August 2nd, 2016 by Elma Jane

Credit card machine or point of sale terminals are used for processing debit and credit card transactions and are often integrated into a Point of Sale System. Let’s take a look at the POS terminal evolution.

Manual Imprinters – although the process was time consuming and did not offer the speed or instant transfer capabilities, manual imprinters have been around since the start of a wide acceptance of credit cards. Manual imprinters are still widely used and are considered a great backup processing method.

Electronic Authorizations – Merchants had the choice of calling in for an authorization or imprinting their transactions. The first electronic credit card authorizations were done over the phone, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing a transaction over the phone,

Point of Sale Terminals: Point of sale terminals emerged in 1979, which was a turning point in the credit card processing industry. Visa introduced a bulky electronic data capturing terminal. This was the first of credit card machine or terminal as we know them today, it has greatly reduced the time required to process a credit card. MasterCharge became MasterCard in the same year and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement. Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: credit card, credit card machine, debit, electronic credit card, Electronic Data, EMV/chip, merchants, mobile, nfc, PIN, point of sale, POS, processing industry, terminals, transactions, visa

July 26th, 2016 by Elma Jane

Mobile payment space is growing yet, many small businesses and retailers are choosing to overlook the idea of mobile payment acceptance.

Here are stats that prove the importance of mobile payments:

About 45% of consumers use mobile payments out of convenience.

1 billion users will use in-store mobile payments by 2019.

An increase from $3.2 billion in 2014 to $487 billion by 2020 in US in-store mobile payments is predicted.

Millenials use contactless payments on a regular basis.

Over the next five years, mobile payments will reach about $3 trillion in volume.

There are 16 million Starbucks mobile app active users that make 8 million mobile payments per week.

Transactions globally are on mobile devices.

It is a great investment for a merchant to upgrade your point-of-sale (POS) to have near field communication (NFC) capabilities. If you’re not currently accepting mobile payments, you should start now, your customers who are already using mobile payments will thank you and your business will be ahead of the game as more businesses onboard mobile payment acceptance.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, Mobile Payments, Near Field Communication, Point of Sale Tagged with: contactless payments, customers, merchant, mobile payment, Near Field Communication, nfc, point of sale, POS, transactions

June 20th, 2016 by Elma Jane

Batch – is a collection of credit card transactions, usually a single day’s worth.

Batch Processing – refers to a one-time closing or settling the entire batch of transactions.

The point-of-sale terminal or credit card processing software can be set on:

Manual Batch close – merchant will need to batch out at the end of each day. The processor will receive a command to settle all transactions that have been entered. There will be a printed report showing the transaction totals in the batch once a batch is settled.

Changes can be made to existing transactions in the batch before a batch is settled. Example: If you want to change an amount of one of the transactions or you want to void a transaction.

Automatic Batch close – The terminal or software will automatically close the batch, (settle the transactions) at a certain time each day, no manual intervention is needed by the merchant or in some case the processor will settle the batch (called host batch close at the processor level). Automatic batch close set-up is advisable for most businesses unless a tip edit function is required, manual batch close would be the better option.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, point of sale, processor, terminal, transactions

June 16th, 2016 by Elma Jane

Merchants and cardholders have been challenged by the perceived additional time to complete the EMV transaction.

To address concern over EMV checkout time Visa and MasterCard create an alternate EMV payment process that will improve the speed of transaction:

Quick Chip from Visa is available free-of-charge to acquiring banks, payment networks, and other payment processors to offer to merchants. The enhancement requires only a simple software update to the merchant’s card terminal or point-of-sale system.

M/Chip Fast from MasterCard merchants can easily integrate this with their current systems to provide both speed and security for all chip cards. Designed for select environments where fast transaction times, in addition to security, are at a premium.

The new card network options do not require the financial institution to reissue cards, or the merchants to re-certify their point-of-sale terminals.

Alignment in the payments industry and the ability to process a secure transaction in a timely manner for the consumer experience is important.

Keeping current on the payment industry news like Quick Chip and M/Chip Fast or discussion about EMV developments is a smart move for merchants and cardholder as well.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa Tagged with: banks, card, card network, cardholders, chip cards, EMV, financial institution, merchants, payment, payment networks, payment processors, payments industry, point of sale, Security, terminal, transaction

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

June 2nd, 2016 by Elma Jane

Having the right tools to provide great service is important, this will make and keep your customers happy. An updated point-of-sale (POS) can help you improve customer satisfaction.

EMV – merchants are still behind in EMV acceptance. It may cost you to update but, it will save you money in the event of a fraudulent charge. EMV is here to stay, it is best to update your POS equipment now.

Insights – inventory management feature enables sales people to see available inventory. Tracking the products that sell the best and identifying products in high demand helps the owner stock strategically to better assist customers.

Loyalty Programs – an excellent way to keep current customers coming back.

Mobile Payments – Giving your customers more options on how to make payments by accepting mobile payments. Merchant gains the ability to speed up transaction times for customers.

Speed – customers want to check out at the store as quickly as possible. An updated point-of-sale solution will process transaction faster. A fast and easy system contribute to a better customer experience.

Need to upgrade your point-of-sale give us a call at 888-996-2273. NTC is here to help you.

Posted in Best Practices for Merchants Tagged with: customers, EMV, Loyalty Programs, merchants, Mobile Payments, payments, point of sale, POS, service, solution, transaction

May 25th, 2016 by Elma Jane

Gaining new customers? Gift cards are a great way for your business!

The gift card is your first opportunity to make an impression. Displaying your gift cards at your checkout counter in front of your point of sale terminal is a good idea, even if the customer doesn’t buy a gift card that day, they know that they have the option in the future.

Offering a special discount for purchasing a gift card such as 10% off the next purchase or a $5 certificate. This will bring your customer back.

Having a stock of customized gift cards is a great way to show that your cards are for every occasion. (Birthday, Anniversary, Get Well Soon and Congratulations cards)

Posted in Best Practices for Merchants, Gift & Loyalty Card Processing Tagged with: customer, gift Card, point of sale, terminal

April 15th, 2016 by Elma Jane

Dynamic Currency Conversion

- Five supported currencies

- Retail, Restaurant, MOTO, E-commerce

- Price listed in merchant’s currency

- Customer is aware of currency conversion

- Customer may opt-out at the point of sale

- Conversion occurs at the point of sale

- Merchants may choose settlement method & time

- Supported by terminals, viaWarp and Virtual Merchant

- Merchant rebate up to 100bp

Multi-Currency Conversion

- 100+ supported currencies

- E-commerce only

- Price listed in customer’s currency

- Customer is not aware of currency conversion

- Customer may not opt-out at the point of sale

- Conversion occurs between the point of sale and settlement

- All transactions auto settle at 6pm (eastern) daily

- Supported by Internet Secure or direct certification

- No merchant rebate

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Merchant Account Services News Articles, Travel Agency Agents Tagged with: currency, Currency Conversion, customer, e-commerce, merchants, moto, point of sale, terminals, virtual merchant

February 25th, 2016 by Elma Jane

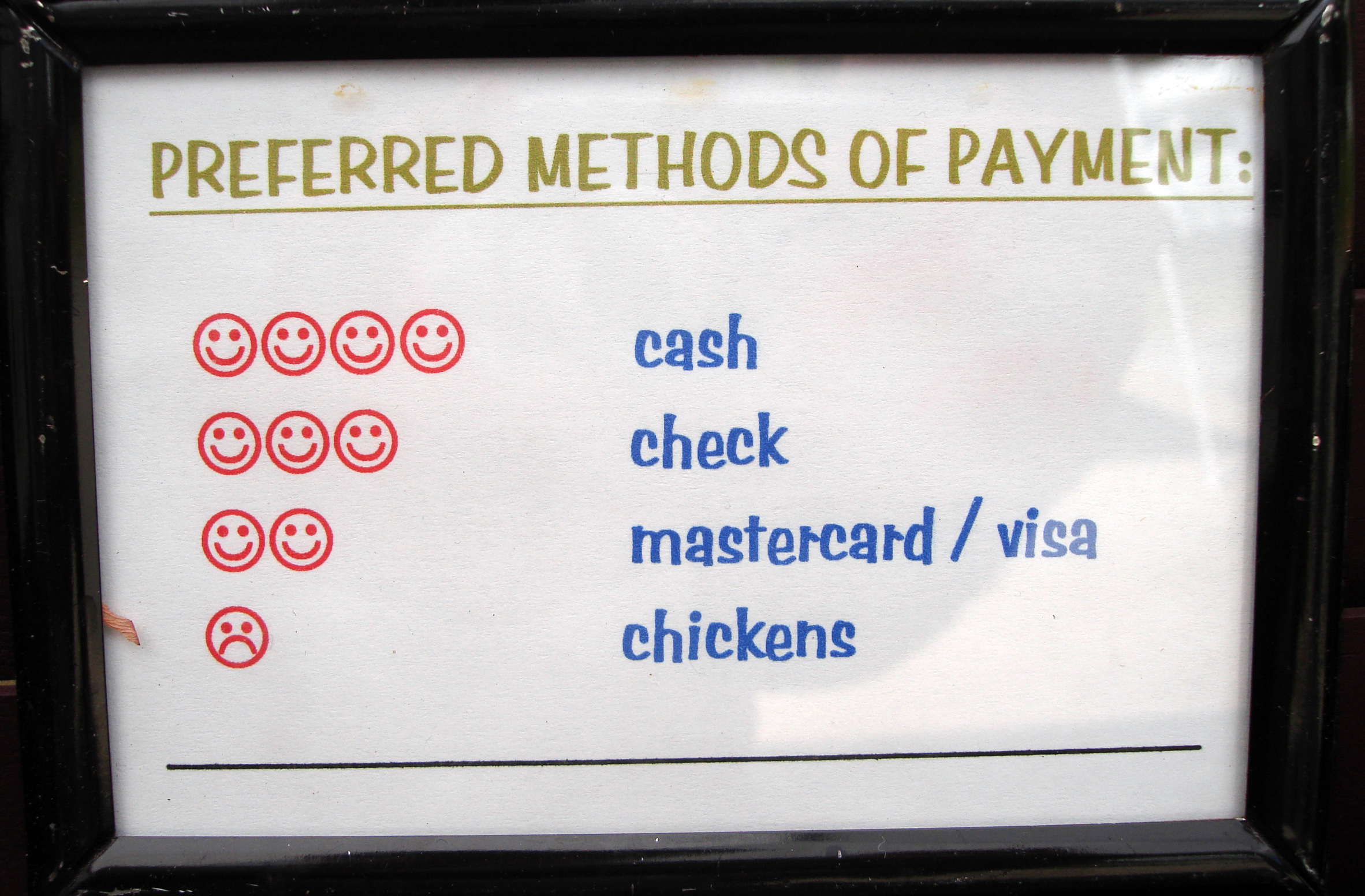

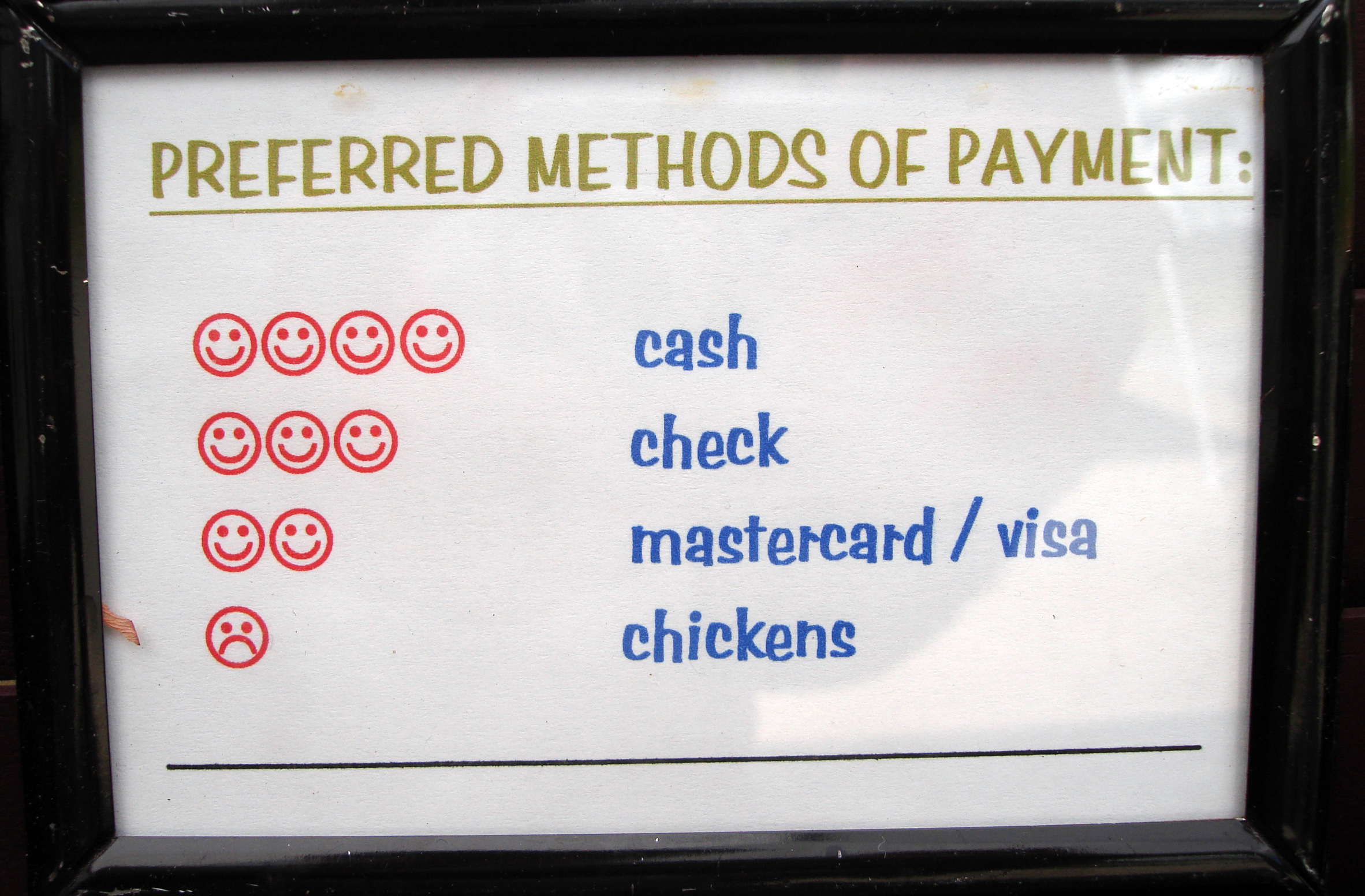

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 24th, 2016 by Elma Jane

Merchants can bring in new customers and encourage repeat business by using their point-of-sale terminal as a marketing tool. A point-of-sale terminal allows you to process payment and accept debit and credit cards, and generate more business by using the right tools.

Customize Receipts – a customized receipt becomes an advertisement. The customer knows where that receipt is from should they want to contact you.

Gift Cards Program – Gift card recipient are likely to spend over the face value of the card. Customers will appreciate simplified gift shopping.

Loyalty Program – Loyalty program makes customers think of your business first and encourages them to come back often to earn a reward.

Referral Rewards – Print an offer to reward referrals, so they can send people to you.

A merchant account is not just an expense by finding the right tool you can generate more income for your business!

visit www.nationaltransaction.com today, or call 888-996-2273 Extension 1

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Point of Sale Tagged with: credit cards, customers, debit, gift Card, loyalty program, merchant account, merchants, payment, point of sale, terminal