Category: Best Practices for Merchants

August 24th, 2017 by Elma Jane

Travel agencies are viewed as high-risk merchants. As such, you need a merchant solution that best suits a travel merchant needs.

You want an account that eliminates the complexities of a typical shopping cart. Ideally, it allows you to request payment from clients without the need of setting up booking engines and carts.

This post is going to guide you on how to use a payment solution e-Pay and other merchant solutions to ensure a seamless operation of your business.

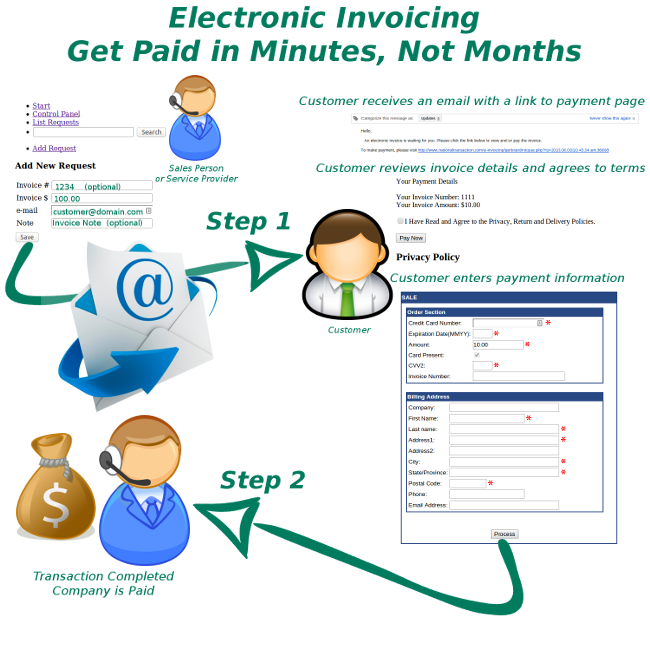

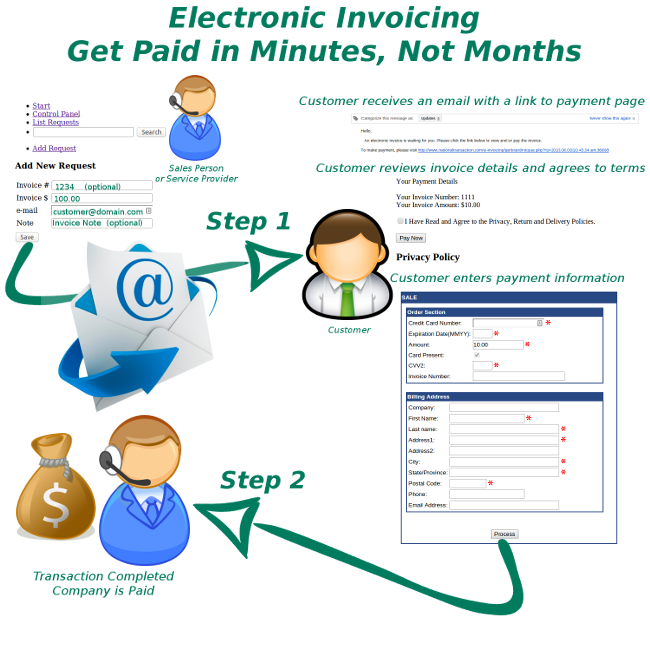

Leveraging the NTC e-Pay Service

Payment solution e-Pay allows you to eliminate the complexities of integrating payment processing into your point-of-sale or an accounting system.

With this payment method, you only need to send a payment request to your customers via email. You don’t need to send invoices via snail mail or fax any forms to your customers. Plus, NTC e-Pay doesn’t need you to take orders over the phone.

With this service, you can create a “BUY” button for any transaction amount in seconds. You also don’t need a website to you use this service. NTC e-Pay allows you to generate a digital link that you can email to clients.

The service allows you to customize the process to make everything simple for your customers. After the customer pays the specified amount, a receipt is generated, and the amount is sent to your account.

Tomorrow we are going to discuss on how to understand your Travel Merchant Account….So standby to learn more.

For NTC e-Pay Set Up call Now 888-996-2273

Posted in Best Practices for Merchants Tagged with: customers, merchants, payment, transaction, travel, travel agencies

August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

August 18th, 2017 by Elma Jane

Before you can start accepting credit card or electronic payments, there are a number of factors to consider.

You will need to decide on a Point of Sale system. Some Merchant Services Providers require you to use only their equipment.

Some of these systems have expensive equipment costs. Others will provide you with free card readers. Companies offering free equipment may do so in exchange for higher processing fees.

Before you choose a Merchant Services Provider, you should look into how they work those fees.

Understanding Processing Fees

Credit card processing fees have several moving parts, so we aren’t going to dive too deeply into how these fees are determined. We will, however, take a broad overview.

Merchant Services Providers will charge either a flat rate, a percentage, or a combination of the two. This fee is called an interchange rate.

Interchange rates vary between card providers, which is why some sellers don’t accept certain credit cards and why many small companies have minimum requirements for credit card payments.

Some Merchant Services Providers don’t charge a flat transaction fee, however, they usually charge a higher percentage for payments.

Each model has its benefits and disadvantages.

Before choosing a Merchant Services Provider, familiarize yourself with their processing fees. Consider how they will fit with your business model. Are most of your transactions smaller or larger? How much will a free card reader save you?

Weigh every option out before you lock yourself into an agreement.

For Payment Consultation call now and speak to our Payment Consultants 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card readers, credit card, electronic payments, interchange, merchant, point of sale, transaction

August 17th, 2017 by Elma Jane

How Do Credit Cards Work?

Paying with a credit card seems like a simple process. You charge the customer, they swipe their card, and then they walk out the door.

But behind the scenes, it’s a bit more complicated.

A credit card payment involves four parties.

- The Merchant

- The Customer

- The Issuing Bank

- The Merchant Services Provider

You know who the Merchant and Customer are – that’s the easy part.

The Issuing Bank is the institution that lends money to the Customer.

When the Customer swipes their card, the Issuing Bank lends them the sale amount. This loan is given with the understanding that the Customer will pay the amount back within 30 days or repay it with interest.

Before the Merchant sees any of that money, it goes through the Merchant Services Provider. In exchange for their credit card processing services, they take out a fee before paying that money to the Merchant.

These fees vary between Merchant Services Providers, but one thing is certain: The Merchant always receives less money than the Customer paid them.

This might seem like a raw deal. However, accepting credit cards can lead to more sales than if you only accept cash.

On our next article we will discuss how to start accepting credit card payments and understanding the processing fees….so stand by for more information about Electronic Payment Processing.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments Tagged with: bank, credit card, customer, electronic payment, loan, merchant, payment

August 16th, 2017 by Elma Jane

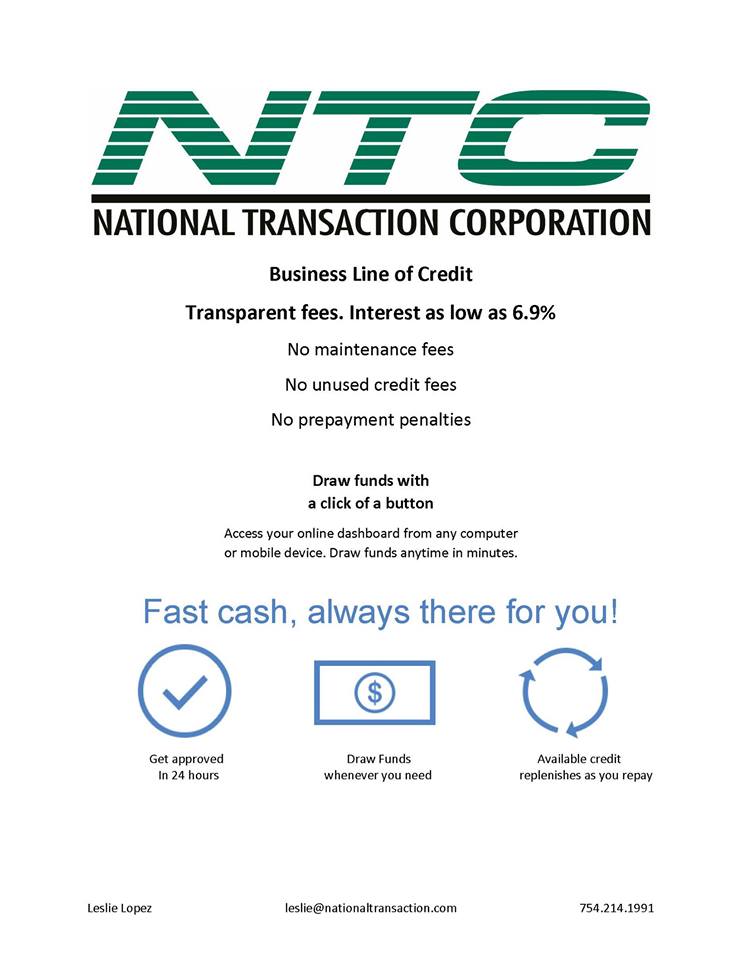

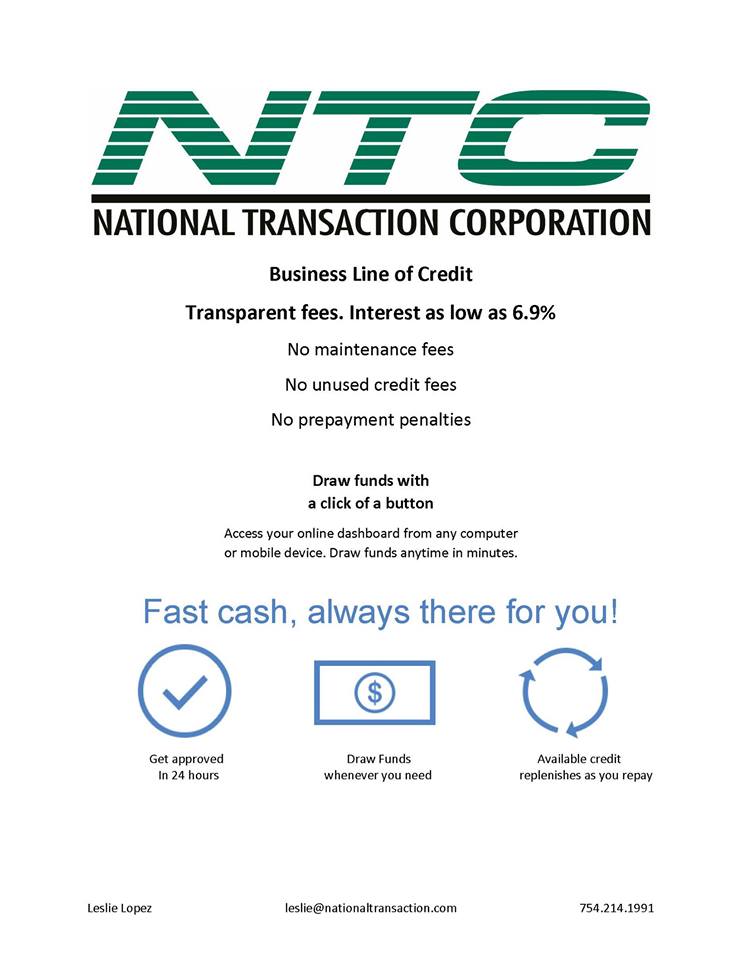

National Transaction.Com

We work with Business owners to find the easiest and least expensive way for your business to access capital. For Loan Consultant call now at 888-996-2273 Ext 1159

Thank You – from my MMC!

First approved loan $1.2 Million August 10, 2017 Thursday! Very cool

1.2-Million 4.35%

Thank you for all the help -all done First business- towards many More.

Elisea

Sent from my iPhone

Posted in Best Practices for Merchants Tagged with: loan

August 1st, 2017 by Elma Jane

NTC Gives™ is an Electronic Payment Organization that allows congregations to accept payments on multiple platforms and support non-profit organizations, utilizing the award-winning customer service and industry leading technology of National Transaction Corporation™.

Accept Donations and Giving In-Church or Mobile

IN-CHURCH – accept donations in person with ease using broad range of optional devices.

MOBILE – make donations on the go with an intuitive mobile app.

- Accept and Receive Donations Anywhere

- Easy Automatic Recurring Donations

- Credit, Debit and ACH

- Data Tracking and Security

WATCH NTC GIVES HERE

Posted in Best Practices for Merchants

July 26th, 2017 by Elma Jane

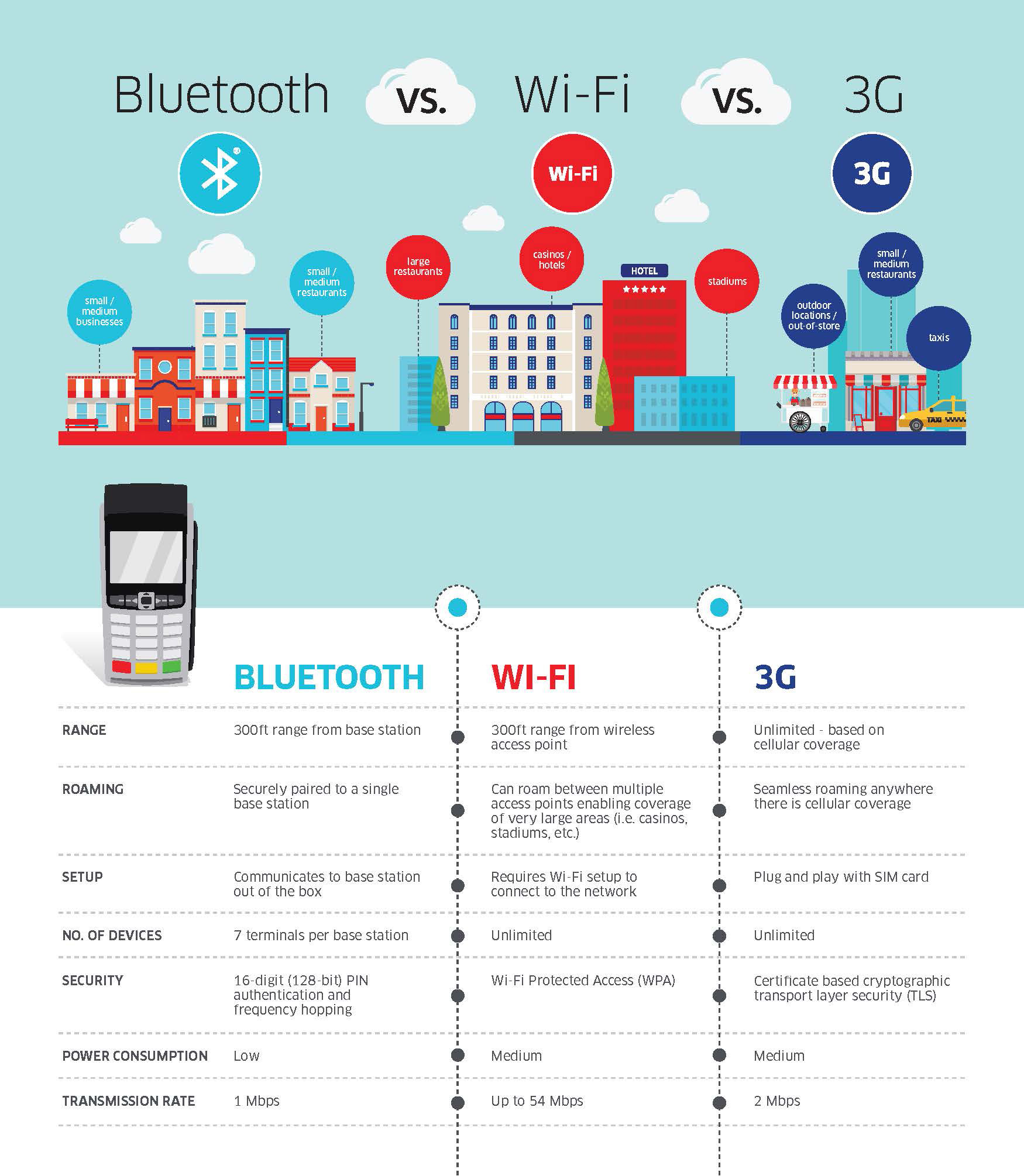

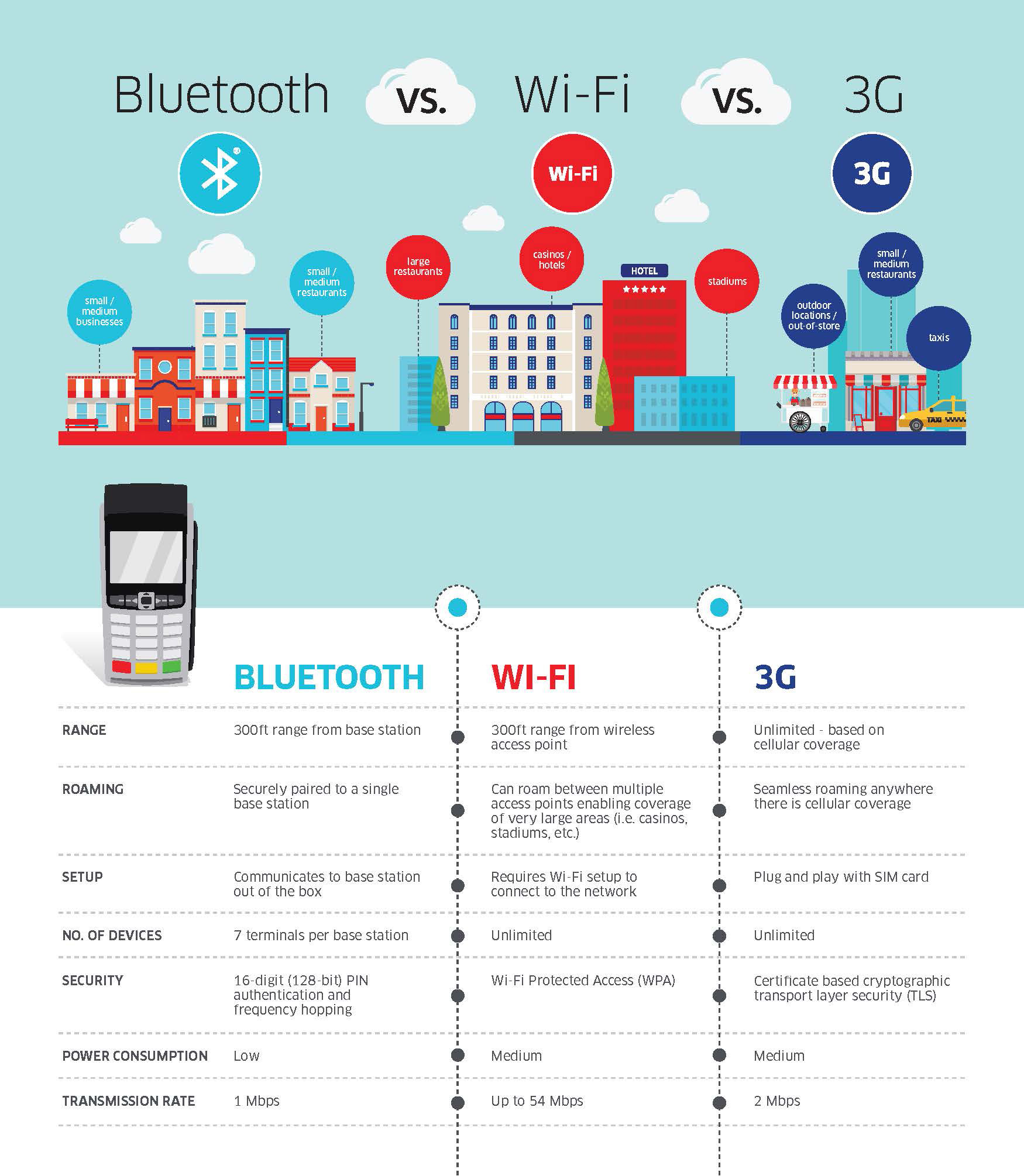

Check out the wide range of smart wireless terminal connectivity options and know the difference.

Bluetooth Wireless: Designed for reliable Bluetooth connectivity even in the most demanding environments.

Rage – 300ft from base station

Roaming – paired to single base station

Setup – Communicates to base station out of the box

No. Of Devices – 7 Terminals per base station

Security – 16-Digit (128-Bit) PIN authentication and frequency hopping

Accept EMV Chip & PIN, magstripe and NFC/Contactless

WiFi: Designed for reliable WiFi connectivity, Wireless mobility for the point of sale.

Rage – 300ft from base station

Roaming – can roam between multiple access points enabling coverage of very large areas.

Setup – Requires WiFi Setup to connect to the network

No. Of Devices – Unlimited

Security – WiFi Protected Access (WPA)

Accept EMV Chip & PIN, magstripe and NFC/Contactless

3G Wireless: Bring compact, reliable 3G Wireless Technology and mobility to the point of sale.

Rage – unlimited – based on cellular coverage

Roaming – Seamless roaming anywhere there is cellular coverage

Setup – Plug and play with SIM card

No. Of Devices – Unlimited

Security – Certificate based cryptographic transport layer security

Accept EMV Chip & PIN, magstripe and NFC/Contactless

Wireless terminals provide merchants with a number of benefits including:

Mobility – enable merchants to better serve the customer and bring the transaction right to the point of service.

Printed Receipt – give your servers the capability to print a receipt for the customer even when away from the POS.

Variety of Payment Options – provide the ability to accept magstripe, EMV, and NFC payments including the latest mobile wallets.

For Electronic Payment Set Up Call Now 888-996-2273

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: bluetooth, chip, Contacless, EMV, magstripe, nfc, PIN, Security

July 24th, 2017 by Elma Jane

NTC provides customers with multiple options for their online business. Customers can work with one company and one product to satisfy all of their payment needs. This is a great benefit to small businesses and large businesses alike. If you have any questions or would like to set up an account, call now 888-996-2273.

Electronic Invoicing Made Simple with NTC e-Pay

NTC GIVES.Com allows congregation to accept payments on multiple platforms.

NTC GIVES provide Electronic Payment System for:

Church, funding raising and charity projects.

Process your Travel Agency Payments for less. Get 100% funding the next day.

Electronic Payment Processing:

Take payments quickly and securely anywhere and anytime

Transaction can be processed in physical face-to-face, mail order/telephone order or e-commerce environments.

Recurring and installment payments available

Posted in Best Practices for Merchants Tagged with: e-commerce, electronic payment, payment, recurring, transaction, Travel Agency Payments

July 18th, 2017 by Elma Jane

1979 was a turning point in the credit card processing industry. Point of sale terminals emerged that year when Visa introduced a bulky electronic data capturing terminal which was the first payment credit card terminal.

In the same year, magnetic information stripe was added to the credit card which allowed card information to be captured electronically. Now Mag stripe was replaced by EMV (Europay, MasterCard and Visa) .

In 1994, the first version of the EMV was released and it became stable in 1998.

The United States started using the EMV Technology in 2014.

The future of payment will see Mobile payments, Electronic payments and Contactless payments like NFC (Near Field Communication) and smart cards, and is now taking over the traditional payment. Electronic Payment Technology will continue to evolve.

Posted in Best Practices for Merchants Tagged with: contactless, credit card, Electronic Data, electronic payment, EMV, mobile, nfc, payment, point of sale, terminals

July 12th, 2017 by Elma Jane

NTC Gives™ is an Electronic Payment Organization that allows congregations to accept payments on multiple platforms and supports non-profit organizations in our communities utilizing the award-winning customer service and industry leading technology of National Transaction Corporation™.

Keep Giving – allows recurring donations regardless of your worshipers attendance.

Mobile Giving – accept donations on a multitude of devices.

Secure Donations – Offload your protection mechanism to the banks payment gateway to ensure security breach while protecting your members.

For church congregations, start accepting donations online as well as recurring donations. Call now 888-996-2273 or go to NTC GIVES.Com

Posted in Best Practices for Merchants Tagged with: banks, electronic payment, gateway, Security