March 31st, 2016 by Elma Jane

E-commerce – the process of using the Internet or computer networks in order to buy or sell information, services, or products.

Everyday people go on the Internet and make purchases for different products or services, just like they would in a store. The act of buying or selling over these networks allows for secure paperless transactions to happen electronically.

Electronic transactions have been around for quite some time involving business to business transactions over private networks in the form of EDI. Electronic Data Interchange (EDI), which was a transfer of electronic data from a computer to another computer and Electronic Funds Transfer (EFT), which was a transfer of money electronically from a computer to another in order to do business with each other.

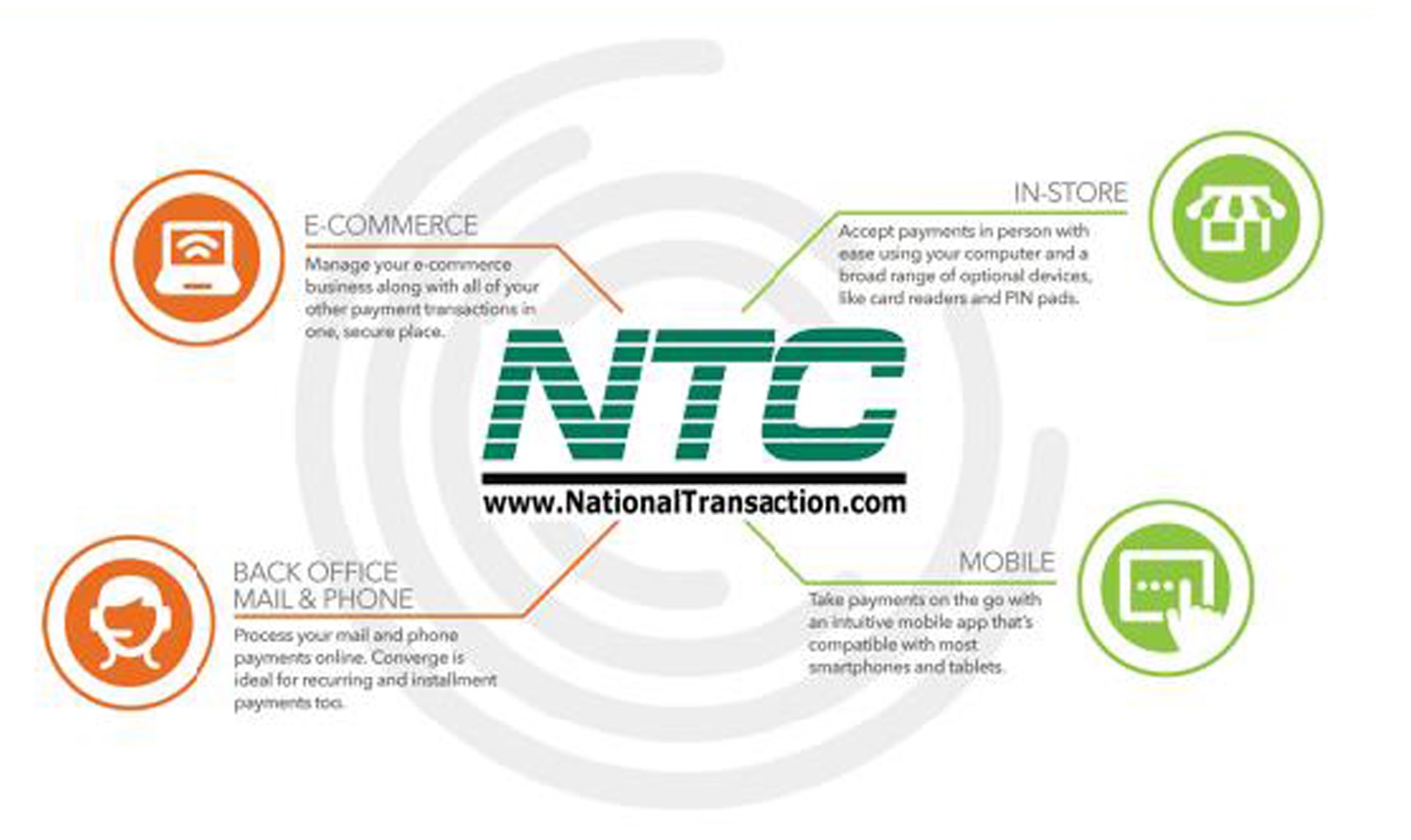

Accepting online payments is very rewarding. If you’re new to e-commerce keep things simple check out our NTC e-Pay the NO SHOPPING CART E-Commerce Solution!

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: e-commerce, Electronic Data, electronic transactions, online payments, payments, transactions

July 7th, 2015 by Elma Jane

The global brand MasterCard is in the process of launching a pilot program with the help of Google, BlackBerry, Apple, Microsoft, and Samsung to boost security for online payments using facial recognition systems.

About 500 customers are trialing for the new features, participants will provide feedback based on their experience. The company will continue to refine the product until ready to launch. MasterCard confirmed that it is planning to eventually release the new biometric security system publicly.

The payments company is also in the process of securing agreements with two major banking institutions. If all goes as planned, the undisclosed financial establishments will likely participate in the launching of the new security option.

When consumers shop on the Internet, their banks need ways to verify their identities. So this particular product seamlessly integrates biometrics into the overall payments experience, a security expert at MasterCard said.

The system does not actually save a photo of the user during the verification process. Instead, it creates a map of the individual’s face. Afterwards, the map is turned into code, which is sent to MasterCard for confirmation. The facial recognition feature only kicks in when an individual makes an online purchase.

During checkout, users will be prompted to confirm their identity using fingerprint scanning or facial detection.

To prevent criminals from using a photo to dupe the verification process, a user is required to blink once while having his or her face scanned. Technical specifications and mobile requirements for the security feature are still unknown.

With the test of facial recognition, MasterCard seemingly hopes to move away from password-based protocols by providing additional security options for consumers.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: consumers, financial establishments, MasterCard, online payments, payments, payments company, products, Security

June 16th, 2015 by Elma Jane

When you own a travel agency, a merchant account can take the worry out of the financial side of your business. Since many people prefer to pay for their vacation services with a credit card, your Merchant Account will ensure that you’re able to process those payments as easily and efficiently as possible.

Merchant accounts generally work in real time. Payment processing occurs immediately, with quick authorization, you and your customer will know right away that the payment has gone through. These types of accounts allow your business to accept almost every major brand of credit card. This further benefits your customers by allowing them to pay through the cards that they have.

You can also offer your customers advanced payment processing solutions that include more than simple credit card payments. That’s important in this economic climate, when many people are turning from credit cards to other methods of payment.

Debit cards, checks, pre-paid cards, and electronic transfers are all available through Merchant Accounts.

Debit cards are somewhat treated like credit cards when you have a Merchant Account, ensuring that you’ll receive the promised funds before your client sets foot on their cruise ship or the airplane.

New business should lead to repeat business, and with a loyalty program set up through your Merchant Account, it will! Your merchant account provider can customize a loyalty program for you.

Creating a loyalty program will bring repeat business, increase the amount of money that customers spend with you, attract new customers to your business and, most importantly, keep them coming back.

Online payments are another benefit you’ll enjoy when you set up a Merchant Account. With online payments, your customers can click on your website, set up their own vacation itineraries, and pay for their trips simply by entering their payment data into a secure online form. The payments will be validated instantly, so your customers will know that their vacation has been authorized within seconds, and you will have access to those funds by the following day.

Finally, one of the best things about a merchant account is that the funds will be available to you the next day. Your customer pays you today and you can access the funds tomorrow. This improves your cash flow and makes it possible for you to take care of your business expenses in a timely manner. And, as you know, paying for things on time usually means those things cost you less money.

You’ll save money and time by setting up a merchant account, and you can do it today with National Transaction! (888)-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants, Merchant Account Services News Articles, Travel Agency Agents Tagged with: checks, credit card, credit card payments, debit cards, electronic transfers, loyalty program, merchant account, merchant account provider, online payments, payment data, payment processing, payments, pre-paid cards

June 23rd, 2014 by Elma Jane

How online payments can help improve health care efficacy? 76 percent of providers said that it took more than one month to collect from a patient. However, patients have made it clear that they prefer to have the option of making payments online. Consumer responsibility is also increasing, but many providers still rely on paper-based, manual payment collection and posting processes. As a result of waiting for those payments, providers are spending more money and more time to collect, yet still accumulating a large amount of bad debt.

The majority of providers 76 percent did say that they offered the option of online payments to their patients. As providers and their clients increasingly rely on consumer payments for revenue, many have started to use more consumer-centered strategies, like payment plans, to collect payments. However, they will have to implement best practices and policies, including automating payments and communications and ensuring payment data is secure, to improve collection processes.

Posted in Uncategorized Tagged with: consumer, health care, online payments, payment data, payments, provider's