April 8th, 2016 by Elma Jane

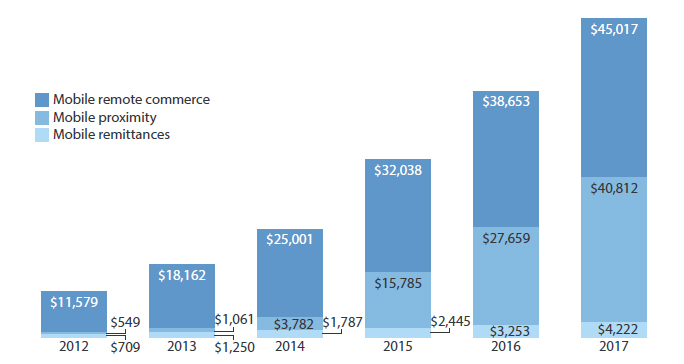

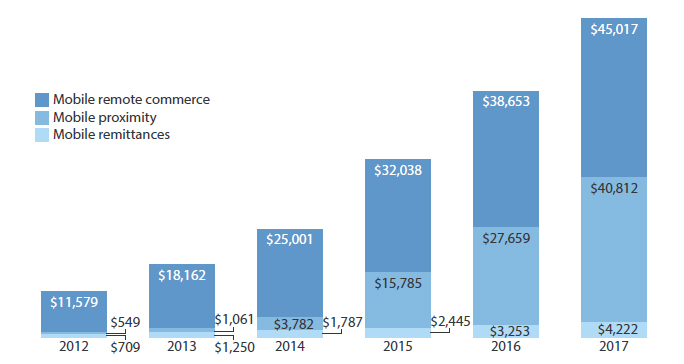

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

February 25th, 2016 by Elma Jane

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 9th, 2016 by Elma Jane

Since the implementation of the EMV liability shift last year, consumers are still unsure whether to dip or swipe their payment cards at the checkout register, and transaction process itself is slower than a card swipe.

As the EMV process continues, can contactless register only help to make checkout process faster? With contactless register checkout only, consumers can just tap and pay with either card or mobile wallet.

Contactless like NFC is now a standard feature in most high-end smartphones, and most EMV-enabled point-of-sale terminals contain the necessary technology to accept contactless payments. So the idea of contactless register checkout only is something to test for some merchants in a certain retail sector.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Near Field Communication, Point of Sale Tagged with: cards, consumers, contactless, EMV, merchants, mobile, mobile wallet, nfc, payment, payment cards, point of sale, Smartphones, terminals, transaction

February 5th, 2016 by Elma Jane

Businesses and banking institutions must require consumers to use other types of authentication methods, like biometrics, mobile verification codes and geo-location.

Merchants and banks can expect more hackers to breach customer accounts that rely only on usernames and passwords for online authentication.

This type of fraud will only grow more as hackers recognize and take advantage of the opportunity presented by on-file accounts protected by weak authentication.

Many online users use the same username and password for multiple accounts, once those credentials are compromised, criminals can use them to access accounts on different websites.

With the ease and simplicity of password vaults and safes that are easy and efficient to use and user education, this problem finds a solution.

A stronger authentication that goes far beyond username and password, is a powerful tool in effort to prevent data breaches.

Posted in Best Practices for Merchants Tagged with: banking institutions, banks, biometrics, consumers, customer, data, data breaches, fraud, merchants, mobile, online

February 4th, 2016 by Elma Jane

Companies providing electronic money services, such as online or mobile payments accounts, have more than doubled since 2013.

This number has been on the rise over the past few years as consumer confidence in alternative payments methods has increased.

UK consumers and businesses are increasingly comfortable with the idea of a cashless economy, in which they might not be able to physically see or access money. More are embracing pre-paid cards, contactless and mobile payment systems for ease of use, efficiency and enhanced security.

According to a specialist financial services regulatory consultancy, there has been a significant increase in the number of electronic money providers registered with the Financial Conduct Authority (FCA).

E money providers must be authorized with the FCA under the Electronic Money Regulations 2011 and meet stringent consumer protection criteria, including adequate capital, the separation of customer’s money from the company’s funds.

The regulatory background is complex and electronic money providers need to ensure that systems, processes and controls are tight to ensure a high level of consumer protection. The FCA is not afraid to place these businesses under a microscope.

Many are concerned that this increase in alternative payments methods will lead to the death of the traditional bank, but only if they fail to innovate and adapt to market trends and consumer needs.

Posted in Best Practices for Merchants Tagged with: bank, cards, consumers, contactless, customers, electronic money, financial services, Mobile Payments, online, payment systems, payments, payments methods, provider's, Security

January 28th, 2016 by Elma Jane

The shift to EMV is helping to address vulnerabilities in the United States payments ecosystem. It has been shown that EMV can deliver benefits as a part of industry efforts to combat fraud.

EMV migration is a critical focus for enhancing payments security, which is why the current efforts around chip card deployment are greatly beneficial for consumers and merchants alike. EMV technology helps to reduce counterfeit card fraud, as it generates dynamic data with each payment to authenticate the card, after which the cardholder is prompted to sign or enter a PIN to confirm their identity.

The EMV rollout represents a dynamic time for card payments that promises great advances, among them is enhanced security for cardholders. It also presents an opportunity to consider other innovations such as mobile wallets and mobile POS to further engage your customers and drive customer loyalty. When merchants continue to invest in EMV and NFC (near field communications, used for tap-and-pay transactions), the purchases made at their EMV-enabled terminals are made more secure than magnetic stripe.

New mobile payment options such as mobile wallets support EMV and therefore offer this added layer of security. Ultimately, by enabling contactless payments, merchants can also enable more flexibility in addition to increasing security for their customers.

Additionally, industry players are backing major mobile wallets, such as Android Pay, Apple Pay, and Samsung Pay.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card, cardholder, chip card, consumers, contactless payments, customers, data, EMV, fraud, magnetic stripe, merchants, mobile, mobile payment, mobile wallets, near field communications, nfc, payments, PIN, POS, Security, terminals, transactions

July 7th, 2015 by Elma Jane

The global brand MasterCard is in the process of launching a pilot program with the help of Google, BlackBerry, Apple, Microsoft, and Samsung to boost security for online payments using facial recognition systems.

About 500 customers are trialing for the new features, participants will provide feedback based on their experience. The company will continue to refine the product until ready to launch. MasterCard confirmed that it is planning to eventually release the new biometric security system publicly.

The payments company is also in the process of securing agreements with two major banking institutions. If all goes as planned, the undisclosed financial establishments will likely participate in the launching of the new security option.

When consumers shop on the Internet, their banks need ways to verify their identities. So this particular product seamlessly integrates biometrics into the overall payments experience, a security expert at MasterCard said.

The system does not actually save a photo of the user during the verification process. Instead, it creates a map of the individual’s face. Afterwards, the map is turned into code, which is sent to MasterCard for confirmation. The facial recognition feature only kicks in when an individual makes an online purchase.

During checkout, users will be prompted to confirm their identity using fingerprint scanning or facial detection.

To prevent criminals from using a photo to dupe the verification process, a user is required to blink once while having his or her face scanned. Technical specifications and mobile requirements for the security feature are still unknown.

With the test of facial recognition, MasterCard seemingly hopes to move away from password-based protocols by providing additional security options for consumers.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: consumers, financial establishments, MasterCard, online payments, payments, payments company, products, Security

May 26th, 2015 by Elma Jane

MasterCard is aiming to change the way people transfer money between debit cards, with its new program called MasterCard Send. This first-of-its-kind, global personal payments platform allows consumers to send and receive funds within seconds, rather than waiting for the standard 1-3 business day transfer time.

Unlike most person-to-person (P2P) processors like PayPal, MasterCard Send is not designed specifically for consumers. Instead, it aims to help businesses send disbursements and cash back to customers in something very close to real-time.

Customers can receive direct deposits into their debit card accounts for shipping rebates. There is no waiting for a check in the mail or a long transfer process.

Consumers can still use MasterCard Send to send and receive money from friends and family members. The recipient does not need a debit card to access the funds. Send will also work with programs like Western Union.

According to MasterCard, cash and checks still contribute $1 trillion in global spending every year. MasterCard Send is attempting to be a safer, faster and cheaper alternative to these transactions. The program is now live in the United States.

MasterCard Send is addressing a real need that exists in today’s digital world to enable consumers, businesses, governments and more to have a safe, simple and secure way to transfer and receive funds quickly.

Posted in Financial Services Tagged with: card accounts, cash back, check, consumers, debit cards, direct deposits, funds, MasterCard, p2p, payments, processors, transactions

With the EMV migration just a few months away, Visa is stepping up its merchant education efforts, by launching an online portal for merchants featuring a background on chip cards, demonstrations on proper usage, and tips for implementation.

Visa also kicked off its 20-City Small Business Chip Education Tour expounding on the benefits and necessity of chip cards to local small businesses.

Visa is bringing payment industry experts to connect directly with merchants to answer their questions on the transition across the United States.

Merchant education will be a herculean task, but payments industry stakeholders should make every effort to make sure chip cards are adopted and used effectively by both merchants and consumers.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: cards, chip, chip cards, consumers, EMV, EMV migration, Merchant's, payment, payment industry, visa