August 11th, 2016 by Elma Jane

CURRENCY CONVERSION

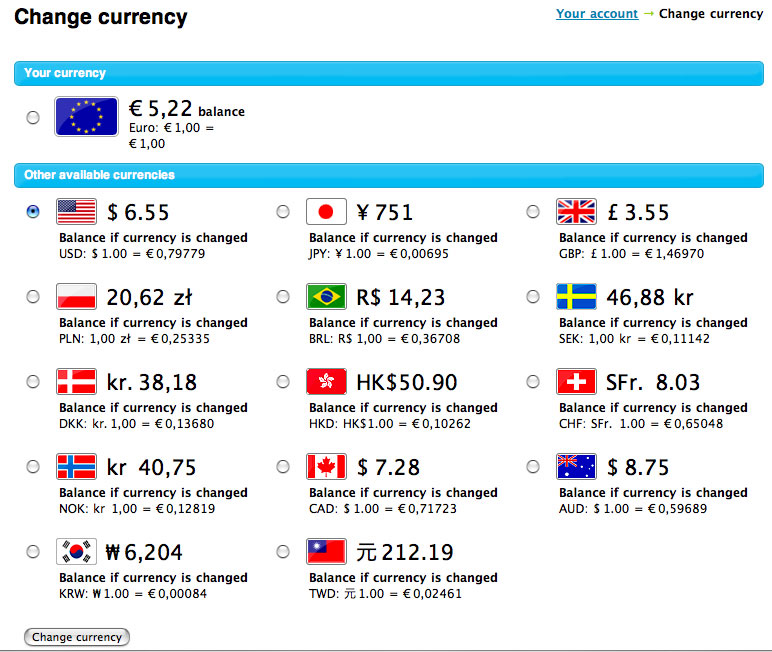

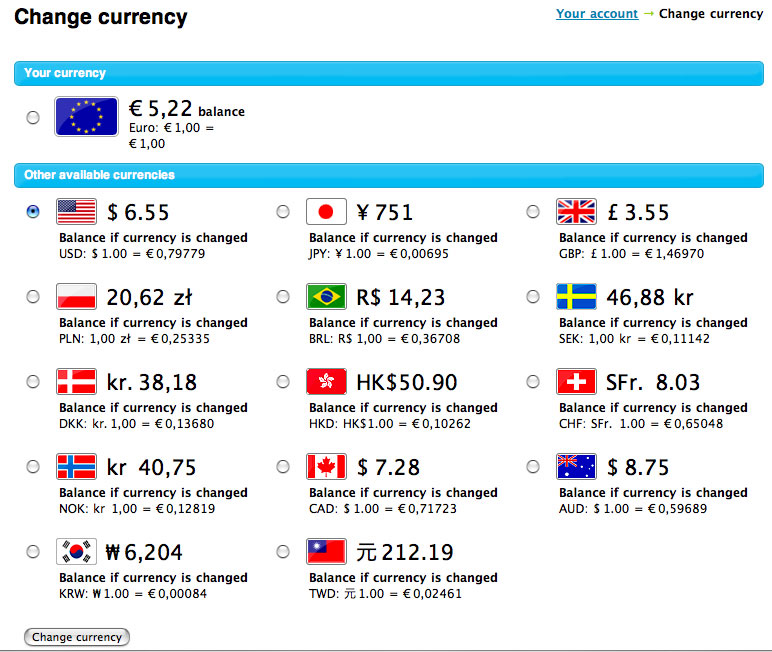

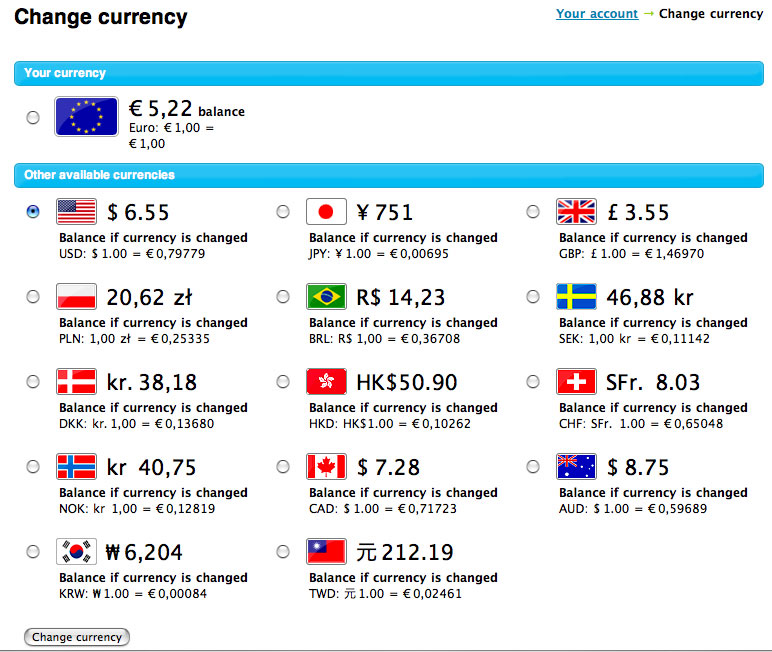

Multi Currency Conversion (MCC):

In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

Conversion occurs between the point of sale and settlement.

E-commerce only and no merchant rebate.

Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC): Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

Conversion occurs at the point of sale and five supported currencies less than MCC.

Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

Price listed in merchant’s currency conversion.

For Retail, Restaurant, MOTO and E-commerce.

Supported by terminals, via Warp and Virtual Merchant.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Point of Sale Tagged with: currency, customer, DCC, Dynamic Currency Conversion, e-commerce, Internet Secure, MCC, merchant, moto, Multi Currency Conversion, point of sale, retail, terminals, transactions, virtual merchant

April 15th, 2016 by Elma Jane

Dynamic Currency Conversion

- Five supported currencies

- Retail, Restaurant, MOTO, E-commerce

- Price listed in merchant’s currency

- Customer is aware of currency conversion

- Customer may opt-out at the point of sale

- Conversion occurs at the point of sale

- Merchants may choose settlement method & time

- Supported by terminals, viaWarp and Virtual Merchant

- Merchant rebate up to 100bp

Multi-Currency Conversion

- 100+ supported currencies

- E-commerce only

- Price listed in customer’s currency

- Customer is not aware of currency conversion

- Customer may not opt-out at the point of sale

- Conversion occurs between the point of sale and settlement

- All transactions auto settle at 6pm (eastern) daily

- Supported by Internet Secure or direct certification

- No merchant rebate

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Merchant Account Services News Articles, Travel Agency Agents Tagged with: currency, Currency Conversion, customer, e-commerce, merchants, moto, point of sale, terminals, virtual merchant

January 26th, 2015 by Elma Jane

Accept Electronic Payments in Their Currency,

Convert it to Yours

DCC or Dynamic Currency Conversion is a system where the Visa or MasterCard holder in a foreign country can shop on an American based web site that displays prices in their own local currency. The web site can offer multiple choices as to which country the shopper is based in and the shopper can be immediately familiar with the pricing of goods and services.

Exchange rates are in constant flux. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. Even if the shopper does not choose the correct currency, at the time the card information is presented, the system automatically recognizes that the card is foreign and applies the appropriate currency and exchange rate.

At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied. In today’s global business environment, this level of convenience to the customer insures they are comfortable with the transaction from shopping cart to the door. Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line.

On the merchant end, all transactions are settled in $USD. Reporting mechanisms can display the consumers pricing and the exchange rate they paid for analysis and cost reduction.

Currency Conversion

- Accept currencies from other nations.

- Convert funds to US Dollars.

- Set prices in local currency to avoid confusion or calculation.

- Works with e-commerce as well as Mail Order / Phone Order.

- Ease the sales process for your customers.

- Increase customer familiarity.

- Immediately convert currency to avoid value gaps.

Posted in Best Practices for Merchants, Electronic Payments Tagged with: Bank Reference Table, Card Recognition Table, consumer, conversion rate, currency, customer, Dynamic Currency Conversion, e-commerce, electronic payments, exchange rate, invoice, MasterCard, Merchant's, receipt, shopping cart, transactions, visa

October 9th, 2014 by Elma Jane

This 300-year-old coin around my neck. It was off of a Spanish Shipwreck known as the Shipwreck of 1715. When I first saw it, I noticed a little hole with a speck of a diamond. I questioned the jeweler about it, why would you drill a hole in a 300-year-old coin and damage this 300-year-old treasure? The jeweler preceded to tell me that it was a 300-year-old hole.

Think about how we used currency 300 years ago. There were no banks, no financial institutions to hold merchants money. So if I had a bunch of money, I had it on a wire or had it in a box. I may have kept my money in my mattress. People would keep their money on a wire, punch holes in the coins, string the money through the wire and then go back to business on their horse and buggy, or however they got from point-to-point 300 years ago. If you have ever heard a phrase that the business owner started his business on a shoe string, you now know where the phrase originated.

What I found amazing in this one coin that I wear is that, It has thousands of transactions in its history. Who knows what was bought and sold with this very coin? Whether it was goats or chickens, a piece of property somewhere, or a boat ride to the states, or whatever it might be. There is no documented history behind each one of those transactions.

Today, when National Transaction processes a transaction for a merchant, we know the date and time. We know the amount of sale, we probably know the email address and the owner zip code, we actually know quite about the information around that transaction.

Many articles are written that answer the who, what, when, where and why questions with today’s electronic transactions. We have four of the five answers. We know who, what, when and where. The only thing that we don’t know is why the customer bought the item.

If this coin had today’s technologies there would have been thousands of transactions that this coin could have shared. The story of those purchases would be fascinating.

All business owners wants to make a sale. Each time they do make a sale, we recommend capturing any and all contact information. This customer is a buyer! Today, most people have an email address or cell phone number. If we don’t capture the customer’s information we have just ignored the single most important thing in any business’s life cycle: the customer.

Posted in Best Practices for Merchants Tagged with: banks, business owner, currency, customer, financial institutions, Merchant's, purchases, transactions

September 19th, 2014 by Elma Jane

MasterCard is claiming a 98% success rate for pilot trials of a biometric verification system combining both voice and facial recognition.

It recently held a closed pilot to understand the consumer experience around voice and facial recognition.

A beta mobile app was tested in an e-commerce environment on over 14,000 transactions. The test group, used both Android and iOS operating systems. The results, yielding a successful verification rate of 98%, mixing a combination of voice and facial recognition. The process usually took less than 10 seconds.

With the first wave of apps utilising Apple’s TouchID fingerprint recognition system coming to market – both US neo-bank Simple and PFM outfit Mint have shipped their first iOS upgrades to incorporate the technology. Biometric verification is beginning to gain currency among businesses and consumers as a useful tool in the fight against fraud.

The launch of Apple Pay will start to bring true scale to the next generation of payments authentication. The challenge is to take lessons from the different applications of biometrics already in place and elevate them into the next generation of authentication, not just for one platform, but for the mass market globally.

MasterCard already has first hand experience of a mass-market implementation of biometric card technology with the recent launch of the Nigerian eIDcard, which combines payment card functionality with a mix of fingerprint, facial and iris recognition.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: Android, Android and iOS operating systems, Apple Pay, Apple's TouchID, beta mobile app, biometric card, biometric card technology, biometric verification, biometric verification system, card, card technology, consumer, currency, e-commerce, facial recognition, fingerprint recognition, fingerprint recognition system, fraud, iOS, iOS operating systems, iris recognition, mass market, MasterCard, mobile app, payments authentication, platform, rate, transactions, verification rate, verification system, voice and facial recognition

August 21st, 2014 by Elma Jane

Accept Electronic Payments in Their Currency, Convert it to Yours. National Transaction helps you and your customers transact with confidence.

DCC provides convenient currency conversion service at the time of purchase benefiting both the credit card holder and merchants. Our solution provides a system where the Visa or MasterCard holder in a foreign country can shop on an American based website that displays prices in their own local currency. Dynamic Currency Conversion utilizes a Bank Reference Table (BRT) otherwise known as a Card Recognition Table (CRT). This table is updated on a daily basis so that transactions have the most up to date conversion rate for transactions. Your web site holds pricing information in $USD, and based on the selection of the shopper, prices are converted to their native currency. At the close of the transaction an invoice or receipt can present the total to the customer in their currency, along with the merchants local currency along with the exchange rate that was applied.Your business reaches foreign nations expanding your market while presenting new opportunities, increasing your businesses bottom line and making international transaction with confidence. We have diverse set of applications to enable various kinds of business models and financial frameworks.

Posted in Best Practices for Merchants Tagged with: Bank Reference, Card Recognition, conversion rate, credit-card, currency, Currency Conversion, customers, DCC, Dynamic Currency, electronic payments, exchange rate, financial, invoice, MasterCard, Merchant's, pricing, rate, receipt, transactions, visa, website

May 6th, 2014 by Elma Jane

Mobile commerce platform provider ROAM, an Ingenico company has expanded its mPOS solutions to include chip-and-PIN acceptance with the RP750x mobile card reader. The reader allows mPOS players to get to market quickly with their own custom-branded solution, providing merchants with a powerful set of features that include device and fraud management, remote application configuration, and an mPOS application that can be localized for any language and currency in any country. Features include: Backlit display, EMV PIN pad, magnetic stripe reader, NFC reader and smart card reader. Configurable through the cloud, enabling direct shipment from factory to any country. Connects with smartphones, tablets and feature phones via Bluetooth or audio jack. Customizable for branding and form factor. Just Slightly larger than a credit card, a compact form factor. PCI PTS 3.1 with SRED, EMV Level 1 and 2, Visa-ready (Compliant with the latest industry standards).

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Financial Services, Mobile Payments, Mobile Point of Sale, Near Field Communication, Payment Card Industry PCI Security, Point of Sale, Smartphone, smartSD Cards, Visa MasterCard American Express Tagged with: bluetooth, Chip and PIN, cloud, compliant, credit-card, currency, EMV, fraud, magnetic stripe reader, Merchant's, mobile card reader, Mobile commerce platform, mPOS solutions, nfc, PIN pad, smart card reader, Smartphones, tablets, visa

November 22nd, 2013 by Admin

As we move to smartphones and tablets as payment methods security and privacy concerns are a real issue. With recent NSA leaks shedding light on our data and the access others have to it, we have to consider security, privacy and health implications. This year alone e-commerce transactions on smartphones and tablets during the holiday season are set to grow by 15%. Although tablets, not smartphones will drive the bulk of that growth, smartphones are set to overtake mobile-commerce payments over the next 5 years. Tablet payments in the U.S. alone are expecting to reach $26 billion in transactions. Currently tablets are more convenient for m-commerce due to their size, but as far as the future of electronic payment processing, smartphones are where it’s at.

The smart merchant sees this coming and realizes frictionless transactions increase sales. The more comfortable and less complicated a transaction is for a customer, the better. Smartphones, tablets, PCs, laptops and more can already process electronic transactions from credit and debit cards, gift cards, electronic checks and more. Money movement is easier than ever and more convenient than cash. Cash is king however in situations where internet connectivity and power are an issue. In India for example, a poor electric grid makes power outages a common occurrence. During natural disasters, when resources are badly needed, power outages or severed internet communications mean no electronic transactions can be processed. So physical currency remains a must, in the future we may see payment technology evolve to where digital money like crypto currency (BitCoin) may be stored on the device itself similar to having cash. As these electronic payment systems evolve, merchants need to position themselves to accept what their market prefers to transact with.

The smart citizen also sees this coming and has concerns that things like a National ID program being established may compromise their privacy.

As an extreme example of electronic transactions, a nightclub in Spain used subdermally implanted RFID chips in a woman that allowed patrons to pay for food and beverages without a credit card.

Posted in e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Merchant Services Account, Near Field Communication, Smartphone Tagged with: bitcoin, cash, connectivity, credit, crypto currency, currency, debit cards, digital money, e-commerce, electronic, electronic checks, frictionless, Gift Cards, health, internet, laptops, leaks, m-commerce, Merchant's, mobile-commerce payments, money, national id, nsa, pay, payment methods, payment processing, PCs, privacy, processed, RFID, Security, smartphone, tablets, technology, transact, transactions