January 17th, 2023 by Admin

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Posted in Mobile Payments Tagged with: bluetooth, Chip and PIN, EMV, gift Card, Mobile Payments, MPOS, nfc, PayPal, QR Code Payments, retailers, smartphone, Square, tablet, Tap to Pay

June 19th, 2014 by Elma Jane

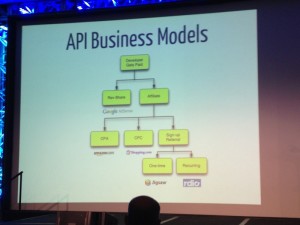

API Software Inc. has created an application ISOs can use to help merchants tabulate the best payment services deals. The Square Deal Pro app for the merchant services industry enables sales reps to compare their company’s rates to those of Square, PayPal, Stripe and other payments aggregators. Essentially, the application takes the mathematics burden off of the merchant and helps an ISO or agent compare bundled pricing with interchange-plus pricing.

Frank Haggar, a software developer, started asking merchants why they chose a certain provider and they just said the pricing was simpler. It might be more expensive, but it was easier for them to understand. That moved to develop Square Deal Pro. It’s a software that salespeople can have right on their phones and it makes a comparison and is easy to understand. Square Deal Pro, which operates on iPhones, Android devices and Windows phones, was established as a vendor-neutral tool that is also available for merchants to download if they were inclined to want to crunch numbers themselves. Service providers pay for the application and all of its sales features, but a free version for price comparisons only is available to merchants.

Merchants are experts in what they know how to do and they may not want something that includes math distracting them from that, but the sales rep can do it for them and use it along the lines of a calculator helping someone figure out mortgage rates. ISOs have various tools at their disposal and lock in key information in their brains to prepare for sales presentations, but most will likely find Square Deal Pro a valuable addition. Something that takes complicated pricing schemes and factors it all into an easy interface that puts out a clear comparison that is valuable, certainly out in the field.

API Software has to deliver something difficult or impossible to copy because that would set this permanently apart as opposed to being a lead to other similar products in the market. An ISO can change rates or make adjustments for a client if the numbers show that another provider is offering a less expensive option, but the numbers in the app don’t lie. The app will show how a bundled rate can work in your favor, such as if you are selling Girl Scouts cookies at $3 a box. Then use Square all day long, but an ISO can compare how his product works compared to others and the app can show, that at a certain time, it might be beneficial to switch over.

Square Deal Pro takes into account factors other than interchange rates, including merchant volume, average ticket price and whether transactions are keyed or swiped or both. All of those things determine where you fit in on the diagram of how your rate should be structured. There is a lot of analysis on minimal focal points. The application may also help defuse potential problems with merchants who sometimes feel their sales rep was not providing a fair assessment of pricing structure or comparisons.

As for the application’s name, Haggar doesn’t want any confusion over whether this might be a new Square product.

Posted in Best Practices for Merchants Tagged with: account, aggregators, Android, assessment, bundled pricing, developer, devices, interchange, interchange rates, interchange-plus pricing, iPhones, ISOs, market, merchant services, merchant volume, Merchant's, mortgage rates, payment, PayPal, phones, pricing, Pro app, products, provider, Rates, sales, Service providers, software, Square, Square Deal Pro app, Stripe, transactions, Windows phones

May 21st, 2014 by Elma Jane

Mobile credit card processing is way cheaper than traditional point-of-sale (POS) systems. Accepting credit cards using mobile devices is stressful, not to mention a hassle to set up and customers would never dare compromise security by saving or swiping their credit cards on a mobile device. Some of the many myths surrounding mobile payments, which allow merchants to process credit card payments using smartphones and tablets. Merchants process payments using a physical credit card reader attached to a mobile device or by scanning previously stored credit card information from a mobile app, as is the case with mobile wallets. Benefits include convenience, a streamlined POS system and access to a breadth of business opportunities based on collected consumer data. Nevertheless, mobile payments as a whole remains a hotly debated topic among retailers, customers and industry experts alike.

Although mobile payment adoption has been slow, consumers are steadily shifting their preferences as an increasing number of merchants implement mobile payment technologies (made easier and more accessible by major mobile payment players such as Square and PayPal). To stay competitive, it’s more important than ever for small businesses to stay current and understand where mobile payment technology is heading.

If you’re considering adopting mobile payments or are simply curious about the technology, here are mobile payment myths that you may have heard, but are completely untrue.

All rates are conveniently the same. Thanks to the marketing of big players like Square and PayPal – which are not actually credit card processors, but aggregators rates can vary widely and significantly. For instance, consider that the average debit rate is 1.35 percent. Square’s is 2.75 percent and PayPal Here’s is 2.7 percent, so customers will have to pay an additional 1.41 percent and 1.35 percent, respectively, using these two services. Some cards also get charged well over 4 percent, such as foreign rewards cards. These companies profit & mobile customers lose. Always read the fine print.

Credit card information is stored on my mobile device after a transaction. Good mobile developers do not store any critical information on the device. That information should only be transferred through an encrypted, secure handshake between the application and the processor. No information should be stored or left hanging around following the transaction.

I already have a POS system – the hassle isn’t worth it. Mobile payments offer more flexibility to reach the customer than ever before. No longer are sales people tied to a cash register and counters to finish the sale. That flexibility can mean the difference between revenue and a lost sale. Mobile payments also have the latest technology to track sales, log revenue, fight chargebacks, and analyze performance quickly and easily.

If we build it, they will come. Many wallet providers believe that if you simply build a new mobile payment method into the phones, consumers will adopt it as their new wallet. This includes proponents of NFC technology, QR codes, Bluetooth and other technologies, but given very few merchants have the POS systems to accept these new types of technologies, consumers have not adopted. Currently, only 6.6 percent of merchants can accept NFC, and even less for QR codes or BLE technology, hence the extremely slow adoption rate. Simply put, the new solutions are NOT convenient, and do not replace consumers’ existing wallets, not even close.

It raises the risk of fraud. Fraud’s always a concern. However, since data isn’t stored on the device for Square and others, the data is stored on their servers, the risk is lessened. For example, there’s no need for you to fear one of your employees walking out with your tablet and downloading all of your customers’ info from the tablet. There’s also no heightened fraud risk for data loss if a tablet or mobile device is ever sold.

Mobile processing apps are error-free. Data corruption glitches do happen on wireless mobile devices. A merchant using mobile credit card processing apps needs to be more diligent to review their mobile processing transactions. Mobile technology is fantastic when it works.

Mobile wallets are about to happen. They aren’t about to happen, especially in developed markets like the U.S. It took 60 years to put in the banking infrastructure we have today and it will take years for mobile wallets to achieve critical mass here.

Setup is difficult and complicated. Setting up usually just involves downloading the vendor’s app and following the necessary steps to get the hardware and software up and running. The beauty of modern payment solutions is that like most mobile apps, they are built to be user-friendly and intuitive so merchants would have little trouble setting them up. Most mobile payment providers offer customer support as well, so you can always give them a call in the unlikely event that you have trouble setting up the system.

The biggest business opportunity in the mobile payments space is in developed markets. While most investments and activity in the Mobile Point of Sale space take place today in developed markets (North America and Western Europe), the largest opportunity is actually in emerging markets where most merchants are informal and by definition can’t get a merchant account to accept card payments. Credit and debit card penetration is higher in developed markets, but informal merchants account for the majority of payments volume in emerging markets and all those transactions are conducted in cash today.

Wireless devices are unreliable. Reliability is very often brought up as I think many businesses are wary of fully wireless setups. I think this is partly justified, but very easily mitigated, for example with a separate Wi-Fi network solely for point of sale and payments. With the right device, network equipment, software and card processor, reliability shouldn’t be an issue.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: (POS) systems, aggregators rates, apps, BLE technology, bluetooth, card, card processor, card reader, cash, cash register, chargebacks, consumer data, credit, credit card payments, credit card processing, credit card processors, credit card reader, credit-card, customer support, data, data loss, debit card, debit rate, device, fraud, fraud risk, hardware, industry experts, merchant account, Merchant's, mobile, mobile app, mobile credit card processing, Mobile Devices, Mobile Payments, mobile point of sale, Mobile processing apps, mobile processing transactions, mobile technology, mobile wallets, network, network equipment, nfc, nfc technology, payment solutions, payment technology, PayPal, phones, point of sale, qr codes, retailers, rewards cards, Security, Smartphones, software, Square, tablet, tablets, vendor's app, wallet providers, Wi-Fi network, wireless mobile, wireless mobile devices

May 21st, 2014 by Elma Jane

There are no enforced standards in the card processing industry regarding rates, fees, and contractual terms. It is possible for two providers to offer seemingly the same rates and fees that result in different processing costs.

Excessive Monthly, Annual, or Quarterly Fees

There are numerous monthly, annual, or quarterly fees merchants may see on their statements each month. Many merchants pay far more than they should for these fees. The fees may have names like statement fee, service fee, membership fee, regulatory fee, PCI fee, and host of other names. The fair amount each merchant should pay for these fees varies by sales volume and merchant type. Also, the amount a merchant pays for any given fee isn’t as important as the overall processing cost. These are general guidelines; some merchants should pay far less. If you are currently paying more, it may be a good time to review your overall processing cost including your pricing plan, rates, and fees.

Excessive Payment Gateway Fees

A payment gateway route transactions from the merchant’s website to the provider. Some retail point-of-sales devices require a gateway to route the transactions. Merchants generally pay a per-month and a per-transaction fee for use of the gateway. As a rule, the direct cost to process through the gateway is a few cents per transaction.

PCI Non-compliance or Non-validation Fee

Many providers now charge a monthly non-compliance or non-validation fee if the merchant is not PCI compliant. This fee may be in addition to a monthly, quarterly, or annual PCI fee. Supposedly, providers charge the non-compliant or non-validation fee as an incentive for merchants to become compliant. Nonetheless, some providers use this fee more for revenue generation, than as an incentive. Some providers do not charge this fee at all.

Merchants should not change providers because of this fee. Instead, the merchants should become PCI compliant to eliminate the fee and reduce the probability of being breached, which could easily result in huge monetary penalties – tens of thousands of dollars. To become compliant, merchants should complete the PCI Self-Assessment Questionnaire and adhere to the PCI requirements, which may require quarterly scans. In short, if a merchant is being charged a non-compliance or non-validation fee, it is as much the merchant’s fault as anyone else.

Visa FANF Fee

In 2012, Visa started charging providers a Fixed Acquirer Network Fee (FANF). The actual fee charged by Visa is dependent on the merchant type. The fee for customer-present retail merchants is based on the number of locations. The cost for ecommerce and fast food merchants is based on the volume of business. Customer-present retail merchants that have non-swiped transactions can also pay an additional customer-not-present FANF fee.

Most aggregators – i.e., merchant account providers that group multiple merchants into a single merchant account, such as Square, PayPal – integrate the FANF cost into their rates and fees versus itemizing them out separately. Most traditional providers properly pass through the actual Visa FANF fee to their merchants. However, there are a few that treat this fee as another hidden revenue stream. I’ve seen providers charge a flat monthly fee for customer-present merchants and I’ve seen the FANF fee inflated by as much as 50 percent for ecommerce merchants. Keep in mind when reviewing that the fee is generally based on the volume of the prior month. In order words, the fee you see on your statement for April activity is likely based on the March volume, as providers need to know the monthly Visa volume before they can assess the fee.

Unusual Discover Card Fees

For Discover transactions, some providers charge a higher percentage, or higher per-item fee, or monthly access fee.

Posted in Best Practices for Merchants, Credit card Processing Tagged with: (FANF), access fee, aggregators, breached, card processing industry, compliant, contractual terms, customer-not-present, customer-present retail merchants, devices, Discover transactions, ecommerce, ecommerce merchants, fast food merchants, fees, Fixed Acquirer Network Fee, flat monthly fee, gateway, integrate, membership fee, merchant account, merchant account providers, merchant type, Merchant's, merchant’s website, monetary penalties, non-compliance, non-swiped transactions, non-validation fee, payment gateway, PayPal, PCI fee, PCI non-compliance, PCI requirements, PCI Self-Assessment Questionnaire, pci-compliant, point-of-sales, pricing plan, processing cost, processing costs, provider, provider's, quarterly fees, Rates, regulatory fee, retail, retail point-of-sales devices, revenue, route transactions, sales volume, service fee, Square, statement, statement fee, statements, transactions, visa, Visa volume, website

May 12th, 2014 by Elma Jane

New iPhone and VeriFone-made shell combination that can accept chip and PIN card payments. Apple’s revamp in its in-store mPOS system

In 2009, Apple introduced its EasyPay mPOS technology. It consists of an iPod Touch and a shell made by Infinite Peripherals that includes a card swiper and a barcode scanner.

As first reported by 9to5mac,the iPod is now being replaced by an iPhone while VeriFone is being brought in to provide a new shell which will cater for chip and PIN payments as the US finally gets ready for the switch to EMV. The shell also has a spot above the PIN pad that opens the way for NFC contactless payments, according to Forbes. Apple has long been expected to equip the iPhone with NFC but has so far ignored the technology.

Separately, mPOS giant Square has ditched its Wallet app, pulling it from the Google and Apple stores. The app has failed to take off since its launch in 2011, despite the support of Starbucks. It has been replaced by Square Orders, which lets users order and pay ahead at participating merchants and then pick up their goods when they are ready.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: app, Apple stores, Apple's, barcode, barcode scanner, card, card swiper, chip, contactless payments, EasyPay, EMV, Forbes, google, in-store mPOS, Infinite Peripherals, Iphone, iPod, iPod Touch, Merchant's, MPOS, mPOS giant, mPOS system, mPOS technology, nfc, NFC contactless payments, PIN, PIN card, PIN card payments, PIN pad, Square, Starbucks, swiper, verifone, Wallet app

August 16th, 2013 by Admin

Square credit card processing service was fined $507,000 by Florida’s Office of Finance Regulation for operating an electronic payment processing service without a money transmission license. Some may remember the same treatment in Illinois in March of this year. The order covers two years of operation and processing including Square Register, stored value and prepaid access credit card services.

Square credit card processing service was fined $507,000 by Florida’s Office of Finance Regulation for operating an electronic payment processing service without a money transmission license. Some may remember the same treatment in Illinois in March of this year. The order covers two years of operation and processing including Square Register, stored value and prepaid access credit card services.

Square was granted a money transmission license after it paid the fine via wire transfer and is now in compliance. Square neither admits or denies any wrongdoing. Although it’s an emerging field the Florida based fines show that adhering to state laws is a tricky situation that needs extra scrutiny on the processors end. Due to the state by state nature of the laws, credit card processing companies find themselves complying with each state’s independent regulation laws.

In a statement from Square.. “We worked with Florida to resolve our application and receive our license to operate as a money transmitter in the state, We look forward to continuing to help merchants across Florida grow their business with Square.”

Posted in Credit card Processing, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: account, credit card, Florida, merchant, merchants, Processing, Square

August 13th, 2013 by Admin

MasterCard who has endorsed Google Wallet on the Sprint network will now endorse the ISIS network for mobile wallet solutions. Both Google and Sprint have not joined ISIS and it is interesting to see card issuers invest in both platforms. With Verizon, AT&T and T-Mobile in alliance with ISIS, could Sprint be next? Google? Well count Visa and MasterCard as Isis partners. After securing American Express both Visa and MasterCard will now have their credit cards available in Isis’ Wallet. What will be in your mobile wallet?

Many mobile wallet providers are looking at the various options for electronic transaction processing. Will NFC beat out all the others? It’s hard to say but with Apple having yet to release an iPhone model with the chip on board, it could be a yet unseen technology that wins out. QR Codes and Carrier billing are gaining traction for devices without NFC installed and SmartSD cards are coming equipped with NFC to extend devices that have a card slot available.

With device limitations, mobile wallets are still in flux. There are approximately 5 different types of mobile wallets today. There are digital bank accounts similar to prepaid credit cards offered by banks and mostly used for person to person or P2P payments. Mobile payment apps that link payment accounts like those offered by Starbucks or PayPal. Card containers like Apple Passbook store credit cards and loyalty rewards card information and can even fill in forms requesting that information. Similarly, Credential and Card containers store credit card and loyalty rewards but also store identity credentials.

True mobile wallets directly mimic a physical wallet and allow the customer to chose between various credit cards, debit cards even electronic benefits transfer or EBT cards at the point of sale. These wallets are typically app based for both iPhone and Android smartphones and tablets. These wallets can link account information to a point of sale terminal via NFC or other methods for a secure electronic transaction.

Branding and Banks

In recent times Visa, MasterCard and American Express signs at the point-of-sale was a branding element designed to instill confidence for the consumer. With digital wallets becoming the interface for payments, this branding may fade into the background. Yet payment card issuers find themselves in a precarious position. The big three are participating in multiple digital wallet programs in order to not be excluded. This early in the game there are multiple movers and shakers like Square, PayPal, Lemon, Google and now banks and cellular carriers getting into the game, no one knows who consumers and merchants will eventually prefer over the others. It’s like a wait and see game that forces them to play. As banks enter the arena they are favored to win because of the solid loyalty they enjoy from their customers. Though they may not be fair in other categories, they win the security of their customers.

Posted in Credit card Processing, Digital Wallet Privacy, Electronic Payments, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, smartSD Cards, Visa MasterCard American Express Tagged with: American Express, Android, Apple, AT&T, google, Iphone, ISIS, MasterCard, PayPal, Square, Starbucks, T-Mobile, Verizon, Visa MasterCard American Express

August 12th, 2013 by Admin

Small businesses are gaining traction in the mobile payment landscape. Mobile credit card readers attached to a smartphone or tablet now account for billions of dollars in m-commerce sales. “Together, mobile and social are transforming the way SMBs acquire and retain customers, With the heavy use of social media, SMB marketing is quickly becoming a two-way engagement rather than a one-way promotion.” Said Steve Marshall of BIA/Kesley. As more people switch to and upgrade their smartphones, AT&T, Verizon and T-mobile are looking to partner with digital wallet provider Isis. Read more of this article »

Posted in Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Mobile Payments, Near Field Communication, Smartphone Tagged with: American Express, biometrics, electronic payments, iPhones, m-commerce, mobile, PayPal, recognition, Smartphones, Square

August 6th, 2013 by Admin

In Canada, the game to corner mobile payment systems and the Digital Wallet is being played seriously. PayPal and Square are present but the 800 pound gorilla may have just entered the ring. Canadian banks are presenting merchant accounts capable of handling tap to pay transactions competing directly with Square and PayPal. Royal Bank of Canada has launched a mobile payment solution to provide contactless payment using Near Field Communication (NFC) enabled smartphones and tablets. Shoppers can simply wave their smartphone over a cash register or payment terminal and be on their way. No more swiping a credit card into a terminal or punching keys into a terminal and no more fumbling with cash or coins to settle a payment. Read more of this article »

Posted in Credit card Processing Tagged with: bank, bankers, blackberry, Canada, Canadian, Canadian travel agency agents, digital, electronic, financial services, ipad, Iphone, mobile, nfc, payments, PayPal, Rogers Communications, Royal Bank, smartphone, Square, tablet, travel

In discussions about merchant service providers, Square and PayPal entering talks is a given. Sqaure offers free credit card readers to entice merchants to switch their credit card processing to them. PayPal recently launched an initiative to expand it’s reach into retail stores and offers to waive processing fees through 2013. With the coming rush to mobile transaction processing more companies are entering the fray. AT&T, Verizon, T-mobile and Sprint are looking to get into the credit card transaction processing gig as they already carry that data over their cellular networks. ISIS Wallet and Google’s digital wallet bring credit card transactions to Android smartphones and tablets, and Visa is expected to launch its Visa Ready program as it rolls out test merchants. Read more of this article »

Posted in Mobile Payments Tagged with: Android, bluetooth, Chip & PIN, credit card processing, Digital Wallet, EMV, fees, google, ISIS, m-commerce, merchant, merchant account, nfc, payment processor, PayPal, Rates, Square, transactions, Visa MasterCard American Express

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.