January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions

January 9th, 2017 by Elma Jane

The Travel industry payment experts! Why NTC?

NTC is the preferred payment processor for over 3,000 Travel Related Agencies.

High application approval rates while striving to eliminate holds & reserves is a big part of our Travel Merchant’s success.

Guaranteed Lowest Rates

Next Day Deposits

We Integrate with Trams & Sabre Red

Integration with a wide range of Booking Engines

Live US Based Concierge Service within three rings

Preferred by Many Associations including ASTA

NTC ePay Electronic Invoicing

Highest Approval Rating

Accept Payment from Anywhere in the World

Online Reporting and Processing Tools Included

Get the most from your Payment Processing Call Now 888-472-7112

Not all Travel Merchant Accounts Are The Same!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: merchant, online, payment, payment processing, payment processor, travel, travel industry, Travel Merchant

January 6th, 2017 by Elma Jane

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions

December 21st, 2016 by Admin

Ways to Prevent CHARGEBACK:

Provide Receipts for every single transaction. Receipt serves as a good reminder to the purchase they make and decreases the likelihood of a charge back. Have the conditions of sale written on the receipt

Be clear about refunds, returns and cancellation policies – include refund, return and cancellation policy on your website.

Make sure charge descriptions are clear. Use dynamic descriptors – with dynamic descriptors, you can include specifics like the product purchased, business name, business location and contact information. Include a number as part of the charge description.

Provide accurate descriptions of products and services – accurate product descriptions are particularly important for online ecommerce where customers often dispute transactions because the product they received is not as it was described online.

Get signed proof of delivery products – especially if you’re an online ecommerce vendors that ships products regularly.

Communicate with customers about renewals – if your customer accounts are set to automatically renew, make sure you notify those customers of their renewal months leading up to the renewal day.

When a cardholder contacts their credit card-issuing bank and asks for a refund on a transaction for a purchase or service made on their card is called chargeback.

Most Common Reasons for Chargebacks:

Point-of-sale processing errors

Customer disputes like, customer doesn’t recognize the charge, customer claims they didn’t receive the item they ordered.

Fraud, or potential fraud (customer claims the transaction is fraudulent – the purchase was made with a stolen card).

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, ecommerce, fraud, online, point of sale, transaction

July 21st, 2016 by Elma Jane

Always ask for the card security codes:

CVV2 for Visa

CVC2 for MasterCard

CID for Discover and American Express.

Always use the Address Verification Service (AVS) and only process sales after receiving a positive AVS response.

Avoid using voice authorizations, unless absolutely necessary.

Billing descriptor must set up properly and shows your phone number. Customer can contact you directly if there is an issue,

Consider using the associations’ 3-D secure services:

Verified By Visa

SecureCode by MasterCard

A 3-D transaction confirmation proves card ownership and protects you from certain types of chargeback. An additional layer of security for online credit and debit card transactions.

Inform your customers by email when a refund has been issued or a membership service cancelled. Notify them of the date the refund was processed and provide a reference number.

Make available customer support phone number and email address on your website so that customers can contact you directly. You need to meet this requirement before opening a merchant account.

Make it easy for your customers to discontinue a recurring plan, membership or subscription. Have a no-questions-asked policy.

Notify your customers by email of each transaction and indicate that their cards will be charged.

Obtain a confirmation of delivery for each shipment.

Process refunds as quickly as possible.

Secure an authorization approval for every transaction.

Secure customers’ written or electronic signatures, for recurring payments or monthly fees. Giving you express permission to charge their cards on a regular basis.

Terms and conditions must be clearly stated on your website. Customers must acknowledge acceptance by clicking on an Agree or a similar affirmative button.

Transaction amount must never exceed the authorized amount.

You are required to reauthorize the transaction before settling it if an authorization approval is more than seven days old.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Merchant Services Account Tagged with: card, chargeback, credit, customer, debit, merchant, merchant account, online, sales, Security, service, transaction

June 30th, 2016 by Elma Jane

Let’s face it, it’s hard to build a customer email list if you continue getting declined. There’s a way for a customer to say YES!

Get Exclusive – let your customers know that you treat your email list to exclusive offers and information. Offering a special email customer only discount code or exclusive benefits to members on your email list.

Make it Creative – whether you’re collecting emails online or at the checkout counter, make it creative. Getting creative with how you sell your email program will help you get more YES at the point of subscription.

Offer Value – Give your customers something in return for their email address. Make your customers feel like they are receiving something rather than just giving out their personal information. Identifying what piques your customer’s attention and offering that as an added value to their email subscription, your customers will see value in giving out their information when they receive something in return.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customer, online

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

May 18th, 2016 by Elma Jane

Terminals are ready, but the software isn’t – many merchants have EMV capable equipment, but has not been activated yet because it still needs to be certified.

The certification process includes security and compatibility tests.

For a small merchant, all you need to worry about is your equipment or software is EMV certified.

For software, developers, terminal manufacturers needs to get certification before they can deploy their products to merchants.

So many merchants who want to accept EMV, are now just waiting for their POS system to get necessary upgrades, which they can’t do until they’re certified.

Slower Checkout Time – common complaint by consumers. Dipping takes several seconds longer than swiping the card. There’s also a chance of forgetting your card because you have to leave your card inserted while waiting for the transaction to get approved.

The fastest Path to EMV – Depending on the nature of your business, the risk of landing yourself for credit card fraud is slim. The easiest way is to contact your merchant account provider and they will tell you what equipment and software you need and how much it will cost.

For our retail customers, we have the iCT250, the smart and compact desktop device designed for maximum efficiency. iCT250 offers a smart and effective payment experience on minimum counter space. Accept all electronic payment methods including EMV chip & PIN, magstripe and NFC/contactless.

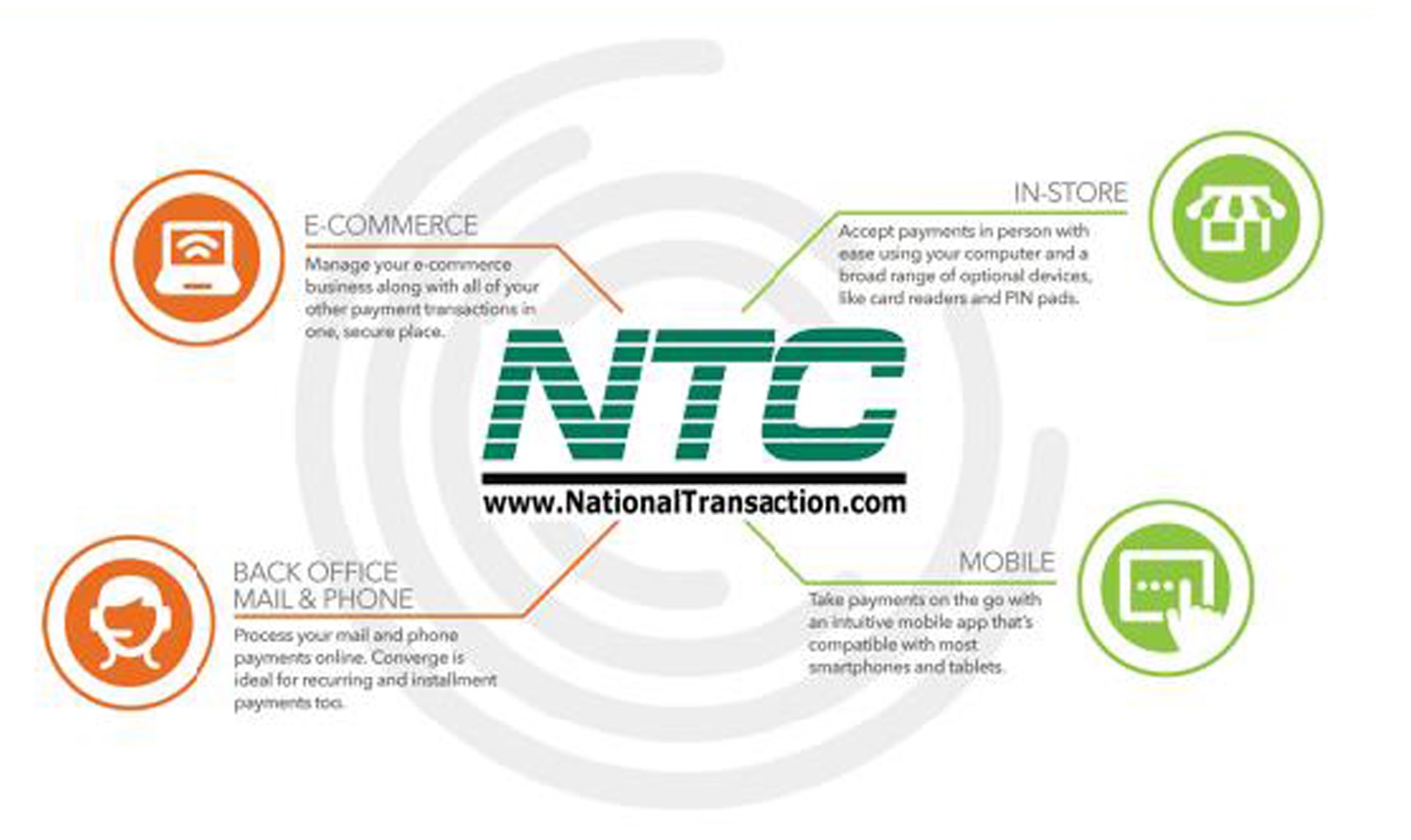

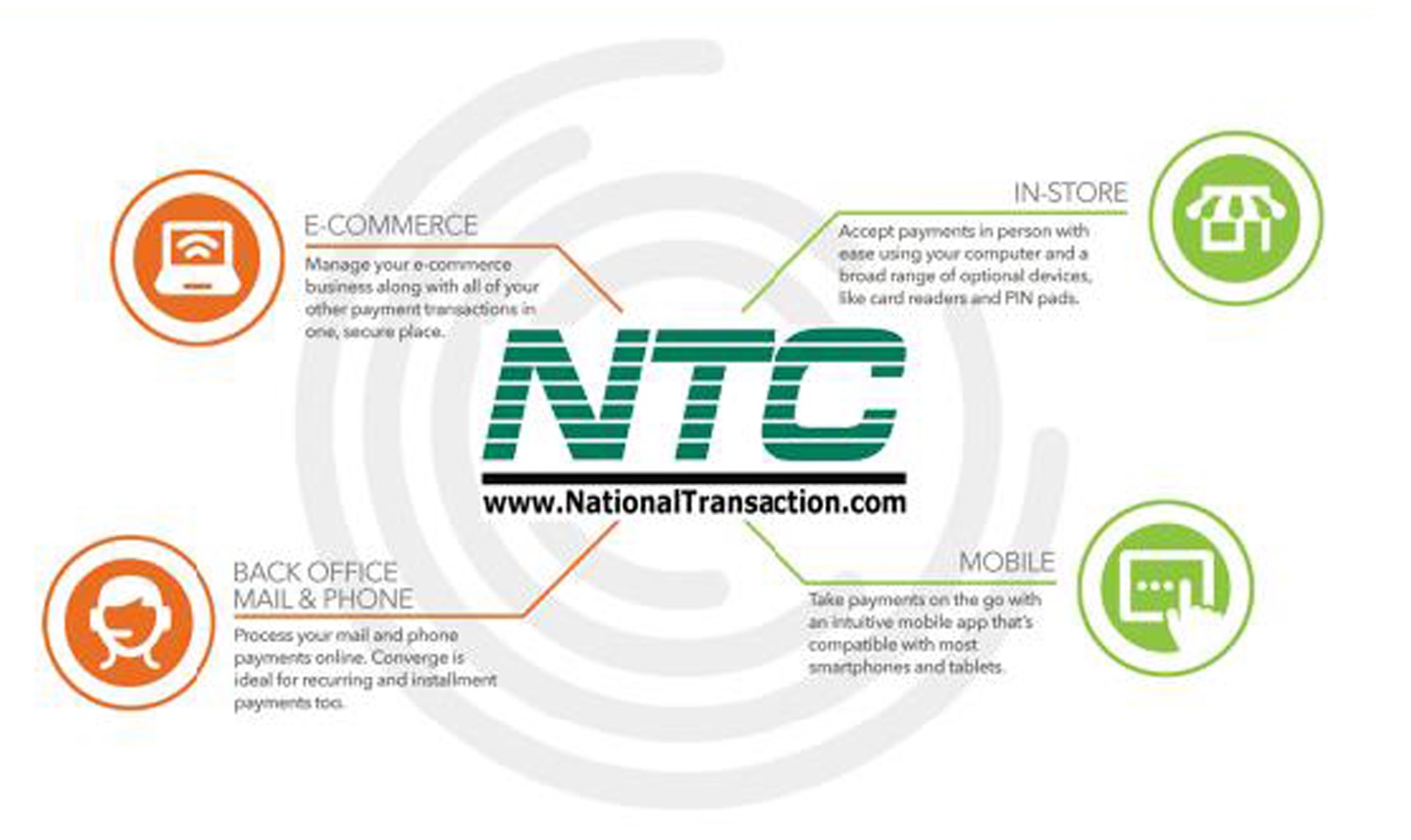

For card-not-present, we have our payment gateway platform that accepts payments your way Online, In-Store and On the Go.

- E-commerce – manage your e-com business along with all of your other payment transactions in one, secure place.

- In-Store – accept payments in person with ease using your computer and a broad range of an optional device, like card readers and PIN pads.

- Back Office Mail & Phone – Process you mail and phone payments online. Converge is ideal for recurring and installment payments too.

- Mobile – Take payments on the go with an intuitive mobile app that’s compatible with most smartphones and tablets.

For more details give us a call at 888-996-2273 or check out our website for our products and services.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Internet Payment Gateway, Mail Order Telephone Order, Merchant Account Services News Articles, Mobile Payments, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: card, card readers, Chip & PIN, consumers, contactless, credit card, customers, e-commerce, electronic payment, EMV, fraud, in-store, magstripe, merchant account, merchants, mobile, nfc, online, payment, payment gateway, PIN pads, POS, provider, Security, terminals, transaction

May 12th, 2016 by Elma Jane

Electronic commerce (eCommerce) is a type of business transaction, that involves the transfer of information on the Internet. This allows consumers to exchange goods and services with no barriers of time or distance electronically.

Business-to-Business (B2B) this refers to electronic commerce, between businesses rather than between a business and a consumer. These transactions electronically provide competitive advantages over traditional methods. It’s faster, cheaper and more convenient.

Creating a successful online store can be difficult if you don’t have knowledge of e-commerce and what it is supposed to do for your online business.

What do you need to have an online store?

- Shopping cart – an operating system that allows consumers to buy goods and or services. Track customers, and tie together all aspects of e-commerce into one.

- Or you can check out our NTC e-Pay no shopping cart Solution.

- Taking online payment by getting a merchant account and accept credit cards through an online payment gateway.

You just need to make a better decision in choosing the right shopping cart and a merchant account for your eCommerce shop.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: b2b, commerce, consumers, credit cards, customers, ecommerce, gateway, merchant, merchant account, NTC e-Pay, online, online payment, payment gateway, shopping cart, transaction

May 5th, 2016 by Elma Jane

Businesses or merchants accepting payments online needs an up-to-date and active security software that includes:

- FIREWALL PROTECTION – a software program that helps to screen out malware and hackers that try to reach you through the internet.

- ANTI-VIRUS PROGRAMS – Not all anti-virus program offers protection against all kinds of malware. Viruses are one type of malware. Spyware is another type of malware that can steal credit card information or your bank account.

Update:

- Keeping your operating systems, security software programs, and browser current can help secure your data information.

- Evaluate browser’s privacy settings, limit or disable cookies. Other cookies can be used maliciously and collect data information.

- Back up your data regularly. If your computer or device got compromised, you still have access to important files.

Need to set up an account give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank account, credit card, data, merchants, online, payments, Security