August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Hotel, Motel and Bed & Breakfast customers will benefit from this smart terminal:

- Smaller, independent motels or hotels

- Hotels without property management systems

- Existing hospitality customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

May 11th, 2017 by Elma Jane

Three Domain Secure (3-D Secure)

Visa is announcing a global plan to support 3-D Secure 2.0 to help protect e-commerce transactions.

3-D Secure (3DS) – stands for Three-Domain Secure. A messaging protocol to enable consumers to authenticate themselves with their card issuer when making card-not-present (CNP) e-commerce purchases. 3DS is an additional security layer that will help prevent unauthorized CNP transactions and protects the merchant from CNP exposure to fraud.

The three domains consist of:

The merchant/acquirer domain

Issuer domain

the interoperability domain (payment systems)

The purpose of the 3DS protocol within the payments community is to facilitate the exchange of data between the merchant, cardholder and card issuer. The objective is to benefit each of these parties by providing the ability to authenticate cardholders during a CNP e-commerce purchase, reducing fraud.

Visa currently offers its 3-D Secure service through the Verified by Visa program, which supports the existing 3-D Secure 1.0 specifications for consumer authentication.

Visa anticipates that early adoption of 3-D Secure 2.0 will begin in the second half of 2017.

Merchants that authenticate transactions using 3-D Secure are generally protected from issuer card-not-present fraud-related chargeback claims,1 and this rule will extend to merchant-attempted 3-D Secure 2.0 transactions after 12 April 2019, the global program activation date.

For Electronic Payment Set Up go to NationalTransaction.Com or call now 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card, card-not-present, cnp, data, e-commerce, electronic payment, merchant, payment, Security, transactions

April 10th, 2017 by Elma Jane

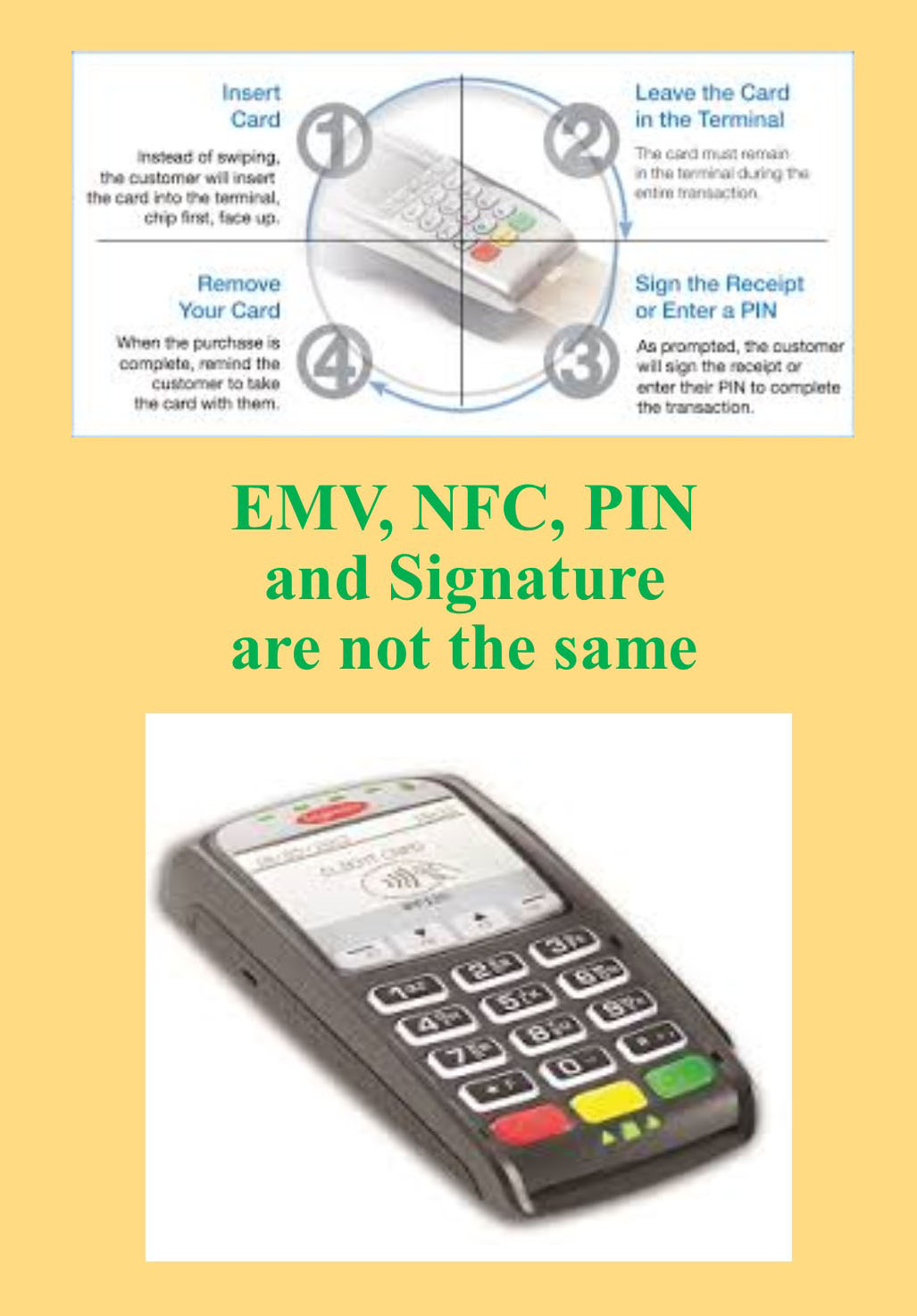

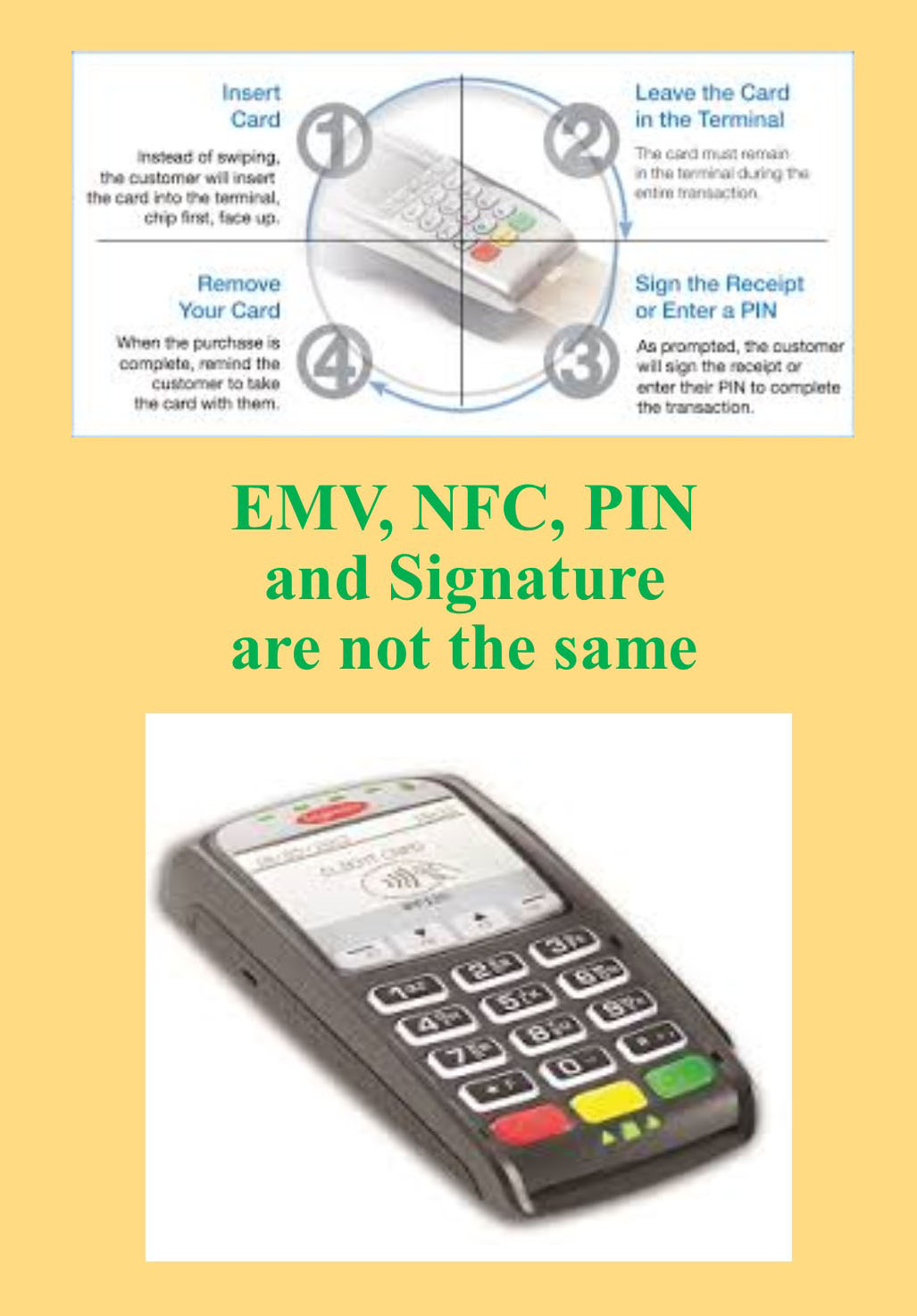

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

March 7th, 2017 by Elma Jane

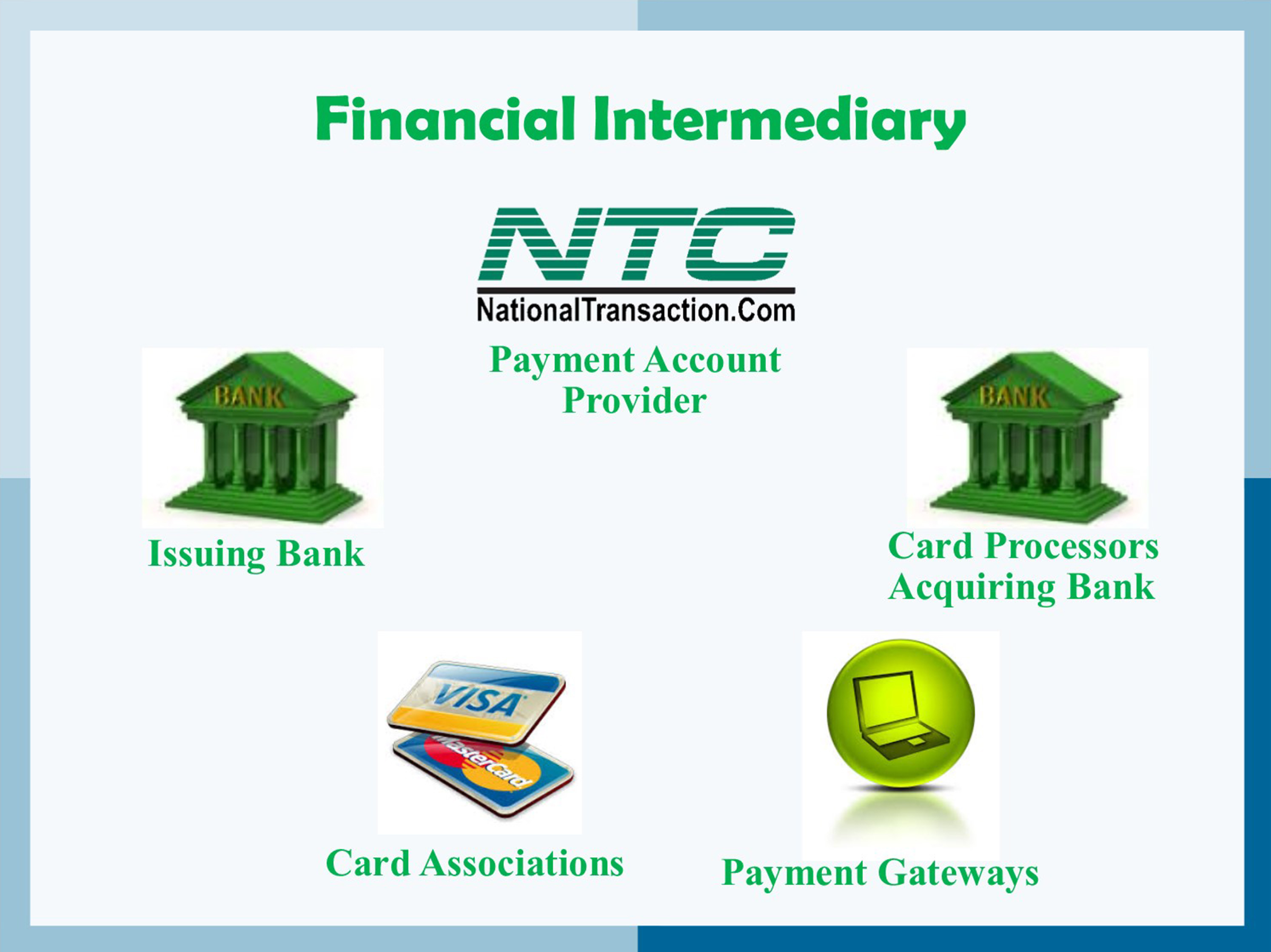

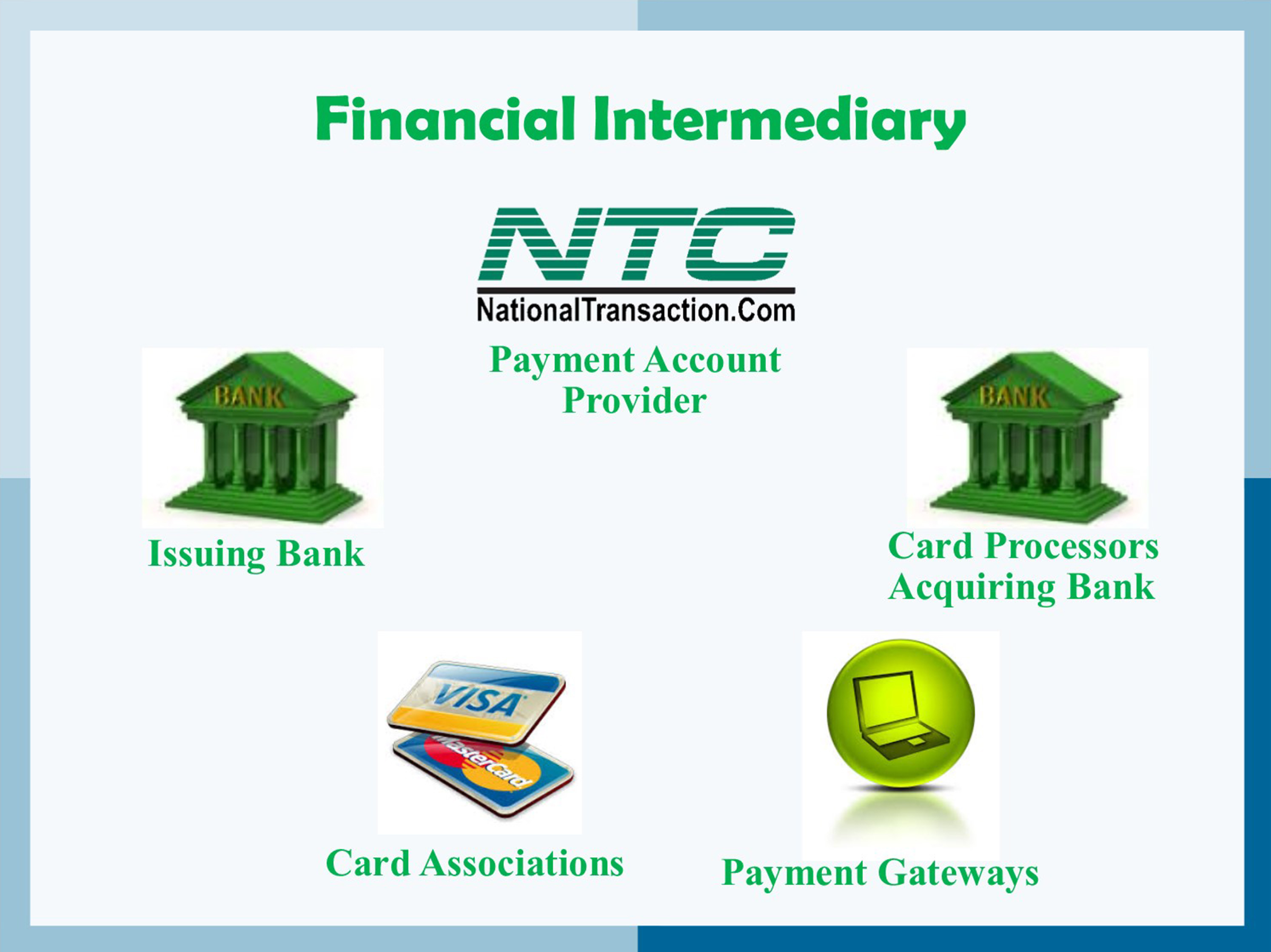

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

March 1st, 2017 by Elma Jane

ELECTRONIC PAYMENTS

When it comes to electronic payments, certain types of businesses are considered high risk.

Most merchants do not realize that electronic payment processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank.

Essentially, a merchant account is an unsecured loan.

Different factors used to determine when a business is a high risk are:

- Types of products

- Services they sell how

- How they sell them

Online transactions are considered high risk because there are increased risks of fraud.

A key factor used to determine the risk of a business is chargebacks.

Chargebacks include customer refunds and fraudulent transactions.

Payment providers assess this risk to determine the percentage of chargebacks your business is likely to experience.

Businesses that are considered high risk where they take advanced payments:

- Travel agencies

- Ticketing services

Electronic payments provider is necessary if you want to accept debit and credit card transactions.

For high-risk electronic payments please feel free to call us at 888-996-2273.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, credit card, debit, electronic payments, fraud, loan, merchant accounts, merchants, online, payment processors, transactions, travel agencies

February 13th, 2017 by Elma Jane

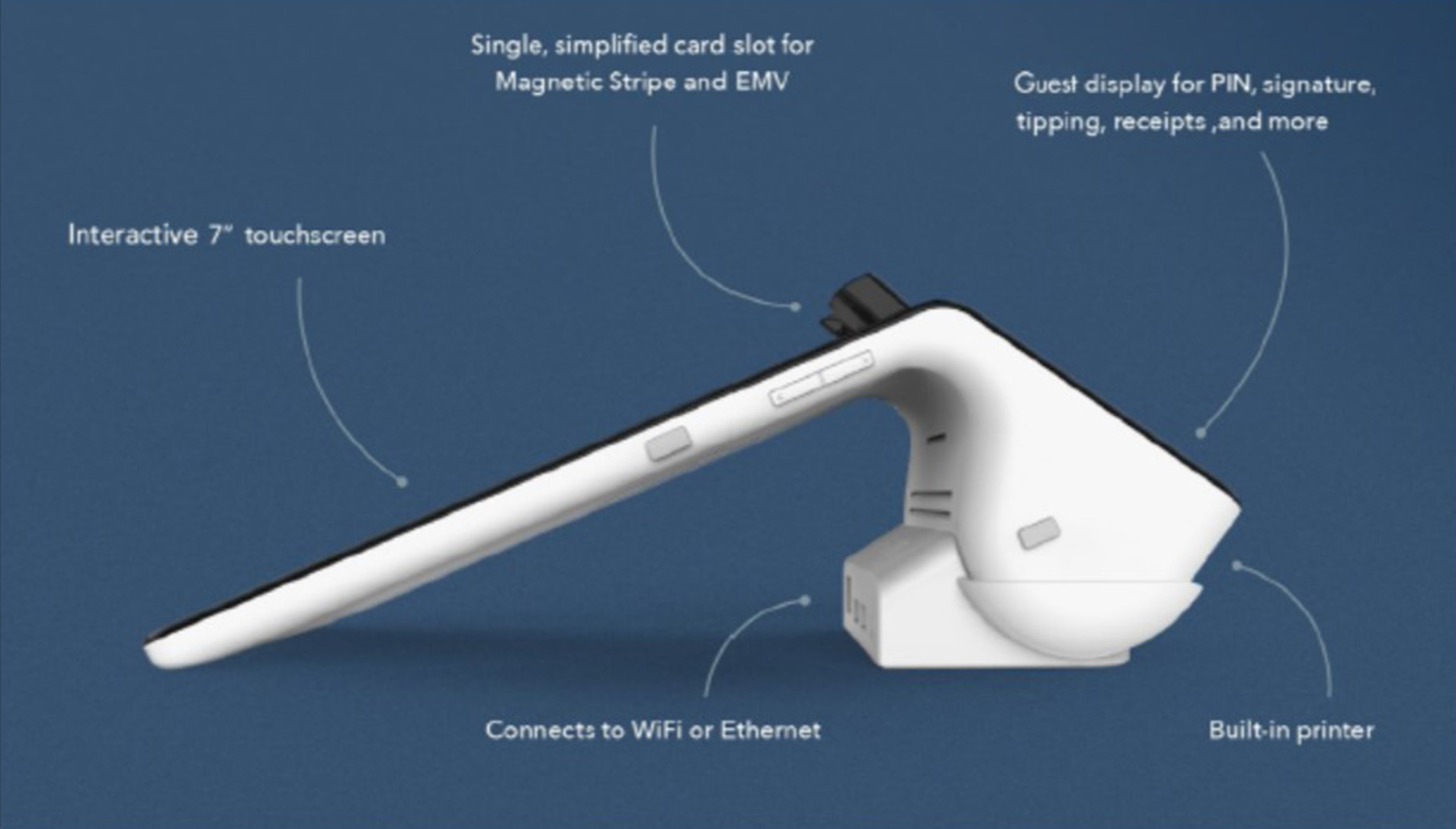

Smart Device for Lodging Transactions

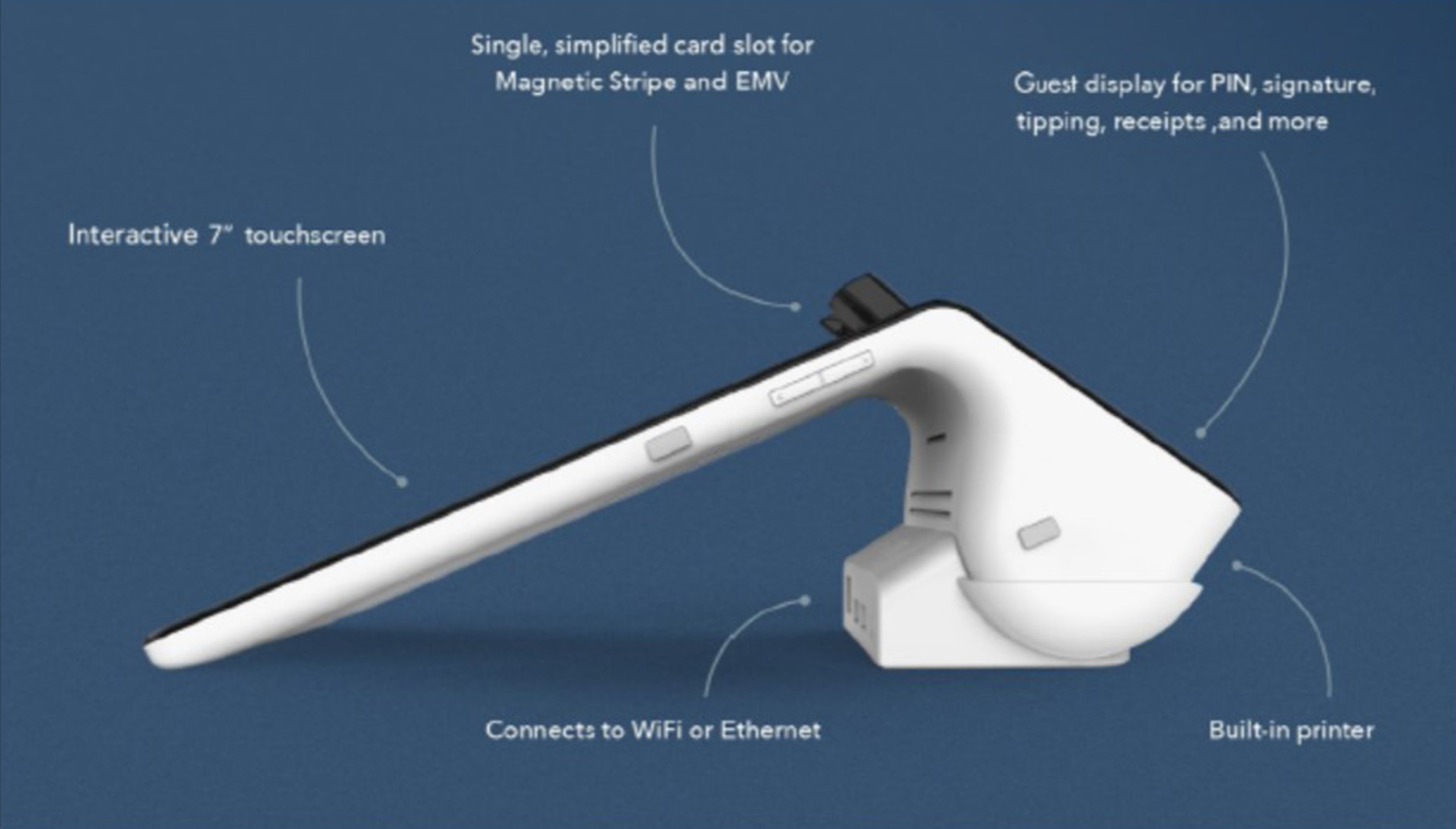

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions

January 25th, 2017 by Elma Jane

PIN vs. Signature: What’s the Difference?

PIN Debit – PIN transactions are routed through what are known as (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

Signature Debit – Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, debit card, electronic, electronic funds transfer, online, payment, PIN, POS, terminal, transactions

January 18th, 2017 by Elma Jane

The cost of accepting card payments is driven primarily by the interchange. When you settle your transactions each day; payment network routes them to the respective card associations (Visa, MasterCard, Discover, and UnionPay) and debit networks through the interchange. Card associations and debit networks establish the rules and manage the interchange of all transactions; for which they charge fees to offset their costs. Interchange fees are paid at the time the transaction is exchanged.

Although interchange fees are applied to all credit card processors equally, they fluctuate in amount, based on a variety of factors. Card associations quote the lowest rate for a transaction, assuming that a number of requirements (which vary according to the card type, the type of business accepting the card payment, and the transaction channel) are met. Transactions that meet all of the requirements for your industry are charged the “qualified rate.” If one or more of these requirements are not met, the transaction is categorized at a more expensive interchange level, known as a Mid-Qualified Non-Qualified the most common “downgrades”.

Some common causes of downgrades include manually entering or requesting voice authorization for a significant number of transactions rather than use a POS device, or you routinely settle

transactions more than 24 hours after they are authorized.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card associations, card payments, debit networks, interchange, payment network, transactions

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions