November 22nd, 2013 by Admin

As we move to smartphones and tablets as payment methods security and privacy concerns are a real issue. With recent NSA leaks shedding light on our data and the access others have to it, we have to consider security, privacy and health implications. This year alone e-commerce transactions on smartphones and tablets during the holiday season are set to grow by 15%. Although tablets, not smartphones will drive the bulk of that growth, smartphones are set to overtake mobile-commerce payments over the next 5 years. Tablet payments in the U.S. alone are expecting to reach $26 billion in transactions. Currently tablets are more convenient for m-commerce due to their size, but as far as the future of electronic payment processing, smartphones are where it’s at.

The smart merchant sees this coming and realizes frictionless transactions increase sales. The more comfortable and less complicated a transaction is for a customer, the better. Smartphones, tablets, PCs, laptops and more can already process electronic transactions from credit and debit cards, gift cards, electronic checks and more. Money movement is easier than ever and more convenient than cash. Cash is king however in situations where internet connectivity and power are an issue. In India for example, a poor electric grid makes power outages a common occurrence. During natural disasters, when resources are badly needed, power outages or severed internet communications mean no electronic transactions can be processed. So physical currency remains a must, in the future we may see payment technology evolve to where digital money like crypto currency (BitCoin) may be stored on the device itself similar to having cash. As these electronic payment systems evolve, merchants need to position themselves to accept what their market prefers to transact with.

The smart citizen also sees this coming and has concerns that things like a National ID program being established may compromise their privacy.

As an extreme example of electronic transactions, a nightclub in Spain used subdermally implanted RFID chips in a woman that allowed patrons to pay for food and beverages without a credit card.

Posted in e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Merchant Services Account, Near Field Communication, Smartphone Tagged with: bitcoin, cash, connectivity, credit, crypto currency, currency, debit cards, digital money, e-commerce, electronic, electronic checks, frictionless, Gift Cards, health, internet, laptops, leaks, m-commerce, Merchant's, mobile-commerce payments, money, national id, nsa, pay, payment methods, payment processing, PCs, privacy, processed, RFID, Security, smartphone, tablets, technology, transact, transactions

November 19th, 2013 by Elma Jane

ISIS Electronic Wallet

Available Nationwide Isis Mobile Wallet

Latest version of the Isis Mobile Wallet has been announced. This is now available to consumers for download in the Google Play app store and at thousands of AT&T, T-Mobile and Verizon Wireless retail stores nationwide. Isis Mobile Wallet allows customers to pay at contactless payment terminals, and to save money through special offers and loyalty cards at participating merchants – all from their Isis Ready smartphone.

Today’s Isis Mobile Wallet nationwide launch is a milestone for consumers, merchants and banks. It’s the start of a smarter way to pay.

Together with Isis partners, a seamless mobile commerce experience have been built. Isis pleased to bring the magic and simplicity of the Isis Mobile Wallet to consumers across the U.S.

The redesigned Isis Mobile Wallet features a simplified user interface with a clean, white background and easy-to-navigate toolbars. Starting today, customers with one of the more than 40 Isis Ready smartphones available from AT&T, T-Mobile or Verizon Wireless can receive a free enhanced SIM card from their wireless carrier and download the Isis Mobile Wallet for free from Google Play. Integration with American Express Serve makes it convenient for Isis Mobile Wallet users to load funds to their American Express Serve Account from a U.S. debit or credit card, bank account, or through direct deposit, as well as pay bills online and send money to friends and family using an American Express Serve Account.

Posted in Digital Wallet Privacy, Electronic Payments, Mobile Payments, Near Field Communication, Smartphone, Visa MasterCard American Express Tagged with: American Express, AT&T, banks, bills, carrier, contactless, debit or credit, google, interface, ISIS, loyalty cards, Merchant's, mobile wallet, online, payment terminal, play app, smartphone, T-Mobile, Verizon, wireless

October 24th, 2013 by Elma Jane

Reflecting recent research that concludes mobile payment adoption remains low, Total System Services Inc. (TSYS) issued results from a survey that confirm consumers prefer banking applications other than payments for their mobile devices.

While reinforcing the dominance of debit and credit cards as payment mechanisms, the TSYS 2013 Consumer Payment Choice Study revealed that mobile devices are used as a tool for ancillary financial services, such as checking account balances and accessing discounts and rewards.

“For now, the hype largely remains hope for mobile from a payments standpoint,” the survey said. “On a relative basis, consumers would overwhelmingly prefer to have the ability to use their smartphone to monitor transaction activity or prevent fraud versus using their mobile phone as a form factor in a transaction.”

Columbus, Georgia-based processor TSYS found in its third annual survey that, out of 1,000 consumers surveyed online in the summer of 2013, 40 percent of respondents were interested in using mobile devices to instantly stop illegitimate transactions. Additionally, 37 percent indicated that the ability to view in real-time the transactions made with debit and credit cards was also an important feature.

Receiving instant offers and promotions from stores being visited (33 percent); temporarily blocking and unblocking purchases using certain bankcards (29 percent); and paying for purchases using reward/loyalty points (28 percent) rounded out the top payment-related uses for smartphones.

At the bottom of the scale was to pay for purchases with mobile wallets (25 percent) and to use credit or debit card-funded prepaid accounts for the same purpose (22 percent). “Industry observers regard mobile payments as an assumed eventuality,” TSYS stated. “Our survey results indicate that consumers are presently more interested in increased non-payment functionality on their mobile device.”

But the processor remains optimistic about the promise of mobile payments. “We believe that as the infrastructure matures and the ability to use mobile payments becomes more widespread, this trend will change,” TSYS said.

Prepaid undermarketed?

In addressing the role of prepaid cards in the payment mix, TSYS expressed surprise that prepaid cards are apparently not being marketed aggressively by financial institutions. The processor noted that major banks jumped into the prepaid card industry in 2012 to offer general-purpose reloadable (GPR) prepaid cards as checking account alternatives.

But TSYS found that just over 10 percent of survey respondents indicated they had received GPR card offers from their banks. TSYS attributed that low percentage to the fact that the survey respondents were by default credit and debit card users, while GPR cards are primarily targeted to individuals without access to credit or debit cards.

Regardless, survey respondents aged 35 and younger accounted for 64 percent of those who had received such offers. “It could be that the younger demographic on average represents a less profitable checking relationship for banks, or that banks perceive them to be more receptive to the offering,” TSYS said.

Steady goes debit and credit

Consumer payment preferences in 2013 remain relatively unchanged from previous years, according to TSYS. Debit still trumps credit as the preferred payment instrument overall, with both methods being favored by every eight of 10 survey respondents. Debit is still the clear winner when it comes to supermarket shopping and gas purchasing, while credit is preferred when dining out and shopping in department stores. But when it comes to fast food cravings, cash is still king.

On the opposite end of the spectrum, and also consistent with TSYS’ 2012 report, only 11 percent of respondents said being able to set up text message alerts for account balances and transactions was most valuable, and a mere 6 percent valued the ability to register payment cards in mobile wallets.

However, credit tops debit for online purchases, TSYS said. Further of note is that PayPal Inc.’s digital wallet service rivals debit online, with both payment methods favored by roughly one-fifth of respondents. But for small-dollar purchases, like coffee and donuts, cash remains the preferred payment vehicle, despite innovative mobile schemes offered by companies like Starbucks and Dunkin’ Donuts.

Posted in Credit card Processing, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Mail Order Telephone Order, Merchant Services Account, Mobile Payments, Smartphone Tagged with: account, adoption, applications, banking, checking, consumers, credit cards, debit, devices, discounts, financial services, form factor, general-purpose, gpr, infrastructure, low percentage, mechanisms, mobile, mobile wallets, non-payment, offers, online, payment, payment related, phone, prepaid, processor, profitable, promotions, real-time, reloadable, reward/loyalty, rewards, smartphone, transaction, tsys

October 22nd, 2013 by Elma Jane

The best place to start understanding your customer is to put yourself into every step of a buying cycle and analyze what influences various purchase decisions.

Who is your customer?

Basic demographics and usually includes the following:

Age range Education level Gender Income level Location Marital status Profession

Many of these basic demographics can be inferred from your interactions with customers. In many cases, you can simply ask them.

Beyond the basics, you will also benefit from more personal data, such as the following:

Interests Activities Political affiliation

That data is harder to access, but there are databases that will allow you to target individuals based on those criteria. Facebook’s ad platform provides an incredible amount of targeting data. You can infer your customer profiles by the types of results you get by running ads aimed at specific target markets. That will help identify the interests of your customers.

What? consider what consumers need to know about a product to make a purchase.

Are there ongoing costs? Does it need anything else to make it work? How big is it? How does it function? How long will it last? How much does it cost? Is there a warranty? What are its specs? What does it look like? What options are there? What sizes and colors are available?

To find those details, shoppers will seek different sources: articles, websites, blogs, and actually looking at products and trying them on. Make sure you understand the “what” questions for your products. Then, provide answers to those questions.

Why? The “why” questions are important. Do you know why your customers buy your products?

It could be for the following reasons.

Address an immediate need or desire. Loyal to a particular brand or store. Need flexibility to return products. Need product occasionally or on a regular schedule. Purchase because product is cool or trendy. Seek bargains. Seek high-quality products Seek little or no shipping or sales tax. Seek the lowest price possible. Shop around every time they buy.

Answers will surely vary. Consider also, what motivates your customers to purchase the products you sell and also why they purchase them from your company versus your competitor. This will help you better refine your value proposition of why shoppers choose your company.

How? This area is the most significant change in a consumer’s shopping cycle. As recently as 15 years ago, most product research was done in stores or catalogs or magazines. Today, product research is done in many ways. In the living room, in the boardroom, at the hospital, you name it. Most shoppers start their search at Amazon.com or on Google by searching on a product.

Many searches start with an opportunistic email promoting a product. From there, we may find the shopper looking at the item on that store’s website.

Consumers likely check product reviews, from other consumers. They may read professional reviews. Browse the Internet on SmartPhone.

The point is to understand your customer’s research process. It will vary widely. But in many cases it’s something like this.

An event triggers an interest in a product. Check other brands or alternative products. Conduct research by looking at a product’s pictures, reading descriptions. Evaluate the product’s real value, and eventually make a purchase decision. Narrow your selection and shop for price. Seek out reviews or ask friends.

Where? That leads us to the where customers are researching. They could be reading relevant blogs, going to brick and mortar stores, checking comparison shopping engines, and reading trade publication articles. They may be looking at Pinterest boards, Facebook posts, and checking with their network of friends on Twitter.

They will be using tablets (increasingly the shopper’s preference), smartphones, laptops, desktops, Xboxes, and store visits.

Can an ecommerce merchant be in all of these places with your message? Likely no. But you can identify where your customers are looking for information as they move through their cycle and try to make sure you are seen. You can also ensure that your messaging and content are mobile friendly.

To compete in the future, your store needs to provide input and information to support all those steps. If you lack reviews, your customers will seek them out elsewhere.

Most ecommerce merchants can describe their customers in a general way. They likely know basic demographics – age range, gender, income level. But, do they understand the “why, where, when, and how” their customers make their purchases? These basic tenants of marketing are more important than ever.

The buying process has never been more complex. Consumers have hundred of places online to purchase products that meet their needs. They may shop at home, at work, in the grocery store. They may be using an Android phone, an iPhone, or an Xbox.

Posted in e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: alternative, Android, brick and mortar, comparison, competitor, consumers, content, costs, customers, cycle, data, databases, desktops, ecommerce, Facebook's, flexibility, Iphone, laptops, leads, Merchant's, mobile, ongoing, online, phone, pinterest, platform, price, product, profiles, purchase, selection, shop, shoppers, smartphone, store's, tablets, target, trigger, value, websites, xbox

October 15th, 2013 by Elma Jane

Banking and payments technology provider FIS and City National Bank, a private and business bank, have partnered to pilot FIS’s Cardless Cash Access at City National ATMs in Los Angeles, New York City and San Francisco. The solution lets consumers stage an ATM transaction from their mobile devices.

City National plans to introduce the emerging technology to clients in its three largest markets early next year, according to an FIS announcement, continuing FIS’ rollout of the solution at banks and ATMs in key U.S. locations.

FIS said Cardless Cash Access securely authenticates a user on his or her smartphone. The consumer then uses the phone to select the account and amount of the withdrawal. At the ATM, the consumer scans a QR code on the ATM screen and, within seconds, the cash is dispensed and an e-receipt is sent to the phone.

Consumers continue to look for innovative new ways to engage with their financial institutions via mobile devices, FIS Mobile, said in the release. At the same time, they demand additional security to keep their information safe. Information from Cardless Cash Access is maintained in the cloud, so card data cannot be accessed if the consumer’s phone is lost or stolen – making this a faster, safer, more secure way to make a withdrawal.”

To decrease fraud, FIS said, security within Cardless Cash Access is provided through the app’s authentication and registration of a user’s smartphone, which the company said eliminates card skimming risk and fraud incidents for banks and their clients.

With the proliferation of debit and access to cash at the point of sale, financial institutions are looking for ways to expand the utility of the ATM,” Senior vice president and head of product strategies, Vince Hruska, City National Bank, said in the release. “Cardless Cash Access not only provides a secure and easy way to obtain cash from an ATM, but introduces to the client a new way of looking at ATM use.

Posted in Financial Services Tagged with: account, amount, atm, authenticates, banking, banks, card, cardless, cash, data, e-receipt, emerging, financial, Mobile Devices, national, payments, QR code, securely, Security, Skimming, smartphone, transaction

October 3rd, 2013 by Admin

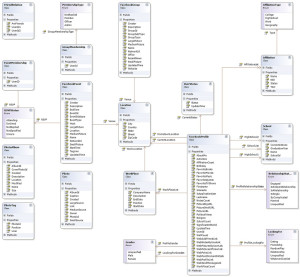

When managing a business nothing helps more than raw data. Storing that data in a database makes it infinitely more flexible and accessible. A database is an application that efficiently and effectively stores and retrieves data as well as ties that data to other data. Many large scale accounting applications like QuickBooks, PeachTree and many other titles store all their information in some form of a database.

Tables are like spreadsheets. Rows and columns group together data in an organized manner. Databases can have many tables with many columns or just a few. Relational databases like SQL database engines link tables together using what are known as primary and foreign keys. So in the example of an invoice the Customer table has a Primary key uniquely identifying a specific customer from the rest of all of the customers. The Invoice table stores a foreign key in its table so the match between customer id’s links the two tables. The invoices themselves also have a primary key so that there can be many invoices for the same customer. These concepts are actually born of a mathematics branch known as Algebra.

Data at its most basic level is a specific bit of information. Like the number 19 or a specific date and/or time. A database holds these bits of data and an application built to interact with a database is used to generate information from the data. A clearer example is the invoice. An invoice has quantities, part numbers, serial numbers, account numbers, dates and even totals which are not stored in the database but are calculated each time the invoice is accessed. Invoices bring many bits of data to a single entity most commonly referred to as a report. Looking at a common invoice explains a transaction with the details stored in many tables all tying back to a single transaction.

Database servers run a service that can be connected over connections on a local area network or over the internet to allow applications on different computers access to data simultaneously. Many websites like Facebook, NASA and even Google make extended use of databases to supply services to millions of users concurrently. Whether it’s over the internet or across a physical office space, a database can be the heart of a businesses information technology.

SQL databases conform to an industry standardized set of functionality so that complex queries can be performed without knowing the underlying technical architecture.

Open Source

Open Source is usually associated with applications that are free to download, distribute and modify. Many times open source applications are developed by a community of developers over the internet that take feature suggestions from the user community and build them into the application. Open source applications tend to follow one of several ‘licenses’ like the GPL or General Public License to make sure the program is unmolested or incorporated into a proprietary software trying to take credit for the programming code.

There are many examples of open source titles here.

http://directory.fsf.org/wiki/All

https://en.wikipedia.org/wiki/List_of_free_and_open-source_software_packages

Open Source Databases

One aspect of open source known as LAMP has become wildly popular as the internet has matured. Lamp stands for Linux, the operating system, Apache, the web server component, MySQL, a wildly popular free and open database engine and the P stands for Perl, Python or PHP the three most popular languages of backend programming. Combining these components provides a very fertile ground for developing Web Applications that can be served across an office or the world. Many sites like Google and WordPress take full advantage of these technology to create feature rich applications that run in a web browser but work like a traditional desktop application like Microsoft Word. Being open source allows anyone to build on top of or out of the offering. This means you can customize the programming of any of these applications to best fit your particular style or way of doing business. This is a huge time saver for any small business.

Some common examples of open source applications that utilize Lamp architecture are listed below:

SugarCRM – A contact and lead management system to manage a sales force.

WordPress – The most popular blogging application on the internet.

OpenCart – An extremely flexible shopping cart software.

GNUCash – A full fledged accounting program.

Mobile Devices

Today we have smartphones and tablets that have web browsers built in and available for each platform. Using new techniques known as adaptive or responsive web layouts, information on a page automatically transform a web page to smaller displays. So any page can be designed once and displayed on a desktop browser, a tablet browser or a mobile phone browser. This allows web designers to best optimize the content for smaller displays while leaving the pages viewed on a desktop for a larger view. Using responsive design techniques your business data can even extend to mobile devices like iPhones and Android or Blackberry phones and tablets. The potential is huge for your business.

Posted in Best Practices for Merchants, Point of Sale Tagged with: Android, bits, blackberry, data, database, e-commerce, information technology, Iphone, MySQL, open source, relational, shopping cart, smartphone, SQL, tablet

September 27th, 2013 by Elma Jane

Mobile Payment Bandwagon

Just this month, September 2013, a number of British retailers announced their partnership with smartphone payment application Zapp, expected to launch summer 2014. Long before that, in November 2012, global coffee chain Starbucks launched a mobile payment system using Square Wallet, allowing customers to pay for their coffees with a simple scan of their smartphone. In China, the mobile payment market tripled in size over the last year, with a growing number of retailers jumping aboard the e-payments trend. Clearly, mobile payments are the new face of commerce…both for consumers and, increasingly, within a B2B setting as well. It may not be long until every type of payment…from mortgages and business loans to utilities bills and income tax…is made through mobiles.

Though it’s a trend that’s now spreading across the globe, the rise of mobile payments can be directly traced back to Africa. It’s an example of how unique conditions give rise to innovative solutions, and how those innovations catch on. Here’s a brief look at the rise of mobile payment technology and at the role Africa has played in its success.

Africa Gets There First – this notion of exchanging funds through a mobile phone really took off in Africa. When M-Pesa was launched by Safaricom in Kenya in 2007, it was a simple solution to issues specific to the region. Kenyans who lived far from banks or couldn’t afford banking fees were given the opportunity to send and receive payments through SMS messages. M-Pesa answered these specific problems, but the concept behind the service has proven to have a far broader reach. After achieving success in Kenya, M-Pesa launched in Tanzania in 2008. Despite getting off to a slow start, the mobile payment services now has 5 million Tanzanian subscribers. It has also launched in South Africa, Afghanistan, India and there’s plans to roll it out in Egypt at some point in 2013.

At the heart of M-Pesa’s success has been efficiency and security. Removing the need to travel to a bank…or even the need to log into online banking…has made the process of transferring funds far easier and faster. Eliminating the need to write a cheque, use cash or enter credit card details has made the process far more secure. Increased efficiency and improved security are qualities that everyone…not just those in the developing world…stands to benefit from.

Thus, though today’s technology has adapted and built upon the M-Pesa model, the world still has Africa…Kenya in particular…to thank for starting the mobile payment revolution.

Posted in Financial Services, Mobile Payments, Smartphone Tagged with: banking, broader, credit card, e-payments, efficiency, fees, global, innovations, innovative, messages, mobile, payment, retailers, Security, services, smartphone, sms, solution, travel

September 26th, 2013 by Elma Jane

With revamped iPhone app Travelocity rethinks smartphone bookings

To accommodate for the more gesture-based features in Apple’s new iOS 7, Travelocity rebuilt its iPhone application from the ground up. The online travel agency’s new app is aimed at moving users through the booking process quicker with more visuals. Travelocity has been streamlining all parts of the trip-planning experience with its mobile apps continuously in the past few years.

“Luckily, we have a great, agile team and some top-notch mobile designers, so we were able to dive into the new design as soon as the beta was released. “We also decided early on to rebuild this version from scratch and really work on making it fast and reliable,” said Blake Clark, director of mobile for Travelocity. “We find mobile travelers demand speed and sometimes they’re in less-than stellar connection areas, so that was a big one.”

Streamlined design

Tavelocity updated its iPhone app with a design that highly plays up images and visuals. The app’s home screen shows photos of world cities to inspire consumers to take a last-minute trip. The app also leverages the new AirDrop feature of iOS 7 to let consumers securely share their travel information with friends and family members after they book a hotel.

The new app includes a feature that lets consumers scan their credit cards with a built-in camera feature to cut down on the number of steps that it takes consumers to check out. The technology detects the number on a credit card and automatically fills in portions of the checkout page. The app also highlights Travelocity’s mobile-exclusive offers that take into account a user’s location to serve up relevant offers and deals.

Travel on mobile

Travelocity has been building up its mobile strategy for quite some time with different mobile products and ad campaigns. Most recently, the brand designed its Web site around responsive design, which led to a 6 percent increase in iOS bookings and an 8 percent jump for Android reservations after two month.

Travelocity’s tablet booking experience was also named the best this spring in a study from Mobivity.

Travelocity is the latest example of how iOS 7 has shifted the way that marketers develop mobile apps with more gesture- and touch-based features. “It’s a shift of how Apple customers interact with their devices, and as a leader in the travel space, we wanted to make sure we’re reducing the amount of friction travelers have when booking a trip.” “With the iOS 7 launch, now our app and the device look, work and feel the same; it’s seamless.” Mr. Clark said.

“Travelers can easily access the deep selection and great value Travelocity is known for. Travelocity’s goal – to be a traveler’s trusted companion before, during and after the travel experience.”

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Near Field Communication, Travel Agency Agents Tagged with: agencies, agency, agency's, agent, app, booking, iOS, ios7, Iphone, mobile, smartphone, travel, travelocity

September 26th, 2013 by Elma Jane

Mobile checkout integrated into transportation ticketing app by Barclay’s Pingit

Barclay’s Pingit mobile payments service is teaming up with Corethree to bring the financial institution’s mobile checkout to public transportation customers in Britain.

Corethree offers a mobile wallet for transport ticketing in Britain. By including Barclays Pingit in its wallet, Corethree can offer users more flexibility in how they pay for tickets.

“Providing a variety of native payment solutions within the application enhances the customer experience by allowing them the same type of purchasing experience that they currently enjoy from their favorite websites and ecommerce sites.”

“In the U.S. this includes integrating with payment option like PayPal and eventually electronic wallet providers as well.”

Mobile checkout

Pingit was introduced in early 2012, enabling users to make person-to-person payments.

The app’s breadth of services have been expanded several times since to include mobile payments from NFC tags and mobile checkout for Web sites and print ads.

Corethree reports that it is the first business to integrate Barclays Pingit mobile checkout, enabling bus passengers to browse, select, purchase and use bus tickets from their mobile devices.

Over the next 12 months, Corethree and Barclays will roll out their mobile payment services to other transport operators, with the goal of reaching up to 1 million passenger journeys per day.

The service will be available via Android and iPhone devices on any mobile network.

Mobile payments entry

Public transportation organizations around the world are embracing mobile ticketing to make it easy for riders to purchase and use tickets from their smartphones. Enabling users to purchase transit tickets anywhere at any time that can be used. Last year, the Massachusetts Bay Transportation Authority rolled out a new mobile ticketing service, giving commuters a way to purchase and display rail tickets on their smartphones.

“Transit is an integral part of consumers’ daily lives, and as such providing consumers with a secure way to pay with their phone and not have to carry cash or exact change is a great starting point for people to get comfortable using mobile payments.”

“Mobile ticketing is a great way to introduce customers to making payments from their mobile device.”

Posted in Credit card Processing, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale, Travel Agency Agents Tagged with: checkout, devices, electronic wallet, integrating, Iphone, mobile, nfc, payment, payments service, smartphone, Tags, ticket, ticketing, tickets, transportation, travel

August 6th, 2013 by Admin

In Canada, the game to corner mobile payment systems and the Digital Wallet is being played seriously. PayPal and Square are present but the 800 pound gorilla may have just entered the ring. Canadian banks are presenting merchant accounts capable of handling tap to pay transactions competing directly with Square and PayPal. Royal Bank of Canada has launched a mobile payment solution to provide contactless payment using Near Field Communication (NFC) enabled smartphones and tablets. Shoppers can simply wave their smartphone over a cash register or payment terminal and be on their way. No more swiping a credit card into a terminal or punching keys into a terminal and no more fumbling with cash or coins to settle a payment. Read more of this article »

Posted in Credit card Processing Tagged with: bank, bankers, blackberry, Canada, Canadian, Canadian travel agency agents, digital, electronic, financial services, ipad, Iphone, mobile, nfc, payments, PayPal, Rogers Communications, Royal Bank, smartphone, Square, tablet, travel