January 24th, 2017 by Elma Jane

How to set up a travel merchant account?

First, you need to find a Merchant Service Provider.

Put together your business profile so you can start applying for a merchant account.

There are questions that you’ll need to answer, that way merchant account providers have an idea of how they should set up your account.

Some of the questions are:

Is your business seasonal?

For Travel Agencies or Tour Operators, it is seasonal, there will be high and low volume. NTC works with seasonal downtime.

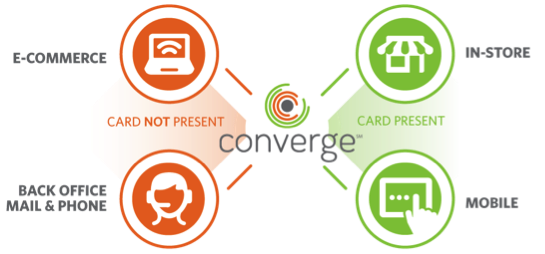

How do you intend to accept payments?

Different business models require different methods of accepting payments.

If you’re doing face to face transaction and have a physical location then you need a credit card terminal.

If you process checks, then you need Electronic Check and ACH Transfers.

For e-Commerce shopping carts, wireless/mobile, you can check out our Converge Virtual Merchant and NTC e-Pay.

How much volume do you plan on processing?

Merchant account providers are going to want to know how much sales volume you plan on processing per month.

If you’re new in the business – give just an estimate average of how much you’ll be processing (per month), within the first 6-months of operation.

if you’ve been in the business – you’ll already have this number ready.

What will be your average ticket price?

Example:

Total Sales Revenue = $150,000

Total Number of Sales = 500 150,000/500 = $300 (Average Ticket Price)

If you need to setup an account give us a call at 888-996-2273 or use our contact form.

Posted in Best Practices for Merchants Tagged with: ach, credit card, e-commerce, E-Pay, Electronic Check, merchant account, merchant service provider, mobile, payments, shopping carts, terminal, transaction, travel, virtual merchant

March 9th, 2016 by Elma Jane

Lisa an independent Travel agent started her business in October 2006. She has been using her bank as their credit card processor and use to do a manual type-in process. When she learned about NTC while trying to shop online because she thinks it’s time for her to upgrade her system, Lisa found that NTC is not only a payment expert when it comes to travel, but a technology expert as well that met her business’s needs.

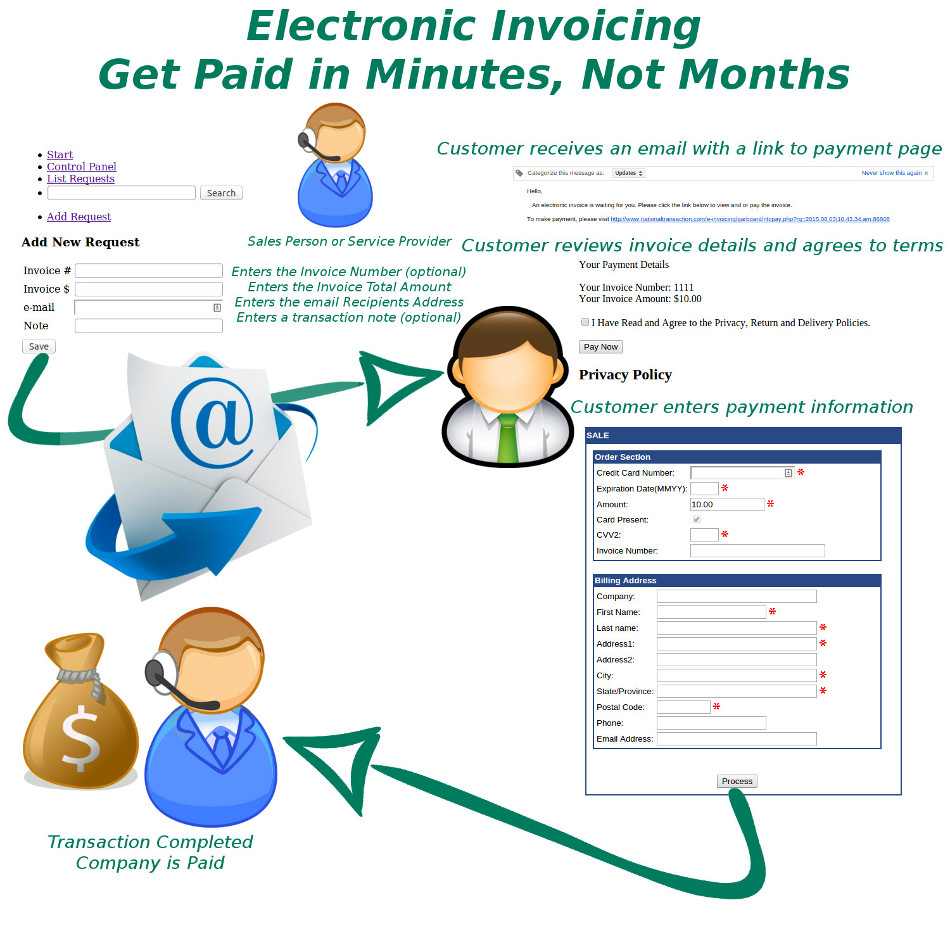

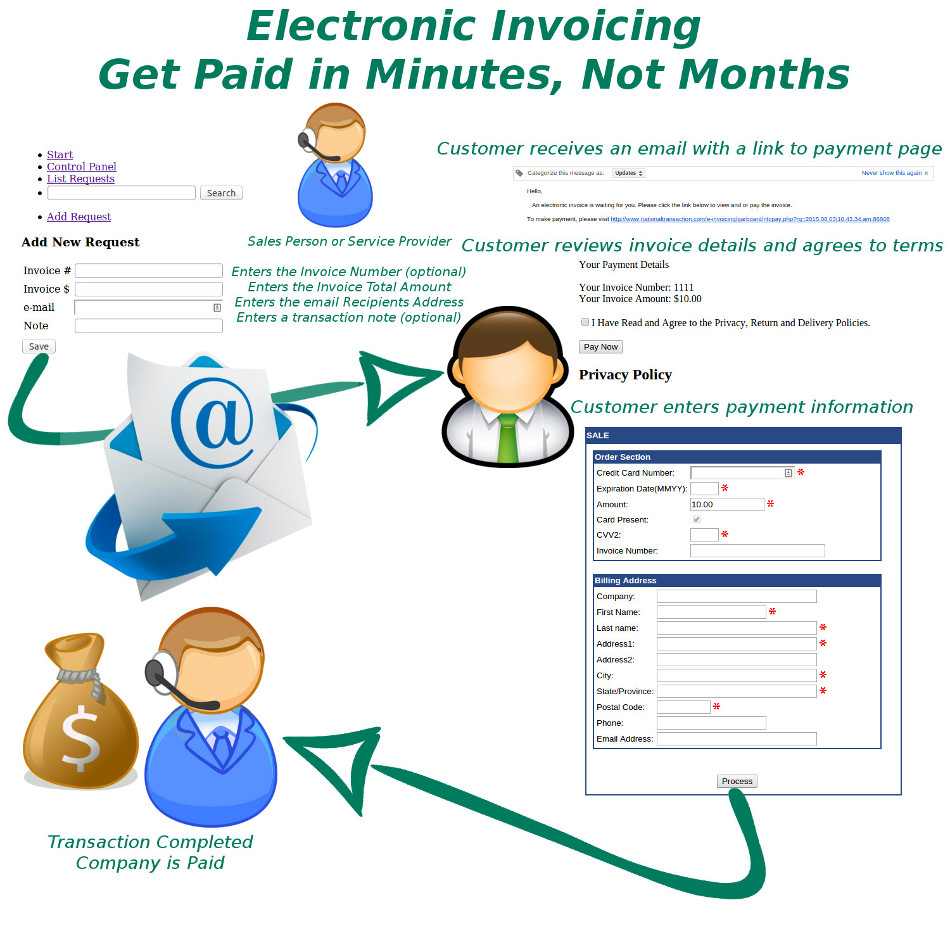

Lisa is using NTC e-Pay an electronic invoicing that has streamlined their credit card processing. The process not only has it saved money with competitive rates but most importantly it saves time. The level of assistance provided went above and beyond what she expected.

NTC e-Pay is for all types of merchants in a Card-Not-Present Transaction.

Consumer Acess – consumer will have access to their transaction details on their device. For travel merchants, the consumer can have access to their itinerary while on the go!

Customizable Pricing – when custom pricing becomes an issue, shopping carts, POS systems and booking engines tend to get really complicated.

Fast – saves time and unnecessary cost. Moves money efficiently and effectively. Simply email payment request that can be paid in 2 simple steps.

- The customer receives an email with a link to the payment page. Customer reviews invoice details and agrees to terms. The customer enters payment information.

- Process, transaction is completed company is paid. You get paid in minutes, not months.

Protects you from Chargeback – the customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy.

Secured – credit card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

The no shopping cart e-Commerce solution! – avoids the complexities of a shopping cart or integration into an accounting or POS.

Thinking of upgrading your system give us a call at 888-996-2273 and know more of our NTC e-Pay platform.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, consumer, credit card, Electronic invoicing, merchants, online, payment, POS, processor, shopping carts, transaction, travel, travel agent

April 7th, 2014 by Elma Jane

Integrate Cloud-Based Platforms

E-commerce businesses increasingly rely on cloud-based applications, such as hosted shopping carts, analytics platforms, cloud-based accounting, customer service tools, and more.

To operating smoothly, a merchant’s cloud-based apps should integrate with each other, to save time and to otherwise prevent data loss and ensure accurate reporting.

It’s important, therefore, to have an integration mindset when choosing and using software-as-a-service solutions.

Some tips:

Ask Around

As with evaluating any vendor for your company, go beyond the company’s website. Ask the vendor about other customers. Get references. Contact those companies and ask how the platform is working. Is it easy to set-up? Does it integrate seamlessly with other apps? How long does it take to transfer data from one app to the other? These are just some of the questions you need to ask when evaluating an app. Also check social media sites for any discussions pertaining to the program. Read what people are tweeting. Check relevant LinkedIn groups.

Check the Company’s Integrations Page or API

When evaluating a software-as-a-service (SaaS) solution, first determine if it integrates with the platforms that you’re already using. Pre-built integrations will save much time. Alternatively, if a company has an application programming interface (API), use it to integrate the app with your existing systems.

If you can’t find the integration you need or if you want to avoid the API option, contact the vendor directly and ask if it can make its platform sync with your existing solutions. Don’t underestimate the power of reaching out to your vendors.

Use Cloud App Integration Services

Another option is to use SaaS integration services. You have plenty of choices, depending on what you need to connect. If you just need to integrate two apps, like Dropbox to Gmail, for instance, you can use (IFTTT) If This Then That – a service that lets you assign triggers and actions to each app through a drag-and-drop interface. When one program does something, it will automatically trigger another app to perform an action. For example, you can create a recipe wherein all your Gmail attachments are automatically saved to your Dropbox folder. IFTTT is free to use, to integrate up to 80 apps.

A similar service, Zapier, lets you do the same thing, but on a larger scale. It supports more than 250 applications, including Salesforce, Zoho CRM, Xero accounting, Campaign Monitor email, and more. Zapier is free for five integrations. It also offers Basic, Business, and Business Plus plans that cost $15, $49, and $99 per month, respectively.

IFTTT and Zapier work well to integrate two cloud applications. However, if you’re running a combination of cloud and on-premise applications, or if you have an ecosystem of apps and data sources that have to connect and exchange data, you need more sophisticated options.

That’s where services such as Dell Boomi and SnapLogic come in. Like IFTTT and Zapier, these solutions use a drag-and-drop interface, but at a larger scale. They connect multiple combinations of cloud and on-premise applications.

Use Free Trials

Always test-drive your apps or integration services. Most SaaS platforms offer free trials. Take note of user-friendliness, functionality, and observe how they function with programs you already have.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Financial Services, Internet Payment Gateway, Payment Card Industry PCI Security, Small Business Improvement, Visa MasterCard American Express Tagged with: api, apps and data sources, cloud applicaitons, cloud based applications, cloud based apps, cloud-based accounting, customer service, dropbox, e-commerce, ecommerce, exchange data, existing systems, gmail, integration, SAAS, salesforce, shopping carts, social media, software-as-a-service, sync, zapier