August 30th, 2024 by Admin

According to a poll by OnePoll on behalf of I Love Velvet titled “Consumer Mobile Point-of-Sale (MPOS) Attitudes Report” over half of retail customers think cash registers are outdated. The poll found that 51% of Americans think the cash register could soon be gone altogether as retailers opt for mobile point of sale systems. Consumers seem to favor MPOS systems allowing the shoppers to check out from anywhere in the store and that they return more often to stores with modern electronic payment technologies. Thirty five percent cited they would shop more often at stores with mobile point of sale payment systems. An additional 17% said they would share their shopping experience via social networking sites and 35% report they likely would tell a friend or recommend stores with these technologies. Forty six percent say that stores that have mobile payment systems seem to be more tech savvy and even more (56%) praise the store for making the experience more convenient and secure. Retailers are struggling to modernize their payment platforms to cut down long lines at registers, and place staff on the floor for better customer access. “It’s a great opportunity for retail store owners to dip into the mobile point of sale arena” said Richard Delos Santos of National Transaction Corporation.

Mobile point-of-sale equipment and software manufacturers are stepping up to the security plate as they seek to pass PCI DSS and other security related issues. As new mobile kiosks and point of sale hardware and software evolve so do the security challenges used to thwart credit card fraud and identity theft. The challenge for point of sale system providers is to create an increasingly secure and convenient way for customers to make electronic payments in-store or on their mobile devices. iPads, iPhones and Android tablets are often used by curious shoppers to compare and contrast features, prices and availability, why not let digital wallets be used to close the transaction? The use and connectivity of these new devices mean more complex security measures are needed to thwart attackers, crackers, and hackers.

In the coming years everything from NFC, to fingerprint readers in smartphones and tablets and even QR codes will change the landscape of mobile payment transaction processing and things are beginning to heat up. An estimated $17 Trillion of mobile transactions are predicted by 2020 and security and adoption will reign king on the streets. It might be time to look into the security and features that a mobile point-of-sale system can add over any existing point of sale systems and cash registers. Mobility is a great tool for a sales force, but security and convenience for the customer is a necessity that will only grow in the future.

If You need help setting up a merchant account, Call 888-996-2273 Today!

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Android, ipad, Iphone, mobile, MPOS, payments, point of sale, Processing, smartphone, tablet, transaction

February 25th, 2024 by Admin

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

With smartphone users on the rise Nielson says that in 2012 47% of smartphone owners use mobile shopping apps in the Shopping / Commerce category. Although these do not account for actual mobile payment transactions they show that smartphone users are frequently turning to their mobile devices to find deals and purchase information.

But what exactly is m-commerce? M-commerce is a hybrid technology that takes web technologies that scale screens to mobile devices like Apple iPads and Android tablets. The commerce end of it comes from shoppers and merchants actually executing payment transactions over mobile devices of some form. Read more of this article »

Posted in Credit Card Security Tagged with: credit card, Digital Wallet, e-commerce, gateway, m-commerce, merchant account, nfc, payment, shopping cart, smartphone, tablet

January 21st, 2023 by Admin

Data Breaches Cost Consumers Billions

Exposure of personal information is a new challenge in todays environment, the initial exposure being a nightmare to unravel. A Javelin Strategy and Research study shows that a single data security breach can cost Billions of dollars in consumer fraud losses. Data security breaches rose 48% from 2011 in 2012 to 1,611 data breaches. Identity theft is on the rise too.

Walmart CEO Mike Duke Expecting $10 Billion in e-commerce payments 2013.

Commenting at a shareholder meeting WalMart CEO Mike Duke expected WalMarts online e-commerce site to bring in $10 Billion in transactions this year.

India Sees Spike in e-commerce and Mobile Payment Investments.

India is seeing deeper saturation of broadband rollouts connecting personal computers and laptops online at a faster pace. Big names such as Intel are keen on India’s development for market opportunities. Amazon and ebay just staked claims to India’s e-commerce playing field with deals to deliver their e-commerce services. Read more of this article »

Posted in Electronic Payments Tagged with: Breach, Digital Wallet, e-commerce, electronic payments, Mobile Payments, nfc, tablet, Virtual Currency

January 17th, 2023 by Admin

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device. Read more of this article »

Posted in Mobile Payments Tagged with: bluetooth, Chip and PIN, EMV, gift Card, Mobile Payments, MPOS, nfc, PayPal, QR Code Payments, retailers, smartphone, Square, tablet, Tap to Pay

January 3rd, 2023 by Admin

Yet another payment solution on the horizon is the MCE initiative for smartphones and tablets. The new solution is being led by 7-eleven, BestBuy, CVS Pharmacy, Darden Restaurants, Lowes, Publix, Sears, Shell Oil, Sunoco, Target, Dunkin’ Donuts, Bed Bath & Beyond and WalMart. According to their website, “Development of the mobile application is underway, with an initial focus on a flexible solution that will offer merchants a customizable platform with the features and functionality needed to best meet consumers’ needs.” The company intends to make their application available on all major smartphone platforms.

Yet another payment solution on the horizon is the MCE initiative for smartphones and tablets. The new solution is being led by 7-eleven, BestBuy, CVS Pharmacy, Darden Restaurants, Lowes, Publix, Sears, Shell Oil, Sunoco, Target, Dunkin’ Donuts, Bed Bath & Beyond and WalMart. According to their website, “Development of the mobile application is underway, with an initial focus on a flexible solution that will offer merchants a customizable platform with the features and functionality needed to best meet consumers’ needs.” The company intends to make their application available on all major smartphone platforms.

This latest solution is a mobile wallet that has serious potential to change the way consumers fulfill their mobile payments. The mobile app links a customers smartphone directly to their bank account allowing merchants to accept non-cash payment without involving credit card processing fees.

Though this is a significant shift from other mobile digital wallet schemes, the biggest difference might be in Loyalty Card programs used to entice existing customers to stop and shop. The creative potential for these types of programs go well beyond gift card processing and extend to e-mail and social networking. Customers could receive special offers based on the word of mouth, social sharing they do for the large retailers.

This mobile payment solution is initially just for the big boys though. They are catering to their own needs currently and there is no future consideration for small to medium size business in their digital wallet. With how fast things change in the mobile payment industry, this too could change and usher in new currencies for universal digital wallet payments.

Posted in Uncategorized Tagged with: Digital Wallet, Merchant Customer, mobile payment, mobile wallet, payments, smartphone, tablet

September 16th, 2016 by Elma Jane

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following features below, that you need from your Electronic Payments provider.

Advanced Security Options – 6 out of 10 small businesses close within six months of a card data breach, it is important that Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. NTC offer Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. The Top-tier security is important on your business’s data especially customer information, consider adding additional authentication procedures.

Fast Payment Processing – first step is having up-to-date technology, because some customers might leave, the sooner you have the money processed by your provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – obtaining the features you need from your payment services provider is very important. Look for a provider that appropriately addresses your payment concerns.

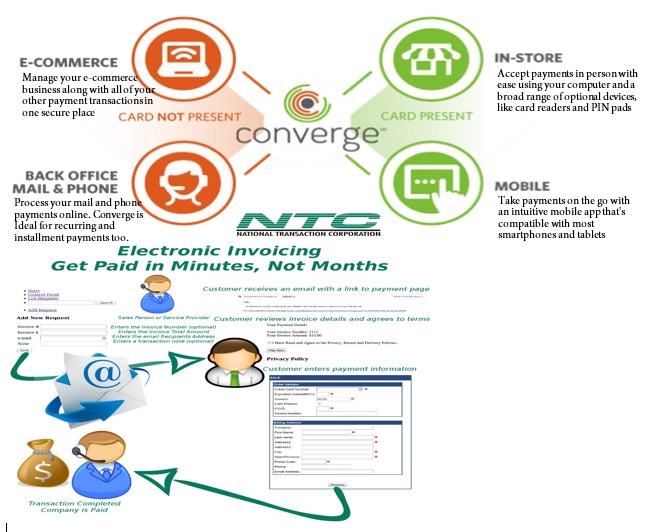

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. Furthermore, the app works with most Apple and Android mobile devices. Accept a key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad or the new RP457c card reader.

Reliable Customer Support – NTC is available 24/7, the phones are answered by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is the most important feature of any business partnership you make. At NTC we are very passionate about that.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a payment service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

September 22nd, 2015 by Elma Jane

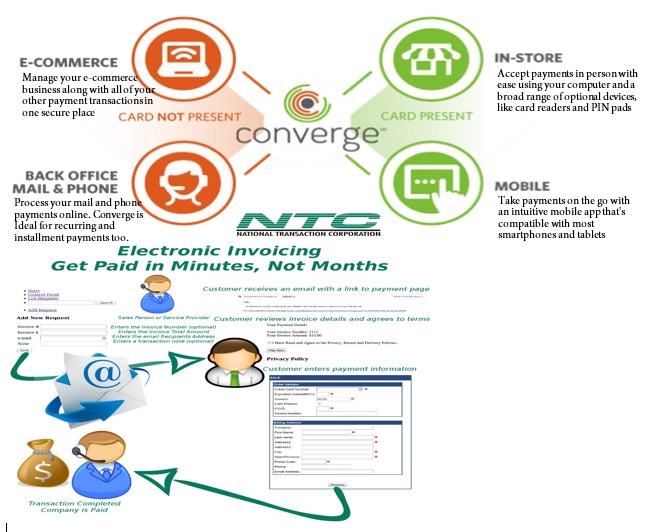

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

July 23rd, 2015 by Elma Jane

The digital payments landscape is changing at a rapid pace. Consumers are finally adopting digital wallets, like Apple Pay and Android Pay.

The deadline for merchants to become EMV compliant, the global standard that covers the processing of credit and debit card payments using a card that contains a microprocessor chip, is quickly approaching.

Today’s consumers show an increasing desire to use new payment methods because they’re convenient. However, this presents a challenge to merchants, as many have not made the switch to the modern technology required to accept these methods since they’re generally hard-wired to resist technology changes.

Merchants must evolve with technology or they’ll find themselves unable to compete and in danger of losing customers.

Looking long term, the benefits of adopting new payment technology will outweigh the cost of transitioning. The fact is that new payment technology will reduce fraud risk due to counterfeit cards, provide greater insight into shoppers with sophisticated data and will ultimately lower costs for merchants over time.

The value merchants will get out of new payment methods:

Security

Investing in new payment technology will help reduce the risk of fraud. EMV, as an example. Beginning in October 2015, merchants and the financial institutions that have made investments in EMV will be protected from financial fraud liability for card-present fraud losses for both counterfeit, lost, stolen and non-receipt fraud.

EMV is already a standard in Europe, where fraud is on the decline. In turn, American credit card issuers are being pressured to replace easily hacked magnetic strips on cards with more secure “chip-and-PIN” technology. Europe has been using Chip, and Chip & Pin for years.

There’s nothing that can guarantee 100 percent security, but when EMV is coupled with other payment innovations, like tokenization that separate the customer’s identity from the payment, much of the cost and risk of identity theft is eliminated. If hackers get access to the token, all they get is information from one transaction. They don’t have access to credit card numbers or banking accounts, so the damage that can be done is minimal.

As card fraud rises, there’s a strong case to upgrade to a payment system that works with a smartphone or tablet and accepts both EMV chip cards and tokens.

Insight into Customer Behavior

In addition to added security, upgrading to new payment technology opens up a door to greater customer insights, improved consumer engagement and enables merchants to grow revenue by providing customers with receipts, rewards, points and coupons. By collecting marketing data at the point of sale a business can save on that data that they only dreamed of buying.

Investment Outweighs the Cost

New technology does have upfront costs, but merchants need to think about it as an investment that will grow top-line revenue. Beware of providers offering free hardware. Business can benefit by doing some research on the actual cost of the hardware.

By increasing security, merchants are further enabling mobile and emerging technologies, which will make shopping easier.

Customers will also be more confident in using their cards.

As an added bonus to merchants, most EMV-enabled POS equipment will include contactless technology, allowing merchants to accept contactless and mobile payments. This will result in a quicker check-out experience so merchants can handle more transactions.

Faster customer checkout.

The best system for is the one that makes the merchant as efficient and profitable as possible, as well as improves the customer checkout experience.

Retail climate is competitive, merchants have two choices:

Do nothing or embrace the fact that payments are changing. Transitions from old systems to new ones require work and risk, but merchants who use modern technology are investing in the future and will certainly outperform those who choose to do nothing.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: American credit card, card, card present, chip, Chip and PIN, contactless technology, credit, data, debit card, digital payments, Digital wallets, EMV, EMV compliant, EMV EuroPay MasterCard Visa, merchants, Mobile Payments, payment innovations, payment methods, payment technology, payments, point of sale, POS, provider's, smartphone, tablet, token, tokenization, transaction

December 1st, 2014 by Elma Jane

Few Americans will likely remember the life and work of Martin Cooper, largely because most Americans have no idea who Martin Cooper is. Without Martin Cooper much of what we identify as normal life for the last two decades would not have been possible, as without his invention we would still be looking for pay phones, dropping off film to be developed, printing out boarding passes and contemplating a future where a plastic rectangle was the height of payments technology.

Anyone reading this has a phone with internet access which means no one has to guess, with a few taps on a smartphone most readers who didn’t already know were able to find out that Martin Cooper invented the handheld mobile phone and by so doing changed the lives of not just Americans, but people all over the world.

Mobile has integrated so seamlessly into our life that we didn’t realize it was changing everything we do.

Here are the list of all of the ways that mobile has improved life for us all.

We All Get To Know Everything All The Time, with just a smartphone. Impulse buy is a thing of the past because consumers just don’t buy on impulse as much anymore. A new intentionality has taken hold of shopping. Many Americans have the money and the will to spend. But they are time-pressed and deal savvy, visiting stores only when they run out of items like cereal or toilet paper and after doing extensive research on purchases online and with friends. They buy what they came for and then leave. Plus consumers are harder to fool, they know if they are being overcharged because they can look it up in real time while they are in the showroom.

Full Price Is A Notion Utterly Without Meaning. There are sites like Groupon, LivingSocial and a thousand imitators offer coupons pretty much across every retailer that mean no matter where one is shopping or eating they’re probably a few button taps away from paying less for the type of service they are out for. And then there are the retailer rewards programs all bent on giving consumers more stuff for free as long as they use their mobile coupons.

We All Think Way More About Privacy And Digital Security Than We Used To. Twenty years ago one’s largest security concern was probably that their home or car would be broken into, followed closely by their wallet being stolen. Now we wait for Russian cybercriminals to steal our cards by hacking into POS systems and lifting the data. Or for cybercriminals to hack our phones and upload naked pictures of us to the internet (celebrity readers only). Or for Nigerian princes to trick our grandparents into wiring them money. In short, while we still fear for our physical possessions as much as we ever did, the mobile world gave us something entirely new to worry about, the integrity of our data and who could use our phones, cards and email accounts as a backdoor into our entire personal and financial lives.

We Want It All, And We Want It Now. Anyone with a phone in their pocket can, in one way or another, buy it on the spot. Which has given rise to the push for same-day delivery, consumers who can buy it now, also want to be able to get it now, or as close to now as possible.

We Also Want It Later. Maybe the consumer likes going to the store, enjoys the Christmas lights, wants to eat at a mall food court, they just don’t want to stand inline. And now, through the magic of omnichannel commerce, they may not have to do. Through the magic of multi-device shopping an instore pick-up, consumers are increasingly getting used to finding something on their mobile, paying on their computer and picking up in store. Or some combination thereof.

Mobile has made commerce less a race between the e-markets and the brick-and-mortars, and more a race to offer the most seamless commerce experience. Mobile has taught ever one to care less about where they buy, and more about what the total buying experience is.

We Pay For Access Instead Of Objects. Ten years ago when your family set about its early experiments in binge watching television with the first season of Lost, odds are everyone gathered round and watched a DVD set or maybe a Blue Ray, if your family happened to be full of early adopters.

This weekend, when entire families are sitting down to watch How To Get Away With Murder, more likely than not they are streaming it through Hulu. Unless they don’t want to watch that, in which case, they are watching something else on Netflix on their phone while sitting in the same room with their family. Unless of course this is a football family, in which case you are paying the NFL for access to every football game played everywhere in America tomorrow and a cable company to watch in HD.

We Want To Use A Phone To Access Everything. It’s almost now quaint to refer to a time when phones were used primarily to talk. With the rapidly emerging internet of things, it will soon be quaint to talk about a phone as a tool used primarily for communicating and shopping.

The smartphone is already heading toward being the key interface between connected devices and products (The Internet of Things) and their users. Among other things, people will use the device to remotely control household appliances, interact with screens and automatically adjust car settings to their preferences.

We Kinda Hope The Phone Might Keep Us Alive. With the release of Apple Pay, also came the release of Apple Health that has widely been reported as ushering in the age of mobile device as wellness guru. Smartphones can already help people lead healthier lives by providing information, recommendations and reminders based on data gathered through sensors embedded in users’ clothing (shoes, wristbands, etc.) or through other phone capabilities (motion detectors, cameras, etc.).

And, even if you don’t listen to your phone and put your health at risk, it will still probably save you. Internet-enabled mobile devices are becoming important tools in broadening access to health care, diagnosing diseases and saving lives in crisis situations.

Making Life A Lot Better For Everyone. Small merchants can do something now that they couldn’t do en masse twenty years ago. Take credit card payments and use a tablet to do that and run their business. With the emergence of mobile, came thousands of the other mPOS solutions and platforms exploding all over the world. This has not only changed the way these small businesses operate, it has changed their entire pitch to their customers.

Mobile has made life easier for many consumers, but for some businesses and many people mobile has made mainstream financial participation possible.

Posted in Best Practices for Merchants, Smartphone Tagged with: (POS) systems, brick-and-mortars, cards, consumers, credit card payments, customers, data, e-markets, email accounts, mobile, mobile coupons, mobile device, mPOS solutions, omnichannel commerce, pay phones, payments technology, platforms, Small merchants, smartphone, tablet

July 22nd, 2014 by Elma Jane

An Android tablet is a great tool for work, but not every Android app was made for tablets. In fact, most Android apps were made for smaller smartphone displays. While those apps will run just fine on your tablet, they don’t do anything to take advantage of the extra screen space, and while smartphone apps are forced to hide options deep in menus, tablet apps have more room to put those controls front and center. Plus, phone apps just don’t look very good on a tablet. The interface is usually stretched and skewed to fill the larger screen. With that in mind, here are apps that will help you get to work on your Android tablet.

Android Device Manager (Free) – a good tool to help you find a lost or stolen Android device. Keeping it installed on your Android tablet will enable you to quickly locate your business phone if it’s ever misplaced. The app can force your phone to ring even if it’s in silent mode. Lock it to prevent thieves from accessing private or confidential business data and even locate your phone using its built-in GPS sensor. Using Android Device Manager on a tablet gives you plenty of space to view and pan around the map while you’re pinpointing the location of your phone. As a last resort, you can use the app to remotely wipe all the data from your smartphone.

Evernote (Free) – is a great app for taking notes, making to-do lists and saving photos and it’s even better on a tablet. The biggest difference between the smartphone and tablet version of Evernote is that the latter features a persistent sidebar that lets you quickly flip between notes, notebooks and tagged items. It has large buttons that let you create a new note, snap a photo or quickly dictate a voice memo. Those options are hidden in a slide-out menu in the smartphone app. You also get more space to view each individual note, which means you can see your entire memo or list at once with less scrolling and swiping.

Google Docs (Free) – Let’s face it: a word processor like Google Docs isn’t all that useful on your smartphone. Sure, it can come in handy when you need to make a few tweaks to an existing document, but you’ll need a bigger display to get much work done. The Google Docs app was really made for tablets, especially when you pair your slate with a Bluetooth keyboard to use it like a laptop computer. Not only do you get a better view of your entire document on the tablet, but you also get quick access to formatting options at the top of the interface, letting you change fonts, colors, text alignment and more. Those options are tucked away in several layers of menus in the smartphone app. Google’s Sheet spreadsheet editor and Slides presentation maker are also better suited for a large tablet display than a smartphone.

Google Drive (Free) – is a solid cloud storage platform for Android users, and a large tablet screen makes it easier to navigate your file library, thanks to a persistent sidebar that lets you jump to any folder with one tap. It also helps you search through shared and starred documents, or jump to a view of your recently uploaded files. But the best reason to use Google Drive on your tablet is that it lets you open those documents on the tablet version of Google Docs, which is much more functional on a large screen than on a smartphone.

Google Keep (Free) – is a minimalist productivity app that lets you quickly capture notes, voice memos and photos, then view all items in a colorful pinboard-style layout. It works fine on smartphones, but on tablets the app scales beautifully to fill the entire screen, letting you view more notes and photos at once. Otherwise, the app offers identical functionality on smartphones and tablets. In addition to pinning new notes to your board, you can create a to-do list and check items off with one tap. You can also set reminders for any item on your tablet and receive an alert on your smartphone when the time comes.

Hangouts (Free) – is an all-in-one messaging app that combines text messaging and videoconferencing functionality. The app imports your contacts from your Google account to let you create new conversations quickly and the ability to add and remove participants in the middle of a conversation helps it stand out from other messaging apps. You can start a video chat session at any time by tapping the video call button during a Hangouts session. That comes in handy when you need to meet with an employee, colleague or client, but can’t meet face-to-face. Hangouts works fine on a smartphone, but it’s better on a tablet. A persistent sidebar makes it easier to browse through your past conversations, and a larger touch-screen keyboard makes it easier to type out messages.

Informant 3 ($9.99) – is a powerful productivity app that combines a business calendar and task manager in a single location. The calendar automatically imports all your events and appointments from the stock Android calendar, so getting started with Informant 3 is easy. Once it’s set up, you can view your agenda at a glance. Change the view to get the optimal view of your day, week or month and add, move and delete items with a few taps. Meanwhile, the task manager lets you add items to a dynamic to-do list, set reminders and alerts, sort tasks by importance and more. Informant 3 works best on a tablet. Browsing your calendars and lists is easier and more comfortable on a larger display. The app also features a special tablet mode with a sidebar that lets you quickly jump between calendar dates.

Posted in Uncategorized Tagged with: Android, Android Device Manager, app, Bluetooth keyboard, computer, data, evernote, Google Docs, google drive, Google Keep, hangouts, Informant 3, laptop, notebooks, notes, phone apps, platform, smartphone, tablet

With smartphone users on the rise

With smartphone users on the rise  Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.

Mobile payment processing is getting heated competition as priority in the electronic payment industry begins to shift. Retailers and restaurants are switching to cheaper solutions like smartphones and tablets linked to a mobile point of sale system or MPOS. These MPOS applications have devices that connect to a smartphone or tablet via Bluetooth wireless interfaces or through a standard headphone jack on the device.  Yet another payment solution on the horizon is the MCE initiative for smartphones and tablets. The new solution is being led by 7-eleven, BestBuy, CVS Pharmacy, Darden Restaurants, Lowes, Publix, Sears, Shell Oil, Sunoco, Target, Dunkin’ Donuts, Bed Bath & Beyond and WalMart. According to their website, “Development of the mobile application is underway, with an initial focus on a flexible solution that will offer merchants a customizable platform with the features and functionality needed to best meet consumers’ needs.” The company intends to make their application available on all major smartphone platforms.

Yet another payment solution on the horizon is the MCE initiative for smartphones and tablets. The new solution is being led by 7-eleven, BestBuy, CVS Pharmacy, Darden Restaurants, Lowes, Publix, Sears, Shell Oil, Sunoco, Target, Dunkin’ Donuts, Bed Bath & Beyond and WalMart. According to their website, “Development of the mobile application is underway, with an initial focus on a flexible solution that will offer merchants a customizable platform with the features and functionality needed to best meet consumers’ needs.” The company intends to make their application available on all major smartphone platforms.