August 27th, 2014 by Elma Jane

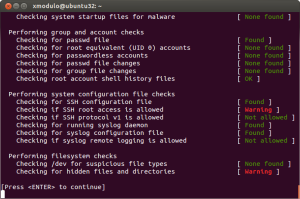

Backoff malware that has attacked point of sale systems at hundreds of businesses may accelerate adoption of EMV chip and PIN cards and two-factor authentication as merchants look for ways to soften the next attack. Chip and PIN are a big thing, because it greatly diminishes the value of the information that can be trapped by this malware, said Trustwave, a security company that estimates about 600 businesses have been victims of the new malware. The malware uses infected websites to infiltrate the computing devices that host point of sale systems or are used to make payments, such as PCs, tablets and smartphones. Merchants can install software that monitors their payments systems for intrusions, but the thing is you can’t just have anti-virus programs and think you are safe. Credit card data is particularly vulnerable because the malware can steal data directly from the magnetic stripe or keystrokes used to make card payments.

The point of sale system is low-hanging fruit because a lot of businesses don’t own their own POS system. They rent them, or a small business may hire a third party to implement their own point of sale system. The Payment Card Industry Security Standards Council issued new guidance this month to address security for outsourced digital payments. EMV-chip cards, which are designed to deter counterfeiting, would gut the value of any stolen data. With this magnetic stripe data, the crooks can clone the card and sell it on the black market. With chip and PIN, the data changes for each transaction, so each transaction is unique. Even if the malware grabs the data, there not a lot the crooks can do with it. The EMV transition in the U.S. has recently accelerated, driven in part by recent highprofile data breaches. Even with that momentum, the U.S. may still take longer than the card networks’ October 2015 deadline to fully shift to chip-card acceptance.

EMV does not by itself mitigate the threat of breaches. Two-factor authentication, or the use of a second channel or computing device to authorize a transaction, will likely share in the boost in investment stemming from data security concerns. The continued compromise of point of sale merchants through a variety of vectors, including malware such as Backoff, will motivate the implementation among merchants of stronger authentication to prevent unauthorized access to card data.

Backoff has garnered a lot of attention, including a warning from the U.S. government, but it’s not the only malware targeting payment card data. It is not the types of threats which are new, but rather the frequency with which they are occurring which has put merchants on their heels. There is also an acute need to educate small merchants on both the threats and respective mitigation techniques.. The heightened alert over data vulnerability should boost the card networks’ plans to replace account numbers with substitute tokens to protect digital payments. Tokens would not necessarily stop crooks from infiltrating point of sale systems, but like EMV technology, they would limit the value of the stolen data. There are two sides to the equation, the issuers and the merchants. To the extent we see both sides adopt tokenization, you will see fewer breaches and they will be less severe because the crooks will be getting a token instead of card data.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Point of Sale Tagged with: access, account, account numbers, anti-virus programs, authentication, Backoff, card, card networks, chip, credit, Credit card data, credit-card, data, data breaches, devices, digital payments, EMV, magnetic stripe, Malware, Merchant's, Payment Card Industry, payments, PCs, PIN, PIN cards, point of sale, POS, POS system, programs, Security, security standards, Smartphones, software, system, tablets, tokenization, tokens, transaction, Trustwave, websites

July 15th, 2014 by Elma Jane

Businesses only stand to benefit by making themselves accessible via mobile devices. With a mobile website or mobile app, businesses can boost sales, retain loyal customers and expand their reach. The question is, which type of mobile presence is best for your business Or should you have both? Both mobile websites and mobile apps let customers find and access your business from devices they use the most, but a mobile website and mobile app are not the same thing. To help you decide, check out the differences between the two and how they can benefit your business.

Mobile App – is a smartphone or tablet application. Unlike a mobile website, a mobile app must be downloaded and installed, typically from an app marketplace, such as the Apple App Store or Android’s Google Play store.

Mobile Website – is designed specifically for the smaller screens and touch-screen capabilities of smartphones and tablets. It can be accessed using any mobile devices Web browser, like Safari on iOS and Chrome on Android. Users simply type in the URL or click on a link to your website, and the website automatically detects the mobile device and redirects the viewer to the mobile version of your website.

Mobile website’s benefits

The primary benefit of a mobile website is that it makes regular websites more accessible for mobile users. It can have all the same elements as the regular version of the website, such as its look and feel, pages, images and other content, but it features a mobile-friendly layout that offers improved readability and functionality when viewed on a smartphone or tablet. By having a mobile website, customers can access your website anytime, anywhere using any device, without compromising the user experience.

Mobile app’s benefits

Although a mobile app functions a lot like a mobile website, a mobile app gives businesses the advantage of having their own corner on a customer’s device, because users have to download and install the app, businesses have more control over their presence on a device than they would with a mobile website. For instance, a mobile app can be closed or inactive, but still work in the background to send geo-targeted push notifications and gather data about customer’s preferences and behaviors. Moreover, mobile apps make it easy to deploy loyalty programs and use mobile payments using a single platform. It’s also much easier to access a mobile app than a mobile website all it takes is one tap, versus having to open a Web browser then type in a URL.

Mobile website and Mobile app features

Although mobile websites and mobile apps aren’t the same thing, they generally offer the same features that can help grow your business by making it easier for customers to find and reach you.

Features include the following:

Click-to-map: Users can use their devices’ GPS to locate your business and instantly get directions, without having to manually input your address.

Mobile commerce: Take your online store mobile with e-commerce-capable mobile websites and apps, such as with Buy Now buttons and mobile carts.

One-click calling: Users can call your business simply by tapping on your phone number from your website or app.

Social sharing: This feature integrates social media apps and websites to enable users to easily share content with friends and followers.

Mobile marketing: This lets users sign up for marketing lists and loyalty programs while enabling businesses to easily launch location-based text-message marketing and email marketing campaigns.

How to build a mobile app

Just like the options available for building a mobile website, businesses can either hire an app developer to build a mobile app or take the budget-friendly DIY mobile app maker route.

How to build a mobile website

To build a mobile website, one option is to hire a mobile Web developer to create one from scratch or convert an existing website into a mobile-friendly one. A more affordable option is to build one yourself with a free DIY mobile website builder, which uses a drag-and-drop platform that doesn’t require programming or Web design skills.

Posted in Uncategorized Tagged with: Android's Google Play, Apple App, Chrome, customers, data, devices, e-commerce, email marketing, GPS, iOS, mobile, mobile app, mobile carts, Mobile Devices, mobile website, platform, programs, Safari, smartphone, tablet, URL, Web browser

April 17th, 2014 by Elma Jane

Issuers participating in the MasterCard Rewards Platform can pursue greater engagement and value in their programs through a partnership MasterCard is announcing today with Points International Ltd. The companies say they struck the deal to take advantage of the popularity of travel and related experiences. Under the agreement, participating issuers can let their cardholders to exchange and trade earned airline miles, hotel points and loyalty currencies.

Travel happens to be one of the most popular redemption options for points on most programs today. So this is really about enabling consumers to get even more choice with regard to getting some redemption options.

Issuers individually will roll out the program later this year based on their own schedules. Any of the hundreds of banks that use the MasterCard Rewards Platform are eligible to participate. Participation is voluntary.

Enhanced flexibility in cardholder reward redemptions was a key driver behind the initiative, what this partnership allows to do is enable all customers that have points that they’ve gained from spending on their credit cards or debit cards to then exchange those points into a miles program or a hotel program that they tend to always have a lot of other points accumulated already.

Variable Exchange Rates

Cardholders will be provided with a conversation ratio applicable to the pair of rewards being exchanged. Ratios will differ by redemption transaction. Consumers also may choose to transfer small buckets of rewards points into one program and the rest in other programs. They can do transfers multiple times and across multiple rewards providers.

Posted in Best Practices for Merchants, Credit card Processing, Gift & Loyalty Card Processing, Travel Agency Agents Tagged with: airline, airline miles, banks, cardholder, credit cards, debit cards, hotel, loyalty, MasterCard, platform, programs, reward, rewards, transaction, transfers, travel, travel related