Category: Best Practices for Merchants

July 11th, 2017 by Elma Jane

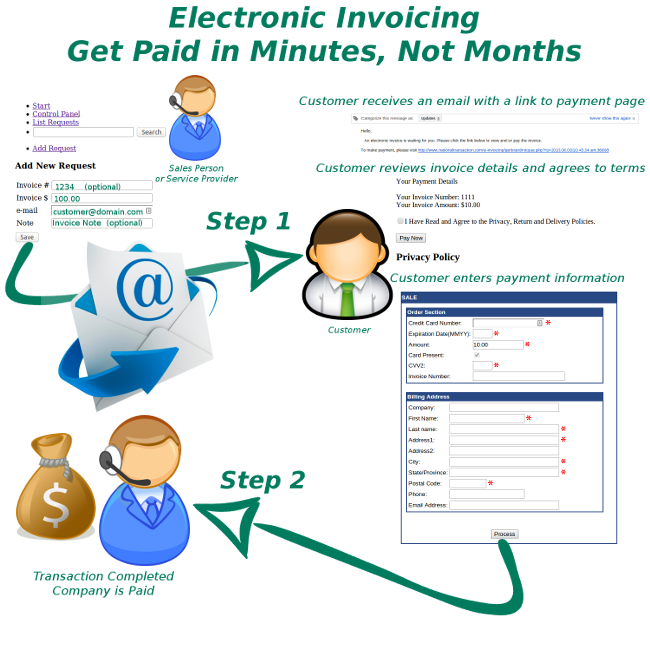

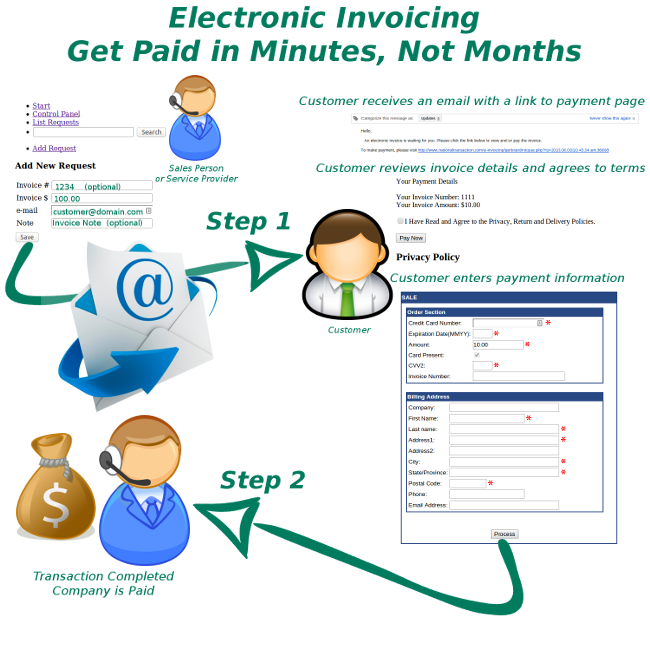

NTC ePay is for any merchant who wants to avoid the complexities of a shopping cart or integration into an accounting system or point-of-sale. When custom pricing becomes an issue, shopping carts, POS systems, and booking engines tend to get immensely complicated.

NTC ePay does away with those complications by allowing merchants to simply email a payment request that can be paid in 2 simple steps.

When you call National Transaction, we pick up the phone ready to assist your business. Our dedication to supporting our merchants is unparalleled, from the point of sale and beyond.

Our commitment to our merchants extends to their interests with NTC Gives.Com, a program designed to give back to a charity of their choice. Call today and let National Transaction Corporation earn your business.

Contact National Transaction Corporation today at 888-996-2273, or visit us online

at www.nationaltransaction.com for more information.

Posted in Best Practices for Merchants Tagged with: merchant, payment, point of sale

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Lodging industry customers that will benefit from this smart terminals:

- Smaller, independent hotels

- Hotels without property management systems

- Existing lodging customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

June 27th, 2017 by Elma Jane

E-commerce has been growing, and now the overall market is starting to take notice; thanks to advances in online payment processing and electronic payment technology, as well as the willingness of almost all merchants to accept credit cards online.

E-commerce ecosystem are set to double and will account for a rising share of overall card payments. In addition to increased internet and smartphone penetration; more e-commerce merchants and an increase in the use of digital wallets.

Cardholders globally are becoming more confident in the security of the e-commerce channel, with the expected implementation of 3D-Secure 2.0 and increased use of sophisticated anti-fraud systems in many markets it gives consumer assurance that payment cards are safe to use for e-commerce purchases.

Trends indicate that e-commerce is the wave of the future for shoppers. But digital shopping is just one piece of the broader payments ecosystem.

For Electronic Payment Set Up Call Now! 888-996-2273

Let’s Get Started National Transaction.Com

Posted in Best Practices for Merchants Tagged with: card payments, credit cards, Digital wallets, e-commerce, electronic payment, merchants, online, payment, Security, smartphone

June 22nd, 2017 by Elma Jane

Join National Transaction on September 13th with LES BROWN

Roz & Cal Kovens Center, FIU Biscayne Bay North Campus

SOUTH FLORIDA’S TOP DECISION MAKERS WILL BE HERE…. WHERE WILL YOU BE?

Read More

Read More

Posted in Best Practices for Merchants

June 21st, 2017 by Elma Jane

How and when you get paid for your products and services is one of the most important thing to consider as a business owner. Therefore, understanding the difference between getting your payments processed over the internet vs. a brick and mortar store is important.

You can choose to have an in-store terminal or POS system where you can do card present transaction, or you could have an online payments account to accept card-not-present transaction from your website, via emailed invoices, over the phone or by mail.

Nowadays, many businesses choose to have both card present and card-not-present payment acceptance, so they don’t miss out any potential business. Having both is an effective way to ensure costumers can pay however they want.

Card present or in-store payments will have lower processing fees than those payments accepted online or over the phone (card-not-present). The reason for this is that the risk for fraud increases in online and other card not present transactions.

There is less risk associated with a business swiping a credit card than keying it in. Why? When a card is swiped, a person is present; where the merchant can check ID and signature. When a person is not present, it’s open for consumer fraud.

Choose your Payment Service Provider carefully. There are payment providers that are experts in each type of industry as well as providers that can process payments in all of them.

It is important to take fees into consideration, but don’t let the benefits outweigh the risks. Choose a provider that offers free reporting tool and delivers outstanding service where you can speak to someone when you call.

For Electronic Payment Set Up Call Now 888-996-2273

or go to NationalTransaction.Com

Posted in Best Practices for Merchants

June 6th, 2017 by Elma Jane

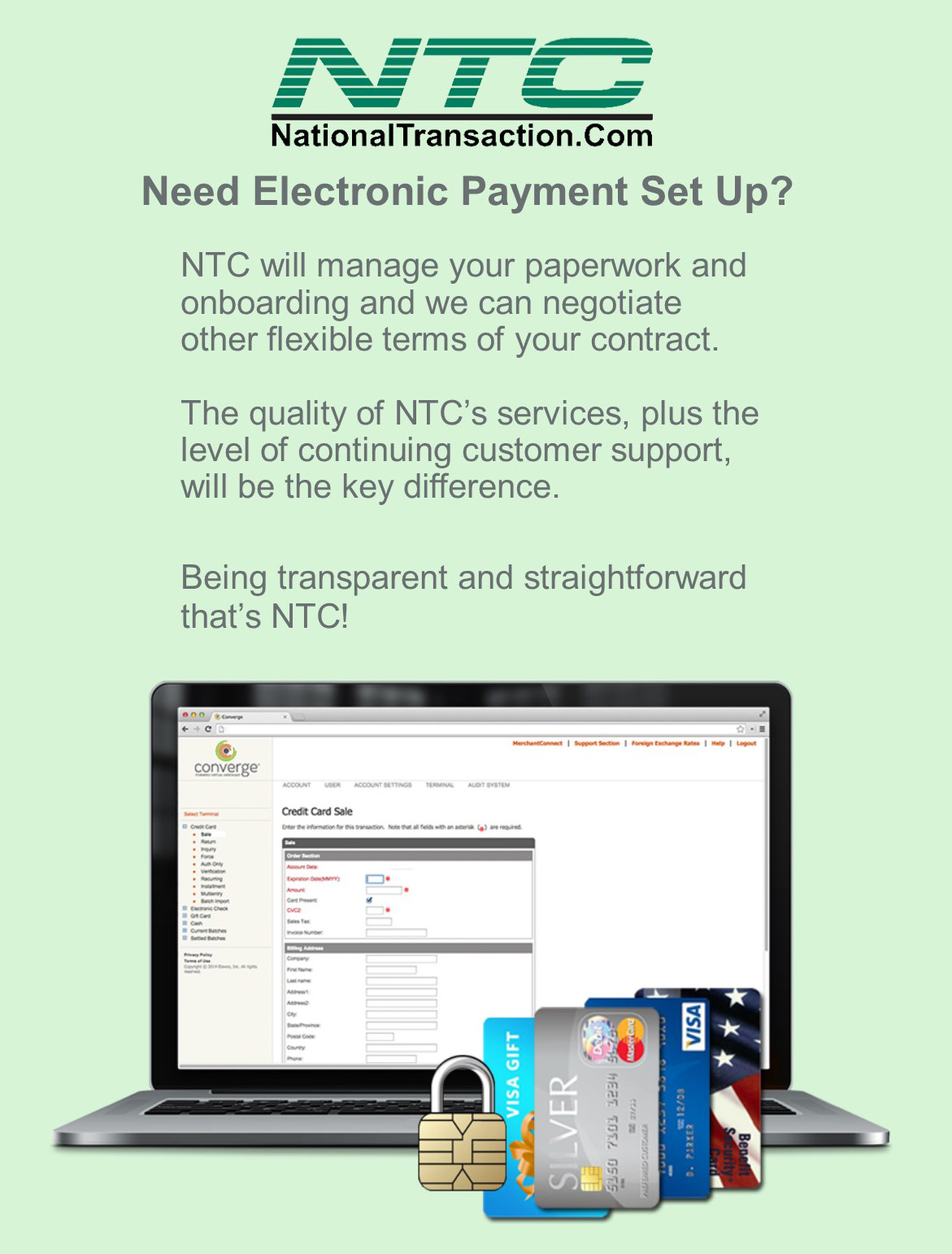

Need Electronic Payment Set Up?

NTC will manage your paperwork and onboarding and we can negotiate other flexible terms of your contract.

The quality of NTC’s services, plus the level of continuing customer support, will be the key difference.

Being transparent and straightforward that’s NTC!

Call NTC now 888-966-2273! or click here NationalTransaction.Com to get started!

Posted in Best Practices for Merchants Tagged with: electronic payment

May 31st, 2017 by Elma Jane

If you’re a retail business you’re going to need a credit card terminal to accept credit cards, and if you have multiple locations; you might need more than one terminal.

Obtaining terminals for your business with multiple locations can be expensive. Because of this, some merchants used leasing arrangements which they think that monthly leasing fee might seem like a bargain compared to the cost of buying a terminal.

One provision of the lease is: Non-Cancelable Lease

Leases commonly have a 48-month (four-year) term, and a clause that makes the lease completely non-cancelable.

They also have a purchase option at the end of the lease. You must exercise your option to end the lease.

In a non-cancelable provision, they’ll keep deducting monthly leasing fees from your account regardless of anything, or an immediate payment of all remaining months of your contract if you break your lease.

In addition to monthly leasing fee, you’ll also pay sales tax and a monthly equipment insurance fee; while you can purchase it for as low as $150-$200.

Beware of free terminal offers, other providers will offer a free terminal, but they also charge higher monthly fees if you elect the free terminal. So the terminal isn’t really FREE.

For Electronic Payment Set Up Call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants, Electronic Payments Tagged with: credit card, electronic payment, merchants, payment, terminal

May 23rd, 2017 by Elma Jane

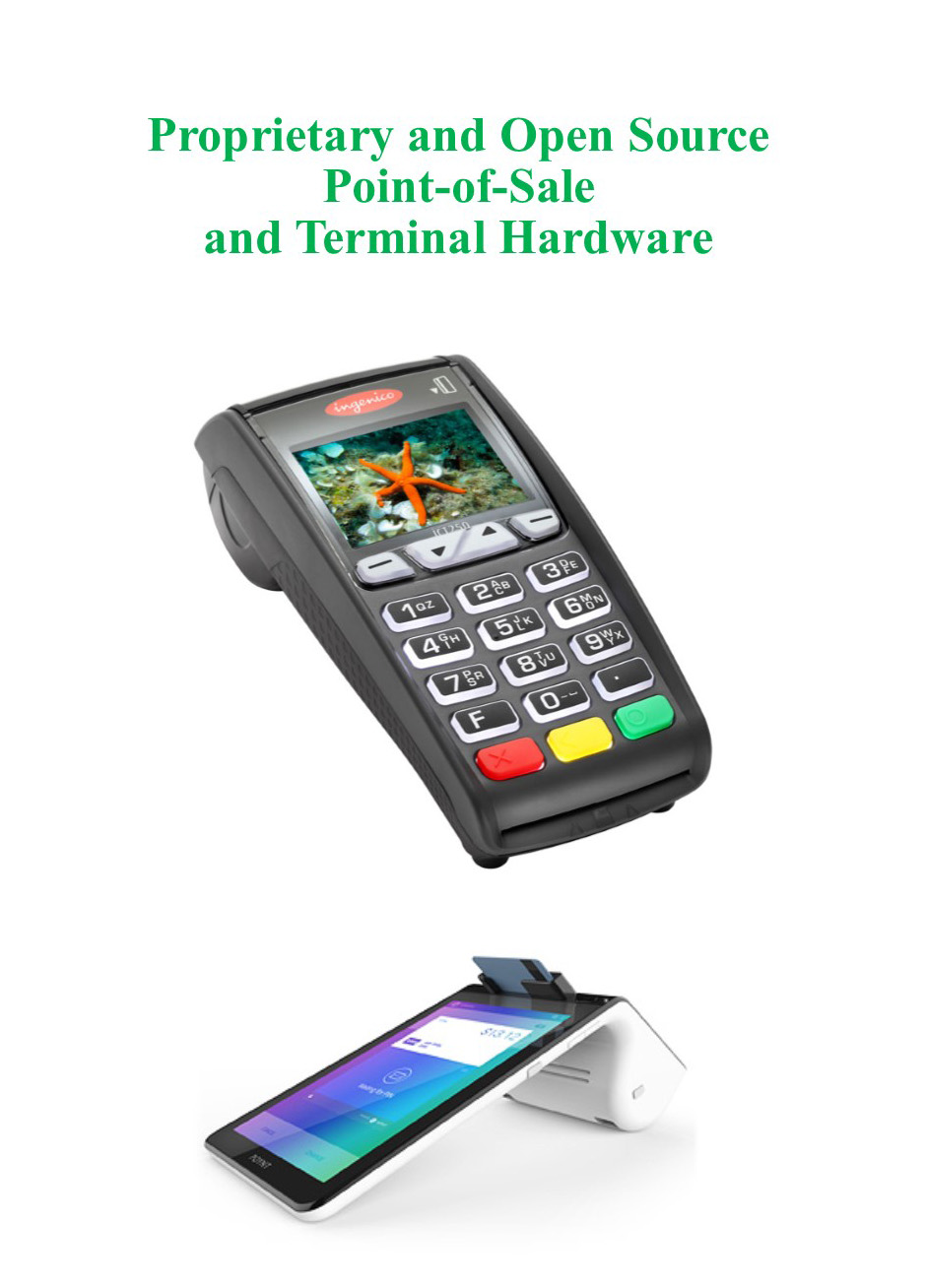

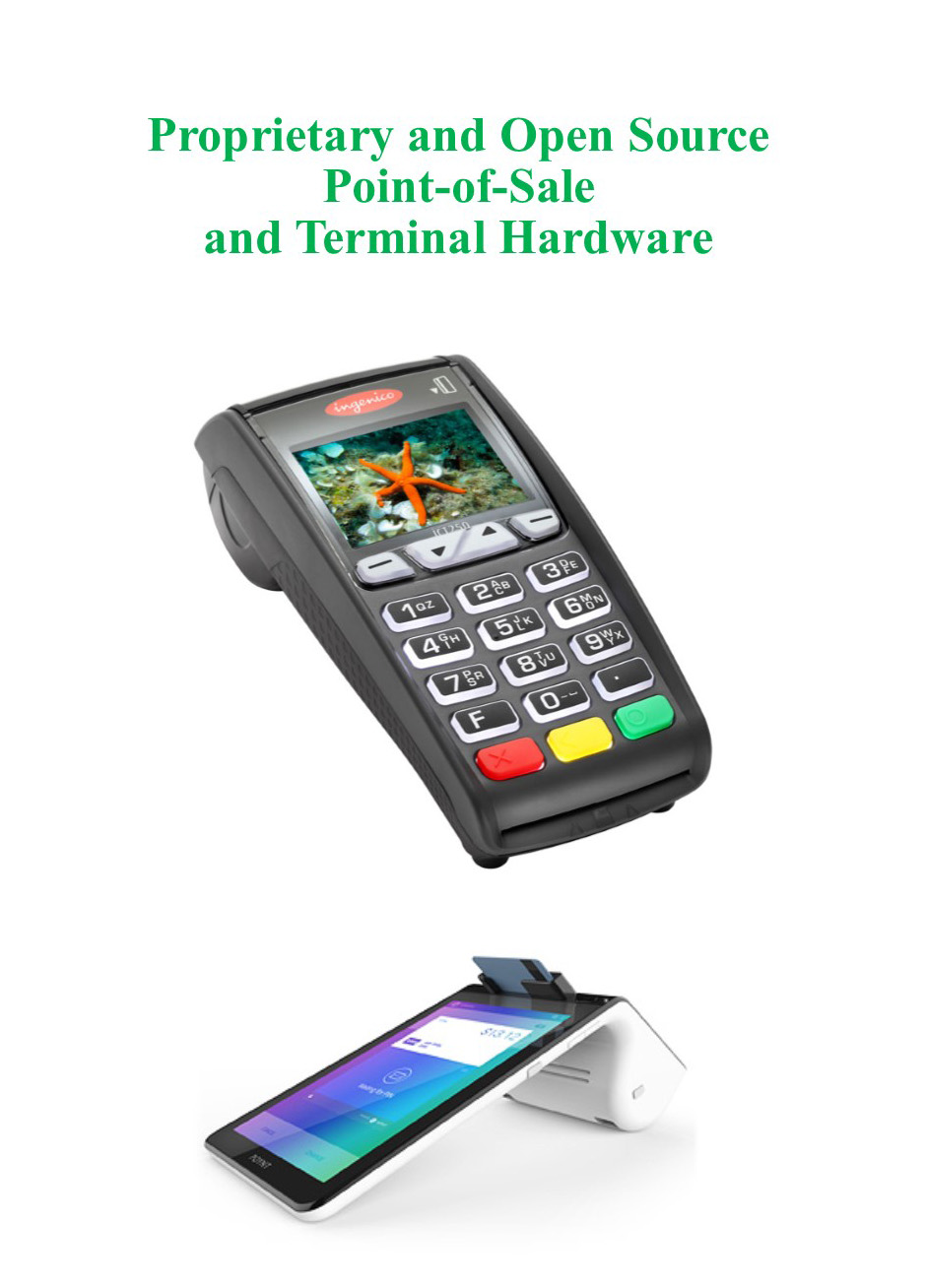

Proprietary hardware is owned and controlled by the company which produces it and in most cases is limited in terms of use. Proprietary system is usually only able to work with software and other hardware products created by its manufacturer, it is often patented or under trade-secret protection. Even though proprietary systems are generally considered outdated, technologically advanced and highly functional proprietary hardware is still being developed today.

Open source hardware sometimes referred to as commercial hardware, is hardware that is available for general public use; anyone can modify, and distribute. If you choose a system that allows for open source hardware, you may be able to use your own iPad, tablet, computer, or smartphone to run your POS system. If your POS works with open source hardware, you have the freedom to shop for hardware from multiple places, guaranteeing that you find the best deal.

Another perk to working with a company which offers open source hardware is that it allows the company to focus on software and the user experience like NTC.

For Electronic Payment Set up call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: electronic payment

May 22nd, 2017 by Elma Jane

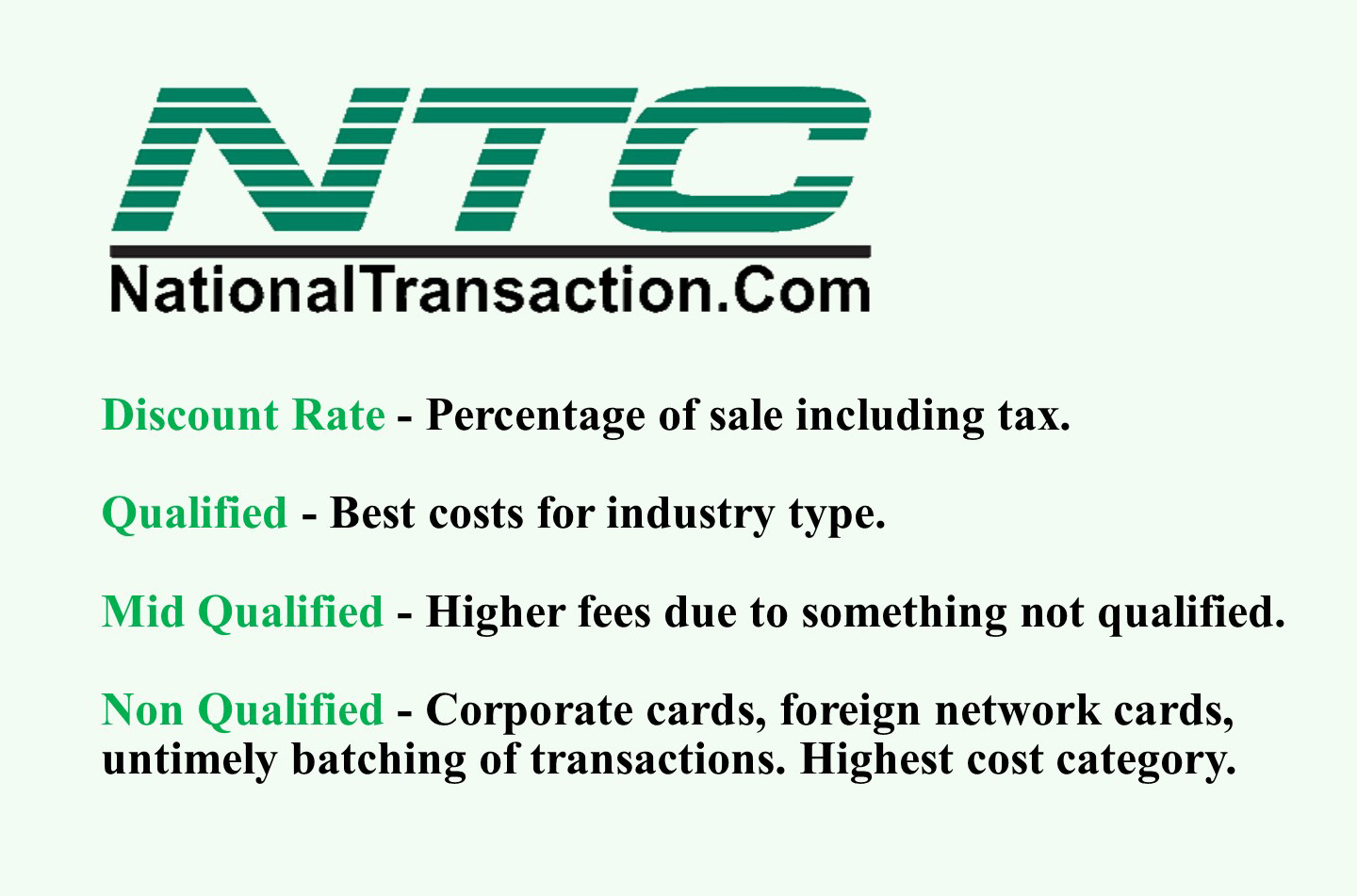

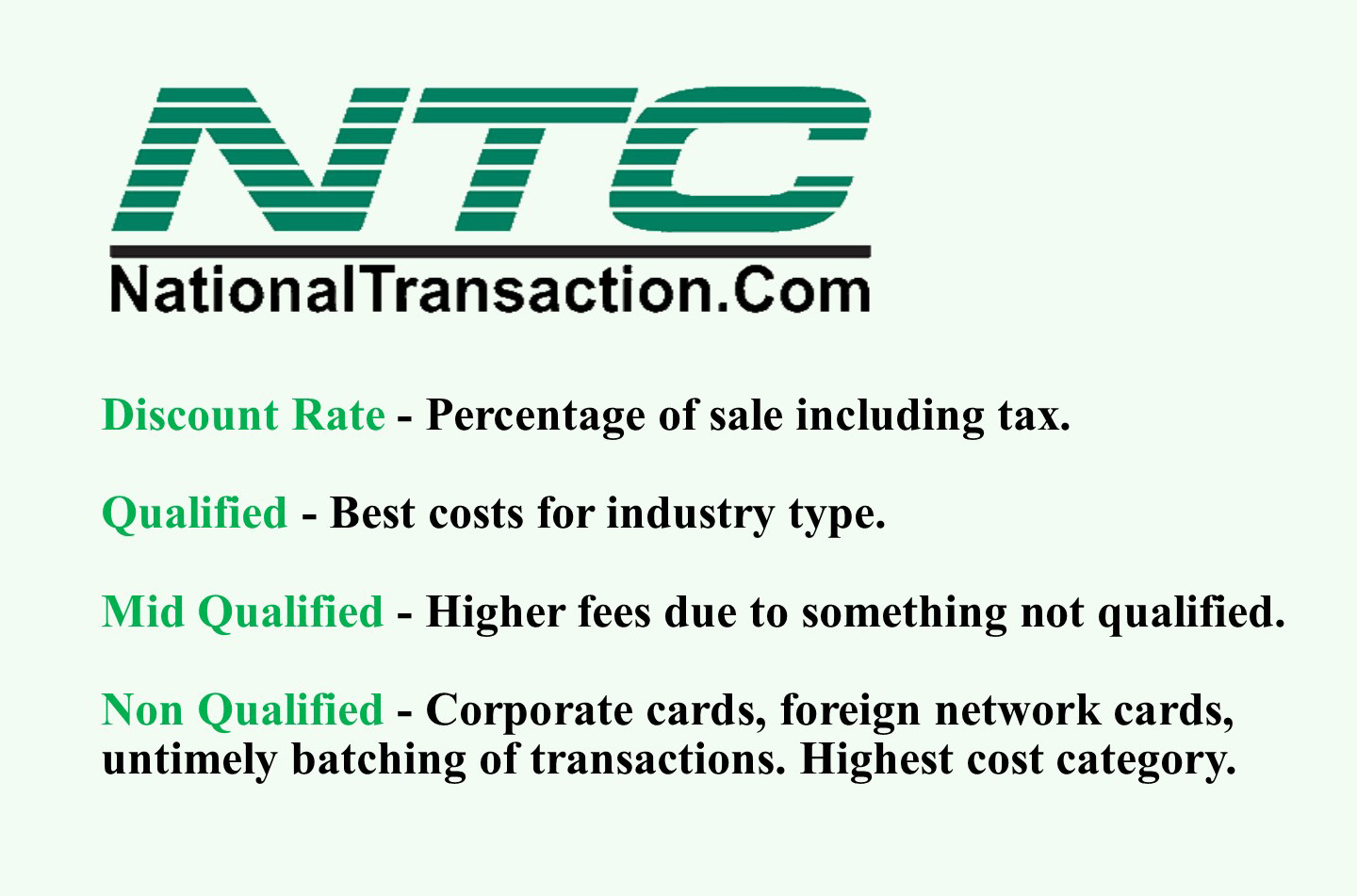

Discount Rate: Qualified Mid or Non-Qualified Transactions

Discount Rate – is a percentage of the total sales submitted to the Bank for processing.

Qualified Transactions – are those in which an authorization was obtained electronically, the transaction was settled within the appropriate time frame, and the transaction meets all other requirements imposed by the bank. With qualified transactions you can get the lowest possible discount rate which is the Qualified Rates. The processor determines what transactions are qualified.

Mid-Qualified Transactions – include but are not limited to those transactions where the card is affiliated with a special issuer program or did not meet requirements imposed by the bank processor.

Non-Qualified Transactions – include but are not limited to those transactions where the authorization was obtained by calling a voice or Voice Recognition Unit (VRU) authorization number, the card is affiliated with a special issuer program, the transaction was not settled in the appropriate time frame, or the transaction did not meet the requirements imposed by the bank.

Mid or Non-Qualified transactions may be subject to increased fees and or Discount Rate as determined by the Bank.

If you are a mail order telephone order or e-commerce Merchant, the bank card brands/organizations require additional data elements to be submitted as part of the transaction record in order for the transactions to qualify for the lowest possible discount rate.

For Electronic Payment Set up call now 888-996-2273 or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: bank, data, e-commerce, electronic payment, merchant, processor, transaction

May 19th, 2017 by Elma Jane

NTC Product and Services

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 20 years of experience, National Transaction offers a variety of electronic payment services and technology for Retail and Ecommerce industries. From Travel, Medical Industry, Charitable Institution and Franchise.

Our services include:

Loans/Funding Program

Credit and Debit Card Processing

Currency Conversion

Electronic Checks

Electronic Invoicing

Gift and Loyalty Card Programs

Mobile and Online Solutions

Shopping Cart E-commerce Payment Gateway

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, nothing to integrate; secure and fast.

Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-996-2273

or visit Nationaltransaction.Com

Posted in Best Practices for Merchants Tagged with: debit card, ecommerce, electronic payment, loans, Loyalty Card, mobile, online, payment gateway, travel