January 6th, 2017 by Elma Jane

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions

December 27th, 2016 by Admin

Merchant aggregator is an entity that can run many transactions through a single merchant account, an opposite to the traditional merchant account since you’re the sole owner.

Preferred for a smaller business because its not intended as a long term scalable solution to accepting payments.

For businesses that want to expand their processing needs, traditional merchant account will outgrow an aggregator, since the goal is for a business to grow, but it will always come to what’s best for individual business.

While you have the pros of quick application process and instant approval there are a lot of cons to check before getting an aggregator account.

CONS of an aggregator account:

CUSTOMER SERVICE – aggregators are hard to get hold of.

FEES – fixed fees .

FREQUENT HOLDS and DELAY OF FUNDS – aggregators hold funds 24-48 hours before depositing, while longer holds occur 30 days. (A client of ours who signed up with an aggregator came back in tears and wants to open her merchant account with us again because her funds was held with the merchant aggregator. She then promised will not leave and stay for life with NTC).

LOWER LIMITS – processing limits lower, annual limit of $100k.

PROS of a Traditional Account:

CUSTOMER SERVICE – 24/7 technical support.

FUNDS – next day funding, no frequent account holds.

FEES – tailored to your business needs.

LIMITS – varies by financial strength and business

Setting up a Merchant Account? Call us now! 888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customer, fees, funds, merchant, merchant account, payments, transactions

December 12th, 2016 by Elma Jane

Wireless Freedom with Smart Terminal!

Point-of-sale with WiFi capabilities. Now customers can take advantage of total mobility within their location when accepting payments, and managing their business either in-store or remotely. The device is NFC enabled for contactless transactions, and also designed to be easily transported due to its rechargeable battery.

Perfect for Pay at the Table!

Intended to provide cardholders with the ability to pay from anywhere within a business, the Smart Terminal is the ideal solution for processing transactions (and tips) tableside. Other benefits for this service include:

- 8 hour battery life on a single charge.

- Customer screen displays for PIN, Signature, tips, and receipts (via paper/email/text).

- Cardholders have the ability to complete transactions quicker, increasing profitability.

- Enhances the customer service experience.

Available for Retail and Restaurant customers only.

Posted in Best Practices for Merchants Tagged with: cardholders, customers, nfc, payments, POS, terminal, transactions

December 6th, 2016 by Elma Jane

The Process of Processing Electronic Payments

Today new technologies are emerging in electronic payment that allow merchants to collect valuable data on their customers; from emailing receipts to providing incentives to mention the merchant on social media.

So what’s behind the process of processing electronic payments? The heart of all your payment processing needs will most likely lie in a merchant account; with a merchant account you can deposit funds from ebt cards, debit cards, gift or loyalty cards and even checks into your bank account. If your business has never had its own merchant account, it’s probably missing out on some very valuable opportunities.

At National Transaction Corporation this process is simplified to a signature page and a voided check. We consult your business personally to establish the lowest rates and fees possible with your electronic payment processing. We ask detailed questions about how you process your transactions, and if you already process credit cards, we offer a free statement review where we determine your most common transaction types and how to lower their fees and rates.

How Much Will Electronic Payment Processing Cost?

There are three parts to the answer:

Up front or startup costs – include things like an application fee, an account setup fee and equipment fees. At NTC, we don’t have any application, setup or cancellation fees on our services. Our credit card readers and terminals are nonproprietary and will work with almost any merchant services provider and we sell them at cost to make it easier on our merchants.

When you buy a terminal from us you own it and are free to leave us at any time and use the terminal to process through another merchant account provider with no penalty payments at all.

Other startup costs might be:

- check readers,

- cash registers and receipt printers

- mobile point of sale software

- credit card swipe readers

- Accounting software (Intuit’s Quickbooks Pro or PeachTree)

If you already own any of this equipment we can integrate your existing hardware into our services.

Monthly service fees – depend on what services are required; included in the monthly fee detailed statements and reporting on transaction activity.

Transaction fees – MasterCard, Visa and American Express set what are called interchange rates. Interchange rates are a per transaction fee and/or a percentage rate based on the total of a sale. Interchange rates are very complex and consume hundreds of pages of different types of electronic transactions. These transactions are based on the type of business processing the transaction, the way the credit card data is input (like a credit card that is swiped in or manually keyed into a credit card terminal of some type) and the type of credit card used for the transaction (rewards card, corporate card, travel and entertainment credit cards, ebt cards and so on). With so many types of cards and businesses to process it’s impossible to give an accurate rate for all charges.

Again, we have no fees associated with applying for or setting up the merchant account and there is no penalty for cancellation so there are no risks in trying it out. We can do merchant rate review for free. Call us now 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit cards, customers, data, electronic payment, merchant account, merchants, mobile, payment processing, point of sale, services provider, terminal, transactions

December 1st, 2016 by Elma Jane

The All in One Smart Terminal!

Finally, a dynamic all-in-one smart terminal that offers a turnkey solution for customers to immediately implement in their place of business. Think of it also like a smart phone for accepting payments.

Function meets Form

Enables the speed of business with a modern, engaging design. Here are a few highlights:

- Dual, interactive touchscreens for the customer and cardholder.

- Built-in intuitive software, PIN pad and also signature pad, and printer.

- Charging dock station that includes extra USB ports.

- One card slot for EMV/MSR transactions.

- NFC enabled to accept contactless transactions, for example ApplePay.

- Mobile and web applications to help owners manage their business from anywhere.

- Ability to print, email and also send SMS receipts.

Sleek modern device that delivers an incredible customer experience, therefore a great option for retailers, coffee shops, and pop-up shops.

It comes with the powerful security of Safe-T built in.

For your EMV/NFC terminal needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: ApplePay, cardholder, contactless transactions, customers, EMV, mobile, nfc, payments, PIN pad, smart phone, terminal, transactions

November 22nd, 2016 by Elma Jane

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

In addition, you can enjoy from e-commerce payment gateways to retail and restaurant solutions, business-to-business processing capabilities to electronic invoicing (NTC ePay).

NTC is offering a cost-effective credit card payment processing services that are very fast, secure and easy to integrate.

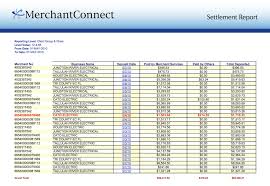

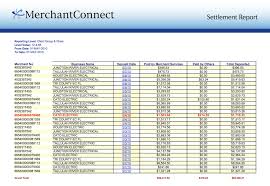

Get your Secure MerchantConnect Reporting Tool:

Get your Secure MerchantConnect Reporting Tool:

- Review and reconcile all of your transactions settle or batch settle and also much more.

- Create and save your custom reports that also can be imported or exported easily.

- Use our solution to turn any computer, laptop, smartphone or tablet into a processing center.

- Run & enjoy this on one or more devices to process credit card transactions with your merchant account.

- Peripherals allow swiping transactions and printing out receipts.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Receive up to $150,000 per location in less than 10 business days—sometimes in as few as 72 hours.

National Transaction Merchant Cash Advance eliminates many hassles and delays common with bank loans.

Our Merchant Cash Advance builds on the strength of your business’ future credit and debit card sales, so a damaged personal credit history is not an immediate disqualifier.

Posted in Best Practices for Merchants Tagged with: bank, cash advance, credit card, debit card, e-commerce, Electronic invoicing, electronic payment, gateways, loans, merchant account, payment, payment services, Security, smartphone, transactions

November 15th, 2016 by Elma Jane

SMART TERMINAL

Another all-in-one mobile (IP countertop and Wi-Fi capable) terminal that gives customers the functionality they want and need.

Sleek modern device that delivers an incredible customer experience, and is a great option for retailers, coffee shops, and pop-up shops.

Includes two touch screens: a larger one for easy visibility of orders and other information, as well as a cardholder facing one that can be used for payments and tipping. It also offers a dashboard function, so your customers can monitor their transactions and other reports remotely. On top of that, it comes with the powerful security of Safe-T built in.

For your EMV/NFC terminal needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Reader Terminal Tagged with: cardholder, customers, EMV/NFC, mobile, payments, Security, terminal, transactions

October 20th, 2016 by Elma Jane

Ways consumer can use NFC!

Near field communication technology (NFC) is on the rise, and as a result consumers can use NFC not just for making payments.

Top ways consumers can use NFC (Near field communications):

NFC Access Keys – can also be used as your access to certain buildings or hotels.

NFC Boarding Pass – are used in airports to expedite the boarding process. No more keeping track of that printed boarding pass!

File Sharing – on certain Android phones, consumers can also share songs, contacts and files from phone to phone with a simple tap.

Retail – Paying in stores simply requires a wave of the customer’s smartphone. This provides speedier transactions, but also provides merchants the opportunity to offer their customers loyalty points and rewards.

NFC Ticketing – speeds up subway boarding time by allowing consumers to use their phones also at the reader.

Vending Machines – NFC-enabled vending machines will allow customers to simply tap and go.

With the growing list of NFC technology uses, merchants should be prepared for the adoption. Upgrade your terminal to be NFC-enabled give us a call at 888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: customers, merchants, nfc, payments, terminal, transactions

September 29th, 2016 by Elma Jane

MerchantConnect is a great tool for merchants because it contains all the information that a merchant needs to manage their electronic payment activity. Furthermore, it’s fast, easy and secure!

- Merchant can either view or update account information and make changes.

- Find copies of statements.

- Furthermore find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants, Electronic Check Services, Electronic Payments Tagged with: bank, card, chargeback, electronic payment, merchants, payments, risk, terminal, transactions

September 19th, 2016 by Elma Jane

Terminal or credit card machines are used for processing debit and credit card transactions. Therefore, are often integrated into a Point of Sale System.

Electronic Authorizations – merchants had the choice of calling in for an authorization or imprinting their transactions, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing transaction over the phone.

Manual Imprinters – are considered a great backup processing method. Although time consuming and did not offer the speed or instant transfer capabilities, this imprinters are still widely used.

Point of Sale Terminals: POS emerged in 1979, which was a turning point in the credit card processing industry. As a result,

Visa introduced a bulky electronic data capturing terminal. The first of credit card machine or terminal as we know them today. It has greatly reduced the time required to process a credit card.

In the same year, MasterCharge became MasterCard and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement.

Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Near Field Communication, Visa MasterCard American Express Tagged with: chip, contactless, credit card, debit, EMV, mobile, nfc, PIN, point of sale, Security, terminal, transactions, visa