April 8th, 2014 by Elma Jane

Today’s consumers are defining themselves by their mobile devices, their social presences and how they interact with brands, both offline and online. The digital evolution of the average consumer is alive and kicking.

Today’s consumer is more connected than ever, with more access to and deeper engagement with content and brands. Thanks to the proliferation of digital devices and platforms. Content that was once only available to consumers via specific methods of delivery such as via print, radio and broadcast television can now be sourced and delivered to consumers through their multiple connected devices. This is driving the media revolution and blurring traditional media definitions.

What are the specific characteristics or dynamics shaping today’s consumer behavior? Digital consumers are social-savvy and more connected to their friends, family and favorite brands than ever before.

Focused On The Gadgetry

Consumers love gadgets.

One out of four Americans plan to buy a smartphone in the near future. Thirty percent intend to upgrade from a regular mobile phone to a smartphone once able. For those ages 18 to 24, 49 percent they want to upgrade to a smartphone.

How frequently consumers use their mobile devices in a given month? Consumers spent an average of 34 hours and 17 minutes per month using apps on their devices, an increase of 9 hours and 52 minutes from 2012.

Interestingly, the amount of time consumers spend surfing the Web fell 1 hour and 54 minutes to a total of 27 hours and 3 minutes. The amount of time used to watch videos online increased by 43 minutes, to 6 hours and 41 minutes.

Social Media & Everyday Life

Digital consumers, by and large love their social media.

Sixty-four percent said that they use social media at least once per day. For mobile however, the growth figures reported suggest a broad shift is happening, pushing more people to access social networks via mobile platforms.

Forty-seven percent of smartphone owners log onto a social network each day. Additionally, the number of people who use social-media apps on their smartphones rose by 37 percent from 2012.

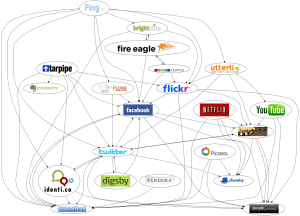

Digital consumers are also diversifying their choice of social networks, opting to use LinkedIn and Pinterest in addition to so-called traditional social media platforms like Facebook and Twitter.

As digital consumers find their own mix of devices and platforms to access and engage with social media, they are building profiles and connections on multiple social networks as well.

Two Screens Is A King

Digital consumers also rely on their mobile devices as a second type of television screen.

In a survey, eighty-four percent said they use their smartphone or tablet to surf the Web or to use apps while watching television. Of those, 44 percent of tablet owners shopped while watching TV, and 24 percent used their smartphones to make purchases.

Fourteen percent of tablet owners used their device to buy a product or service as it was being advertised on TV. Just 7 percent of smartphone owners said they would do the same.

Posted in Best Practices for Merchants, Credit card Processing, Financial Services, Merchant Services Account, Mobile Payments, Small Business Improvement, Smartphone Tagged with: apps on their devices, average consumer, content, deeper engagement, digital consumers, digital devices, digital evolution, Facebook, gadgets, linkedin, media revolution, Mobile Devices, mobile platforms, offline and online, pinterest, regular mobile phone, smartphone, social media, social network, social presences, social-media apps, social-savvy, tablet, traditional media, twitter

March 17th, 2014 by Elma Jane

With so much to do each day, it’s easy for a small business owner to get bogged down in details. That’s where your smartphone comes in. With the right apps, your mobile device can automate the tasks that used to be daily chores. Whether you need help keeping track of all your business documents, or organizing your calendar and contacts list, it’s time to let your smartphone do some of the heavy lifting.

Back up your business files. Your work machine contains everything you need for a productive day, including every file and document you are working on. But you can’t always be at the office. With your smartphone and the right apps, however, you can back up and access your business files from anywhere. Dropbox, Box, Google Drive, SkyDrive and iCloud are all solid mobile apps that automate the process of syncing your business files to the cloud so you can access them from any Web-connected device, including your smartphone or tablet. Better yet, any edits you make will be synced across all your devices, so you can stay productive and organized.

Manage new contacts. Swapping business cards is a great networking strategy, but cards are easy to lose, and manually inputting all that contact information into your address book is a chore. So let your smartphone enter all that data into your address books. CamCard (available for iOS and Android) is an all-in-one business card management solution. Just point your iPhone camera at a card and snap a photo. The app’s text-recognition software will pull out the key details and update your address book automatically. It can even search for new contacts on LinkedIn to add a photo and additional personal details for each new contact.

Silence your smartphone. A buzzing or ringing smartphone can be distracting – not to mention embarrassing – during a business meeting. Silencing your phone is simple, but chances are you’ll occasionally forget. That’s why there are handy apps that monitor your smartphone calendar for meetings and appointments, then silence your phone for the duration of that event. You can even whitelist specific numbers so you won’t miss an emergency call. When the meeting is over, your smartphone’s ringer and vibration settings will be returned to their normal state. That way, you can stay focused and free from distraction when it matters most. Android users can try Silencify. For iPhone users, AutoSilent is a good option.

Sync your calendars. Both Android and iOS have built-in calendars to help you plan your week and schedule meetings. But juggling both a mobile calendar and a desktop office calendar is a pain, so why not use your smartphone to synchronize the two? If you use Microsoft Outlook as your business calendar, for example, Google Calendar offers an easy way to link them. And iPhone users can synchronize their mobile calendar with Outlook by plugging their smartphone into their computer and accessing the Calendars tab in the iTunes options menu. Automating the process of syncing your calendars means you’ll never mix up appointments. And if you share your business calendar with your employees, it ensures that everyone is always on the same page.

Sync your social media accounts. A strong presence on Facebook and Twitter can help you engage your customers and grow your business. Mobile apps can help you keep your business profiles fresh when you’re on the go, but reposting those updates on each platform individually can be a chore especially from a tiny smartphone screen. Fortunately, there’s an easy way to automate the process of synchronizing social media posts between your business profiles. Simply visit this page to link your Facebook and Twitter accounts. After that, go ahead and use the Facebook mobile app to post updates, news or promotions to your business’s Facebook page, each post will be automatically funneled to your Twitter followers as well.

Posted in Best Practices for Merchants, Mobile Payments, Small Business Improvement, Smartphone Tagged with: all-in-one, Android, apps, automate, automate the process, automating, box, business documents, business profiles, camcard, devices, dropbox, Facebook, google drive, icloud, iOS, Iphone, linkedin, Mobile Apps, mobile device, networking, organizing, productive, skydrive, small business, smartphone, synchronize, synchronizing social media, syncing, tablet, twitter, web-connected

March 17th, 2014 by Elma Jane

Lots of talk has gone on since the recent spate of merchant data breaches on ways to potentially prevent hackers from gaining access to stored payment card data. Use of biometric information, such as a fingerprint, to access stored credentials is among the solutions often bandied about.

The prospects of using individuals’ biometric information for credentialing is fairly scary. Security may be what biometrics is trying to achieve, but it’s also its biggest flaw. Imagine having your fingerprint information stored at Target this holiday season, that information would now be in the hands of lots of people not intended to have access to it. Unlike a password, someone can’t change his or her fingerprint. So once someone has the print, they have it forever. So even if something is biometric based, it also has to have a lot of other security measures, and that could include GPS-based location services tied to an individual’s smartphone.

Biometrics alone won’t work. It’s very scary that that information could be stored in a way that someone could figure out how to get it. Even if encrypted, that’s a huge security concern. You can’t change your fingerprint.

Posted in Credit card Processing, Credit Card Security, Electronic Payments, Payment Card Industry PCI Security, Smartphone Tagged with: biometric, card data, credentialing, encrypted, fingerprint, gaining access, gps-based, merchant data breaches, password, prevent hackers, Security, security measures, smartphone, stored credentials

February 20th, 2014 by Elma Jane

Android-iPhone-Credit-Card-Reader

Several options exist for mobile credit card processing.

Credit card processing on iPhone/ipad/Android/BlackBerry or Tablets – Using NTC’s portable credit card readers, merchants can now swipe credit cards on iPad or Android tablet devices. NTC’s Virtual Merchant solution allows users to download a secure application to interfere your smartphone with our merchant account services seamlessly. The application and credit card processing data on the carriers network or a WiFi connection to the internet.

NTC’s MagTek Bullet Swipe Credit Card Reader for Android Phones and Tablets.

Using any Android 2.2. or higher device you can process credit card transactions securely to the smartphone via Bluetooth and utilize wireless devices internet connection (WiFi or Carrier) to send the credit card processing data encrypted for processing approval.

Security anywhere. With the BulleT Secure Credit Card Reader Authenticator (SCRA), security comes with the flexibility and portability of a Bluetooth wireless interface. Small enough to fit into the palm of your hand, the BulleT enables secure wireless communications with a PC or mobile phone using the popular Bluetooth interface. Not only does the BulleT encrypt card data from the moment the card is swiped, but it also enables card authentication to immediately detect counterfeit or altered cards.

Ideal for merchant services accounts and financial institutions’’ mobile credit card processing, NTC’s BulleT offers MagnaSafe credit card processing security features with the convenience of a Bluetooth interface. This powerful combination assures credit card data protection, transaction security and convenience needed to secure mobile credit card processing with strong encryption and 2-factor authentication. The BulleT is specifically designed to leverage the existing magnetic stripe credit card reader as a secure token empowering cardholders with the freedom and confidence of knowing that their credit card transactions are secure and protected anytime, anywhere. Android Credit Card Swipe Reader for Android Phones and Tablets on your wireless mobile merchant account.

NTC’s MagTek iDynamo Credit Card processing swipe reader for iPhone and Ipad.

Credit card processing on an iPhone has never been easier. Simply attach NTC’s iDynamo card reader to your iPhone or iPad device, install our Virtual Merchant software from the App Store and you’re ready to go. Take advantage of lower credit card processing rates by processing swiped transactions instead of keying the credit card in later and get paid faster. From the company that leads with Security from the Inside MagTek has done it again with the iDynamo, a secure card reader authenticator (SCRA) designed to work with the iPhone and iPad. The iDynamo offers MagnasafeTM security and delivers open standards encryptions with simple, yet proven DUKPT key management, immediate tokenization of card data and MagnePrint card authentication to maximize data protection and prevent the use of counterfeit cards. Mobile merchants can now leverage the power of their iPhone/iPod Touch products without the worries of handling or storing sensitive card data at any time. Ideal for wireless mobile merchant accounts and mobile credit card processing, the iDynamo offers MagneSafe security features combined with the power of iPhone and iPod Touch products. This powerful combination assures convenience and cost savings, while maximizing credit card data protection and credit card transaction security from the moment the card is swiped all the way to authorization. No other credit card reader beats the protection offered by a MagnaSafe product.

Other credit card devices claim to encrypt data in the reader. NTC’s iDynamo encrypts the data inside the read head, closest to the magnetic stripe and offers additional credit card security layers with immediate tokenization of card data and MagnePrint card authentication. This layered approach to security far exceeds the protection of encryption by itself, decreases the scope of PCI compliance, and reduces fraud.

NTC’s iDynamo is rugged and affordable, so it not only withstands real world use, it performs to the high standards set by MagTek as the leader in magnetic credit card swipe reading products for nearly 40 years.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Payment Card Industry PCI Security, Smartphone Tagged with: Android, android phones and tablets, authenticator, blackberry, bluetooth, card authentication, credit card processing data, devices, encrypt card data, encrypted, internet, ipad, Iphone, magnetic stripe, magtek bullet, merchant account, merchant services accounts, Merchant's, mobile credit card processing, portable credit card readers, process credit card transactions, processing approval, secure, secure application, secure token, smartphone, swipe credit card reader, swipe credit cards, tablets, transaction security, virtual merchant, wifi, wireless devices internet connection

February 14th, 2014 by Elma Jane

News from Target, increasing the number of cards compromised to 70 million and the expansion of data loss to mailing and email addresses, phone numbers and names, affirms that we are in a security crisis.

Card data is from a brand and business perspective, the new radioactive material. Add personally identifiable information (PII) to the list of toxic isotopes.

The depressing vulnerabilities these breaches reveal are a result of skilled hackers, the Internet’s lack of inherent security, inadequate protections through misapplied tools or their outright absence. Security is very very hard when it comes to playing defense.

There is a set of new technologies that could, in a combination produce a defense in depth that we have not enjoyed for some time.

Looking at the Age of Context (ACTs)

Age of Context released, a book based on the hundreds of interviews conducted with tech start-up and established company leaders. A wide-ranging survey. They examine what happens when our location and to whom we are connected are combined with the histories of where and when we shop. Result is a very clear picture of our needs, wants and even what we may do next.

Combining the smartphone and the cloud, five Age of Context technologies ACTs, will change how we live, interact, market, sell and navigate through our daily and transactional lives. The five technologies are:

1. Big Data. Ocean of data generated from mobile streams and our online activity, can be examined to develop rich behavioral data sets. This data enables merchants to mold individually targeted marketing messages or to let financial institutions improve risk management at an individual level.

2. Geolocation. Nearly every cell phone is equipped with GPS. Mobile network operators and an array of service providers can now take that data to predict travel patterns, improve advertising efficiency and more.

3. Mobile Devices and Communications. These are aggregation points for cloud-based services, sending to the cloud torrents of very specific data.

4. Sensors. Smartphones, wearables (think Fitbits, smart watches and Google Glass) and other devices are armed with accelerometers, cameras, fingerprint readers and other sensors. Sensors enable highly granular contextual placement. A merchant could know not only which building we are at and the checkout line we are standing in but even which stack of jeans we are perusing.

5. Social. Social networks map the relationships between people and the groups they belong to, becoming powerful predictors of behavior, affiliations, likes, dislikes and even health. Their role in risk assessment is already growing.

The many combinations and intersections of these technologies are raising expectations and concerns over what is to come. Everyone has a stake in the outcome: consumers, retailers, major CPG brands, watchdog organizations, regulators, politicians and the likes of Google, Apple, Microsoft, Amazon, eBay / PayPal and the entire payments industry.

We are at the beginning of the process. We should have misgivings about this and as an industry, individuals and as a society, we need to do better with respect to privacy and certainly with respect to relevance.

Provided we can manage privacy permissions we grant and the occasionally creepy sense that someone knows way too much about us, the intersections of these tools should provide more relevant information and services to us than what we have today. Anyone who has sighed at the sight of yet another web ad for a product long since purchased or completely inappropriate to you understands that personalized commerce has a long way to go. That’s part of what the Age of Context technologies promise to provide.

ACTs in Security

ACTs role in commerce is one albeit essential application. They have the potential to power security services as well, specially authentication and identity-based approaches. We can combine data from two or more of these technologies to generate more accurate and timely risk assessments.

It doesn’t take the use of all five to make improvements. One firm have demonstrated that the correlation of just two data points is useful, it demonstrated that if you can show that a POS transaction took place in the same state as the cardholder’s location then you can improve risk assessment substantially. (based off of triangulated cell phone tower data).

Powerful questions of each technology that ACTs let us ask:

Data – What have I done in the past? Is there a pattern? How does that fit with what I’m doing now?

Geolocation – What building am I in? Is it where the transaction should be? Which direction am I going in or am I running away?

Mobile – Where does device typically operate? How’s the device configured? Is the current profile consistent with the past?

Sensors – Where am I standing? What am I looking at? Is this my typical walking gait? What is my heart rate and temperature?

Social – Am I a real person? Who am I connected to? What is their reputation?

Knowing just a fraction of the answers to these questions places the customer’s transaction origination, the profiles of the devices used to initiate that transaction and the merchant location into a precise context. The result should improve payment security.

More payments security firms are making use of data signals from non-payment sources, going beyond the traditional approach of assessing risk based primarily on payment data. One firm have added social data to improve fraud detection for ecommerce payment risk scoring. Another firm, calling its approach Social Biometrics, evaluates the authenticity of social profiles across multiple social networks including Facebook, Google+, LinkedIn, Twitter and email with the goal of identifying bogus profiles. These tools are of course attractive to ecommerce merchants and others employing social sign on to simplify site registration. That ability to ferret out bogus accounts supports payment fraud detection as well.

This triangulation of information is what creates notion of context. Apply it to security. If you can add the cardholder’s current location based on mobile GPS to the access device’s digital fingerprint to the payment card, to the time of the day when she typically shops, then the risk becomes negligible. Such precise contextual information could pave the way for the retirement of the distinction between card present and card-not-present transactions to generate a card-holder-present status to guide risk decision-making.

Sales First, Then Security

The use of ACT generated and derived signals will be based on the anticipated return for the investment. Merchants and financial institutions are more willing to pay to increase sales than pay for potential cost savings from security services. As a result, the ACTs will impact commerce decision making first-who to display an ad to, who to provide an incentive to.

New Combinations

Behind the scene, the impact of the ACTs on security will be fascinating and important to watch. From a privacy perspective, the use of the ACTs in security should prove less controversial because their application in security serves the individual, merchant and the community.

Determining the optimal mix of these tools will take time. How different are the risks for QR-code initiated transactions vs. a contactless NFC transaction? What’s the right set of tools to apply in that case? What sensor-generated data will prove useful? Is geolocation sufficient? Will we find social relationships to be strong predictor of payment risk or are these more relevant for lending? And what level of data sharing will the user allow-a question that grows in importance as data generation and consumption is shared more broadly and across organizational boundaries. It will be important for providers of security tools to identify the minimum data for the maximum result.

I expect the ACT’s to generate both a proliferation of tools to choose from and a period of intense competition. The ability to smoothly integrate these disparate tools sets will be a competitive differentiator because the difficulty of deployment for many merchants is as important as cost. Similar APIs would be a start.

Getting More from What We Already Have

The relying parties in a transaction – consumers, merchants, banks, suppliers – have acquired their own tools to manage those relationships. Multi-factor authentication is one tool kit. Banks, of course issue payment credentials that represent an account and proxy for the card holder herself at the point of sale or online. Financial institutions at account opening perform know your customer work to assure identity and lower risk.

Those siloed efforts are now entering an era where the federated exchange of this user and transactional data is becoming practical. Firms are building tools and the economic models to leverage these novel combinations of established attributes and ACT generated data.

The ACTs are already impacting the evolution of the payments security market. Payment security incumbents, choose just two from the social side, find themselves in an innovation rich period. Done well, society’s security posture could strengthen.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Payment Card Industry PCI Security, Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: big data, breaches, card data, cardholders, checkout lines, commerce, data loss, data sets, digital, ecommerce, geolocation, GPS, inherent security, Merchant's, Mobile Devices, mobile network, online activity, personally identifiable information, pii, POS, Security, security crisis, sensors, smartphone, social networks, transaction, transactional, travel patterns, vulnerabilities

January 29th, 2014 by Elma Jane

Ecommerce and mobile-based e-commerce have grown significantly this year. Cyber Monday ecommerce sales, as an example, reached $1.735 billion originating from desktop and laptop devices, according to comScore. Even Black Friday, which is better known for brick-and-mortar retail sales, saw online spending reach $1.198 billion in the United States, again according to comScore. Mobile online spending may also have grown, as some reports indicate that mobile-based site traffic was up 55 percent around Thanksgiving.

Many ecommerce merchants are enjoying a robust holiday selling season even as some brick-and-mortar stores are seeing relatively flat Christmas sales. To ensure continued growth and success, Internet retailers may want to challenge their businesses to improve in several areas in 2014.

Retailers, however, should not rest on their current success, but rather should challenge their businesses to improve in several areas, including free shipping offers, mobile optimization, personalization, data driven decision making, and cross channel sales.

Offer Free, Two-Day Shipping

The first challenge for online sellers in 2014 may be to find ways to offer free, two-day shipping to all or most shoppers. While it is likely there will still be minimum purchase and maximum weight requirements and restrictions, online shoppers are going to expect faster free shipping options thanks, in part, to the growth in services like Amazon Prime and ShopRunner.

Consider order fulfillment services, distributed warehouses, drop shipping, or even partnerships with other retailers to help meet this challenge.

Offer Personalization and Customization

Personalization and customization could be a significant competitive advantage in 2014.

Challenge your business to finally begin offering personalization and customization both onsite and in marketing. The easiest place to start may be with email marketing. Work to segment email marketing campaigns so that they address customers by name and with relevant products and offers that are based on an individual’s or group of shoppers’ stated preferences or on-site behavior.

Taking on this challenge means that the retailer’s marketing department will need to collect meaningful information about what interests shoppers and organize separate, custom campaigns around those interests.

Put Mobile Design and Marketing First

In November, IBM reported that mobile devices accounted for 31 percent of U.S. ecommerce-related web traffic around the Thanksgiving holiday this year, and that 17 percent of ecommerce transactions came from smartphones or tablets. On average, tablet users spent more than $126.00 per order, and smartphone users spent about $106 per order.

This data shows that mobile e commerce is not simply a novelty, but rather a must have for 2014.

If an e-commerce business is not optimized for mobile sales, 2014 is the year to take on that challenge, including offering a responsive design and mobile friendly payment options.

Sell Seamlessly Across Channels, Devices

Try to think of every way that a shopper might interact with an online store, and then make all of those touch points work together in 2014.

Retailers online or in physical stores need to offer shoppers a seamless, cross channel shopping experience that makes buying things easier for the customer. To continue to enjoy success in 2014, consider offering shoppers the ability to share orders across devices, applications, and even marketplaces.

In practice, this might mean that items added to a cart in an online store show up in the cart for the retailer’s iPhone app too. Or that a customer’s order history displayed on a retailer’s site shows orders placed on-site and via a marketplace like Amazon or eBay.

Use Big Data for Big Information

In 2014, find sources of good, usable Big Data, and put the resulting big information to use.

As an example consider, Weather Trends International, a Big Data company that uses historical weather information and advanced data processing to accurately predict weather 11 months in advance. This sort of Big Data information could show a snowboard and ski retailer what sort of winter major ski resorts are likely to have next year, and could inform purchasing and inventory choices.

Similarly, knowing that a particular region is going to have a warmer than normal July and August might impact how, where, and when a clothing retailer promotes shorts or bikinis on Facebook or AdWords.

Big Data is a popular trend in business and in marketing. The concept can mean different things to different businesses. For ecommerce, retailers should seek to use Big Data to gather big information, if you will, that may be used to make better buying and selling decisions.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: adwords, Amazon, big data, big information, brick and mortar, cross channel, cyber, drop shipping, e-commerce, ecommerce, Facebook, internet retailers, laptop devices, Mobile Devices, mobile friendly payment options, mobile optimization, mobile-based site, on-site, online, online shoppers, online store, onsite, personalization, retailers marketing, retailers online, shopping experience, smartphone, Smartphones, tablet, tablets

January 9th, 2014 by Elma Jane

Notably after the Japanese tsunami…the Hungarian Red Cross has used mobile technology to raise funds for disaster relief, but for the first time has enlisted social media in the process. The organization is running a Facebook campaign that lets smartphone users make instant donations to aid victims of Typhoon Haiyan in the Philippines.

The donations will pass through the MasterCard Mobile app that was developed by the Hungarian m-payments firm Cellum. The solution relies on QR codes. The method is available only in Hungary.

Process works like this:

Download the MasterCard Mobile app to your smartphone and register your bank card, then follow the steps to secure your personal data.

To donate, scan the QR code shared on Facebook with the built-in scanner of MasterCard Mobile. Transaction data are displayed on the screen to ensure the donation goes to the chosen cause.

The QR code contains a minimum sum, which can be increased.

Then press the send button to review and confirm transaction data.

The app then initiates the transaction, which you need to authorize by entering your mPIN.

You will receive feedback on the successful transaction, which can later be viewed in the transactions menu.

The donations will pass through Cellum’s system and quickly go to the Hungarian Red Cross’ account, which is dedicated to typhoon relief efforts.

Donations are a matter of impulse and that people who decide to give want to act quickly, chances are they don’t carry around a pen to put down a 24-digit bank account number on a piece of paper. By the time they get home and visit their online bank where they could transfer the money, they have already been distracted by a hundred other stimuli, so they end up sending nothing. Cellum’s solution is simple; whenever the impulse hits people, they probably have their phone at hand said Cellum spokesman Balazs Inotay.

Posted in e-commerce & m-commerce, Internet Payment Gateway, Medical Healthcare, Smartphone Tagged with: account number, authorize, confirm transaction data, Facebook, m-payments, MasterCard, mobile app, mobile technology, personal data, phone, PIN, process, qr codes, Red Cross, scanner, secure, smartphone, social media, solution, successful transaction, transfer

December 30th, 2013 by Elma Jane

Alternative Payments and Ecommerce Conversions

There’s no shortage of alternative payment choices: eBay’s PayPal, Google’s Wallet, Visa V.me, and MasterCard MasterPass, to name a few. There is also a proliferation of alternate contenders, as mobile shopping threatens to disrupt traditional methods of payments.

Alternative payment companies each claim that their payment method increases conversions. My company, SeeWhy, performed an independent analysis and confirmed these claims.

In this study data shows significant increases in conversion compared with credit cards, peaking at a 101 percent increase on smartphones.

But this is not the whole story. While these increases are impressive, they only applied to around 15 percent of traffic, so the impact on your site’s overall conversion rate will be much less. Depending on the characteristics of your site you will probably see somewhere in the region of 5 to 10 percent improvement in your site’s overall conversion rate, which is still significant enough not to be ignored. As mobile commerce grows, then alternative payments will become ever more important.

However, before embarking on an alternative payment implementation, there are three important considerations you need to take into account.

1. How Many Alternative Payment Methods?

Choosing only one alternative payment method might be tough, so why not implement several, and cover the market more thoroughly? This may be a valid approach, but think carefully before choosing this option.

For example, RunningShoes.com has implemented PayPal, Google Wallet, and MasterPass as alternative payment options.

The problem is that offering payment choices can create four different competing calls-to-action, as you can see. Whenever consumers are faced with too much choice, indecision tends to follow.

This is also problematic when you consider the whole page. There are lots of visual distractions to the primary call to action, which in this case is the red Secure Checkout button.

Before embarking on implementing multiple calls-to-action, consider how you are going to solve this issue. One route you could consider is to suppress the alternate payment methods for returning customers if the customer always pays by credit card, for example. Or if the customer always purchases by PayPal, show the PayPal button most prominently, and hide the others under a Show alternate methods of payment link.

2. How to Implement

Not all sites will see significant increases in conversion when implementing alternate payment methods. The main reason for this is that implementations can be done badly. One of the primary benefits of these payment methods is that they enable visitors to bypass the billing, shipping, and card entry steps on an ecommerce site. This is especially important for mobile sites, where entering these details using fingers and small screens defeats all but the most determined.

However, many sites implement these payment methods as an alternative only to entering the credit card number. You can see this here on Barnes and Noble ‘s site, where you are forced to enter shipping and billing information before being presented with the PayPal button. This may be a simpler implementation to do than providing an alternate checkout path, but it is frankly a waste of time, and surprisingly prevalent in PayPal implementations.

The correct method is to implement the alternative payment method as a button at the start of the checkout process, probably on the cart summary page. You can see a good example here of this at PacSun.com, an apparel site, but note the competing calls-to-action problem here as well.

PacSun deals with this slightly differently on mobile devices by not offering V.me. as a payment alternative. This avoids having a four choice vertical list of competing calls-to-action.

Alternative payments can undoubtedly result in higher conversions. However, to be effective they need to be implemented correctly to provide an alternative checkout flow, not simply a payment alternative to credit cards. This takes more effort to implement, but it is worth it. Implementing one payment method properly is a better route than superficially implementing multiple payment methods. This is especially true for mobile sales where the goal is to eliminate data entry as much as possible and alternate payments can do this very effectively. As mobile commerce becomes more important, so will alternative payments, for all merchants.

3. Which Payment Method?

Since there are multiple choices, the obvious route is to adopt PayPal. PayPal claims over 30 million U.S. mobile customers, and over a 100 million active accounts…which is a larger base than any of its competitors. SeeWhy found that 34 percent of U.S. consumers shopping online had PayPal accounts as of July 2013.

However, PayPal also carries some baggage. Having grown up as a payment method of choice for eBay, its reputation is not always considered positive. Some consumers are wary about PayPal, having had negative experiences in the past, probably with smaller merchants on eBay. In fact, according to SeeWhy’s analysis, two thirds of PayPal account holders state that their preferred payment method is a credit card.

Merchants selling luxury items might want to consider alternatives before implementing PayPal because of its reputation issues. Google Wallet is an alternative that is growing fast in part because of the growth of Android smartphones where a Google Wallet account is required to use the Play store, the Android equivalent of the app store. Google Wallet can also be linked to Google+ social sign on, so if you are considering implementing social sign on as well this might be a route to consider.

Both Visa’s V.me and MasterCard’s MasterPass both hold significant potential but the companies are only just beginning to roll out their service. It’s also worth noting that both Visa and MasterCard are rolling out their services through the acquiring banks. This will cause a proliferation of payment choices, leading to complexity and confusion for the shopper. You can see this already with MasterPass where having selected the Buy with MasterPass option, you are then presented with an array of different MasterPass wallets to choose from. Currently there are only six options, but what happens when there are hundreds?

Posted in e-commerce & m-commerce, Electronic Payments, Mobile Payments, Smartphone Tagged with: billing, calls-to-action, card entry, checkout, conversion, credit cards, e-commerce, ebay, ecommerce, electronic, google, MasterCard, masterpass, mobile commerce, mobile sales, mobile shopping, payments, PayPal, process, screens, shipping, smartphone, visa, wallet

December 16th, 2013 by Elma Jane

1. Account Updater (Visa)

Incorrect billing information leads to declined credit cards, loss of sales and unhappy customers.

Visa touts its Account Updater as an easier way to keep customer data current. The tool appends all card data with up-to-date customer info so businesses can avoid difficulties over address changes, name changes, expired cards and more.

The tool can benefit any business that bills customers on a recurring basis.

It eliminates the need for manual administration, so it can lower your business’s operational costs and customer-service expenses. And by saving your clients the hassle of a declined payment, you can boost customer satisfaction and overall sales.

2. Netswipe

Paying online is convenient for customers, but keying in an unwieldy credit card number is still a pain.

Netswipe from Jumio gives customers an easier way: The tool lets users pay by snapping a photo of their credit card; it’s almost as easy as swiping your card through a traditional card reader.

According to Jumio, customers can use their smartphone or tablet to scan a card in as little as 5 seconds, whereas traditional key entry takes 60 seconds or more, on average. Having a quick and convenient way to pay could help contribute to a positive buying experience and encourage repeat business.

The system is compatible with any iOS or Android mobile device, as well as with any computer with a webcam.

3. Netverify

Jumio’s fraud-scrubbing tool helps you determine if your customers are who they say they are.

Net verify allows customers to snap a picture of their driver’s license or other identification using a smartphone, tablet or PC webcam. Once the image is taken, the tool can verify the authenticity of the documentation in as little as 60 seconds.

That’s much faster and more convenient than asking a customer to fax or mail a copy of their ID in the middle of a transaction.

The tool can verify identifying documents from more than 60 countries…including passports, ID cards and driver’s licenses, and even bank statements and utility bills. Jumio says its software is smart enough to automatically reject nonauthentic documents.

And customers can rest easy knowing that all submitted information is protected with 256-bit encryption to prevent identity theft.

Online merchants embed Netverify into their websites as part of the checkout process.

4. Payment Gateway

Payment Gateway service does all the heavy lifting of routing and managing credit card transactions online.

Portals like this one benefit small businesses by providing a fast and secure transmission of credit card data between your website and the major payment networks. It works a lot like a traditional credit card reader, but uses the Internet to process transactions instead of a phone line.

Payment Gateway also offers built-in fraud-prevention tools and supports a range of payment options, including all major credit cards and debit cards.

5. PayPal Here

Mobile credit card processing services like PayPal Here make it easy to accept credit cards in person using a smartphone or tablet.

PayPal Here and other similar services send you a dongle that attaches directly to your iPhone, iPad or Android device, allowing you to swipe physical credit cards wherever you are.

One major benefit of mobile credit card readers is that they work with the devices you already own. That means there’s no need to carry around additional hardware, aside from the reader add-on itself. Most credit card readers attach to your device via the headphone jack or charger port, and are small enough to fit in your pocket.

The smallest businesses have the most to gain by opting for mobile credit card readers, which are cheaper and far more portable than traditional options.

6. Virtual Terminal

If you do business online, your website needs the infrastructure to accept credit card information.

Web-based applications like virtual terminal offer the basic processing functionality of a physical point-of-sale system, and are easy to install on your business’s website.

The system allows merchants to collect orders straight from the Web, or take orders via phone or mail and before initiating card authorizations online.

It also includes extensive transaction history to help you manage payment data, split shipments, back orders and reversals. Business owners can even receive a daily email report of all credit card transaction activity from the prior day.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, e-commerce & m-commerce, Electronic Payments, EMV EuroPay MasterCard Visa, Gift & Loyalty Card Processing, Mail Order Telephone Order, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: account, Android, authenticity, card data, card reader, checkout, checkout process, credit card number, credit card transactions, debit cards, declined payment, expired, fraud, id, iOS, mail, mobile device, nonauthentic, online, online merchants, passports, payment data, payment gateway, payment options, phone, point of sale, recurring, smartphone, tablet, verify, visa, webcam

December 12th, 2013 by Elma Jane

A new study reveals that a staggering 68% of smartphone owners plan to use their devices to assist with their holiday shopping this year. According to Deloitte’s 28th annual survey of holiday spending intentions and trends, 56% of smartphone owners plan to use their phones to search for store locations. 54% will compare prices with their phones and 47% expect to use their phones to learn more about the products they wish to purchase.

The survey showed smartphone shoppers plan to spend 27% more on holiday gifts than non-mobile shoppers. Smartphone ownership has skyrocketed in 2013, rising from 42% last year to 61%, a change that is sure to influence the biggest buying season of the year.

The study also showed 38% of the consumers in the survey owned a tablet. 63% of those tablet owners will use their devices for holiday shopping this year. “Tablets are a two-way street for retailers. They have opened up an entirely new consumer touchpoint, where shoppers can view multiple retailers’ products regardless of their location…from their couch to the point of purchase. Retailers can also put tablets to work in their stores, providing both their sales team and customers with a broader lens into merchandise selection,” said Alison Paul, a vice chairman of Deloitte LLP retail & distribution. Now that the majority of consumers also own smartphones, these two devices have altered the way they interact with a brand, while also yielding a higher spend per customer.

Posted in Electronic Payments, Mobile Payments, Near Field Communication, Smartphone Tagged with: devices, merchandise, phones, retailers, shoppers, shopping, smartphone, tablet, touchpoint