September 14th, 2017 by Elma Jane

Payments standards body EMVCo has updated its Payment Tokenisation Technical Framework to introduce the new roles of token programme and token user, refine the roles of token service provider and token requestor and detail their interrelationships within the global payments environment.

EMV Payment Tokenisation Specification — also includes expanded ecommerce use cases and operational management enhancements to support global interoperability and facilitate transaction security.

This latest version offers significant updates and use cases that reflect payment industry input to define how EMV payment tokens are generated, deployed and managed. The level of detail assists in establishing a stable payment environment and delivering a common set of tools to facilitate transaction security.

The technical framework needs to capture these industry requirements and be flexible enough to interoperate with the existing payment ecosystem while supporting ecommerce, new payment methods and regional variations.

EMVCo is calling on the payments community to get involved and provide feedback.

EMVCo was formed by Europay International, MasterCard International, and Visa International to manage, maintain and enhance the EMV specifications for payment systems.

Posted in Best Practices for Merchants Tagged with: ecommerce, EMV, payments, Security, service provider, token, Tokenisation

August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

July 26th, 2017 by Elma Jane

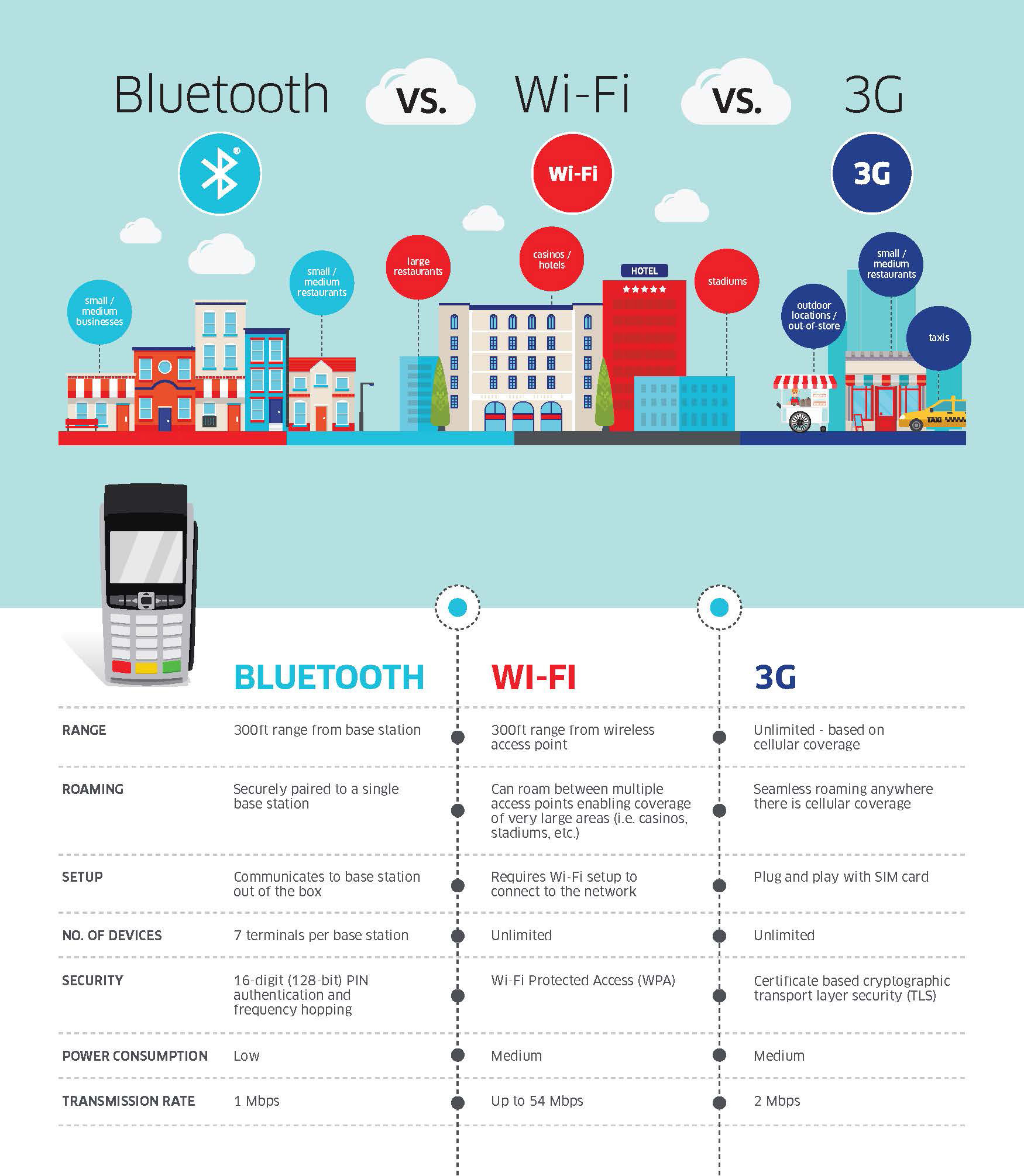

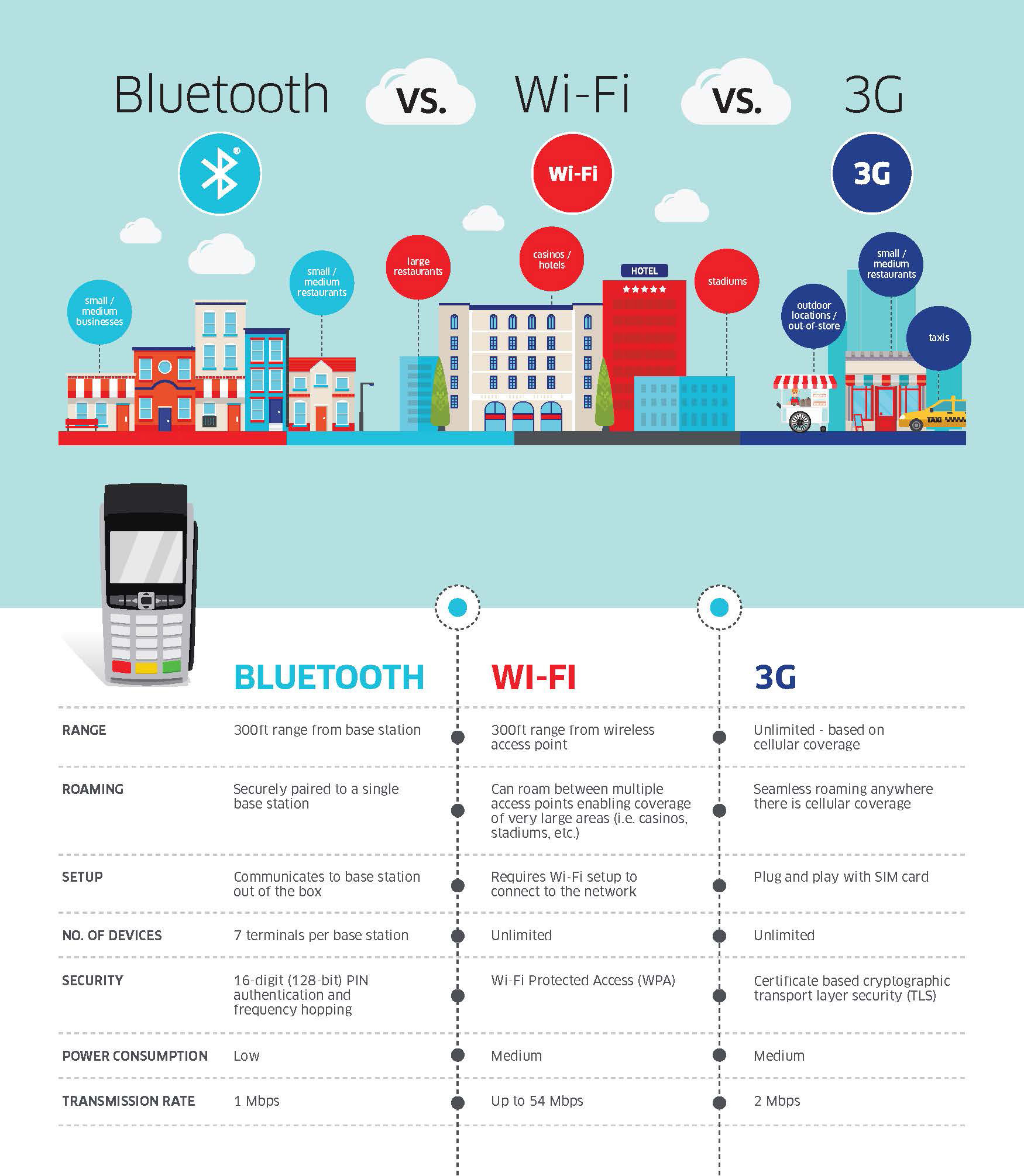

Check out the wide range of smart wireless terminal connectivity options and know the difference.

Bluetooth Wireless: Designed for reliable Bluetooth connectivity even in the most demanding environments.

Rage – 300ft from base station

Roaming – paired to single base station

Setup – Communicates to base station out of the box

No. Of Devices – 7 Terminals per base station

Security – 16-Digit (128-Bit) PIN authentication and frequency hopping

Accept EMV Chip & PIN, magstripe and NFC/Contactless

WiFi: Designed for reliable WiFi connectivity, Wireless mobility for the point of sale.

Rage – 300ft from base station

Roaming – can roam between multiple access points enabling coverage of very large areas.

Setup – Requires WiFi Setup to connect to the network

No. Of Devices – Unlimited

Security – WiFi Protected Access (WPA)

Accept EMV Chip & PIN, magstripe and NFC/Contactless

3G Wireless: Bring compact, reliable 3G Wireless Technology and mobility to the point of sale.

Rage – unlimited – based on cellular coverage

Roaming – Seamless roaming anywhere there is cellular coverage

Setup – Plug and play with SIM card

No. Of Devices – Unlimited

Security – Certificate based cryptographic transport layer security

Accept EMV Chip & PIN, magstripe and NFC/Contactless

Wireless terminals provide merchants with a number of benefits including:

Mobility – enable merchants to better serve the customer and bring the transaction right to the point of service.

Printed Receipt – give your servers the capability to print a receipt for the customer even when away from the POS.

Variety of Payment Options – provide the ability to accept magstripe, EMV, and NFC payments including the latest mobile wallets.

For Electronic Payment Set Up Call Now 888-996-2273

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: bluetooth, chip, Contacless, EMV, magstripe, nfc, PIN, Security

July 12th, 2017 by Elma Jane

NTC Gives™ is an Electronic Payment Organization that allows congregations to accept payments on multiple platforms and supports non-profit organizations in our communities utilizing the award-winning customer service and industry leading technology of National Transaction Corporation™.

Keep Giving – allows recurring donations regardless of your worshipers attendance.

Mobile Giving – accept donations on a multitude of devices.

Secure Donations – Offload your protection mechanism to the banks payment gateway to ensure security breach while protecting your members.

For church congregations, start accepting donations online as well as recurring donations. Call now 888-996-2273 or go to NTC GIVES.Com

Posted in Best Practices for Merchants Tagged with: banks, electronic payment, gateway, Security

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Hotel, Motel and Bed & Breakfast customers will benefit from this smart terminal:

- Smaller, independent motels or hotels

- Hotels without property management systems

- Existing hospitality customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

June 27th, 2017 by Elma Jane

E-commerce has been growing, and now the overall market is starting to take notice; thanks to advances in online payment processing and electronic payment technology, as well as the willingness of almost all merchants to accept credit cards online.

E-commerce ecosystem are set to double and will account for a rising share of overall card payments. In addition to increased internet and smartphone penetration; more e-commerce merchants and an increase in the use of digital wallets.

Cardholders globally are becoming more confident in the security of the e-commerce channel, with the expected implementation of 3D-Secure 2.0 and increased use of sophisticated anti-fraud systems in many markets it gives consumer assurance that payment cards are safe to use for e-commerce purchases.

Trends indicate that e-commerce is the wave of the future for shoppers. But digital shopping is just one piece of the broader payments ecosystem.

For Electronic Payment Set Up Call Now! 888-996-2273

Let’s Get Started National Transaction.Com

Posted in Best Practices for Merchants Tagged with: card payments, credit cards, Digital wallets, e-commerce, electronic payment, merchants, online, payment, Security, smartphone

May 11th, 2017 by Elma Jane

Three Domain Secure (3-D Secure)

Visa is announcing a global plan to support 3-D Secure 2.0 to help protect e-commerce transactions.

3-D Secure (3DS) – stands for Three-Domain Secure. A messaging protocol to enable consumers to authenticate themselves with their card issuer when making card-not-present (CNP) e-commerce purchases. 3DS is an additional security layer that will help prevent unauthorized CNP transactions and protects the merchant from CNP exposure to fraud.

The three domains consist of:

The merchant/acquirer domain

Issuer domain

the interoperability domain (payment systems)

The purpose of the 3DS protocol within the payments community is to facilitate the exchange of data between the merchant, cardholder and card issuer. The objective is to benefit each of these parties by providing the ability to authenticate cardholders during a CNP e-commerce purchase, reducing fraud.

Visa currently offers its 3-D Secure service through the Verified by Visa program, which supports the existing 3-D Secure 1.0 specifications for consumer authentication.

Visa anticipates that early adoption of 3-D Secure 2.0 will begin in the second half of 2017.

Merchants that authenticate transactions using 3-D Secure are generally protected from issuer card-not-present fraud-related chargeback claims,1 and this rule will extend to merchant-attempted 3-D Secure 2.0 transactions after 12 April 2019, the global program activation date.

For Electronic Payment Set Up go to NationalTransaction.Com or call now 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card, card-not-present, cnp, data, e-commerce, electronic payment, merchant, payment, Security, transactions

May 8th, 2017 by Elma Jane

Tips for preventing funding delays!

If you’re running an unusual transaction and know of it beforehand, let your merchant provider know; sending an invoice in advance can cut processing time.

Make sure to give your most up to date information. Keeping provider in the loop on the fluctuations in your processing volumes will help tremendously, especially as your business grows.

Funding delays are an inconvenience, but being prepared can keep the delay to a minimum. If you keep these tips in mind, you’ll be processing without ever having to worry about delays again.

Flagged, Security and Review Process

Why some merchant accounts hold funds and others do not?

There are a number of reasons:

Underwriting merchant account is ongoing. Imagine a small business convenience store was set up and accidentally enters $1,000.000 should we transfer that or hold it?

One reason is something has gone with that particular business account.

Another reason could be that particular institution’s practices are more efficient than others.

Financial institutions use different payment processing systems, and they are not uniform in their practices. For this reason, some transactions are significantly faster than others.

Though there are other reasons funds get held, the main reason for this occurrence is when a payment is out of the ordinary patterns.

Unusual transactions are any transaction that vary from your typical processing patterns.

If It’s for security, an account will be flag as a way to reduce fraud as well as ensuring no one is using your account.

How do I know if I’m flagged?

Security checks are carried out by processing banks or processor. You’ll be contacted by a loss prevention officer. They’ll provide all details of the hold, including the review process as well as the next steps.

What’s the review process?

The review is simply to verify your transaction before delivering your funds. A typical review is confirming the transaction with yourself as well as your customer’s credit card company. You’ll speak briefly with a loss prevention officer to discuss the transaction. If further review is required, the loss prevention officer may ask you for a copy of the transaction’s invoice.

How can I speed up the process?

For an easy review, make sure to provide detailed documents. When an invoice is asked for, make sure it clearly shows the following:

- Product Description of Items Sold

- Your Customer’s Name

- Address

- Phone Number

For Electronic Payment set up call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: credit card, electronic payment, funds, merchant provider, processor, Security, transaction

March 13th, 2017 by Elma Jane

SECURITY PROTECTION

Make smart decisions when it comes to protecting your business with five layers of protection.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: Security

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization