September 5th, 2024 by Elma Jane

It’s true that the travel agencies are high risk. This is because of the high chargebacks by travelers who fail to complete their trips or stays due to a variety of reasons. It also has to do with the nature of delayed delivery where items or services are sold today but not used/consumed for a delayed period of time. Using the right merchant solutions can make a difference.

You want merchant solutions that help you to manage chargebacks, errant transactions, and terminal messages. Additionally, you should be able to integrate your software with services such as Sabre Red, Sabre, Trams or other accounting programs such as QuickBooks and Peachtree.

With NTCePay, simply create a pay button for any dollar amount. Then send this digital link to your customers via email. The customer reviews the invoice details and enters their payment information to complete payment. You can also create custom links that can be added to your web site or posted to your social media accounts for payment collection. With advanced invoices, you can easily break down payments into installments.

With this service, you avoid the complexities of integrating the software with your shopping cart, point of sale, or accounting system yet still collect your travel payments in a seamless manner.

For Electronic Payment Set Up Call Now! 888-996-227

Posted in Uncategorized Tagged with: chargebacks, high risk, merchant, payment, point of sale, terminal, transactions, travel

August 25th, 2017 by Elma Jane

A travel merchant account helps you manage all your transactions. It also allows you to integrate into your booking software; plus, there are more features that you get to process payments in a secure environment.

Virtual Merchant Payment Terminal

This is a web-based system that allows you to view processed payments in real-time. You can access it using any web browser, and the transactions are conducted over a secure and encrypted connection.

Customers get receipts for their payments via email once the transaction is complete. You can also handle installments and recurring payments online. It also accepts different payment methods, including gift cards, electronic checks, and credit and debit cards.

Loyalty Programs

With a travel merchant account, you are able to reward your loyal travel customers. You can personalize your loyalty program for customers basing on their behavior. A loyalty program can offer free products or discounts on certain tour or travel packages.

Also, you can make gift cards part of your program. With these cards, you can simply load them with any dollar amount and present them to your customers. Plus, they’re re-loadable and offer a great way of advertising. These programs can go a long way in boosting your customer’s loyalty.

Trams & Sabre Integration

If you’re using Sabre Travel Network for agency services, you can easily integrate your account into Sabre to improve your travel options. This integration allows you to provide convenient payment methods for customers searching for cruise lines, hotel properties, car rental services, and airlines.

Also, for those using Trams for accounting and reporting, NTC travel merchant account lets you make a simple integration. In the long run, you are able to focus on growing your travel agency and offer quality services to your clients.

Mobile Processing

Accepts payments fast and on-the-go with mobile processing solutions that are PCI compliant. With this service, you only need to use a mobile device card reader to swipe cards.

Mobile payment processing allows you to use your own iOS or Android device with a free mobile app which you can integrate with your account to manage transactions.

Offering a convenient and smooth payment methods to your clients is one of the ways to grow your business. National Transaction Corporation merchant account, offers secured travel payment processing services e-Pay, to process your payments; with no delays and at a very competitive rates.

Also, you can accept payments from anywhere and get 100 percent funding. Faster deposits for bookings, which can occur as quick as the next business day.

To speak to our travel payment consultant, call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: card reader, credit, debit cards, electronic checks, Gift Cards, Loyalty Programs, mobile, payment processing, payments, PCI, swipe, terminal, transactions, travel agency, Travel Merchant, virtual merchant

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Hotel, Motel and Bed & Breakfast customers will benefit from this smart terminal:

- Smaller, independent motels or hotels

- Hotels without property management systems

- Existing hospitality customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

May 31st, 2017 by Elma Jane

If you’re a retail business you’re going to need a credit card terminal to accept credit cards, and if you have multiple locations; you might need more than one terminal.

Obtaining terminals for your business with multiple locations can be expensive. Because of this, some merchants used leasing arrangements which they think that monthly leasing fee might seem like a bargain compared to the cost of buying a terminal.

One provision of the lease is: Non-Cancelable Lease

Leases commonly have a 48-month (four-year) term, and a clause that makes the lease completely non-cancelable.

They also have a purchase option at the end of the lease. You must exercise your option to end the lease.

In a non-cancelable provision, they’ll keep deducting monthly leasing fees from your account regardless of anything, or an immediate payment of all remaining months of your contract if you break your lease.

In addition to monthly leasing fee, you’ll also pay sales tax and a monthly equipment insurance fee; while you can purchase it for as low as $150-$200.

Beware of free terminal offers, other providers will offer a free terminal, but they also charge higher monthly fees if you elect the free terminal. So the terminal isn’t really FREE.

For Electronic Payment Set Up Call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants, Electronic Payments Tagged with: credit card, electronic payment, merchants, payment, terminal

May 10th, 2017 by Elma Jane

Mobile Wallet Technology have flooded the market in the last few years with offerings such as Apple Pay, Android pay, Samsung Pay and more. And so far, they seem to be succeeding.

To understand how contactless payments work, here is an example.

A smart phone like Android or iPhone allows you to take advantage of mobile wallets like Android Pay, Apple Pay or Samsung Pay. You input your credit card information onto your phone, which stores it for later use.

If you’re shopping at a store that has mobile payment readers at the register, rather than reach for your wallet and get your credit card; you take out your phone to make a payment.

The point-of-sale (POS) terminal will automatically reads the payment information stored by holding your mobile phone a few inches away from the POS, and then processes the transaction. When the mobile device is in range, a wireless communication protocol links the terminal and the phone, which exchange information and conduct a secure transaction in a fraction of a second.

Near-field communication or NFC technology, works by bringing together two electronic devices. In terms of payments technology, a mobile device such as a smartphone and a reader. The reader would be the initiator and the smartphone would be the target, which contains the stored credit card information.

The market potential for NFC payment technology is huge, as more merchants adopt the EMV. EMV compliant terminals accept NFC payments through mobile wallets.

For Electronic Payment set up call now 888-996-2273!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Near Field Communication, Smartphone Tagged with: contactless payments, credit card, electronic payment, merchants, mobile wallets, Near Field Communication, nfc, point of sale, POS, smart phone, terminal

April 10th, 2017 by Elma Jane

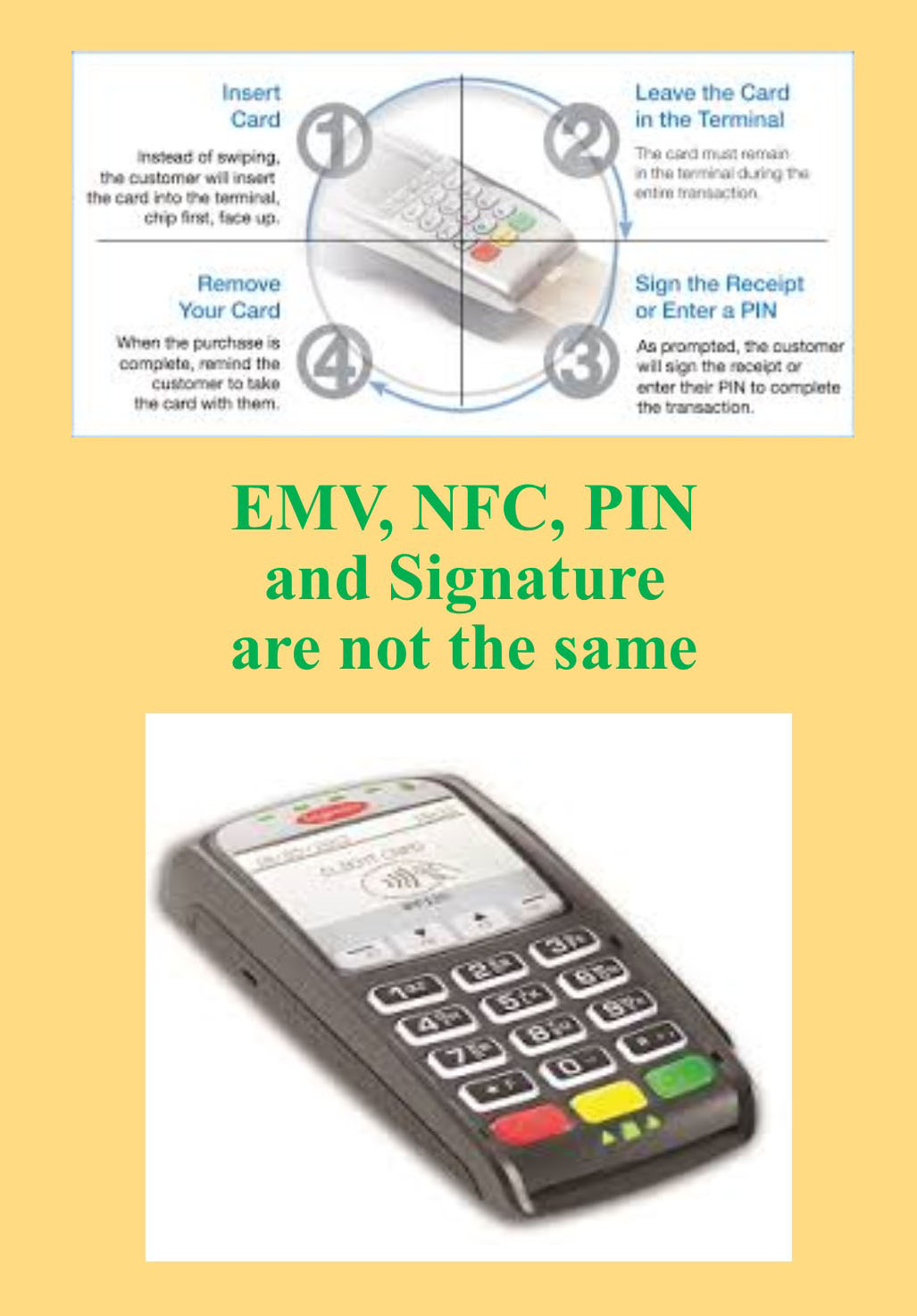

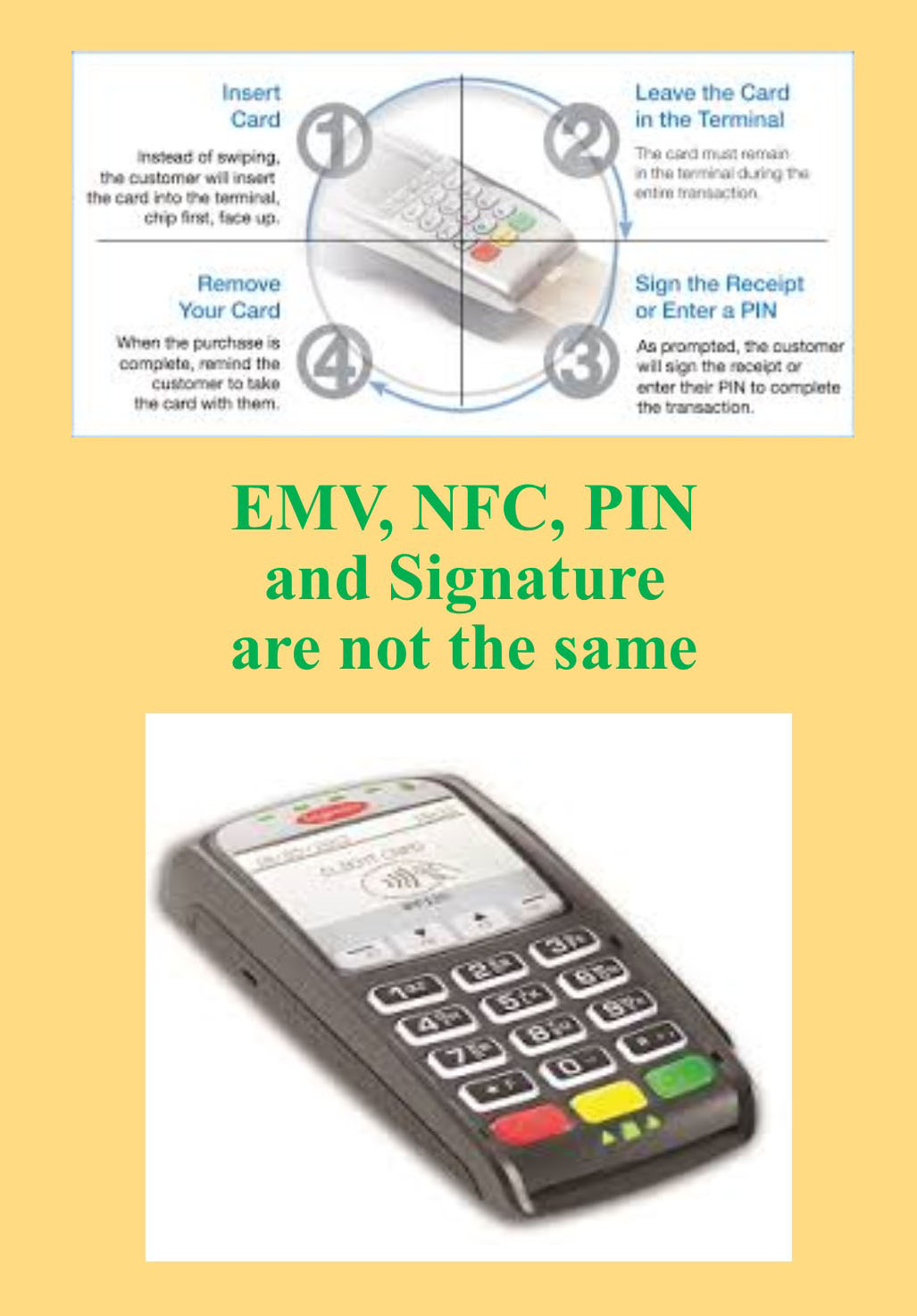

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

April 6th, 2017 by Elma Jane

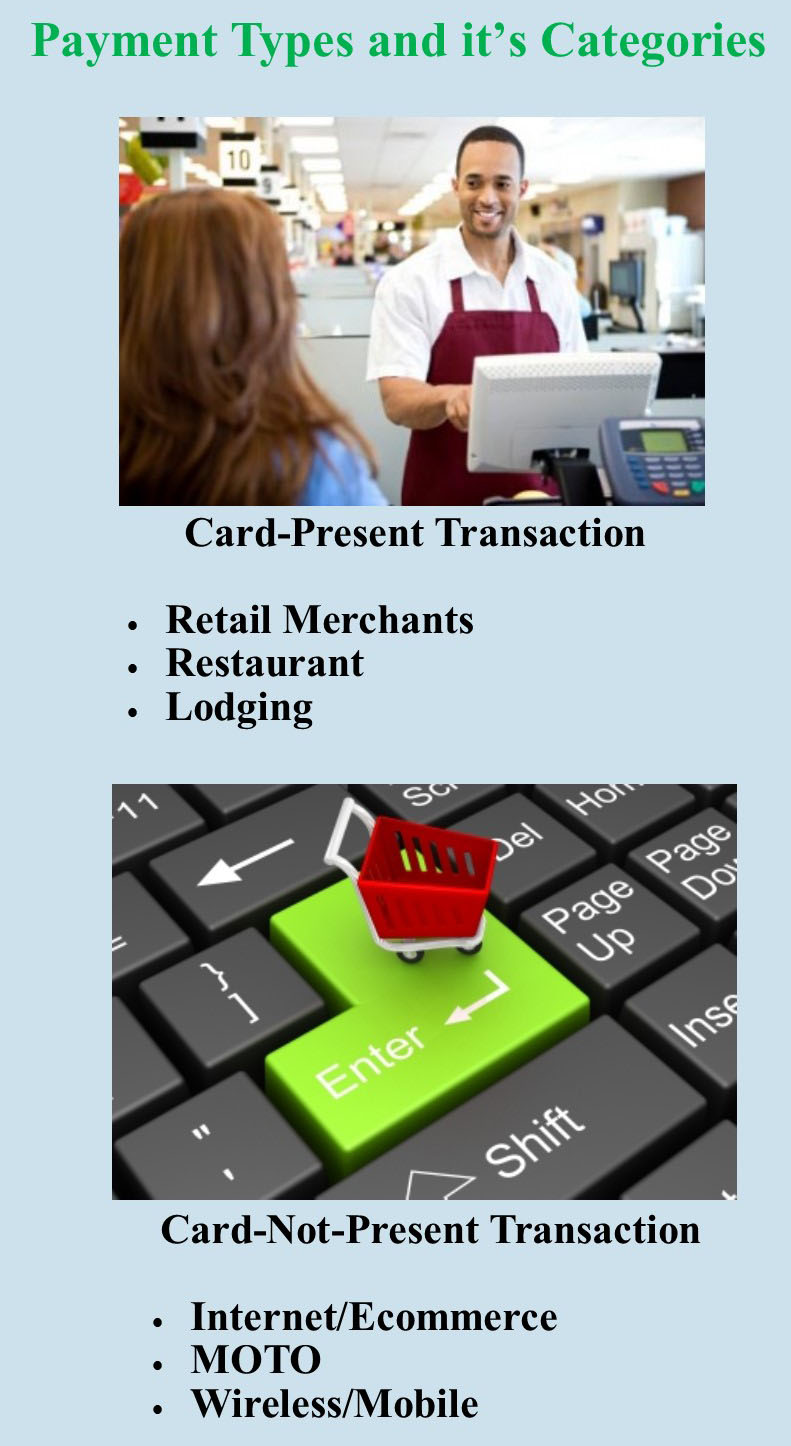

Payment types and it’s categories

The two main category types when it comes to credit card processing are swiped and keyed. Card present or card-not-present.

Swiped or card present transaction – merchants do a face-to-face transaction. A merchant can capture card information by dipping the chip or swiping the card in the terminal or POS. Merchants directly interact with a customer so the risk is low.

Card-Present Sub Categories:

Retail Merchants – conduct transactions face to face in a retail environment.

Face to Face (mobile) – this type of merchant is typically on the go, such as a vendor at a trade show. You can use a service like converge mobile that allows you to take the information in person.

Restaurant – the same as retail merchants, the difference is they may require the ability to add tips to their charges.

Lodging – processes their transactions like retail merchants except they may adjust the settlement amount depending on the customer’s length of stay.

Keyed or card-not-present are high risk, because merchants indirectly collect customers card information, and can process transactions in various ways.

Card-Not-Present Sub categories:

Internet/Ecommerce – conducts business through a web site by utilizing a shopping cart and an Internet payment gateway service. The payment gateway then collects the credit card information and processes it in real time.

Mail & Telephone Order (MOTO) – typically take the customer’s credit card information over the phone, by mail or through the Internet. They then manually process the transaction by keying it into either a credit card machine or through a virtual terminal such as Converge.

Talk to our payment consultant to know the best solution for your business.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit card, customer, ecommerce, merchants, payment, payment gateway, POS, swiped and keyed, terminal, virtual terminal

March 30th, 2017 by Elma Jane

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

February 13th, 2017 by Elma Jane

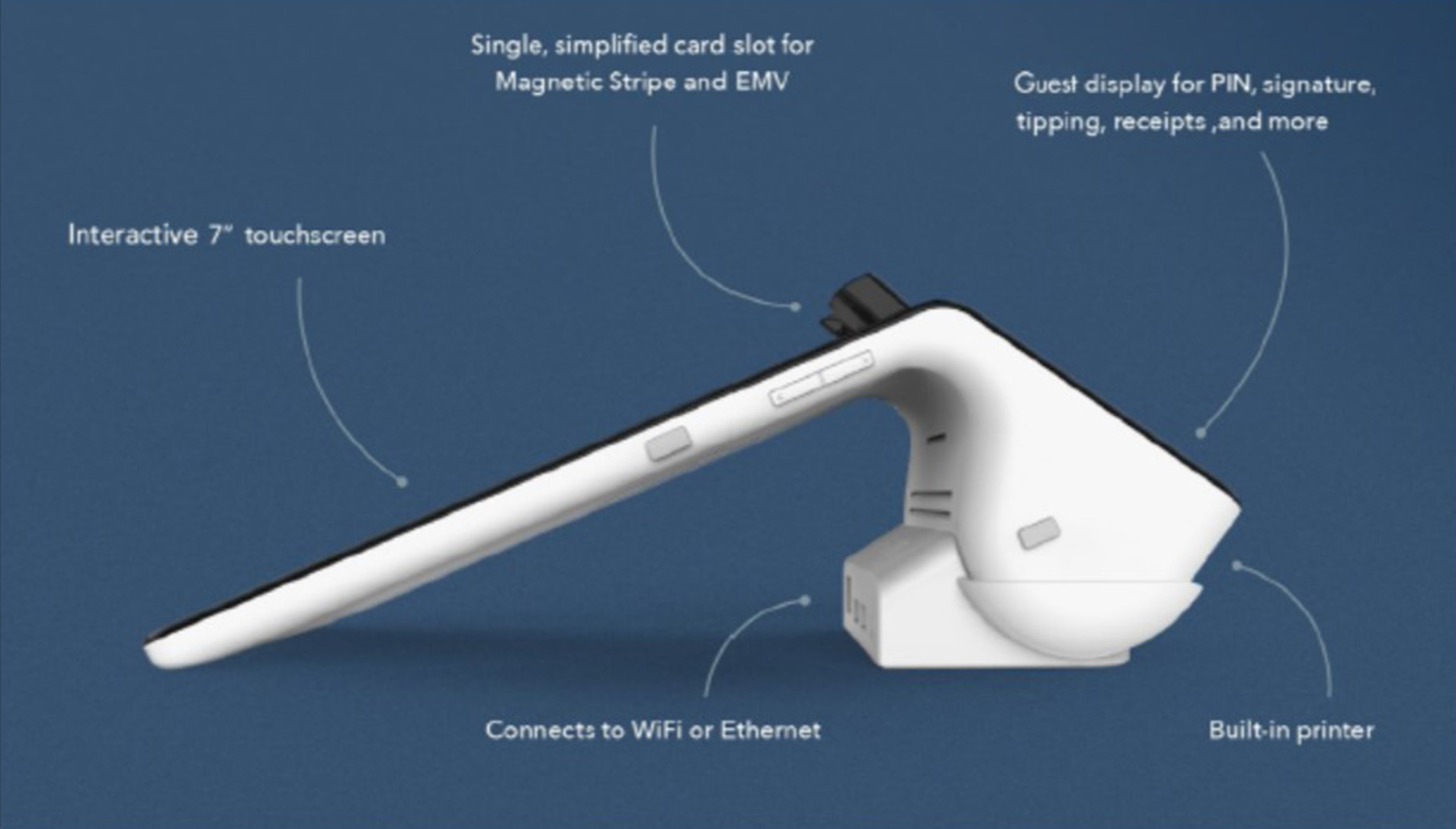

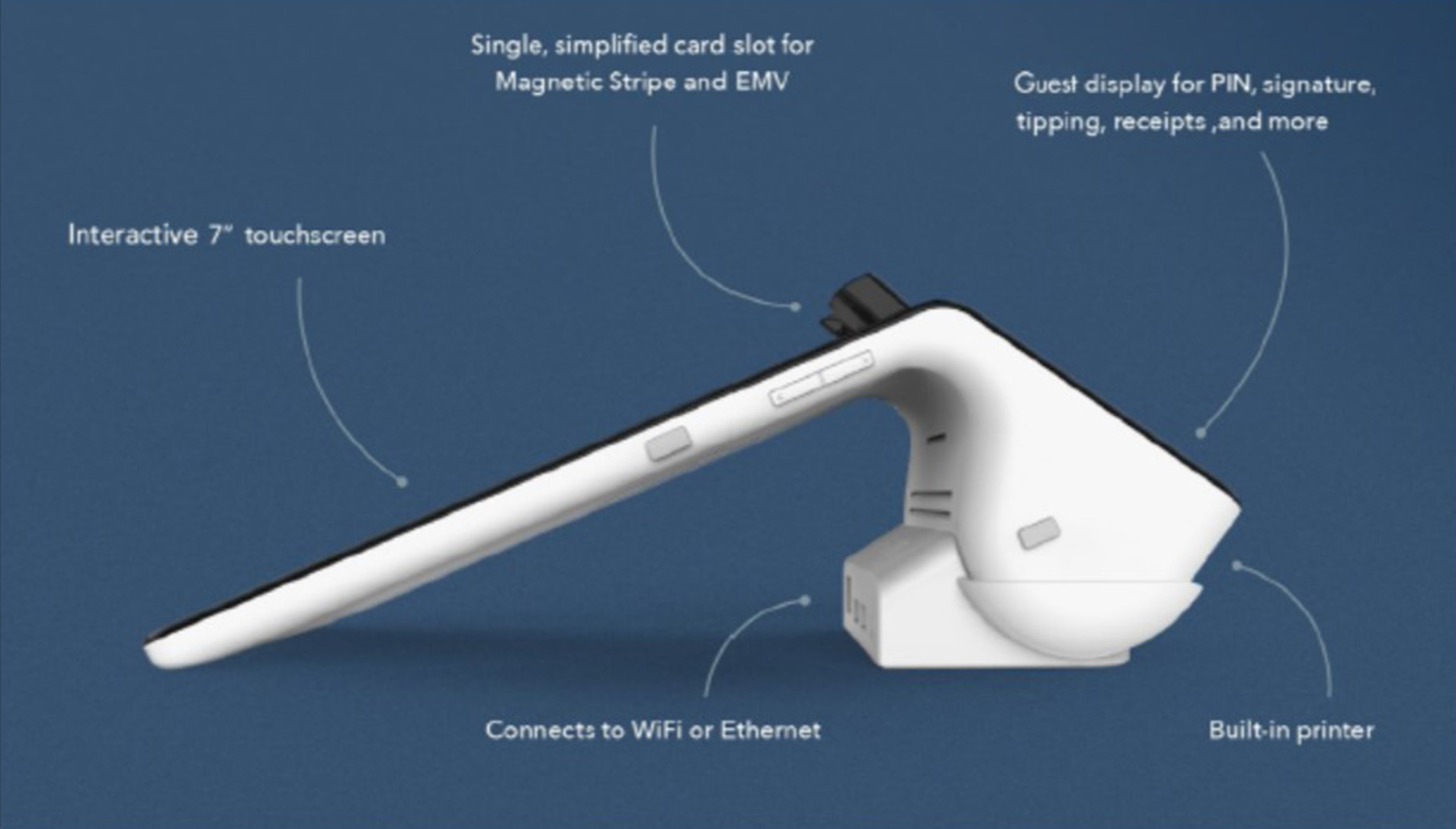

Smart Device for Lodging Transactions

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions