December 18th, 2024 by Elma Jane

What makes your travel merchant account high risk?

Travel environments are unique and transactions are usually keyed in. There’s almost always a delayed delivery period, and large ticket transactions.

One card holder may be paying for multiple tickets and they tend to be seasonal; with peak season months generating an unusual spike in their “average” monthly volume and chargebacks, pose a potential threat by travelers who are unable to complete their trip.

These factors can cause for either a reserve or account termination. Therefore travel merchant accounts are considered high risk.

Most merchants do not realize that merchant processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank. Therefore, a merchant account is an unsecured loan.

The merchant runs a transaction and at the end of the day they settle their batch. The merchant will receive the funds for that batch in their bank account within 2 business days, even though the travel arrangements the client paid for do not take place right away.

Here at National Transaction Corp, we specialize in understanding what makes your transactions as a travel agent unique and how they affect your merchant account.

Educating the merchant and ensuring they have a good understanding of what makes travel merchant account high risk, is one of our specialties.

Call NTC to speak with a Travel Merchant Account Specialist today!

Dial 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, card, chargebacks, financial, loan, merchant, payment, processors, transactions, travel, travel agent, Travel Merchant

November 11th, 2024 by Elma Jane

MasterCard is releasing a new program for its corporate clients that allows them to closely monitor and control their travel expenses online. The program, known as Travel Controller, lets businesses track all of their individual travel accounts under one system, giving owners a chance to reduce those travel expenses.

Typically, travel and entertainment is the second-largest controllable expense after salaries and benefits, and yet companies worldwide are overwhelmed with huge amounts of travel spend data requiring expense reconciliation said, head of travel and entertainment at MasterCard. “With minimal upfront investment and systems integration, Travel Controller gives companies the opportunity to remedy this pain point.

This program is somewhat an extension of the Smart Data service that MasterCard launched in July. This program lets company treasurers analyze business-wide spending by assessing big data from all employees.

MasterCard’s Travel Controller is not scheduled to be on the market until early 2014, but it is currently being used as a pilot at a select group of banks. With this program, business owners can gain a better understanding of how their travel expenses are being spent. If an employee is spending more than the amount dictated by the company’s travel policy, the Travel Controller will show that information.

Posted in Credit card Processing, Travel Agency Agents, Visa MasterCard American Express Tagged with: accounts, benefits, control, corporate, entertainment, expenses, investment, market, MasterCard, online, pilot, reconcilliation, remedy, salaries, systems integration, travel, travel controller, upfront

September 20th, 2024 by Elma Jane

Merchant Account Risks for Travel Agencies

The travel industry, with its high-value transactions and international clientele, faces unique challenges when it comes to credit card processing. While accepting plastic is crucial for smooth booking and customer convenience, travel agencies must be aware of the inherent risks and implement strategies to mitigate them. Here’s a breakdown of the key credit card processing risks and how to minimize them:

1. Chargebacks:

- The Problem: Travel plans change, flights get delayed, and unforeseen circumstances arise. This can lead to a higher rate of chargebacks, where customers dispute charges with their credit card company. Chargebacks can be costly, involving fees, lost revenue, and potential damage to your merchant account reputation.

- Mitigation:

- Clear Cancellation Policies: Crystal-clear terms and conditions regarding cancellations, refunds, and travel changes are essential. Ensure these are easily accessible during booking.

- Thorough Documentation: Maintain detailed records of all transactions, customer communications, and travel itineraries. This provides evidence in case of a dispute.

- Proactive Communication: Keep customers informed about any changes to their travel plans and address concerns promptly.

- Secure Payment Processing: Utilize 3D Secure (like Verified by Visa or Mastercard SecureCode) for added authentication and fraud prevention.

2. Fraud:

- The Problem: The travel industry is an attractive target for fraudsters due to high transaction values and the potential for anonymity. Fraudulent activities can include using stolen credit card details, booking fictitious trips, or exploiting vulnerabilities in online booking systems.

- Mitigation:

- Address Verification System (AVS): Verify the billing address provided by the customer against the address on file with the credit card company.

- Card Security Code (CVV): Always require the CVV code for card-not-present transactions.

- Fraud Detection Tools: Implement fraud screening tools that analyze transactions for suspicious patterns and flag potentially fraudulent activity.

- PCI DSS Compliance: Adhere to the Payment Card Industry Data Security Standard (PCI DSS) to ensure secure handling of sensitive cardholder data.

3. Currency Fluctuations:

- The Problem: International travel often involves transactions in multiple currencies. Fluctuating exchange rates can impact your profit margins and create uncertainty in pricing.

- Mitigation:

- Dynamic Currency Conversion: Offer customers the option to pay in their home currency, providing transparency and potentially reducing chargebacks related to exchange rate discrepancies.

- Hedging Strategies: Explore financial instruments to mitigate currency risk, such as forward contracts or currency options.

4. High Processing Fees:

- The Problem: Travel agencies often face higher processing fees due to the perceived risk associated with the industry.

- Mitigation:

- Negotiate with Processors: Shop around and compare rates from different credit card processors. Don’t hesitate to negotiate for better terms, especially if you have a high volume of transactions.

- Consider Interchange-Plus Pricing: Opt for transparent pricing models like interchange-plus, which separates the interchange fee (charged by card networks) from the processor’s markup.

5. Technological Challenges:

- The Problem: Keeping up with evolving payment technologies and security standards can be challenging. Outdated systems can increase your vulnerability to fraud and data breaches.

- Mitigation:

- Invest in Secure Technology: Use a robust and secure online booking system that integrates with reputable payment gateways.

- Regular System Updates: Ensure your software and security protocols are regularly updated to address emerging threats.

- Partner with Reliable Providers: Choose payment processors and technology vendors with a strong track record of security and reliability.

By understanding and proactively addressing these credit card processing risks, travel agencies can protect their business, enhance customer trust, and navigate the exciting world of travel with greater financial security.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card-not-present, cardholder, chargeback, credit card, customer, fraud, high-risk merchants, merchant account, merchants, payment, processors, risk, transaction, travel, travel agencies, travel agency, travel agents

September 5th, 2024 by Elma Jane

It’s true that the travel agencies are high risk. This is because of the high chargebacks by travelers who fail to complete their trips or stays due to a variety of reasons. It also has to do with the nature of delayed delivery where items or services are sold today but not used/consumed for a delayed period of time. Using the right merchant solutions can make a difference.

You want merchant solutions that help you to manage chargebacks, errant transactions, and terminal messages. Additionally, you should be able to integrate your software with services such as Sabre Red, Sabre, Trams or other accounting programs such as QuickBooks and Peachtree.

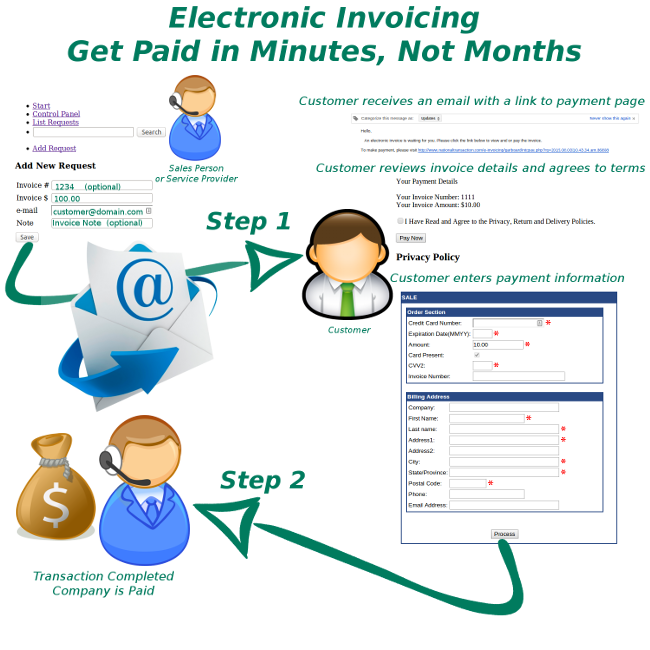

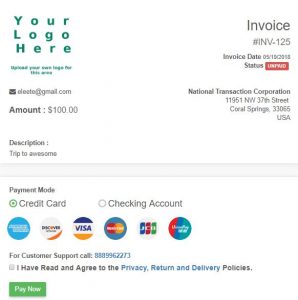

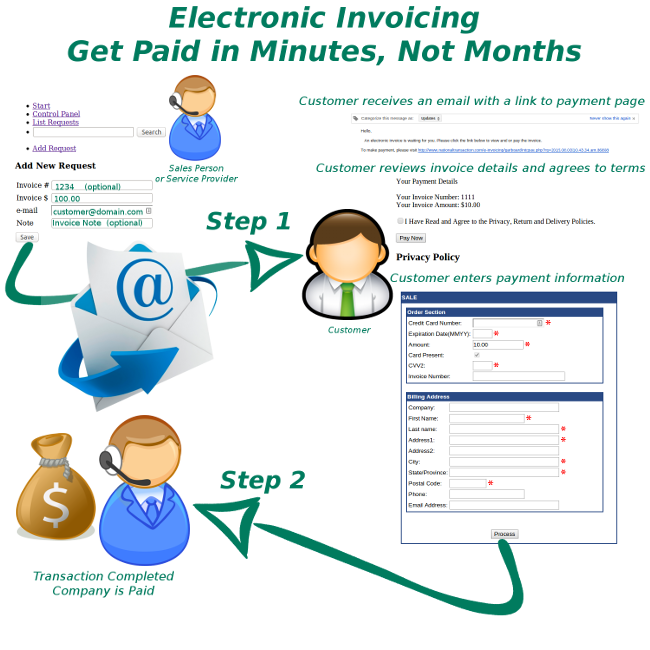

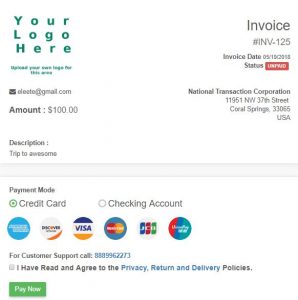

With NTCePay, simply create a pay button for any dollar amount. Then send this digital link to your customers via email. The customer reviews the invoice details and enters their payment information to complete payment. You can also create custom links that can be added to your web site or posted to your social media accounts for payment collection. With advanced invoices, you can easily break down payments into installments.

With this service, you avoid the complexities of integrating the software with your shopping cart, point of sale, or accounting system yet still collect your travel payments in a seamless manner.

For Electronic Payment Set Up Call Now! 888-996-227

Posted in Uncategorized Tagged with: chargebacks, high risk, merchant, payment, point of sale, terminal, transactions, travel

August 29th, 2024 by Elma Jane

Running an e-commerce website, travel agency, retail store or any other business that requires payment processing can be overwhelming.

You’ve got to monitor your transactions, ensure security to your customers, and generate reports. That’s a lot of work. However, with NTC payment solutions, you can streamline the whole payment process and stay on top of your operations.

With the right service, it allows you to get paid faster, offer loyalty programs, and process payments on the go. Depending on your business, you want to pick the right solution that best suit your needs.

Let’s explore some of the options you can consider.

With the right software, you can gain control of your business from inventory and order management to refunds and returns. No matter how you have set up your point of sale system, having the right software can make a great difference.

You want a software that lets you add other functionality, such as loyalty cards, sales exchanges, layaways, discounts, etc. This allows you to experience seamless customer management, inventory management, and retail accounting.

With the advancement in technology, you can access your point of sale system right on your iOS or Android device. This technology can replace your bar code scanners and cash registers to improve your in-store payment processing. There are also card readers that you can connect to your phone to start processing payments.

National Transaction can provide hardware, software, and support for any point of sale and other merchant solutions that your business needs.

To speak with our Payment Consultant Call Now 888-996-2273

Posted in Best Practices for Merchants Tagged with: card readers, e-commerce, Loyalty Programs, merchant, payment processing, point of sale system, Security, technology, transactions, travel

July 11th, 2024 by Elma Jane

Travel agencies are viewed as high-risk merchants. As such, you need a merchant solution that best suits a travel merchant needs.

You want an account that eliminates the complexities of a typical shopping cart. Ideally, it allows you to request payment from clients without the need of setting up booking engines and carts.

This post is going to guide you on how to use a payment solution NTCePay and other merchant solutions to ensure a seamless operation of your business.

Leveraging the NTC e-Pay Service

Payment solution e-Pay allows you to eliminate the complexities of integrating payment processing into your point-of-sale or an accounting system.

With this payment method, you only need to send a payment request to your customers via email. You don’t need to send invoices via snail mail or fax any forms to your customers. Plus, NTC ePay doesn’t need you to take orders over the phone.

With this service, you can create a “BUY” button for any transaction amount in seconds. You also don’t need a website to you use this service. NTCePay allows you to generate a digital link that you can email to clients.

The service allows you to customize the process to make everything simple for your customers. After the customer pays the specified amount, a receipt is generated, and the amount is sent to your account.

Tomorrow we are going to discuss on how to understand your Travel Merchant Account….So standby to learn more.

For NTCePay Set Up call Now 888-996-2273

Posted in Best Practices for Merchants Tagged with: customers, merchants, payment, transaction, travel, travel agencies

Cash When You Need it by Not Holding Funds

In our second installment, we talked about NTC’s newest solution, NTC ePay. This third and final reason in this series we will go over how NTC keeps your cashflow going.

Due to the history of travel businesses, many travel agencies are given a travel merchant account with monthly credit card processing volume caps. This means merchants are only permitted to handle a specific number of credit card transactions or volume amount per month. Once that limit amount is reached, the merchant can no longer take credit cards for purchases that month. This keeps a business, especially an e-commerce merchant that relies on credit card payments, from operating effectively.

Imagine the impact on as a travel agent when you no longer have to worry about having your cash flow stopped. We work very hard to eliminate holds and reserves on all our travel merchant accountsaccounts.

Now imagine getting approved for large volume.

You will agree that those two factors will have a huge positive impact on your business growth.

Most merchant providers usually hold funds from travel agents, because historical data shows that consumers are much more likely to dispute and chargeback travel agency transactions because of a change in their travel plans.

You may be wondering, why do we not hold your funds?

Well simply said, because we understand your business. NTC has been doing business with travel professionals like you for over 20 years and we understand that holding funds creates a huge hassle for your operation. We understand that cash flow is essential to your continued success.

With NTC travel agents can feel confident that they will maintain cash flow to help their business operate smoothly and efficiently without interruptions.

Why do travel merchants flag large transactions?

Many times travel merchants run tens of thousands of dollars worth of transactions and their processor tells them they’re going to simply hold the funds and pay the merchant at a later date.

We understand how critical it is to have funds available because many agents have shared how with other merchant providers, their cash flow has come to a complete halt at times.

Remember that when you choose a travel payment processor, you must be sure to choose one with experience in working with travel agencies like NTC.

At NTC, we assist you in developing and implementing your fraud prevention procedures, so that you can be proactive in identifying and correcting potential weak spots in your processing cycle.

Over these past three blog articles, we have shared the three main reasons why travel agents like you prefer National Transaction Corporation. Now we want to hear from you as to which of these three reasons is most important for your travel agency business. We’d love to read your comments below.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Merchant Services Account, nationaltransaction.com, Travel Agency Agents Tagged with: credit cards, e-commerce, electronic payment, merchant account, travel

May 19th, 2024 by Elma Jane

NTC Product and Services

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 20 years of experience, National Transaction offers a variety of electronic payment services and technology for Retail and Ecommerce industries. From Travel, Medical Industry, Charitable Institution and Franchise.

Our services include:

Loans/Funding Program

Credit and Debit Card Processing

Currency Conversion

Electronic Checks

Electronic Invoicing

Gift and Loyalty Card Programs

Mobile and Online Solutions

Shopping Cart E-commerce Payment Gateway

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, nothing to integrate; secure and fast.

Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-996-2273

or visit Nationaltransaction.Com

Posted in Best Practices for Merchants, Credit card Processing, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Mail Order Telephone Order, Merchant Services Account Tagged with: debit card, ecommerce, electronic payment, loans, Loyalty Card, mobile, online, payment gateway, travel

Over the next three weeks we will explore on this blog some of the reasons why National Transaction Corporation is the preferred choice for travel agents.

The Travel industry is one of the world’s largest industries with a global economic contribution of over 7.6 trillion U.S. dollars in 2016. (Statista)

At NTC we recognize that travel agency payment processing has some unique hurdles to overcome, but we are leveraging our innovation because we want our travel agency partners to explore how our solutions transcend the challenges that travel agents face.

Secure processing is one of the reasons why National Transaction is the preferred choice for travel agents

National Transaction Corporation has Secure Merchant Payment Processing – Because when your customers know their data is safe, they keep coming back!

You’ve heard of the many data breaches within major corporations that have occurred in just the last few years, when customers’ confidential credit card information is stolen and businesses lose a small fortune in repairing the problem. The cost of such a security breach goes far beyond that, however; once a business has lost the trust of its customers, 60% of those cardholders will go elsewhere for their purchases and services, according to studies on the problem.

Imagine if this happened to your travel agency merchant account? It could be disastrous, especially because agencies tend to deal with high-dollar sales from a moderately-sized pool of customers – so every client counts.

NTC knows that you, like us, care about your customers, and we want your travel agency to be seen as a trustworthy place to book a dream vacation. The first step is for your business to be PCI-DSS compliant.

PCI-DSS (Payment Card Industry-Digital Security Standards) requirements were put in place by the credit card associations to deal with the increasing problem of identity theft and data loss. The requirements vary according to the types and the number of payment transactions your agency goes through, but you can be sure that NTC will help you stay compliant with the latest security standards.

In the event of a data breach, we are here to eliminate the negative impact it can have on your company. NTC may be able to help you with the fines, assessments, and other costs from the networks, and we will consult with you on how to proceed to protect your agency and your reputation.

As you know, data security is as much a concern for the business owner as it is for the cardholder – your customer. When your clients know that their data is safe with you, they will keep coming back to your agency to book their next great trip!

If you cannot wait to read blog number two out of this three part series, feel free to call NTC now at 888-996-2273 to find out the best options for your travel agency!

Posted in Credit card Processing, Credit Card Security, Travel Agency Agents Tagged with: cardholder, data, fraud, merchant account, payments, Security, transaction, travel, visa

Travel Agents prefer NTC ePay because they get paid faster with their very own “Buy Now” button or simply by requesting payments by email!

In our last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTCePay helps your travel agency.

In our last installment, we shared how the security of NTC Payment Processing works for you. In this second part of our three-part series, we discuss the ways that the technology behind NTCePay helps your travel agency.

NTCePay offers travel agents the most innovative technology because it is fast, mobile friendly and easy to use.

Whether you use Quickbooks, Peachtree or any other accounting application, you can enter the invoice number into the ePay application for reconciliation, and you can customize your pricing to any amount you choose. Your agency can create invoice and payment links that can be posted to your website or any social media website for payment.

Things flow better when everything seems to work together, making your day a lot easier? Technology is something that can get your daily workflow to go smoothly, and NTC ePay works for you. If you need a customized solution to go with your workflow, NTC can make most anything a reality for your business workflow.

National Transaction Corporation is one of the few travel payment processing companies that can directly integrate with both TRAMS and SABRE. You can perform your bookings like you always have but have the payment flow the way you need it to. We also integrate with many booking engines and shopping carts allowing you many options that are not available by host agencies.

NTC ePay is simple, secure and sets up in just minutes. It’s a web application, so you can use it on any device you already own: your desktop, laptop, tablet or phone. It lets you add inventory items or use the quick send feature for simplified invoicing.

Our ePay product was designed from the ground up with your security in mind. Even though we encrypt data back and forth to the payment gateway, we also use the gateway to handle the cardholder’s input. NTC’s cutting-edge technology doesn’t store credit card data, nor does it transmit that data. What that means to you is that the liability is 100% on the bank and not your business, as is typically the case. The application is written and hosted on our own servers, so you can set up and be in the e-commerce business within minutes.

By the way, there are also many customizations available to you with NTC ePay which can be set up very easily by your users. Inquire with your specific process and we will meet your specific needs in the travel payment scope.

Now, when you run a social media campaign you can leverage our NTCePay technology to help you increase sales. Use our ePay links to post vacation travel packages or special sales and have customers pay in two clicks.

Next week we will share the third reason in this series why National Transaction Corporation is the preferred choice for travel agents like you.

Remember, when you need a safe and technologically advanced gateway to manage all your travel agency payments, look no further than NTC.

Feel free to call us now at 888-996-2273, if you are ready to start using NTC ePay today.

Posted in Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, nationaltransaction.com, Travel Agency Agents Tagged with: card-not-present, credit card, customers, e-commerce, electronic payment, merchant account, Mobile Payments, payments, Security, transactions, travel