March 7th, 2017 by Elma Jane

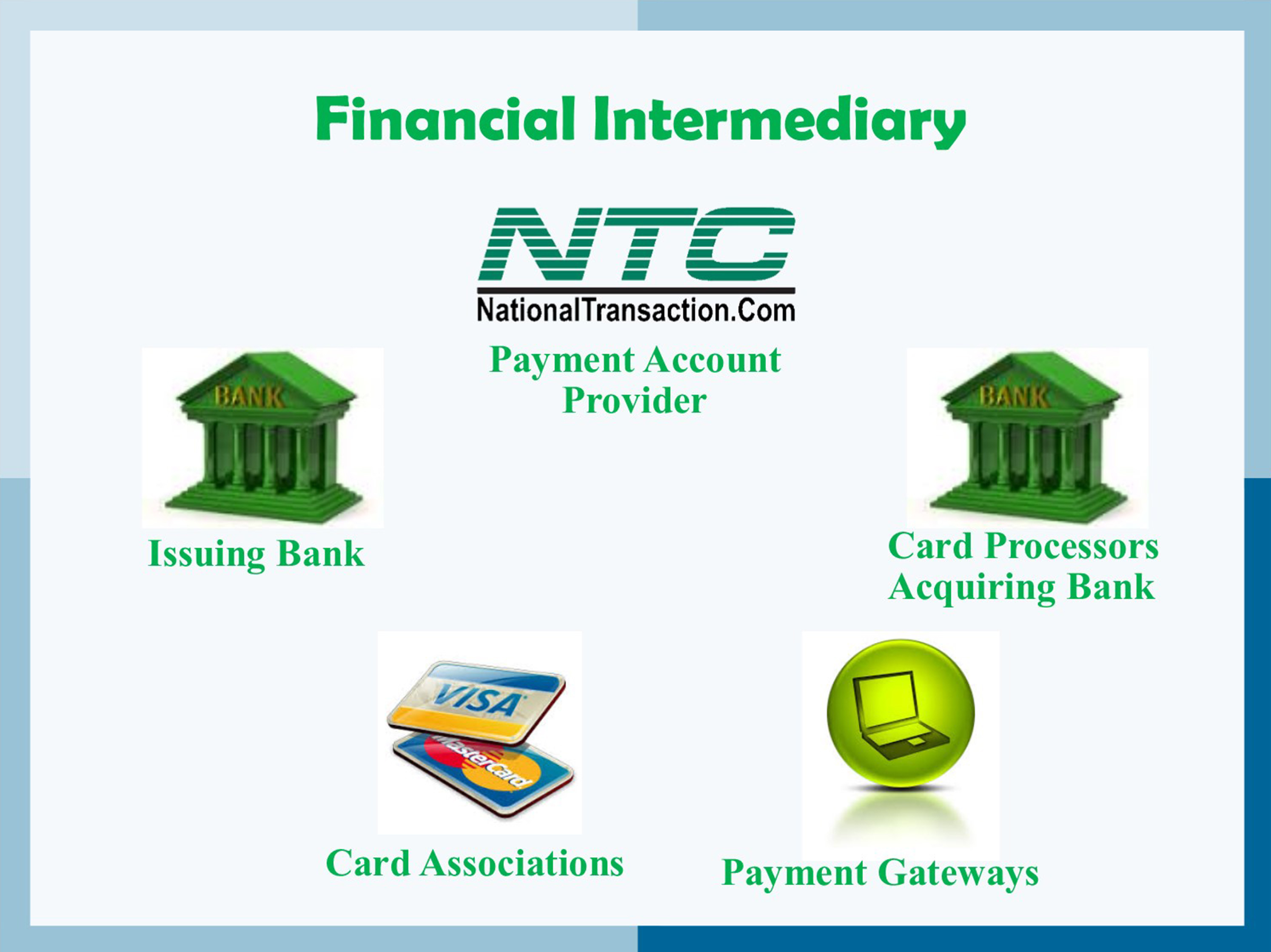

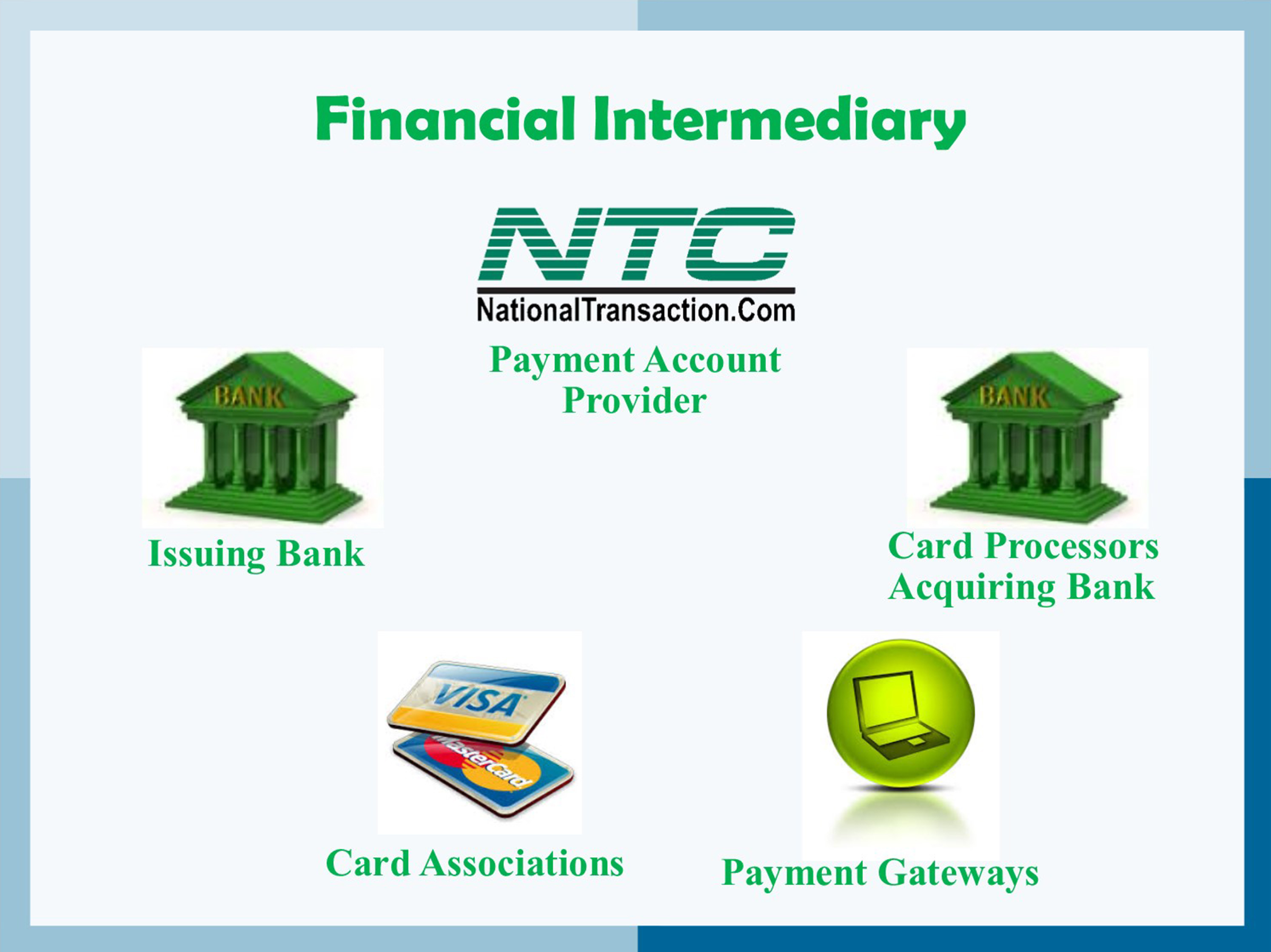

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

April 8th, 2016 by Elma Jane

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

February 4th, 2016 by Elma Jane

Companies providing electronic money services, such as online or mobile payments accounts, have more than doubled since 2013.

This number has been on the rise over the past few years as consumer confidence in alternative payments methods has increased.

UK consumers and businesses are increasingly comfortable with the idea of a cashless economy, in which they might not be able to physically see or access money. More are embracing pre-paid cards, contactless and mobile payment systems for ease of use, efficiency and enhanced security.

According to a specialist financial services regulatory consultancy, there has been a significant increase in the number of electronic money providers registered with the Financial Conduct Authority (FCA).

E money providers must be authorized with the FCA under the Electronic Money Regulations 2011 and meet stringent consumer protection criteria, including adequate capital, the separation of customer’s money from the company’s funds.

The regulatory background is complex and electronic money providers need to ensure that systems, processes and controls are tight to ensure a high level of consumer protection. The FCA is not afraid to place these businesses under a microscope.

Many are concerned that this increase in alternative payments methods will lead to the death of the traditional bank, but only if they fail to innovate and adapt to market trends and consumer needs.

Posted in Best Practices for Merchants Tagged with: bank, cards, consumers, contactless, customers, electronic money, financial services, Mobile Payments, online, payment systems, payments, payments methods, provider's, Security

January 19th, 2016 by Elma Jane

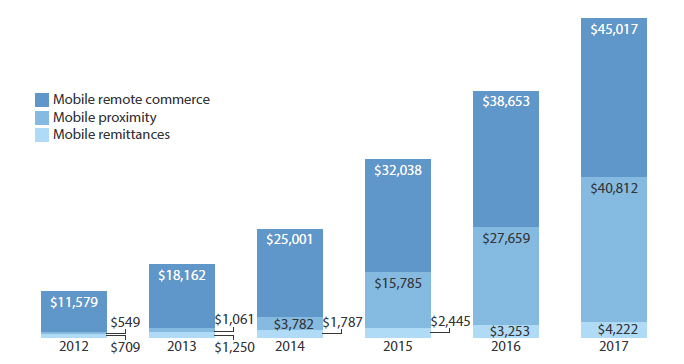

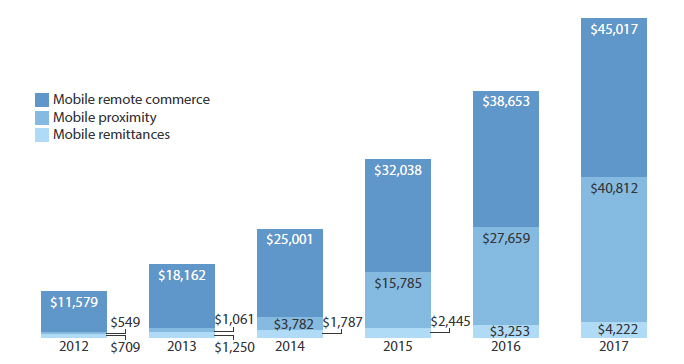

2015 was a major period of growth for the online and mobile payment industry. Close to 60 million Americans used mobile payments on a consistent basis, representing close to 18 percent of the population. However, around 52 percent of Americans are aware of mobile payments and how to use them.

Because of both the wide awareness and accessibility of mobile payments, analysts expect consistent mobile payment use to double this year. Millennials and high-income spenders tended to adopt the technology more quickly, at 23 percent and 38 percent consistent usage respectively.

Even more intriguing than the wide-spread use of mobile payments is how large the market grew. In 2015, $8.71 billion passed through online payment services providers. Even more intriguing is the prediction that this market will more than triple to $27.05 billion by the end of this year.

Posted in Best Practices for Merchants Tagged with: mobile payment, online, online payment, payment, payment industry, payment services, provider's, services providers

November 2nd, 2015 by Elma Jane

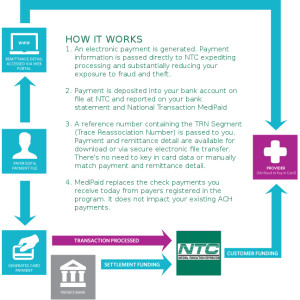

Delivering Paperless, Next-Day Deposits for Health Insurance Payments.

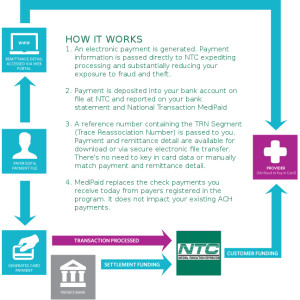

NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance payments. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: checking account, credit card, electronic payments, health insurance, healthcare provider's, medical insurance, MediPaid, merchant accounts, payments, provider's

July 23rd, 2015 by Elma Jane

The digital payments landscape is changing at a rapid pace. Consumers are finally adopting digital wallets, like Apple Pay and Android Pay.

The deadline for merchants to become EMV compliant, the global standard that covers the processing of credit and debit card payments using a card that contains a microprocessor chip, is quickly approaching.

Today’s consumers show an increasing desire to use new payment methods because they’re convenient. However, this presents a challenge to merchants, as many have not made the switch to the modern technology required to accept these methods since they’re generally hard-wired to resist technology changes.

Merchants must evolve with technology or they’ll find themselves unable to compete and in danger of losing customers.

Looking long term, the benefits of adopting new payment technology will outweigh the cost of transitioning. The fact is that new payment technology will reduce fraud risk due to counterfeit cards, provide greater insight into shoppers with sophisticated data and will ultimately lower costs for merchants over time.

The value merchants will get out of new payment methods:

Security

Investing in new payment technology will help reduce the risk of fraud. EMV, as an example. Beginning in October 2015, merchants and the financial institutions that have made investments in EMV will be protected from financial fraud liability for card-present fraud losses for both counterfeit, lost, stolen and non-receipt fraud.

EMV is already a standard in Europe, where fraud is on the decline. In turn, American credit card issuers are being pressured to replace easily hacked magnetic strips on cards with more secure “chip-and-PIN” technology. Europe has been using Chip, and Chip & Pin for years.

There’s nothing that can guarantee 100 percent security, but when EMV is coupled with other payment innovations, like tokenization that separate the customer’s identity from the payment, much of the cost and risk of identity theft is eliminated. If hackers get access to the token, all they get is information from one transaction. They don’t have access to credit card numbers or banking accounts, so the damage that can be done is minimal.

As card fraud rises, there’s a strong case to upgrade to a payment system that works with a smartphone or tablet and accepts both EMV chip cards and tokens.

Insight into Customer Behavior

In addition to added security, upgrading to new payment technology opens up a door to greater customer insights, improved consumer engagement and enables merchants to grow revenue by providing customers with receipts, rewards, points and coupons. By collecting marketing data at the point of sale a business can save on that data that they only dreamed of buying.

Investment Outweighs the Cost

New technology does have upfront costs, but merchants need to think about it as an investment that will grow top-line revenue. Beware of providers offering free hardware. Business can benefit by doing some research on the actual cost of the hardware.

By increasing security, merchants are further enabling mobile and emerging technologies, which will make shopping easier.

Customers will also be more confident in using their cards.

As an added bonus to merchants, most EMV-enabled POS equipment will include contactless technology, allowing merchants to accept contactless and mobile payments. This will result in a quicker check-out experience so merchants can handle more transactions.

Faster customer checkout.

The best system for is the one that makes the merchant as efficient and profitable as possible, as well as improves the customer checkout experience.

Retail climate is competitive, merchants have two choices:

Do nothing or embrace the fact that payments are changing. Transitions from old systems to new ones require work and risk, but merchants who use modern technology are investing in the future and will certainly outperform those who choose to do nothing.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: American credit card, card, card present, chip, Chip and PIN, contactless technology, credit, data, debit card, digital payments, Digital wallets, EMV, EMV compliant, EMV EuroPay MasterCard Visa, merchants, Mobile Payments, payment innovations, payment methods, payment technology, payments, point of sale, POS, provider's, smartphone, tablet, token, tokenization, transaction

January 15th, 2015 by Elma Jane

The fact that your business needs a mobile presence is by no means news. Brands today know that being accessible to the increasing number of smartphones and tablet users is a must NOW, the goal is to provide a top-notch user experience.

Mobile is opening the door for designing new experiences that complement a brand’s physical presence. The context of WHEN, WHERE and WHAT a customer is doing during their day allows companies to enhance a person’s interaction and customize device-specific experiences.

Brands will need to meet the following mobile experience expectations in 2015:

Combating fraud through mobile. Mobile users want to safeguard themselves against fraud, and 56 percent are willing to deal with a slightly more complex user experience if it means greater protection. Businesses can provide an intuitive, high-quality mobile experience that also protects against fraud by offering to validate transactions, set fraud controls and generate unique payment IDs through the user’s mobile device.

Complement, not copy: E-commerce providers must leverage mobile to complement the user experience, rather than provide a replica of what users get through a Web browser. Nearly 4 in 10 mobile users are most likely to use their mobile phone for shopping, so businesses need to ensure that those customers are getting something unique from their mobile interaction.

CRM through mobile marketing: Mobile marketing isn’t just for acquisition anymore. Today, it’s about boosting loyalty by using mobile for customer, consumers always have their mobile device on them and check it more than 150 times a day. Businesses can communicate with their existing customers through alert notifications, in-app, email and mobile Web. But don’t overdo it. The key to maintaining an effective relationship is doing so in a complementary way, giving users what they need when they need it.

Mobile apps and mobile Web: Got a mobile app but not a mobile-friendly website, or vice versa? You might want to put your energy into leveling out your mobile presence. Consumers are about equally split when it comes to their preference of app versus browser: The percentage of users who prefer their mobile browser when completing a task 28 percent is only slightly higher than the 23 percent that prefer to use an app. Both app and Web designs are critical for businesses in the mobile space, so it pays to do them right.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: consumers, crm, customers, e-commerce, mobile, mobile device, payment, provider's, Smartphones, transactions

September 12th, 2014 by Elma Jane

If you needed a loan, would you shop around first or go with the first lender you found? Small business owners are more likely to do the latter. For small business owners, personal interaction is key, and with many lenders focusing strictly on online marketing methods to reach new customers, these findings may come as a surprise.

While there is a plethora of alternative online lending options for small businesses, 44% of all loan applications are completed in person, even though business owners of all ages surveyed reported using an online process for researching and initiating a loan application, only younger business owners were very open to using it to complete the process.

User-friendly websites do help aid in conversion, but they don’t influence lender choice. Small business owners are more likely to use the first lender they meet, proof that even in an age of technology and advancements in online lending, human interaction is still one of the most important parts of the loan process, this may be due to the challenges small businesses face during the loan process as restrictions have increased on traditional loans.

First thing business owner do is ask rate…When it is more important to get the terms you want. If a lender term wants a higher rate, but let you pay it off on a longer term you may find more is less!

Despite great interest in strictly online alternative lending, many business owners still desire personal interactions with financial providers that will take the time to discuss business challenges and solutions. National Transaction standout over competitors because of its human/personal interactions.

Posted in Small Business Improvement Tagged with: business, competitors, customers, financial providers, lending options, loan, loan applications, marketing methods, National Transaction, provider's, rate, solutions, traditional loans, websites

September 5th, 2014 by Elma Jane

Businesses are rapidly adopting a third-party operations model that can put payment data at risk. Today, the PCI Security Standards Council, an open global forum for the development of payment card security standards, published guidance to help organizations and their business partners reduce this risk by better understanding their respective roles in securing card data. Developed by a PCI Special Interest Group (SIG) including merchants, banks and third-party service providers, the information supplement provides recommendations for meeting PCI Data Security Standard (PCI DSS) requirement 12.8 to ensure payment data and systems entrusted to third parties are maintained in a secure and compliant manner.

Breach reports continue to highlight security vulnerabilities introduced by third parties as a leading cause of data compromise. The leading mistake organizations make when entrusting sensitive and confidential consumer information to third-party vendors is not applying the same level of rigor to information security in vendor networks as they do in their own. Per PCI DSS Requirement 12.8, if a merchant or entity shares cardholder data with a third- party service provider, certain requirements apply to ensure continued protection of this data will be enforced by such providers. The Third-Party Security Assurance Information Supplement focuses on helping organizations and their business partners achieve this by implementing a robust third-party assurance program.

Produced with the expertise and real-world experience of more than 160 organizations involved in the Special Interest Group, the guidance includes practical recommendations on how to:

Conduct due diligence and risk assessment when engaging third party service providers to help organizations understand the services provided and how PCI DSS requirements will be met for those services.

Develop appropriate agreements, policies and procedures with third-party service providers that include considerations for the most common issues that arise in this type of relationship.

Implement a consistent process for engaging third-parties that includes setting expectations, establishing a communication plan, and mapping third-party services and responsibilities to applicable PCI DSS requirements.

Implement an ongoing process for maintaining and managing third-party relationships throughout the lifetime of the engagement, including the development of a robust monitoring program.

The guidance includes high-level suggestions and discussion points for clarifying how responsibilities for PCI DSS requirements may be shared between an entity and its third-party service provider, as well as a sample PCI DSS responsibility matrix that can assist in determining who will be responsible for each specific control area.

PCI Special Interest Groups are PCI community-selected and developed initiatives that provide additional guidance and clarifications or improvements to the PCI Standards and supporting programs. As part of its initial proposal, the group also made specific recommendations that were incorporated into PCI DSS requirements 12.8 and 12.9 in version 3.0 of the standard.One of the big focus areas in PCI DSS 3.0 is security as a shared responsibility. This guidance is an excellent companion document to the standard in helping merchants and their business partners work together to protect consumers’ valuable payment information.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: banks, Breach, card, card data, cardholder, consumer, data, data security, Merchant's, networks, payment, payment card security, payment data, payment information, PCI, PCI-DSS, provider's, Security, Security Assurance, security standards, security standards council, Service providers, services

September 4th, 2014 by Elma Jane

The move to mobile point of sale (mobile POS) is radically changing the face of customer interactions and payments, as both customers and merchants grow increasingly comfortable with the concept of mobile payments. In the current, crowded marketplace most mobile payment solutions are not compatible with each other. Instead of unifying the payment experience they create islands separated by technology or usage that are tailored to individual providers in the market. Multiple devices are currently needed in-store to process different payment types and the challenge is how they can make payments unified in such a way that only one device is needed in store.

The use of cash by customers also adds a level of complication to the mobile POS story. The removal of IDM terminals, removal of customer queues and ability for customers to simply walk up and pay an assistant or to leave a store and have their bank card automatically debited certainly suits the expectations of customers today, however a large number of customers still use traditional cash methods to pay for goods and services. A number of stores that have gone down the route of implementing mobile POS now have a problem dealing with cash because the wandering shop assistants and personal shoppers can only accept card or web-based payment options. The future for mobile POS has potential to be bright, a dominant player will have to emerge in the market. This will break down the technology barriers and usage barriers between different players. The success to mobile POS lies in the payment process being truly unified with one device in one place and very seamless workflow. This will be very complicated thing to achieve, there have been a lot of attempts and a lot of false starts in the history of mobile POS. MPOS will be the future. Five years from now people will be amazed that they did transactions with landlines. NO child will ever see a telephone with a cord attached. Never a popcorn on top of the stove since we developed microwave ovens. Technology changes, and we are slow to adopt new stuff. Once we change we don’t know how we did without it.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: bank, card, cash, customer, devices, IDM terminals, Merchant's, mobile, mobile point of sale, MPOS, payment solutions, payment types, payments, point of sale, POS, provider's, services, technology, terminals, web-based payment