May 4th, 2016 by Elma Jane

Some processors specialize in leasing terminals, but equipment lease locks up merchants and ends up costing you more, whereas you could get that same machine in a matter of months and get more than one.

If you lease a terminal you may also be required to purchase equipment insurance, another added cost. And, have the equipment return at the end of your lease. If a merchant owns an existing equipment, it can be reprogrammed at NO CHARGE and the merchant can continue to use it.

For account set-up, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: merchants, processors, terminals

April 29th, 2016 by Elma Jane

The credit card industry in the U.S. underwent a liability shift October 1st of 2015. The one major exception to the October 2015 liability shift has been automated fuel dispensers. Automated payment terminals at the pumps were given until October of 2017, to comply with the new standard.

Upgrading a gas pump payment terminal is more expensive than what other retailers face upgrading a typical credit card reader.

• First, the cost of replacing the payment terminal itself.

• After replacing gas station’s payment terminal, it also needs to re-certify the entire pump, which costs additional time and money.

• Gas pumps also have to be certified by state officials, to make sure that they are dispensing and charging correctly.

Consumers need to be vigilant while gas stations are getting a break, the card might be exposed to counterfeit credit card fraud, because whenever the card is swiped the traditional way using the mag-stripe, that EMV chip is not doing anything.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa Tagged with: card reader, chip, consumers, credit card, EMV, fraud, payment, terminals

April 28th, 2016 by Elma Jane

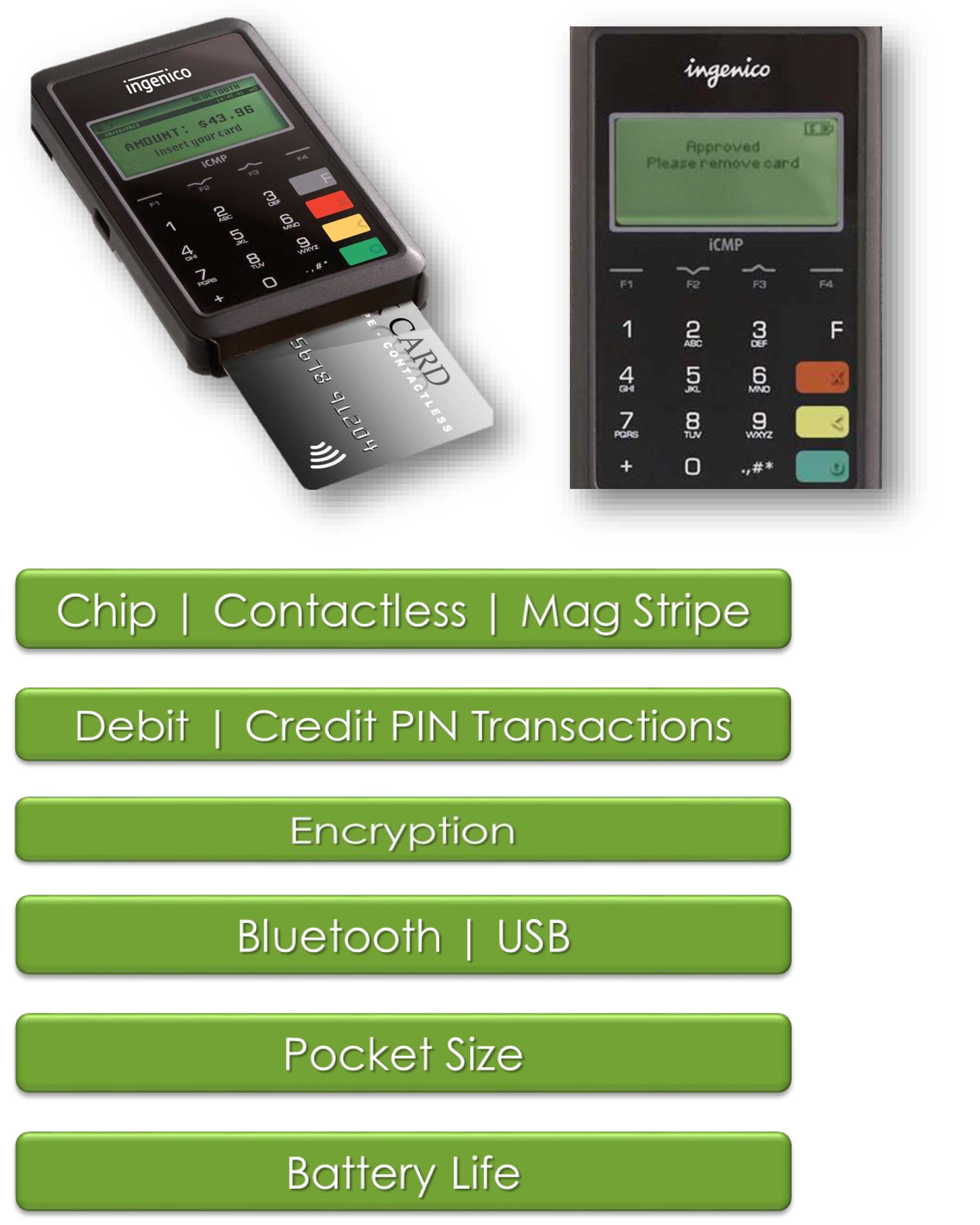

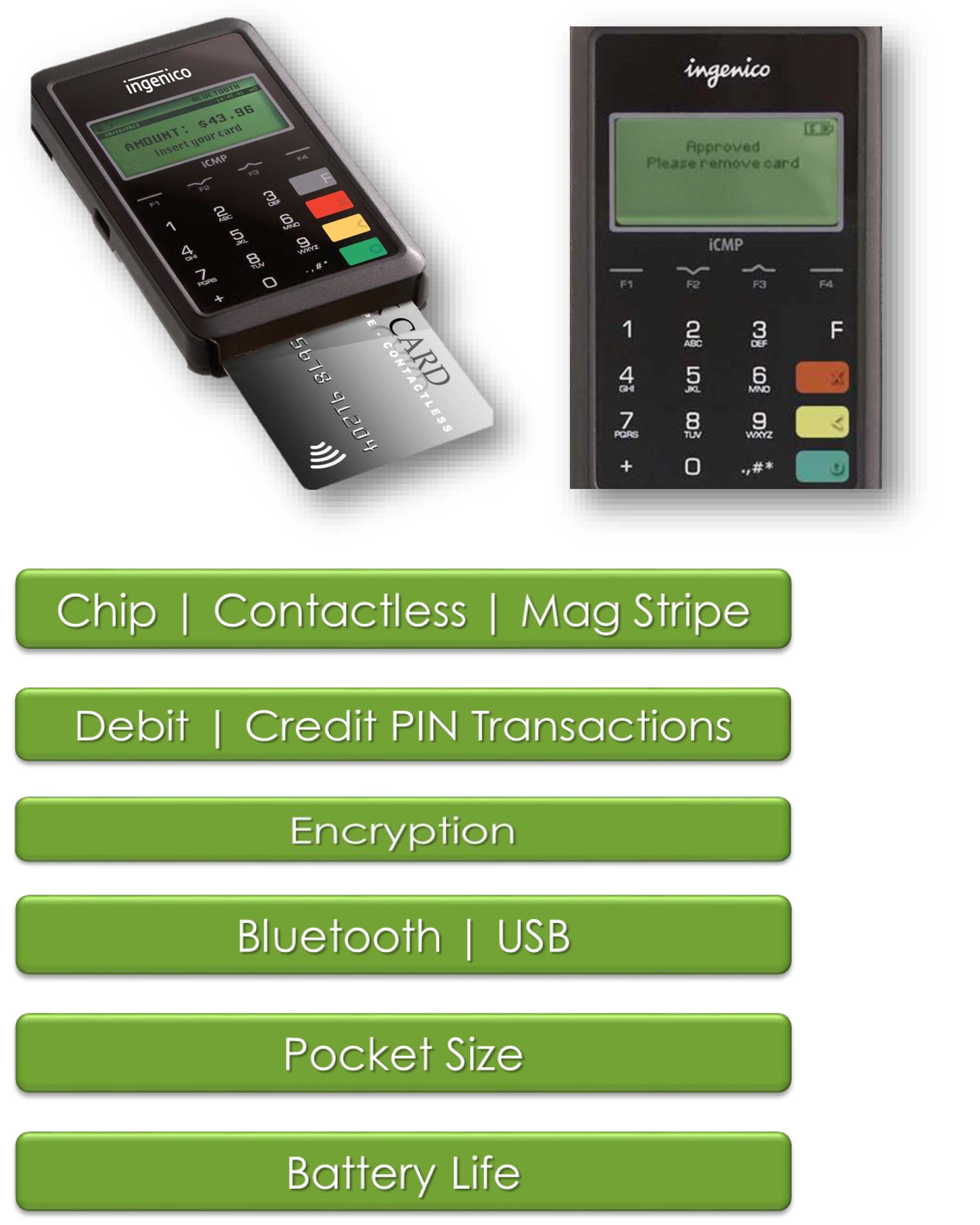

You can offer your customers preferred payment method with the next generation point-of-sales terminals, an all-in-one credit card processing experience: which not only support Near Field Communication (NFC) contactless payment transactions such as Apple Pay but chip cards and the traditional magnetic stripe cards; and manual entry transactions as well.

Contactless payment transactions are happening now. NTC are here to help.

Posted in Best Practices for Merchants Tagged with: chip cards, contactless payment, credit card processing, customers, magnetic stripe cards, Near Field Communication, nfc, payment, point-of-sales, terminals, transactions

April 15th, 2016 by Elma Jane

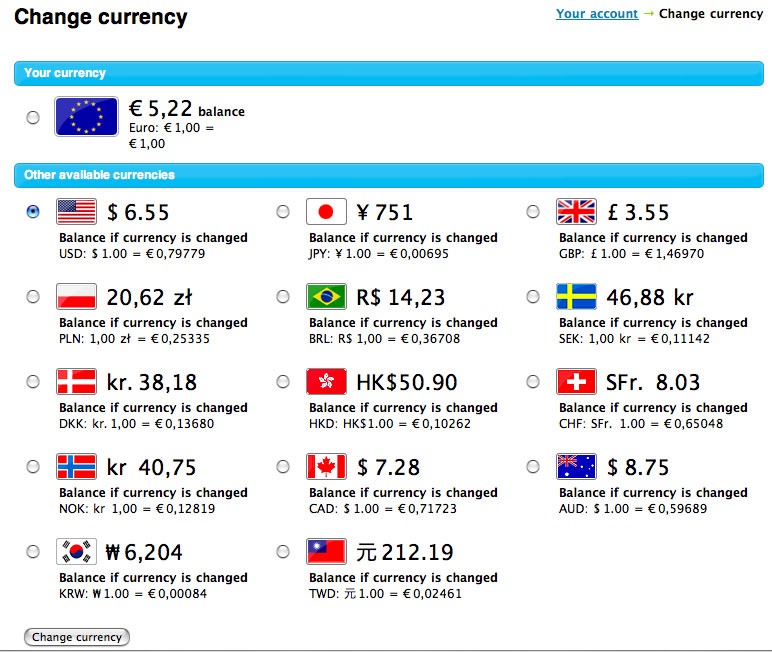

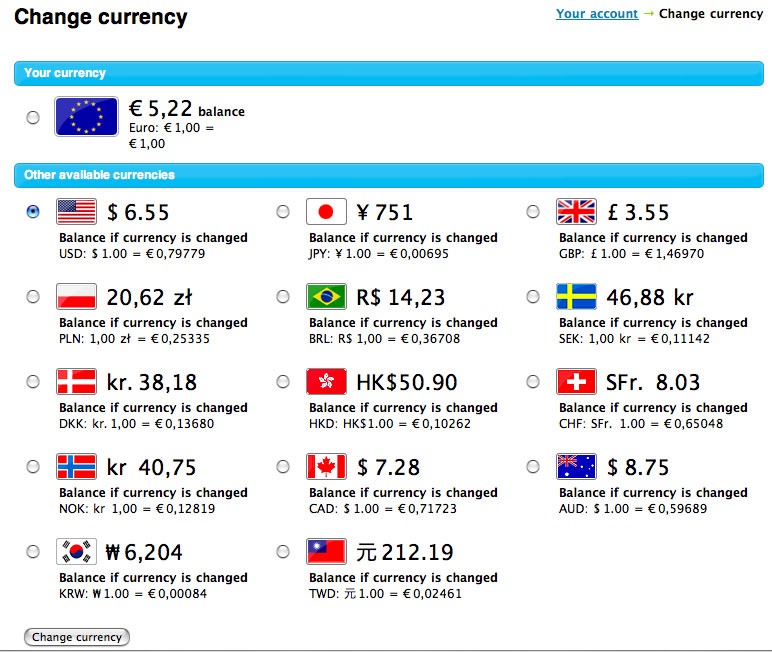

Dynamic Currency Conversion

- Five supported currencies

- Retail, Restaurant, MOTO, E-commerce

- Price listed in merchant’s currency

- Customer is aware of currency conversion

- Customer may opt-out at the point of sale

- Conversion occurs at the point of sale

- Merchants may choose settlement method & time

- Supported by terminals, viaWarp and Virtual Merchant

- Merchant rebate up to 100bp

Multi-Currency Conversion

- 100+ supported currencies

- E-commerce only

- Price listed in customer’s currency

- Customer is not aware of currency conversion

- Customer may not opt-out at the point of sale

- Conversion occurs between the point of sale and settlement

- All transactions auto settle at 6pm (eastern) daily

- Supported by Internet Secure or direct certification

- No merchant rebate

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Merchant Account Services News Articles, Travel Agency Agents Tagged with: currency, Currency Conversion, customer, e-commerce, merchants, moto, point of sale, terminals, virtual merchant

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

February 9th, 2016 by Elma Jane

Since the implementation of the EMV liability shift last year, consumers are still unsure whether to dip or swipe their payment cards at the checkout register, and transaction process itself is slower than a card swipe.

As the EMV process continues, can contactless register only help to make checkout process faster? With contactless register checkout only, consumers can just tap and pay with either card or mobile wallet.

Contactless like NFC is now a standard feature in most high-end smartphones, and most EMV-enabled point-of-sale terminals contain the necessary technology to accept contactless payments. So the idea of contactless register checkout only is something to test for some merchants in a certain retail sector.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Near Field Communication, Point of Sale Tagged with: cards, consumers, contactless, EMV, merchants, mobile, mobile wallet, nfc, payment, payment cards, point of sale, Smartphones, terminals, transaction

January 28th, 2016 by Elma Jane

The shift to EMV is helping to address vulnerabilities in the United States payments ecosystem. It has been shown that EMV can deliver benefits as a part of industry efforts to combat fraud.

EMV migration is a critical focus for enhancing payments security, which is why the current efforts around chip card deployment are greatly beneficial for consumers and merchants alike. EMV technology helps to reduce counterfeit card fraud, as it generates dynamic data with each payment to authenticate the card, after which the cardholder is prompted to sign or enter a PIN to confirm their identity.

The EMV rollout represents a dynamic time for card payments that promises great advances, among them is enhanced security for cardholders. It also presents an opportunity to consider other innovations such as mobile wallets and mobile POS to further engage your customers and drive customer loyalty. When merchants continue to invest in EMV and NFC (near field communications, used for tap-and-pay transactions), the purchases made at their EMV-enabled terminals are made more secure than magnetic stripe.

New mobile payment options such as mobile wallets support EMV and therefore offer this added layer of security. Ultimately, by enabling contactless payments, merchants can also enable more flexibility in addition to increasing security for their customers.

Additionally, industry players are backing major mobile wallets, such as Android Pay, Apple Pay, and Samsung Pay.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card, cardholder, chip card, consumers, contactless payments, customers, data, EMV, fraud, magnetic stripe, merchants, mobile, mobile payment, mobile wallets, near field communications, nfc, payments, PIN, POS, Security, terminals, transactions

January 7th, 2016 by Elma Jane

National Transaction is now offering Apple Pay to Canadian Merchants.

Apple Pay works with NTC’s EMV-contactless point of sale terminals in Canada.

Security and privacy is at the core of Apple Pay, and when a consumer adds a credit card to Apple’s mobile wallet, the actual card numbers are not stored on the device, or on Apple servers.

Apple Pay will create a unique Device Account Number that is assigned, encrypted and securely stored in the secure element on the device, the same way it operates in the U.S. Each transaction is authorized with a one-time unique dynamic security code.

To pay, consumers simply hold their mobile device near the contactless reader, exactly as they would a contactless card today. The payment information is then passed to the POS system once the consumer confirms the transaction using Touch ID on their device.

Bringing Apple Pay to NTC terminals addresses an increasing consumer demand for contactless payments, while also allowing Canadian businesses to offer customers the convenience of paying through an iPhone, iPad or Apple Watch.

American Express is Apple’s issuing partner in Canada.

Posted in Best Practices for Merchants Tagged with: Contactless card, contactless point of sale, contactless reader, credit card, EMV, merchants, mobile device, mobile wallet, payment, POS system, security code, terminals

November 17th, 2015 by Elma Jane

Get your Business Ready for Apple Pay and Let your Customers know you Accept Apple Pay!

Business owners can order Apple Pay Decals for their Stores. Each Packs includes Two Glass Decals and Two Register Decals in different sizes, and a tool for affixing the ads to the appropriate surfaces. Those who need more than five will need to call Apple to place an order.

Apple made the Apple Pay Logo available for download and provided a PDF explaining its guidelines. Apple specifies that the Apple Pay Logo should be placed ahead of similar marks for other payment services like MasterCard and Visa. The guidelines document of the payment mark are available from the Apple Site.

It’s easy!

Click here to download Apple Pay mark to use within email, on your terminal screen, and on your website.

Order Apple Pay decals for your store to put on your storefront window and register.

National Transaction Terminals with EMV/NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC payment transactions at your business. Give us a call now at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: Android Pay, Apple Pay, EMV, MasterCard, Near Field Communication, nfc, payment services, payment transactions, terminals, visa

November 3rd, 2015 by Elma Jane

While EMV represents a significant improvement in the way credit/debit card fraud is detected and prevented, some have confused EMV’s capabilities with the concepts of data security and PCI compliance.

Does EMV override PCI?

The answer is NO, EMV technology does not satisfy any PCI requirements, nor does it reduce PCI scope.

- EMV is counterfeit card fraud protection – it makes it more difficult to make use of stolen card data.

- EMV is not encryption – EMV does not encrypt the Primary Account Number (PAN) and therefore the card data must still be protected according to PCI guidelines.

- EMV only works for card present transactions.

If your business accepts credit or debit cards in a physical store or other face-to-face setting, you will need to implement the EMV technology and PCI standards. If you upgrade your terminals for EMV, consider adding point-to-point encryption (P2PE) capabilities to reduce PCI scope and protect data end to end. In addition, using tokens after authorization can prevent the card data from being used, should it be stolen.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security Tagged with: card data, card fraud, card present, counterfeit card, credit, data security, debit card, EMV, emv technology, fraud, p2pe, PAN, PCI, PCI Compliance, point-to-point encryption, Primary Account Number, terminals, tokens