May 5th, 2024 by Elma Jane

Tokenization is a powerful security feature that allows a merchant to support all of their existing business processes that require card data without the risk of holding card data and without any security implications, because tokens are useless to criminals, they can be saved by the merchant as they do not represent any threat.

The liability and costs associated with PCI compliance is substantially reduced and the risk of storing sensitive data is eliminated.

Tokenization applies to credit card and gift card transactions.

Imagine a world where you could accept credit card payments without actually storing any sensitive cardholder data. No more worrying about data breaches, PCI compliance headaches, or the crippling costs of a security breach. That’s the power of tokenization.

Here’s how it works:

Instead of storing sensitive credit card information on your systems, each card number is replaced with a unique, randomly generated “token.” This token is useless to hackers, but it can be used to process payments securely on the merchant account that created the token.

Think of it like a valet ticket:

You hand over your car (the sensitive data) to the valet (the tokenization provider), who gives you a unique ticket (the token). The valet keeps your car safe, and you can use the ticket to retrieve it when needed.

The benefits are immense:

- Ironclad Security: Reduce your PCI DSS scope and minimize the risk of costly data breaches. With tokenization, even if your system is compromised, the actual card data remains safe.

- Effortless Compliance: Simplify PCI compliance and avoid hefty fines. Tokenization helps you meet the stringent security requirements for handling sensitive cardholder data.

- Recurring Billing Made Easy: Securely store tokens for recurring billing or future transactions. This allows you to charge customers later without having to store their sensitive information.

- Improved Customer Trust: Demonstrate your commitment to data security and build customer trust. Knowing their information is protected encourages repeat business and loyalty.

- Streamlined Checkout: Offer a frictionless checkout experience with saved payment information. Tokenization enables faster and more convenient payments for your customers.

Tokenization is not just a security measure, it’s a strategic advantage:

- Reduce costs: Minimize the expenses associated with data breaches and PCI compliance audits.

- Boost efficiency: Streamline your payment processes and reduce administrative overhead.

- Enhance your reputation: Position your business as a leader in data security and customer trust.

In conclusion:

Tokenization is a game-changer for businesses that accept credit cards. It offers unparalleled security, simplifies compliance, and unlocks new opportunities for growth. Embrace the future of secure payments with tokenization and watch your business thrive.

For Electronic Payments with Tokenization call now 888-996-2273 or click here NationalTransaction.Com

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, Payment Card Industry PCI Security Tagged with: card, credit card, data, electronic payments, merchant, PCI, Security, token, tokenization, transaction

March 8th, 2024 by Elma Jane

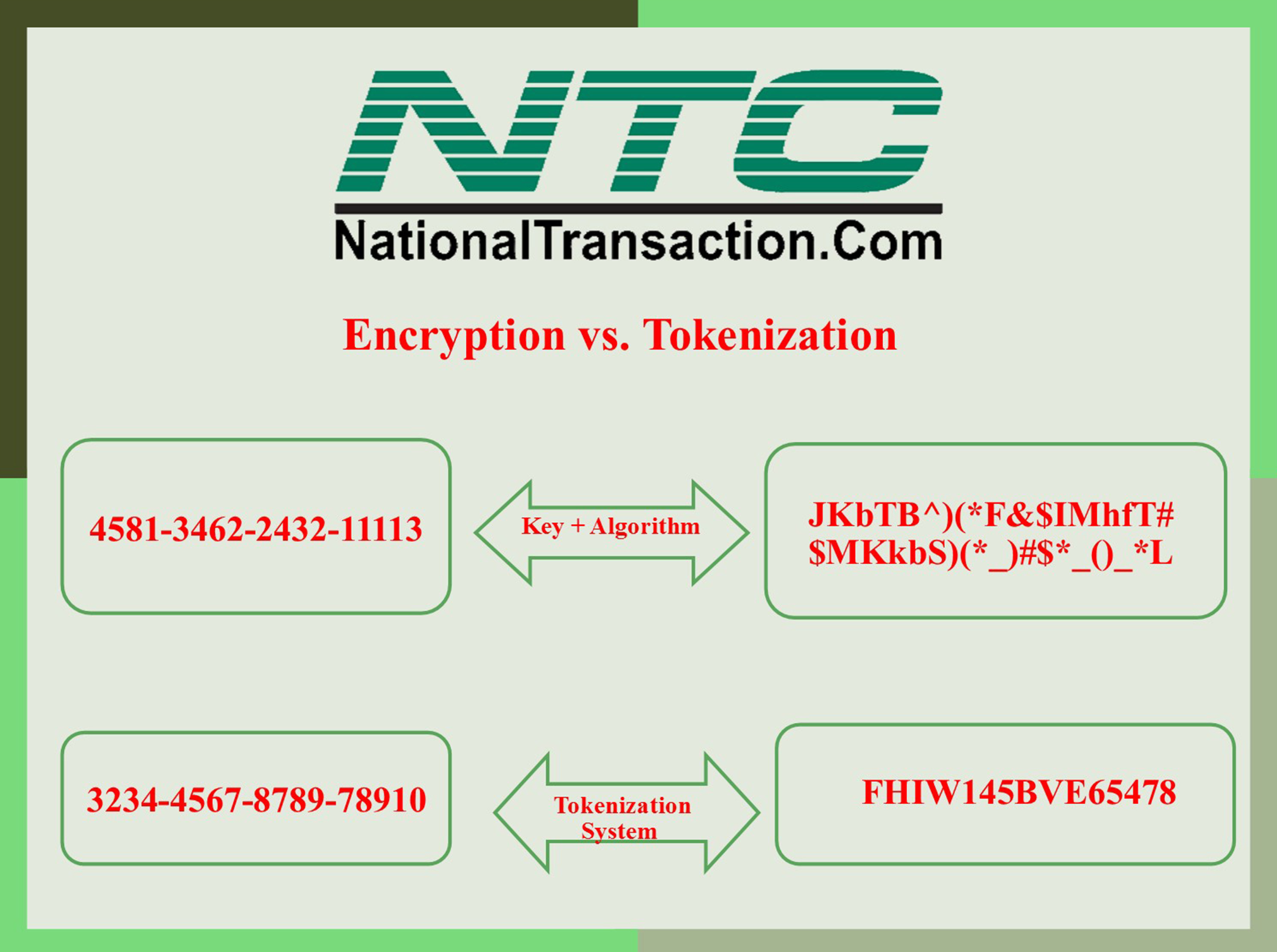

TOKENIZATION AND ENCRYPTION SECURITY

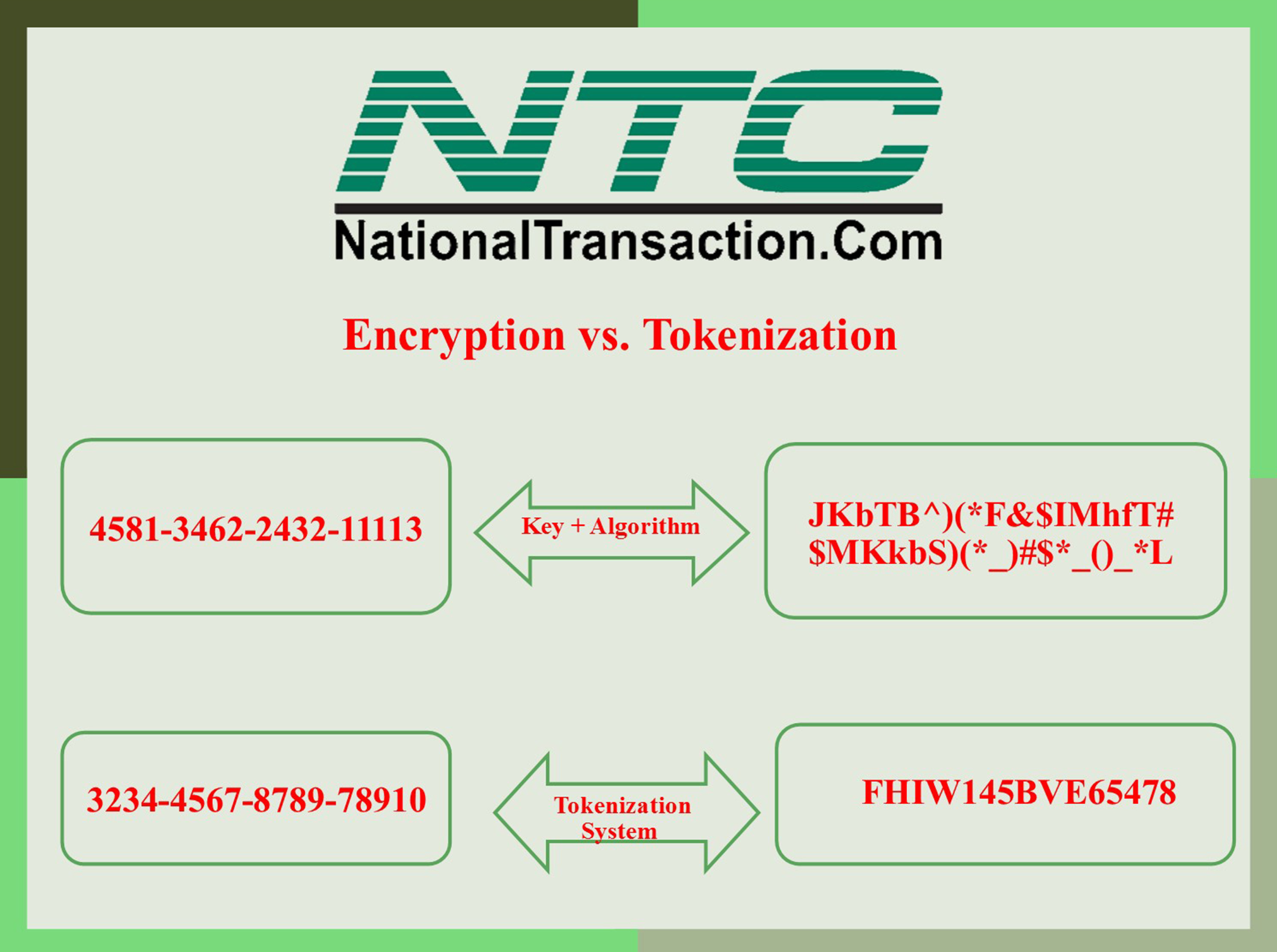

Encryption is reversible. Encrypted data can be returned back to its original, unencrypted form. The encryption strength is based on the algorithm it uses. A more complex algorithm will create stronger encryption to secure the data. Encryption is most often “end-to-end.”

PCI Security Standards Council and other governing compliance entities still view encrypted data as sensitive data.

Tokenization system replaces sensitive data and the token cannot be reversed into true data, it has no value. The real, sensitive information is stored in a secured offsite platform. An entirely different location. That means sensitive customer data does not enter or reside within your environment.

Unlike encryption, tokenization isn’t subject to issues with PCI/DSS compliance or other data security organizations, because tokens do not contain any real data.

If a hacker managed to steal your tokens they cannot be used for a fraudulent transaction.

Using tokens doesn’t change a merchant’s payment processing experience as it protects their valuable credit card information.

For Electronic Payments call us now 888-996-2273

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: data, encryption, PCI, Security, tokenization, transaction

September 18th, 2017 by Elma Jane

Smart Security for Smart Businesses:

Safe-T for SMB streamlines the PCI process while providing the layered security needed to protect card data

EMV – Fraud protection at the point of sale

EMV chip technology keeps the consumer’s card in their hand. It also helps protect the business from card-present fraud related chargebacks.

Encryption – Protection of payment card data in-transit

Safe-T scrambles cardholder data using advanced encryption technology, so data is protected at the point of entry, and throughout the authorization process.

Tokenization – Token ID protection of stored payment card data

Safe-T returns a token ID or an alias, consisting of a random sequence of numbers to the point-of-sale so the actual card number is never stored. Token IDs can be used for follow up transactions (i.e. recurring payments, voids, etc.).

Reduced PCI – Protection from complex PCI compliance

Maintaining PCI Compliance can be intimidating – second only, perhaps, to completing your taxes. Safe-T eases this process for customers by reducing the number of PCI Self-Assessment questions by more than 60% from 80 questions to 31.

Financial Reimbursement – Financial protection from a card data breach

Recovering from a card data breach can be costly for a small business. Safe-T offers Card Data Breach Reimbursement to financially protect your customer’s business in the event of a card data breach – regardless of the type of card data breach.

For Electronic Payment Set up with this feature call now! 888-996-2273

Posted in Best Practices for Merchants Tagged with: card data, card present, chargebacks, chip, data, data breach, EMV, encryption, fraud, payment, PCI, point of sale, Security, tokenization

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Hotel, Motel and Bed & Breakfast customers will benefit from this smart terminal:

- Smaller, independent motels or hotels

- Hotels without property management systems

- Existing hospitality customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

April 27th, 2017 by Elma Jane

Adding Tokenization Service

Important notes when adding tokenization:

– Tokens replace credit or gift card numbers.

– The terminal must be enabled to accept tokenization.

– Tokens are unique for each merchant, for example:

The same card will produce a different token for each merchant.

– Merchants with multiple terminals sharing tokenization domains will receive the same token for a unique card and the token can be used across their stores if they wish to do so.

– Merchants may supply the token in place of card information in any subsequent transaction.

– Tokenization is supported for both credit cards and gift cards.

Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions. This eliminates the possibility of having card data stolen because it no longer exists within your environment.

Tokens can be used in card not present environments such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments.

Tokens can reside on your POS/PMS or within your e-commerce infrastructure “at rest” and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions “in use”.

For Electronic Payment Set up with Tokenization call now 888-996-2273

or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit, e-commerce, electronic payment, encryption, gift Card, merchant, moto, POS, terminals, tokenization, tokens, transaction

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

January 6th, 2017 by Elma Jane

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions

January 5th, 2017 by Elma Jane

Smart terminal for the lodging industry will be available beginning January 25, 2017.

Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience, this solution will serve as a catalyst to drive significant sales opportunities and market share within the lodging.

For SMB/independent lodging establishments, benefits include:

- Available of an EMV terminal solution. A first for the lodging industry.

- Dynamic all-in-one smart device that looks great and delivers an exceptional guest experience.

- Modern, simple and intuitive interface

- Powerful security equipped with Safe-T technology which includes EMV, encryption, tokenization and PCI

- Robust, cloud-based reporting to help hotel owners manage their business better, and see transaction settlements in real time.

For your Electronic Payments need call now 888-996-2273

or visit www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, lodging industry, PCI, Security, terminal, tokenization

November 18th, 2016 by Elma Jane

Tokenization and Encryption are completely different technologies when it comes to securing sensitive data, such as credit cards.

Encryption tools and techniques is to mask original data, then allow it to be decrypted. It uses an algorithm to scramble credit card information that makes the data unreadable to anyone.

Encryption is most often “end-to-end.”

Example: When someone enters card data into a web browser to buy an item and decrypted when the purchaser’s authorized credit card information reaches its intended destination, which is the merchant’s e-commerce database.

Encrypted card data is unreadable while it’s “at rest” in a database or “in motion” during a purchase transaction; and inaccessible until a key decrypts it. The chances of a hacker stealing the data is minimal. But, if card data passes through multiple internal systems en route to an acquiring bank or payment gateway, the encrypt/decrypt/re-encrypt process could open a wide security hole, thus creating vulnerabilities to hackers.

Tokenization have found to be cheaper, easier to use and more secure than end-to-end encryption.

Tokenization completely removes credit card data from internal networks and replaces it with a generated, unique “token”. Tokens have no meaning and are worthless to criminals if a company’s system is breached.

Merchants use only the token to retrieve, access, or maintain their customers’ credit card information.

Example: Actual credit card number was 3234 4567 8789 78910, it might become FHIW145BVE65478 when a token is generated. The token is randomly generated and there is no algorithm to regain the original card number. hackers can’t reverse-engineer the actual credit card number, even if they were to grab the tokens off the servers.

Using tokens doesn’t change a merchant’s payment processing experience. Only they’re much safer for a merchant than actual credit cards.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: card, credit cards, customers, data, encryption, gateway, merchants, payment, Security, token, tokenization, transaction

October 11th, 2016 by Elma Jane

Cybersecurity via Converge:

Converge uses a multi-layered approach to security which helps keep cardholder data safe throughout the entire payment process; from beginning to end.

- EMV: All new Ingenico PIN pads and readers – iCMP and RP457c used with Converge Mobile offer EMV to help protect against counterfeit card use. The PIN pads go a step further in helping protect against lost; stolen and NRI (never received/issued) when a PIN-preferred card is accepted with PIN entry.

- Encryption: All new Ingenico devices also include encryption as a standard security component in addition to protect card data in transit.

- Tokenization: An enhanced security feature that is particularly valuable in card-not-present (CNP) environments when cards are stored on file for processing at a later time, or either for recurring/installment payments.

Get the Ingenico iCMP EMV PIN Pad for only $130.00.

For all payment applications, either Debit or Credit PIN Transaction. Work with both Apple and Android Devices.

Ingenico EMV RP457c card reader for only $75.00.

For Merchants that do not need PIN Pad. Works with hundreds of mobile devices.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Smartphone Tagged with: card, card-not-present, cardholder, data, EMV, mobile, payment, PIN pads, Security, tokenization