Category: e-commerce & m-commerce

April 15th, 2016 by Elma Jane

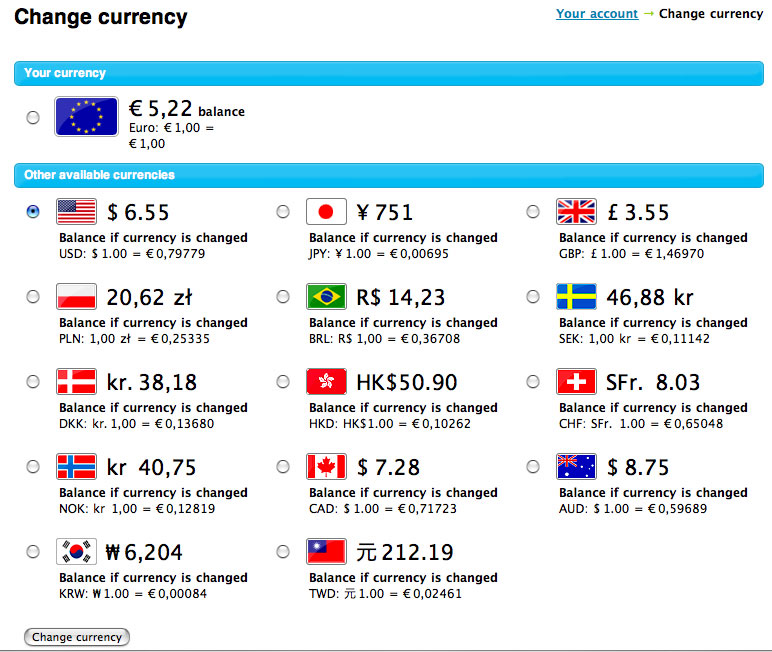

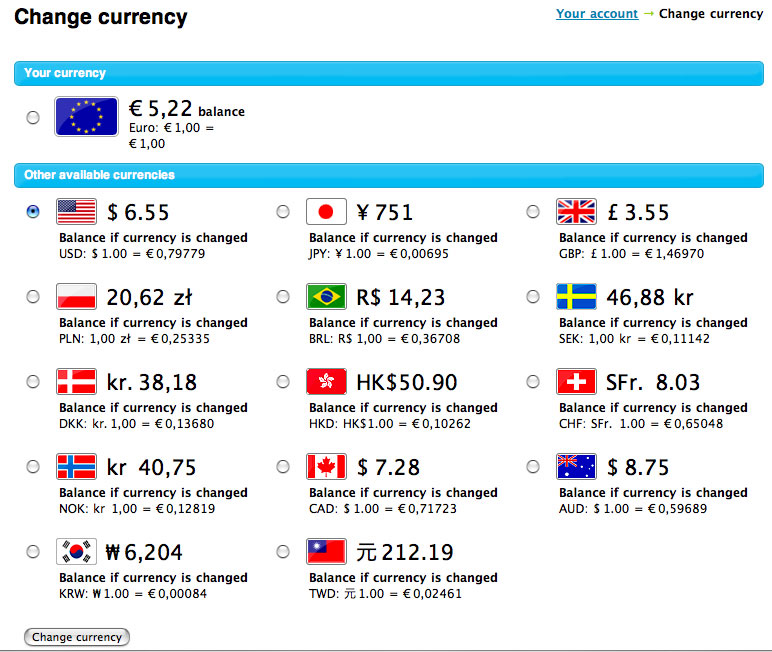

Dynamic Currency Conversion

- Five supported currencies

- Retail, Restaurant, MOTO, E-commerce

- Price listed in merchant’s currency

- Customer is aware of currency conversion

- Customer may opt-out at the point of sale

- Conversion occurs at the point of sale

- Merchants may choose settlement method & time

- Supported by terminals, viaWarp and Virtual Merchant

- Merchant rebate up to 100bp

Multi-Currency Conversion

- 100+ supported currencies

- E-commerce only

- Price listed in customer’s currency

- Customer is not aware of currency conversion

- Customer may not opt-out at the point of sale

- Conversion occurs between the point of sale and settlement

- All transactions auto settle at 6pm (eastern) daily

- Supported by Internet Secure or direct certification

- No merchant rebate

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Merchant Account Services News Articles, Travel Agency Agents Tagged with: currency, Currency Conversion, customer, e-commerce, merchants, moto, point of sale, terminals, virtual merchant

April 14th, 2016 by Elma Jane

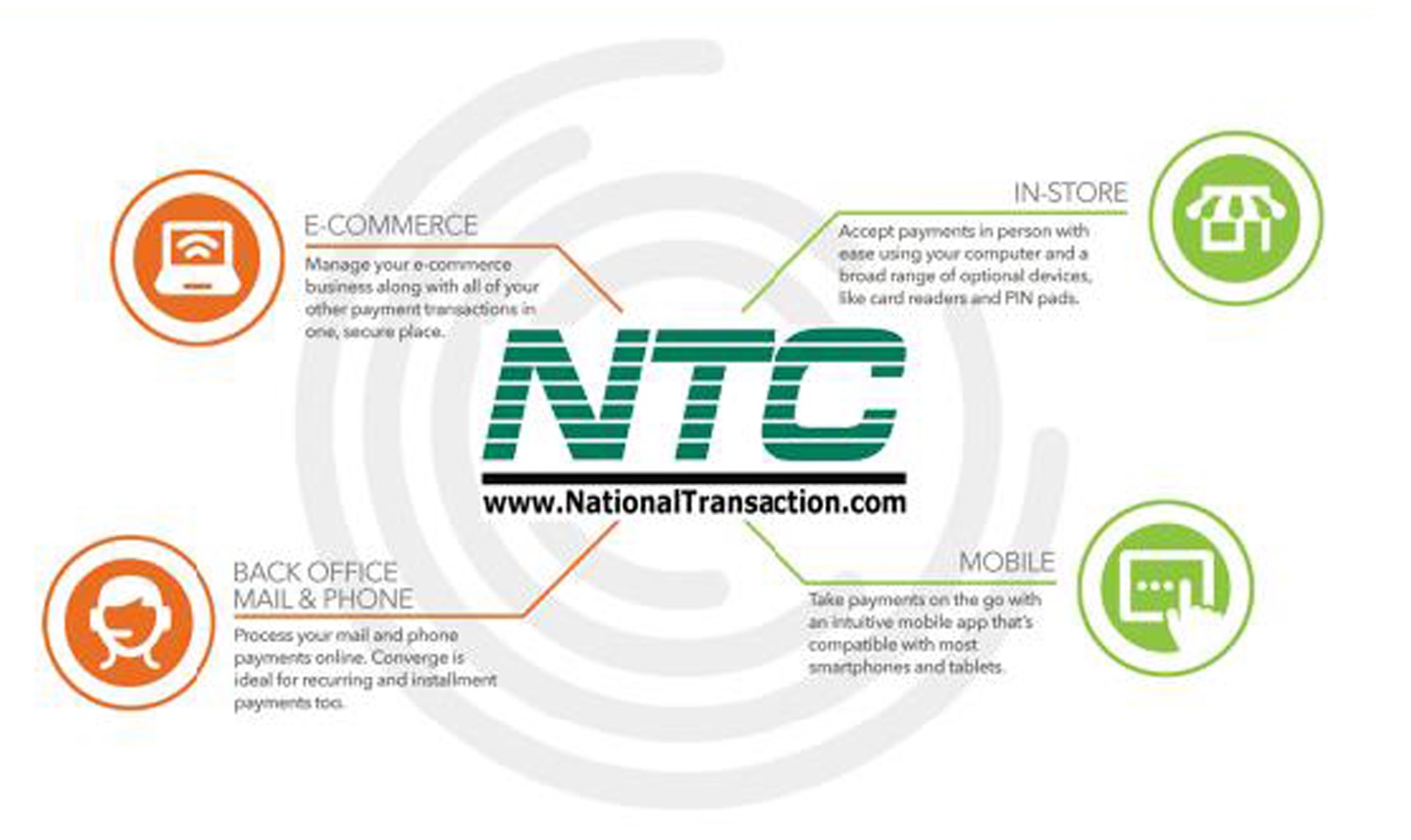

Accepting credit card payments is a must if you’re planning to start a business. It’s good to know what is out there and how it applies to your situation. So you need to learn about credit card processing machines, depending on your business.

Here are some of the different types of credit card processing machines:

Dial-Up Terminal – the grandfather of credit card processing machines. Dial-up terminals use a phone line to connect with a credit card processing company. The advantage is that they are normally inexpensive than some higher-end options. The disadvantage is slower processor speed.

IP Terminal – connect the merchant over a high-speed internet connection. The advantage of IP terminal over dial-up terminal is speed. IP machines can process transactions as fast as 3 seconds as opposed the 10 to 25 seconds that a dedicated dial-up machine might take. IP terminals now cost about the same as dial-up units and that a single DSL link can accommodate more than one credit card terminal.

Wireless Terminals – the priciest yet most convenient type is a wireless machine that runs on a wireless network, much like your mobile phone.

Virtual Terminal – virtual terminals are computers running credit card processing software connected to a credit card reader. Virtual terminals are a great addition to an office because they don’t require a standalone credit card processing terminal.

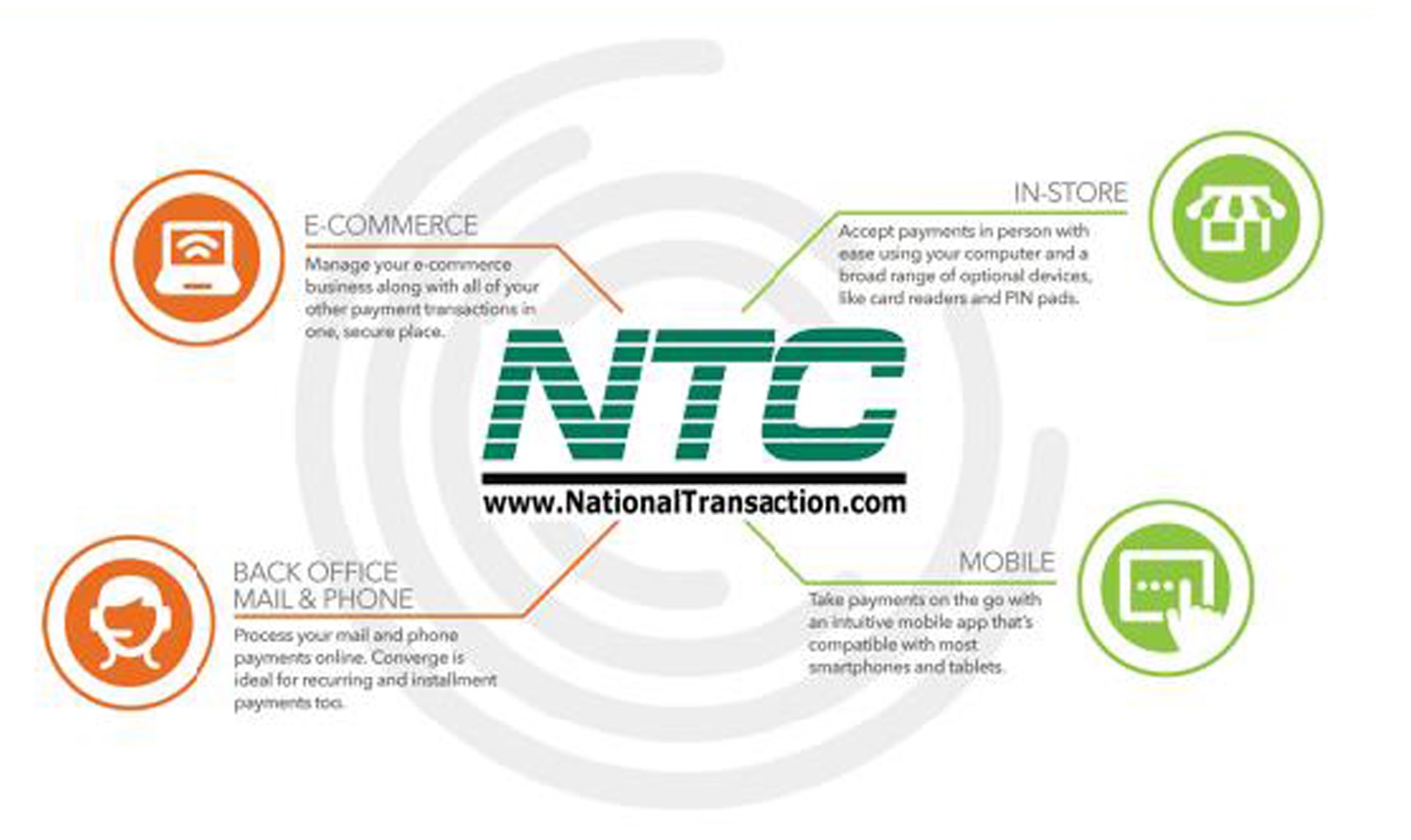

There are many options available for your business, whether you’re e-Commerce, MOTO, In-Store or Mobile there’s a credit card processing machine and platform out there that will fit your business.

Give us a call to know more at 888-996-2273 or visit us at www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce Tagged with: card reader, credit card, credit card processing, e-commerce, merchant, mobile, moto, payments, terminal, virtual terminal

April 11th, 2016 by Elma Jane

Card-not-present fraud is projected to worsen. However, 3D secure technology has made progress and is gaining more and more adoption.

How can e-Commerce merchants avoid CNP fraud?

Here are other ways to make card-not-present transaction safe:

Biometrics – Using Fingerprint Scans and Facial Recognition or Selfie. To validate the identity of the consumer.

Challenge Questions – Such as listing your father’s middle name or a fact known only to the consumer is an effectively added layer of security.

Location Data – Another way to fight against fraud is location data and the use of IP addresses to certify the location and identity of the consumer making the transaction.

Outsource Your Payment Platform – Payments pages hosted by a reputable payment service provider are much more secure.

One-time Passwords – During the checkout process, there will be a window to enter a one-time password which the consumer receives a text message on his/her mobile phone. The consumer enters the password within a short time frame to authenticate the transaction. This solution is especially effective against cyber criminals who steal credentials.

For your payment services needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: 3D Secure, biometrics, card-not-present, cnp, consumer, data, e-commerce, fraud, merchants, payment, Security, service provider, technology, transaction

April 4th, 2016 by Elma Jane

Visa

- Visa is introducing updates to their dispute process.

- Visa is introducing reduced timeframes for transaction processing and late presentment.

- Visa is eliminating the “Call Auth” referral responses, replacing them with Approved or Declined responses.

MasterCard

- MasterCard is adjusting some chargeback reason codes.

- MasterCard is introducing new standards for processing authorizations and pre-authorizations.

- MasterCard is introducing new auth reversal fees.

Discover

- Discover is introducing ProtectBuy for e-commerce transactions.

- Discover is modifying recurring payment interchange programs.

American Express

- American Express is introducing new MCC codes.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Visa MasterCard American Express Tagged with: e-commerce, payment, transactions

March 31st, 2016 by Elma Jane

E-commerce – the process of using the Internet or computer networks in order to buy or sell information, services, or products.

Everyday people go on the Internet and make purchases for different products or services, just like they would in a store. The act of buying or selling over these networks allows for secure paperless transactions to happen electronically.

Electronic transactions have been around for quite some time involving business to business transactions over private networks in the form of EDI. Electronic Data Interchange (EDI), which was a transfer of electronic data from a computer to another computer and Electronic Funds Transfer (EFT), which was a transfer of money electronically from a computer to another in order to do business with each other.

Accepting online payments is very rewarding. If you’re new to e-commerce keep things simple check out our NTC e-Pay the NO SHOPPING CART E-Commerce Solution!

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: e-commerce, Electronic Data, electronic transactions, online payments, payments, transactions

March 17th, 2016 by Elma Jane

A bank in Mexico is the first in the world to publicly experiment with this technology. With their mobile wallet application, cardholders are able to use dynamic CVC/CVV codes, which are generated every twenty minutes.

If somebody is using credit card information stolen from a data intrusion and the merchant accepting payment online asks for the CVV, it likely would have changed by that time, they would enter the wrong CVV and the transaction would be declined.

Cards with CVV code display that randomly changes will ensure that users making orders online are who they say they are. Many e-Commerce sites already ask shoppers for the CVV code during online transactions or over the phone.

The technology is an intuitive solution, but costly to issuers. Cards with displays that enable a dynamic CVV code are 10 times more expensive than chip cards.

As mobile banking, e-commerce, and m-commerce is growing, something had to change sooner or later in the online payment industry.

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: bank, cardholders, cards, credit card, data, e-commerce, m-commerce, merchant, mobile, online, payment, payment industry, transaction, wallet

February 25th, 2016 by Elma Jane

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 16th, 2016 by Elma Jane

NTC ePay is an easy and effective way to process transactions for any Merchants.

National Transaction creates a custom link for your business, which you will use to send your customers an Electronic Invoice. Once your customer received the invoice, they will click on the link and pay the amount on the invoice.

The customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy before they can pay the invoice, this will protect you in a case of a Chargeback.

With this system in place, Credit Card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

Electronic Invoicing saves time and unnecessary costs. Documents don’t need to be scanned or email, all transactions are processed through the electronic invoice making it easy to keep track of.

Most of our Merchants using NTC ePay are in the Travel Industry, some are into boat Repair Business and Church Ministries. If you want to process securely, save time and unnecessary costs like our existing merchants, check out NTC ePay, The No Shopping Cart e-Commerce Solution!

Posted in Best Practices for Merchants, e-commerce & m-commerce, Travel Agency Agents Tagged with: credit card, customers, e-commerce, Electronic Invoice, merchants, transactions, travel, travel industry

February 12th, 2016 by Elma Jane

If there’s an e-commerce trend there’s also a delivery trend.

Will drone be the future of delivery?

Drone delivery is the next big key to e-commerce.

Place an order, payment is collected from a mobile payment system. Drone goes out to deliver the order.

Drone delivery is a great concept to combine for any retail merchants or company that deals with the public. It represents a new system to connect buyers with merchandise, and quickly. The trend for e-commerce delivery.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: e-commerce, merchants, mobile, mobile payment, payment, Retail Merchants

February 11th, 2016 by Elma Jane

E-commerce is a virtual platform, where we can get products and services and make payments through the internet.

E-commerce trend is constantly changing, it is necessary for a merchant to watch out for the upcoming Trends in this industry for a business to success.

To help boost your conversion rates here are the trends to be followed:

Contextual Commerce – The next big thing in payments and e-commerce. Providing complete description with images and videos to help your customer decide to purchase a product. Customization is an important factor as well to convince about the products or services.

Fast Delivery Shipping – Customer wants to receive the products after purchasing as soon as possible. So Reliable, Timely shipping means a lot.

Mobile Shopping – getting your online store ready for mobile shoppers is not an optional feature, it’s a mandatory part of a strategy.

Multiple Channels For Shopping – optimization is a great experience for shoppers. Having online store presence in different technology gadgets is a must.

Real Time Analytics – analyzing consumer behavior based on data entered into a system less than one minute before the actual time of use. Finds out why a customer leaves the store and prevents customer loss.

Virtual Sales Force – Hiring virtual salesforce, utilizing pop-ups and live chat who will help customers which are similar in a physical store.

Step ahead out of the conventional methods and adapt prevailing trends by embracing innovation so you can offer something new to your customer.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: business, consumer, customer, data, e-commerce, internet, merchant, mobile, online, payments