February 25th, 2024 by Admin

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

But what exactly is m-commerce? M-commerce is a hybrid technology that takes web technologies that scale screens to mobile devices like Apple iPads and Android tablets. The commerce end of it comes from shoppers and merchants actually executing payment transactions over mobile devices of some form. Read more of this article »

Posted in Credit Card Security Tagged with: credit card, Digital Wallet, e-commerce, gateway, m-commerce, merchant account, nfc, payment, shopping cart, smartphone, tablet

May 12th, 2016 by Elma Jane

Electronic commerce (eCommerce) is a type of business transaction, that involves the transfer of information on the Internet. This allows consumers to exchange goods and services with no barriers of time or distance electronically.

Business-to-Business (B2B) this refers to electronic commerce, between businesses rather than between a business and a consumer. These transactions electronically provide competitive advantages over traditional methods. It’s faster, cheaper and more convenient.

Creating a successful online store can be difficult if you don’t have knowledge of e-commerce and what it is supposed to do for your online business.

What do you need to have an online store?

- Shopping cart – an operating system that allows consumers to buy goods and or services. Track customers, and tie together all aspects of e-commerce into one.

- Or you can check out our NTC e-Pay no shopping cart Solution.

- Taking online payment by getting a merchant account and accept credit cards through an online payment gateway.

You just need to make a better decision in choosing the right shopping cart and a merchant account for your eCommerce shop.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: b2b, commerce, consumers, credit cards, customers, ecommerce, gateway, merchant, merchant account, NTC e-Pay, online, online payment, payment gateway, shopping cart, transaction

November 17th, 2015 by Elma Jane

Within the payment processing industry, Merchant accounts are categorized according to how they process their transactions.

There are two primary merchant account categories:

Swiped (Card Present) and Keyed (Card-Not-Present).

Swiped or Card-Present Transactions: Are those in which both the card and the cardholder are present at the time the payment is processed, they physically swipe their customers credit card through a terminal or point-of-sale system.

The sub-categories within this group include:

Retail Merchants – Normally conduct their business in an actual storefront or office space. They primarily use counter-top terminals or Point-of-Sale systems. Restaurant Merchants – Requires a special set-up that allows for tips to be added to the final sale amount by settling the transaction with an adjusted price that will include the tip amount.

Wireless / Mobile Merchants – They use wireless terminals or mobile phones to run these transactions in Real-Time. Have the ability to accept credit cards transactions wherever they are located out on the road.

Hotel / Lodging Merchant – Will authorize a customer’s credit card for a certain sale amount.

Card-Present Transactions also include grocery stores, department stores, movie theaters, etc. Card acceptance settings where cardholders use unattended point-of-sale (POS) terminals, such as gas stations, are also defined as card-present transactions.

Keyed-In or Card-Not-Present Transactions: Whenever the transaction is completed and the cardholder (or his or her credit card) is not physically present to hand to the seller.

The sub-categories within this group include:

Mail Order / Telephone Order (MOTO) – The customers card information is gathered via over the phone, fax, email or internet and then manually key-entered into a terminal or payment gateway software. Once the transaction is approved and completed, the product is then shipped to the customer for delivery.

eCommerce / Internet – Conduct ALL of their business over the internet through a web site. So all credit card transactions are processed online via a payment gateway in real-time. The payment gateway is integrated into the web sites shopping cart. The cardholders card is charged instantly.

Travel Merchants is one example of Keyed or Card-Not-Present Transactions.

Start processing credit card payments today whether Swiped or Keyed.

Give us a call now at 888-996-2273 so more details!

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone, Travel Agency Agents Tagged with: Card Not Present transactions, card present, card-not-present, card-present transactions, cardholder, credit card, credit card payments, credit card transaction, ecommerce, keyed, Lodging Merchant, mail order, merchant accounts, merchants, mobile merchants, moto, payment gateway, payment processing, point of sale, POS terminals, Restaurant Merchants, Retail Merchants, shopping cart, swiped, telephone order, terminal, transactions, travel merchants

October 30th, 2015 by Elma Jane

National Transaction Corporation is the preferred Credit Card Processing Agent for many National Travel Agencies & Associations. We are the preferred merchant account service provider for ASTA, OSSN, ARTA, HBTA,Vacation.com, Travel Leaders, Trams and many more. We are also affiliated with JaxFax, Travel weekly, TRO / Travel Research Online and other travel agency associations in the travel agent industry.

Benefits of our Merchant Account Services for Travel Agencies.

Competitive credit card processing rates & fees for travel agents

Faster deposits (as quick as 24 hrs from transaction)

No holds on funding

Trams Credit Card Merchant Account Integration

Sabre Red Merchant Account Integration

Booking Software Processing Integration

Lower Processing Rates & Fees

Swiped Rates for face to face credit card processing

ecommerce for shopping cart credit card processing

National Transaction Corporation has a proven track record with many of the Largest Travel Agency Associations in the U.S. and Canada. In fact for several of those, we are the preferred credit card processing merchant account services provider for their members. We can take your business to the next level with integration into Trams, Sabre, Sabre Red or off the shelf accounting programs like QuickBooks and Peachtree Accounting.

We are more than happy to provide you with a free merchant account rate review and go over your current credit card processing details and show you how we can save you money and get deposits even faster. We also offer industry leading technical support around the clock, you call, we answer. Simple as that. We can assist errant transactions, chargebacks, terminal messages and much more. Find out why National Transaction Corporation is the preferred merchant account services provider for travel agents & agencies.

Call us now and put us to the test. 888-472-7112

American Society of Travel Agents, Vacation.com, ASTA, Trams, Virtuoso, Travel Leaders, Association of Retail Travel Agents, Specialty Travel Agent Association, Cruise Holidays Credit Card Processing.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: chargebacks, credit card, credit card processing, ecommerce, merchant account, Merchant Account Services, National Travel Agencies, shopping cart, travel agencies, travel agency, travel agent

January 26th, 2015 by Elma Jane

Accept Electronic Payments in Their Currency,

Convert it to Yours

DCC or Dynamic Currency Conversion is a system where the Visa or MasterCard holder in a foreign country can shop on an American based web site that displays prices in their own local currency. The web site can offer multiple choices as to which country the shopper is based in and the shopper can be immediately familiar with the pricing of goods and services.

Exchange rates are in constant flux. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. Even if the shopper does not choose the correct currency, at the time the card information is presented, the system automatically recognizes that the card is foreign and applies the appropriate currency and exchange rate.

At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied. In today’s global business environment, this level of convenience to the customer insures they are comfortable with the transaction from shopping cart to the door. Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line.

On the merchant end, all transactions are settled in $USD. Reporting mechanisms can display the consumers pricing and the exchange rate they paid for analysis and cost reduction.

Currency Conversion

- Accept currencies from other nations.

- Convert funds to US Dollars.

- Set prices in local currency to avoid confusion or calculation.

- Works with e-commerce as well as Mail Order / Phone Order.

- Ease the sales process for your customers.

- Increase customer familiarity.

- Immediately convert currency to avoid value gaps.

Posted in Best Practices for Merchants, Electronic Payments Tagged with: Bank Reference Table, Card Recognition Table, consumer, conversion rate, currency, customer, Dynamic Currency Conversion, e-commerce, electronic payments, exchange rate, invoice, MasterCard, Merchant's, receipt, shopping cart, transactions, visa

October 8th, 2014 by Elma Jane

When the PCI Security Standards Council (PCI SSC) launched PCI DSS v3.0 in January 2014, businesses were given one year to implement the updated global standard. Now that the deadline is fast approaching, interest is picking up in what v3.0 entails. On Jan. 1, 2015, version 3.0 of the Payment Card Industry (PCI) Data Security Standard (DSS) will reach year one of its three-year lifecycle.

Trustwave, a global data security firm, is on the frontlines of helping secure the networks of merchants and other businesses on the electronic payments value chain against data breaches. As an approved scanning vendor, Trustwave is used by businesses to achieve and validate PCI DSS compliance.

PCI DSS v3.0 is business as usual for the most part, except for a few changes from v2.0 that considers impactful for large swaths of merchants. The top three changes involve e-commerce businesses that redirect consumers to third-party payment providers. The expansion of penetration testing requirements and the data security responsibilities of third-party service providers.

Penetration testing

Penetration testing is the way in which merchants can assess the security of their networks by pretending to be hackers and probing networks for weaknesses. V3.0 of the PCI DSS mandates that merchants follow a formal methodology in conducting penetration tests, and that the methodology goes well beyond what merchants can accomplish using off-the-shelf penetration testing software solutions.

Merchants that are self assessing and using such software are going to be surprised by the rigorous new methodology they are now expected to follow.

Additionally, penetration testing requirements in v3.0 raises the compliance bar for small merchants who self assess. Those merchants could lower the scope of their compliance responsibilities by segmenting their networks, which essentially walls off data-sensitive areas of networks from the larger network. In this way merchants could reduce their compliance burdens and not have to undergo penetration testing.

Not so in v3.0. If you do something to try to reduce the scope of the PCI DSS to your systems, you now need to perform a penetration test to prove that those boundaries are in fact rigid.

Redirecting merchants

The new redirect mandate as affecting some, but not all, e-commerce merchants that redirect customers, typically when they are ready to pay for online purchases to a third party to collect payment details. If you are a customer and you are going to a website and you add something to your shopping cart, when it comes time to enter in your credit card, this redirect says I’m going to send you off to this third party.

The redirect can come in several forms. It can be a direct link from the e-commerce merchant’s website to another website, such as in a PayPal Inc. scenario, or it can be done more silently.

An example of the silent method is the use of an iframe, HTML code used to display one website within another website. Real Estate on the merchant’s website is used by the third-party in such a way that consumers don’t even know that the payment details they input are being collected and processed, not by the e-commerce site, but by the third party.

Another redirect strategy is accomplished via pop-up windows for the collection of payments in such environments as online or mobile games. In-game pop-up windows are typically used to get gamers to pay a little money to purchase an enhancement to their gaming avatars or advance to the next level of game activity.

For merchants that employ these types of redirect strategies, PCI DSS v3.0 makes compliance much more complicated. In v2.0, such merchants that opted to take Self Assessment Questionnaires (SAQs), in lieu of undergoing on-site data security assessments, had to fill out the shortest of the eight SAQs. But in v3.0, such redirect merchants have to take the second longest SAQ, which entails over 100 security controls.

The PCI SSC made this change because of the steady uptick in the number and severity of e-commerce breaches, with hackers zeroing in on exploiting weaknesses in redirect strategies to steal cardholder data. Also, redirecting merchants may be putting themselves into greater data breach jeopardy when they believe that third-party payment providers on the receiving end of redirects are reducing merchants’ compliance responsibilities, when that may not, in fact, be the case.

Service providers

Service provider is any entity that stores, processes or transmits payment card data. Examples include gateways, web hosting companies, back-up facilities and call centers. The update to the standard directs service providers to clearly articulate in writing which PCI requirements they are addressing and what areas of the PCI DSS is the responsibility of merchants.

A web hosting company may tell a merchant that the hosting company is PCI compliant. The merchant thought, they have nothing left to do. The reality is there is still always something a merchant needs to do, they just didn’t always recognize what that was.

In v3.0, service providers, specifically value-added resellers (VARs), also need to assign unique passwords, as well as employ two-factor authentication, to each of their merchants in order to remotely access the networks of those merchants. VARs often employ weak passwords or use one password to access multiple networks, which makes it easier for fraudsters to breach multiple systems.

The PCI SSC is trying to at least make it more difficult for the bad guys to break into one site and then move to the hub, so to speak, and then go to all the other different spokes with the same attack.

Overall, v3.0 is more granular by more accurately matching appropriate security controls to specific types of merchants, even though the approach may add complexity to merchants’ compliance obligations. On the whole a lot of these changes are very positive.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (PCI SSC), call centers, cardholder data, consumers, credit-card, customers, data breaches, data security assessments, Data Security Standard, e-commerce breaches, e-commerce businesses, e-commerce merchant's website, electronic payments, global data security, global standard, Merchant's, merchant’s website, mobile, networks, payment, payment card data, Payment Card Industry, payment providers, PCI Security Standards Council, PCI-DSS, Penetration testing, Service providers, shopping cart, software solutions, web hosting, website

August 29th, 2014 by Elma Jane

High risk credit card processing is electronic payment processing for businesses deemed as HIGH RISK by the MERCHANT SERVICES INDUSTRY

The high risk segment of payment processing has become more important as banks and ISO’s have begun to tighten up their credit restrictions and underwriting policies. Businesses are classified as high risk primarily because of their product or service and the way they go to market. In merchant services, risk is related to CHARGEBACKS or customer disputes.

The more likely a business to have chargebacks, the higher risk the business. For instance, online businesses selling a weight loss product through a free trial offer, is more likely to have chargebacks than a retail store selling the same weight loss product.

Merchants are often unaware their business falls into the high risk category when they first start shopping for a merchant account. Getting a high risk merchant account can be difficult.

These providers have more stringent requirements and the application process is longer compared to traditional merchant account providers.

High risk businesses should expect to pay higher rates and fees for payment processing services. As a general rule of thumb, merchants should count on paying at least more than a traditional merchant account. Most high risk merchant accounts also require a contract of at least 18 months, whereas low risk providers offer accounts without cancellation fees or contracts.

ROLLING RESERVES are also a big part of high risk credit card processing. Most high risk merchants have some sort of rolling reserve placed on the account, especially new accounts without any processing history. A Reserve refers to an account where a percentage of the funds from transactions are held in reserve to cover against any chargebacks or fees that the processor may not be able to collect from the merchant. This is similar to a security deposit, but merchants don’t have to pay it up front. Reserves are a pain point for many small high risk merchants, but they are definitely necessary and without them, processors would not accept any high risk merchants at all.

What Businesses Are High Risk?

As mentioned earlier, businesses are usually classified as high risk due to the product or service they offer, however merchants with severely damaged credit or a recent bankruptcy can also be considered high risk. Below are just of the few common high risk merchant categories:

Adult Websites

Cigars & Pipe Tobacco Online

Collection Agencies

Credit Repair

Debt Consolidation

E-Books & Software

Electronic Cigarettes

Firearms – Online

High Ticket & High Volume

Medical Marijuana Dispensaries

Multi Level Marketing & Business Opportunities

Nutraceuticals like weight loss supplements, cleansers etc.

Penny Auctions

Sports Betting Advice

Ticket Brokers – Online Tickets

TMF Merchants

Travel & Timeshare

Unfortunately this list is growing and some credit card processing companies even classify any start up Internet business, that doesn’t have extensive financials to be high risk. With the recent economic recession in the United States, there has been an increase in these start up Internet ventures. People are either looking to supplement their income or start their own business instead of looking for work.

How To Protect Your Business

Accepting credit cards is the single most important part of most online businesses. Unfortunately, many successful businesses go under after having their merchant account shut down. High risk merchants should always be cognizant of their merchant account and pay attention to chargeback percentages. Below are some tips for high risk merchants looking for payment processing solutions.

Be Upfront: Make sure your processor knows exactly what you sell and how you market the product/service. If they don’t accept your business type, keep shopping for a new merchant account provider. Many merchants will try to fly under the radar by not revealing all their products or fully disclose their marketing methods to the processor. This is a bad move, the processor will eventually find out the details about your business. This is usually from doing an audit on your transactions and contacting your customers.

Negotiate Every 3 Months: Credit card processing companies underwrite applications based on previous processing history. If there is no previous history, the account is riskier and the terms offered are usually more expensive and restrictive. You can always re-negotiate your rates, reserves and other contract terms with your current processor. Once they have 3 months of history to evaluate, they may be able to offer you a better deal. Three months of history is the magic number for most processors. If you applied without the previous history and were declined, there is a chance the same processor will approve your application if you provide 3 months of previous statements.

Prepare For The Worst: All high risk merchants should keep at least 2 active merchant accounts, from different providers. You never know when underwriting guidelines might change, or you may have an influx of chargebacks. Having a backup account or even multiple back up accounts is a good idea. Many high risk providers offer a load balancing gateway, which allows for multiple merchant accounts to be integrated into one payment gateway. This way you can spread transactions across multiple accounts, through one shopping cart/gateway.

Posted in Best Practices for Merchants Tagged with: account, account providers, accounts, banks, card, chargebacks, contract, credit, credit card processing, credit restrictions, customer, customers, deposit, electronic payment, fees, financials, gateway, High risk credit card, High Ticket & High Volume, ISOs, low risk, marketing, merchant, merchant account, merchant services, multiple accounts, payment gateway, payment processing, processing services, processing solutions, processor, product, Rates, reserves, retail store, risk, ROLLING RESERVES, Security, security deposit, service, shopping cart, statements, terms, TMF Merchants, transactions, travel, underwriting

May 23rd, 2014 by Elma Jane

Before making a purchase, there are several devices that consumers may use to help them make a decision: Use a specific store’s mobile app on their smartphones. Visit the store’s website on a tablet or computer, or just pick up the phone and call customer service to ask a question. Whatever the case, omnichannel is an important buzzword for merchants.

Here are ways to ensure a seamless and secure retail experience to turn browsers into loyal buyers.

Ensure Channels Work Together

Even in historically single-channel retail sectors such as grocery, more than half of customers now use two or more channels before completing a purchase, shown in a recent study. Retailers must therefore offer both traditional and digital channels. However, before investing in the latest mobile-optimized website feature or app, retailers should learn how existing online and physical channels can together enhance the customer experience. What customers value most is not the number of channels offered, but how these channels support each other.

A merchant’s website might encourage visitors to take advantage of a special event in-store, while sales assistants on the floor can use Wi-Fi enabled tablets to access additional product information.

Help Customers Find What They Want

With Internet access ubiquitous, cost-conscious customers are just a click away from being able to compare prices and find special offers. Many take out their smartphone or tablet in stores to compare prices, a trend called Showrooming.

Online retailers can take advantage of this trend by encouraging shoppers to compare prices in-store using a mobile app. In-store retailers, on the other hand, could provide greater value through targeted offers, price match guarantees, expert advice, convenient delivery choices and personalized customer care.

Optimize The Checkout Experience

Businesses must be sure to have a quick, streamlined checkout process once they have converted an online browser into a customer or else they risk facing shopping cart abandonment. This can be done in a few steps:

1. Assess how the checkout experience can be customized for its customers. Keep the mandatory information required from new or first-time online or mobile shoppers to a minimum and shorten the process for returning customers by securely storing their payment details and other personal information.

2. Develop a dedicated mobile app or other innovative functions that can increase long-term satisfaction and loyalty.

3. Test different payment methods to find those that are most convenient for customers. These payment options may include paying with reward points, using a digital wallet or providing a digital offer or coupon at checkout. There is a balance to be found between having additional payment methods to meet customer expectations and choosing methods appropriate to a merchant’s business model.

4. Establish a one-click online checkout process. Chase for example, is currently developing a Chase Wallet and Quick Checkout solution. The Chase Wallet will allow customers to store and access their Chase cards and ultimately, any branded card for a quick checkout. It will also update Chase-branded cards when a customer replaces an existing card and use tokenization to securely process payments with select merchants.

Merchants also face the challenge of ensuring that the online and in-store checkout experience is secure, while at the same time eliminating as many false positives as possible. False positives are a hindrance to any business as they may reduce sales, increase chargebacks and frustrate customers. A quick-checkout solution may help reduce false positives because customer information is automatically populated rather than manually keyed into the checkout page.

Acquirers should also work with online retailers to provide a conditional approval code for a transaction. This code allows the fulfillment process to move forward while authentication is taking place. The additional time for a thorough authentication also helps reduce the number of false positives.

Use Data to Build Loyalty

Customers will likely return to a retailer if product marketing reflects their past purchases or interests. Therefore, taking advantage of data including a customer’s purchasing history, loyalty, behavior or social media interests may help retailers to better understand their customers as well as personalize their shopping experience.

According to a study released in March 2013, Chase Paymentech found that 32 percent of merchants use their payment data to help craft their multi-channel sales strategy and 42 percent use it to improve the online customer experience. In addition, further analysis of payment methods, chargeback rates, fraud rates and authorization rates may improve the customer shopping experience and drive overall profitability.

Posted in Best Practices for Merchants Tagged with: approval code, authentication, branded card, chargebacks, Chase, Chase Wallet, checkout process, computer, customer service, data, digital channels, digital offer, Digital Wallet, In-store retailers, internet access, Merchant's, merchant’s website, mobile app, mobile-optimized website, omnichannel, online retailers, payment, payment data, phone, physical channels, Quick Checkout solution, reward points, shopping cart, Showrooming, single-channel retail, Smartphones, social media, tablet, tokenization, transaction, website, Wi-Fi

October 3rd, 2013 by Admin

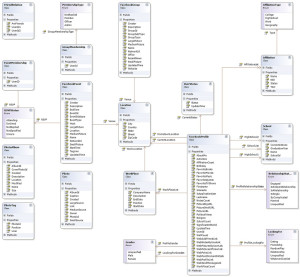

When managing a business nothing helps more than raw data. Storing that data in a database makes it infinitely more flexible and accessible. A database is an application that efficiently and effectively stores and retrieves data as well as ties that data to other data. Many large scale accounting applications like QuickBooks, PeachTree and many other titles store all their information in some form of a database.

Tables are like spreadsheets. Rows and columns group together data in an organized manner. Databases can have many tables with many columns or just a few. Relational databases like SQL database engines link tables together using what are known as primary and foreign keys. So in the example of an invoice the Customer table has a Primary key uniquely identifying a specific customer from the rest of all of the customers. The Invoice table stores a foreign key in its table so the match between customer id’s links the two tables. The invoices themselves also have a primary key so that there can be many invoices for the same customer. These concepts are actually born of a mathematics branch known as Algebra.

Data at its most basic level is a specific bit of information. Like the number 19 or a specific date and/or time. A database holds these bits of data and an application built to interact with a database is used to generate information from the data. A clearer example is the invoice. An invoice has quantities, part numbers, serial numbers, account numbers, dates and even totals which are not stored in the database but are calculated each time the invoice is accessed. Invoices bring many bits of data to a single entity most commonly referred to as a report. Looking at a common invoice explains a transaction with the details stored in many tables all tying back to a single transaction.

Database servers run a service that can be connected over connections on a local area network or over the internet to allow applications on different computers access to data simultaneously. Many websites like Facebook, NASA and even Google make extended use of databases to supply services to millions of users concurrently. Whether it’s over the internet or across a physical office space, a database can be the heart of a businesses information technology.

SQL databases conform to an industry standardized set of functionality so that complex queries can be performed without knowing the underlying technical architecture.

Open Source

Open Source is usually associated with applications that are free to download, distribute and modify. Many times open source applications are developed by a community of developers over the internet that take feature suggestions from the user community and build them into the application. Open source applications tend to follow one of several ‘licenses’ like the GPL or General Public License to make sure the program is unmolested or incorporated into a proprietary software trying to take credit for the programming code.

There are many examples of open source titles here.

http://directory.fsf.org/wiki/All

https://en.wikipedia.org/wiki/List_of_free_and_open-source_software_packages

Open Source Databases

One aspect of open source known as LAMP has become wildly popular as the internet has matured. Lamp stands for Linux, the operating system, Apache, the web server component, MySQL, a wildly popular free and open database engine and the P stands for Perl, Python or PHP the three most popular languages of backend programming. Combining these components provides a very fertile ground for developing Web Applications that can be served across an office or the world. Many sites like Google and WordPress take full advantage of these technology to create feature rich applications that run in a web browser but work like a traditional desktop application like Microsoft Word. Being open source allows anyone to build on top of or out of the offering. This means you can customize the programming of any of these applications to best fit your particular style or way of doing business. This is a huge time saver for any small business.

Some common examples of open source applications that utilize Lamp architecture are listed below:

SugarCRM – A contact and lead management system to manage a sales force.

WordPress – The most popular blogging application on the internet.

OpenCart – An extremely flexible shopping cart software.

GNUCash – A full fledged accounting program.

Mobile Devices

Today we have smartphones and tablets that have web browsers built in and available for each platform. Using new techniques known as adaptive or responsive web layouts, information on a page automatically transform a web page to smaller displays. So any page can be designed once and displayed on a desktop browser, a tablet browser or a mobile phone browser. This allows web designers to best optimize the content for smaller displays while leaving the pages viewed on a desktop for a larger view. Using responsive design techniques your business data can even extend to mobile devices like iPhones and Android or Blackberry phones and tablets. The potential is huge for your business.

Posted in Best Practices for Merchants, Point of Sale Tagged with: Android, bits, blackberry, data, database, e-commerce, information technology, Iphone, MySQL, open source, relational, shopping cart, smartphone, SQL, tablet

With smartphone users on the rise

With smartphone users on the rise