August 18th, 2017 by Elma Jane

Before you can start accepting credit card or electronic payments, there are a number of factors to consider.

You will need to decide on a Point of Sale system. Some Merchant Services Providers require you to use only their equipment.

Some of these systems have expensive equipment costs. Others will provide you with free card readers. Companies offering free equipment may do so in exchange for higher processing fees.

Before you choose a Merchant Services Provider, you should look into how they work those fees.

Understanding Processing Fees

Credit card processing fees have several moving parts, so we aren’t going to dive too deeply into how these fees are determined. We will, however, take a broad overview.

Merchant Services Providers will charge either a flat rate, a percentage, or a combination of the two. This fee is called an interchange rate.

Interchange rates vary between card providers, which is why some sellers don’t accept certain credit cards and why many small companies have minimum requirements for credit card payments.

Some Merchant Services Providers don’t charge a flat transaction fee, however, they usually charge a higher percentage for payments.

Each model has its benefits and disadvantages.

Before choosing a Merchant Services Provider, familiarize yourself with their processing fees. Consider how they will fit with your business model. Are most of your transactions smaller or larger? How much will a free card reader save you?

Weigh every option out before you lock yourself into an agreement.

For Payment Consultation call now and speak to our Payment Consultants 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card readers, credit card, electronic payments, interchange, merchant, point of sale, transaction

May 10th, 2017 by Elma Jane

Mobile Wallet Technology have flooded the market in the last few years with offerings such as Apple Pay, Android pay, Samsung Pay and more. And so far, they seem to be succeeding.

To understand how contactless payments work, here is an example.

A smart phone like Android or iPhone allows you to take advantage of mobile wallets like Android Pay, Apple Pay or Samsung Pay. You input your credit card information onto your phone, which stores it for later use.

If you’re shopping at a store that has mobile payment readers at the register, rather than reach for your wallet and get your credit card; you take out your phone to make a payment.

The point-of-sale (POS) terminal will automatically reads the payment information stored by holding your mobile phone a few inches away from the POS, and then processes the transaction. When the mobile device is in range, a wireless communication protocol links the terminal and the phone, which exchange information and conduct a secure transaction in a fraction of a second.

Near-field communication or NFC technology, works by bringing together two electronic devices. In terms of payments technology, a mobile device such as a smartphone and a reader. The reader would be the initiator and the smartphone would be the target, which contains the stored credit card information.

The market potential for NFC payment technology is huge, as more merchants adopt the EMV. EMV compliant terminals accept NFC payments through mobile wallets.

For Electronic Payment set up call now 888-996-2273!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Near Field Communication, Smartphone Tagged with: contactless payments, credit card, electronic payment, merchants, mobile wallets, Near Field Communication, nfc, point of sale, POS, smart phone, terminal

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions

December 21st, 2016 by Admin

Ways to Prevent CHARGEBACK:

Provide Receipts for every single transaction. Receipt serves as a good reminder to the purchase they make and decreases the likelihood of a charge back. Have the conditions of sale written on the receipt

Be clear about refunds, returns and cancellation policies – include refund, return and cancellation policy on your website.

Make sure charge descriptions are clear. Use dynamic descriptors – with dynamic descriptors, you can include specifics like the product purchased, business name, business location and contact information. Include a number as part of the charge description.

Provide accurate descriptions of products and services – accurate product descriptions are particularly important for online ecommerce where customers often dispute transactions because the product they received is not as it was described online.

Get signed proof of delivery products – especially if you’re an online ecommerce vendors that ships products regularly.

Communicate with customers about renewals – if your customer accounts are set to automatically renew, make sure you notify those customers of their renewal months leading up to the renewal day.

When a cardholder contacts their credit card-issuing bank and asks for a refund on a transaction for a purchase or service made on their card is called chargeback.

Most Common Reasons for Chargebacks:

Point-of-sale processing errors

Customer disputes like, customer doesn’t recognize the charge, customer claims they didn’t receive the item they ordered.

Fraud, or potential fraud (customer claims the transaction is fraudulent – the purchase was made with a stolen card).

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, ecommerce, fraud, online, point of sale, transaction

December 6th, 2016 by Elma Jane

The Process of Processing Electronic Payments

Today new technologies are emerging in electronic payment that allow merchants to collect valuable data on their customers; from emailing receipts to providing incentives to mention the merchant on social media.

So what’s behind the process of processing electronic payments? The heart of all your payment processing needs will most likely lie in a merchant account; with a merchant account you can deposit funds from ebt cards, debit cards, gift or loyalty cards and even checks into your bank account. If your business has never had its own merchant account, it’s probably missing out on some very valuable opportunities.

At National Transaction Corporation this process is simplified to a signature page and a voided check. We consult your business personally to establish the lowest rates and fees possible with your electronic payment processing. We ask detailed questions about how you process your transactions, and if you already process credit cards, we offer a free statement review where we determine your most common transaction types and how to lower their fees and rates.

How Much Will Electronic Payment Processing Cost?

There are three parts to the answer:

Up front or startup costs – include things like an application fee, an account setup fee and equipment fees. At NTC, we don’t have any application, setup or cancellation fees on our services. Our credit card readers and terminals are nonproprietary and will work with almost any merchant services provider and we sell them at cost to make it easier on our merchants.

When you buy a terminal from us you own it and are free to leave us at any time and use the terminal to process through another merchant account provider with no penalty payments at all.

Other startup costs might be:

- check readers,

- cash registers and receipt printers

- mobile point of sale software

- credit card swipe readers

- Accounting software (Intuit’s Quickbooks Pro or PeachTree)

If you already own any of this equipment we can integrate your existing hardware into our services.

Monthly service fees – depend on what services are required; included in the monthly fee detailed statements and reporting on transaction activity.

Transaction fees – MasterCard, Visa and American Express set what are called interchange rates. Interchange rates are a per transaction fee and/or a percentage rate based on the total of a sale. Interchange rates are very complex and consume hundreds of pages of different types of electronic transactions. These transactions are based on the type of business processing the transaction, the way the credit card data is input (like a credit card that is swiped in or manually keyed into a credit card terminal of some type) and the type of credit card used for the transaction (rewards card, corporate card, travel and entertainment credit cards, ebt cards and so on). With so many types of cards and businesses to process it’s impossible to give an accurate rate for all charges.

Again, we have no fees associated with applying for or setting up the merchant account and there is no penalty for cancellation so there are no risks in trying it out. We can do merchant rate review for free. Call us now 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit cards, customers, data, electronic payment, merchant account, merchants, mobile, payment processing, point of sale, services provider, terminal, transactions

September 19th, 2016 by Elma Jane

Terminal or credit card machines are used for processing debit and credit card transactions. Therefore, are often integrated into a Point of Sale System.

Electronic Authorizations – merchants had the choice of calling in for an authorization or imprinting their transactions, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing transaction over the phone.

Manual Imprinters – are considered a great backup processing method. Although time consuming and did not offer the speed or instant transfer capabilities, this imprinters are still widely used.

Point of Sale Terminals: POS emerged in 1979, which was a turning point in the credit card processing industry. As a result,

Visa introduced a bulky electronic data capturing terminal. The first of credit card machine or terminal as we know them today. It has greatly reduced the time required to process a credit card.

In the same year, MasterCharge became MasterCard and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement.

Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Near Field Communication, Visa MasterCard American Express Tagged with: chip, contactless, credit card, debit, EMV, mobile, nfc, PIN, point of sale, Security, terminal, transactions, visa

September 16th, 2016 by Elma Jane

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following features below, that you need from your Electronic Payments provider.

Advanced Security Options – 6 out of 10 small businesses close within six months of a card data breach, it is important that Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. NTC offer Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. The Top-tier security is important on your business’s data especially customer information, consider adding additional authentication procedures.

Fast Payment Processing – first step is having up-to-date technology, because some customers might leave, the sooner you have the money processed by your provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – obtaining the features you need from your payment services provider is very important. Look for a provider that appropriately addresses your payment concerns.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. Furthermore, the app works with most Apple and Android mobile devices. Accept a key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad or the new RP457c card reader.

Reliable Customer Support – NTC is available 24/7, the phones are answered by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is the most important feature of any business partnership you make. At NTC we are very passionate about that.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a payment service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

September 9th, 2016 by Elma Jane

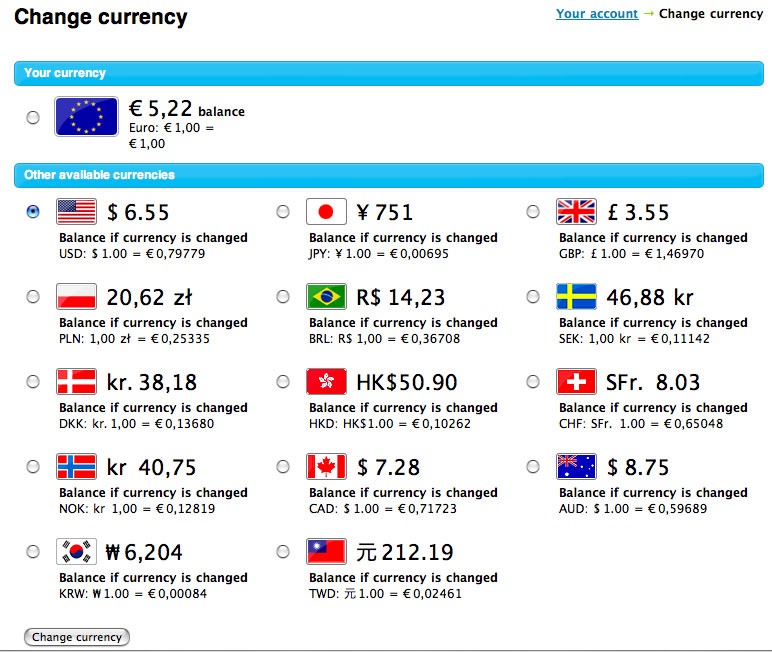

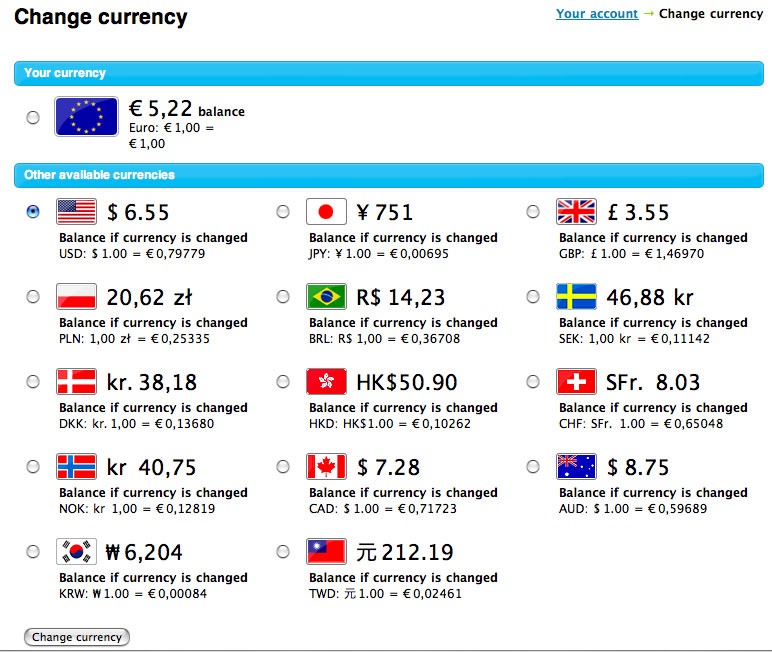

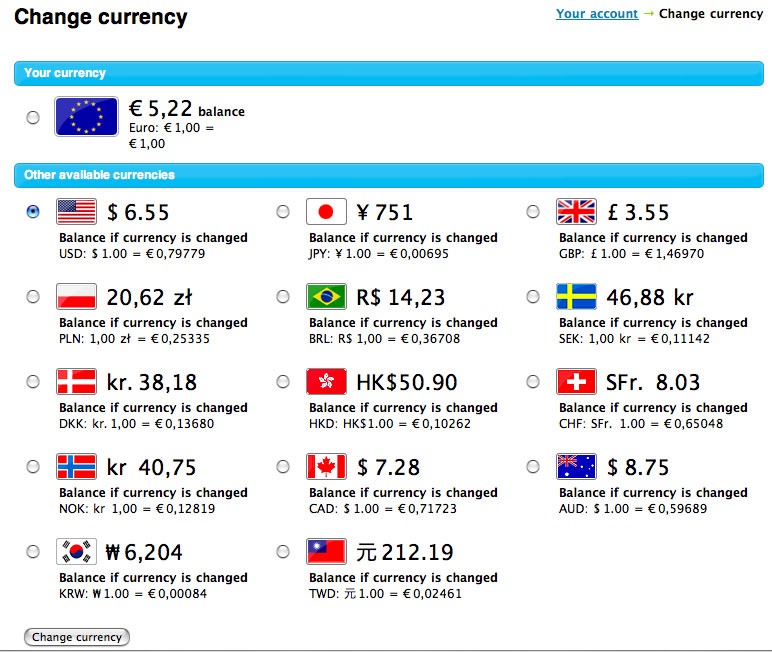

Multi Currency Conversion (MCC):

- In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

- Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

- Conversion occurs between the point of sale and settlement.

- E-commerce only and no merchant rebate.

- Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC):

- Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

- Conversion occurs at the point of sale and five supported currencies less than MCC.

- Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

- Price listed in merchant’s currency conversion.

- For Retail, Restaurant, MOTO and E-commerce.

- Supported by terminals, via Warp and Virtual Merchant.

For more information give us a call at 888-996-2273 or visit our website: www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order Tagged with: customer, e-commerce, merchant, moto, Multi Currency Conversion, point of sale, terminals, transactions, virtual merchant

August 11th, 2016 by Elma Jane

CURRENCY CONVERSION

Multi Currency Conversion (MCC):

In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

Conversion occurs between the point of sale and settlement.

E-commerce only and no merchant rebate.

Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC): Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

Conversion occurs at the point of sale and five supported currencies less than MCC.

Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

Price listed in merchant’s currency conversion.

For Retail, Restaurant, MOTO and E-commerce.

Supported by terminals, via Warp and Virtual Merchant.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Point of Sale Tagged with: currency, customer, DCC, Dynamic Currency Conversion, e-commerce, Internet Secure, MCC, merchant, moto, Multi Currency Conversion, point of sale, retail, terminals, transactions, virtual merchant

August 3rd, 2016 by Elma Jane

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions