January 6th, 2025 by Admin

Streamline Travel Transactions with Credit Card Processing

Have you ever wondered how seamless payment experiences can elevate your travel agency to new heights? These days, when customers expect instant bookings and secure transactions, credit card processing is more than a convenience…it’s a necessity.

No matter your needs, offering efficient payment options can set your business apart. Credit card processing not only simplifies transactions but also enhances trust and opens doors to a global customer base.

Read on to discover how optimizing your travel payment systems can revolutionize your operations and create lasting impressions in the competitive travel industry.

The Importance of Credit Card Processing in Travel

Credit card processing plays a pivotal role for travel advisors, acting as a cornerstone for seamless financial transactions between customers and travel agencies. Below are some benefits that underscore its importance:

Convenience

Today’s travelers demand fast and hassle-free payment options. Credit card processing eliminates the need for cumbersome cash payments and allows for instant confirmation of bookings, enhancing the overall customer experience. This level of convenience can be a deciding factor for travelers when choosing between competing service providers.

Global Reach

The travel industry is inherently global, catering to customers from diverse regions with varied currencies. A credit card payment gateway enables travel agencies to accept payments in over 100 different currencies, breaking down barriers to international sales.

This capability not only makes transactions smoother for international clients, but also positions your travel agency as a truly global service provider.

Security

In an era where digital transactions dominate, ensuring the security of financial data is paramount. Credit card processing systems employ advanced encryption and fraud detection measures to minimize risks associated with data breaches and unauthorized transactions.

For travel agencies, security features are essential to building and maintaining customer trust. Secure payment systems protect your customers’ sensitive information and your company’s reputation.

Operational Efficiency

Streamlined payment processes save time, reduce manual errors, and enhance overall business efficiency. Integrating credit card processing into your operations will allow you to automate many aspects of transaction management. Doing so minimizes the administrative burden on your staff and allows them to focus on delivering exceptional customer service.

Also, faster and more accurate payment processing helps prevent disputes, which ensures a smoother workflow for your business.

Customer Expectations and Competitive Edge

As consumer expectations evolve, offering credit card payment options is no longer a luxury but a necessity. Travelers expect the ability to use their preferred payment methods, and agencies that fail to meet these expectations risk losing out to competitors.

The Primary Features of Travel Payment Processing

Modern travel payment solutions are designed to meet the unique demands of the travel industry. Here are the must-have features:

- Multi-Currency Support

- Mobile Compatibility

- Real-Time Payment Processing

- Integration with Travel Systems

Overcoming Challenges in Travel Agency Transactions

The travel industry operates in a dynamic, but this comes with unique challenges in payment processing that demand careful management. Here are some of the key challenges faced by travel agencies and strategies to overcome them:

High Fraud Risk

The high value and frequency of travel transaction processing make the industry a prime target for fraudsters. Cybercriminals often exploit vulnerabilities in online payment systems, leading to unauthorized transactions and financial losses. To combat this, travel agencies must invest in advanced fraud prevention tools, such as artificial intelligence-driven fraud detection systems, tokenization, and multi-factor authentication (MFA).

Chargeback Management

Chargebacks-when customers dispute transactions and request refunds from their card issuers-are a significant challenge for travel agencies. Frequent chargebacks can lead to financial losses, strained relationships with payment processors, and reputational damage. To mitigate this issue, travel agencies should adopt chargeback management strategies.

Regulatory Compliance

Adhering to industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS), is essential for maintaining a secure payment environment. Non-compliance can result in hefty fines and loss of customer trust. Ensuring compliance requires regular audits, employee training, and the use of compliant payment processing solutions.

Partnering with a payment provider that prioritizes regulatory compliance and offers built-in security features can simplify the process and reduce the administrative burden.

Global Transactions and Currency Conversion

Travel agencies often deal with international customers, which introduces complexities related to currency conversion and cross-border transactions. Fluctuating exchange rates and hidden fees can create friction for customers and impact their overall experience.

Agencies can overcome this challenge by working with payment processors that support multi-currency transactions and provide transparent exchange rate policies.

Seasonal and Volume-Based Challenges

The travel industry experiences seasonal fluctuations, with peaks during holidays and vacation periods. High transaction volumes during these times can strain payment processing systems, leading to delays and customer dissatisfaction. To address this, agencies should partner with scalable payment processors capable of handling increased transaction loads.

Customer Expectations for Seamless Experiences

Modern travelers expect seamless and convenient payment experiences across multiple channels, including online, mobile, and in-person. Failure to meet these expectations can result in lost business. To overcome this, travel agencies should adopt omnichannel payment solutions that provide consistent experiences.

Why Secure Payment Processing Matters

Secure payment processing is not just a feature but a necessity for travel agencies. It ensures:

- Protection Against Fraud

- Customer Trust

- Compliance

The Advantages of Using a Credit Card Payment Gateway

A credit card payment gateway is the backbone of efficient travel transactions. Here’s why:

Speed: Accelerates transaction processing, reducing wait times for customers.

Reliability: Ensures payments go through seamlessly, even during peak booking seasons.

Flexibility: Supports various payment methods, including credit and debit cards, digital wallets, and more.

Analytics: Provides insights into payment trends, helping agencies optimize their offerings.

Enhancing Customer Experiences with Merchant Services for Travel

Customer satisfaction is paramount in the travel industry. High-quality merchant services for travel enable agencies to:

- Offer Multiple Payment Options

- Provide Transparent Pricing

- Ensure Quick Refunds

Who Does National Transaction Help?

National Transaction provides tailored payment solutions that cater to various segments within the travel industry. Here’s how we serve:

Travel Agencies

Whether you are a host agency or a team of agents, National Transaction can help increase your cash flow and provide the tools your entire organization can use. Our services streamline processes, allowing agencies to focus on delivering unforgettable travel experiences.

Travel Agents

Individual travel agents can leverage our virtual terminal or our exclusive electronic invoicing platform to transform their businesses. These tools simplify payment handling and boost productivity, allowing agents to serve clients more efficiently.

Tour Operators

We understand the unique challenges that tour operators face when creating and delivering the adventures and experiences that travelers desire. Our payment solutions are designed to make tour operator transactions smoother, ensuring reliable cash flow and secure transactions.

Hospitality & Lodging

From car rental agencies to hotels, motels, and bed-and-breakfast establishments, we offer payment processing to enhance the revenue cycle. With National Transaction, you can get paid faster, enabling your travel business to thrive in the competitive hospitality sector.

Tips for Optimizing Travel Payment Processing

To make the most of your credit card processing system, consider these best practices:

Implement Fraud Detection Tools: Use AI-powered solutions to identify and prevent fraudulent transactions.

Regularly Update Security Protocols: Stay ahead of emerging threats by updating encryption and security measures.

Train Staff: Ensure your team understands the nuances of secure payment processing and customer service.

Selecting the Right Partner for Travel Payment Processing

When it comes to managing payments in the travel industry, selecting the right partner can significantly impact your business’s overall customer experience. Here’s why choosing the right partner and working with us can make all the difference:

Industry Expertise

The travel industry has unique challenges, from managing fluctuating exchange rates to accommodating diverse payment preferences from global travelers. With years of experience, National Transaction has developed a profound understanding of these complexities. We provide solutions specifically designed to meet the demands of travel businesses.

Global Capabilities

In a world where international travel is more accessible than ever, your customers expect seamless payment options no matter where they are from. National Transaction enables you to accept payments in over 100 different currencies. This feature enhances the customer experience by allowing travelers to pay in their preferred currency.

Secure and Reliable

Payment security is a top priority for businesses and their customers, especially in the travel industry, where transactions often involve significant sums of money. At National Transaction, we utilize state-of-the-art security measures, including advanced encryption and fraud prevention technologies, to protect your transactions.

Why Choose National Transaction

- Dedicated to the travel industry

- Secure, reliable transactions from any device

- Support for over 100 currencies

- Competitive rates tailored for travel agencies

- Exceptional customer service and support

A Unique Approach to Travel Payment Solutions

National Transaction takes a unique approach to travel payment processing by focusing on the specific requirements of travel agencies. Our solutions are designed to:

- Enhance Competitiveness

- Reduce Costs

- Improve Customer Satisfaction

Partner With National Transaction Corporation

At National Transaction Corporation, we understand that our success depends on your travel agency’s ability to compete effectively in a demanding market. That’s why we offer secure, reliable credit card processing solutions.

Join countless travel agencies that trust National Transaction for their payment processing. To learn more about how we can help your business thrive, call us at 1-888-996-2273, or visit our website.

Posted in Uncategorized Tagged with: travel agencies, Travel Agency Payments, travel industry, Travel Technology

September 20th, 2024 by Elma Jane

Merchant Account Risks for Travel Agencies

The travel industry, with its high-value transactions and international clientele, faces unique challenges when it comes to credit card processing. While accepting plastic is crucial for smooth booking and customer convenience, travel agencies must be aware of the inherent risks and implement strategies to mitigate them. Here’s a breakdown of the key credit card processing risks and how to minimize them:

1. Chargebacks:

- The Problem: Travel plans change, flights get delayed, and unforeseen circumstances arise. This can lead to a higher rate of chargebacks, where customers dispute charges with their credit card company. Chargebacks can be costly, involving fees, lost revenue, and potential damage to your merchant account reputation.

- Mitigation:

- Clear Cancellation Policies: Crystal-clear terms and conditions regarding cancellations, refunds, and travel changes are essential. Ensure these are easily accessible during booking.

- Thorough Documentation: Maintain detailed records of all transactions, customer communications, and travel itineraries. This provides evidence in case of a dispute.

- Proactive Communication: Keep customers informed about any changes to their travel plans and address concerns promptly.

- Secure Payment Processing: Utilize 3D Secure (like Verified by Visa or Mastercard SecureCode) for added authentication and fraud prevention.

2. Fraud:

- The Problem: The travel industry is an attractive target for fraudsters due to high transaction values and the potential for anonymity. Fraudulent activities can include using stolen credit card details, booking fictitious trips, or exploiting vulnerabilities in online booking systems.

- Mitigation:

- Address Verification System (AVS): Verify the billing address provided by the customer against the address on file with the credit card company.

- Card Security Code (CVV): Always require the CVV code for card-not-present transactions.

- Fraud Detection Tools: Implement fraud screening tools that analyze transactions for suspicious patterns and flag potentially fraudulent activity.

- PCI DSS Compliance: Adhere to the Payment Card Industry Data Security Standard (PCI DSS) to ensure secure handling of sensitive cardholder data.

3. Currency Fluctuations:

- The Problem: International travel often involves transactions in multiple currencies. Fluctuating exchange rates can impact your profit margins and create uncertainty in pricing.

- Mitigation:

- Dynamic Currency Conversion: Offer customers the option to pay in their home currency, providing transparency and potentially reducing chargebacks related to exchange rate discrepancies.

- Hedging Strategies: Explore financial instruments to mitigate currency risk, such as forward contracts or currency options.

4. High Processing Fees:

- The Problem: Travel agencies often face higher processing fees due to the perceived risk associated with the industry.

- Mitigation:

- Negotiate with Processors: Shop around and compare rates from different credit card processors. Don’t hesitate to negotiate for better terms, especially if you have a high volume of transactions.

- Consider Interchange-Plus Pricing: Opt for transparent pricing models like interchange-plus, which separates the interchange fee (charged by card networks) from the processor’s markup.

5. Technological Challenges:

- The Problem: Keeping up with evolving payment technologies and security standards can be challenging. Outdated systems can increase your vulnerability to fraud and data breaches.

- Mitigation:

- Invest in Secure Technology: Use a robust and secure online booking system that integrates with reputable payment gateways.

- Regular System Updates: Ensure your software and security protocols are regularly updated to address emerging threats.

- Partner with Reliable Providers: Choose payment processors and technology vendors with a strong track record of security and reliability.

By understanding and proactively addressing these credit card processing risks, travel agencies can protect their business, enhance customer trust, and navigate the exciting world of travel with greater financial security.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card-not-present, cardholder, chargeback, credit card, customer, fraud, high-risk merchants, merchant account, merchants, payment, processors, risk, transaction, travel, travel agencies, travel agency, travel agents

July 11th, 2024 by Elma Jane

Travel agencies are viewed as high-risk merchants. As such, you need a merchant solution that best suits a travel merchant needs.

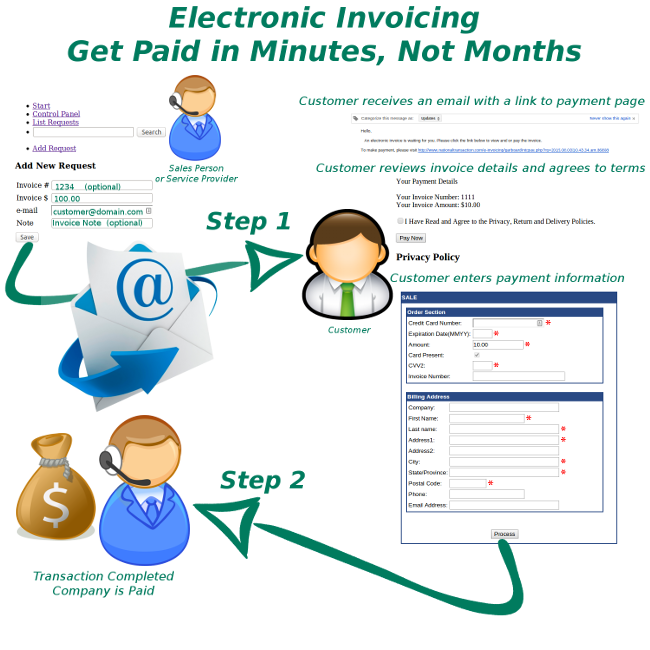

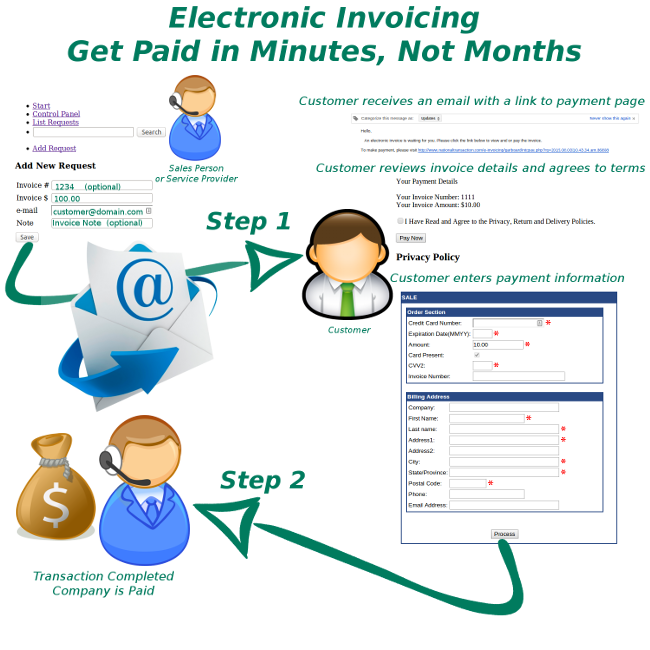

You want an account that eliminates the complexities of a typical shopping cart. Ideally, it allows you to request payment from clients without the need of setting up booking engines and carts.

This post is going to guide you on how to use a payment solution NTCePay and other merchant solutions to ensure a seamless operation of your business.

Leveraging the NTC e-Pay Service

Payment solution e-Pay allows you to eliminate the complexities of integrating payment processing into your point-of-sale or an accounting system.

With this payment method, you only need to send a payment request to your customers via email. You don’t need to send invoices via snail mail or fax any forms to your customers. Plus, NTC ePay doesn’t need you to take orders over the phone.

With this service, you can create a “BUY” button for any transaction amount in seconds. You also don’t need a website to you use this service. NTCePay allows you to generate a digital link that you can email to clients.

The service allows you to customize the process to make everything simple for your customers. After the customer pays the specified amount, a receipt is generated, and the amount is sent to your account.

Tomorrow we are going to discuss on how to understand your Travel Merchant Account….So standby to learn more.

For NTCePay Set Up call Now 888-996-2273

Posted in Best Practices for Merchants Tagged with: customers, merchants, payment, transaction, travel, travel agencies

March 1st, 2017 by Elma Jane

ELECTRONIC PAYMENTS

When it comes to electronic payments, certain types of businesses are considered high risk.

Most merchants do not realize that electronic payment processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank.

Essentially, a merchant account is an unsecured loan.

Different factors used to determine when a business is a high risk are:

- Types of products

- Services they sell how

- How they sell them

Online transactions are considered high risk because there are increased risks of fraud.

A key factor used to determine the risk of a business is chargebacks.

Chargebacks include customer refunds and fraudulent transactions.

Payment providers assess this risk to determine the percentage of chargebacks your business is likely to experience.

Businesses that are considered high risk where they take advanced payments:

- Travel agencies

- Ticketing services

Electronic payments provider is necessary if you want to accept debit and credit card transactions.

For high-risk electronic payments please feel free to call us at 888-996-2273.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, credit card, debit, electronic payments, fraud, loan, merchant accounts, merchants, online, payment processors, transactions, travel agencies

September 23rd, 2016 by Elma Jane

What is ARC, IATA, and CLIA? what’s the difference? What it does and what type of agents would benefit most from it.

CLIA Number – is a way for vendors to identify you as a travel agent. It is issued by the Cruise Lines International Association; without the ARC accreditation, CLIA agencies cannot issue airline tickets since CLIA numbers were designed specifically for cruise-focused travel agencies.

You don’t need to get your own CLIA number if you’re working with a host agency. You can always go under their umbrella organization and use their identification number therefore, it won’t incur the costs associated with obtaining your own CLIA number.

If you are not issuing airline tickets, CLIA is a practical option because it is NOT accepted by the airlines, but nearly accepted everywhere.

CLIA vs. ARC/IATA Number – If you’re ticketing air-only reservation, ARC and IATA are must-haves.

ARC (Airlines Reporting Corporation) – gives out these ARC numbers to accredited agencies, which allows travel agencies to issue airline tickets.

The use of an ARC number extends from either a hotel to a cruise ship booking not only air tickets for travel agencies.

For a home-based travel agent or a storefront agency that only books leisure travel (no air), having your own ARC number seems too much.

IATA – International Air Transport Association Network use extensive data resource to connect the suppliers to the U.S. travel distribution network.

IATA ID card holders get promotional benefits. A concessionary incentives from suppliers (participating members) who identify the agent with an IATA/IATAN number as a valid associate; in addition to approving travel agents for the sale of travel tickets.

IATA certifies either a referral agent or an affiliate travel agent to find clients for the hosting travel agency’s business needs as well.

Give us a call 888-996-2273 and and process your travel agency payments for less!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card holders, payments, travel, travel agencies, travel agent

February 24th, 2016 by Elma Jane

Helping customers protect and safeguard their payment data is one of National Transaction’s top priorities.

Our Payments Expert for travel agencies welcomes your questions, and always glad to give you assistance. We are good at what we do and we value your time.

We offer very valuable services and information to help you with your travel business needs, which saves you time, money & provide insights into your payment logistics.

National Transaction’s Electronic Payments Expert doesn’t sell anything, instead helps you choose wisely and discuss your options.

If you haven’t consulted a Payments Expert for your travel business take the time to seek one out and ask for their professional input.

visit www.nationaltransaction.com today, or call 888-996-2273 Extension 1. The Payments expert for travel agencies!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customers, data, payment, travel, travel agencies, travel business

February 1st, 2016 by Elma Jane

What is Zika Virus?

The Virus has been around for a long time, and for the most part was a benign mosquito-borne disease. Zika is transmitted through infected Aedes mosquitoes and can be passed from a pregnant mother to her baby during pregnancy or around the time of birth. It has spread from equatorial Africa into South and Central America as well as the Caribbean.

Recently in the last month, the virus was linked to microcephaly in infants. From October 2015 to January 2016, there were almost 4,000 cases of babies born with microcephaly in Brazil. Before then, there were just 150 cases per year.

The Centers for Disease Control and Prevention (CDC) has issued a travel alert that recommends pregnant women postpone travel to areas where the virus has been reported.

Affected areas

While Zika typically was found in equatorial Africa, the disease has spread and now threatens the bread and butter of most travel professionals in the United States. The affected areas include most of South America, in particular Brazil who is hosting the 2016 Summer Games, and the Caribbean, including several popular tourist destinations.

Airlines took note of this potential threat

Airlines offered refunds to travelers with concerns of the Zika Virus.

The key for travel agencies right now is to keep abreast of the virus and monitor it’s spread via the Centers for Disease Control and Prevention (CDC).

Contact your preferred suppliers who service destinations that are impacted and become familiar with their cancellation policies.

Be prepared to offer your clients some alternative destinations. One of the best options might be a cruise versus the destination. A cruise might be the answer for your clients as a ship can change itineraries on a moment’s notice.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel, travel agencies

January 21st, 2016 by Elma Jane

Merchant accounts are as varied as the merchants themselves and the goods being sold.

What kind of account would you fall under:

High Risk Merchant Accounts – Finding a processor who is willing to take your account can be more challenging. High risk merchants range from travel agencies to multi-level marketing companies, credit restoration merchants, casinos, online pharmaceutical companies, adult/dating merchants and many other.

Internet based merchant account (Ecommerce/Website order processing) – E-Commerce is a booming market, with so many people buying and selling goods online due to the wide reach and easy access to the internet.

Mobile or Wireless merchant account – This merchant is specifically designed for small businesses, solo professionals, and mobile services (including lawyers, landscapers, contractors, consultants, repair tradesmen, etc), who are constantly on the move and require a payment to processed on the spot.

MOTO (Mail or Telephone order) – This enables phone based or direct mail orders processing for customers who can buy your product or service from the comfort of their home. Since there is no card present there is no need for traditional equipment.

Multiple Merchant Accounts – Some businesses can have merchant accounts of a couple or all different types. Merchants who fall into this category are called multi-channel merchants as they sell their goods through a number of different channels. Most commonly this is related to retail stores who also have an online presence to sell their goods. This is very common in today’s competitive market where constant contact with customers is critical to success.

Traditional Account with Equipment – Most commonly used for retail businesses (grocery, departmental stores etc) where the transactions are processed in a face to face interaction also known as Point of Sale (PoS).

Interested to setup an account give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Travel Agency Agents Tagged with: account, card, card present, credit, customers, e-commerce, high risk merchant, internet, merchant accounts, merchants, mobile, mobile services, moto, multi-channel merchants, payment, point of sale, POS, processor, transactions, travel, travel agencies

October 30th, 2015 by Elma Jane

National Transaction Corporation is the preferred Credit Card Processing Agent for many National Travel Agencies & Associations. We are the preferred merchant account service provider for ASTA, OSSN, ARTA, HBTA,Vacation.com, Travel Leaders, Trams and many more. We are also affiliated with JaxFax, Travel weekly, TRO / Travel Research Online and other travel agency associations in the travel agent industry.

Benefits of our Merchant Account Services for Travel Agencies.

Competitive credit card processing rates & fees for travel agents

Faster deposits (as quick as 24 hrs from transaction)

No holds on funding

Trams Credit Card Merchant Account Integration

Sabre Red Merchant Account Integration

Booking Software Processing Integration

Lower Processing Rates & Fees

Swiped Rates for face to face credit card processing

ecommerce for shopping cart credit card processing

National Transaction Corporation has a proven track record with many of the Largest Travel Agency Associations in the U.S. and Canada. In fact for several of those, we are the preferred credit card processing merchant account services provider for their members. We can take your business to the next level with integration into Trams, Sabre, Sabre Red or off the shelf accounting programs like QuickBooks and Peachtree Accounting.

We are more than happy to provide you with a free merchant account rate review and go over your current credit card processing details and show you how we can save you money and get deposits even faster. We also offer industry leading technical support around the clock, you call, we answer. Simple as that. We can assist errant transactions, chargebacks, terminal messages and much more. Find out why National Transaction Corporation is the preferred merchant account services provider for travel agents & agencies.

Call us now and put us to the test. 888-472-7112

American Society of Travel Agents, Vacation.com, ASTA, Trams, Virtuoso, Travel Leaders, Association of Retail Travel Agents, Specialty Travel Agent Association, Cruise Holidays Credit Card Processing.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: chargebacks, credit card, credit card processing, ecommerce, merchant account, Merchant Account Services, National Travel Agencies, shopping cart, travel agencies, travel agency, travel agent

February 3rd, 2014 by Elma Jane

National Transaction and Virtuoso Agreement Official

National transaction and Virtuoso signed a preferred supplier agreement this 30th of January. NTC’s Electronic Payment System will be offered to its more than 330 agencies with 7,200 elite advisors in 20 countries.

Virtuoso is the travel industry’s leading luxury network. Travelers who use Virtuoso’s Advisors get access to more than 1,300 of the world’s premier travel providers, as well as exclusive, experiences and products. Virtuoso’s history dates to the 1950s, when the tour company Allied Travel formed to help travel agencies with foreign, international and group trips. In 1986, Allied Travel merged with Percival Tours to form (API) Allied Percival International, joining the best travel agents in the country. In 2000, API was rebranded Virtuoso, and has since become the leading travel network in the world.

While National Transaction with over 15 years in the payment service industry, has gained experience to integrate vast range of payment services. Processing digital transactions for more than 3,000 business owners and has been the preferred merchant account provider for many industry associations including ASTA, CLIA, HBTA, ARTA OSSN and now VIRTUOSO.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Travel Agency Agents, Visa MasterCard American Express Tagged with: arta, ASTA, clia, hbta, merchant account provider, National Transaction Corporation, ossn, travel, travel agencies, travel industry's, travel network, travel providers, travelers, Virtuoso