April 17th, 2024 by Elma Jane

Intelligent Use Of Big Data

In understanding Big Data for Merchants, NTC provided a general overview of how online merchants can use Big Data. Think about this application of big data as adopting a more intelligent use of data.

Keeping customers happy is the key to the travel industry, but customer satisfaction can be hard to gauge in a timely manner. Big data analytics gives these businesses the ability to collect customer data, apply analytics and immediately identify potential problems before it’s too late.

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex.

One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as a CRM and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter.

A business could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions.

In a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

A Virtual Terminal can capture email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected.

As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants. Application of big data is a more intelligent use of data.

You know WHO, WHAT, WHEN, AND WHERE a purchase took place.

NationalTransaction.Com 888-996-2273.

Posted in Best Practices for Merchants Tagged with: data, database, merchants, mobile, online, point of sale, virtual merchant, website

October 15th, 2014 by Elma Jane

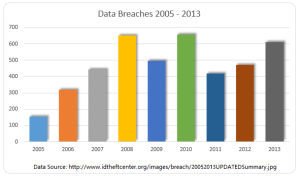

Another day, another corporate data breach. Business owners are now aware that cyber criminals are becoming increasingly smart and sophisticated in their hacking methods, and they can target just about anyone. But smaller companies that think, It can’t happen, or they are too small for hackers to notice, may be setting themselves up for a devastating data breach.

Large corporations typically have a lot more money and resources to invest in IT security, whereas small to medium businesses do not have the IT staffing, resources, money or know-how to put effective security measures into place to combat security vulnerabilities.

If a small business owner is responsible for security practices, it’s going to fall to the lower end of the priority list. The business will have less protections in place and hackers recognize that. Criminals are looking for unlocked doors.

Recent research found that more than half of all small and midsize businesses have been hacked at some point, and nearly three-quarters weren’t able to restore all the lost data. The two most common methods of attack are phishing, gathering sensitive information by masquerading as a trusted website and watering holes. Installing malware on commonly used websites of a target group. These tactics, grant cyber criminals access to the information that leads to identity theft and stolen credit card information.

A credit card breach is fairly easy to recognize once customers of a certain company all begin reporting fraudulent charges. But by that point, a breach has already done a significant amount of damage, not just to the consumers but to the company they trusted to protect their data.

A computer that appears to have been tampered with.If you turned off your computer when you left work and it’s on or has windows and programs running when you return, someone may have been trying to steal important information. This is an especially likely scenario with internal data theft, such as the AT&T breach. Keeping your machines password-protected and encrypting any sensitive data can prevent unauthorized individuals from accessing the information.

Locked-out accounts. If you’ve ever been locked out of your email or social media accounts, you know it’s usually because you typed the wrong login credentials one too many times. If you receive a lock-out message the first time you try to access an account (and you know you’ve typed your password correctly), you might have been hacked. This can mean that someone is attempting to brute force an account, or that an account has already been compromised and the password changed.

Unusually slow Internet or computers. This could be a sign of a compromised machine that is sending out lots of traffic, or that malware or a virus is on the machine. You should also look for pop-up ads (especially if you have an activated blocker) or websites that don’t load properly.

In all of these instances, minor inconveniences that most people might ignore if the problem seems to resolve itself could be signs of a much more serious problem. Both experts advised keeping your antivirus software, firewalls and device operating systems up-to-date, and always remaining alert for any suspicious activity.

Posted in Best Practices for Merchants Tagged with: consumers, credit card breach, credit card information, customers, data, data breach, device, Security, website

October 8th, 2014 by Elma Jane

When the PCI Security Standards Council (PCI SSC) launched PCI DSS v3.0 in January 2014, businesses were given one year to implement the updated global standard. Now that the deadline is fast approaching, interest is picking up in what v3.0 entails. On Jan. 1, 2015, version 3.0 of the Payment Card Industry (PCI) Data Security Standard (DSS) will reach year one of its three-year lifecycle.

Trustwave, a global data security firm, is on the frontlines of helping secure the networks of merchants and other businesses on the electronic payments value chain against data breaches. As an approved scanning vendor, Trustwave is used by businesses to achieve and validate PCI DSS compliance.

PCI DSS v3.0 is business as usual for the most part, except for a few changes from v2.0 that considers impactful for large swaths of merchants. The top three changes involve e-commerce businesses that redirect consumers to third-party payment providers. The expansion of penetration testing requirements and the data security responsibilities of third-party service providers.

Penetration testing

Penetration testing is the way in which merchants can assess the security of their networks by pretending to be hackers and probing networks for weaknesses. V3.0 of the PCI DSS mandates that merchants follow a formal methodology in conducting penetration tests, and that the methodology goes well beyond what merchants can accomplish using off-the-shelf penetration testing software solutions.

Merchants that are self assessing and using such software are going to be surprised by the rigorous new methodology they are now expected to follow.

Additionally, penetration testing requirements in v3.0 raises the compliance bar for small merchants who self assess. Those merchants could lower the scope of their compliance responsibilities by segmenting their networks, which essentially walls off data-sensitive areas of networks from the larger network. In this way merchants could reduce their compliance burdens and not have to undergo penetration testing.

Not so in v3.0. If you do something to try to reduce the scope of the PCI DSS to your systems, you now need to perform a penetration test to prove that those boundaries are in fact rigid.

Redirecting merchants

The new redirect mandate as affecting some, but not all, e-commerce merchants that redirect customers, typically when they are ready to pay for online purchases to a third party to collect payment details. If you are a customer and you are going to a website and you add something to your shopping cart, when it comes time to enter in your credit card, this redirect says I’m going to send you off to this third party.

The redirect can come in several forms. It can be a direct link from the e-commerce merchant’s website to another website, such as in a PayPal Inc. scenario, or it can be done more silently.

An example of the silent method is the use of an iframe, HTML code used to display one website within another website. Real Estate on the merchant’s website is used by the third-party in such a way that consumers don’t even know that the payment details they input are being collected and processed, not by the e-commerce site, but by the third party.

Another redirect strategy is accomplished via pop-up windows for the collection of payments in such environments as online or mobile games. In-game pop-up windows are typically used to get gamers to pay a little money to purchase an enhancement to their gaming avatars or advance to the next level of game activity.

For merchants that employ these types of redirect strategies, PCI DSS v3.0 makes compliance much more complicated. In v2.0, such merchants that opted to take Self Assessment Questionnaires (SAQs), in lieu of undergoing on-site data security assessments, had to fill out the shortest of the eight SAQs. But in v3.0, such redirect merchants have to take the second longest SAQ, which entails over 100 security controls.

The PCI SSC made this change because of the steady uptick in the number and severity of e-commerce breaches, with hackers zeroing in on exploiting weaknesses in redirect strategies to steal cardholder data. Also, redirecting merchants may be putting themselves into greater data breach jeopardy when they believe that third-party payment providers on the receiving end of redirects are reducing merchants’ compliance responsibilities, when that may not, in fact, be the case.

Service providers

Service provider is any entity that stores, processes or transmits payment card data. Examples include gateways, web hosting companies, back-up facilities and call centers. The update to the standard directs service providers to clearly articulate in writing which PCI requirements they are addressing and what areas of the PCI DSS is the responsibility of merchants.

A web hosting company may tell a merchant that the hosting company is PCI compliant. The merchant thought, they have nothing left to do. The reality is there is still always something a merchant needs to do, they just didn’t always recognize what that was.

In v3.0, service providers, specifically value-added resellers (VARs), also need to assign unique passwords, as well as employ two-factor authentication, to each of their merchants in order to remotely access the networks of those merchants. VARs often employ weak passwords or use one password to access multiple networks, which makes it easier for fraudsters to breach multiple systems.

The PCI SSC is trying to at least make it more difficult for the bad guys to break into one site and then move to the hub, so to speak, and then go to all the other different spokes with the same attack.

Overall, v3.0 is more granular by more accurately matching appropriate security controls to specific types of merchants, even though the approach may add complexity to merchants’ compliance obligations. On the whole a lot of these changes are very positive.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (PCI SSC), call centers, cardholder data, consumers, credit-card, customers, data breaches, data security assessments, Data Security Standard, e-commerce breaches, e-commerce businesses, e-commerce merchant's website, electronic payments, global data security, global standard, Merchant's, merchant’s website, mobile, networks, payment, payment card data, Payment Card Industry, payment providers, PCI Security Standards Council, PCI-DSS, Penetration testing, Service providers, shopping cart, software solutions, web hosting, website

September 11th, 2014 by Elma Jane

Online retailers are finding the bricks-and-clicks strategy to be an effective way to serve and engage shoppers. Perhaps that is why an increasing number of ecommerce merchants are setting up shop offline. It’s important to note, however, that a bricks-and-clicks business isn’t just about having a physical store and an ecommerce site. For this model to be effective, each channel must complement and add value to the other.

Guidelines to execute a bricks-and-clicks strategy:

Allow Access to Online Account Information in Physical Store

Bridge the gap between bricks and clicks by giving your customers and physical-store staff access to online account information. Doing so can enhance shopping experiences and drive sales.

Integrate Online and Offline Inventory, Fulfillment

Offer click-and-collect services that allow shoppers to buy merchandise online and pick it up at a local retail branch or service station. Many consumers would rather forgo the shipping costs and wait time and instead pick up their items at a time and place that’s convenient for them. Also, use your brick-and-mortar inventory when an item is out of stock online.

Use Online Data for Offline Selling, and Vice Versa

Data pertaining to online sales and traffic won’t just help you optimize your ecommerce site. It can also apply to offline decisions. For instance, if you see an increase in sales for a particular product on your website, you should consider promoting it offline, as well, to your brick-and-mortar shoppers.

Also pay attention to social media data such as Facebook likes and Pinterest pins. What’s trending on social sites can help with merchandising and marketing. Consider something similar in your brick-and-mortar business. Take note of the most liked, viewed, and pinned items online and then leverage that information when making decisions regarding product displays, inventory and more.

You can also use offline information to enhance your ecommerce site. Utilize in-store analytics tools, such as people counters and sensors, to better understand how your offline customers behave and then compare that with online behavioral data to spot patterns and opportunities.

Qualitative information, such as shoppers’ common questions and concerns, can also be used to improve your online shop. For instance, if your physical store associates keep getting the same questions about a particular product, there’s a good chance that online shoppers have similar queries. So you may want to include the answer in that item’s product description page.

Use Smartphone Beacons in Physical Stores

Beacons are Bluetooth-enabled devices that let brick-and-mortar merchants send customized offers and recommendations to their shoppers via their smartphones based on where the shoppers are in the store. For example, if a shopper is in the footwear department, the retailer can use its store beacons to send the shopper a coupon for shoes. Bricks-and-clicks businesses can also use the technology to send tailored offers to shoppers based on their online behavior.

Posted in Best Practices for Merchants Tagged with: account, Beacons, bluetooth, brick and mortar, business, consumers, coupon, customers, data, devices, ecommerce, Facebook, inventory, marketing, merchandising, Merchant's, Online Account Information, Online Data, pinterest, product, sales, shoppers, site, smartphone, social sites, store, website

September 10th, 2014 by Elma Jane

Merchant go into business to make a sale. They go to great length to advertise their business and then they make a sale and don’t track it… They don’t track the very customer they went into business to attract…That seems crazy…But now more companies are embracing the practice of collecting email addresses at the point of sale (POS) and they’re doing so with increasing regularity. An example, when customers are at the cash register, many brick-and-mortar stores now offer to email them receipts

Confidently collect email addresses at POS:

Your email service provider should be able to implement a text-to-join acquisition program for you that executes quickly and can be built specifically to mitigate the risks around POS data collection.

Instead of relying on sales associates to accurately input email addresses, your customers can use SMS to text their email addresses to your short code.

Customers receive an immediate SMS reply message letting them know to check their email for their receipt.

A mobile-optimized receipt is immediately emailed to the address.

This can be followed by an email inviting customers to join your company’s email program. Offering a purchase discount can increase opt-ins. New joiners can be sent an age verification email, if relevant.

Your welcome email, including discount coupon, is sent and the relationship starts off on the right foot.

Increasing your confidence about POS email address collection, a text-to-join program can increase your acquisition rates. It can engage those customers who prefer to provide their information privately via their mobile devices. It can help protect companies against potential blacklisting because of typos and confirmed opt-ins. It can even reduce overhead costs by saving sales associates valuable time. Understanding these important email address collection issues and adopting the prescribed best practices are critical to ensuring customers have a safe, positive and valuable experience with your company at the point of sale and beyond.

Virtual Merchant can collect data too, and as a provider we can help merchant use that data. We are committed to providing appropriate protection for the information that is collected from customers who visit the website and use the Virtual Merchant payment system. Policy Privacy is updated from time to time.The website is provided to our customers as a business service and use of the site is limited to customers only.

If the merchant never makes a sale before 10 why do they open at 9 ?? This is only one small example on how collecting data first and then analyzing that data can shape businesses and find money you may be throwing away ….

Posted in Best Practices for Merchants, Mobile Point of Sale, Point of Sale Tagged with: brick and mortar, business, cash, cash register, customers, data, discount, discount coupon, email, merchant, mobile, Mobile Devices, payment, payment system, point of sale, policy, POS, provider, purchase, Rates, receipts, sale, service, sms, store's, virtual merchant, website

August 21st, 2014 by Elma Jane

Accept Electronic Payments in Their Currency, Convert it to Yours. National Transaction helps you and your customers transact with confidence.

DCC provides convenient currency conversion service at the time of purchase benefiting both the credit card holder and merchants. Our solution provides a system where the Visa or MasterCard holder in a foreign country can shop on an American based website that displays prices in their own local currency. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied.Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line and making international transaction with confidence. We have diverse set of applications to enable various kinds of business models and financial frameworks.

Posted in Best Practices for Merchants Tagged with: Bank Reference, Card Recognition, conversion rate, credit-card, currency, Currency Conversion, customers, DCC, Dynamic Currency, electronic payments, exchange rate, financial, invoice, MasterCard, Merchant's, pricing, rate, receipt, transactions, visa, website

August 18th, 2014 by Elma Jane

As a small business, you may have ignored Facebook, but it turns out that by not having a presence on Facebook, you could be missing out on a huge business opportunity. The social networking site has a huge influence on what products and services people buy. More specifically, Facebook significantly influences millennial shoppers’ opinions of small businesses, including their decisions to purchase items not just online, but in-store as well. Nearly 60 percent of consumers ages 18 to 29 engage with Facebook ads at least once per week before buying an item in-store from a small business. Additionally, 62 percent believe Facebook is the most useful social media outlet for researching small businesses before visiting a store in person. That’s considerably higher than the 11 percent who feel the same about Twitter and the 12 percent who believe Pinterest is the best site for researching small businesses. Overall, 59 percent of millennial consumers visit the Facebook pages of small businesses at least once a week. To succeed both online and offline small businesses must first understand consumers’ online-to-offline shopping behaviors and invest at least a portion of their digital marketing dollars into the right technology and tools to create precisely targeted, relevant and personalized experiences.

The true value of Facebook, doesn’t lie in simply driving likes and adding new fans. It lies in using personalized content to convert digital hunters into loyal, repeat in-store buyers. The study discovered that by increasing the deals they offer on Facebook, businesses have the potential to make an immediate impact on their bottom line. Nearly 85 percent of the shoppers surveyed said local deals and offers on Facebook are important in their decision to purchase an item in-store. Forty percent of those surveyed said they think Facebook offers that can be redeemed in local stores are most likely to influence their decision to visit the website of a small business. With so many consumers constantly turning to Facebook when making purchasing decisions, business owners especially those in the restaurant, spa/beauty and education industries need to come to terms with the fact that Facebook is a highly important marketing tool that needs to be actively attended to and not just something they check in on every now and then.

Posted in Best Practices for Merchants, Small Business Improvement Tagged with: consumers, digital marketing, Facebook, marketing, marketing tool, millennial consumers, networking, pinterest, products, purchasing, services, shoppers, social media, social networking, twitter, website

June 30th, 2014 by Elma Jane

The best way to grow your business is to grow your customer base, but finding the time to round up new customers can be a challenge. What time-strapped business owners need is a strategy that lets them attract more customers without logging in more hours at work.

Here are steps that will allow any small business to set up a marketing system in a hurry.

Address specific concerns – Businesses also have to have a component in place that tracks customers who don’t opt in for a free consultation or other service right away. If someone does not sign up to discuss your services, then you need to prepare a series of messages that addresses their specific concerns, along with the call to action that repeats the offer of the free consultation. If repeated messages don’t inspire a customer to buy what you’re selling, you still get to add another name to your weekly newsletter or list of potential leads, which you can come back to later. To make follow-up messages and further communications most effective, using a tone that is a mix of personal and professional. In other words, don’t be too formal, but do make sure you explain why your business is worth patronizing.

Get to know your customers – Most of us who have been in our respective businesses for any length of time know the fears, hopes, dreams and aspirations of our clients. If you don’t do a great job of communicating benefits to prospective clients based on what you know they want, then your prospects won’t be willing to spend even a dollar. Knowing what concerns and challenges your prospects face should be at the heart of your business marketing strategy. Once you have this information, you can use technology, sales and marketing software for small business to create a powerful and intelligent marketing funnel system.

Prepare effective content – Once your prospective customers have completed your short survey, they’ll be entitled to the information they came to your site to receive. To effectively engage these customers, preparing a video based on each of the answers customers might have chosen during the survey. What kind of video you produce is up to you, but there are two main types: “The talking head and the narrated PowerPoint”. As you might guess, the talking head video is preferable, since it enables prospects to get a sense for who you are as a person. Next to seeing you live, it’s the next best thing. When it’s done right, it’s very effective. If you’re uncomfortable in front of the camera, you might want to opt for a narrated PowerPoint or Keynote for Mac users presentation. It’s not quite as effective in building rapport as the talking head video, but prospects will pick up a lot of your personality simply by hearing your voice. Regardless of which format you use. Keeping each video under 10 minutes and using the opportunity to really provide prospects with valuable information like a useful tip, perspective or idea. At the end of the video should be a call to action to go to a specific page on your website that offers a free consultation.

Start with a survey – Any marketing funnel begins with the challenge of how you get people to enter it, adding that small business owners can attract prospective clients by offering worthwhile information that their customers want access to, preferably in the form of videos, articles or other easily digested media. Once a prospect opts into receiving free content, it’s the businesses turn to find out more about who that customer is and what they need. One way to do this is to ask visitors to your website to complete a simple one-question survey. The survey you build should be based on the three to four biggest challenges you know your customers face, which is why step one “getting to know your customers” is so important. To create a survey that will point prospective customers in the right direction, you have to ask the right questions.

Posted in Uncategorized Tagged with: customer, customer base, free consultation, Keynote, leads, marketing software, marketing system, newsletter, PowerPoint, prospects, software, survey, technology, website

June 24th, 2014 by Elma Jane

Compliance with a single set of regulations is often taxing enough, without other regulations causing a conflict, but this is exactly the situation that the insurance industry finds itself in with its contact centres.

PCI-DSS compliance insists that sensitive information in particular credit card numbers, must be protected and cannot be stored. However, the Financial Conduct Authority (FCA), the UK regulator for the financial services industry, demands that insurers keep sufficient detail of their transactions.

In insurance contact centres, FCA recommendations are met by recording calls. So in order to comply with PCI-DSS regulations, some contact centres simply pause recordings while the card information is read out, and resume recording once the payment process is complete. There’s a very big problem with this method, it undermines the very reason calls are recorded. The call recording is there to provide an unequivocal record of the circumstances under which the policy is granted. A gap in this record creates doubt. What was said during this time? If a customer is claiming a policy is mis-sold or they were misinformed in some way, a complete record to refute this claim no longer exists. Because of situations such as this, the insurance industry has an inherent dependence on contact centres and person-to-person interaction when selling policies, though in the process has to somehow comply with both regulations. But how? One way is to get the sensitive card information directly and securely to the bank’s payment gateway without storing it. Online, this is done quite easily, insurers can embed a secure payment page into a website and the customer can enter information securely that way. By phone a similar method can be used. A caller can input information directly on their telephone keypad and the tones are only transmitted to the credit card payment gateway not the contact centre. This solves the paradox of the conflicting regulations.

Insurance contact centres need to walk a very fine line, ensuring that they comply with all of the relevant regulations from multiple regulators – even those that, at first glance, contradict each other.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (FCA), card information, compliance, contact centres, credit card payment, credit-card, customer, Financial Conduct Authority, financial services industry, insurance industry, payment gateway, payment process, PCI-DSS, phone, regulations, secure payment, taxing, telephone keypad, transactions, website

June 12th, 2014 by Elma Jane

QR: The Bridge to the Modern World

Involvement devices have come a long way from the time of Clearinghouse mailings, where you would peel off a label and stick it onto another page before dropping it back in the mail.

Today, print’s best involvement device is the QR code. It works as a portal or bridge into the mobile online world where the cataloger’s brand lives and breathes in real time. Even better, it can lead the customer from the catalog page to the checkout button on their smartphone within minutes.

The printed catalog delivers rich colors and a personal, tactile experience still not attainable through any mobile device. In many ways, though, it is a vestige of a bygone era, and an expensive one at that. Catalogers know this. Even the U.S. Postal Service also knows this. That’s why the USPS is running a postage discount promotion for the second year in a row this summer to encourage the use of QR codes by direct mailers.

Let’s take a quick look at the way a few catalogers are using QR codes.

Anthropologie

Anthropologie’s marketing strategy is more about selling a lifestyle than selling products. That explains why making it easy for customers to move toward actually buying something doesn’t seem like such a big priority in their catalog. They did not include a QR code anywhere. The closest they came was one line next to the address: For store information, go to www.anthropologie.com. Their 800 number, they do take phone orders is printed only once in tiny type, so having no QR code seems to fit in with their attempts to play hard to get. Marketing critique aside, by not using a QR code on their catalog, they are missing the opportunity to draw customers into closer involvement with their brand, whether or not they intend to make an immediate sale.

Best Practices

With these few examples in mind, it’s time to look at best practices for using QR codes in catalogs, which can be a two-sided equation. There is the technical aspect and the branding/selling aspect. As far as the technical side goes, customers need to use their smartphone to scan the code successfully, and the destination on the other end must be optimized for mobile access. Sometimes the hardest part is organizing the resources required to execute the backend side of things, especially if the goal is to make an immediate sale.

The main thing to consider is that QR codes work as a bridge and that bridge is a smartphone, iPad, or some other tablet with all their usual constraints (screen size, internet connection, quality of camera, QR reader app, user proficiency, etc.). Also, don’t assume that everyone has a QR reader or even knows what a QR code is. Especially in catalogs, where customers have been seeing postal service barcodes for years, people may assume that the pixelated square thing is just something else for the USPS to lose money on. Instead, including a brief call to action to scan the QR code should do the trick.

Crossing the Bridge

Getting customers to scan the QR code is only half the battle. Now you need to make sure they feel it was worth their while to scan. It’s all about the next steps in your customer relationship. If you have an Apple or Android app, then that’s where to send people if you know that you can convert sales successfully on mobile devices. Sending them to your Facebook fan page is an option too, but not a big win if a majority of your customers are already fans.

Special promotions, optimized for mobile access, will certainly earn your QR its keep. If your goal is to inspire a trip to one of your stores, then do what Brookstone does and send customers to a Google map with all store locations within a hundred miles. It’s also possible to send scanners to a dedicated page, again, optimized for mobile where you give them a number of options: Facebook, shop, app, etc.

Delia’s

By appealing to fashion-hungry American teens via retail stores, web, and catalog, Delia’s sold over $220 million in 2011. In the single catalog we looked at, Delia’s had a QR code on its back cover. When scanned, the code points to Delia’s Facebook page. That’s certainly one way to build involvement with the Delia’s brand, but it may not be the best. Delia’s has an Apple app with full e-commerce capabilities, so Delia’s could be missing out on the opportunity to help the customer cut to the chase and get straight to their virtual shopping bag. Still, at least they’re using the code.

King Schools

Unless you’re a pilot in training or know one fairly well, you have probably never heard of King Schools. They offer more than 90 flight training courses, plus all sorts of accessories for pilots-in-training. They have no retail stores, but that’s all the more reason to mention them here, retailers can learn a lot from King Schools about how to use QR codes in their catalogs.

In the one catalog, King used a QR code on the front cover and the back cover. Now, the iPad shows enormous potential for use in general and commercial aviation, so King is smart to use their QR codes to point customers directly toward their mobile apps and offerings. In fact, King Schools uses QR codes on the Take Courses on Your iPad landing page itself.

In most cases it seems counterintuitive to display a QR code on a website for people to scan. After all, they’re already there. It’s a smart use of codes in this case, for two reasons. First, the codes lead the customer directly to the Apple app store, so it actually makes sense to scan the codes even though the customer is already on their website. The customer is now just a few clicks away from buying and installing the app. Second, there is one QR code for their app store in general, and then there are unique codes for individual apps.

Technicalities

The content in a QR code tops out at 4,296 alphanumeric characters, but catalogers only need a fraction of that to get the customer to where they want them. However, even when the character count is down to a few dozen, size does matter, because QR codes with more data embedded in them are more complex visually. This means that even smartphones with the latest and greatest optics will have trouble reading densely populated codes. Make sure the QR code is big enough. Even the simplest codes will frustrate the scanning process if they are too small or if there isn’t enough white space around them. Maybe a QR code isn’t the most photogenic thing in the world, so it’s a good challenge for catalog art directors to incorporate it into the design without shrinking it into oblivion.

More sophisticated catalogers will want to use personalized QR codes. Today, even local printers are likely to have the means to print unique QR codes for each recipient in a mailing. This creates the ability to track scans back to the individual, a marketer’s dream when it comes to one-to-one marketing relationships.

Innovation can get you traction within the social media realm and that’s money in the bank. Whether you’re a major catalog player or using QR for something completely different, always consider getting the marketing and PR people involved to leverage any novelty aspects of the application.

The benefits pile up quickly to those catalogers who take the time to get smart about QR codes. Thick catalog books can be thinned down a bit if QR codes succeed in pulling customers from the page and onto their site or apps, cutting postal costs for the millions of mailings every year. And, even if the cataloger doesn’t go to the extreme of printing unique QR codes, the branding value of offering that connection from the old-style printed piece to the dynamic world of interactive mobile technology makes it well worth the effort.

The ink needed to print a QR code on a major retailer’s catalog might weigh only a fraction of an ounce, but when used right, it’s worth its weight in gold. Too bad the majority of catalogs seem to be squandering the opportunity by underutilizing the code or worse, not including any at all. In a world where an integrated multi-channel approach is a must-have for any retailer to survive, the stakes of leveraging every opportunity for interaction are higher than ever.

Posted in Best Practices for Merchants, Smartphone Tagged with: Android app, Anthropologie, app, Apple, bank, barcodes, Best Practices, Brookstone, clearinghouse, code, commercial aviation, Crossing the Bridge, customer relationship, data, data embedded, Delia’s, e-commerce, Facebook, google, Google map, interactive mobile technology, ipad, King Schools, marketing, mobile, mobile access, mobile device, mobile online, mobile technology, multi-channel, phone, portal, Postal Service, QR code, QR reader, retail stores, scan, scanners, smartphone, social media, tablet, USPS, virtual shopping, web, website