September 4th, 2014 by Elma Jane

EMV, which stands for Europay, MasterCard and Visa, and is slated to be mandated across the United States starting in October 2015 and automated fuel dispensers have until October 2017 to comply. Unlike magnetic swipe cards, EMV chip cards encrypt data and authenticate communication between the card and card reader. Additionally, chip card user is prompted for a PIN for authentication.

Why are those dates important? Companies lose $5.33 billion to fraud today, with card issuers and merchants incurring 63 and 37 percent of these losses, respectively. Under the EMV mandate, merchants who do not process chip cards will bear the burden of the issuer loss. By accepting chip card transactions, merchants and issuers should see a reduction in fraud.

Overcoming Barriers to EMV Adoption

Given the significant barriers to EMV adoption, it may be tempting for merchants to meet minimum requirements for accepting EMV payments. However, medium to large retailers should also consider the bigger picture of customer security and peace of mind.

Some key critical success factors for a payment initiative of this size include:

Business Continuity Architecture: As with all payment systems, it is imperative to have the EMV system running at all times. The solution should preferably have Active-Active architecture across multiple data centers and have a low Recovery Point Objective (the point in time to which the systems and data must be recovered after an outage).

Cost Benefit Analysis: Take a top down approach and decide accordingly on the scope of the analysis. This will ensure that decisions on scope are made on basis of quantitative data and not just qualitative arguments.

Phased Approach: To overcome time or cost overage in a project of this scope and complexity, retailers should try using an iterative approach for development. The rollout can be divided into multiple releases of six to seven months, which will provide the opportunity to review, capture lessons learnt, and improve subsequent releases.

Proactive Monitoring Alerts: Considering the criticality of business function carried out by EMV, tokenization and payment gateway, a vigorous supervising environment must be defined to perform proactive and reactive monitoring. It should take into consideration the monitoring targets, tools, scope and methods. This will provide advance visibility to the failure points and better ensuring maximum system availability.

Resilience Testing: Typically in a software project, the testing is limited to the unit, integration, performance and user acceptance. However, due to the critical nature of the applications and systems involved, robust resiliency testing is vital. This will ensure that there are no single points of failure and the system remains available when running in error conditions.

Stakeholder Identification: This is a key step to ensure that you have varied perspectives from all departments and their support. It will keep your organization from being blindsided and reduce the risk of disagreements in later stages of the program. Key stakeholders should include Store Operations, Card Accounting, Loss Prevention, Contact Center and IT & Data Security.

Organizations should adopt a five step approach to implement a secure, robust and industry-leading payment solution:

Encryption – Point to point encryption will ensure card data is secure and encrypted from the point of capture to the processor. Usually, merchants use data encryption that is not point to point, rendering their organization vulnerable to data breaches. Software encryption is the most common form of encryption, as it is easily installed and quires little or no hardware upgrades; however, it is less secure, may expose encryption keys, and is prone to memory scanning attacks. Hardware encryption is considered more secure but requires more costly terminal upgrades. Hardware encryption is designed to self-destruct the keys if tampered, but is not well-defined as very limited headway has been made in this space.

Tokenization – Build a Card Data Environment (CDE) that will host a centralized card data storage solution. Only limited applications with firewall access and capability to mutually authenticate via certificates can access CDE and receive card data. The rest of the applications will have tokens which are random numbers. This architecture will ease the merchant’s burden with existing and emerging PCI Data Security Standards.

Payment Gateway – Perform a risk assessment on the current payment gateway and identify gaps in functionality, manageability, compliance, scalability, speed to market and best practices. Determine the alternatives to mitigate the risks. Some of the important aspects of a leading payment gateway solution are support for all forms of credit, debit, gift cards and check transactions. Its ability to work with any acquirer, in-built encryption abilities, support for settlement and reconciliation must also be kept into consideration.

Settlement, Funding and Reconciliation – A workflow-based system to handle chargebacks and the automation of chargeback processing will greatly reduce labor-intensive work and enhance the quality of data used for settlement and reconciliation. Upgrades to the existing receipt retrieval system may be needed.

Card fraud is on the rise in the U.S., and merchants are the primary target for stealing information. With the EMV deadline just over a year away, the responsible retailer must take steps to prepare now. Although EMV implementation might seem overwhelming to merchants, they should start their journey to secure payments rather than wait for a looming deadline. Solutions such as data encryption and tokenization should be used in combination with EMV to implement a robust payment solution to better protect merchants against fraud. By proactively adopting EMV payment solutions, merchants can stay ahead of the regulatory curve and better protect their customers from fraud.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: authentication, automation, card, card data, Card Data Environment, card fraud, card issuers, card transactions, CDE, chargeback, chargeback processing, check, check transactions, chip, chip cards, credit, customer, customer security, data, data breaches, data encryption, data security, debit, EMV, emv chip cards, EuroPay, fraud, gateway, Gift Cards, host, integration, magnetic swipe cards, MasterCard, Merchant's, payment, payment gateway, payment solution, payment systems, PCI, PCI Data Security Standards, PIN, processor, retailers, Security, software, swipe, terminal, tokenization, tools, visa

August 27th, 2014 by Elma Jane

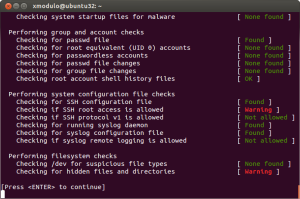

Backoff malware that has attacked point of sale systems at hundreds of businesses may accelerate adoption of EMV chip and PIN cards and two-factor authentication as merchants look for ways to soften the next attack. Chip and PIN are a big thing, because it greatly diminishes the value of the information that can be trapped by this malware, said Trustwave, a security company that estimates about 600 businesses have been victims of the new malware. The malware uses infected websites to infiltrate the computing devices that host point of sale systems or are used to make payments, such as PCs, tablets and smartphones. Merchants can install software that monitors their payments systems for intrusions, but the thing is you can’t just have anti-virus programs and think you are safe. Credit card data is particularly vulnerable because the malware can steal data directly from the magnetic stripe or keystrokes used to make card payments.

The point of sale system is low-hanging fruit because a lot of businesses don’t own their own POS system. They rent them, or a small business may hire a third party to implement their own point of sale system. The Payment Card Industry Security Standards Council issued new guidance this month to address security for outsourced digital payments. EMV-chip cards, which are designed to deter counterfeiting, would gut the value of any stolen data. With this magnetic stripe data, the crooks can clone the card and sell it on the black market. With chip and PIN, the data changes for each transaction, so each transaction is unique. Even if the malware grabs the data, there not a lot the crooks can do with it. The EMV transition in the U.S. has recently accelerated, driven in part by recent highprofile data breaches. Even with that momentum, the U.S. may still take longer than the card networks’ October 2015 deadline to fully shift to chip-card acceptance.

EMV does not by itself mitigate the threat of breaches. Two-factor authentication, or the use of a second channel or computing device to authorize a transaction, will likely share in the boost in investment stemming from data security concerns. The continued compromise of point of sale merchants through a variety of vectors, including malware such as Backoff, will motivate the implementation among merchants of stronger authentication to prevent unauthorized access to card data.

Backoff has garnered a lot of attention, including a warning from the U.S. government, but it’s not the only malware targeting payment card data. It is not the types of threats which are new, but rather the frequency with which they are occurring which has put merchants on their heels. There is also an acute need to educate small merchants on both the threats and respective mitigation techniques.. The heightened alert over data vulnerability should boost the card networks’ plans to replace account numbers with substitute tokens to protect digital payments. Tokens would not necessarily stop crooks from infiltrating point of sale systems, but like EMV technology, they would limit the value of the stolen data. There are two sides to the equation, the issuers and the merchants. To the extent we see both sides adopt tokenization, you will see fewer breaches and they will be less severe because the crooks will be getting a token instead of card data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Point of Sale Tagged with: access, account, account numbers, anti-virus programs, authentication, Backoff, card, card networks, chip, credit, Credit card data, credit-card, data, data breaches, devices, digital payments, EMV, magnetic stripe, Malware, Merchant's, Payment Card Industry, payments, PCs, PIN, PIN cards, point of sale, POS, POS system, programs, Security, security standards, Smartphones, software, system, tablets, tokenization, tokens, transaction, Trustwave, websites

August 11th, 2014 by Elma Jane

Tokenization technology has been available to keep payment card and personal data safer for several years, but it’s never had the attention it’s getting now in the wake of high-profile breaches. Still, merchants especially smaller ones haven’t necessarily caught on to the hacking threat or how tools such as tokenization limit exposure. That gap in understanding places ISOs and agents in an important place in the security mix, it’s their job to get the word out to merchants about the need for tokenization. That can begin with explaining what it is.

The biggest challenge that ISOs will see and are seeing, is this lack of awareness of these threats that are impacting that business sector. Data breaches are happening at small businesses, and even if merchants get past the point of accepting that they are at risk, they have no clue what to do next. Tokenization converts payment card account numbers into unique identification symbols for storage or for transactions through payment mechanisms such as mobile wallets. It’s complex and not enough ISOs understand it, even though it represents a potential revenue-producer and the industry as a whole is confused over tokenization standards and how to deploy and govern them.

ISOs presenting tokenization to merchants should echo what security experts and the Payment Card Industry Security Council often say about the technology. It’s a needed layer of security to complement EMV cards. EMV takes care of the card-present counterfeit fraud problem, while tokenization deters hackers from pilfering data from a payment network database. The Target data breach during the 2013 holiday shopping season haunts the payments industry. If Target’s card data had been tokenized, it would have been worthless to the criminals who stole it. It wouldn’t have stopped malware access to the database, but it would been as though criminals breaking into a bank vault found, instead of piles of cash, poker chips that only an authorized user could cash at a specific bank.

A database full of tokens has no value to criminals on the black market, which reduces risk for merchants. Unfortunately, the small merchants have not accepted the idea or the reality and fact, that there is malware attacking their point of sale and they are being exposed. That’s why ISOs should determine the level of need for tokenization in their markets. It is always the responsibility of those who are interacting with the merchant to have the knowledge for the market segment they are in. If you are selling to dry cleaners, you probably don’t need to know much about tokenization, but if you are selling to recurring billing or e-commerce merchants, you probably need a lot more knowledge about it.

Tokenization is critical for some applications in payments. Any sort of recurring billing that stores card information should be leveraging some form of tokenization. Whether the revenue stream comes directly from tokenization services or it is bundled into the overall payment acceptance product is not the most important factor. The point is that it’s an important value to the merchant to be able to tokenize the card number in recurring billing, but ISOs sell tokenization products against a confusing backdrop of standards developed for different forms of tokenization. EMVCo, which the card brands own, establishes guidelines for EMV chip-based smart card use. It’s working on standards for “payment” tokenization with the Clearing House, which establishes payment systems for financial institutions. Both entities were working on separate standards until The Clearing House joined EMVCo’s tokenization working group to determine similarities and determine whether one standard could cover the needs of banks and merchants.

Posted in Best Practices for Merchants Tagged with: account numbers, bank, billing, card, card brands, card number, card present, Clearing House, data, data breaches, database, e-commerce, EMV, emvco, fraud, ISOs, Malware, Merchant's, mobile wallets, network, payment, Payment Card Industry, Security, smart card, target, tokenization, transactions

May 23rd, 2014 by Elma Jane

Before making a purchase, there are several devices that consumers may use to help them make a decision: Use a specific store’s mobile app on their smartphones. Visit the store’s website on a tablet or computer, or just pick up the phone and call customer service to ask a question. Whatever the case, omnichannel is an important buzzword for merchants.

Here are ways to ensure a seamless and secure retail experience to turn browsers into loyal buyers.

Ensure Channels Work Together

Even in historically single-channel retail sectors such as grocery, more than half of customers now use two or more channels before completing a purchase, shown in a recent study. Retailers must therefore offer both traditional and digital channels. However, before investing in the latest mobile-optimized website feature or app, retailers should learn how existing online and physical channels can together enhance the customer experience. What customers value most is not the number of channels offered, but how these channels support each other.

A merchant’s website might encourage visitors to take advantage of a special event in-store, while sales assistants on the floor can use Wi-Fi enabled tablets to access additional product information.

Help Customers Find What They Want

With Internet access ubiquitous, cost-conscious customers are just a click away from being able to compare prices and find special offers. Many take out their smartphone or tablet in stores to compare prices, a trend called Showrooming.

Online retailers can take advantage of this trend by encouraging shoppers to compare prices in-store using a mobile app. In-store retailers, on the other hand, could provide greater value through targeted offers, price match guarantees, expert advice, convenient delivery choices and personalized customer care.

Optimize The Checkout Experience

Businesses must be sure to have a quick, streamlined checkout process once they have converted an online browser into a customer or else they risk facing shopping cart abandonment. This can be done in a few steps:

1. Assess how the checkout experience can be customized for its customers. Keep the mandatory information required from new or first-time online or mobile shoppers to a minimum and shorten the process for returning customers by securely storing their payment details and other personal information.

2. Develop a dedicated mobile app or other innovative functions that can increase long-term satisfaction and loyalty.

3. Test different payment methods to find those that are most convenient for customers. These payment options may include paying with reward points, using a digital wallet or providing a digital offer or coupon at checkout. There is a balance to be found between having additional payment methods to meet customer expectations and choosing methods appropriate to a merchant’s business model.

4. Establish a one-click online checkout process. Chase for example, is currently developing a Chase Wallet and Quick Checkout solution. The Chase Wallet will allow customers to store and access their Chase cards and ultimately, any branded card for a quick checkout. It will also update Chase-branded cards when a customer replaces an existing card and use tokenization to securely process payments with select merchants.

Merchants also face the challenge of ensuring that the online and in-store checkout experience is secure, while at the same time eliminating as many false positives as possible. False positives are a hindrance to any business as they may reduce sales, increase chargebacks and frustrate customers. A quick-checkout solution may help reduce false positives because customer information is automatically populated rather than manually keyed into the checkout page.

Acquirers should also work with online retailers to provide a conditional approval code for a transaction. This code allows the fulfillment process to move forward while authentication is taking place. The additional time for a thorough authentication also helps reduce the number of false positives.

Use Data to Build Loyalty

Customers will likely return to a retailer if product marketing reflects their past purchases or interests. Therefore, taking advantage of data including a customer’s purchasing history, loyalty, behavior or social media interests may help retailers to better understand their customers as well as personalize their shopping experience.

According to a study released in March 2013, Chase Paymentech found that 32 percent of merchants use their payment data to help craft their multi-channel sales strategy and 42 percent use it to improve the online customer experience. In addition, further analysis of payment methods, chargeback rates, fraud rates and authorization rates may improve the customer shopping experience and drive overall profitability.

Posted in Best Practices for Merchants Tagged with: approval code, authentication, branded card, chargebacks, Chase, Chase Wallet, checkout process, computer, customer service, data, digital channels, digital offer, Digital Wallet, In-store retailers, internet access, Merchant's, merchant’s website, mobile app, mobile-optimized website, omnichannel, online retailers, payment, payment data, phone, physical channels, Quick Checkout solution, reward points, shopping cart, Showrooming, single-channel retail, Smartphones, social media, tablet, tokenization, transaction, website, Wi-Fi

February 18th, 2014 by Elma Jane

Payment Tokenization Standards

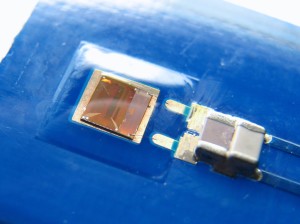

Tokenization is the process of replacing a traditional card account number with a unique payment token that is restricted in how it can be used with a specific device, merchant, transaction type or channel. When using tokenization, merchants and digital wallet operators do not need to store card account numbers; instead they are able to store payment tokens that can only be used for their designated purpose. The tokenization process happens in the background in a manner that is expected to be invisible to the consumer.

EMVCo – which is collectively owned by American Express, Discover, JCB, MasterCard, UnionPay and Visa – has announced that it is expanding its scope to lead the payments industry’s work to standardize payment tokenization. EMVCo says that the new specification will help provide the payments community with a consistent, secure and interoperable environment to make digital payments when using a mobile handset, tablet, personal computer or other smart device.

Key elements of EMVCo’s work include adding new data fields to provide richer industry information about the transaction, which will improve transaction efficiency and enhance the consumer and merchant payment experience by helping to prevent fraudulent card account use. EMVCo will also create a consistent approach to identify and verify the valid use of a token during payment processing including authorization, capture, clearing and settlement.

EMVCo’s announcement follows an earlier joint announcement from MasterCard, Visa and American Express that proposed an initial framework for industry collaboration to standardize payment tokenization. EMVCo says it will now build on this framework with collective input from all of its members and the industry as a whole.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, authorization, capture, card account numbers, clearing, data fields, device, digital payments, Digital Wallet, Discover, EMV, emvco, fraudulent card account, interoperable, jcb, MasterCard, merchant, mobile handset, payment, payment processing, payment token, secure, security standards, settlement, smart device, specification, standardize, tablet, token, tokenization, transaction, visa