August 25th, 2017 by Elma Jane

A travel merchant account helps you manage all your transactions. It also allows you to integrate into your booking software; plus, there are more features that you get to process payments in a secure environment.

Virtual Merchant Payment Terminal

This is a web-based system that allows you to view processed payments in real-time. You can access it using any web browser, and the transactions are conducted over a secure and encrypted connection.

Customers get receipts for their payments via email once the transaction is complete. You can also handle installments and recurring payments online. It also accepts different payment methods, including gift cards, electronic checks, and credit and debit cards.

Loyalty Programs

With a travel merchant account, you are able to reward your loyal travel customers. You can personalize your loyalty program for customers basing on their behavior. A loyalty program can offer free products or discounts on certain tour or travel packages.

Also, you can make gift cards part of your program. With these cards, you can simply load them with any dollar amount and present them to your customers. Plus, they’re re-loadable and offer a great way of advertising. These programs can go a long way in boosting your customer’s loyalty.

Trams & Sabre Integration

If you’re using Sabre Travel Network for agency services, you can easily integrate your account into Sabre to improve your travel options. This integration allows you to provide convenient payment methods for customers searching for cruise lines, hotel properties, car rental services, and airlines.

Also, for those using Trams for accounting and reporting, NTC travel merchant account lets you make a simple integration. In the long run, you are able to focus on growing your travel agency and offer quality services to your clients.

Mobile Processing

Accepts payments fast and on-the-go with mobile processing solutions that are PCI compliant. With this service, you only need to use a mobile device card reader to swipe cards.

Mobile payment processing allows you to use your own iOS or Android device with a free mobile app which you can integrate with your account to manage transactions.

Offering a convenient and smooth payment methods to your clients is one of the ways to grow your business. National Transaction Corporation merchant account, offers secured travel payment processing services e-Pay, to process your payments; with no delays and at a very competitive rates.

Also, you can accept payments from anywhere and get 100 percent funding. Faster deposits for bookings, which can occur as quick as the next business day.

To speak to our travel payment consultant, call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: card reader, credit, debit cards, electronic checks, Gift Cards, Loyalty Programs, mobile, payment processing, payments, PCI, swipe, terminal, transactions, travel agency, Travel Merchant, virtual merchant

September 16th, 2016 by Elma Jane

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following features below, that you need from your Electronic Payments provider.

Advanced Security Options – 6 out of 10 small businesses close within six months of a card data breach, it is important that Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. NTC offer Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. The Top-tier security is important on your business’s data especially customer information, consider adding additional authentication procedures.

Fast Payment Processing – first step is having up-to-date technology, because some customers might leave, the sooner you have the money processed by your provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – obtaining the features you need from your payment services provider is very important. Look for a provider that appropriately addresses your payment concerns.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. Furthermore, the app works with most Apple and Android mobile devices. Accept a key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad or the new RP457c card reader.

Reliable Customer Support – NTC is available 24/7, the phones are answered by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is the most important feature of any business partnership you make. At NTC we are very passionate about that.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a payment service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

August 18th, 2015 by Elma Jane

NFC stands for near-field communication, it allows two devices to share data.

You’ve likely used it already, even if you haven’t realized it. It’s embedded in computer cards, print ads, smart cards and it is featured in many Android phones, Windows phones and the new iPhone.

NFC works in two ways:

The first is two-way communication, where two devices can read and write each other – like transferring contacts or photos from one device to another. The second is one-way communication where a device can read and write to an NFC chip – similar to using an NFC enabled card to pay for something using an NFC terminal.

Sure there are other technologies, like Bluetooth, that can do things similar to NFC, but NFC uses less power and is better for your smartphone’s battery life. NFC is also less complicated to use than Bluetooth and doesn’t need to be paired with anything.

NFC is extremely secure. Intercepting payment information from an NFC device is very difficult because of how the process works. To use NFC for payments, the payment application is first launched on a phone that is then tapped on a terminal. The customer then enters a code or scans a fingerprint to approve the transaction. A secure element (SE) then authorizes the payment and sends the information to the NFC modem. The payment is then processed like a credit card swipe.

NFC is likely to continue to grow in popularity in the mobile payments space, to learn more about NFC payments and how you can prepare your business with National Transaction Corporation, visit www.nationaltransaction.com or give us a call at 1-888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: credit card, Mobile Payments, Near Field Communication, nfc, NFC payments, payments, swipe, terminal

July 17th, 2015 by Elma Jane

Turn Around Strip Down

There was a bit of confusion at a supermarket. When this senior was ready to pay for his groceries, the cashier said, Strip Down facing me.

Making a mental note to complain about excessive security running amok, the senior did just as the lady cashier had instructed.

When the hysterical shrieking and alarms finally subsided, he found out that the lady cashier was referring to his credit card, to turn around the card, strip down and swipe it.

The senior have been asked to shop elsewhere in the future.

Posted in Best Practices for Merchants Tagged with: card, credit card, swipe

July 7th, 2015 by Elma Jane

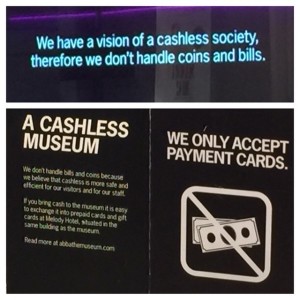

Cashless society is about to happen, hard to believe for some. We are all unable to decide on the edge of a new, cashless world where mobile payments reign supreme. If so, is this a bad thing? For some people yes, because for them change can be scary.

Every revolution needs a good crisis in order to grow its seed. The cashless revolution is the same. Current global financial conditions serves as the potential crisis, and truly the cashless revolution is upon us. Society is on the brink of great economic change, which will likely usher in a new era of worldwide, electronic currencies. The cashless society is coming.

Advances in mobile payment options as evidence of this impending cashless society, consider the practical benefits of mobile payments for the consumer. The most obvious is convenience. Many people prefer to swipe their smartphone atop a scanner to carrying around a stack of cash. Electronic payments are traceable, which is useful for tracking one’s spending and can add a sense of security. Also, carrying around large stacks of cash isn’t always feasible or safe.

Mobile payments also offer interested individuals a way to incorporate social media into their purchases; they can check-in to a site and tell all their friends about an exciting new product they bought, or announce their presence at a new coffee shop, all with that same initial swipe of an NFC-enabled phone. Add to this the many practical benefits of mobile payments as far as business owners are concerned, and it’s easy to see why so the technology is becoming so widespread.

And yet for all the benefits of mobile payments and point of sale technology, the two don’t necessarily exclude cash. Other company focuses on blending cash transactions with POS. This allows technologically savvy businesses to incorporate POS and mobile payment technology into their business, without excluding potential customers who prefer to use cash.

We aren’t necessarily evolving towards a cashless society, but towards a society with a plethora of payment options. POS technology is all about options. Want to pay with a swipe of your credit card? Swipe your credit card. Want to tap your NFC-enabled phone against a console. Tap and go. Want to pull a crisp twenty-dollar bill from your wallet and walk away from the counter with milk and eggs in your hand and a handful of coins jingling in your pocket? Go for it.

The question is: Will we ever become a truly cashless society? Maybe, maybe not, but as mobile payments become increasingly common, cash may very well fall into the retro category.

Posted in Best Practices for Merchants, Mobile Payments, Near Field Communication, Point of Sale Tagged with: credit card, electronic currencies, electronic payments, Mobile Payments, nfc, point of sale, POS, swipe

Biometrics Market To Reach $14.9 Billion by 2024

The Biometrics market currently sits at $2 billion, by 2024, it will reach $14.9 billion, with a cumulative total revenue of $67.8 billion. This is being driven by new advancements in Biometrics Hardware and Software that are not only transforming payments, but also serving as frictionless alternatives to security in a myriad of use cases.

For consumer facing security, Biometrics can be deployed at a low price-point for high-volume authentication. Think an iris scan or finger swipe for quickly unlocking a mobile device like an iPhone 6 or Samsung Galaxy S6.

The forecast goes over use cases that spans from Point-of-Sale transactions, to voter identification, making the case for Biometrics embedding itself into a vast number of aspects in everyday life.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: biometrics, consumer, device, mobile, mobile device, payments, point of sale, Security, swipe, transactions

April 27th, 2015 by Elma Jane

I was shopping in Kmart and didn’t understand why my Credit Card transaction was declined. My card is EMV and Kmart is EMV, but the Kmart system did not forced the transaction to run as EMV so, Citibank declined it. Kmart can loose a $600 sale can your small business afford it? If you think hiring a professional is expensive try an amatuer…

A lot of stores, specially big chain stores, have EMV capable terminals, but they haven’t turned them on yet and still force you to swipe. Some think, migration is just getting a new terminal and asking their acquirer to enable EMV on their account. Its not only about the liability shift, and the EMV equipment, It’s the lack of information for the Merchants.

There has to be training and orientation that merchants will need to invest into for their employees. As well as changing our mentality that we all need to be prepared for this upcoming transition….as both consumers and business owners.

The issuing banks can, and are starting to decline transactions when a merchant CAN use EMV but do not. EMV is coming October 2015 and if you are not ready you may loose sales, and will loose when a fraudulent card walks in your business.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: banks, card, consumers, credit card transaction, credit-card, EMV, Merchant's, swipe, terminals

September 4th, 2014 by Elma Jane

EMV, which stands for Europay, MasterCard and Visa, and is slated to be mandated across the United States starting in October 2015 and automated fuel dispensers have until October 2017 to comply. Unlike magnetic swipe cards, EMV chip cards encrypt data and authenticate communication between the card and card reader. Additionally, chip card user is prompted for a PIN for authentication.

Why are those dates important? Companies lose $5.33 billion to fraud today, with card issuers and merchants incurring 63 and 37 percent of these losses, respectively. Under the EMV mandate, merchants who do not process chip cards will bear the burden of the issuer loss. By accepting chip card transactions, merchants and issuers should see a reduction in fraud.

Overcoming Barriers to EMV Adoption

Given the significant barriers to EMV adoption, it may be tempting for merchants to meet minimum requirements for accepting EMV payments. However, medium to large retailers should also consider the bigger picture of customer security and peace of mind.

Some key critical success factors for a payment initiative of this size include:

Business Continuity Architecture: As with all payment systems, it is imperative to have the EMV system running at all times. The solution should preferably have Active-Active architecture across multiple data centers and have a low Recovery Point Objective (the point in time to which the systems and data must be recovered after an outage).

Cost Benefit Analysis: Take a top down approach and decide accordingly on the scope of the analysis. This will ensure that decisions on scope are made on basis of quantitative data and not just qualitative arguments.

Phased Approach: To overcome time or cost overage in a project of this scope and complexity, retailers should try using an iterative approach for development. The rollout can be divided into multiple releases of six to seven months, which will provide the opportunity to review, capture lessons learnt, and improve subsequent releases.

Proactive Monitoring Alerts: Considering the criticality of business function carried out by EMV, tokenization and payment gateway, a vigorous supervising environment must be defined to perform proactive and reactive monitoring. It should take into consideration the monitoring targets, tools, scope and methods. This will provide advance visibility to the failure points and better ensuring maximum system availability.

Resilience Testing: Typically in a software project, the testing is limited to the unit, integration, performance and user acceptance. However, due to the critical nature of the applications and systems involved, robust resiliency testing is vital. This will ensure that there are no single points of failure and the system remains available when running in error conditions.

Stakeholder Identification: This is a key step to ensure that you have varied perspectives from all departments and their support. It will keep your organization from being blindsided and reduce the risk of disagreements in later stages of the program. Key stakeholders should include Store Operations, Card Accounting, Loss Prevention, Contact Center and IT & Data Security.

Organizations should adopt a five step approach to implement a secure, robust and industry-leading payment solution:

Encryption – Point to point encryption will ensure card data is secure and encrypted from the point of capture to the processor. Usually, merchants use data encryption that is not point to point, rendering their organization vulnerable to data breaches. Software encryption is the most common form of encryption, as it is easily installed and quires little or no hardware upgrades; however, it is less secure, may expose encryption keys, and is prone to memory scanning attacks. Hardware encryption is considered more secure but requires more costly terminal upgrades. Hardware encryption is designed to self-destruct the keys if tampered, but is not well-defined as very limited headway has been made in this space.

Tokenization – Build a Card Data Environment (CDE) that will host a centralized card data storage solution. Only limited applications with firewall access and capability to mutually authenticate via certificates can access CDE and receive card data. The rest of the applications will have tokens which are random numbers. This architecture will ease the merchant’s burden with existing and emerging PCI Data Security Standards.

Payment Gateway – Perform a risk assessment on the current payment gateway and identify gaps in functionality, manageability, compliance, scalability, speed to market and best practices. Determine the alternatives to mitigate the risks. Some of the important aspects of a leading payment gateway solution are support for all forms of credit, debit, gift cards and check transactions. Its ability to work with any acquirer, in-built encryption abilities, support for settlement and reconciliation must also be kept into consideration.

Settlement, Funding and Reconciliation – A workflow-based system to handle chargebacks and the automation of chargeback processing will greatly reduce labor-intensive work and enhance the quality of data used for settlement and reconciliation. Upgrades to the existing receipt retrieval system may be needed.

Card fraud is on the rise in the U.S., and merchants are the primary target for stealing information. With the EMV deadline just over a year away, the responsible retailer must take steps to prepare now. Although EMV implementation might seem overwhelming to merchants, they should start their journey to secure payments rather than wait for a looming deadline. Solutions such as data encryption and tokenization should be used in combination with EMV to implement a robust payment solution to better protect merchants against fraud. By proactively adopting EMV payment solutions, merchants can stay ahead of the regulatory curve and better protect their customers from fraud.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: authentication, automation, card, card data, Card Data Environment, card fraud, card issuers, card transactions, CDE, chargeback, chargeback processing, check, check transactions, chip, chip cards, credit, customer, customer security, data, data breaches, data encryption, data security, debit, EMV, emv chip cards, EuroPay, fraud, gateway, Gift Cards, host, integration, magnetic swipe cards, MasterCard, Merchant's, payment, payment gateway, payment solution, payment systems, PCI, PCI Data Security Standards, PIN, processor, retailers, Security, software, swipe, terminal, tokenization, tools, visa

August 22nd, 2014 by Elma Jane

Turn Around Strip Down

There was a bit of confusion at a supermarket. When this senior was ready to pay for his groceries, the cashier said, Strip Down facing me.

Making a mental note to complain about excessive security running amok, the senior did just as the lady cashier had instructed.

When the hysterical shrieking and alarms finally subsided, he found out that the lady cashier was referring to his credit card, to turn around the card, strip down and swipe it.

The senior have been asked to shop elsewhere in the future.

Posted in Uncategorized Tagged with: card, credit, credit-card, swipe

May 15th, 2014 by Elma Jane

Looking to buy a new business phone? Wait!!! A slew of hot new smartphones are set to launch in the coming months, 2014 has already seen its share of major releases. This spring, HTC unveiled the new HTC One M8, which packs a slick all-metal body and Samsung debuted the featured-packed Galaxy S5. Nokia also released the Lumia Icon, its new flagship Windows Phone. But some of the year’s biggest releases are still to come, including a new version of Apple’s iPhone and a follow-up to Samsung’s stylus-equipped Galaxy Note 3. Meanwhile, a new Android phone from startup OnePlus could make a splash.

Galaxy Note 4

Samsung is expected to launch a follow-up to the Galaxy Note 3 this fall, one of the best business phones ever made, thanks in part to the included S Pen stylus, which slides out from a slot on the phone’s chassis and turns the device into a note-taking machine. The phablet also boasts a stunning 5.7-inch display that’s big enough for real productivity tasks. Samsung hasn’t officially confirmed any details about the Note 3’s successor, but there are a few safe bets. For starters, fans can expect the line’s trademark stylus to return for the Galaxy Note 4. Its display meanwhile, should rival the Samsung’s newer Galaxy S5 in terms of brightness and picture quality. Finally, considering Samsung packed a fingerprint reader into the S5’s home button, it’s likely the company will do the same for the Note 4. A fingerprint reader can make your business phone more secure, since only you can unlock the device with a quick swipe of your finger.

iPhone 6

Apple’s iPhone 5s is a great phone, but its compact 4-inch display could be too small for some people. Reports indicate that Apple might deliver a much bigger device in the iPhone 6, which is expected to debut this fall in 4.7-inch and 5.5-inch variants. That’s a big deal for business users who depend on their smartphone to stay productive but prefer a larger display. Both models are also rumored to include a blazing-fast A8 processor, an upgrade over the speedy 64-bit A7 chip found in the iPhone 5s. The iPhone 6 is also expected to include the same fingerprint reader that debuted with the iPhone 5s. The reader is embedded in the phone’s home button, and lets you unlock the device simply by placing your finger on the button. And of course, the iPhone is the only smartphone that gives you access to Apple’s App Store, which features the biggest and arguably the best, library of business and productivity apps on any platform.

LG G3

LG is preparing to unveil a successor to its flagship phone, the LG G2 this spring. The so-called LG G3 could be one of the year’s most noteworthy business phones if it retains the G2’s superlong battery life. The phone ran for up to 11 hours in tests that involved continuous Web browsing, making it one of the longest-lasting smartphones ever made. In addition to longevity, the G2 boasts a snappy quad-core processor, a roomy 5.2-inch display and a handy multitasking feature called QSlide, which lets you run a second app in a floating window over your main app. That’s a plus for business users who need to juggle tasks such as responding to email while conducting research in a Web browser. LG hasn’t yet announced which features will get an upgrade for the LG G3, but fans won’t have to wait long to find out. The company is expected to show the device off at a special press event on May 27, though it’s not yet known when the phone will hit store shelves.

Lumia 635

Windows Phone fans saw the release of a new flagship device in the Nokia Lumia Icon this spring. Now, Nokia is following that up with the Lumia 635. A new midrange Windows Phone with a lower price point, that could make it worth a look for budget-minded business users, especially since the device runs on Windows Phone 8.1, a new version of Microsoft’s mobile operating system. One of the phone’s standout features is Cortana, a voice-activated personal digital assistant that can notify you of upcoming appointments, flight information, weather alerts and more. Also, new in Windows Phone 8.1 is the Action Center, which is similar to the notification hub found on both the Android and iOS operating systems. Just swipe down from the top of your phone’s display to view all of your alerts at a glance, and like every Windows Phone device. The Lumia 635 is fully integrated with the desktop version of Microsoft Office.

OnePlus One

The OnePlusOne set to launch this June, is a powerful new business phone with a unique set of features. The 5.5-inch Android device packs a huge display, a top-tier processor and a high-capacity battery. The phone also adds features you won’t find in many flagship phones, such as always-on voice commands. So instead of fiddling with menus and touch-screen controls, you can set an alarm, place an appointment in your calendar or access turn-by-turn directions by uttering a few words – even when the display is off. The OnePlus One also offers a few notable security features you won’t find in most other smartphones. For instance, the phone’s Privacy Guard setting lets you block individual apps from accessing personal information stored on your device. The OnePlus One also ships with built-in encryption for SMS text messages to ensure your private business communications remain private.

Posted in Smartphone Tagged with: Android, Android and iOS operating systems, Android device, Android phone, App Store, Apple's iPhone, Apple's iPhone 5s, chip, Cortana, desktop, device, digital, email, encryption, fingerprint reader, flagship phones, Galaxy Note 3, Galaxy Note 4, Galaxy S5, high-capacity, HTC, HTC One M8, hub, integrated, iOS, iPhone 6, LG G2, LG G3, Lumia 635, Microsoft, Microsoft Office, Microsoft's mobile operating system, mobile, Nokia, Nokia Lumia Icon, OnePlusOne, operating systems, phablet, phones, platform, Privacy Guard, processor, QSlide, S Pen stylus, Samsung, Security, slot, Smartphones, sms, stylus, swipe, top-tier processor, touch-screen controls, voice commands, web, Web browsing, windows, windows phone, Windows Phone 8.1