June 20th, 2016 by Elma Jane

Batch – is a collection of credit card transactions, usually a single day’s worth.

Batch Processing – refers to a one-time closing or settling the entire batch of transactions.

The point-of-sale terminal or credit card processing software can be set on:

Manual Batch close – merchant will need to batch out at the end of each day. The processor will receive a command to settle all transactions that have been entered. There will be a printed report showing the transaction totals in the batch once a batch is settled.

Changes can be made to existing transactions in the batch before a batch is settled. Example: If you want to change an amount of one of the transactions or you want to void a transaction.

Automatic Batch close – The terminal or software will automatically close the batch, (settle the transactions) at a certain time each day, no manual intervention is needed by the merchant or in some case the processor will settle the batch (called host batch close at the processor level). Automatic batch close set-up is advisable for most businesses unless a tip edit function is required, manual batch close would be the better option.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, point of sale, processor, terminal, transactions

June 8th, 2016 by Elma Jane

Near field communication technology (NFC) is on the rise, and consumers can use NFC not just for making payments.

Top ways consumers can use NFC (Near field communications):

NFC Access Keys – can also be used as your access to certain buildings or hotels.

NFC Boarding Pass – are used in airports to expedite the boarding process. No more keeping track of that printed boarding pass!

File Sharing – on certain Android phones, consumers can share songs, contacts and files from phone to phone with a simple tap.

Retail – Paying in stores simply requires a wave of the customer’s smartphone. This provides speedier transactions, but also provides merchants the opportunity to offer their customers loyalty points and rewards.

NFC Ticketing – speeds up subway boarding time by allowing consumers to use their phones at the reader.

Vending Machines – NFC-enabled vending machines will allow customers to simply tap and go.

With the growing list of NFC technology uses, merchants should be prepared for the adoption. Upgrade your terminal to be NFC-enabled give us a call at 888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: consumers, customer’s smartphone, merchants, Near Field Communication, nfc, payments, retail, rewards, technology, terminal, transactions

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

May 3rd, 2016 by Elma Jane

MerchantConnet is a great tool for merchants, it contains all the information that a merchant needs to manage their electronic payment activity. It’s fast, easy and secure!

- Merchant can view or update account information and make changes.

- Find copies of statements.

- Find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History.

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal.

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, card, chargeback, merchants, payment, terminal, transactions

April 28th, 2016 by Elma Jane

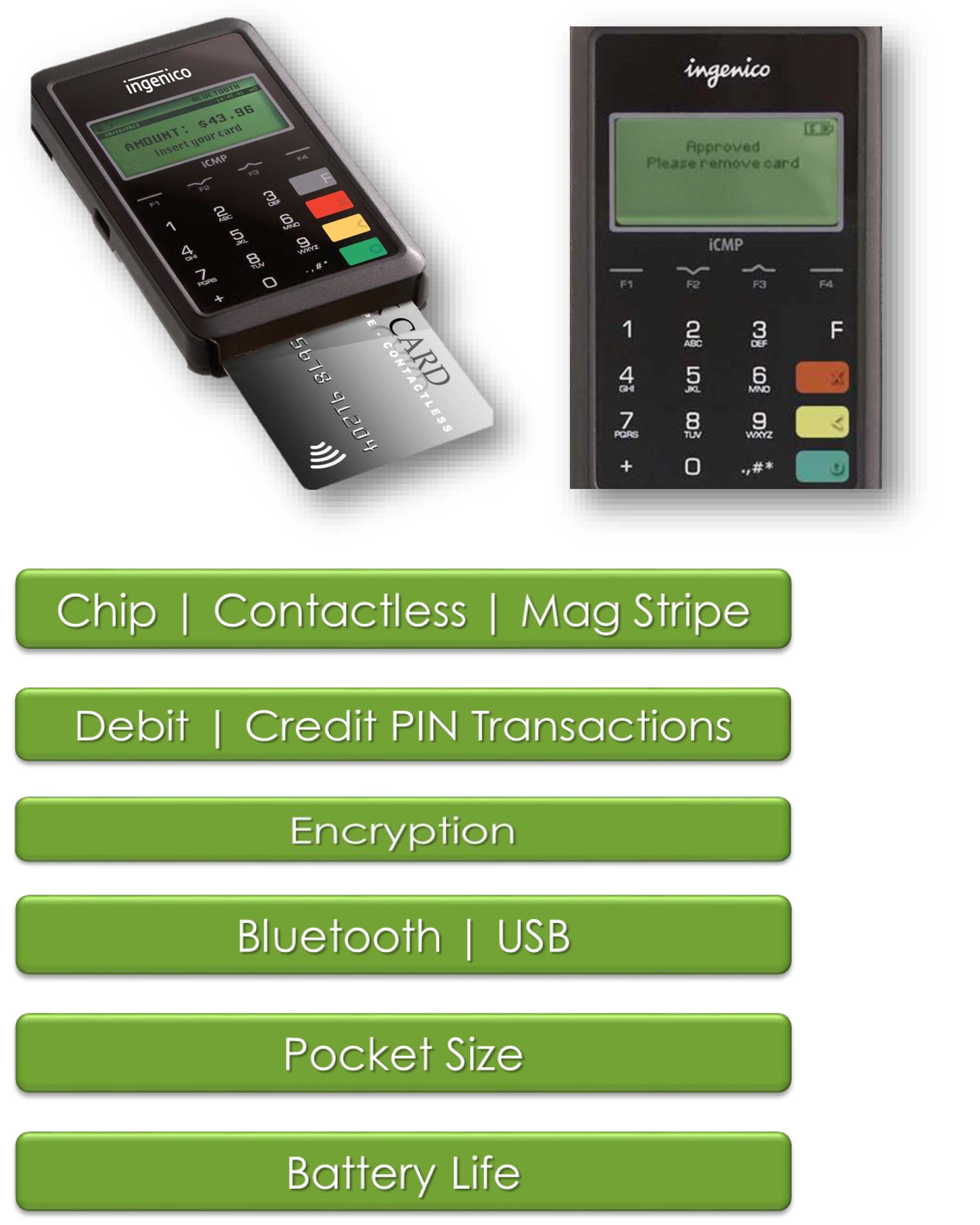

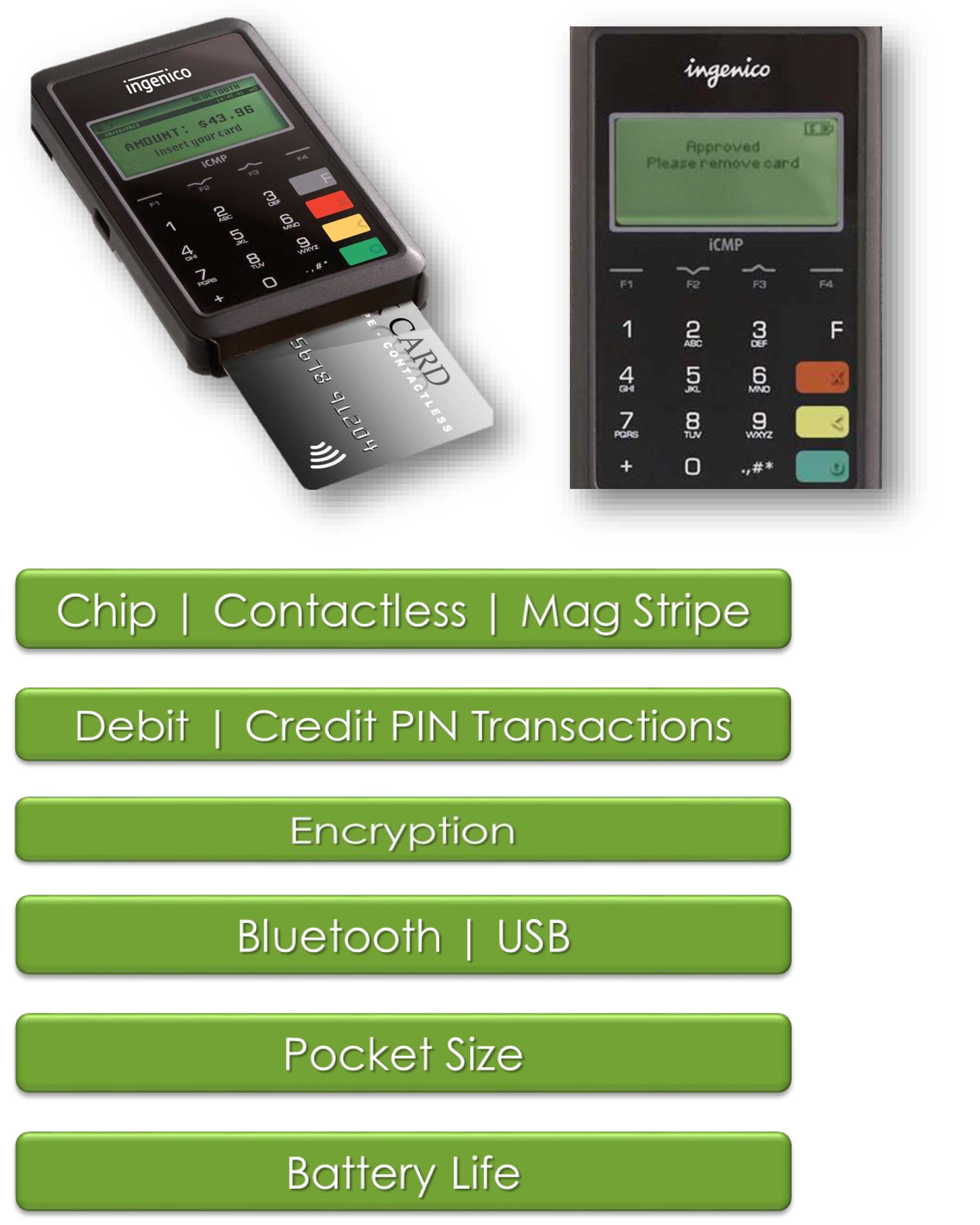

You can offer your customers preferred payment method with the next generation point-of-sales terminals, an all-in-one credit card processing experience: which not only support Near Field Communication (NFC) contactless payment transactions such as Apple Pay but chip cards and the traditional magnetic stripe cards; and manual entry transactions as well.

Contactless payment transactions are happening now. NTC are here to help.

Posted in Best Practices for Merchants Tagged with: chip cards, contactless payment, credit card processing, customers, magnetic stripe cards, Near Field Communication, nfc, payment, point-of-sales, terminals, transactions

April 28th, 2016 by Elma Jane

You may now give your customers the option to pay with PayPal in person. There is nothing you or they need to do – merchant card processing accounts with NTC have been automatically updated to accept PayPal in-person payments in addition to the other payment options currently offered.

How PayPal transactions work

When businesses accept a PayPal in-person payment, it could be processed in a number of ways. This will be reflected on the monthly processing statement and customer receipts, and the businesses you serve will receive the same pricing they currently do for payments over these networks:

- PayPal mobile payments will be processed as Discover transactions and are subject to Discover operating regulations.

- PayPal-branded card payments will be processed over the payment network designated on the card and are subject to operating regulations designated by the network on the card.

Posted in Best Practices for Merchants, Credit card Processing Tagged with: card, card payments, card processing, customer, merchant, Mobile Payments, payment network, payments, transactions

April 26th, 2016 by Elma Jane

The PCI-DSS is a security standard for organizations that handle branded credit cards from the major card including Visa, MasterCard, Amex, Discover, and JCB. It is designed to ensure that ALL companies that process credit card information maintain a secure environment.

PCI applies to organization or merchant, that has a Merchant ID (MID), regardless of size or number of transactions, that accepts credit card.

Merchants will fall into one of the four merchant levels based on Visa transaction volume over a 12-month period.

| Merchant Level |

Description |

| 1 |

Any merchant — regardless of acceptance channel — processing over 6M Visa transactions per year. Any merchant that Visa, at its sole discretion, determines should meet the Level 1 merchant requirements to minimize risk to the Visa system. |

| 2 |

Any merchant — regardless of acceptance channel — processing 1M to 6M Visa transactions per year. |

| 3 |

Any merchant processing 20,000 to 1M Visa e-commerce transactions per year. |

| 4 |

Any merchant processing fewer than 20,000 Visa e-commerce transactions per year, and all other merchants — regardless of acceptance channel — processing up to 1M Visa transactions per year. |

Does is each location required to validate PCI Compliance for multiple business locations?

If a business locations process under the same Tax ID, then you are only required to validate once annually for all locations.

Penalties for non-compliance

The payment brands may fine an acquiring bank $5,000 to $100,000 per month for PCI compliance violations. The banks will pass this fine along until it eventually hits the merchant. The bank will also terminate your relationship or increase transaction fees.

PCI Compliance Manager

To help you achieve and report compliance, we have Trustwave PCI Compliance Manager. It’s an online portal that enables you to understand requirements that apply to your business, and guides you through your self-assessment, step by step.

If you have any questions regarding your PCI Compliance please call our office at 888-996-2273. We would be more than happy to help.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: banks, credit cards, merchant, PCI-DSS, Security, transactions

April 4th, 2016 by Elma Jane

Visa

- Visa is introducing updates to their dispute process.

- Visa is introducing reduced timeframes for transaction processing and late presentment.

- Visa is eliminating the “Call Auth” referral responses, replacing them with Approved or Declined responses.

MasterCard

- MasterCard is adjusting some chargeback reason codes.

- MasterCard is introducing new standards for processing authorizations and pre-authorizations.

- MasterCard is introducing new auth reversal fees.

Discover

- Discover is introducing ProtectBuy for e-commerce transactions.

- Discover is modifying recurring payment interchange programs.

American Express

- American Express is introducing new MCC codes.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Visa MasterCard American Express Tagged with: e-commerce, payment, transactions

March 31st, 2016 by Elma Jane

E-commerce – the process of using the Internet or computer networks in order to buy or sell information, services, or products.

Everyday people go on the Internet and make purchases for different products or services, just like they would in a store. The act of buying or selling over these networks allows for secure paperless transactions to happen electronically.

Electronic transactions have been around for quite some time involving business to business transactions over private networks in the form of EDI. Electronic Data Interchange (EDI), which was a transfer of electronic data from a computer to another computer and Electronic Funds Transfer (EFT), which was a transfer of money electronically from a computer to another in order to do business with each other.

Accepting online payments is very rewarding. If you’re new to e-commerce keep things simple check out our NTC e-Pay the NO SHOPPING CART E-Commerce Solution!

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: e-commerce, Electronic Data, electronic transactions, online payments, payments, transactions

March 7th, 2016 by Elma Jane

It is my pleasure to write this testimonial for National Transaction Company!

My travel agency has been associated with this organization since 2005 and I continue to believe they are the best solution for my home based operation’s credit card merchant transactions. The process is simple, efficient and it provides me a profitable way to accept client credit cards and manage my agency’s cash flow.

Their support team is the best!

Judy K

JMK TRAVEL INC.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, transactions, travel, travel agency