February 14th, 2017 by Elma Jane

Prevent Freeze, Holds, and Terminations

Common ways to prevent freezing; holds and termination to your account.

Minimize Chargebacks – chargeback should always be limited. An excessive number of chargeback whether won or lost is a red flag.

Minimize Fraud – if fraud is suspected, your account will be frozen pending an investigation.

One account per business type – if you have multiple businesses, you must have a separate account. If one account is being used for a different business altogether, that’s the quickest way for an account to be fully terminated.

Sell only the services or products you said you’d sell – selling other product or services could violate your Marketing Services Agreements.

Stay within your average monthly volume and ticket – an unusually high processing volume or average ticket is one of the fastest ways to get your funds held. To avoid this, notify your provider of an expected busy month. Call your provider for a large transaction before running it.

Use appropriate payment account types – card present (retail) and card-not-present accounts (internet). Card present means both customer and their credit card are present in the store. Card-not-present means card nor the person are not physically present at the time of the transaction. A large number of card present transactions on a card-not-present account or vice versa can result in a hold or termination of an account.

For Electronic Payments call now 888-996-2273 or got to www.nationaltransaction.com and click on get started

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargeback, electronic payments, fraud, provider

January 6th, 2017 by Elma Jane

Online fraud is not going away; hackers are becoming more sophisticated. While technology offer more avenues for consumers to pay, they also offer new ways for hackers to steal data.

There are several factors that increases the growth of online fraud:

EMV migration: because of EMV migration, fraud in face to face transactions becomes more difficult and moves to card-not-present transaction. This has been observed after EMV is implemented in other country.

Banking activity: it is moving online not only via online-only banks, but also mobile and online bank services.

An increase of online marketplaces: financial services pros are more proficient in identifying fraud compare to individual consumers who become sellers that can be victims of online fraud.

How can e-commerce and financial services companies reduce online fraud?

Merchants: Ensure that you have payment security. Fraudsters use sophisticated technologies, ask your payment provider for encryption and tokenization. You can also use BIN LookUp as an added security and number of benefits. Bin LookUp allows merchant or institution to check more about the transaction.

Online marketplaces: Marketplaces can protect their reputation by validating new sellers using sophisticated device and applying advanced models and machine learning to detect unusual patterns of activity that indicate misuse.

Banks: Fraudsters continue to innovate. Bank technology needs to be flexible and stay one step ahead.

For account set up or terminal upgrade call now 888-996-2273 or visit www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale Tagged with: banks, card-not-present, data, e-commerce, EMV, encryption, financial services, fraud, merchants, online, payment, provider, Security, terminal, tokenization, transactions

September 16th, 2016 by Elma Jane

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following features below, that you need from your Electronic Payments provider.

Advanced Security Options – 6 out of 10 small businesses close within six months of a card data breach, it is important that Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. NTC offer Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. The Top-tier security is important on your business’s data especially customer information, consider adding additional authentication procedures.

Fast Payment Processing – first step is having up-to-date technology, because some customers might leave, the sooner you have the money processed by your provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – obtaining the features you need from your payment services provider is very important. Look for a provider that appropriately addresses your payment concerns.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. Furthermore, the app works with most Apple and Android mobile devices. Accept a key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad or the new RP457c card reader.

Reliable Customer Support – NTC is available 24/7, the phones are answered by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is the most important feature of any business partnership you make. At NTC we are very passionate about that.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a payment service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

August 9th, 2016 by Elma Jane

Businesses are discouraged from storing credit card data, but many feel the practice is necessary in order to facilitate recurring payments. Merchants that need to store credit card data are doing it for recurring billing.

Using a third party vault provider is the best way to store credit card data for recurring billing, it helps reduce or eliminate the need for electronically stored cardholder data while still maintaining current business processes. The risk of storing card data is removed from your possession and you are given back a token that can be used for the purpose of recurring billing, by utilizing a vault. Modern payment gateways allow card tokenization.

Any business that storing data via hard copy needs to review and follow PCI DSS requirement in order for the electronic storage of cardholder data to be PCI compliant. Appropriate encryption must be applied to the PAN (primary account number). In this situation, the numbers in the electronic file should be encrypted either at the column level, file level or disk level.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: cardholder, credit card, data, merchants, payment gateways, payments, PCI, provider, tokenization

August 3rd, 2016 by Elma Jane

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions

July 13th, 2016 by Elma Jane

Monthly statement fee is a fixed fee that is charged monthly and is associated with the statement that is sent to a merchant in one billing cycle, approximately 30 days worth of credit card processing by the merchant account provider; whether it’s a printed one, a mailed statement or an electronic version. Requesting online statements won’t necessarily be able to waive statement fee.

Every credit card and merchant account provider have a different set of costs associated with its services, but remember that there are several processors out there that are very transparent with their fees like National Transaction.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, fee, merchant, merchant account, processors, provider, services

May 18th, 2016 by Elma Jane

Terminals are ready, but the software isn’t – many merchants have EMV capable equipment, but has not been activated yet because it still needs to be certified.

The certification process includes security and compatibility tests.

For a small merchant, all you need to worry about is your equipment or software is EMV certified.

For software, developers, terminal manufacturers needs to get certification before they can deploy their products to merchants.

So many merchants who want to accept EMV, are now just waiting for their POS system to get necessary upgrades, which they can’t do until they’re certified.

Slower Checkout Time – common complaint by consumers. Dipping takes several seconds longer than swiping the card. There’s also a chance of forgetting your card because you have to leave your card inserted while waiting for the transaction to get approved.

The fastest Path to EMV – Depending on the nature of your business, the risk of landing yourself for credit card fraud is slim. The easiest way is to contact your merchant account provider and they will tell you what equipment and software you need and how much it will cost.

For our retail customers, we have the iCT250, the smart and compact desktop device designed for maximum efficiency. iCT250 offers a smart and effective payment experience on minimum counter space. Accept all electronic payment methods including EMV chip & PIN, magstripe and NFC/contactless.

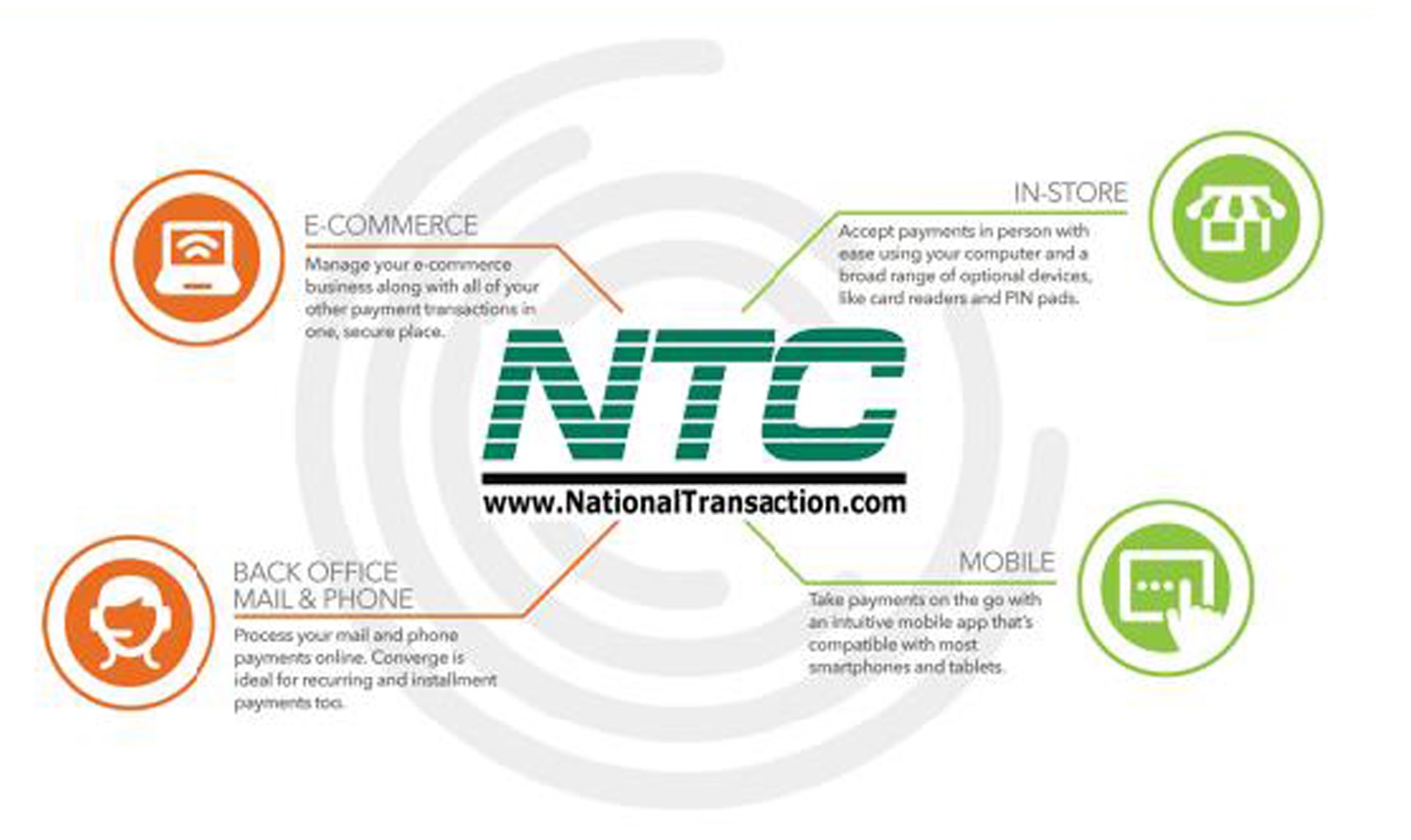

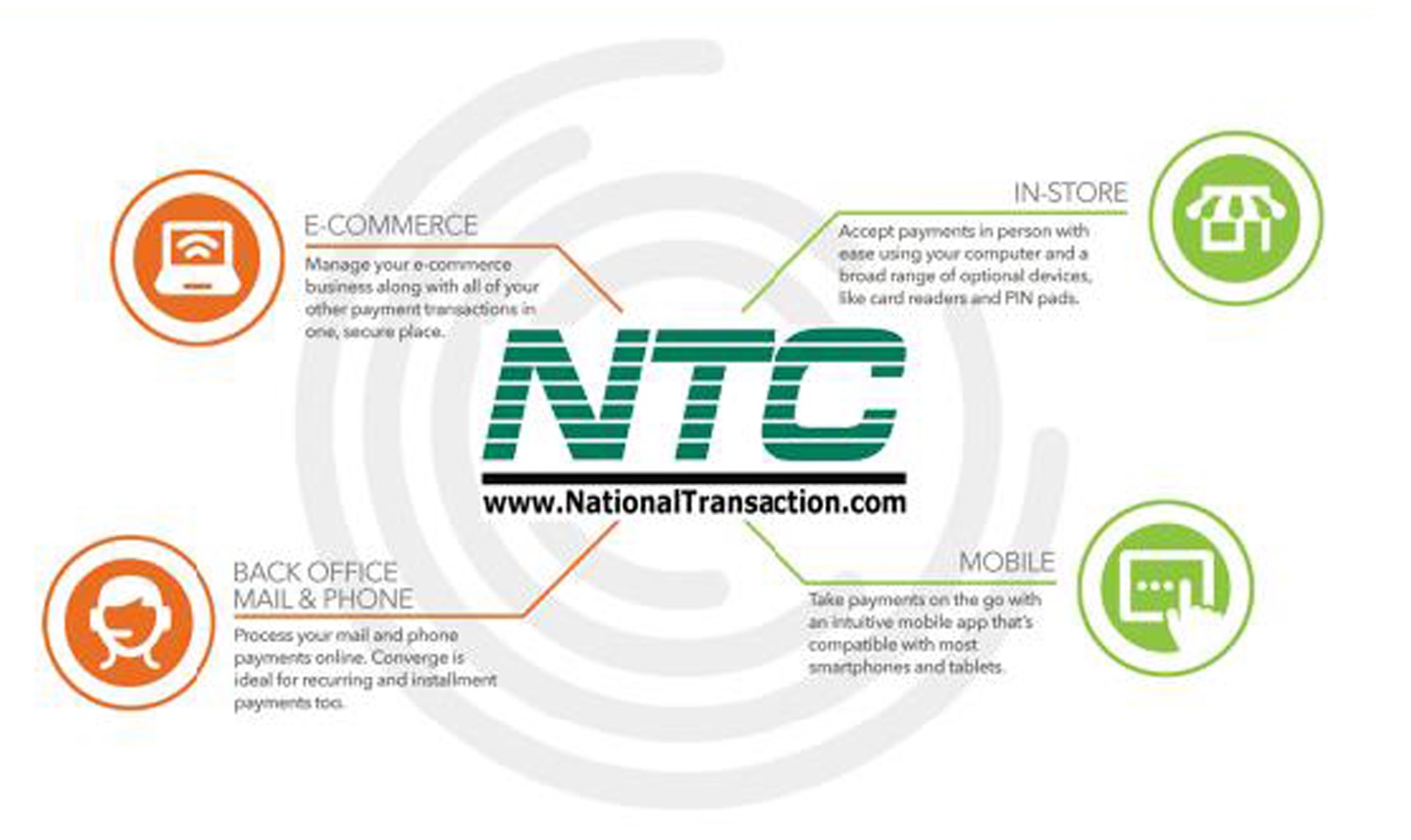

For card-not-present, we have our payment gateway platform that accepts payments your way Online, In-Store and On the Go.

- E-commerce – manage your e-com business along with all of your other payment transactions in one, secure place.

- In-Store – accept payments in person with ease using your computer and a broad range of an optional device, like card readers and PIN pads.

- Back Office Mail & Phone – Process you mail and phone payments online. Converge is ideal for recurring and installment payments too.

- Mobile – Take payments on the go with an intuitive mobile app that’s compatible with most smartphones and tablets.

For more details give us a call at 888-996-2273 or check out our website for our products and services.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Internet Payment Gateway, Mail Order Telephone Order, Merchant Account Services News Articles, Mobile Payments, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: card, card readers, Chip & PIN, consumers, contactless, credit card, customers, e-commerce, electronic payment, EMV, fraud, in-store, magstripe, merchant account, merchants, mobile, nfc, online, payment, payment gateway, PIN pads, POS, provider, Security, terminals, transaction

December 18th, 2015 by Elma Jane

A leading provider of mobile point of sale and mobile payment technology, published today the EMV Migration Tracker.

Many merchants have deployed EMV capable terminals while cardholders have received cards with EMV chips, but not much data has been published about the real world use of EMV chip card technology in the U.S. Most published statistics rely on surveys or forecasts rather than real transactional data.

The EMV Migration Tracker shows new data and insights since the October 1 liability shift, including:

- Over 50% of all cards in use now have EMV chips on them. From October to November, the percent grew 5% as banks and card issuers accelerated their rollout of new chip cards.

- Over 83% of American Express cards have EMV chips, while Discover lags at 40%

- Over 63% of the cards used in Hawaii have EMV chips, but Mississippi sees just 11% penetration of chip cards.

While EMV chip card technology has been implemented in Europe years ago, the rollout of EMV in the U.S is just beginning. The rollout came earlier this year with the October 1 liability shift in card present transaction, meaning that merchants who have not upgraded their POS system can become liable for counterfeit card fraud losses that occur at their stores. This is an early step in an ongoing process that the Payments Security Task Force predicts will lead to 98 percent of U.S. credit and debit cards containing EMV chips by the end of 2017.

http://www.finextra.com/news/announcement.aspx?pressreleaseid=62506

Posted in Best Practices for Merchants Tagged with: American Express, banks, card issuers, card present, card technology, cardholders, chip cards, credit, data, debit, Discover, EMV, EMV chips, merchants, mobile payment, mobile point of sale, payment technology, point of sale, POS, provider

September 11th, 2014 by Elma Jane

Every year Americans take more than 59 million trips abroad. Yet many of us don’t know which questions to ask regarding the use of credit cards. Before you hit the road, let your card issuer know where and when you’ll be traveling, so it doesn’t mistake those overseas charges with fraudulent activity. Start asking some questions below:

Does my card charge a foreign transaction fee? Because these fees can run as high as 3% and can be quite costly.

Does my card have an EMV chip? A smart chip widely used in Europe and other places. Contact your credit card provider and see if they can provide you at no cost a chip-and-PIN card if you don’t already have one. Most of the card companies are moving this way, but typically you have to request it.

Does my card offer any travel perks? You may want to inquire about additional coverage your card may provide you when you’re abroad such as insurance for accidents, lost luggage or auto collision.

How can I get cash overseas? Reach out to the bank or credit card provider and find out what relationships they have in the local market you’re traveling to. This will be helpful for avoiding ATM fees. Additionally, if you need to access cash from your credit card, they’ll be very helpful if you do it through a banking institution that has a relationship with your provider.

Will my card be accepted at my destination? Thirty to sixty days before traveling contact your bank or credit card provider and ask some important questions. Find out if their card is going to be accepted or if there will be any restrictions for it to be used abroad.

The best thing to do is to have a plan before you travel. Know how to minimize your fees and protect your credit cards. Then you can enjoy your adventure.

Posted in Uncategorized Tagged with: atm, ATM fees, bank, banking, banking institution, card, card issuer, chip, Chip and PIN, chip-and-PIN card, credit card provider, credit cards, EMV, EMV chip, fee, fees, foreign transaction fee, institution, PIN, provider, transaction, transaction fee, travel

September 10th, 2014 by Elma Jane

Merchant go into business to make a sale. They go to great length to advertise their business and then they make a sale and don’t track it… They don’t track the very customer they went into business to attract…That seems crazy…But now more companies are embracing the practice of collecting email addresses at the point of sale (POS) and they’re doing so with increasing regularity. An example, when customers are at the cash register, many brick-and-mortar stores now offer to email them receipts

Confidently collect email addresses at POS:

Your email service provider should be able to implement a text-to-join acquisition program for you that executes quickly and can be built specifically to mitigate the risks around POS data collection.

Instead of relying on sales associates to accurately input email addresses, your customers can use SMS to text their email addresses to your short code.

Customers receive an immediate SMS reply message letting them know to check their email for their receipt.

A mobile-optimized receipt is immediately emailed to the address.

This can be followed by an email inviting customers to join your company’s email program. Offering a purchase discount can increase opt-ins. New joiners can be sent an age verification email, if relevant.

Your welcome email, including discount coupon, is sent and the relationship starts off on the right foot.

Increasing your confidence about POS email address collection, a text-to-join program can increase your acquisition rates. It can engage those customers who prefer to provide their information privately via their mobile devices. It can help protect companies against potential blacklisting because of typos and confirmed opt-ins. It can even reduce overhead costs by saving sales associates valuable time. Understanding these important email address collection issues and adopting the prescribed best practices are critical to ensuring customers have a safe, positive and valuable experience with your company at the point of sale and beyond.

Virtual Merchant can collect data too, and as a provider we can help merchant use that data. We are committed to providing appropriate protection for the information that is collected from customers who visit the website and use the Virtual Merchant payment system. Policy Privacy is updated from time to time.The website is provided to our customers as a business service and use of the site is limited to customers only.

If the merchant never makes a sale before 10 why do they open at 9 ?? This is only one small example on how collecting data first and then analyzing that data can shape businesses and find money you may be throwing away ….

Posted in Best Practices for Merchants, Mobile Point of Sale, Point of Sale Tagged with: brick and mortar, business, cash, cash register, customers, data, discount, discount coupon, email, merchant, mobile, Mobile Devices, payment, payment system, point of sale, policy, POS, provider, purchase, Rates, receipts, sale, service, sms, store's, virtual merchant, website