October 11th, 2016 by Elma Jane

Cybersecurity via Converge:

Converge uses a multi-layered approach to security which helps keep cardholder data safe throughout the entire payment process; from beginning to end.

- EMV: All new Ingenico PIN pads and readers – iCMP and RP457c used with Converge Mobile offer EMV to help protect against counterfeit card use. The PIN pads go a step further in helping protect against lost; stolen and NRI (never received/issued) when a PIN-preferred card is accepted with PIN entry.

- Encryption: All new Ingenico devices also include encryption as a standard security component in addition to protect card data in transit.

- Tokenization: An enhanced security feature that is particularly valuable in card-not-present (CNP) environments when cards are stored on file for processing at a later time, or either for recurring/installment payments.

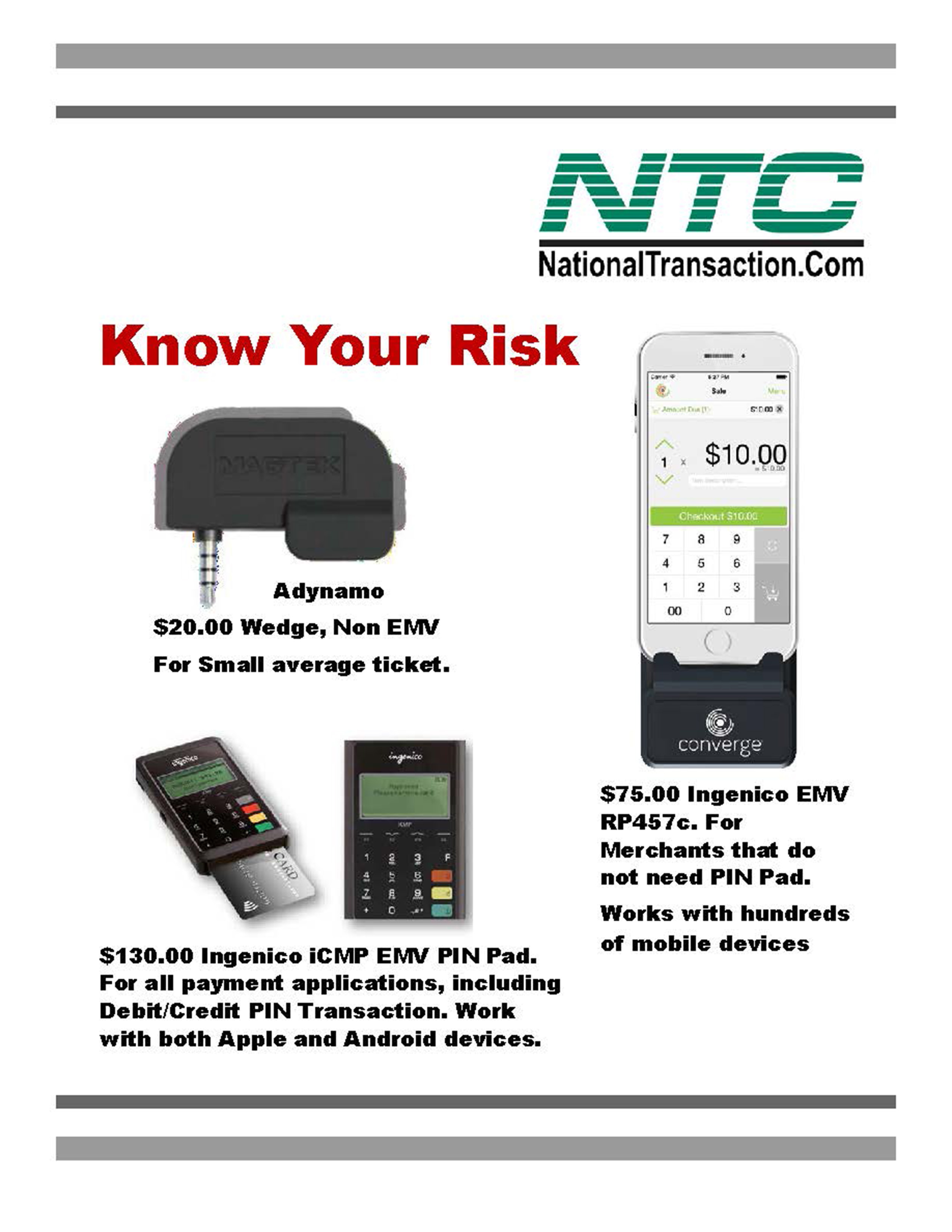

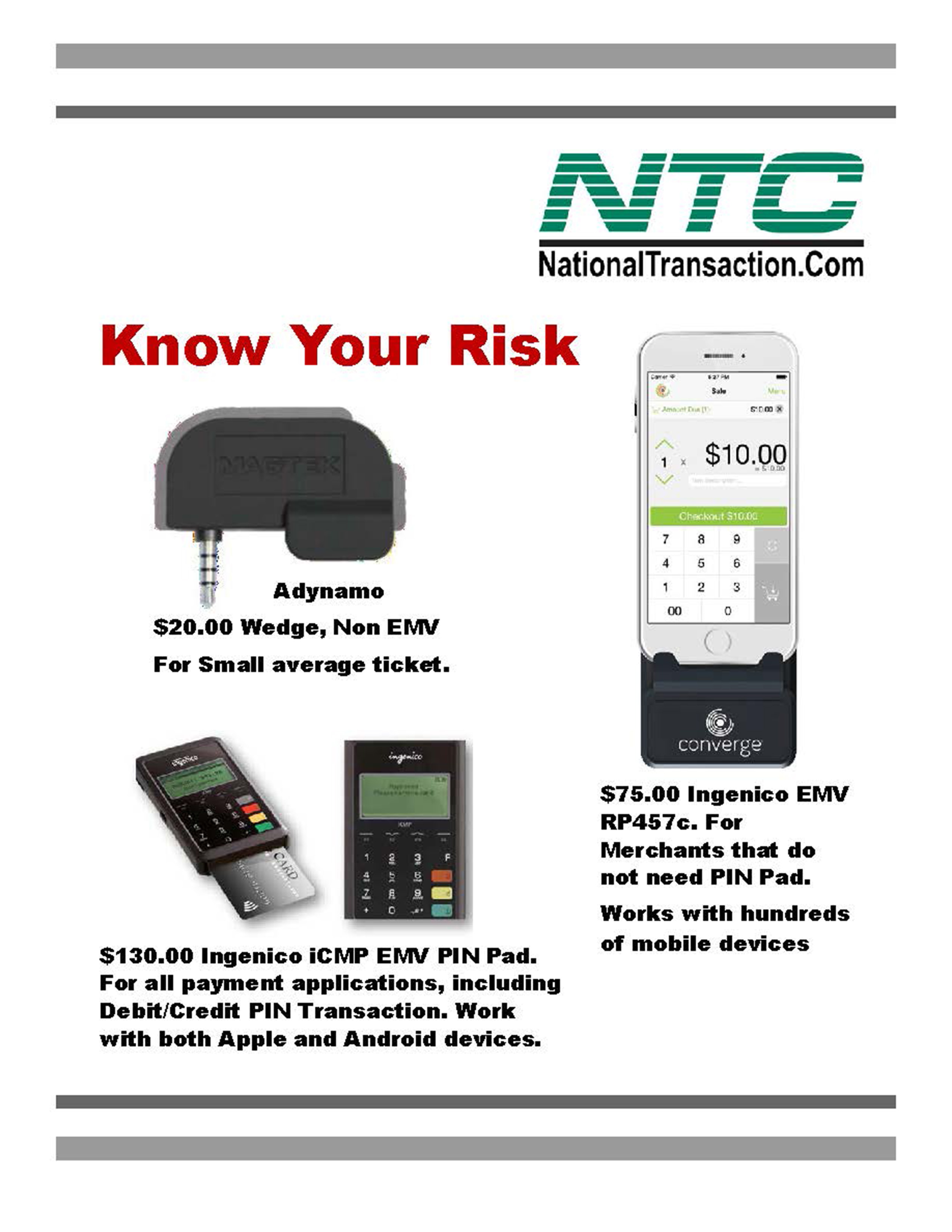

Get the Ingenico iCMP EMV PIN Pad for only $130.00.

For all payment applications, either Debit or Credit PIN Transaction. Work with both Apple and Android Devices.

Ingenico EMV RP457c card reader for only $75.00.

For Merchants that do not need PIN Pad. Works with hundreds of mobile devices.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Smartphone Tagged with: card, card-not-present, cardholder, data, EMV, mobile, payment, PIN pads, Security, tokenization

September 19th, 2016 by Elma Jane

Terminal or credit card machines are used for processing debit and credit card transactions. Therefore, are often integrated into a Point of Sale System.

Electronic Authorizations – merchants had the choice of calling in for an authorization or imprinting their transactions, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing transaction over the phone.

Manual Imprinters – are considered a great backup processing method. Although time consuming and did not offer the speed or instant transfer capabilities, this imprinters are still widely used.

Point of Sale Terminals: POS emerged in 1979, which was a turning point in the credit card processing industry. As a result,

Visa introduced a bulky electronic data capturing terminal. The first of credit card machine or terminal as we know them today. It has greatly reduced the time required to process a credit card.

In the same year, MasterCharge became MasterCard and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement.

Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Near Field Communication, Visa MasterCard American Express Tagged with: chip, contactless, credit card, debit, EMV, mobile, nfc, PIN, point of sale, Security, terminal, transactions, visa

September 16th, 2016 by Elma Jane

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following features below, that you need from your Electronic Payments provider.

Advanced Security Options – 6 out of 10 small businesses close within six months of a card data breach, it is important that Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. NTC offer Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. The Top-tier security is important on your business’s data especially customer information, consider adding additional authentication procedures.

Fast Payment Processing – first step is having up-to-date technology, because some customers might leave, the sooner you have the money processed by your provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – obtaining the features you need from your payment services provider is very important. Look for a provider that appropriately addresses your payment concerns.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. Furthermore, the app works with most Apple and Android mobile devices. Accept a key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad or the new RP457c card reader.

Reliable Customer Support – NTC is available 24/7, the phones are answered by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is the most important feature of any business partnership you make. At NTC we are very passionate about that.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a payment service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

September 12th, 2016 by Elma Jane

Ingenico RP457c card reader is now available at NTC for $75.00 plus encryption and shipping!

NTC are pleased to announced the launch of Converge Mobile 1.3, which includes support for the new Ingenico RP457c.

An all-in-one card reader that accepts:

- Mag stripe

- chip card

- contactless payments including mobile wallets

Customers can utilize audio jack to connect the device to their either smartphone, tablet or connect via Bluetooth.

In addition to the converge Mobile portfolio, Ingenico RP457c is a lower price point for customers who are cost sensitive. It offers the same payment flexibility as the iCMP.

Both RP457c’s and iCMP devices also offer encryption technology, adding another layer of security to help protect card data at the point of entry and throughout the payment lifecycle.

One key difference is that iCMP is a PIN pad that supports chip & PIN as well as debit PIN transactions, while the PR457c is a card reader only; therefore chip and signature and signature debit are supported on this device.

For your electronic payment needs or to purchase the device give us a call now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card data, card reader, Chip & PIN, chip and signature, contactless payments, customers, mobile wallets, payment, PIN pad, Security, signature debit, smartphone, transactions

August 3rd, 2016 by Elma Jane

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions

July 21st, 2016 by Elma Jane

Always ask for the card security codes:

CVV2 for Visa

CVC2 for MasterCard

CID for Discover and American Express.

Always use the Address Verification Service (AVS) and only process sales after receiving a positive AVS response.

Avoid using voice authorizations, unless absolutely necessary.

Billing descriptor must set up properly and shows your phone number. Customer can contact you directly if there is an issue,

Consider using the associations’ 3-D secure services:

Verified By Visa

SecureCode by MasterCard

A 3-D transaction confirmation proves card ownership and protects you from certain types of chargeback. An additional layer of security for online credit and debit card transactions.

Inform your customers by email when a refund has been issued or a membership service cancelled. Notify them of the date the refund was processed and provide a reference number.

Make available customer support phone number and email address on your website so that customers can contact you directly. You need to meet this requirement before opening a merchant account.

Make it easy for your customers to discontinue a recurring plan, membership or subscription. Have a no-questions-asked policy.

Notify your customers by email of each transaction and indicate that their cards will be charged.

Obtain a confirmation of delivery for each shipment.

Process refunds as quickly as possible.

Secure an authorization approval for every transaction.

Secure customers’ written or electronic signatures, for recurring payments or monthly fees. Giving you express permission to charge their cards on a regular basis.

Terms and conditions must be clearly stated on your website. Customers must acknowledge acceptance by clicking on an Agree or a similar affirmative button.

Transaction amount must never exceed the authorized amount.

You are required to reauthorize the transaction before settling it if an authorization approval is more than seven days old.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Merchant Services Account Tagged with: card, chargeback, credit, customer, debit, merchant, merchant account, online, sales, Security, service, transaction

June 28th, 2016 by Elma Jane

Financial Cost – on average, it costs a small business between $36,0000 and $50,000 in the event of a data breach. From PCI examination to liability costs and POS upgrades. The many costs of a data breach add up.

Notification Cost – if your business falls victim to a data breach, it is your moral and sometimes legal (depending on the state in which your business operates) obligation to notify your customers of the breach.

Reputation Cost – data breach lessens your credibility and trust with your customers. This can have a long-term affect on your business.

Time Cost – as a small business owner, your focus is on the daily operations of your business. In the event of a data breach, your focus will be shifted entirely to clearing up the issue.

The cost of a data breach is more than financial and can often have a lasting negative impact on your business.

The quickest and easiest way to protect your business is to prevent fraud from happening. At National Transaction, we give importance to your security. For your electronic payments needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: customers, data breach, electronic payments, financial, fraud, PCI, POS, Security

June 16th, 2016 by Elma Jane

Merchants and cardholders have been challenged by the perceived additional time to complete the EMV transaction.

To address concern over EMV checkout time Visa and MasterCard create an alternate EMV payment process that will improve the speed of transaction:

Quick Chip from Visa is available free-of-charge to acquiring banks, payment networks, and other payment processors to offer to merchants. The enhancement requires only a simple software update to the merchant’s card terminal or point-of-sale system.

M/Chip Fast from MasterCard merchants can easily integrate this with their current systems to provide both speed and security for all chip cards. Designed for select environments where fast transaction times, in addition to security, are at a premium.

The new card network options do not require the financial institution to reissue cards, or the merchants to re-certify their point-of-sale terminals.

Alignment in the payments industry and the ability to process a secure transaction in a timely manner for the consumer experience is important.

Keeping current on the payment industry news like Quick Chip and M/Chip Fast or discussion about EMV developments is a smart move for merchants and cardholder as well.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa Tagged with: banks, card, card network, cardholders, chip cards, EMV, financial institution, merchants, payment, payment networks, payment processors, payments industry, point of sale, Security, terminal, transaction

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

May 26th, 2016 by Elma Jane

NFC stands for Near Field Communication. It is a technology that allows contactless data exchange between two electronic devices

Contactless Payment is a description for the ability to pay without touching anything.

How do mobile wallets fit into NFC?

Mobile wallets like Apple and Android Pay use NFC technology. NFC technology allows the data to securely pass back and forth between each device to make a contactless payment.

How secure are NFC Payments?

Tokenization converts or replaces cardholder data with a unique token ID. This eliminates the possibility of having card data stolen. These tokens help heighten protection and security for the consumer.

As a merchant, preparing to accept payments that meet customers satisfaction is needed. With the mobile wallet transaction process, it makes the traditional transaction quick and efficient.

NTC terminals allow merchants to accept NFC Payments, allowing you to process more transactions. For more information give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: cardholder, consumer, contactless, customers, data, merchant, mobile wallets, Near Field Communication, nfc, payment, Security, terminals, tokenization, transaction