July 15th, 2014 by Elma Jane

Businesses only stand to benefit by making themselves accessible via mobile devices. With a mobile website or mobile app, businesses can boost sales, retain loyal customers and expand their reach. The question is, which type of mobile presence is best for your business Or should you have both? Both mobile websites and mobile apps let customers find and access your business from devices they use the most, but a mobile website and mobile app are not the same thing. To help you decide, check out the differences between the two and how they can benefit your business.

Mobile App – is a smartphone or tablet application. Unlike a mobile website, a mobile app must be downloaded and installed, typically from an app marketplace, such as the Apple App Store or Android’s Google Play store.

Mobile Website – is designed specifically for the smaller screens and touch-screen capabilities of smartphones and tablets. It can be accessed using any mobile devices Web browser, like Safari on iOS and Chrome on Android. Users simply type in the URL or click on a link to your website, and the website automatically detects the mobile device and redirects the viewer to the mobile version of your website.

Mobile website’s benefits

The primary benefit of a mobile website is that it makes regular websites more accessible for mobile users. It can have all the same elements as the regular version of the website, such as its look and feel, pages, images and other content, but it features a mobile-friendly layout that offers improved readability and functionality when viewed on a smartphone or tablet. By having a mobile website, customers can access your website anytime, anywhere using any device, without compromising the user experience.

Mobile app’s benefits

Although a mobile app functions a lot like a mobile website, a mobile app gives businesses the advantage of having their own corner on a customer’s device, because users have to download and install the app, businesses have more control over their presence on a device than they would with a mobile website. For instance, a mobile app can be closed or inactive, but still work in the background to send geo-targeted push notifications and gather data about customer’s preferences and behaviors. Moreover, mobile apps make it easy to deploy loyalty programs and use mobile payments using a single platform. It’s also much easier to access a mobile app than a mobile website all it takes is one tap, versus having to open a Web browser then type in a URL.

Mobile website and Mobile app features

Although mobile websites and mobile apps aren’t the same thing, they generally offer the same features that can help grow your business by making it easier for customers to find and reach you.

Features include the following:

Click-to-map: Users can use their devices’ GPS to locate your business and instantly get directions, without having to manually input your address.

Mobile commerce: Take your online store mobile with e-commerce-capable mobile websites and apps, such as with Buy Now buttons and mobile carts.

One-click calling: Users can call your business simply by tapping on your phone number from your website or app.

Social sharing: This feature integrates social media apps and websites to enable users to easily share content with friends and followers.

Mobile marketing: This lets users sign up for marketing lists and loyalty programs while enabling businesses to easily launch location-based text-message marketing and email marketing campaigns.

How to build a mobile app

Just like the options available for building a mobile website, businesses can either hire an app developer to build a mobile app or take the budget-friendly DIY mobile app maker route.

How to build a mobile website

To build a mobile website, one option is to hire a mobile Web developer to create one from scratch or convert an existing website into a mobile-friendly one. A more affordable option is to build one yourself with a free DIY mobile website builder, which uses a drag-and-drop platform that doesn’t require programming or Web design skills.

Posted in Uncategorized Tagged with: Android's Google Play, Apple App, Chrome, customers, data, devices, e-commerce, email marketing, GPS, iOS, mobile, mobile app, mobile carts, Mobile Devices, mobile website, platform, programs, Safari, smartphone, tablet, URL, Web browser

June 17th, 2014 by Elma Jane

BioCatch, an Israeli startup that uses behavioural biometrics to authenticate visitors to banking and e-commerce sites, has raised $10 million in a funding round. BioCatch aims to eliminate passwords and authentication dongles for online banking and shopping, replacing them with a system that recognizes users by how they physically use their computer or tablet. The firm’s technology collects and analyses over 400 bio-behavioral, cognitive and physiological parameters based on how people type and move a cursor around to create unique profiles for visitors to sites.

In addition, the system creates invisible challenges for visitors to sites. For example, when a user moves the cursor towards a button, they are deliberately knocked slightly off course and subconsciously have to correct in what the company says is a way unique to them. This, argues BioCatch, is more secure than traditional authentication methods, demonstrating an 80% reduction in false positives for detecting the same amount of fraud. It also significantly reduces friction for the customer because the system automatically kicks in when they visit a site using the technology. BioCatch says that it has signed up several unnamed banks and e-commerce sites, and that it will use the new funding to push on in North American and Europe as well as to expand R&D efforts. Funding will also allow to continue strengthening BioCatch offering and expand global reach in strategic markets, while keeping the world’s largest and most influential institutions safe and secure.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: banking, banking and e-commerce, behavioural biometrics, BioCatch, biometrics, computer, e-commerce, funding, online banking, R&D, tablet

June 12th, 2014 by Elma Jane

QR: The Bridge to the Modern World

Involvement devices have come a long way from the time of Clearinghouse mailings, where you would peel off a label and stick it onto another page before dropping it back in the mail.

Today, print’s best involvement device is the QR code. It works as a portal or bridge into the mobile online world where the cataloger’s brand lives and breathes in real time. Even better, it can lead the customer from the catalog page to the checkout button on their smartphone within minutes.

The printed catalog delivers rich colors and a personal, tactile experience still not attainable through any mobile device. In many ways, though, it is a vestige of a bygone era, and an expensive one at that. Catalogers know this. Even the U.S. Postal Service also knows this. That’s why the USPS is running a postage discount promotion for the second year in a row this summer to encourage the use of QR codes by direct mailers.

Let’s take a quick look at the way a few catalogers are using QR codes.

Anthropologie

Anthropologie’s marketing strategy is more about selling a lifestyle than selling products. That explains why making it easy for customers to move toward actually buying something doesn’t seem like such a big priority in their catalog. They did not include a QR code anywhere. The closest they came was one line next to the address: For store information, go to www.anthropologie.com. Their 800 number, they do take phone orders is printed only once in tiny type, so having no QR code seems to fit in with their attempts to play hard to get. Marketing critique aside, by not using a QR code on their catalog, they are missing the opportunity to draw customers into closer involvement with their brand, whether or not they intend to make an immediate sale.

Best Practices

With these few examples in mind, it’s time to look at best practices for using QR codes in catalogs, which can be a two-sided equation. There is the technical aspect and the branding/selling aspect. As far as the technical side goes, customers need to use their smartphone to scan the code successfully, and the destination on the other end must be optimized for mobile access. Sometimes the hardest part is organizing the resources required to execute the backend side of things, especially if the goal is to make an immediate sale.

The main thing to consider is that QR codes work as a bridge and that bridge is a smartphone, iPad, or some other tablet with all their usual constraints (screen size, internet connection, quality of camera, QR reader app, user proficiency, etc.). Also, don’t assume that everyone has a QR reader or even knows what a QR code is. Especially in catalogs, where customers have been seeing postal service barcodes for years, people may assume that the pixelated square thing is just something else for the USPS to lose money on. Instead, including a brief call to action to scan the QR code should do the trick.

Crossing the Bridge

Getting customers to scan the QR code is only half the battle. Now you need to make sure they feel it was worth their while to scan. It’s all about the next steps in your customer relationship. If you have an Apple or Android app, then that’s where to send people if you know that you can convert sales successfully on mobile devices. Sending them to your Facebook fan page is an option too, but not a big win if a majority of your customers are already fans.

Special promotions, optimized for mobile access, will certainly earn your QR its keep. If your goal is to inspire a trip to one of your stores, then do what Brookstone does and send customers to a Google map with all store locations within a hundred miles. It’s also possible to send scanners to a dedicated page, again, optimized for mobile where you give them a number of options: Facebook, shop, app, etc.

Delia’s

By appealing to fashion-hungry American teens via retail stores, web, and catalog, Delia’s sold over $220 million in 2011. In the single catalog we looked at, Delia’s had a QR code on its back cover. When scanned, the code points to Delia’s Facebook page. That’s certainly one way to build involvement with the Delia’s brand, but it may not be the best. Delia’s has an Apple app with full e-commerce capabilities, so Delia’s could be missing out on the opportunity to help the customer cut to the chase and get straight to their virtual shopping bag. Still, at least they’re using the code.

King Schools

Unless you’re a pilot in training or know one fairly well, you have probably never heard of King Schools. They offer more than 90 flight training courses, plus all sorts of accessories for pilots-in-training. They have no retail stores, but that’s all the more reason to mention them here, retailers can learn a lot from King Schools about how to use QR codes in their catalogs.

In the one catalog, King used a QR code on the front cover and the back cover. Now, the iPad shows enormous potential for use in general and commercial aviation, so King is smart to use their QR codes to point customers directly toward their mobile apps and offerings. In fact, King Schools uses QR codes on the Take Courses on Your iPad landing page itself.

In most cases it seems counterintuitive to display a QR code on a website for people to scan. After all, they’re already there. It’s a smart use of codes in this case, for two reasons. First, the codes lead the customer directly to the Apple app store, so it actually makes sense to scan the codes even though the customer is already on their website. The customer is now just a few clicks away from buying and installing the app. Second, there is one QR code for their app store in general, and then there are unique codes for individual apps.

Technicalities

The content in a QR code tops out at 4,296 alphanumeric characters, but catalogers only need a fraction of that to get the customer to where they want them. However, even when the character count is down to a few dozen, size does matter, because QR codes with more data embedded in them are more complex visually. This means that even smartphones with the latest and greatest optics will have trouble reading densely populated codes. Make sure the QR code is big enough. Even the simplest codes will frustrate the scanning process if they are too small or if there isn’t enough white space around them. Maybe a QR code isn’t the most photogenic thing in the world, so it’s a good challenge for catalog art directors to incorporate it into the design without shrinking it into oblivion.

More sophisticated catalogers will want to use personalized QR codes. Today, even local printers are likely to have the means to print unique QR codes for each recipient in a mailing. This creates the ability to track scans back to the individual, a marketer’s dream when it comes to one-to-one marketing relationships.

Innovation can get you traction within the social media realm and that’s money in the bank. Whether you’re a major catalog player or using QR for something completely different, always consider getting the marketing and PR people involved to leverage any novelty aspects of the application.

The benefits pile up quickly to those catalogers who take the time to get smart about QR codes. Thick catalog books can be thinned down a bit if QR codes succeed in pulling customers from the page and onto their site or apps, cutting postal costs for the millions of mailings every year. And, even if the cataloger doesn’t go to the extreme of printing unique QR codes, the branding value of offering that connection from the old-style printed piece to the dynamic world of interactive mobile technology makes it well worth the effort.

The ink needed to print a QR code on a major retailer’s catalog might weigh only a fraction of an ounce, but when used right, it’s worth its weight in gold. Too bad the majority of catalogs seem to be squandering the opportunity by underutilizing the code or worse, not including any at all. In a world where an integrated multi-channel approach is a must-have for any retailer to survive, the stakes of leveraging every opportunity for interaction are higher than ever.

Posted in Best Practices for Merchants, Smartphone Tagged with: Android app, Anthropologie, app, Apple, bank, barcodes, Best Practices, Brookstone, clearinghouse, code, commercial aviation, Crossing the Bridge, customer relationship, data, data embedded, Delia’s, e-commerce, Facebook, google, Google map, interactive mobile technology, ipad, King Schools, marketing, mobile, mobile access, mobile device, mobile online, mobile technology, multi-channel, phone, portal, Postal Service, QR code, QR reader, retail stores, scan, scanners, smartphone, social media, tablet, USPS, virtual shopping, web, website

May 23rd, 2014 by Elma Jane

Before making a purchase, there are several devices that consumers may use to help them make a decision: Use a specific store’s mobile app on their smartphones. Visit the store’s website on a tablet or computer, or just pick up the phone and call customer service to ask a question. Whatever the case, omnichannel is an important buzzword for merchants.

Here are ways to ensure a seamless and secure retail experience to turn browsers into loyal buyers.

Ensure Channels Work Together

Even in historically single-channel retail sectors such as grocery, more than half of customers now use two or more channels before completing a purchase, shown in a recent study. Retailers must therefore offer both traditional and digital channels. However, before investing in the latest mobile-optimized website feature or app, retailers should learn how existing online and physical channels can together enhance the customer experience. What customers value most is not the number of channels offered, but how these channels support each other.

A merchant’s website might encourage visitors to take advantage of a special event in-store, while sales assistants on the floor can use Wi-Fi enabled tablets to access additional product information.

Help Customers Find What They Want

With Internet access ubiquitous, cost-conscious customers are just a click away from being able to compare prices and find special offers. Many take out their smartphone or tablet in stores to compare prices, a trend called Showrooming.

Online retailers can take advantage of this trend by encouraging shoppers to compare prices in-store using a mobile app. In-store retailers, on the other hand, could provide greater value through targeted offers, price match guarantees, expert advice, convenient delivery choices and personalized customer care.

Optimize The Checkout Experience

Businesses must be sure to have a quick, streamlined checkout process once they have converted an online browser into a customer or else they risk facing shopping cart abandonment. This can be done in a few steps:

1. Assess how the checkout experience can be customized for its customers. Keep the mandatory information required from new or first-time online or mobile shoppers to a minimum and shorten the process for returning customers by securely storing their payment details and other personal information.

2. Develop a dedicated mobile app or other innovative functions that can increase long-term satisfaction and loyalty.

3. Test different payment methods to find those that are most convenient for customers. These payment options may include paying with reward points, using a digital wallet or providing a digital offer or coupon at checkout. There is a balance to be found between having additional payment methods to meet customer expectations and choosing methods appropriate to a merchant’s business model.

4. Establish a one-click online checkout process. Chase for example, is currently developing a Chase Wallet and Quick Checkout solution. The Chase Wallet will allow customers to store and access their Chase cards and ultimately, any branded card for a quick checkout. It will also update Chase-branded cards when a customer replaces an existing card and use tokenization to securely process payments with select merchants.

Merchants also face the challenge of ensuring that the online and in-store checkout experience is secure, while at the same time eliminating as many false positives as possible. False positives are a hindrance to any business as they may reduce sales, increase chargebacks and frustrate customers. A quick-checkout solution may help reduce false positives because customer information is automatically populated rather than manually keyed into the checkout page.

Acquirers should also work with online retailers to provide a conditional approval code for a transaction. This code allows the fulfillment process to move forward while authentication is taking place. The additional time for a thorough authentication also helps reduce the number of false positives.

Use Data to Build Loyalty

Customers will likely return to a retailer if product marketing reflects their past purchases or interests. Therefore, taking advantage of data including a customer’s purchasing history, loyalty, behavior or social media interests may help retailers to better understand their customers as well as personalize their shopping experience.

According to a study released in March 2013, Chase Paymentech found that 32 percent of merchants use their payment data to help craft their multi-channel sales strategy and 42 percent use it to improve the online customer experience. In addition, further analysis of payment methods, chargeback rates, fraud rates and authorization rates may improve the customer shopping experience and drive overall profitability.

Posted in Best Practices for Merchants Tagged with: approval code, authentication, branded card, chargebacks, Chase, Chase Wallet, checkout process, computer, customer service, data, digital channels, digital offer, Digital Wallet, In-store retailers, internet access, Merchant's, merchant’s website, mobile app, mobile-optimized website, omnichannel, online retailers, payment, payment data, phone, physical channels, Quick Checkout solution, reward points, shopping cart, Showrooming, single-channel retail, Smartphones, social media, tablet, tokenization, transaction, website, Wi-Fi

May 21st, 2014 by Elma Jane

Mobile credit card processing is way cheaper than traditional point-of-sale (POS) systems. Accepting credit cards using mobile devices is stressful, not to mention a hassle to set up and customers would never dare compromise security by saving or swiping their credit cards on a mobile device. Some of the many myths surrounding mobile payments, which allow merchants to process credit card payments using smartphones and tablets. Merchants process payments using a physical credit card reader attached to a mobile device or by scanning previously stored credit card information from a mobile app, as is the case with mobile wallets. Benefits include convenience, a streamlined POS system and access to a breadth of business opportunities based on collected consumer data. Nevertheless, mobile payments as a whole remains a hotly debated topic among retailers, customers and industry experts alike.

Although mobile payment adoption has been slow, consumers are steadily shifting their preferences as an increasing number of merchants implement mobile payment technologies (made easier and more accessible by major mobile payment players such as Square and PayPal). To stay competitive, it’s more important than ever for small businesses to stay current and understand where mobile payment technology is heading.

If you’re considering adopting mobile payments or are simply curious about the technology, here are mobile payment myths that you may have heard, but are completely untrue.

All rates are conveniently the same. Thanks to the marketing of big players like Square and PayPal – which are not actually credit card processors, but aggregators rates can vary widely and significantly. For instance, consider that the average debit rate is 1.35 percent. Square’s is 2.75 percent and PayPal Here’s is 2.7 percent, so customers will have to pay an additional 1.41 percent and 1.35 percent, respectively, using these two services. Some cards also get charged well over 4 percent, such as foreign rewards cards. These companies profit & mobile customers lose. Always read the fine print.

Credit card information is stored on my mobile device after a transaction. Good mobile developers do not store any critical information on the device. That information should only be transferred through an encrypted, secure handshake between the application and the processor. No information should be stored or left hanging around following the transaction.

I already have a POS system – the hassle isn’t worth it. Mobile payments offer more flexibility to reach the customer than ever before. No longer are sales people tied to a cash register and counters to finish the sale. That flexibility can mean the difference between revenue and a lost sale. Mobile payments also have the latest technology to track sales, log revenue, fight chargebacks, and analyze performance quickly and easily.

If we build it, they will come. Many wallet providers believe that if you simply build a new mobile payment method into the phones, consumers will adopt it as their new wallet. This includes proponents of NFC technology, QR codes, Bluetooth and other technologies, but given very few merchants have the POS systems to accept these new types of technologies, consumers have not adopted. Currently, only 6.6 percent of merchants can accept NFC, and even less for QR codes or BLE technology, hence the extremely slow adoption rate. Simply put, the new solutions are NOT convenient, and do not replace consumers’ existing wallets, not even close.

It raises the risk of fraud. Fraud’s always a concern. However, since data isn’t stored on the device for Square and others, the data is stored on their servers, the risk is lessened. For example, there’s no need for you to fear one of your employees walking out with your tablet and downloading all of your customers’ info from the tablet. There’s also no heightened fraud risk for data loss if a tablet or mobile device is ever sold.

Mobile processing apps are error-free. Data corruption glitches do happen on wireless mobile devices. A merchant using mobile credit card processing apps needs to be more diligent to review their mobile processing transactions. Mobile technology is fantastic when it works.

Mobile wallets are about to happen. They aren’t about to happen, especially in developed markets like the U.S. It took 60 years to put in the banking infrastructure we have today and it will take years for mobile wallets to achieve critical mass here.

Setup is difficult and complicated. Setting up usually just involves downloading the vendor’s app and following the necessary steps to get the hardware and software up and running. The beauty of modern payment solutions is that like most mobile apps, they are built to be user-friendly and intuitive so merchants would have little trouble setting them up. Most mobile payment providers offer customer support as well, so you can always give them a call in the unlikely event that you have trouble setting up the system.

The biggest business opportunity in the mobile payments space is in developed markets. While most investments and activity in the Mobile Point of Sale space take place today in developed markets (North America and Western Europe), the largest opportunity is actually in emerging markets where most merchants are informal and by definition can’t get a merchant account to accept card payments. Credit and debit card penetration is higher in developed markets, but informal merchants account for the majority of payments volume in emerging markets and all those transactions are conducted in cash today.

Wireless devices are unreliable. Reliability is very often brought up as I think many businesses are wary of fully wireless setups. I think this is partly justified, but very easily mitigated, for example with a separate Wi-Fi network solely for point of sale and payments. With the right device, network equipment, software and card processor, reliability shouldn’t be an issue.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: (POS) systems, aggregators rates, apps, BLE technology, bluetooth, card, card processor, card reader, cash, cash register, chargebacks, consumer data, credit, credit card payments, credit card processing, credit card processors, credit card reader, credit-card, customer support, data, data loss, debit card, debit rate, device, fraud, fraud risk, hardware, industry experts, merchant account, Merchant's, mobile, mobile app, mobile credit card processing, Mobile Devices, Mobile Payments, mobile point of sale, Mobile processing apps, mobile processing transactions, mobile technology, mobile wallets, network, network equipment, nfc, nfc technology, payment solutions, payment technology, PayPal, phones, point of sale, qr codes, retailers, rewards cards, Security, Smartphones, software, Square, tablet, tablets, vendor's app, wallet providers, Wi-Fi network, wireless mobile, wireless mobile devices

May 9th, 2014 by Elma Jane

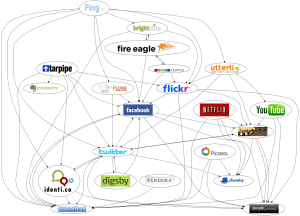

Facebook is apparently ready to become a person-to-person (P2P) money transfer network. The clear decision to launch a money transfer service in the region can be seen as a test bed for Facebook’s larger ambitions of becoming a payments hub for its 1 billion user base. Facebook was only weeks away from gaining regulatory approval in Ireland for its remittance platform FT quoted unnamed sources. Facebook’s P2P platform will be geared to facilitating migrant remittances, with the goal of expanding its payment presence in emerging markets such as India. Facebook makes the bulk of its revenue from advertising, but 10 percent of its profits reportedly come from in-game payments for online and mobile games, such as Zynga’s popular FarmVille.

From WhatsApp to what’s next

Facebook’s February 2014 acquisition of mobile messaging service WhatsApp for $19 billion clarified the social network’s strategy. The WhatsApp acquisition and the expected P2P network launch as part of the first phase of Facebook’s deeper immersion into payments.

Tech giants face up to payments

When comparing the payment strategies of tech giants Google Inc., Apple Inc. and Facebook, the latter two competitors as having bigger potential upsides than Google. Facebook and Apple (via iTunes) already have established financial relationships with millions of users who have attached funding mechanisms – debit and credit cards – to their social media accounts. As primarily a search engine, Google is playing catch up to persuade its users to set up Google Wallet accounts.

In May 2013, Google launched its own P2P network by integrating Google Wallet with Gmail accounts, so that wallet users can facilitate money transfers via email. More recently, reports have surfaced indicating Google plans to extend Google Wallet to its wearable technology solution Google Glass. But the success of such ventures rests on users’ confidence with Google as a financial service provider.

Facebook as having a brighter financial services future than Apple. Apple’s reach is limited to consumers who have iPhones and iPads, whereas Facebook is not tied to any branded mobile devices, it is a very ubiquitous offering. It could apply to anybody with any type of phone or tablet.

Eventually, tech companies like Facebook will need to partner with payment businesses in order to expand into the merchant-centric brick-and-mortar world. The mobile POS solution provider, a business unit of global POS terminal manufacturer Ingenico SA, would be an ideal partner for Facebook. If they extend what they do from P2P payments to more of a wallet purchasing capability for their users, then the next step could very easily be an extension of that into servicing the merchant side.

Posted in Financial Services, Mobile Payments, Smartphone Tagged with: Apple Inc.Facebook, consumers, credit cards, debit, device, financial service, financial service provider, Gmail accounts, Google Glass, Google Inc., Google Wallet accounts, ingenico, iPads, iPhones, iTunes, merchant-centric brick-and-mortar, migrant remittances, mobile, Mobile Devices, mobile games, mobile messaging service, mobile pos, mobile POS solution, mobile POS solution provider, money transfer, money transfer network, money transfer service, network, online, p2p, P2P network, P2P payments, P2P platform, payment businesses, payments, payments hub, phone, POS terminal, remittance, remittance platform, search engine, service provider, social media, social media accounts, social networks, tablet, wearable technology

April 8th, 2014 by Elma Jane

Today’s consumers are defining themselves by their mobile devices, their social presences and how they interact with brands, both offline and online. The digital evolution of the average consumer is alive and kicking.

Today’s consumer is more connected than ever, with more access to and deeper engagement with content and brands. Thanks to the proliferation of digital devices and platforms. Content that was once only available to consumers via specific methods of delivery such as via print, radio and broadcast television can now be sourced and delivered to consumers through their multiple connected devices. This is driving the media revolution and blurring traditional media definitions.

What are the specific characteristics or dynamics shaping today’s consumer behavior? Digital consumers are social-savvy and more connected to their friends, family and favorite brands than ever before.

Focused On The Gadgetry

Consumers love gadgets.

One out of four Americans plan to buy a smartphone in the near future. Thirty percent intend to upgrade from a regular mobile phone to a smartphone once able. For those ages 18 to 24, 49 percent they want to upgrade to a smartphone.

How frequently consumers use their mobile devices in a given month? Consumers spent an average of 34 hours and 17 minutes per month using apps on their devices, an increase of 9 hours and 52 minutes from 2012.

Interestingly, the amount of time consumers spend surfing the Web fell 1 hour and 54 minutes to a total of 27 hours and 3 minutes. The amount of time used to watch videos online increased by 43 minutes, to 6 hours and 41 minutes.

Social Media & Everyday Life

Digital consumers, by and large love their social media.

Sixty-four percent said that they use social media at least once per day. For mobile however, the growth figures reported suggest a broad shift is happening, pushing more people to access social networks via mobile platforms.

Forty-seven percent of smartphone owners log onto a social network each day. Additionally, the number of people who use social-media apps on their smartphones rose by 37 percent from 2012.

Digital consumers are also diversifying their choice of social networks, opting to use LinkedIn and Pinterest in addition to so-called traditional social media platforms like Facebook and Twitter.

As digital consumers find their own mix of devices and platforms to access and engage with social media, they are building profiles and connections on multiple social networks as well.

Two Screens Is A King

Digital consumers also rely on their mobile devices as a second type of television screen.

In a survey, eighty-four percent said they use their smartphone or tablet to surf the Web or to use apps while watching television. Of those, 44 percent of tablet owners shopped while watching TV, and 24 percent used their smartphones to make purchases.

Fourteen percent of tablet owners used their device to buy a product or service as it was being advertised on TV. Just 7 percent of smartphone owners said they would do the same.

Posted in Best Practices for Merchants, Credit card Processing, Financial Services, Merchant Services Account, Mobile Payments, Small Business Improvement, Smartphone Tagged with: apps on their devices, average consumer, content, deeper engagement, digital consumers, digital devices, digital evolution, Facebook, gadgets, linkedin, media revolution, Mobile Devices, mobile platforms, offline and online, pinterest, regular mobile phone, smartphone, social media, social network, social presences, social-media apps, social-savvy, tablet, traditional media, twitter

March 17th, 2014 by Elma Jane

With so much to do each day, it’s easy for a small business owner to get bogged down in details. That’s where your smartphone comes in. With the right apps, your mobile device can automate the tasks that used to be daily chores. Whether you need help keeping track of all your business documents, or organizing your calendar and contacts list, it’s time to let your smartphone do some of the heavy lifting.

Back up your business files. Your work machine contains everything you need for a productive day, including every file and document you are working on. But you can’t always be at the office. With your smartphone and the right apps, however, you can back up and access your business files from anywhere. Dropbox, Box, Google Drive, SkyDrive and iCloud are all solid mobile apps that automate the process of syncing your business files to the cloud so you can access them from any Web-connected device, including your smartphone or tablet. Better yet, any edits you make will be synced across all your devices, so you can stay productive and organized.

Manage new contacts. Swapping business cards is a great networking strategy, but cards are easy to lose, and manually inputting all that contact information into your address book is a chore. So let your smartphone enter all that data into your address books. CamCard (available for iOS and Android) is an all-in-one business card management solution. Just point your iPhone camera at a card and snap a photo. The app’s text-recognition software will pull out the key details and update your address book automatically. It can even search for new contacts on LinkedIn to add a photo and additional personal details for each new contact.

Silence your smartphone. A buzzing or ringing smartphone can be distracting – not to mention embarrassing – during a business meeting. Silencing your phone is simple, but chances are you’ll occasionally forget. That’s why there are handy apps that monitor your smartphone calendar for meetings and appointments, then silence your phone for the duration of that event. You can even whitelist specific numbers so you won’t miss an emergency call. When the meeting is over, your smartphone’s ringer and vibration settings will be returned to their normal state. That way, you can stay focused and free from distraction when it matters most. Android users can try Silencify. For iPhone users, AutoSilent is a good option.

Sync your calendars. Both Android and iOS have built-in calendars to help you plan your week and schedule meetings. But juggling both a mobile calendar and a desktop office calendar is a pain, so why not use your smartphone to synchronize the two? If you use Microsoft Outlook as your business calendar, for example, Google Calendar offers an easy way to link them. And iPhone users can synchronize their mobile calendar with Outlook by plugging their smartphone into their computer and accessing the Calendars tab in the iTunes options menu. Automating the process of syncing your calendars means you’ll never mix up appointments. And if you share your business calendar with your employees, it ensures that everyone is always on the same page.

Sync your social media accounts. A strong presence on Facebook and Twitter can help you engage your customers and grow your business. Mobile apps can help you keep your business profiles fresh when you’re on the go, but reposting those updates on each platform individually can be a chore especially from a tiny smartphone screen. Fortunately, there’s an easy way to automate the process of synchronizing social media posts between your business profiles. Simply visit this page to link your Facebook and Twitter accounts. After that, go ahead and use the Facebook mobile app to post updates, news or promotions to your business’s Facebook page, each post will be automatically funneled to your Twitter followers as well.

Posted in Best Practices for Merchants, Mobile Payments, Small Business Improvement, Smartphone Tagged with: all-in-one, Android, apps, automate, automate the process, automating, box, business documents, business profiles, camcard, devices, dropbox, Facebook, google drive, icloud, iOS, Iphone, linkedin, Mobile Apps, mobile device, networking, organizing, productive, skydrive, small business, smartphone, synchronize, synchronizing social media, syncing, tablet, twitter, web-connected

February 18th, 2014 by Elma Jane

Payment Tokenization Standards

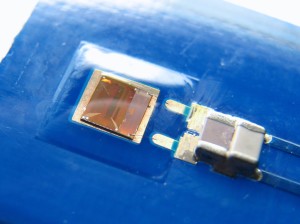

Tokenization is the process of replacing a traditional card account number with a unique payment token that is restricted in how it can be used with a specific device, merchant, transaction type or channel. When using tokenization, merchants and digital wallet operators do not need to store card account numbers; instead they are able to store payment tokens that can only be used for their designated purpose. The tokenization process happens in the background in a manner that is expected to be invisible to the consumer.

EMVCo – which is collectively owned by American Express, Discover, JCB, MasterCard, UnionPay and Visa – has announced that it is expanding its scope to lead the payments industry’s work to standardize payment tokenization. EMVCo says that the new specification will help provide the payments community with a consistent, secure and interoperable environment to make digital payments when using a mobile handset, tablet, personal computer or other smart device.

Key elements of EMVCo’s work include adding new data fields to provide richer industry information about the transaction, which will improve transaction efficiency and enhance the consumer and merchant payment experience by helping to prevent fraudulent card account use. EMVCo will also create a consistent approach to identify and verify the valid use of a token during payment processing including authorization, capture, clearing and settlement.

EMVCo’s announcement follows an earlier joint announcement from MasterCard, Visa and American Express that proposed an initial framework for industry collaboration to standardize payment tokenization. EMVCo says it will now build on this framework with collective input from all of its members and the industry as a whole.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, authorization, capture, card account numbers, clearing, data fields, device, digital payments, Digital Wallet, Discover, EMV, emvco, fraudulent card account, interoperable, jcb, MasterCard, merchant, mobile handset, payment, payment processing, payment token, secure, security standards, settlement, smart device, specification, standardize, tablet, token, tokenization, transaction, visa

January 29th, 2014 by Elma Jane

Ecommerce and mobile-based e-commerce have grown significantly this year. Cyber Monday ecommerce sales, as an example, reached $1.735 billion originating from desktop and laptop devices, according to comScore. Even Black Friday, which is better known for brick-and-mortar retail sales, saw online spending reach $1.198 billion in the United States, again according to comScore. Mobile online spending may also have grown, as some reports indicate that mobile-based site traffic was up 55 percent around Thanksgiving.

Many ecommerce merchants are enjoying a robust holiday selling season even as some brick-and-mortar stores are seeing relatively flat Christmas sales. To ensure continued growth and success, Internet retailers may want to challenge their businesses to improve in several areas in 2014.

Retailers, however, should not rest on their current success, but rather should challenge their businesses to improve in several areas, including free shipping offers, mobile optimization, personalization, data driven decision making, and cross channel sales.

Offer Free, Two-Day Shipping

The first challenge for online sellers in 2014 may be to find ways to offer free, two-day shipping to all or most shoppers. While it is likely there will still be minimum purchase and maximum weight requirements and restrictions, online shoppers are going to expect faster free shipping options thanks, in part, to the growth in services like Amazon Prime and ShopRunner.

Consider order fulfillment services, distributed warehouses, drop shipping, or even partnerships with other retailers to help meet this challenge.

Offer Personalization and Customization

Personalization and customization could be a significant competitive advantage in 2014.

Challenge your business to finally begin offering personalization and customization both onsite and in marketing. The easiest place to start may be with email marketing. Work to segment email marketing campaigns so that they address customers by name and with relevant products and offers that are based on an individual’s or group of shoppers’ stated preferences or on-site behavior.

Taking on this challenge means that the retailer’s marketing department will need to collect meaningful information about what interests shoppers and organize separate, custom campaigns around those interests.

Put Mobile Design and Marketing First

In November, IBM reported that mobile devices accounted for 31 percent of U.S. ecommerce-related web traffic around the Thanksgiving holiday this year, and that 17 percent of ecommerce transactions came from smartphones or tablets. On average, tablet users spent more than $126.00 per order, and smartphone users spent about $106 per order.

This data shows that mobile e commerce is not simply a novelty, but rather a must have for 2014.

If an e-commerce business is not optimized for mobile sales, 2014 is the year to take on that challenge, including offering a responsive design and mobile friendly payment options.

Sell Seamlessly Across Channels, Devices

Try to think of every way that a shopper might interact with an online store, and then make all of those touch points work together in 2014.

Retailers online or in physical stores need to offer shoppers a seamless, cross channel shopping experience that makes buying things easier for the customer. To continue to enjoy success in 2014, consider offering shoppers the ability to share orders across devices, applications, and even marketplaces.

In practice, this might mean that items added to a cart in an online store show up in the cart for the retailer’s iPhone app too. Or that a customer’s order history displayed on a retailer’s site shows orders placed on-site and via a marketplace like Amazon or eBay.

Use Big Data for Big Information

In 2014, find sources of good, usable Big Data, and put the resulting big information to use.

As an example consider, Weather Trends International, a Big Data company that uses historical weather information and advanced data processing to accurately predict weather 11 months in advance. This sort of Big Data information could show a snowboard and ski retailer what sort of winter major ski resorts are likely to have next year, and could inform purchasing and inventory choices.

Similarly, knowing that a particular region is going to have a warmer than normal July and August might impact how, where, and when a clothing retailer promotes shorts or bikinis on Facebook or AdWords.

Big Data is a popular trend in business and in marketing. The concept can mean different things to different businesses. For ecommerce, retailers should seek to use Big Data to gather big information, if you will, that may be used to make better buying and selling decisions.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: adwords, Amazon, big data, big information, brick and mortar, cross channel, cyber, drop shipping, e-commerce, ecommerce, Facebook, internet retailers, laptop devices, Mobile Devices, mobile friendly payment options, mobile optimization, mobile-based site, on-site, online, online shoppers, online store, onsite, personalization, retailers marketing, retailers online, shopping experience, smartphone, Smartphones, tablet, tablets