The poll found that 51% of Americans think the cash register could soon be gone altogether as retailers opt for mobile point of sale systems. Consumers seem to favor MPOS systems allowing the shoppers to check out from anywhere in the store and that they return more often to stores with modern electronic payment technologies. Thirty five percent cited they would shop more often at stores with mobile point of sale payment systems. An additional 17% said they would share their shopping experience via social networking sites and 35% report they likely would tell a friend or recommend stores with these technologies. Forty six percent say that stores that have mobile payment systems seem to be more tech savvy and even more (56%) praise the store for making the experience more convenient and secure. Retailers are struggling to modernize their payment platforms to cut down long lines at registers, and place staff on the floor for better customer access. “It’s a great opportunity for retail store owners to dip into the mobile point of sale arena” said Richard Delos Santos of National Transaction Corporation.

Mobile point-of-sale equipment and software manufacturers are stepping up to the security plate as they seek to pass PCI DSS and other security related issues. As new mobile kiosks and point of sale hardware and software evolve so do the security challenges used to thwart credit card fraud and identity theft. The challenge for point of sale system providers is to create an increasingly secure and convenient way for customers to make electronic payments in-store or on their mobile devices. iPads, iPhones and Android tablets are often used by curious shoppers to compare and contrast features, prices and availability, why not let digital wallets be used to close the transaction? The use and connectivity of these new devices mean more complex security measures are needed to thwart attackers, crackers, and hackers.

In the coming years everything from NFC, to fingerprint readers in smartphones and tablets and even QR codes will change the landscape of mobile payment transaction processing and things are beginning to heat up. An estimated $17 Trillion of mobile transactions are predicted by 2020 and security and adoption will reign king on the streets. It might be time to look into the security and features that a mobile point-of-sale system can add over any existing point of sale systems and cash registers. Mobility is a great tool for a sales force, but security and convenience for the customer is a necessity that will only grow in the future.

If You need help setting up a merchant account, Call 888-996-2273 Today!

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Android, ipad, Iphone, mobile, MPOS, payments, point of sale, Processing, smartphone, tablet, transaction

July 18th, 2024 by Elma Jane

The way we pay for goods and services has undergone a dramatic transformation. From bartering to coins to paper money, the journey of payment methods has been long and fascinating. But no shift has been as revolutionary as the rise of electronic payments. Let’s dive into this evolution and explore where this exciting technology might lead us next.

Early Days (1950s – 1970s):

- 1950: The Diners Club card emerges as the first multipurpose charge card, laying the foundation for modern credit card systems.

- 1958: American Express launches its charge card, initially paper-based, revolutionizing travel and expense tracking.

- 1966: Barclays Bank in London introduces the first Automated Teller Machine (ATM), allowing customers basic account access outside banking hours.

- 1970s: Electronic Funds Transfer (EFT) systems gain traction, enabling direct deposit of paychecks and automated bill payments.

Rise of Digital Networks (1980s – 1990s):

- 1979: Visa introduces the first electronic authorization system and point-of-sale (POS) terminal, paving the way for real-time transaction processing.

- 1983: Debit cards become more prevalent, allowing consumers to access funds directly from their bank accounts.

- 1994: First Virtual Holdings pioneers the first secure online payment system, marking the dawn of e-commerce.

- Late 1990s: Online banking explodes in popularity, offering customers convenient account management and payment options.

The Internet Age (2000s – Present):

- 1998: PayPal emerges, simplifying online transactions and boosting consumer confidence in online shopping.

- 2003: Mobile payments gain momentum in various countries, driven by the increasing adoption of mobile phones.

- 2010s: Near Field Communication (NFC) technology enables contactless payments, giving rise to mobile wallets like Apple Pay and Google Pay.

- 2020s: Biometric authentication adds another layer of security to electronic payments, using fingerprints and facial recognition. Real-time payment systems gain popularity, allowing for instant fund transfers.

The Future of Electronic Payments:

- Invisible Payments: Imagine a world where payments happen seamlessly in the background. Technology like Amazon Go is already showcasing this, with customers simply walking out of stores with their purchases.

- Cryptocurrency and Blockchain: While still in its early stages, the potential of cryptocurrencies and blockchain technology to disrupt traditional payment systems is enormous. Expect to see more integration and wider acceptance in the coming years.

- AI-Powered Payments: Artificial intelligence will play a crucial role in fraud prevention, personalized payment experiences, and the development of even more innovative payment solutions.

- Increased Financial Inclusion: Electronic payments have the potential to bring banking services to underserved populations, promoting financial inclusion on a global scale.

The evolution of electronic payments is an ongoing journey. As technology continues to advance, we can expect even more exciting developments that will reshape the way we transact and interact with the world around us.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

Areas Include:

MasterCard, American Express, Discover

A new report shows that American Express, MasterCard, Capital One, Discover and Western Union were focusing on electronic transaction processing. While American Express Company (American Express) recently announced a new executive vice president and a new chief financial officer. Read more of this article »

Posted in Mobile Payments Tagged with: Digital Wallet, e-commerce, electronic transaction, gift, loyalty, m-commerce, mcommerce, mobile point of sale, MPOS, point of sale, POS, rewards

April 17th, 2024 by Elma Jane

Intelligent Use Of Big Data

In understanding Big Data for Merchants, NTC provided a general overview of how online merchants can use Big Data. Think about this application of big data as adopting a more intelligent use of data.

Keeping customers happy is the key to the travel industry, but customer satisfaction can be hard to gauge in a timely manner. Big data analytics gives these businesses the ability to collect customer data, apply analytics and immediately identify potential problems before it’s too late.

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex.

One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as a CRM and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter.

A business could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions.

In a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

A Virtual Terminal can capture email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected.

As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants. Application of big data is a more intelligent use of data.

You know WHO, WHAT, WHEN, AND WHERE a purchase took place.

NationalTransaction.Com 888-996-2273.

Posted in Best Practices for Merchants Tagged with: data, database, merchants, mobile, online, point of sale, virtual merchant, website

April 5th, 2024 by Elma Jane

Fighting chargebacks is important to a business. Whether you process transactions at a point of sale location or operate an e-Commerce business making sure you have implemented a process to dispute your chargebacks is critical.

Basic concepts that can be used to begin learning how to dispute chargebacks:

Keep accurate records of data that is easily accessible. Keeping track of your sales and products have a much easier time in collecting the information necessary to combat a chargeback.

Act quickly, don’t wait! You only have 10 days to respond to a chargeback or retrieval request. If you do not respond in 10 days you lose to a chargeback, and It gets worse; as you will not be able to re-present your case.

Compile and submit the documents to your processor. Make sure the documents have the original chargeback documents attached as well as the other supporting documents.

Follow up to make sure they have been received. Your processor may have an online system that allows you to submit documents directly into the processor chargeback system and some even allow you to view submitted documents in REAL TIME.

Monitor your chargebacks, this will help you understand what processes work for each specific chargeback type.

KEEP YOUR CUSTOMERS HAPPY

NationalTransaction.com 888-996-2273

Posted in Best Practices for Merchants Tagged with: chargebacks, data, e-commerce, point of sale, processor, transactions

July 11th, 2023 by Elma Jane

NTC ePay is for any merchant who wants to avoid the complexities of a shopping cart or integration into an accounting system or point-of-sale. When custom pricing becomes an issue, shopping carts, POS systems, and booking engines tend to get immensely complicated.

NTC ePay does away with those complications by allowing merchants to simply email a payment request that can be paid in 2 simple steps.

When you call National Transaction, we pick up the phone ready to assist your business. Our dedication to supporting our merchants is unparalleled, from the point of sale and beyond.

Our commitment to our merchants extends to their interests with NTC Gives.Com, a program designed to give back to a charity of their choice. Call today and let National Transaction Corporation earn your business.

Contact National Transaction Corporation today at 888-996-2273, or visit us online

at www.nationaltransaction.com for more information.

Posted in Best Practices for Merchants Tagged with: merchant, payment, point of sale

October 7th, 2018 by Admin

National Transaction is celebrating 21 years in the business today. Founded in 1997 National Transaction (NTC) purpose is to serve businesses of all sizes with their cash flow with the highest levels of professionalism and care.

This 21 year anniversary would not be possible without our leader, Mark Fravel and we want to take you back to his why and the reason we are still here today.

The beginnings:

Mark, a single parent of 3 beautiful daughters, wanted to provide for their kids without being on the road all the time. And so, with this passion in mind, a desire to serve and commitment to his family, National Transaction was born.

NTC began like many business and passions, with no customers and only one employee but quickly grew and Mark knew that leading with confidence and excellence will drive this business somewhere.

The Present:

Now, NTC often ranks in the top 10 of many data and technology awards. This Excellence has also earned us an A+ rating in the Better Business Bureau.

This 21 years would not be possible without our desire to help a business grow and give them the right tools for their transactions. We love being on the phone with our customers, we love getting to know them and how we can provide our best service.

The Future

Mark started this with a desire to be a family man, and so, this family feeling has stayed with our company. We treat our team like family, and we are excited about what our future holds the next 21 years.

Thank you for celebrating 21 years of customer service, passion, connection and above all, quality. We will continue to provide you with the best service we know how to give, and we will uphold our promise and mission to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

Thank you for being part of the National Transaction Corporation‘s family.

Posted in nationaltransaction.com Tagged with: Anniversary, ASTA, Better Business Bureau, business, card, consumers, credit card, credit cards, credit-card, customer, customers, data, e-commerce, entrepreneur, entrepreneurship, MasterCard, merchant, merchant account, merchants, Mobile Payments, National Transaction, payments, point of sale, Security, transaction, visa

September 18th, 2017 by Elma Jane

Smart Security for Smart Businesses:

Safe-T for SMB streamlines the PCI process while providing the layered security needed to protect card data

EMV – Fraud protection at the point of sale

EMV chip technology keeps the consumer’s card in their hand. It also helps protect the business from card-present fraud related chargebacks.

Encryption – Protection of payment card data in-transit

Safe-T scrambles cardholder data using advanced encryption technology, so data is protected at the point of entry, and throughout the authorization process.

Tokenization – Token ID protection of stored payment card data

Safe-T returns a token ID or an alias, consisting of a random sequence of numbers to the point-of-sale so the actual card number is never stored. Token IDs can be used for follow up transactions (i.e. recurring payments, voids, etc.).

Reduced PCI – Protection from complex PCI compliance

Maintaining PCI Compliance can be intimidating – second only, perhaps, to completing your taxes. Safe-T eases this process for customers by reducing the number of PCI Self-Assessment questions by more than 60% from 80 questions to 31.

Financial Reimbursement – Financial protection from a card data breach

Recovering from a card data breach can be costly for a small business. Safe-T offers Card Data Breach Reimbursement to financially protect your customer’s business in the event of a card data breach – regardless of the type of card data breach.

For Electronic Payment Set up with this feature call now! 888-996-2273

Posted in Best Practices for Merchants Tagged with: card data, card present, chargebacks, chip, data, data breach, EMV, encryption, fraud, payment, PCI, point of sale, Security, tokenization

August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions